Content

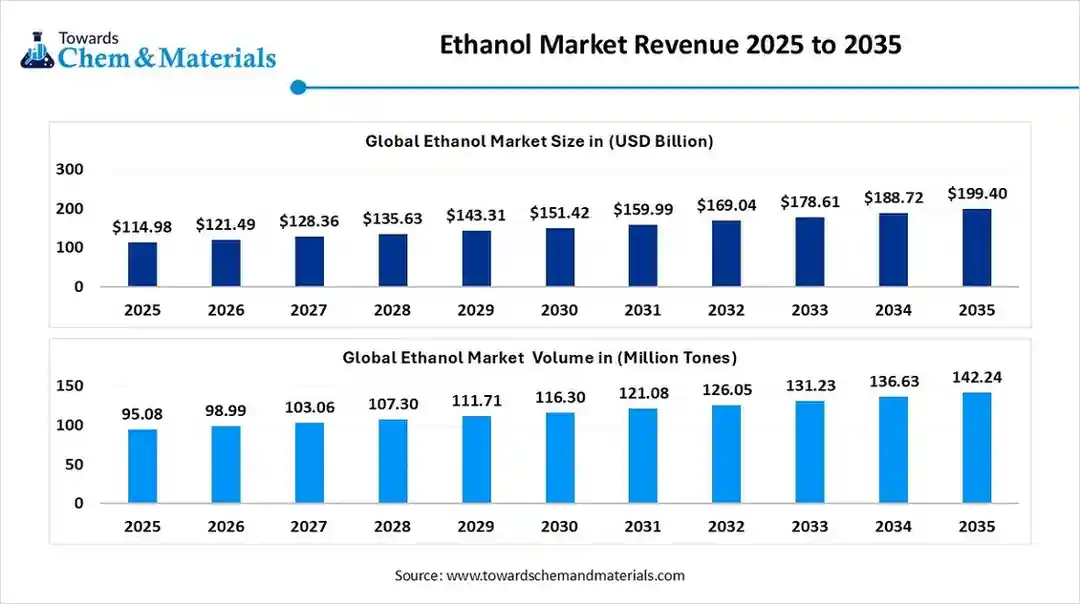

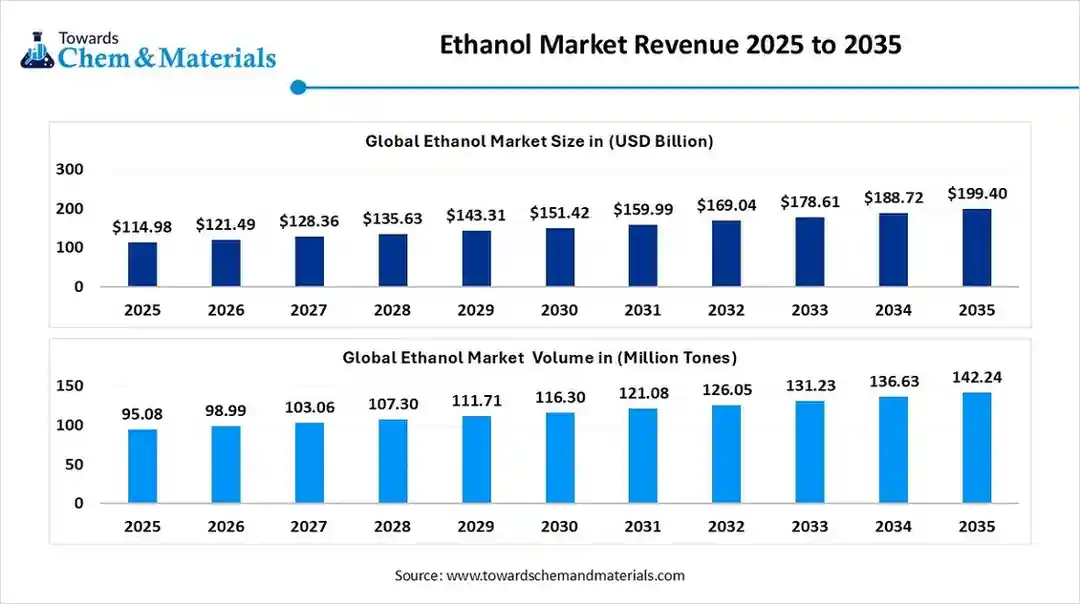

What is the Current Ethanol Market Size and Volume?

The global ethanol market stands at 95.08 million tons in 2025 and is forecast to reach 142.24 million tons by 2035, expanding at a CAGR of 4.11% from 2026 to 2035.

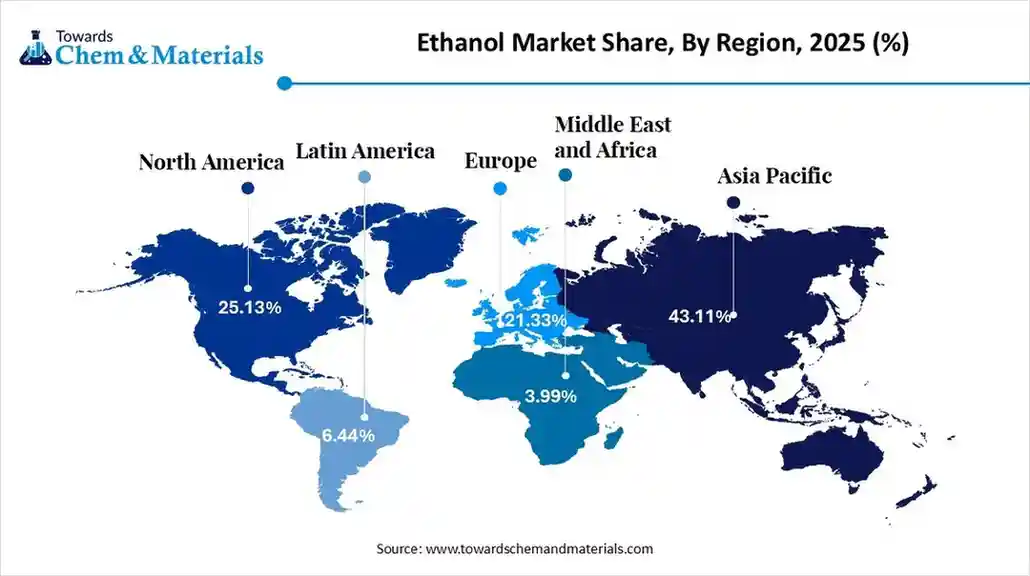

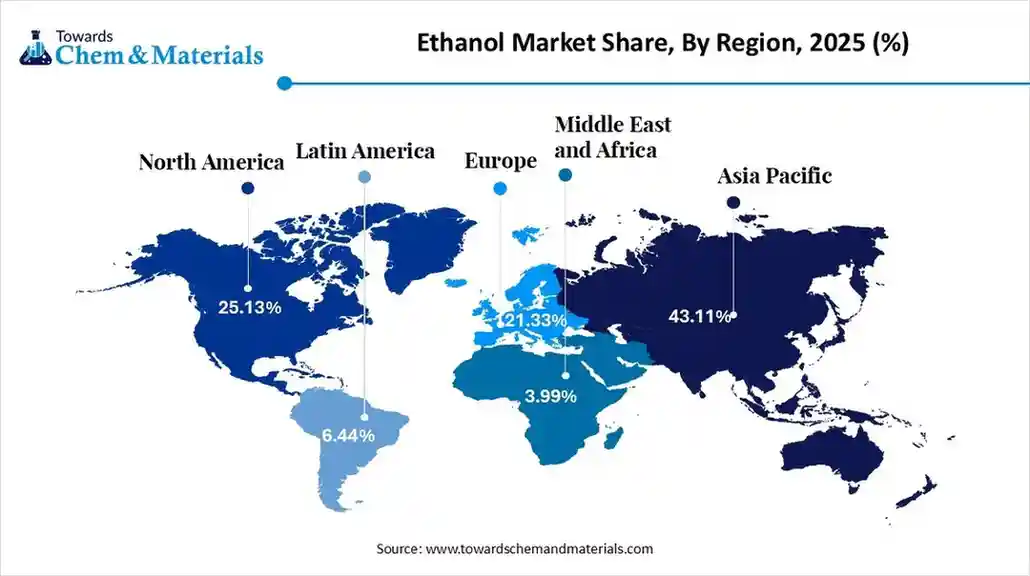

The global ethanol market size is calculated at USD 114.98 billion in 2025 and is predicted to increase from USD 121.49 billion in 2026 and is projected to reach around USD 199.40 billion by 2035, The market is expanding at a CAGR of 5.66% between 2026 and 2035. Asia Pacific dominated the Ethanol market with a market share of 43.11% the global market in 2025. The growth of the market is driven by the growing use as a transportation fuel, which helps reduce emissions, and by its key applications in various fields.

Key Takeaway

- Asia Pacific dominated the ethanol market with a revenue share of 43.11% in 2025.

- By source/feedstock, the bio-based feedstocks segment led the market and accounted for 55% of the global revenue share in 2025.

- By type, the fuel-grade ethanol segment accounted for the largest revenue share of 65% in 2025.

- By end-use industry, the transportation and automotive segment dominated with the largest revenue share of 60% in 2025.

- By distribution channel, the direct supply segment dominated the market and accounted for the largest revenue share of 55% in 2025.

Market Overview

What is the Significance of the Ethanol Market?

The importance of the ethanol market lies in its environmental, economic, and social advantages, mainly through lowering carbon emissions, increasing energy security by reducing reliance on imported oil, and supporting rural communities and farmers with new income sources. As a renewable fuel, it helps combat climate change and improve air quality, while government mandates and rising consumer awareness further boost its growth as a mainstream energy source and industrial chemical.

Ethanol Market Growth Trends:

- Technological Advancements: Innovations in production technologies, such as advanced fermentation processes, improved enzyme use, and the development of second-generation (2G) cellulosic ethanol from non-food sources, are enhancing efficiency and sustainability.

- Expansion of End-Use Applications: Beyond fuel, ethanol demand is growing in the industrial, pharmaceutical, and personal care sectors. It is widely used as a solvent in products like hand sanitizers, disinfectants, paints and coatings.

- Focus on Sustainability & Circular Economy: The industry is moving towards a circular economy model, exploring the use of waste products and integrating carbon capture, utilisation, and storage (CCUS) initiatives to further reduce its carbon footprint and meet net-zero emissions targets.

- Consolidation and Strategic Partnerships: Market players are engaging in mergers, acquisitions, and partnerships to expand capacity, diversify feedstock options, and strengthen their supply chains against raw material price volatility.

- Key Technological Shifts In The Ethanol Market: Key technological shifts in the ethanol market are primarily focused on enhancing sustainability, increasing production efficiency, and diversifying feedstocks beyond traditional food crops. These shifts are driven by environmental concerns, the push for energy security, and supportive government policies.

Comparative Pricing for Fuels and Co-Products – Adjusted Summary ($/Gallon)

| Product | Current Price | Prior Week Avg | Previous Year | % Change WoW | % Change YoY |

| Ethanol (FOB Gulf) | 1.889 | 1.921 | 1.551 | -1.60% | 21.80% |

| Anhydrous Ethanol (FOB Santos, Brazil) | 2.274 | 2.318 | 2.063 | -1.90% | 10.20% |

| Hydrous Ethanol (FOB Santos, Brazil) | 2.129 | 2.137 | 1.926 | -0.30% | 10.60% |

| Anhydrous – Hydrous Spread | 0.145 | 0.181 | 0.14 | -19.90% | 3.60% |

| Gulf Discount/Premium vs Santos | -0.382 | -0.397 | -0.509 | -3.30% | -24.30% |

| Ethanol (FOB PNW) | 1.933 | 2.053 | 1.667 | -5.50% | 16.00% |

| MTBE (FOB Gulf) | 2.239 | 2.268 | 3.015 | -1.30% | -26.00% |

| MTBE Premium/Discount to Ethanol (FOB Gulf) | 0.351 | 0.347 | 1.476 | 0.50% | -48.10% |

| Benzene (FOB U.S. Gulf) | 3.079 | 3.148 | 4.271 | -2.20% | -28.00% |

| Toluene NITN (FOB U.S. Gulf) | 2.907 | 2.93 | 3.679 | -0.80% | -21.10% |

| Mixed Xylene (FOB U.S. Gulf) | 2.774 | 2.821 | 3.846 | -1.70% | -27.80% |

| Weighted Avg Aromatic Price (BTX) | 2.852 | 2.893 | 3.85 | -1.40% | -26.00% |

| Gasoline (FOB Gulf) | 2.038 | 2.044 | 2.314 | -0.30% | -11.90% |

This table compares weekly, yearly, and current fuel and co-product prices. Ethanol prices in all regions remain below aromatic octane enhancers but above previous-year levels, reflecting stronger demand. Brazilian ethanol (both hydrous and anhydrous) shows mild week-to-week declines but still sits well above last year. Aromatic components such as benzene, toluene, and xylene continue to drop sharply compared to last year, indicating weaker petrochemical margins. Gasoline shows only a slight weekly dip but remains below last year's pricing. Overall, ethanol markets are relatively firm while petrochemical-derived components continue trending lower.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 121.49 Billion |

| Revenue Forecast in 2035 | USD 199.40 Billion |

| Growth Rate | CAGR 5.66% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Segments covered | Source / Feedstock Insight, Type Insight, End-Use Industry Insight, Distribution Channel Insight, Region |

| Key companies profiled | Cremer Oleo GmbH Co.KG, Alto Ingredients (Ireland), AGRANA Beteiligungs-AG , Cardinal Ethanol LLC , Sekab , Nordzucker , Marquis Energy , Tereos |

Trade Analysis of the Ethanol Market: Import & Export Statistics

- In 2025, U.S. ethanol exports reached an all-time high of 1.9 billion gallons, representing an important and growing market for U.S. ethanol producers.

- According to Volza's India Export data, India exported 292 shipments of Ethanol from Nov 2023 to Oct 2025 (TTM). These exports were made by 71 Indian Exporters to 95 Buyers, marking a growth rate of 22% compared to the preceding twelve months.

- Globally, the top three exporters of Ethanol are the United States, Vietnam, and Germany. The United States leads the world in Ethanol exports with 25,164 shipments, followed by Vietnam with 20,371 shipments, and

- Germany taking the third spot with 2,913 shipments. Most of the Ethanol exports from India go to the United States, Tanzania, and Iraq.

- According to Volza's Global Export data, the World exported 21,471 shipments of Ethanol from Jun 2025 to May 2025 (TTM). These exports were made by 2,396 Exporters to 2,564 Buyers, marking a growth rate of 22% compared to the preceding twelve months. Most of the Ethanol exports from the World go to Vietnam, the United States, and Germany.

- Globally, the top three exporters of Ethanol are the United States, Vietnam, and Germany. The United States leads the world in Ethanol exports with 20,871 shipments, followed by Vietnam with 20,126 shipments, and Germany taking the third spot with 2,775 shipments.

Ethanol Market Value Chain Analysis

- Chemical Synthesis and Processing :Ethanol is produced through biological fermentation of biomass sources such as corn, sugarcane, and molasses, or via petrochemical synthesis using ethylene hydration. The process includes fermentation, distillation, dehydration, and purification to achieve fuel-, industrial-, or beverage-grade ethanol.

- Key players Archer Daniels Midland Company (ADM), POET LLC, Green Plains Inc., Valero Energy Corporation, Cargill Inc.

- Quality Testing and Certification :Ethanol undergoes testing for purity, water content, octane rating, and chemical composition under standards such as ASTM D4806 (fuel ethanol), USP grade specifications, and ISO 9001.

- Key players: ASTM International, UL Solutions, SGS, Intertek.

- Distribution to Industrial Users :Ethanol is distributed to end users in automotive fuels, pharmaceuticals, food & beverages, and industrial solvents through blending terminals, chemical distributors, and refinery networks.

- Key players: Valero Energy Corporation, ADM, Green Plains Inc., POET LLC.

Ethanol and Gasoline Price Trends - FOB Houston (52-Week Rolling Average)

This table shows the 52-week rolling average prices for ethanol and gasoline, measured in U.S. dollars per gallon, for each month from March 2024 to February 2025. The data reveals that the price of gasoline (blue line) has generally been higher than ethanol (orange line) throughout the year, with both prices seeing an overall increase in the second half of 2024. The ethanol price is lower compared to gasoline, and both price trends are gradually rising as the months progress, with gasoline showing slightly more volatility over time.

Ethanol Regulatory Landscape: Global Regulations

| Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America | U.S. EPA (Environmental Protection Agency) Environment Canada |

- Renewable Fuel Standard (RFS) - Clean Air Act Fuel Regulations - Canada Clean Fuel Standard (CFS) |

- Ethanol blending mandates (E10–E85) - GHG emission reduction targets - Lifecycle carbon intensity tracking |

EPA sets annual RVOs that directly shape ethanol demand. The U.S. is one of the largest ethanol consumers and producers globally. Canada’s CFS increases future blending needs. |

| Europe | European Commission ECHA |

- Renewable Energy Directive II (RED II) - Fuel Quality Directive (FQD) |

- Biofuel sustainability certification - GHG savings requirement (min 65%) - Traceability and verification |

Europe has the strictest sustainability rules for ethanol. Certification under ISCC/REDcert is mandatory for entering the EU market. |

| Asia-Pacific | NDRC (China) MoPNG (India) METI / MOE (Japan) |

- China Biofuel Development Plan - India Ethanol Blending Programme (EBP) - Japan Biomass Strategy |

- Regional blending programs - Domestic ethanol production incentives - Feedstock diversification |

Asia-Pacific has a rapidly expanding ethanol demand. India targets E20 by 2025–26. China uses regional E10 mandates. Japan relies heavily on low-carbon imported ethanol. |

| Latin America | ANP (Brazil) Ministry of Energy (Argentina) |

- RenovaBio (Brazil) - National Biofuel Policies |

- High blending mandates (up to E27 in Brazil) - Decarbonization credits (CBIOs) |

Brazil is the largest sugarcane ethanol producer. Strong low-carbon incentives make Latin America a global biofuel leader. |

| Middle East & Africa | Various national energy ministries | - Emerging national renewable fuel frameworks - Import-based ethanol programs |

- Fuel diversification - Blending trials - Early-stage regulatory systems |

Region is at an early adoption stage; ethanol demand is mostly import-driven. South Africa shows the fastest regulatory development. |

Segmental Insights

Source / Feedstock Insight

Which Source/Feedstock Segment Dominates The Ethanol Market In 2025?

The bio-based feedstocks segment dominated the ethanol market with a share of 55% in 2025. Bio-based feedstocks include sugarcane, corn, grains, and molasses, which dominate global ethanol production due to their high availability and cost-efficient fermentation. These feedstocks are strongly supported by national biofuel programs and renewable fuel mandates, making them the backbone of commercial ethanol markets, especially in countries with strong agricultural ecosystems such as the U.S., Brazil, India, and Thailand. The cellulosic feedstocks segment expects significant growth in the ethanol market during the forecast period.

Cellulosic feedstocks include agricultural residues, forestry waste, and non-food biomass, offering a more sustainable alternative with much lower carbon intensity. Although production is still limited due to high processing costs and complex pretreatment technologies, strong policy incentives, R&D investments, and decarbonization initiatives are accelerating the commercialisation of cellulosic ethanol, particularly in the U.S., Europe, and emerging Asian markets.

The synthetic ethanol segment has seen notable growth in the ethanol market. Synthetic ethanol is produced from petrochemical routes such as ethylene hydration, mainly used in industrial and chemical applications. It offers consistent purity and quality, making it suitable for paints, inks, adhesives, and cosmetics. While not renewable, synthetic ethanol remains relevant in industries requiring stable supply chains, although rising sustainability mandates are gradually shifting preference toward bio-based and low-carbon alternatives.

Type Insight

How Did The Fuel Grade Segment Dominates The Ethanol Market In 2025?

The fuel-grade ethanol segment dominated the ethanol market with a share of 65% in 2025. Fuel-grade ethanol is the largest market segment, driven by blending mandates such as E10, E20, and E85 across major economies. It plays a key role in reducing vehicle emissions and dependence on fossil fuels. This segment continues to grow due to rising flex-fuel vehicle adoption, renewable energy targets, and increasing interest in sustainable aviation fuel production pathways.

The pharmaceutical-grade ethanol segment expects significant growth in the ethanol market during the forecast period. Pharmaceutical-grade ethanol is highly purified and used in medicines, sanitisers, vaccines, and laboratory processes. Demand surged post-pandemic due to hygiene awareness and increased medical production. Strict regulatory standards govern its purity, making this segment critical for the healthcare and biotechnology industries.Growing manufacturing of injectables, antiseptics, and biopharmaceuticals continues to support long-term demand.

The industrial-grade ethanol segment has seen notable growth in the ethanol market. Industrial-grade ethanol is used in solvents, coatings, cleaning agents, inks, paints, and chemical synthesis. It serves as a key ingredient in resins, adhesives, and various downstream chemicals. Growth in the manufacturing, coatings, and personal care industries drives this segment. Industrial ethanol also supports bio-based chemical production, aligning with sustainability efforts across several end-use sectors.

End-Use Industry Insight

Which End Use Industry Segment Dominates The Ethanol Market In 2025?

The transportation and automotive segment dominated the ethanol market with a share of 60% in 2025. Transportation is the largest consumer of ethanol due to widespread use in blended fuels such as E10–E85. Governments use ethanol blending programs to cut emissions and reduce petroleum imports. Rising logistics activity, rapid urbanisation, and the adoption of flex-fuel vehicles further strengthen demand. Sustainable aviation fuels also represent an emerging growth pathway for this segment.

The healthcare and pharmaceutical segment expects significant growth in the ethanol market during the forecast period. Healthcare uses ethanol in formulations, disinfectants, sanitisers, antiseptics, and extraction processes. High purity requirements make it an essential pharmaceutical ingredient. Growing biotechnology research, increasing vaccine and drug production, and robust demand for hygiene products keep this segment strong. The rise of bioprocessing and sterile manufacturing further enhances the need for pharmaceutical-grade ethanol.

The chemicals and petrochemicals segment has seen notable growth in the ethanol market. Ethanol serves as a crucial building block and solvent in chemical synthesis, producing derivatives such as ethyl acetate, acetic acid, and bio-based chemicals. Industries use ethanol to reduce reliance on petroleum-based solvents. Growing interest in green chemicals, coatings, and speciality formulations is boosting demand. This segment benefits from expanding industrial output across emerging economic regions.

Distribution Channel Insight

How Did Direct Supply Segment Dominates The Ethanol Market In 2025?

The direct supply segment dominated the ethanol market with a share of 55% in 2025. Direct supply involves ethanol manufacturers selling directly to fuel blenders, chemical companies, and large industrial users. This channel ensures consistent quality, bulk procurement advantages, and secure long-term contracts. Large enterprises prefer direct supply for reliability and cost efficiency, particularly in transportation fuels, pharmaceuticals, and petrochemical applications.

The Retail Fuel Networks segment expects significant growth in the ethanol market during the forecast period. Retail fuel networks distribute blended ethanol fuels such as E10, E20, and E85 through petrol stations, making them essential for transportation sector demand. Expanding fuel stations offering high-blend ethanol and rising consumer acceptance of low-carbon fuels support this channel. Government mandates and incentives accelerate retail-level expansion across North America, Brazil, Europe, and Asia.

The industrial distribution segment has seen notable growth in the ethanol market. Industrial distributors supply ethanol to medium and small industries for applications in chemicals, healthcare, coatings, and food processing. These networks help reach customers who require smaller quantities and diverse ethanol grades. Growth in manufacturing, cosmetics, and cleaning products strengthens this channel, particularly in regions where domestic ethanol production is developing.

Regional Analysis

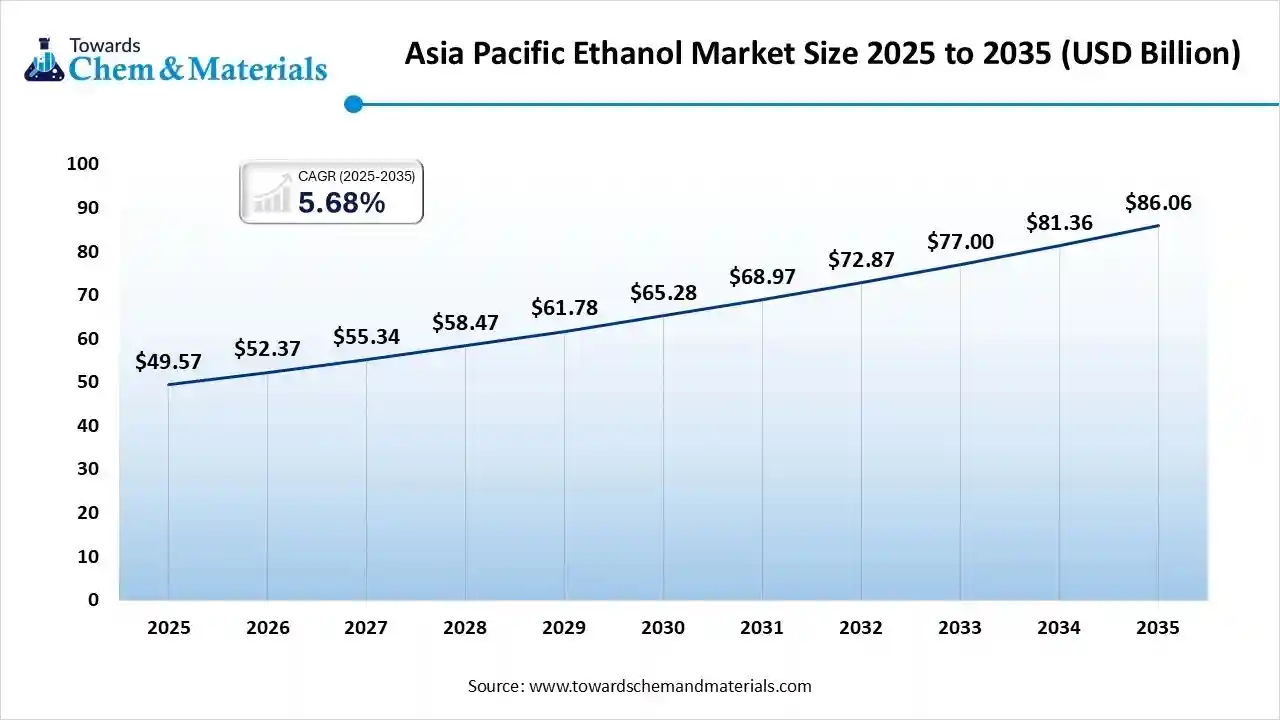

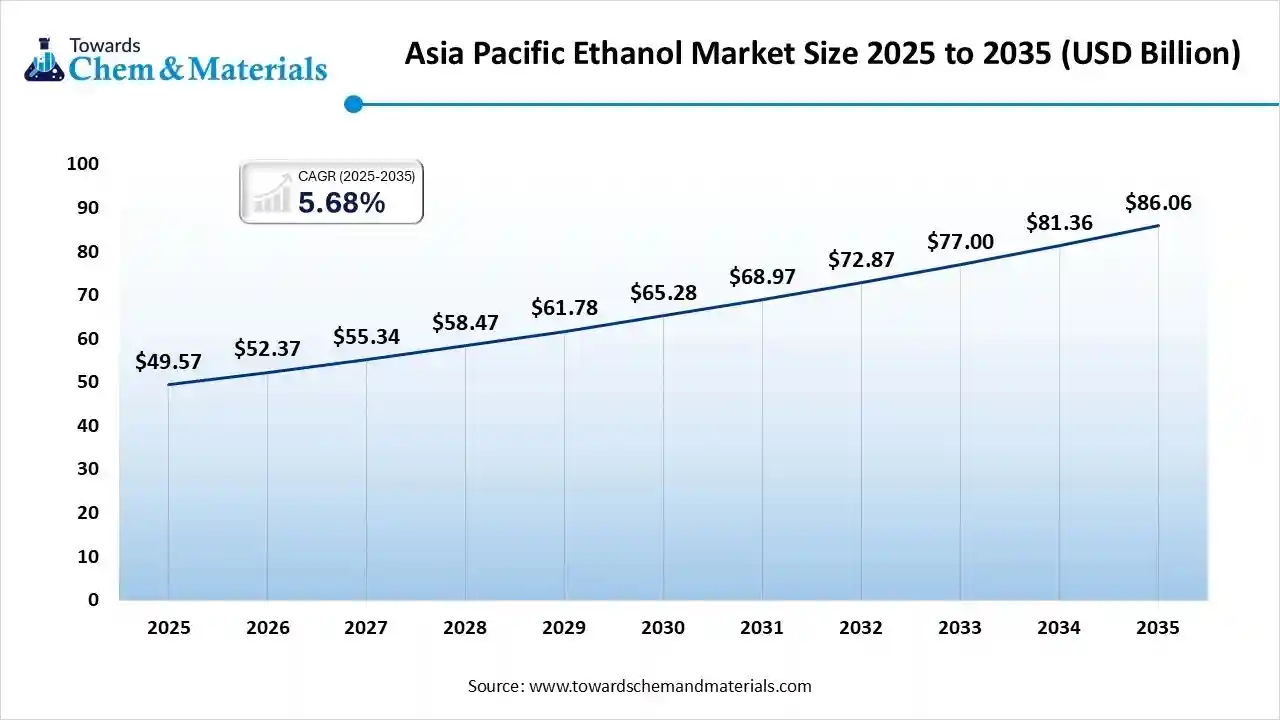

The Asia Pacific ethanol market size was valued at USD 49.57 billion in 2025 and is expected to reach USD 86.06 billion by 2035, growing at a CAGR of 5.68% from 2025 to 2035. Asia Pacific dominates the ethanol market with a share of 43.11% in 2025.

Asia Pacific is the fastest-growing ethanol market due to rising fuel demand, expanding industrial use, and strong government biofuel blending mandates. Countries in the region are expanding capacity for ethanol production using molasses, sugarcane, grains, and non-food biomass. Rapid economic growth, urbanisation, and increasing preference for cleaner transportation fuels drive strong market uptake, particularly in emerging economies.

India Has Seen Growth Due To a Growing Focus On Sustainability

India is witnessing rapid ethanol market expansion driven by the national ethanol blending program targeting E20. The government strongly supports sugarcane- and grain-based ethanol production, offering subsidies, soft loans, and fixed procurement prices. Rising crude oil imports, air-quality concerns, and rural economic development initiatives further strengthen ethanol demand, making India one of the world’s most dynamic ethanol growth markets.

South America's Growth Is Driven By Cost-Effective Production

South America is expected to experience significant growth in the ethanol market in the forecast period. South America is a major ethanol-producing region with strong agricultural capacity and long-standing biofuel programs. Ethanol is widely used as a transportation fuel, especially in flex-fuel vehicles. The region benefits from cost-efficient production, high sugarcane yields, and favourable climate conditions. Export opportunities are rising as global markets seek low-carbon renewable fuels.

Brazil Ethanol Market Growth Trends

Brazil is a global leader in ethanol production, powered by its efficient sugarcane industry and Proálcool program. The country has a highly developed flex-fuel vehicle ecosystem and consistent blending mandates. Brazil’s sugarcane ethanol has one of the lowest carbon intensities globally, creating strong export potential. Growing investments in second-generation ethanol and biorefineries continue to enhance its international competitiveness.

North America's Growth Of The Market Is Driven By Infrastructure Development

North America has seen growth in the ethanol market, driven by strong biofuel blending mandates, advanced production technologies, and a significant corn-based feedstock supply. The region benefits from well-established ethanol infrastructure and strong government incentives promoting renewable fuels. Demand is further supported by rising adoption of low-carbon fuel standards, expansion of E10–E85 fuel usage, and increasing interest in second-generation ethanol and sustainable aviation fuel applications.

United States Ethanol Market Growth Trends

The U.S. is the world’s largest ethanol producer, supported by abundant corn feedstock, the Renewable Fuel Standard (RFS), and large-scale biorefineries. Strong domestic blending demand and growing export activity sustain market growth. The country is also advancing cellulosic ethanol technologies, expanding renewable diesel integration, and enhancing production efficiencies, making it a key global hub for innovation in low-carbon biofuels and sustainable transportation solutions.

Europe Ethanol Market Growth Is Driven By The Growing Demand From Industries

Europe’s ethanol market is shaped by the EU’s strict emissions reduction targets and renewable energy directives supporting biofuel use. The region is expanding production of both grain-based and advanced ethanol, driven by sustainability criteria. Growing demand in automotive fuel blending, increasing emphasis on decarbonising transport, and rising investments in second-generation ethanol refineries strengthen Europe’s position in the global ethanol value chain.

Germany Ethanol Market Growth Trends

Germany plays a central role in Europe’s ethanol industry, with strong regulatory support for renewable fuels under the GHG reduction quota. The country focuses heavily on advanced bioethanol production and energy-efficient biorefineries. Increasing adoption of E10 fuel, rising sustainability requirements, and growing interest in low-emission mobility solutions drive ethanol demand across transportation and industrial applications.

Middle East & Africa Growth Is Driven By Renewable Energy Solutions

The MEA region is emerging in the ethanol market, driven by industrial demand, diversification efforts, and rising interest in renewable energy solutions. Limited agricultural feedstock availability restricts large-scale production, but imports are increasing. Governments are gradually exploring biofuel blending policies and advanced ethanol technologies, particularly in countries aiming to reduce dependence on fossil fuels.

South Africa Ethanol Market Growth Trends

South Africa is developing its ethanol sector through government-led renewable energy policies and efforts to boost rural agricultural output. While production is still modest, initiatives to convert molasses and grains into fuel and industrial ethanol are growing. Demand is supported by industrial, beverage, and potential transportation applications, with increasing focus on establishing a more stable biofuel regulatory framework.

Recent Developments

- In November 2025, US agricultural machinery manufacturer AGCO Group plans to launch an ethanol-powered tractor in Brazil within the next two years. This initiative is motivated by Brazil's increasing corn ethanol output and aims to reduce biodiesel use. Tractor engines are currently being tested with ethanol, focusing initially on mills with established ethanol supply chains.(Source: www.qcintel.com)

- In November 2025, Thunderplus and Trinity Cleantech introduced what they describe as the world's first ethanol-based mobile fast charger, providing a sustainable on-the-go charging solution for electric vehicles using ethanol as fuel.(Source: auto.economictimes.indiatimes.com)

- In October 2025, True Green Bio Energy initiated commercial operations at its new 300 kilo-litres per day (KLPD) ethanol plant located in Gujarat. This facility utilises damaged food grains to produce ethanol and aims to sell to major oil marketing companies in India.(Source: scanx.trade)

Top players in the Ethanol Market & Their Offerings:

- Archer Daniels Midland (ADM): ADM is one of the world’s largest ethanol producers, supplying fuel-grade ethanol, industrial ethanol, and high-protein co-products. The company plays a major role in the biofuel supply chain with extensive corn-processing and fermentation capacities.

- POET LLC: POET is a leading biofuel company specialising in renewable ethanol production from corn. Its offerings include fuel ethanol, bioproducts like distillers' grains, and innovative low-carbon biofuel technologies used in the energy and transportation sectors.

- Green Plains Inc: Green Plains operates multiple ethanol production facilities and focuses on low-carbon, high-protein ingredient production. The company provides fuel ethanol, corn oil, and renewable feed products to global energy and agricultural markets.

- Valero Energy Corporation: Valero, through its subsidiary Valero Renewable Fuels, is a major producer of ethanol using advanced fermentation and processing technologies. Its product portfolio includes renewable ethanol, distillers' grains, and corn oil used in biofuels and animal nutrition.

- Raízen: Raízen is a key global supplier of sugarcane-derived ethanol, including low-carbon bioethanol for transportation and industrial applications. It leads the market in renewable energy, offering 1G and 2G ethanol, bioelectricity, and sustainable aviation fuel components.

Other Top Players Are

- Cremer Oleo GmbH Co.KG

- Alto Ingredients (Ireland)

- AGRANA Beteiligungs-AG

- Cardinal Ethanol LLC

- Sekab

- Nordzucker

- Marquis Energy

- Tereos

Segments Covered:

By Source / Feedstock

- Bio-based Feedstocks

- Corn

- Sugarcane

- Wheat

- Barley

- Cassava

- Cellulosic Feedstocks

- Agricultural Waste

- Forestry Residues

- Energy Crops

- Synthetic Ethanol (petrochemical route)

By Type

- Fuel-Grade Ethanol

- Industrial-Grade Ethanol

- Beverage-Grade Ethanol

- Pharmaceutical-Grade Ethanol

By End-Use Industry

- Transportation & Automotive

- Chemicals & Petrochemicals

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care

- Household & Cleaning Products

By Distribution Channel

- Direct Supply to Blenders & Refineries

- Industrial Distributors

- Chemical Traders

- Retail / Fuel Networks

By Geography

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa