Content

Boiler Market Size and Growth 2025 to 2034

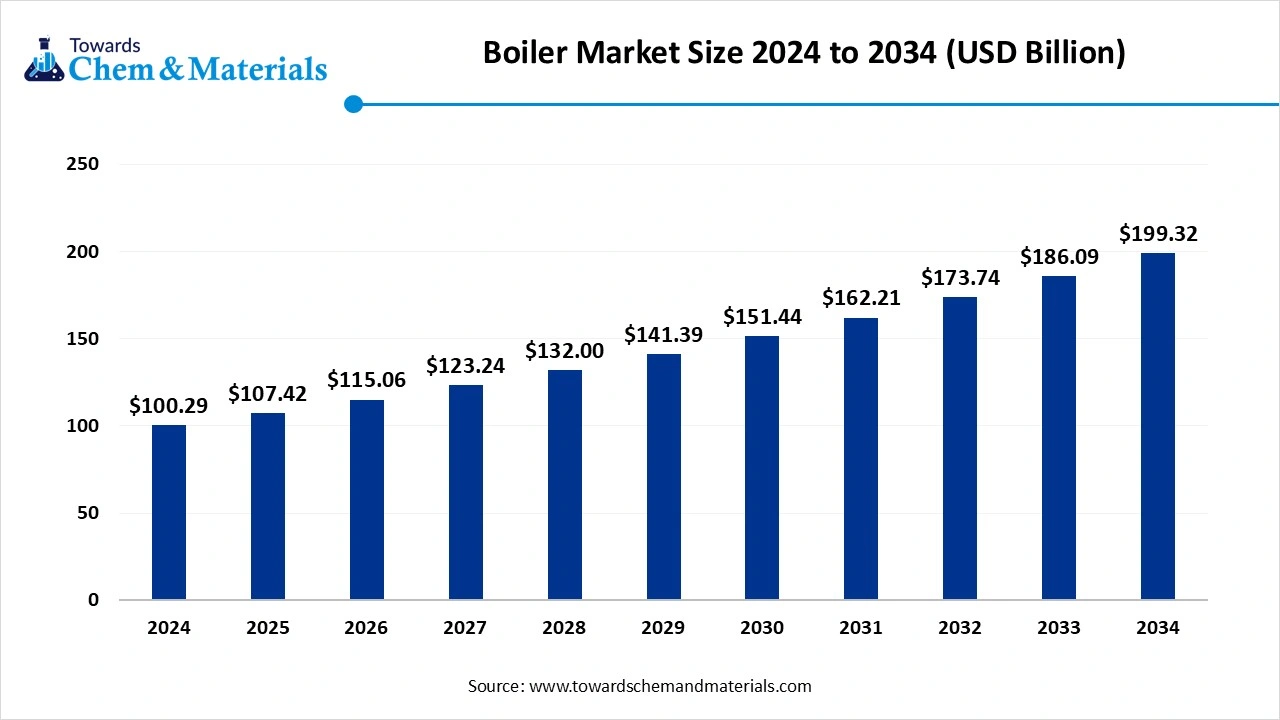

The global boiler market size was reached at USD 100.29 billion in 2024 and is expected to be worth around USD 199.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period 2025 to 2034. The ongoing global infrastructure development has fueled industry potential in the current period.

Key Takeaways

- By region, Asia Pacific dominated the boiler market in 2024, owing to the fast-paced industrial growth in recent years.

- By region, Middle East & Africa is expected to grow at a notable rate in the future, akin to the increased need for energy and rapid industrialization in recent years.

- By type, the fire tube boiler segment led the market in 2024, due to having unique properties such as easy installation, reliability, and simplicity.

- By type, the water tube boiler segment is expected to grow at the fastest rate in the market during the forecast period, akin to the enlarged expansion of the large-scale industrial operations globally.

- By capacity type, the 10-50 MMBTU/HR segment emerged as the top-performing segment in 2024, due to having the heating capacity needed in medium-sized industries.

- By capacity type, the >100 MMBTU/HR segment is expected to lead the market in the coming years, due to the sudden expansion of the power plants and the heavy industries.

- By fuel type, the natural gas-fired segment led the market in 2024, he an increased need for cleaner and cheaper fuel than coal and oil.

- By fuel type, the biomass-fired segment captured the biggest portion of the market in 2024, the increasing need for renewable energy.

- By pressure type, the low-pressure (<15psi) segment captured the biggest portion of the market in 2024, because they are suitable for residential heating, small commercial setups, and industries that do not need high steam pressure.

- By pressure type, the high-pressure (>150psi) segment is anticipated to expand at the highest rate in the coming years, because they are crucial for large industries that need high-temperature steam, such as chemical plants, refineries, and power stations.

- By technology, the non-condensing segment led the market in 2024 as its lower upfront cost, simplicity, and ease of maintenance.

- By technology type, the condensing boiler segment is expected to grow at the fastest rate in the market during the forecast period because they are energy-efficient and eco-friendly.

- By end use, the residential segment led the market in 2024 as most homes use boilers for space heating and hot water.

- By end use, the industrial segment is expected to grow at the fastest rate in the market during the forecast period due to rising manufacturing, food processing, chemical production, and power generation activities.

- By application type, the steam generation segment emerged as the top consumer of the market in 2024, because it's a primary use of boilers across many industries.

- By application type, the process heating segment is likely to witness the most rapid growth in the market in the years ahead, because it is used in industries such as chemicals, oil refining, and food processing.

Market Overview

Boilers at the Core of Power, Manufacturing, and Domestic Heating

The boiler market comprises industrial, commercial, and residential systems that generate steam or hot water for various applications, primarily in power generation, manufacturing, chemical processing, heating, and domestic use. Boilers function by using a heat source (typically combustion of fossil fuels, biomass, or electricity) to heat water or other fluids within closed systems.

Which Factor Is Driving the Boiler Market?

The ongoing industrialization across the globe is spearheading industry growth in recent years. Moreover, several regions are under a heavy requirement for steam and process heat to grow. Furthermore, by playing a crucial role in the power generation industry, boilers have gained immense industry attention in the past few years as per the recent observation. The sectors such as textiles, oil refineries, and food production have actively contributed to the industry's growth in recent years.

Market Trends

- The sudden shift towards energy-efficient boilers has been driving industry growth in recent years. Furthermore, several regional countries are actively replacing their traditional boilers with energy-efficient ones

- The increased demand for smart boilers has fueled market growth in recent years, as manufacturers are actively developing boilers that include smart features such as automation and remote monitoring options.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 107.42 Billion |

| Expected Size by 2034 | USD 199.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | Type Insights, By Capacity , Fuel Type Insights, Pressure Type Insights, Technology Insights, By end Use Industry, Application Type Insights, By Region |

| Key Companies Profiled | General Electric (GE Power), Babcock & Wilcox Enterprises, Mitsubishi Heavy Industries, Bosch Thermotechnology ,Cleaver-Brooks , Thermax Ltd. , Hurst Boiler & Welding Co., Fulton Boiler Works, Inc., Viessmann Group , Miura Co., Ltd. , Lochinvar, LLC , Forbes Marshall , Johnston Boiler Company , Bryan Steam LLC , IHI Corporation , Aalborg Industries (Alfa Laval) , Clayton Industries , Parker Boiler Co. , Unilux Advanced Manufacturing, Sime Heating (Biasi Group) |

Market Opportunity

Manufacturers Eye Growth Through Industrial Heat Recovery Solutions

The increased need for industrial waste heat recovery boilers is expected to create significant opportunities in the coming years, as the reusability of the heat from the industrial process is seen everywhere where manufacturers can gain an advantage by providing them with specific boilers during the forecast period. Furthermore, the manufacturers can also create a partnership with these industries and offer customized boilers in the coming years.

Market Challenge

Pricey Installation Creates Roadblock for Boiler Market Players

The higher initial investment cost for the advanced boilers is expected to hamper the industry's growth in the upcoming years. Furthermore, this higher cost will affect the financial planning of the new entrants and mid-size businesses, which creates growth barriers for the industry in the coming years. Moreover, boilers such as the condensing boilers and the biomass-fired units are seen in require advanced technology with expensive installation costs.

Regional Insights

Asia Pacific

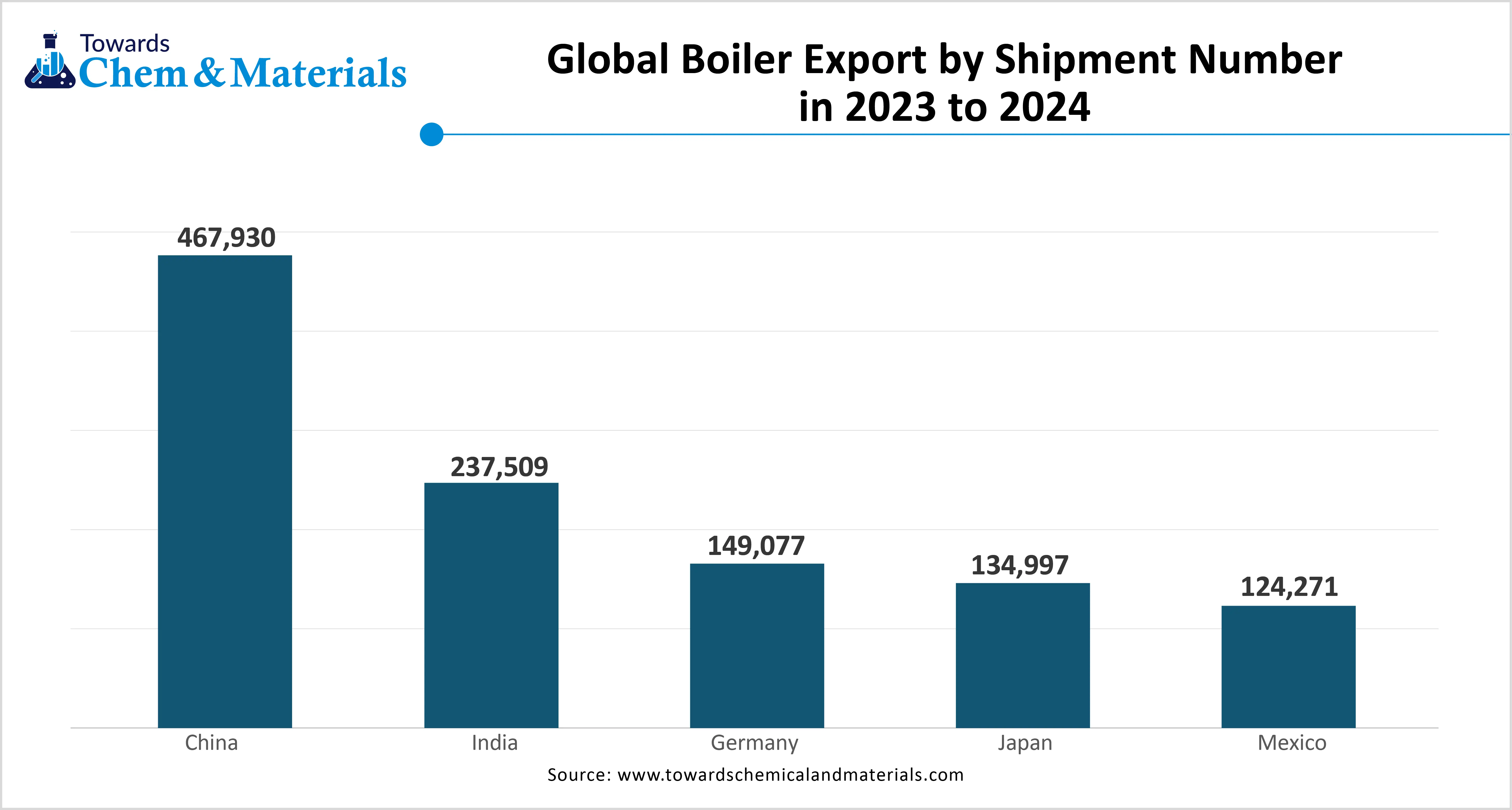

The Asia Pacific region dominated the market 2024, akin to the fast-paced industrial growth in recent years. Moreover, the heavy population is playing a major role in the growth of the industry in recent years. As the regional countries such as China, India, and Japan are seen under strong demand for health and water in their specific sectors, such as the food, paper, textile, and chemical industries nowadays, as per the recent regional survey.

Can China’s Focus on Energy Efficiency Transform the Boiler Industry?

China maintained its dominance in the boiler market, owing to having an enlarged industrial base. Moreover, the presence of the advanced power plants, manufacturing units, and the factories that depend upon the boilers are actively providing a sophisticated consumer base to the industry in recent years. Moreover, the government in China has seen in focused on the energy efficiency programs and is trying to cut down the carbon emissions. Actively replacing the older boiler systems in recent years.

Middle East and Africa

Middle East and Africa is expected to capture a major share of the market during the forecast period, owing to the increased need for energy and rapid industrialization in recent years. Moreover, the regional countries have been actively involved in the heavy infrastructure upgradation and installation of desalination facilities in the past few years. Furthermore, the presence of major oil refineries and petrochemicals is contributing to the sales of boilers in the region, as per the recent regional analysis.

Can Industrial Growth in the Gulf and Africa Drive the Boiler Market Expansion

Saudi Arabia and South Africa are expected to rise as dominant countries in the region in the coming years, owing to the heavy investment in the oil refining industries and power generation, where increased demand for high-performance boilers has emerged in recent years. Furthermore, South Africa’s mining sector has actively provided a huge customer base to the boiler manufacturers in recent years. Also, Saudi Arabia’s rapid industrialization has actively contributed to the boiler industry's growth in the past few years, as per the survey.

Segmental Insights

Type Insights

How did the Fire Tube Boiler Segment Dominate the Boiler Market in 2024?

The fire tube boilers segment held the largest share of the market in 2024, due to having unique properties such as easy installation, reliability, and simplicity. Moreover, playing the ideal role in the low-pressure environment in smaller factories, the fire tube boiler has gained immense industrial attention in recent years.

Furthermore, the boiler has lower maintenance and easy installations, making it perfect for small and mid-size business applications, according to the recent survey. The water tube boiler segment expects the significant growth in the market during the predicted timeframe due to the enlarged expansion of the large-scale industrial operations globally. Moreover, this water tube boiler is seen as much more suitable for these high-pressure applications than the fire tube boilers. Furthermore, these boilers are observed in use in the power plants where energy-efficient infrastructure initiatives are rising.

Capacity Type Insights

Why does the 10-50 MMBTU/HR Segment Dominated the Boiler Market by Process Type?

The 10-50 MMBTU/HR segment held the largest share of the boiler market in 2024, owing to having the heating capacity needed in medium-sized industries. Moreover, this capacity segment is seen in several major sectors such as food processing, textiles, and chemical plants in recent years.

The >100 MMBTU/HR segment is expected to grow at a notable rate, owing to the sudden expansion of the power plants and the heavy industries. Furthermore, this segment is observed as mainly used in energy-intensive operations, which can be expanded in the coming years. Furthermore, as global governments invest in modern infrastructure, the segment is expected to dominate during the forecast period, as per the future industry expectations.

Fuel Type Insights

Why Did the Natural Gas-Fired Segment Dominate the Boiler Market in 2024?

The natural gas-fired segment dominated the market with the largest share in 2024, owing to the increased need for cleaner and cheaper fuel than coal and oil. Furthermore, by emitting fewer harmful gases, which is slightly better than the traditional boilers, they are driving the growth of the segment where environmental regulations are increasing globally.

The biomass-fired segments are expected to grow at a notable rate due to the increasing need for renewable energy. Moreover, by using organic materials like agricultural waste, wood chips, and pellets, the biomass-fired segment is expected to gain immense attention in the coming years, as per industry expectations.

Pressure Type Insights

How does the Low Pressure (<15psi) Segment Maintain Dominance in the Pressure Type?

The low-pressure (<15psi) segment held the largest share of the market in 2024 due to because they are suitable for residential heating, small commercial setups, and industries that do not need high steam pressure. These boilers are safer, easier to operate, and more cost-effective for smaller tasks. They are often used in apartment buildings, small manufacturing units, and food processing units.

The high-pressure (>150psi) segment is expected to grow at the fastest rate during the forecast period because they are crucial for large industries that need high-temperature steam, such as chemical plants, refineries, and power stations. These boilers offer better thermal efficiency and can generate large volumes of steam quickly. With growing demand for energy and industrial output, high-pressure systems provide the power and speed required for intensive applications.

Technology Insights

Why is the Non-Condensing Boiler Segment Dominating the Boiler Market in 2024?

The non-condensing segment led the market in 2024 due to its lower upfront cost, simplicity, and ease of maintenance. These boilers release hot gases through flues without capturing the extra heat, making them less efficient than condensing types, but cheaper to buy and operate. They are widely used in older buildings and industrial facilities that prioritize simple heating systems.

The condensing boiler segment is expected to grow at the fastest rate in the market during the forecast period, because they are energy-efficient and eco-friendly. They work by capturing and reusing the heat from exhaust gases, which reduces energy loss and cuts fuel bills. This makes them more efficient and less polluting than non-condensing boilers.

End Use Industry Insights

Why Did the Residential Segment Dominate the Boiler Market in 2024?

The residential segment held the largest share of the market in 2024, as most homes use boilers for space heating and hot water. In colder regions, boilers are essential for daily living. Residential boilers are small, easy to install, and can be powered by gas, oil, or electricity. Maintenance and replacement needs also boost the residential segment. These consistent needs made it the largest end-use segment in recent years.

The industrial segment expects notable growth in the market during the predicted timeframe due to rising manufacturing, food processing, chemical production, and power generation activities. Industries need large, reliable boilers to support continuous operations. As many factories and plants expand or upgrade, they're investing in advanced boilers that are efficient and environmentally friendly.

Application Type Insights

Why Did the Steam Generation Segment Dominate the Boiler Market in 2024?

The steam generation segment dominated the market with the largest share in 2024 because it's a primary use of boilers across many industries. Steam is used for heating, cooking, sterilization, and powering machinery. Sectors like textiles, chemicals, food, and hospitals all depend on steam boilers.

The process heating segments are expected to grow at a notable rate because it is used in industries such as chemicals, oil refining, and food processing. These industries rely on precise and consistent heat for production, drying, or chemical reactions. As automation and production complexity increase, so does the need for efficient boilers for process heating.

Recent Developments

- In May 2025, Fujifilm introduced its latest electric boiler. Also, this boiler can cut off 26% of carbon emissions, as per the report published by the company recently(Source: https://pharmaceuticalmanufacturer.media)

- In September 2024, Thermax unveiled its latest product line in the boiler India. The newly launched product line includes the bio grate boiler, which is environmentally friendly, as per the company’s claim. (Source: www.oemupdate.com)

Top Companies List

- General Electric (GE Power)

- Babcock & Wilcox Enterprises

- Mitsubishi Heavy Industries

- Bosch Thermotechnology

- Cleaver-Brooks

- Thermax Ltd.

- Hurst Boiler & Welding Co.

- Fulton Boiler Works, Inc.

- Viessmann Group

- Miura Co., Ltd.

- Lochinvar, LLC

- Forbes Marshall

- Johnston Boiler Company

- Bryan Steam LLC

- IHI Corporation

- Aalborg Industries (Alfa Laval)

- Clayton Industries

- Parker Boiler Co.

- Unilux Advanced Manufacturing

- Sime Heating (Biasi Group)

Segment Covered

By Type

- Fire-tube Boiler

- Water-tube Boiler

- Electric Boiler

- Combi Boiler

- Condensing Boiler

- Modular Boiler

By Capacity

- <10 MMBtu/hr

- 10–50 MMBtu/hr

- 50–100 MMBtu/hr

- >100 MMBtu/hr

By Fuel Type

- Natural Gas-fired Boilers

- Coal-fired Boilers

- Oil-fired Boilers

- Biomass-fired Boilers

- Electric Boilers

- Hydrogen-fired Boilers

By Pressure

- Low Pressure (<15 psi)

- Medium Pressure (15–150 psi)

- High Pressure

By Technology

- Condensing Boiler

- Non-condensing Boiler

By End-Use Industry

- Residential

- Commercial

- Educational Institutions

- Healthcare

- Offices

- Hospitality

- Industrial (Fastest growing; driven by chemicals, food, etc.)

- Food & Beverage

- Chemicals

- Oil & Gas

- Pulp & Paper

- Power Generation

- Metals & Mining

- Textiles

By Application

- Steam Generation (Largest; ~50% share)

- Hot Water Generation

- Process Heating (Fastest growing, especially in industrial segments)

- Space Heating

- Sterilization

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE