Content

What is the Current Industrial Water Treatment Market Size and Share?

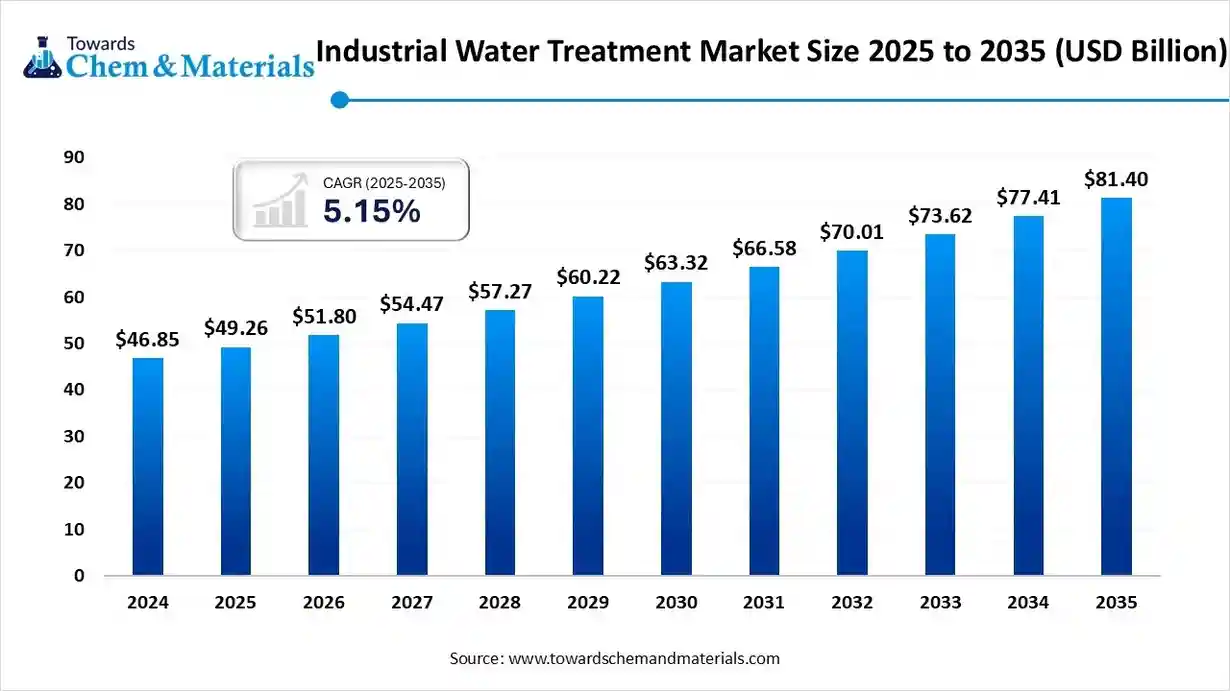

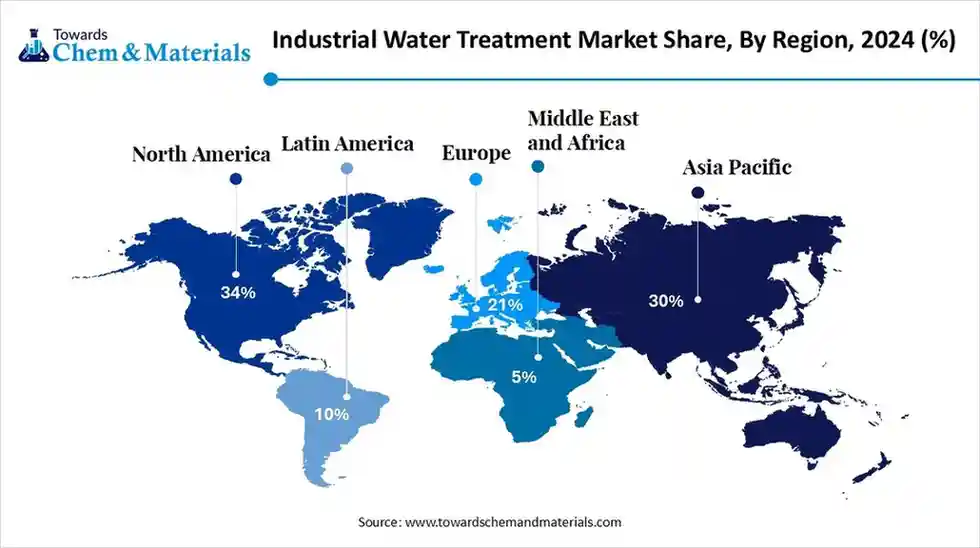

The global industrial water treatment market size is calculated at USD 49.26 billion in 2025 and is predicted to increase from USD 51.80 billion in 2026 and is projected to reach around USD 81.40 billion by 2035, The market is expanding at a CAGR of 5.15% between 2025 and 2035. North America dominated the industrial water treatment market with a market share of 34% the global market in 2024.The global shift towards sustainability and minimization of industrial expenditure has accelerated the market in recent years.

Key Takeaways

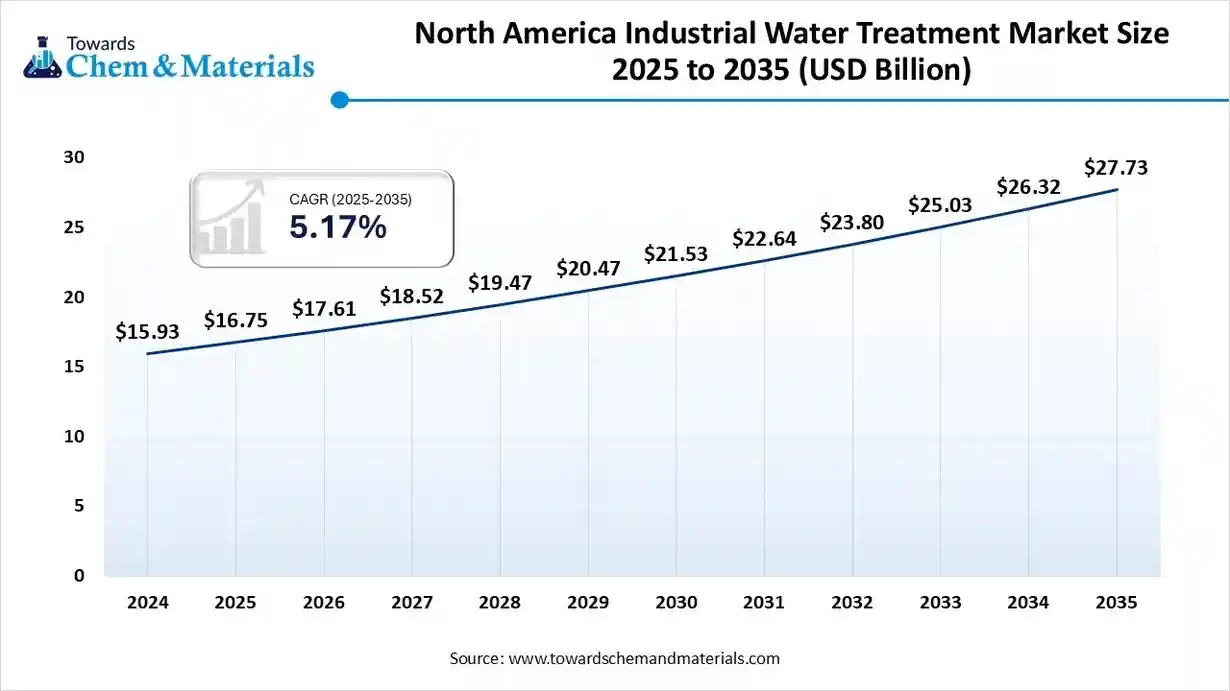

- By region, North America dominated the industrial water treatment market with a 34% industry share in 2024.

- By region, Asia Pacific is expected to capture a greater portion of the market in the future.

- By product type, the equipment & systems segment dominated the market with 40% in 2024.

- By product type, the digital monitoring, automation & analytics segment is expected to grow at the fastest rate in the market during the forecast period.

- By technology type, the membrane separation segment dominated the market with 30% industry share in 2024.

- By technology type, the electrochemical & advanced oxidation segment is expected to grow at the fastest rate in the market during the forecast period.

- By end user industry, the power & utilities segment dominated the market with 22% industry share in 2024.

- By end-use industry, the semiconductor/electronics segment is expected to grow at the fastest rate in the market during the forecast period.

- By deployment, the on-site / engineered, fixed installations segment dominated the market with 78% industry share in 2024.

- By deployment, the packaged / modular / skid-mounted systems segment is expected to grow at the fastest rate in the market during the forecast period.

- By distribution channel type, the direct sales/ OEM accounts segment dominated the market with 55% in 2024.

- By distribution channel type, the online/digital marketplaces & e-channels segment is expected to grow at the fastest rate in the market during the forecast period.

Precision Chemistry, Powerful Impact: Redefining Industrial Water Care

The Industrial Water Treatment Market covers technologies, chemicals, equipment and services used to treat water and wastewater generated by industrial facilities so it can be safely reused, discharged or returned to the environment. It includes unit processes and systems such as filtration, membrane separation (RO/UF/NF), biological treatment, chemical treatment (corrosion inhibitors, scale and fouling control, biocides), desalination, zero-liquid discharge (ZLD) systems, and operation & maintenance, as well as digital monitoring and process-automation solutions tailored to industries (power, oil & gas, chemicals, food & beverage, pharmaceuticals, metals & mining, and manufacturing). The market spans both on-site packaged systems and large engineered projects, plus ongoing service & chemical supply contracts.

Industrial Water Treatment Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the increasing sustainability and chemical-free water treatment in major industrial spaces are fuelling the expansion of opportunities within the sector. Also, several plants are seen under the heavy establishment of the modern treatment systems to minimize wastewater fines and reduce the dependence on freshwater purchases in recent years.

- Sustainability Trends: Industry is heavily shifting towards eco-friendly initiatives by launching several wastewater recovery programs and industrial training these days. Also, some industries are actively recovering the heat from water and some of the biological nutrients, which can play a major role in biogas production.

- Global Expansion: The industry saw very ups and downs globally in recent years, where some of the regions are seen under the heavy adoption of the wastewater treatment initiatives due to high industrial water stress, and some of the regions have implemented these standards, but growth of the industry has stalled due high cost of the service. But the micro clusters near the industrial parks have played the emerging high cost reduction element role in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 51.80 Billion |

| Expected Size by 2035 | USD 81.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Product Type, By Technology / Process, By End-User Industry, By Deployment Type, By Sales / Distribution Channel, By Region |

| Key Companies Profiled | Kemira, Solenis, SNF Floerger, Veolia Environnement , SUEZ , Xylem Inc. , DuPont (Water-related business / Membranes & chemicals) , Pentair plc , Kurita Water Industries Ltd. , Evoqua Water Technologies , WABAG (VA Tech Wabag Ltd.), Thermax Ltd. , Doosan (Doosan Heavy / Doosan Enerbility) , Aquatech International , Fluence Corporation , BWA Water Additives / BASF (water chemicals players) , Calgon Carbon / Cabot (activated carbon & specialty solutions) , Hitachi / Mitsubishi Electric (industrial systems & process equipment) , 3M (industrial filtration & membranes) |

Intelligence Flows: AI Transforms Industrial Water Treatment

The industries are adopting modern water treatment systems, which have modular hardware with smart sensors, in recent years. Also, the technology shift has taken the water treatment process to a different and advanced level, where IoT control, AI to optimize cleaning, and predict fouling have become the main priority of the services nowadays in industrial areas.

Trade Analysis of the Industrial Water Treatment Market:

- Import, Export, Consumption, and Production Statistics

- China has seen under a heavy export of industrial water treatment, and shipment numbers were registered around 1080.

- India is the leading exporter of industrial wastewater treatments, following the greater shipment number, which is 8,916 shipments as per the published report.(Source : www.volza.com)

Value Chain Analysis of the Industrial Water Treatment Market:

- Distribution to Industrial Users : The distribution of industrial water treatment chemicals to end-users involves a multi-tiered ecosystem connecting manufacturers to a diverse range of industries.

- Chemical Synthesis and Processing : The industrial water treatment market relies heavily on the synthesis of both inorganic and organic (synthetic and bio-based) compounds.

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring are critical aspects of the market, driven by stringent government regulations designed to protect human health and the environment.

Industrial Water Treatment Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law | Promoting water recycling and reuse | It is the main environmental protection agency, responsible for setting and enforcing pollution control policies and standards. |

| India | Central Pollution Control Board (CPCB) | Environment (Protection) Act, 1986 | Enforcing strict effluent discharge standards | It's the apex organization that sets national standards for effluent discharge and monitors compliance. |

| United States | Environmental Protection Agency (EPA) | Clean Water Act (CWA) | Controlling pollutant discharges through the NPDES permit system | It’s a federal agency responsible for implementing and enforcing environmental protection laws, including water quality standards. |

| Europe | European Commission (EC) | Water Framework Directive (WFD) | Implementing strict chemical safety standards | This agency proposes and enforces EU-wide legislation, often supported by national and regional agencies. |

Segmental Insights:

Product Type Insights

How did the Equipment & Systems Segment Dominate the Industrial Water Treatment Market in 2024?

- The equipment & systems segment dominated the market with 40% industry share in 2024 due to several industries shifting towards physical solutions such as the RO systems, filtration units, and cooling tower setups. Moreover, by offering long-term reliability with lower chemical dependency, these systems have gained major industry attention in the current period.

- The digital monitoring, automation & analytics segment is expected to grow at a significant rate owing to the industries seen in adoption of heavy technological initiatives. Moreover, IoT devices, real-time sensors, and AI-based platforms have gained greater attention from system investors and corporate backers in the past few years.

- The water treatment chemicals & consumables segment is also notably growing, akin to it is considered a crucial element of the treatment in the current period. Furthermore, the regions which has the supply of only hard waters and varying quality sources have provided the immense consumer base to the segment in recent years as per the survey.

Technology Insights

Why does the Membrane Separation Segment Dominate the Industrial Water Treatment Market by Technology?

- The membrane separation segment dominated the market with a 30%industry share in 2024 due to its ability to efficiently remove impurities, salts, and microorganisms from industrial water. Technologies like reverse osmosis (RO), ultrafiltration, and nanofiltration are widely used in power, electronics, and pharmaceutical industries for high-purity water needs.

- The electrochemical & advanced oxidation segment is expected to grow at a rapid rate because it effectively breaks down complex organic pollutants and emerging contaminants that traditional systems can't remove. These technologies require less chemical input, operate with high energy efficiency, and support zero-discharge goals.

- The biological treatment segment is also notably growing as industries adopt natural and sustainable wastewater solutions. Biological systems use microorganisms to degrade organic waste, making them ideal for food, paper, and textile industries. They reduce chemical use and produce lower sludge volumes, helping companies cut treatment costs and environmental impact.

End User Insights

How did the Power and Utilities Segment Dominate the Industrial Water Treatment Market in 2024?

- The power and utilities segment dominated the market with 22% industry share in 2024 market as water treatment is critical for boilers, cooling towers, and condensers in power plants. Corrosion, scaling, and microbial growth can severely affect turbine efficiency and operational safety. Thus, power plants invest heavily in advanced treatment chemicals to ensure smooth performance and regulatory compliance.

- The semiconductor/electronics segment is expected to grow at a significant rate as it requires ultra-pure water for chip and circuit production. Even microscopic impurities can affect product quality and yield. Moreover, the surge in chip manufacturing in the developed regions is further driving industry growth in recent years.

- The oil & gas/petrochemical segment is also notably growing, due to increased exploration activities and refinery modernization. Water treatment chemicals are essential in controlling corrosion, scaling, and fouling in drilling, production, and processing systems. As environmental standards tighten, companies invest more in effective treatment solutions to minimize water discharge and equipment damage, driving continuous demand for industrial water treatment products in this segment.

Deployment Insights

How did the On-Site/ Engineered, fixed installations Segment Dominate the Industrial Water Treatment Market in 2024?

- The on-site/ engineered, fixed installations segment dominated the market with 78% industry share in the 2024 market, because large industries prefer customized water treatment systems designed for their specific process needs. These setups handle complex water loads and allow real-time operational adjustments by in-house engineers.

- The packaged / modular / skid-mounted systems segment is expected to grow at a significant rate because they offer flexibility, quick installation, and easy relocation. These compact systems suit small and mid-sized industries that need plug-and-play water treatment with minima downtime.

- The cloud-native / digital-only solution subscriptions segment is also notably growing, due to increased shift towards remote and real-time control in the industries in recent years. furthermore, by releasing accurate info and predictions, these solution subscriptions have strengthened their industry presence in the past few years, as per the latest survey.

Sales/Distribution Channel Insights

Why does the Direct Sales/OEM Accounts Segment Dominate the Industrial Water Treatment Market by Distribution Channel?

- The direct sales/field & OEM contracts segment dominated the market with 55% industry share in 2024 because industrial buyers prefer dealing directly with chemical manufacturers for customized formulations, technical support, and consistent supply. This approach ensures better product knowledge, faster service, and cost transparency.

- The online/digital marketplaces & e-channels segment is expected to grow at a rapid rate as industries shift toward digital procurement for convenience and transparency. E-commerce platforms allow easy comparison of prices, specifications, and suppliers, saving time and costs. Small and medium manufacturers benefit from online access to a wider market.

- The distributors/regional dealers segment is also notably growing because they offer localized service, flexible supply options, and on-demand delivery. They bridge the gap between manufacturers and end-users, especially in regions lacking direct supplier presence.

Regional Insights

The North America industrial water treatment market size was valued at USD 16.75 billion in 2025 and is expected to reach USD 27.73 billion by 2035, growing at a CAGR of 5.17% from 2025 to 2035. North America dominated the industrial water treatment market with a 34% industry share, owing to the heavy sustainability regulations implementation and having access to advanced water treatment facilities in the current period. Moreover, major industries such as oil refining, power generation, and food have been seen to depend on the water treatment in the region.

AI and Analytics Transform United States Water Systems

The United States maintained its dominance in the industrial water treatment market due to greater investment in innovations and the presence of major industries. Furthermore, the industries in the United States have increasingly invested in advanced water treatment systems, where smart water management, digital water analytics, and AI integration have gained major industry attention in recent years.

Asia Pacific Industrial Water Treatment Market Analysis

Asia Pacific is expected to capture a major share of the market because of its rapid industrial growth, urbanization, and water scarcity challenges. Manufacturing hubs across regional countries such as China, India, and Southeast Asia are upgrading wastewater systems to meet stricter discharge norms. Growing electronics, textile, and petrochemical sectors require large volumes of treated process water.

China Emerges as a Key Water Treatment Hub

China is expected to emerge as a prominent country for the market in the coming years, owing to its massive manufacturing and power generation capacity. Industrial parks are under government mandates to recycle up to 80-90% of process water, creating huge demand for efficient treatment chemicals.

Europe Industrial Water Treatment Market Trends

Europe is a notably growing region because its industries are modernizing aging infrastructure to comply with evolving water quality and sustainability goals. The European Union's Green Deal encourages industries to minimize water footprints and shift toward biodegradable treatment chemicals

Efficiency and Innovation Power Germany’s Water Sector

Germany is expected to gain a major industry share due to its advanced industrial base and focus on circular water management. Many German plants have already implemented near-zero-liquid-discharge systems and now focus on optimizing chemical efficiency and lowering sludge output.

Latin America Industrial Water Treatment Market Analysis

Latin America is expected to capture a major share of the industrial water treatment market due to increasing industrialization and water stress in several regions. Many countries are upgrading outdated water systems in refineries, pulp & paper mills, and food industries. Rising awareness of water reuse and pollution control is also driving new investments in treatment chemicals.

Brazil’s Industrial Boom Drives a New Wave in Water Treatment

Brazil is expected to emerge as a prominent country for the market in the coming years, owing to its expanding manufacturing, mining, and agribusiness sectors. Many Brazilian industries face high water scarcity and are investing in reuse and recycling systems. The government's new water reuse guidelines are motivating factories to install on-site treatment plants, which boosts chemical demand.

Middle East And Africa Industrial Water Treatment Market Analysis

The industrial water treatment market in the Middle East and Africa is experiencing steady growth. This expansion is driven by rapid industrialization, water scarcity, and stricter environmental regulations promoting wastewater reuse and desalination. Key industries such as oil and gas, power generation, and manufacturing are increasing investments in advanced treatment technologies, including membranes and chemical solutions.

South Africa Industrial Water Treatment Market Trends

South Africa expects the notable growth in the market. Key drivers include South Africa’s water scarcity pressures (it is among the drier countries globally) which push industries to invest in treatment and reuse technologies. Also, growth of key industrial sectors (mining, oil & gas, chemicals) and rising regulatory/effluent treatment requirements are boosting demand.

Recent Development

- In September 2024, DuPont introduced a digital tool. This tool is specifically designed to estimate the sustainability impact of the use of water treatment technologies, as per the company's claim.(Source: www.indianchemicalnews.com)

Top Vendors in the Industrial Water Treatment Market & Their Offerings:

Ecolab

Corporate Information

- Name: Ecolab Inc. (Ticker: ECL)

- Headquarters: St. Paul, Minnesota, USA

- Employees: ~48,000 globally (2024)

- Operations: More than 170 countries

- Primary business: Water, hygiene, and infection prevention solutions and services for industrial, institutional, food & beverage, healthcare, hospitality, and other sectors.

History and Background

- Established in 1923 as “Economics Laboratory” by Merritt J. Osborn.

Initially produced products such as Absorbit (for carpets) and Soilax (dishwasher soap) for hotels and institutional customers. - Changed name to Ecolab Inc. in 1986 when it broadened its scope, and was listed on the New York Stock Exchange.

Key Developments and Strategic Initiatives

- In July 2021, Ecolab launched a new “Global Chemical Organization” combining its heavy chemical and downstream process industries (CPI) groups, emphasizing holistic water‐/carbon‐/energy‐solution approaches.

- Strong emphasis on water stewardship: In its 2024 “Year in Water,” Ecolab reported helping customers conserve more than 226 billion gallons of water (equivalent to the drinking-water needs of ~781 million people) and set a target of helping conserve 300 billion gallons by 2030.

Mergers & Acquisitions

- November 2024: Ecolab announced the acquisition of Barclay Water Management, a provider of water-safety and digital monitoring solutions in the U.S., to enhance its industrial/institutional water business.

- August 2025: Ecolab entered into a definitive agreement to acquire Ovivo’s Electronics ultra-pure water business for ~US$1.8 billion. This is aimed at strengthening its high-tech water business, especially for semiconductor manufacturing & related sectors.

Partnerships & Collaborations

- Partnership with Digital Realty (data-centers) for AI-driven water conservation solutions.

- Collaboration with Novonesis (bio-solutions) for enzyme-based formulations and circular production initiatives.

- Co-founder of the Water Resilience Coalition (WRC) under the UN Global Compact, working with other major corporations to address global water-stress challenges.

Product Launches / Innovations

- Launch of the new “Ecolab CIP IQ” system (AI-enhanced Clean-In-Place for beverage manufacturers) announced September 2025, integrating fluid sensing, AI and Ecolab’s 3D TRASAR® sensor platform, enabling up to ~15% more efficiency and ~20% water use reduction in CIP processes.

- Continued development of digital solutions and sensors (such as the 3D TRASAR® platform) in water and process management services, driving data-based insights, automation and operational optimization. (See the Digital-Realty collaboration)

Key Technology Focus Areas

- Water treatment & circular water management – Focus on reducing, reusing and repurposing water in industrial operations, especially under water-stress conditions and high-tech sectors (data centers, semiconductors).

- Digital/AI/IoT – Sensor technologies, analytics platforms, machine-learning models for water usage benchmarking, predictive control, automation of water/energy/hygiene operations.

- Circular economy & sustainability – Bio-based chemistries, enzyme technology, reducing resource consumption, focusing on net-zero water and carbon footprints for customers.

R&D Organisation & Investment

- Ecolab has a large global research, development and engineering presence (for example, it opened a 200,000 sq ft global R&D centre in Eagan, Minnesota, in 2005) according to historical sources.

- The company publicly emphasizes its investment in innovation: for example, its participation in a US$10 million funding round led by Emerald Technology Ventures to accelerate deployment of PFAS-treatment technology (LEEF System®) in 2024.

SWOT Analysis

Strengths:

- Very broad global footprint (170+ countries), enabling scale and reach.

- Diverse end-markets (industrial water, food & beverage, healthcare, data centres) which reduces dependency on one sector.

- Strong innovation and digital/IoT capabilities positioning ahead in the “smart water” era.

- Strategic acquisitions and partnerships to bolster high-growth areas (e.g., ultra-pure water for semiconductors).

- Strong sustainability credentials and leadership in water stewardship, valuable as regulatory & ESG pressure grows.

Weaknesses:

- Large complexity: global operations, many business segments may lead to operational/integration challenges.

- Exposure to commodity chemical cost inflation, raw material price volatility, and supply‐chain disruptions.

- Revenue and operations are influenced by macroeconomic cycles (industrial capex, manufacturing slowdowns).

- Margins in chemicals business can be under pressure from competition and regulatory constraints (especially environmental/chemical regulation).

Opportunities:

- Growth in high-tech water demand (data centres, semiconductor fabs, AI infrastructure) where water usage is critical and specialized solutions are needed. (Ecolab is explicitly targeting that)

- Increasing regulatory and ESG pressure globally for water conservation, zero-liquid discharge, reuse providing tailwinds for water-treatment solutions.

- Digital transformation of water/wastewater operations: sensors, analytics, service models shifting from product only to subscription/recurring service models.

- Growth in emerging markets where industrialization and water infrastructure needs are still growing.

- Circular economy and bio‐based chemistries: developing more sustainable offerings aligns with future regulation and customer demand.

Threats:

- Regulatory risks: stricter water/chemical/hygiene regulations could raise compliance costs or limit certain chemistries.

Competitive pressures: many players in industrial water, chemicals, services pricing pressure risk.

Macro-economic downturns or reduction in industrial activity could reduce demand for Ecolab’s industrial water/chemicals business. - Raw material cost inflation and supply-chain disruptions especially for chemical inputs.

- Currency risk and geopolitical risk: global operations expose the firm to currency fluctuations, trade barriers, global supply chain instability.

Recent News & Strategic Updates

- August 2025: Announced acquisition of Ovivo’s Electronics ultra-pure water business (~US$1.8 billion) to expand in semiconductor/manufacturing water solutions.

- September 2025: At a public event (Axios House), CEO Christophe Beck revealed that less than 5% of water used in chip manufacturing is currently recycled highlighting Ecolab’s strategic focus on enabling water reuse in high-tech manufacturing.

Other Top Companies

- Kemira: Kemira is a global leader in sustainable chemical solutions, offering a broad range of high-performing coagulants and polymers, combined with digital services (KemConnect®), to optimize all stages of industrial wastewater treatment and enable resource recovery.

- Solenis: Solenis provides one of the most comprehensive portfolios of advanced wastewater treatment chemicals and expertise, including flocculants, coagulants, and bioaugmentation technologies.

SNF Floerger: SNF is a world leader in manufacturing polyacrylamide-based flocculants and coagulants, which are crucial for solid/liquid separation in industrial wastewater treatment. - Veolia Environnement

- SUEZ

- Xylem Inc.

- DuPont (Water-related business / Membranes & chemicals)

- Pentair plc

- Kurita Water Industries Ltd.

- Evoqua Water Technologies

- WABAG (VA Tech Wabag Ltd.)

- Thermax Ltd.

- Doosan (Doosan Heavy / Doosan Enerbility)

- Aquatech International

- Fluence Corporation

- BWA Water Additives / BASF (water chemicals players)

- Calgon Carbon / Cabot (activated carbon & specialty solutions)

- Hitachi / Mitsubishi Electric (industrial systems & process equipment)

- 3M (industrial filtration & membranes)

Segments Covered in the Report

By Product Type

Equipment & Systems (membranes, filters, pumps, ZLD units, desalination units)

- Reverse osmosis / NF / UF membrane systems

- Sand/multimedia filtration

- Pumps, valves, control hardware

- Thermal desalination/evaporators / ZLD

- Pretreatment skids / modular units

Water Treatment Chemicals & Consumables (antiscalants, biocides, coagulants, polymers, corrosion inhibitors)

- Antiscalants & antifoulants

- Biocides/disinfectants

- Coagulants & flocculants

- Corrosion/scale inhibitors

Operation & Maintenance (O&M) services

- Long-term O&M contracts

- Site labor & consumables management

Digital Monitoring, Automation & Analytics (IoT, SaaS, remote monitoring)

- Remote sensors & telematics

- Cloud analytics / predictive maintenance

Spare Parts & Aftermarket

Other (rental, temporary/mobile treatment)

By Technology / Process

- Membrane Separation (RO / NF / UF)

- Biological Treatment (activated sludge, MBBR, SBR)

- Physical / Chemical Treatment (coagulation, flocculation, conventional filtration)

- Ion Exchange & Adsorption (activated carbon, specialty media)

- Thermal Processes (evaporation, multi-effect evaporators, distillation for ZLD)

- Electrochemical & Advanced Oxidation (AOP, electrocoagulation)

- Other / Niche (constructed wetlands, emerging tech)

By End-User Industry

Power & Utilities (boiler feed, cooling, flue gas desulfurization make-up)

- Oil & Gas / Petrochemical

- Chemicals & Pharmaceuticals

- Food & Beverage

- Metals & Mining

- Semiconductor & Electronics (process & ultra-pure water)

- Pulp & Paper

- Textile

- Other industrial end-users

By Deployment Type

- On-site / Engineered, fixed installations

- Packaged / Modular / Skid-mounted systems

- Cloud-native / digital-only solution subscriptions

- Mobile / Temporary treatment units

By Sales / Distribution Channel

- Direct sales / OEM accounts

- Distributors & regional dealers

EPC contractors/system integrators (project channel) - Aftermarket / Service providers

- Online/digital marketplaces & e-channels

By Region

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa