Content

What is the Current Industrial Liquid Waste Management Market Size and Share?

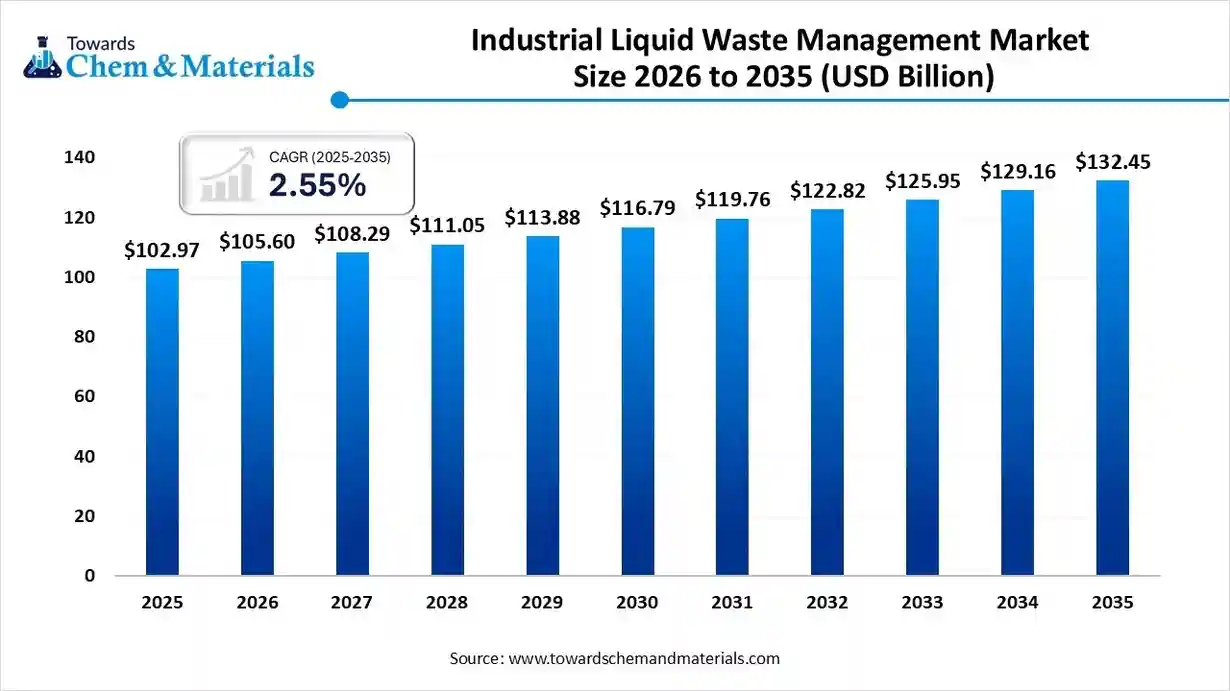

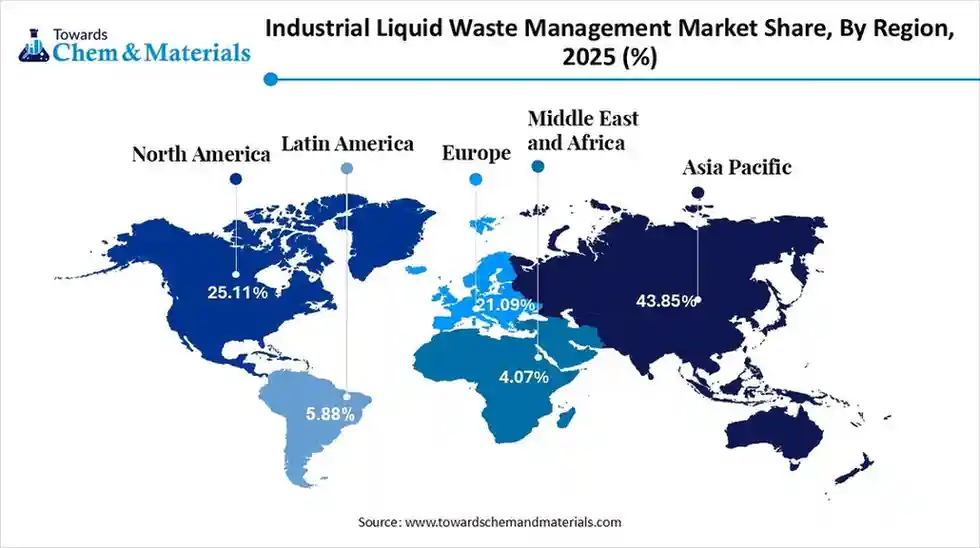

The global industrial liquid waste management market size is estimated at USD 102.97 billion in 2025 and is predicted to increase from USD 105.60 billion in 2026 and is projected to reach around USD 132.45 billion by 2035, The market is expanding at a CAGR of 2.55% between 2026 and 2035. Asia Pacific dominated the industrial liquid waste management market with a market share of 43.85% the global market in 2025. The growing public awareness of water pollution globally is the key factor driving market growth. Also, a rise in global water crises, coupled with the advancements in treatment technologies, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific led the industrial liquid waste management market with the largest revenue share of over 43.85% in 2025. The dominance of the region can be attributed to the rapid urbanization, industrialization, and population growth.

- By region, Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by rapid investment in smart, advanced, and energy-efficient infrastructure.

- By waste type, the wastewater & effluents segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to the increasing industrialization, which creates huge waste volumes.

- By waste type, the hazardous liquid waste segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the stringent environmental regulations.

- By service type, the treatment & disposal services segment held the largest market share in 2025. The dominance of the segment can be linked to the ongoing development of convenient methods.

- By service type, the resource recovery & reuse services segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the extensive adoption of circular economy principles.

- By treatment method, the physical & chemical treatment segment dominated the market with the largest share in 2025. The dominance of the segment is owed to the surge in industrialization globally.

- By treatment method, the advanced treatment technologies segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to increasing environmental consciousness among major organisations.

- By industry vertical, the manufacturing & industrial processing segment held the largest market share in 2025. The dominance of the segment can be attributed to the rapid technological innovations in waste treatment.

- By industry vertical, the mining & metal processing segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growing need for sophisticated solutions.

What is the Industrial Liquid Waste Management Market?

The market is an important industry that emphasises the systematic handling, treatment, and disposal of liquid wastes created by industrial and production processes. The market also addresses the public health and environmental threats posed by different types of liquid waste, ranging from various materials.

Industrial Liquid Waste Management Market Trends

- The market players are increasingly embracing innovative technologies to enhance safety, efficiency, and compliance, which is the latest trend in the market. Advancements such as supercritical water oxidation and advanced oxidation processes (AOPs) are creating more efficient removal of complex and hazardous contaminants.

- The growth in industrial activities, especially in developing economies such as China and India, is creating higher volumes and complexities of liquid waste. This, along with the ongoing population growth and industrialization, offers lucrative growth opportunities in the market soon.

- Governments across the globe are increasingly implementing and enforcing stringent directives and guidelines for industrial effluent discharge. The regulatory pressure is one of the major drivers of the market growth, manufacturers are heavily investing in sectors such as chemicals and pharmaceuticals.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 105.60 Billion |

| Revenue Forecast in 2035 | USD 132.45 Billion |

| Growth Rate | CAGR 2.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Waste Type, By Service Type, By Treatment Method, By Industry Vertical, By Region |

| Key companies profiled | Clean Harbors, SUEZ, Waste Management, Inc. (WM), Clean Harbors, Inc., Republic Services, Inc. , Stericycle, Inc, GFL Environmental Inc, Biffa plc , REMONDIS SE & Co. KG, Va Tech Wabag Ltd. |

How Cutting Edge Technologies are revolutionizing the Industrial Liquid Waste Management Market?

The integration of advanced technologies is revolutionizing the market, shifting it from a conventional disposal-emphasized activity to a sustainable, efficient, and resource-recovery-oriented process. Furthermore, advancements in novel chemical treatments and separation techniques are enabling unprecedented levels of contaminant removal, water reuse, and cost efficiency.

Trade Analysis of Industrial Liquid Waste Management Market: Import & Export Statistics

- In February 2024, China's chemical and allied product exports fell to $163.54 billion from $218.92 billion in January, a decrease from the prior month but still well above the historical average of $73.72 billion since 1993.

Exports

- In 2024, Japan exported ¥140M of Residual products of the chemical or allied industries, being the 971st most exported product in Japan.

- In 2024, the main destinations of Japan's Residual products of the chemical or allied industries exports were: Hong Kong (¥66.6M), Malaysia (¥34.3M), Thailand (¥19.7M), Chinese Taipei (¥11.7M), and China (¥4.76M).

Imports

- In 2024, Japan imported ¥5.66B of Residual products of the chemical or allied industries, being the 741st most imported product in Japan.

- In 2024, the main origins of Japan's Residual products of the chemical or allied industries imports were: Norway (¥4.36B), Germany (¥996M), South Korea (¥154M), China (¥99.4M), and the United States (¥31M).

Industrial Liquid Waste Management Market Value Chain Analysis

- Feedstock Procurement : It is the crucial process of sourcing, collecting, identifying, and transporting industrial liquid waste materials for the purpose of resource recovery, treatment, and energy generation.

- Major Players: SUEZ, Clean Harbors, Inc.

- Chemical Synthesis and Processing :It refers to the specific services and technologies necessary to handle the complex and hazardous liquid effluents generated by the broader chemical industry.

- Major Players: Clean Harbors, Inc., Waste Management, Inc.

- Packaging and Labelling : It is the necessary process, and regulatory requirements include in containing and characterizing liquid waste for safe handling, transport, storage, and disposal.

- Major Players: Biffa Plc, Republic Services, Inc.

- Regulatory Compliance and Safety Monitoring: This stage involves adhering to a complicated network of local, national, and international laws aimed at safeguarding human health and the environment.

- Major Players: ERM, Corpseed ITES Pvt. Ltd.

Industrial Liquid Waste Management Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The Environmental Protection Agency (EPA) enforces strict regulations under the Clean Water Act (CWA) and the Resource Conservation and Recovery Act (RCRA). |

| Europe (EU) | The new EU Waste Shipment Regulation, in force since May 2024, tightens rules on the movement of waste within and outside the EU, aiming to prevent waste dumping in non-OECD countries and promoting a circular economy. |

| China | Regulations are becoming increasingly stringent. The primary laws include the Law on Prevention and Control of Water Pollution and the Action Plan for Prevention and Control of Water Pollution. |

Segmental Insights

Waste Type Insights

How Much Share Did the Wastewater & Effluents Segment Held in 2025?

The wastewater & effluents segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to the increasing industrialization, creating huge waste volumes and a surge in environmental awareness, driving sustainable practices. In addition, advancements in waste-to-energy, anaerobic digestion, and recycling can enhance cost-effectiveness and efficiency.

The hazardous liquid waste segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the stringent environmental regulations and increasing demand for advanced tech for resource recovery. Hazardous waste can have valuable materials, which makes recovery economically feasible, driving growth in specialized management.

Service Type Insights

Which Service Type Segment Dominated Industrial Liquid Waste Management Market in 2025?

The treatment & disposal services segment held the largest market share in 2025. The dominance of the segment can be linked to the ongoing development of convenient methods that improve treatment viability and efficiency. The increase of modular treatment systems provides cost-effective and flexible solutions for remote industrial facilities.

The resource recovery & reuse services segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the extensive adoption of circular economy principles and increasing concerns over water sustainability and scalability. Moreover, Advanced filtration systems are improving the efficiency of contaminant removal.

Treatment Method Insights

How Much Share Did the Physical & Chemical Treatment Segment Held in 2025?

The physical & chemical treatment segment dominated the market with the largest share in 2025. The dominance of the segment is owing to the surge in industrialization globally and advancements in membrane filtration techniques. Corporate sustainability initiatives' inclination towards ZLD systems, preferred treatment processes, which reduce overall environmental impact.

The advanced treatment technologies segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to increasing environmental consciousness among major organisations and the public's push towards responsible waste management. Furthermore, the integration of AI-driven analytics and Internet of Things (IoT) sensors enables predictive maintenance, leading to segment growth soon.

Industry Vertical Insights

Which Industry Vertical Type Segment Dominated Industrial Liquid Waste Management Market in 2025?

The manufacturing & industrial processing segment held the largest market share in 2025. The dominance of the segment can be attributed to the rapid technological innovations in waste treatment, coupled with the increasing need for water reuse. The development and use of convenient treatment methods will contribute to positive segment growth soon.

The mining & metal processing segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growing need for sophisticated solutions such as AI monitoring and other cutting-edge oxidation processes to manage tedious waste streams. Furthermore, emphasis on resource recovery fuels innovation in treatment technologies.

Regional Insights

The Asia Pacific industrial liquid waste management market size is valued at USD 45.15 billion in 2025 and is expected to surpass around USD 58.19 billion by 2035, expanding at a compound annual growth rate (CAGR) of 2.57% over the forecast period from 2026 to 2035. Asia Pacific dominated the market with the largest share in 2025. The dominance of the region can be attributed to the rapid urbanization, industrialization, and population growth, especially in emerging economies. In addition, Governments across the region are enforcing stringent pollution control laws, pushing industries to adopt innovative treatment solutions and services.

China Industrial Liquid Waste Management Market Trends

In the Asia Pacific, China dominated the market owing to a surge in public awareness, and the incorporation of corporate social responsibility (CSR) impels organisations to adopt sustainable waste management. Also, strong national emphasis on circular economy principles fuels the adoption of advanced technologies like ZLD.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing investment in tech for resource recovery and recycling. The region also benefits from a well-established waste management infrastructure, leading to further market expansion.

U.S. Industrial Liquid Waste Management Market Trends

In North America, the U.S. led the market due to expansion sectors such as manufacturing, pharmaceuticals, chemicals, and food processing, which create substantial liquid waste, and a growing demand for management services. Also, government policies and sector emphasis on modernizing wastewater treatment optimise market growth.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by rapid investment in smart, advanced, and energy-efficient infrastructure. Furthermore, a strong focus on recycling, water reuse, and recovering resources from waste streams boosts demand for advanced treatment and recovery technologies.

Germany Industrial Liquid Waste Management Market Trends

The growth of the market in the country can be fueled by its extensive production base and high emphasis on sustainability. There is also a growing trend among German market players to enforce the Zero-Liquid Discharge systems. Both private and public sectors are increasingly investing in modern infrastructure to upgrade wastewater treatment facilities.

South America held a major market share in 2025. The growth of the region can be boosted by growing corporate and public conveners, along with the growing demand for advanced automation, filtration, and digital monitoring techniques by various organizations. The market is witnessing increased adoption of cutting-edge treatment technologies, driving regional growth soon.

Brazil Industrial Liquid Waste Management Market Trends

The growth of the market in the country can be propelled by increasing economic development and urban populations, creating more waste, necessitating smooth liquid management systems. Growing corporate responsibility programs encourage water reuse and circular economy practices.

The growth of the market in the Middle East & Africa can be boosted by ongoing urbanization and extensive industrial growth in the major countries in the region. Rising environmental awareness and stringent rules push industries to adopt better practices. Also, a partnership between private entities and the government is important for developing and funding large-scale infrastructure.

Saudi Arabia Industrial Liquid Waste Management Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be linked to the surge in industrial waste volume and the increase in the need for better collection. Heavy investments in oil/gas and manufacturing, infrastructure generate more liquid waste, necessitating innovative management.

Recent Developments

- In June 2025, Veolia acquired 3 U.S. firms to grow in the business of waste treatment. Veolia's leadership in harmful waste management enables the company to meet consumer needs and to ensure environmental security for communities.(Source: www.alchempro.com)

- In April 2024, Thermax opens a new production factory for wastewater and water solutions in Pune. This marks a substantial step aligned with Thermax's broader mission of preserving and conserving the future.(Source: www.indianchemicalnews.com)

Industrial Liquid Waste Management Market Companies

- SUEZ: SUEZ is a preeminent global leader in the liquid waste management market, specializing in the collection, treatment, and recovery of domestic and industrial wastewater. With over 160 years of operational history.

- Clean Harbors: Clean Harbors is a dominant force and North America's leading provider of comprehensive environmental and industrial services, with a particularly robust and vertically integrated operation in the industrial liquid waste management market.

Other Companies in the Market

- Clean Harbors

- SUEZ

- Waste Management, Inc. (WM)

- Clean Harbors, Inc.

- Republic Services, Inc.

- Stericycle, Inc

- GFL Environmental Inc

- Biffa plc

- REMONDIS SE & Co. KG

- Va Tech Wabag Ltd.

Segments Covered in the Report

By Waste Type

- Wastewater & effluents

- Sludge & slurry waste

- Oily waste

- Hazardous liquid waste

By Service Type

- Treatment & disposal services

- Collection & transportation services

- Recycling & recovery services

- Resource recovery & reuse services

By Treatment Method

- Physical & chemical treatment

- Biological treatment

- Thermal treatment

- Advanced treatment technologies (membrane, ZLD, AOPs)

By Industry Vertical

- Manufacturing & industrial processing

- Oil & gas

- Chemicals & petrochemicals

- Food & beverages

- Pharmaceuticals

- Power generation

- Mining & metal processing

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa