Content

Water & Wastewater Treatment Market Size and Growth 2025 to 2034

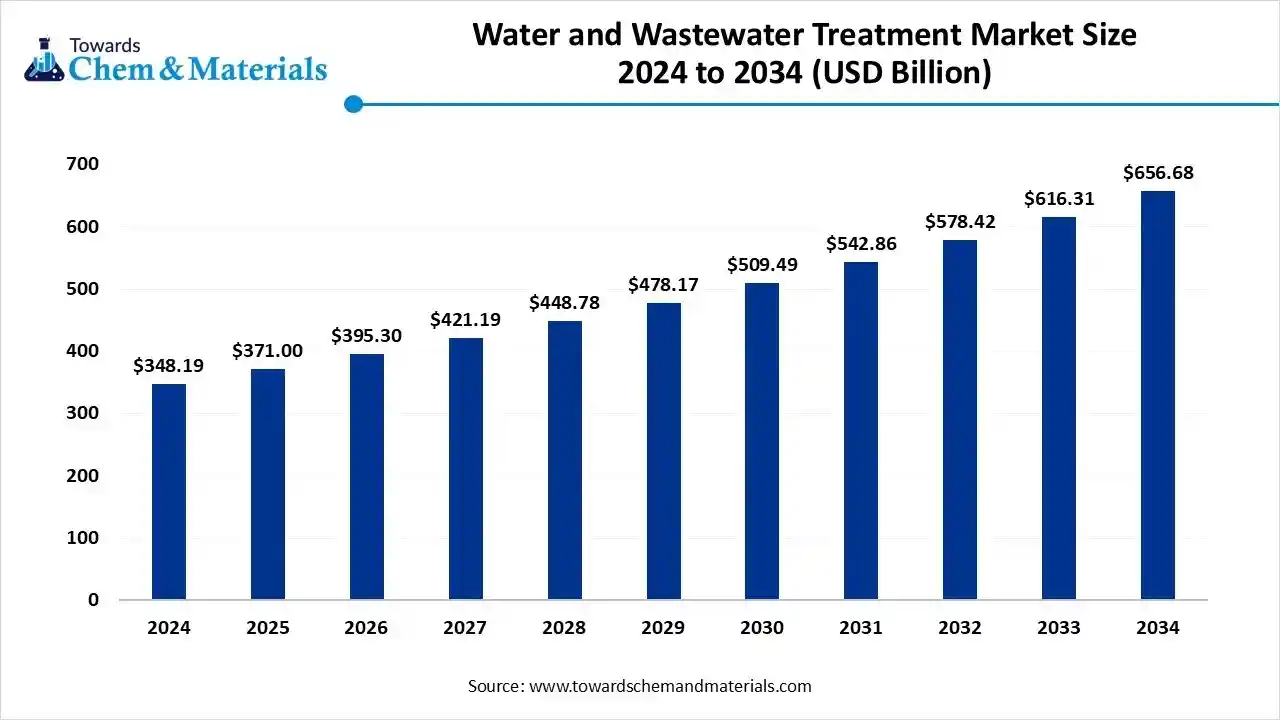

The water & wastewater treatment market size is calculated at USD 348.19 billion in 2024, grew to USD 371.00 billion in 2025, and is projected to reach around USD 656.68 billion by 2034. The market is expanding at a CAGR of 6.55% between 2025 and 2034. The increasing water scarcity issues, growing manufacturing activities, and stricter regulations for water quality drive the market growth.

Key Takeaways

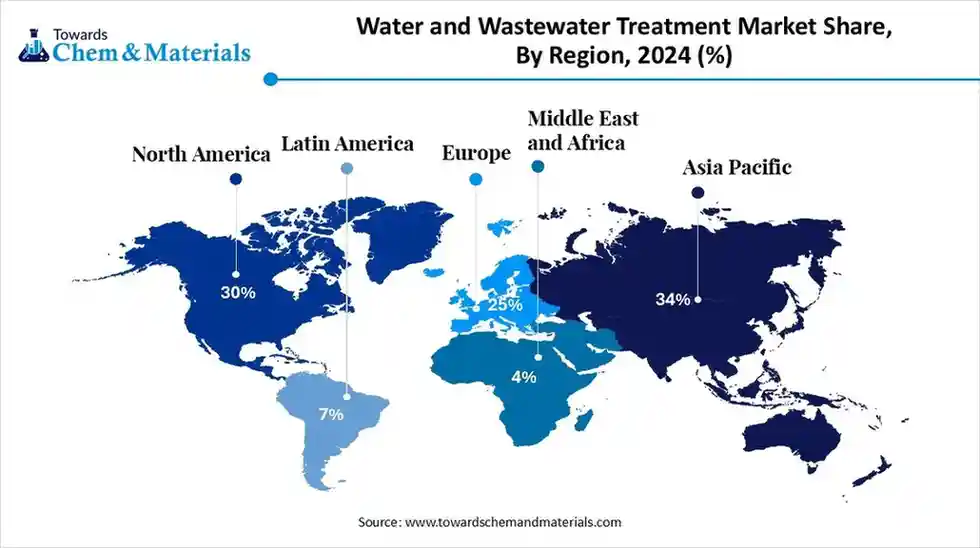

- By region, Asia Pacific held approximately a 34% share in the market in 2024.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period.

- By end-user industry, the municipal segment held approximately a 42% share in the market in 2024.

- By end-user industry, the industrial segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By treatment objective, the wastewater treatment segment held approximately a 38% share in the water & wastewater treatment market in 2024.

- By treatment objective, the water reuse/recycling segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By treatment technology, the biological processes segment held approximately a 33% share in the market in 2024.

- By treatment technology, the membrane processes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the pumps & motors segment held approximately a 28% share in the market in 2024.

- By product, the membranes & modules segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By deployment, the public/municipal segment held approximately a 50% share in the market in 2024.

- By deployment, the decentralized/on-site segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By capacity, the large segment held approximately a 36% share in the market in 2024.

- By capacity, the small segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Water Treatment and Wastewater Treatment?

Water treatment is a process of eliminating impurities from natural water sources, whereas wastewater treatment is the process of removing contaminants from used water. Water & Wastewater treatment uses biological, physical, and chemical methods to remove contaminants from water. It offers benefits like prevention of diseases, reduction of pollution, conservation of water resources, safeguarding aquatic life, and access to safe drinking water.

Factors driving the growth of the water & wastewater treatment market are increasing demand for clean drinking water, stringent regulations on water quality, increasing awareness about water scarcity, high demand for water treatment chemicals, and growth in the development of effective water treatment solutions.

Water & Wastewater Treatment Products Export Data

- Vietnam exported 2647 shipments of the water treatment chemical.(Source:www.volza.com)

- China exported 405 shipments of wastewater treatment equipment.(Source: www.volza.com)

- China exported 960 shipments of water treatment plants.(Source: www.volza.com)

- Russia exported 127 shipments of biological wastewater treatment.(Source: www.volza.com)

- IE HSING INTERNATIONAL CHEMICAL CO LTD is the leading supplier of wastewater treatment chemicals in the world.(Source: www.volza.com)

Growing Industrialization Drives Market Growth

The rapid urbanization and growing industrial activities across various countries increase demand for water & wastewater treatment. The growing utilization of water in activities like cleaning, production, and cooling in various industrial processes increases demand for water & wastewater treatment. The growing expansion of industries like food & beverage, paper production, chemical, oil & gas, pharmaceuticals, and manufacturing increases the generation of wastewater that requires water & wastewater treatment.

The stricter government regulations for water conservation and diverse industrial applications increase demand for wastewater treatment. The growing industrialization is a key driver for the growth of the water & wastewater treatment market.

Market Trends

- Growing Water Scarcity: The growing population and increasing water scarcity problems in various countries increase demand for water treatment. The limited freshwater resources increase the adoption of water treatment.

- Stricter Environmental Regulations: The stringent government regulations on wastewater discharge and clean water increase demand for wastewater treatment.

- Growing Waterborne Diseases: The growing rate of waterborne diseases like thyroid, cryptosporidiosis, typhoid, and hepatitis increases demand for water treatment to produce clean water.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 371.00 Billion |

| Expected Size by 2034 | USD 656.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By End-User Industry, By Treatment Objective, By Treatment Technology / Method, By Product / Equipment, By Deployment / Ownership Model, By Capacity / Plant Size, By Region |

| Key Companies Profiled | Veolia, SUEZ, Xylem Inc., Danaher Corporation, Evoqua Water Technologies, Ecolab (Nalco Water), Pentair PLC, Grundfos, Kurita Water Industries, IDE Technologies, Doosan Heavy Industries & Construction, Thermax Ltd., Mitsubishi Heavy Industries, Fluence Corporation, Aquatech International, Ovivo Inc., Alfa Laval, KSB SE & Co. KGaA, Sulzer Ltd., Hach Company |

Market Opportunity

Technological Advancements Unlock Market Opportunity

The ongoing technological advancements, like nanotechnologies, integration with smart technologies, and development of bio-based solutions, enhance sustainability and efficiency. The development includes advanced filtration such as nanofiltration & RO, and advanced oxidation processes help in disinfecting water and produce high water quality. The integration of IoT and AI helps in monitoring real-time water quality.

The development of hybrid systems and decentralized systems enhances water availability and treats complex wastewater. The growing utilization of energy recovery technologies and zero liquid discharge helps to recover all water and lowers operational costs. The technological advancements create an opportunity for the growth of the water & wastewater treatment market.

Market Challenge

High Operational Cost Halts Market Expansion

Despite several benefits of water & wastewater treatment in various water problems, the high operational cost restricts the market growth. Factors like high labor costs, regular maintenance, stricter regulatory compliance, high utilization of chemicals, and extensive consumption of energy are responsible for high operational costs.

The high consumption of energy due to equipment like blowers & power pumps, and the need for skilled labor, increases the cost. The extensive use of chemicals like flocculation, pH balancing, & coagulation, and the need for electronic, mechanical, and electrical component maintenance, requires high cost. The development of sludge & waste disposal and complexity in treatment technologies increases the cost. The high operational cost hampers the growth of the water & wastewater treatment market.

Regional Insights

Asia Pacific Water & Wastewater Treatment Market Size, Industry Report 2034

The Asia Pacific water & wastewater treatment market size was estimated at USD 118.38 billion in 2024 and is projected to reach USD 223.67 billion by 2034, growing at a CAGR of 6.57% from 2025 to 2034. Asia Pacific dominated the water & wastewater treatment market with approximately 34% share in 2024.

The rapid urbanization and growth in industrial activities increase the demand for water treatment. The growing water scarcity issues and increasing government investment in wastewater infrastructure help the market growth. The growing demand for clean water and high generation of wastewater from industries like manufacturing, pharmaceuticals, and chemicals increases demand for water & wastewater treatment, driving the overall market growth.

- India exported 3699 shipments of the water treatment chemical.(Source: www.volza.com)

- India exported 4042 shipments of water treatment plant. (Source: www.volza.com)

India Water & Wastewater Treatment Market Trends

India is a major contributor to the water & wastewater treatment market. The presence of limited freshwater resources and a growing generation of wastewater increases demand for wastewater treatment. The increasing water scarcity issues and strong focus on improving water infrastructure increase demand for water treatment. The growth in the food & beverage industry and the increasing reuse of industrial & municipal water increase demand for wastewater treatment, supporting the overall market growth.

Middle East & Africa Water & Wastewater Treatment Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growing water scarcity problems and the increasing need for safe drinking water increase demand for water treatment. The growing expansion of industries like mining, oil & gas, and manufacturing increases the adoption of wastewater treatment. The stringent government regulations on water quality and the well-established water treatment infrastructure support the overall market growth.

Saudi Arabia Water & Wastewater Treatment Market Trends

Saudi Arabia is a key contributor to the market. The growing demand for clean water and the limited presence of freshwater resources increase the demand for water treatment. The growing generation of industrial wastewater and increasing water contamination increase demand for wastewater treatment. The well-established desalination infrastructure and stricter regulations on wastewater drive the market growth.

Segmental Insights

End-User Industry Insights

Which End-User Industry Dominated the Water & Wastewater Treatment Market?

The municipal segment dominated the water & wastewater treatment market with an approximately 42% share in 2024. The growing demand for clean drinking water and rising agricultural activities increase the demand for municipal water. The stricter regulations on municipal water and a strong government focus on treating wastewater increase demand for wastewater treatment. The growing applications, such as recreational activities, domestic use, and public facilities, increase demand for water treatment, driving the overall market growth.

The industrial segment is the fastest-growing in the market during the forecast period. The growing food processing sector and the growth in manufacturing activities increase demand for wastewater treatment. The growing generation of wastewater through industries like oil & gas and chemicals increases the demand for wastewater treatment. The increasing industrial activities and stricter regulations on water pollution increase demand for water treatment, supporting the overall market growth.

Treatment Objective Insights

How Wastewater Treatment Segment Held the Largest Share in the Water & Wastewater Treatment Market?

The wastewater treatment segment held the largest revenue share of approximately 38% in the market in 2024. The growing water strain resources and increased generation of wastewater increase demand for wastewater treatment. The stricter standards on wastewater discharge and increasing manufacturing activities' wastewater increase demand for wastewater treatment. The strong focus on water stewardship and the increasing volume of complex wastewater increase demand for wastewater treatment, driving the overall market growth.

The water reuse/recycling segment is experiencing the fastest growth in the market during the forecast period. The lowering availability of freshwater and the high scarcity of water increase demand for water reuse. The increasing overexploitation of freshwater resources and the strong government focus on water conservation increase demand for water recycling. The increasing pressure on natural water resources and growing industrial development increase demand for water reuse, supporting the overall market growth.

Treatment Technology Insights

Why is the Biological Processes Segment Dominating the Water & Wastewater Treatment Market?

The biological processes segment dominated the market with an approximately 33% share in 2024. The strong focus on environmental sustainability and cost-effectiveness increases demand for biological processes. The increasing need for removing phosphorus & nitrogen from waterways and the focus on producing less sludge increase demand for biological processes. The growing water scarcity and a strong focus on sustainable wastewater management increase the adoption of biological processes, driving the market growth.

The membrane processes segment is the fastest-growing in the market during the forecast period. The increasing strain on water resources and stringent regulations on wastewater discharge increase demand for membrane processes. The strong focus on removing contaminants from high-quality treated water and increasing the utilization of water reuse increases demand for membrane processes. The growing demand for high-purity water in various industries requires membrane processes, supporting the overall market growth.

Product / Equipment Insights

How the Pumps & Motor Segment Held the Largest Share in the Water & Wastewater Treatment Market?

The pumps & motors segment held the largest revenue share of approximately 28% in the market in 2024. The strong focus on transporting raw water and moving sludge & sewage through diverse stages increases demand for pumps & motors. The focus on lowering contaminants from water and increasing the development of water supply systems increases the adoption of pumps & motors. The strong focus on handling fluids and chemicals increases the adoption of pumps, driving the overall market growth.

The membranes & modules segment is experiencing the fastest growth in the market during the forecast period. The growing need for clean water and stricter regulations on wastewater discharge increase demand for membranes & modules. The growing contaminants like impurities, bacteria, & viruses in water increase the adoption of membranes. The focus on sustainable water management and large-scale municipal water treatment plants requires membranes & modules, supporting the overall market growth.

Deployment / Ownership Model Insights

Why is the Public or Municipal Segment Dominating the Water & Wastewater Treatment Market?

The public or municipal segment dominated the market with an approximately 50% share in 2024. The stricter regulations on drinking water quality and the government investment in water infrastructure increase demand for water treatment. The focus on public sewage management and the focus on lowering water contamination risks increase the adoption of wastewater treatment. The growing desalination projects and high pressure on municipalities to enhance water quality increase demand for water treatment, driving the market growth.

The decentralized/on-site segment is the fastest-growing in the market during the forecast period. The presence of large sewer networks and the expansion of industrial sites increase the adoption of decentralized systems. The increasing recovery of water for reuse and the focus on lowering water pollution increase demand for water treatment. The increasing implementation of decentralized plants and the expansion of on-site water treatment plants are driving the market growth.

Capacity Insights

Which Capacity Segment Held the Largest Share in the Water & Wastewater Treatment Market?

The large (10000-100000 m3/day) segment held the largest revenue share of approximately 36% in the market in 2024. The strong focus on safe water supply and lower treatment cost per unit increases the development of large plants. The growing demand for safe water and increasing awareness about waterborne diseases increase the development of large plants. The lower operational cost and rise in integrations like MBRs and SBRs filtration increases the development of large plants, driving the overall market growth.

The small (<1000 m3/day) segment is experiencing the fastest growth in the market during the forecast period. The focus on lowering the water strain on municipal systems and compact space increases the development of small plants. The ease of installation and strong focus on environmental sustainability increase demand for small plants. The ease of maintenance and high efficiency of smaller plants in industries, municipalities, & commercial facilities support the market growth.

Water & Wastewater Treatment Market Value Chain Analysis

- Chemical Synthesis and Processing: The chemical synthesis and processing involve methods like precipitation, oxidation, ion exchange, coagulation, neutralization, flocculation, and disinfection.

- Quality Testing & Certification: The quality testing involves biological parameters like viruses & bacteria, physical properties like temperature, turbidity, & color, and chemical properties like nutrients, pH, chloride, hardness, & dissolved oxygen, and certifications like WQA Gold Seal, Water Professionals International, & ISO 14001.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance includes the conduct of regular monitoring, following operational standards, stricter limits on pollutants, & obtaining necessary licenses. Safety monitoring involves hazard identification, checking water quality properties, monitoring system early warning, and safe discharge of wastewater.

Recent Developments

- In March 2025, DuPont Water Solutions launched Wave PRO for water treatment applications. It is useful in applications like industrial utility water, seawater desalination, drinking water, and wastewater. WAVE PRO updates automatically and helps reduce the carbon footprint.(Source: www.dupont.com)

- In June 2025, Toray launched the Water Treatment Technology Center in Saudi Arabia. It utilizes spanning membrane solutions and aims to provide clean water. The facility uses advanced membrane and reverse osmosis technology.(Source: chemindigest.com)

- In April 2024, Thermax launched a new facility for water treatment solutions in Pune. The facility is present in a 2-acre area and consists of advanced production techniques. The facility offers a solution for wastewater and water treatment.(Source: infra.economictimes.indiatimes.com)

Water & Wastewater Treatment Market Top Companies

- Veolia

- SUEZ

- Xylem Inc.

- Danaher Corporation

- Evoqua Water Technologies

- Ecolab (Nalco Water)

- Pentair PLC

- Grundfos

- Kurita Water Industries

- IDE Technologies

- Doosan Heavy Industries & Construction

- Thermax Ltd.

- Mitsubishi Heavy Industries

- Fluence Corporation

- Aquatech International

- Ovivo Inc.

- Alfa Laval

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Hach Company

Segments Covered

By End-User Industry

- Municipal utilities (potable & sewage)

- Industrial (process water & industrial effluent)

- Commercial & Institutional (hospitals, hotels, offices)

- Residential (building/community-level systems)

- Agricultural / Irrigation

By Treatment Objective

- Potable water treatment

- Wastewater treatment for discharge

- Water reuse/recycling (non-potable & indirect potable)

- Desalination (seawater & brackish)

- Sludge/biosolids treatment

By Treatment Technology / Method

- Physical separation (screening, sedimentation, clarification, DAF)

- Filtration (sand/media/cartridge)

- Membrane processes (MF / UF / NF / RO / FO / MD)

- Biological processes (activated sludge, MBR, SBR, biofilm)

- Chemical treatment (coagulation/flocculation, pH adjustment, precipitation)

- Disinfection (chlorination, UV, ozone)

- Ion exchange & adsorption (carbon, resins)

- Advanced oxidation processes (AOPs)

- Thermal processes (evaporation, crystallization, incineration for sludge)

- Electrochemical processes (electrocoagulation, electrooxidation)

By Product / Equipment

- Membranes & modules

- Pumps & motors

- Clarifiers & sedimentation tanks

- Biological reactors

- Filtration units

- Disinfection equipment

- Sludge dewatering & drying equipment

- Chemical dosing & storage systems

- Control & automation systems

- Desalination-specific units

By Deployment / Ownership Model

- Public / Municipal

- Private / Industrial captive

- Public-Private Partnerships (PPP) / BOT / BOOT

- Decentralized / On-site systems

By Capacity / Plant Size

- Small (< 1,000 m³/day)

- Medium (1,000–10,000 m³/day)

- Large (10,000–100,000 m³/day)

- Very large (>100,000 m³/day)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait