Content

What is the Current North America Industrial Liquid Waste Management Market Size and Share?

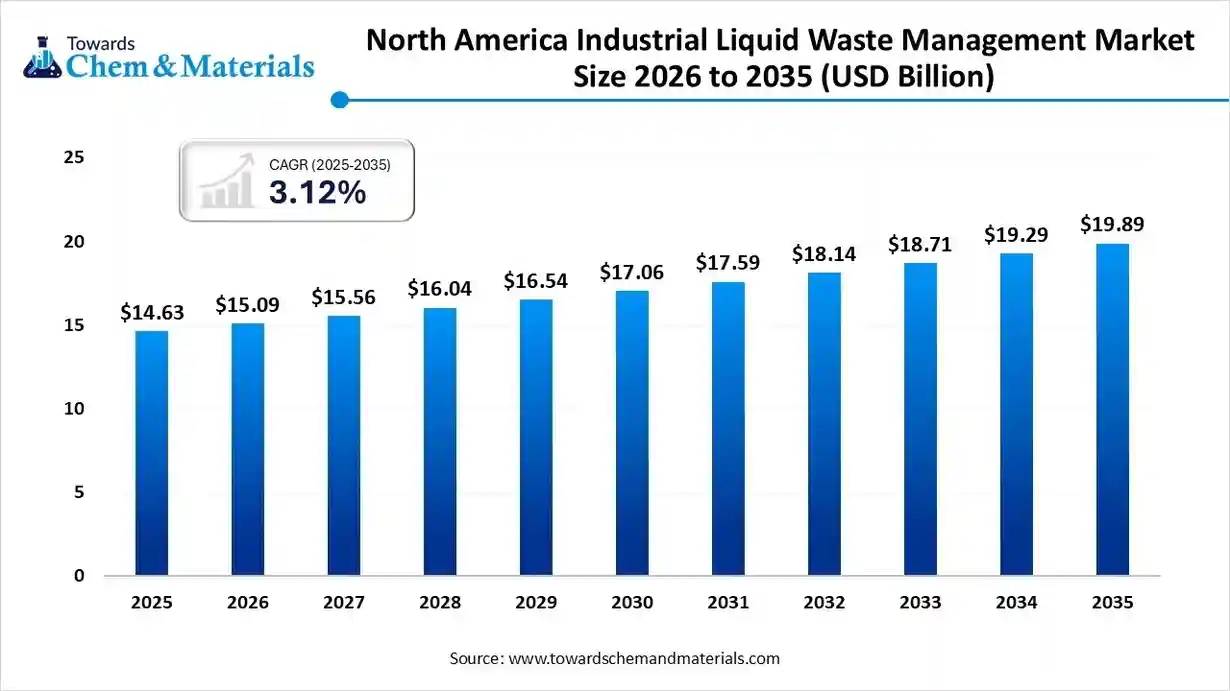

The North America industrial liquid waste management market size was estimated at USD 14.63 billion in 2025 and is predicted to increase from USD 15.09 billion in 2026 and is projected to reach around USD 19.89 billion by 2035, The market is expanding at a CAGR of 3.12% between 2026 and 2035. Asia Pacific dominated the The expanding urban areas and growing expansion of industrial activities drive the market growth.

Key Takeaways

- By industry, the manufacturing segment led the market in 2025 due to the growing industrial manufacturing activities.

- By industry, the oil & gas segment is growing at the fastest CAGR in the market during the forecast period due to the increasing shale gas exploration.

- By category, the centralized waste treatment segment led the market in 2025 due to its complex waste processing ability.

- By category, the onsite treatment segment is expected to grow at the fastest CAGR in the market during the forecast period due to stringent environmental policies.

What is Industrial Liquid Waste Management?

The North America industrial liquid waste management market growth is driven by regulatory pressure for wastewater treatment, expansion of urban areas, innovations in water reuse, increasing investment in waste management modernization, scaling operations in the food industry, acceleration in metal refining, increased recognition of corporate sustainability practices, and a mature petrochemical base.

Industrial liquid waste management involves steps like collecting, treating, recycling, & disposing of liquid waste arising from industrial activities. It prevents environmental pollution, protects aquatic life, lowers landfill waste, and ensures legal compliance.

The various types of treatment for industrial liquid waste management are chemical, advanced, physical, and biological. The overall process for industrial liquid waste management is waste type identification, source reduction, segregation of waste, application of treatment, recovery of resources, management of sludge, and final disposal of waste.

The various types of treatment for industrial liquid waste management are chemical, advanced, physical, and biological. The overall process for industrial liquid waste management is waste type identification, source reduction, segregation of waste, application of treatment, recovery of resources, management of sludge, and final disposal of waste.

North America Industrial Liquid Waste Management Market Trends:

- Rigorous Regulatory Compliance:- The tighter government regulations, like the EPA, and stringent controls on waste disposal in countries like the United States and Canada, increase demand for advanced liquid waste management treatment.

- Growing Health Concerns:- The growing health concerns like skin issues, waterborne diseases, cancers, respiratory diseases, neurological damage, and many more due to high exposure to liquid waste like pathogens, toxic chemicals, & others increase the adoption of liquid waste management.

- Industrial Operation Expansion:- The strong presence of chemical factories and rapid growth in industrial activities like energy, manufacturing, food processing, and pharmaceuticals generate a large amount of liquid waste, which drives demand for efficient waste management solutions.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 15.09 Billion |

| Revenue Forecast in 2035 | USD 19.89 Billion |

| Growth Rate | CAGR 3.12% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Industry, By Category, |

| Key companies profiled | Hull’s Environmental Services, Crystal Clean, Inc., Veolia, Clean Harbors, Reworld, Arcwood Environmental, Republic Services, TradeBe, VLS, Waste Connection, Liquid Environmental Solutions, GFL Environmental |

Key Technological Shifts in the North America Industrial Liquid Waste Management Market:

The North America industrial liquid waste management market is undergoing key technological shifts driven by the demand for resource recovery, sustainability, and smart operations. The major technological changes are advanced oxidation processes, smart systems, novel materials, sensors, machine learning, automation, and electrocoagulation, which enable the efficient management of waste and enhanced precision. The key technological innovation is the integration of the Internet of Things (IoT) enables digital management and cost savings.

IoT tracks flow rates of liquid waste and feeds data to cloud platforms. It redirects problematic waste streams and optimizes waste collection routes. IoT prevents overflows of liquid waste and predicts potential spikes of contaminants. It predicts potential failures of sensors and offers leak detection alerts in pipes. IoT adjusts the dosing of chemicals and controls the entire process of treatment. Overall, IoT improves environmental sustainability and offers data-driven optimization.

Trade Analysis of North America Industrial Liquid Waste Management Market: Import & Export Statistics

- The United States exported 4,899 shipments of membrane filters.

- The United States exported 188 shipments of centrifuge systems.

- The United States exported 1,646 shipments of oil water separator.

- The United States imported 271 shipments of oil water separator.

- The United States imported 57 shipments of bioreactors.

North America Industrial Liquid Waste Management Market Value Chain Analysis

- Chemical Synthesis and Processing: The chemical synthesis and processing involve methods like neutralization, coagulation, flocculation, precipitation, oxidation, reduction, disinfection, and ion exchange.

- Key Players:- Veolia, ChemTreat, Inc., Clean Harbors, Ecolab, GFL Environmental Inc.

- Quality Testing and Certifications: The quality testing refers to verification of characteristics like total pH, suspended solids, biochemical oxygen demand, salinity, total volatile solids, heavy metals, total organic carbon, microbiology, total nitrogen, bioassays, total phosphorus, & turbidity. Certifications for industrial liquid waste management, like CHMWMP, ISO 14001, CPWM, SWANA, and NASP, are required in North America.

- Key Players:- Clark Testing, Eurofins USA, EQM, SGS

- Regulatory Compliance and Safety Monitoring: The regulatory compliance involves the Resource Conservation and Recovery Act, CEPA, Waste Characterization and Classification, CWA, and Safety monitoring involves key aspects like worker safety, operational integrity, & environmental protection.

- Key Players:- Veolia Environmental Services, Waste Connections, Cority, UL Solutions, GFL Environmental

Nation-Wise Regulatory Framework for Industrial Liquid Waste Management

| Country | Key Regulations | Major Players |

| United States |

|

|

| Mexico |

|

|

| Canada |

|

GFL Environmental Maratek Environmental Inc. Clean Harbors SECURE Energy Services |

Segmental Insights

Industry Insights

Which Industry Dominated the North America Industrial Liquid Waste Management Market?

The manufacturing segment dominated the North America industrial liquid waste management market in 2025. The growing manufacturing of automotive parts and the strong presence of electronics manufacturing increase demand for industrial liquid waste management solutions to manage chemical residues and process water. The stricter EPA regulations in the manufacturing industry and the surge in manufacturing activities generate wastes like heavy metals, solvents, and others that require waste management solutions. The high generation of non-hazardous waste during the manufacturing process drives the overall market growth.

The oil & gas segment is the fastest-growing in the market during the forecast period. The booming shale gas exploration and a strong focus on disposing of oil & gas waste increase demand for waste management solutions. The rise in refining activities and the increasing adoption of drilling operations increase demand for industrial liquid waste management. The stringent environmental policies for the oil & gas industry and environmental regulations for sludge disposal increase demand for advanced waste management solutions. The extensive exploration of shale gas supports the overall market growth.

Category Insights

Why did the Centralized Waste Treatment Segment hold the Largest Share in the North America Industrial Liquid Waste Management Market?

The centralized waste treatment (CWT) segment held the largest revenue share in the North America industrial liquid waste management market in 2025. The abundance of non-hazardous waste, like process water, refinery sludge, and others, increases the adoption of CWT. The rapid growth in hazardous pollutants like toxic chemicals and stringent regulations for waste disposal increases demand for CWT. The standardization, cost-effectiveness, and efficiency of CWT drive the market growth.

The onsite treatment segment is experiencing the fastest growth in the market during the forecast period. The stricter rules for organic compound disposal and the focus on minimizing the environmental footprint increase demand for onsite treatment. The lower transport cost, energy efficiency, and modularity of onsite treatment support the overall market growth.

Country-Level Insights

The United States at the Core of Industrial Liquid Waste Management

The United States is a major contributor to the market. The rigorous environmental regulations for waste treatment and the strong presence of manufacturing activities increase demand for industrial liquid waste management. The higher production of diverse chemicals and a strong focus on reusing water increase demand for advanced waste management solutions. The increasing water scarcity issues in California and the growing development of new treatment plants help market expansion. The well-developed liquid waste management infrastructure and increasing investment in smart technologies drive the overall market growth.

Canada’s Influence on North America's Industrial Liquid Waste Management

Canada is a key contributor to the market. The pharmaceutical industry's expansion and growing public awareness about environmental issues increase the development of industrial liquid waste management solutions. The surge in manufacturing activities and focus on resource recovery increases demand for liquid waste management solutions. The growing use of biological treatment and well-established liquid waste services infrastructure supports the overall growth of the market.

Mexico’s Rising Role in Industrial Liquid Waste Management

Mexico is substantially growing in the market. The growing mining activities and stringent sustainability frameworks increase the adoption of industrial liquid waste management solutions. The rapid urbanization and strong government focus on waste segregation increase the adoption of industrial liquid waste management solutions.

Recent Developments

- In October 2025, VLS launched RCRA-compliant mercury disposal technology in the United States. The technology is present in the Deer Park facility and supports mercury waste management. The technology is used across industries like chemical, mining, and energy. (Source: www.thesafetymag.com)

- In March 2025, VLS Environmental Solutions acquired Samex Environmental to expand operations on the West Coast. The acquisition aims to offer an innovative solution for the management of waste. The acquisition focuses on sustainability and enhancing operational efficiency.(Source: www.prnewswire.com)

Top Companies List

- Clean Harbors:-The North America-based company provides solutions for non-hazardous & hazardous waste to support various industries like manufacturing and chemicals.

- Veolia:- The company offers services like waste-to-energy conversion, collection of waste, processing of hazardous waste, and recycling of waste to serve industrial and municipal clients.

- Crystal Clean, Inc.:- The company offers solutions for the management of diverse wastes like hazardous, bulk, containerized, and non-hazardous to serve industries like energy, automotive, and industrial machinery.

- Hull’s Environmental Services:- The company provides waste management operations like disposal, handling, and transportation to serve diverse industries across the Midwest, Southeast, and South Central United States.

Other Companies List

- Hull’s Environmental Services

- Crystal Clean, Inc.

- Veolia

- Clean Harbors

- Reworld

- Arcwood Environmental

- Republic Services

- TradeBe

- VLS

- Waste Connection

- Liquid Environmental Solutions

- GFL Environmental

Segments Covered

By Industry

- Chemicals

- Power (Scheduled Maintenance)

- Metals

- Oil & Gas

- Food & Beverage

- Manufacturing

- Marine

- Environmental Services

- Waste Management

- Others

By Category

- CWT

- POTW

- Onsite

By Region

- North America

- U.S.

- Canada

- Mexico