Content

What is the Current Waterborne Coatings Market Size and Share?

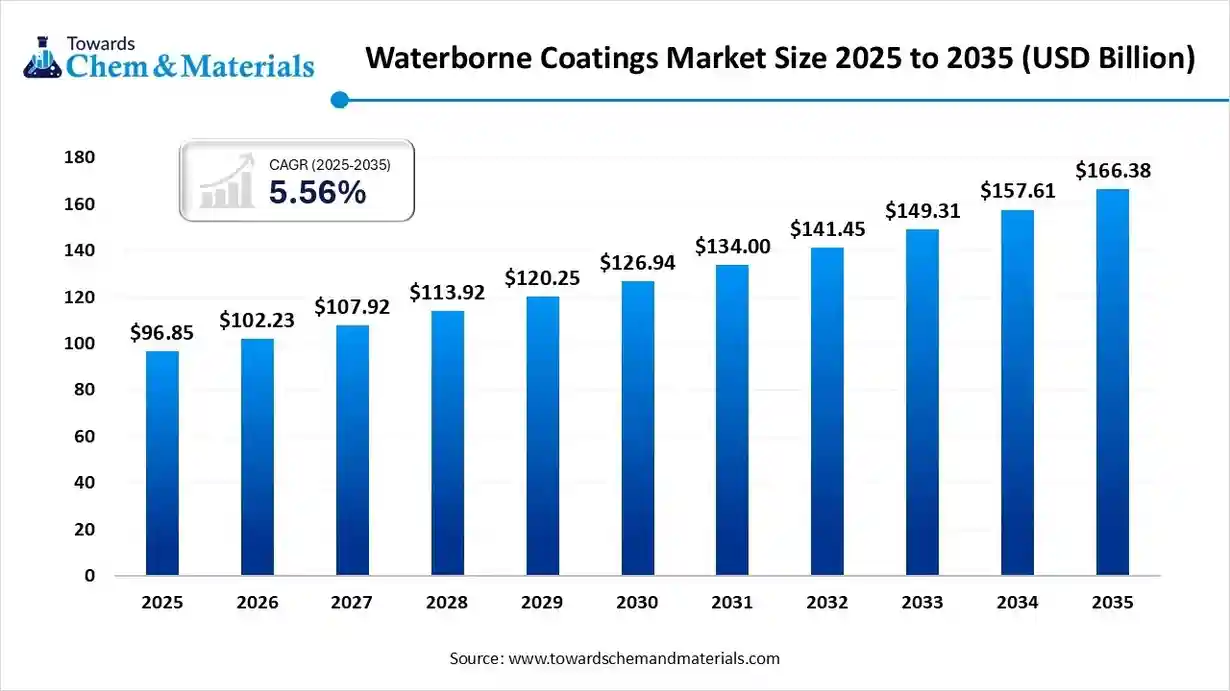

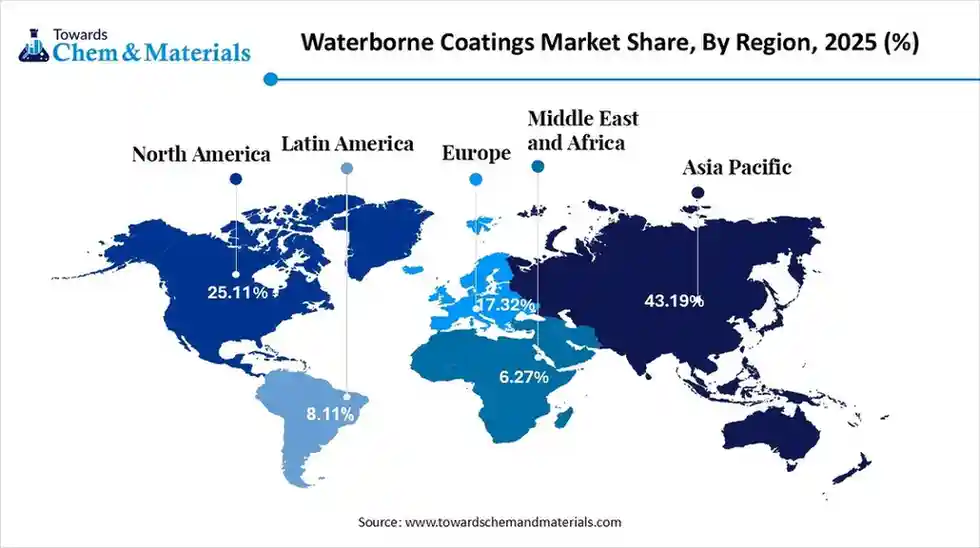

The global waterborne coatings market size was estimated at USD 96.85 billion in 2025 and is predicted to increase from USD 102.23 billion in 2026 and is projected to reach around USD 166.38 billion by 2035, The market is expanding at a CAGR of 5.56% between 2026 and 2035. Asia Pacific dominated the waterborne coatings market with a market share of 43.19% the global market in 2025. The growth of the market is driven by urbanisation and consumer awareness, alongside technological advancements improving performance and expanding applications.

Key Takeaways

- By region, Asia Pacific led the waterborne coatings market with the largest revenue share of over 43.19% in 2025.

- By resin type, the acrylic segment dominated the market in 2025. The durability and other properties make it a preferred choice.

- By product type, the water-soluble paints segment dominated the market in 2025. The ease of application and use increases the demand.

- By end-use industry, the building and construction segment dominated the market in 2025. The growing demand for sustainable and eco-friendly materials drives the growth.

Market Overview

What Is The Significance Of The Waterborne Coatings Market?

The significance of the waterborne coatings market lies in its role as a sustainable, eco-friendly alternative to solvent-based paints, driven by strict VOC regulations and growing consumer demand for greener products, leading to widespread adoption in automotive, architectural, and industrial sectors due to improved performance, lower toxicity, and better air quality. Technological advancements further enhance their performance, making them crucial for meeting global environmental goals while offering diverse aesthetic and functional benefits.

Waterborne Coatings Market Growth Trends:

- Environmental Regulations: Stricter rules on VOCs (Volatile Organic Compounds) favour waterborne coatings over solvent-based ones.

- Sustainability Focus: Growing consumer & corporate demand for eco-friendly products boosts adoption.

- Automotive Growth: Increased production, including the shift to Electric Vehicles (EVs), fuels demand for waterborne solutions

- Advanced Resin Technology: Innovations in acrylic resins for better performance (gloss, durability) and wider application.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 102.23 Billion |

| Revenue Forecast in 2035 | USD 166.38 Billion |

| Growth Rate | CAGR 5.56% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Resin Type, By Product Type, By End-Use Industry,By Region |

| Key companies profiled | Axalta Coating Systems, BASF SE, PPG Industries, Inc., Akzo Nobel N.V., Berger Paints India Ltd., Kansai Paint Co., Nippon Paint Holdings Company Ltd., RPM International Inc., The Valspar Corp., Tikkurila Oyj |

Key Technological Shifts In The Waterborne Coatings Market :

Key tech shifts in waterborne coatings focus on advanced polymer resins (PU, acrylics), nanotechnology, self-healing/smart features, and eco-friendly additives (like HEURs) to boost performance (durability, cure time, adhesion) and meet strict VOC rules, enabling growth in automotive, construction, and industrial uses despite historical cost/application hurdles, driven by sustainability demands.

Trade Analysis Of Waterborne Coatings Market: Import & Export Statistics

According to Global Export data, the world shipped 329 loads of water-based coating, contributed by 82 exporters and purchased by 78 buyers. Most exports of coatings are directed to India, Pakistan, and Sri Lanka. China, Italy, and the United States are the leading exporters for water-based coating. China leads with 72 shipments, followed by Italy with 68 shipments, and the United States with 68.

Based on U.S. export data, the country shipped 46 shipments of water-based paint coating, exported by 28 U.S. exporters to 17 buyers. Most of these exports from the United States go to Vietnam, South Korea, and China.

Globally, Vietnam, Malaysia, and Japan are the leading exporters of water-based paint coatings, with Vietnam with 572 shipments, Malaysia 456 shipments, and Japan 312 shipments.

Waterborne Coatings Market Value Chain Analysis

- Chemical Synthesis and Processing: Waterborne coatings are developed through processes such as polymer dispersion, emulsification, pigment mixing, resin synthesis, viscosity adjustment, and environmentally safe formulation for low-VOC coatings.

- Key players: Akzo Nobel N.V., PPG Industries Inc., Sherwin-Williams Company, BASF SE.

- Quality Testing and Certification: Waterborne coatings require certifications for VOC compliance, environmental safety, performance durability, and chemical quality. Certifications include ISO standards, Green Seal, EcoLabel, and ASTM coating performance standards.

- Key players: ISO (International Organisation for Standardisation), Green Seal, UL Solutions, ASTM International.

- Distribution to Industrial Users: Waterborne coatings are supplied to industries such as automotive, construction, packaging, furniture, marine coatings, and general industrial manufacturing.

- Key players: RPM International Inc., Axalta Coating Systems, Nippon Paint Holdings.

Waterborne Coatings Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency) | - Clean Air Act (VOC limits) - TSCA (Toxic Substances Control Act) |

- VOC emissions reduction - Chemical safety - Environmental compliance |

EPA has continuously tightened VOC limits for architectural and industrial coatings, driving the adoption of waterborne systems. |

| European Union | ECHA (European Chemicals Agency) | - REACH - CLP Regulation - Industrial Emissions Directive |

- Hazard classification - VOC reduction - Worker safety |

The EU has the strictest VOC caps globally; additional restrictions apply for solvents and hazardous monomers. |

| China | Ministry of Ecology and Environment (MEE) | - MEE Order No. 12 - GB Standards for coatings - VOC Emission Standards |

- New chemical registration - VOC control - Environmental risk review |

China enforces stringent VOC taxes and emission norms; local manufacturers are rapidly shifting to waterborne formulations. |

| India | CPCB (Central Pollution Control Board) + BIS | - BIS Coating Standards - Hazardous Chemicals Rules - Proposed Chemicals (Management & Safety) Rules |

- Environmental clearance - Quality standards - VOC monitoring |

India is drafting REACH-like rules that will impact resin, pigment, and additive suppliers for waterborne coatings. |

| Japan | METI + MOE | - CSCL (Chemical Substances Control Law) - Air Pollution Control Act |

- Chemical approval - VOC control - Eco-friendly product mandates |

Japan promotes low-VOC and waterborne systems under its national sustainability roadmap for coatings. |

Segmental Insights

Resin Type Insights

How Did the Acrylic Segment Dominated The Waterborne Coatings Market In 2025?

The acrylic segment dominated the market in 2025. Acrylic waterborne coatings are widely adopted due to their excellent colour retention, UV resistance, and fast drying characteristics. They are preferred in architectural, automotive refinish, and industrial applications because of superior durability and environmental compliance. Their low VOC profile makes them a key choice as industries shift toward eco-friendly coating solutions across diverse end-use sectors.

The polyurethane segment is projected to grow at a CAGR between 2026 and 2035 in the waterborne coatings market. Polyurethane waterborne coatings deliver high-performance protection with superior chemical, abrasion, and weather resistance. These coatings are commonly used in automotive, wood finishing, and industrial equipment applications where high durability and premium finish quality are essential. Their increasing acceptance is driven by regulatory push for low-emission materials and the need for long-lasting, high-strength coating systems.

Product Type Insights

Which Product Type Segment Dominated The Waterborne Coatings Market In 2025?

The water-soluble paints segment dominated the market in 2025. Water-soluble paints are formulated using water as the primary solvent, offering excellent environmental safety and minimal emissions. They are widely used in DIY, architectural, and commercial coatings due to ease of application and cleanup. Growing consumer preference for non-toxic, odourless coatings is fueling demand across residential construction and interior refurbishment activities.

The emulsion paints segment is projected to grow at a CAGR between 2026 and 2035. Emulsion paints dominate the waterborne coatings category with strong adhesion, washability, and versatility across interior and exterior surfaces. Their stable formulation using polymer emulsions provides improved durability and resistance to fading and cracking. Increasing construction activity and rapid urbanisation continue to elevate their adoption in commercial and residential building projects.

End-Use Industries Insights

How Did the Building And Construction Segment Dominated The Waterborne Coatings Market In 2025?

The building and construction segment dominated the market in 2025. The building and construction sector represents the largest consumer of waterborne coatings due to strict VOC regulations and rising demand for sustainable materials. These coatings are applied across walls, facades, woodwork, and metal structures to provide protective and aesthetic finishes. Growing infrastructure development and real estate expansion significantly contribute to market growth in this segment.

The automotive segment is projected to grow at a CAGR between 2026 and 2035 in the waterborne coatings market. In the automotive industry, waterborne coatings are increasingly preferred for their superior finish quality, corrosion resistance, and compliance with stringent emission standards. They are used in OEM applications, repainting, and component finishing. Advancements in fast-drying formulations and the shift toward eco-conscious production processes support rising adoption among global automotive manufacturers.

Regional Insights

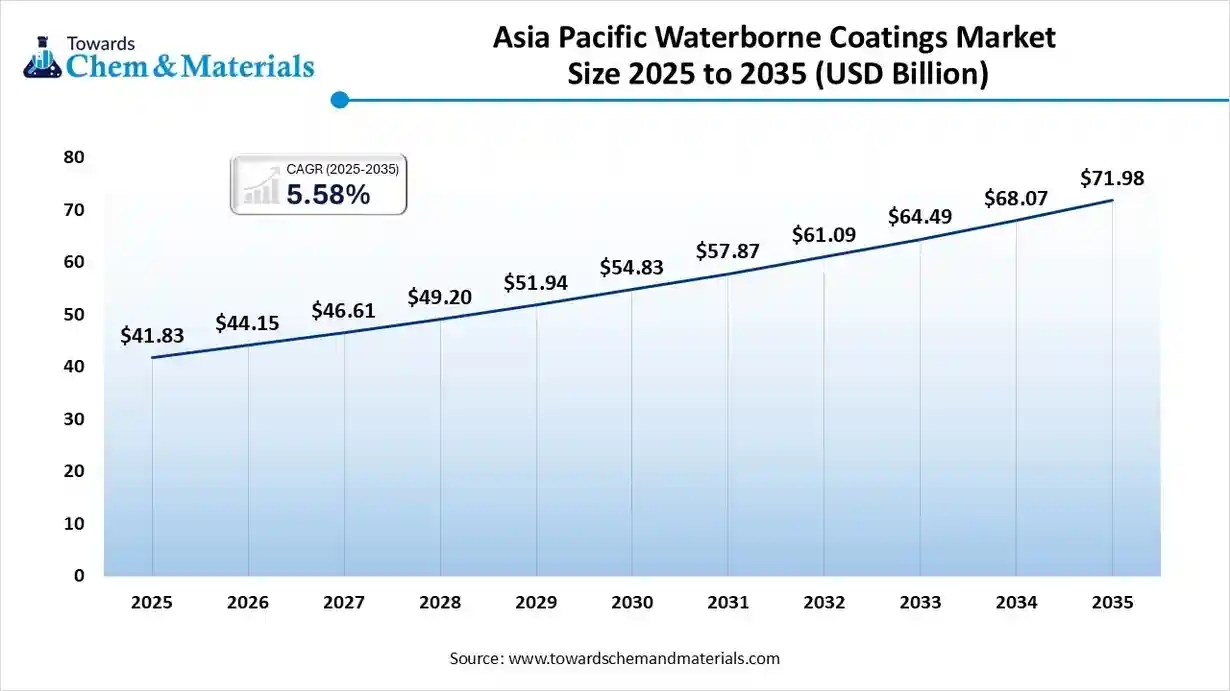

The Asia Pacific waterborne coatings market size was valued at USD 41.83 billion in 2025 and is expected to reach USD 71.98 billion by 2035, growing at a CAGR of 5.58% from 2026 to 2035. Asia Pacific dominates the market in 2025. Asia-Pacific is a growing region due to rapid urbanisation, large-scale infrastructure projects, and booming automobile production. Rising environmental awareness and government policies promoting low-emission coatings are boosting the shift from solvent-borne to waterborne systems. The presence of large manufacturing clusters further drives consumption.

China: Waterborne Coatings Market Growth Trends

China represents the largest market in APAC, driven by massive construction activity, strong demand for architectural coatings, and expansion of the automotive OEM and aftermarket sectors. Government initiatives to curb VOC emissions are accelerating the adoption of waterborne acrylic and polyurethane coatings across end-use industries.

North America Market Growth Is Driven By The Strong Demand From Various Sectors

North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The North American market is driven by strong demand from construction, automotive refinish, and industrial applications. Growth is supported by stringent VOC emission regulations, increasing adoption of green coatings, and robust innovation from key manufacturers. The region also benefits from high renovation spending and rapid acceptance of sustainable coating technologies.

United States: Waterborne Coatings Market Growth Trends

The U.S. dominates the regional market due to its mature construction sector, rising automotive production, and strong regulatory pressure from the EPA. Waterborne acrylic and polyurethane coatings see high penetration, supported by fast adoption in architectural applications and continuous product innovation by leading domestic manufacturers.

Europe's Advanced Market Drives The Growth Of The Market

Europe remains one of the most advanced markets for waterborne coatings, driven by strict environmental standards such as REACH and the Green Deal's focus on reducing industrial emissions. Demand is strong across decorative coatings, industrial wood, and transportation sectors. The shift toward low-VOC and eco-friendly formulations continues to accelerate market penetration.

Germany: Waterborne Coatings Market Growth Trends

Germany leads the European market owing to its strong automotive industry, significant industrial base, and high consumer preference for sustainable building materials. Waterborne systems held the dominating share in OEM coatings and architectural, supported by advanced regulatory compliance requirements and R&D capabilities.

South America's Growth Is Driven By The Growing Economic Conditions

The South American market is experiencing stable growth driven by improving economic conditions, recovery in the construction sector, and rising investments in infrastructure. Increased awareness of eco-friendly coatings is gradually pushing manufacturers toward waterborne formulations, although solventborne systems still hold a noticeable share in some countries.

Brazil: Waterborne Coatings Market Growth Trends

Brazil: Waterborne Coatings Market Growth Trends

Brazil leads the regional market, supported by expanding construction activities, increasing automotive production, and growing adoption of sustainable coatings. Local manufacturers are shifting toward water-based formulations due to environmental regulations and rising consumer preference for low-odour decorative paints.

Middle East & Africa Waterborne Coatings Market Trends

The MEA region is witnessing moderate growth as infrastructure development, urban expansion, and investments in commercial construction drive demand. Awareness of sustainable coatings is increasing, and multinational companies are expanding their presence to meet the rising demand for low-VOC architectural and industrial coatings.

United Arab Emirates: Waterborne Coatings Market Growth Trends

The UAE is a key contributor to regional demand, driven by mega construction projects, rapid modernisation, and growth in commercial infrastructure. Waterborne coatings are gaining prominence due to government sustainability goals, green building initiatives, and preference for high-performance architectural finishes.

Recent Developments

- In March 2025, PPG commissioned a new waterborne automotive coatings manufacturing plant in Samut Prakan, Thailand. This launch aims to meet rising regional demand for sustainable products.(Source: www.just-auto.com)

- In June 2025, Tnemec introduced two new waterborne epoxy products, Series 288 Enviro-Pox and Series 289 Enviro-Pox, specifically for concrete surfaces. These products are formulated for improved performance and application ease compared to standard waterborne epoxies, featuring low VOCs and significant durability.(Source: www.coatingsworld.com)

- In February 2025, AkzoNobel launched Sikkens Autowave Optima, a new waterborne basecoat for the automotive refinish industry designed to improve efficiency and sustainability for bodyshops.(Source: www.chemanalyst.com)

Top Players in the Waterborne Coatings Market & Their Offerings:

- Akzo Nobel N.V.: Akzo Nobel is a major global supplier of waterborne coatings used across architectural, automotive, furniture, and industrial applications. The company focuses on low-VOC, eco-friendly formulations and advanced resin technologies that meet stringent environmental regulations.

- PPG Industries, Inc.: PPG offers a wide portfolio of high-performance waterborne coatings for construction, automotive refinishing, packaging, and protective applications. Its innovations centre on durability, corrosion resistance, and sustainability-driven coating solutions with reduced environmental impact.

- BASF SE: BASF supplies waterborne coating resins and complete formulation systems used in automotive coatings, furniture finishes, and general industrial applications. The company emphasises high-performance dispersion technologies, low-VOC systems, and sustainability-focused formulations.

- Axalta Coating Systems: Axalta delivers waterborne coating products for automotive OEMs, refinish markets, and industrial segments. Its solutions are known for excellent adhesion, fast curing, and improved environmental performance, supported by advanced application technologies.

Top Companies in the Waterborne Coatings Market

- Axalta Coating Systems

- BASF SE

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Berger Paints India Ltd.

- Kansai Paint Co.

- Nippon Paint Holdings Company Ltd.

- RPM International Inc.

- The Valspar Corp.

- Tikkurila Oyj

Segments Covered

By Resin Type

- Acrylic

- Polyurethane

By Product Type

- Water-Soluble Paints

- Emulsions Paints

- Water-Based Alkyds

By End-Use Industry

- Building & Construction

- Automotive

- Electronics

- Paper & Packaging

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa