Content

Water Treatment Chemicals Market Size | Companies Analysis 2034

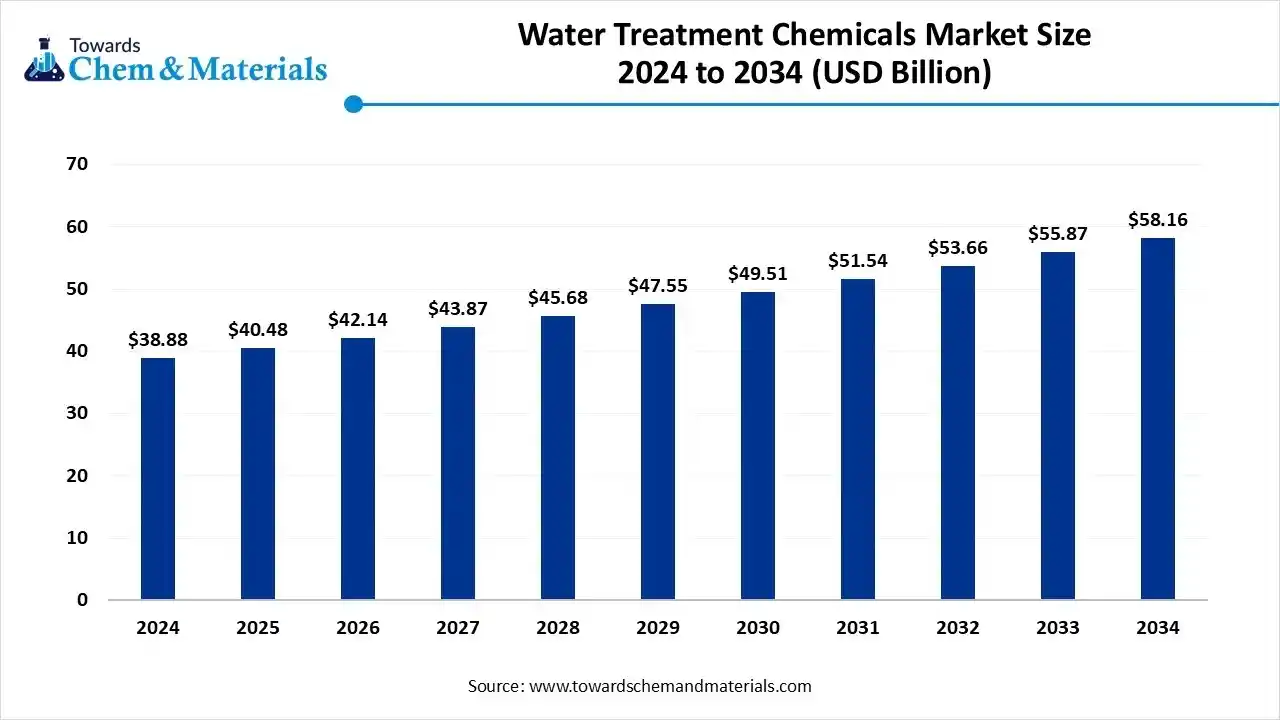

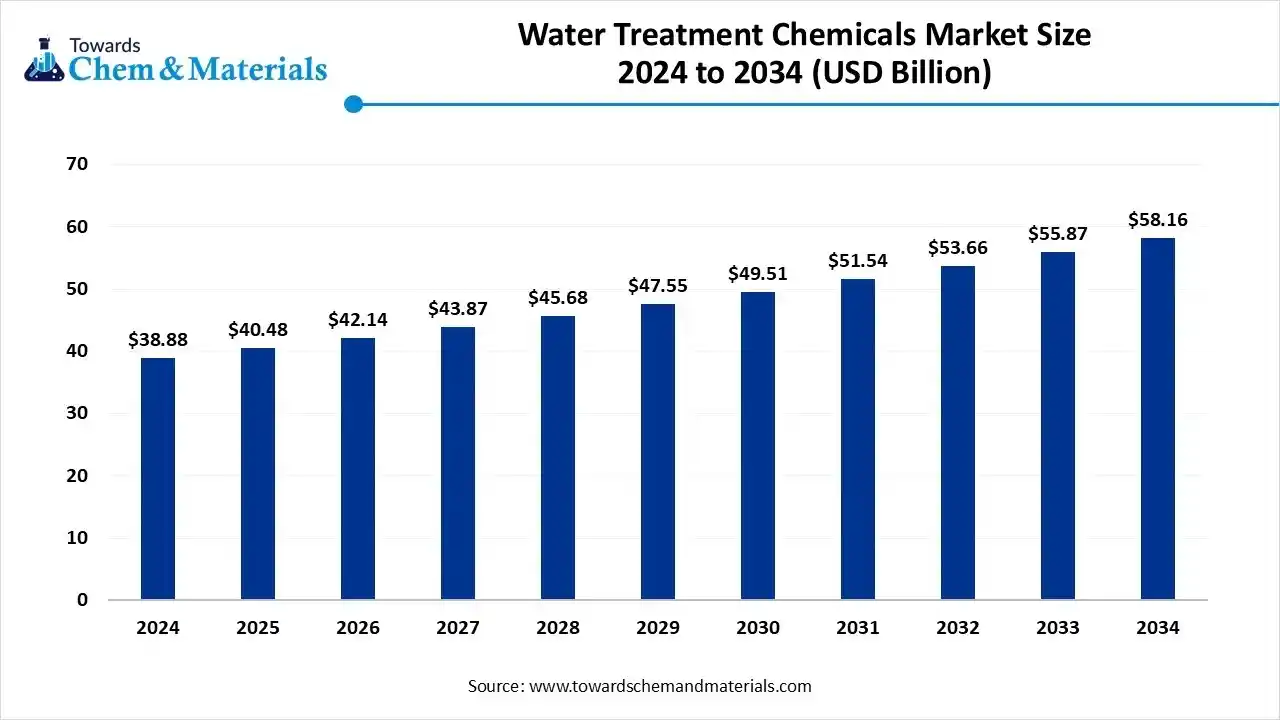

The global water treatment chemicals market size was reached at USD 38.88 billion in 2024 and is expected to be worth around USD 58.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period 2025 to 2034. The growing demand for clean drinking water and increasing water scarcity issues drive the market growth.

Key Takeaways

- North America dominated the market and accounted for the largest revenue share of 33% in 2024.

- By product, the coagulants & flocculants segment accounted for the largest revenue share of 42% in 2024.

- By application, the raw water treatment segment held the largest revenue share of 51% in 2024.

- By end-use, the municipal segment accounted for the largest revenue share of around 45% in 2024.

What are Water Treatment Chemicals?

The water treatment chemicals market growth is driven by the increasing need for safe drinking water, aging water infrastructure, growing power generation, increasing awareness about water scarcity, and growing municipal investment in water treatment solutions.

Water treatment chemicals are substances added to water to improve the quality of water, purify water, and remove contaminants from water. The functionality of water treatment chemicals is to kill harmful bacteria, remove coagulation, adjust pH, inhibit pipe corrosion, and remove unwanted tastes. Water treatment chemicals prevent waterborne diseases, improve water quality, and reduce pollution.

Water Treatment Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expanding rapidly due to the growing expansion of industrial activities and increasing water scarcity issues. The stricter regulation on water quality and the rise in water reuse in regions like the United States, Europe, and the Asia Pacific drives market growth.

- Sustainability Trends: Sustainability is reshaping the water treatment chemicals industry, with the adoption of bio-based chemicals, green chemicals, and water recycling. For instance, Kemira produces biomass-balanced flocculants Superfloc BioMB for drinking water and wastewater treatment.

- Startup Ecosystem: The water treatment chemicals startup ecosystem is rapidly growing, especially in areas like smart water management and production of clean water. For instance, Kurita Water Industries (Japan) launched Kurita AquaChemie India Pvt Ltd (KAIL) to sell water treatment chemicals in India.

Key Technological Shifts in the Water Treatment Chemicals Market:

The market is undergoing key technological innovations driven by the demand for sustainable operation and improving outcomes of treatment. One of the significant transformations is the integration of AI offers real-time data analysis and optimizes chemical dosages. AI analyses chemical concentration, pH, & turbidity and predicts future water quality issues. AI makes real-time adjustments and helps to maintain high-quality water standards. AI easily detects faults in equipment and optimizes the usage of chemicals. For instance, Xylem uses the AI-based Xylem Vue platform to optimize chemical use in water and wastewater utilities.

Trade Analysis of the Water Treatment Chemicals Market: Import & Export Statistics

- India exported 3699 shipments of water treatment chemicals.(Source: www.volza.com )

- Vietnam exported 2647 shipments of water treatment chemicals.(Source: www.volza.com)

- China exported $704M of activated carbon in 2023.(Source: oec.world )

- The United States imported $290M of activated carbon in 2023.9(Source: oec.world)

- Mexico exported 7777 shipments of biocide.(Source: www.volza.com)

- Vietnam exported 802 shipments of pH adjuster.(Source: www.volza.com)

Water Treatment Chemicals Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement is the process of sourcing raw materials like acids, bases, coagulants, adsorbents, and bio-based materials.

- Key Players: BASF SE, Ecolab, Solenis, Dow, Kemira, Solvay

- Chemical Synthesis and Processing : The chemical synthesis and processing involve processes like coagulation, flocculation, disinfection, pH adjustment, oxidation, adsorption, precipitation, and ion exchange.

Key Players: Kurita Water Industries, BASF SE, Ecolab, Solenis, SNF Floerger - Quality Testing certification : Quality testing is testing of properties like purity, smell, color, presence of contaminants, pH, turbidity, hardness, & dissolved oxygen, and certification includes NSF, BIS, Kiwa Watermark, & WQA Gold Seal.

What are Popular Water Treatment Chemicals

| Chemicals | Purpose | Application |

| Citric Acid | Removing scale and mineral deposits |

|

| Ferric Chloride | Binding fine particles in water |

|

| Ferric Sulphate | Sticking suspended solids together |

|

| Hydrochloric Acid | Adjusting pH levels of alkaline water |

|

| Hydrogen Peroxide | Disinfects water and removes contaminants from water. |

|

| Phosphoric Acid | Prevent corrosion in tanks and metal pipes. |

|

| Poly Aluminum Chloride | Removes organic materials and suspended solids from water. |

|

Segmental Insights

Product Insights

Why the Coagulants & Flocculants Segment Dominates the Water Treatment Chemicals Market?

The coagulants & flocculants segment dominated the market in 2024. The growing development of municipal water treatment plants and increasing treatment of wastewater increases the adoption of coagulants & flocculants. The stricter regulations on clean water and high investment in public water infrastructure increase demand for coagulants & flocculants. The increasing need to remove organic matter from water and stricter compliance on water quality require coagulants & flocculants, driving the overall market growth.

The biocides & disinfectants segment is the fastest-growing in the market during the forecast period. The growing awareness of hygiene & sanitation in industries and increased consumption of drinking water increases demand for biocides & disinfectants. The high prevalence of waterborne diseases and stricter regulations on municipal water quality increase the adoption of biocides & disinfectants. The growing sectors like power generation and manufacturing require biocides & disinfectants, supporting the overall market growth.

End-Use Insights

Which End-Use Segment Held the Largest Share in the Water Treatment Chemicals Market?

The municipal segment held the largest revenue share in the market in 2024. The strong focus on managing wastewater and the growing demand for clean drinking water increase the adoption of water treatment chemicals. The stricter regulations on municipal water quality and the strong presence of municipal water treatment plants increase the adoption of water treatment chemicals. The strong government support for the development of municipal water infrastructure drives the overall growth of the market.

The oil & gas segment is experiencing the fastest growth in the market during the forecast period. The increasing generation of high volumes of water from the oil & gas industry increases demand for water treatment chemicals. The presence of advanced oil recovery technology and the need for protection of pipelines increases demand for water treatment chemicals. The increased exploration of onshore & offshore activities requires water treatment chemicals, supporting the overall market growth.

Application Insights

How the Raw Water Treatment Segment Dominated the Water Treatment Chemicals Market?

The raw water treatment segment dominated the market in 2024. The growing industrial activities and expansion of the food & beverage industry generate raw water that requires raw water treatment. The rise in potable drinking water and a strong focus on safe drinking water require raw water treatment. The stricter regulations on water quality and growing concerns of water scarcity drive the overall market growth.

The boiler segment is the fastest-growing in the market during the forecast period. The growing development of nuclear & thermal power plants increases the adoption of boiler systems. The increasing industrial activities like oil & gas and manufacturing require boiler systems. The strong focus on maintaining boiler efficiency and stricter regulations on water pollution support the overall growth of the market.

Regional Insights

North America Water Treatment Chemicals Market Trends

The North America water treatment chemicals market size was valued at USD 12.83 billion in 2024 and is expected to surpass around USD 19.23 billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.13% over the forecast period from 2025 to 2034. North America dominated the market in 2024. The growing demand for safe drinking water and increasing concern about water scarcity problems increase demand for water treatment chemicals. The stricter environmental regulations on water quality and focus on upgrading water infrastructure increase demand for water treatment chemicals. The growing expansion of industries like oil & gas, manufacturing, and power generation requires water treatment chemicals, driving the overall growth of the market.

United States Water Treatment Chemicals Market Trends

The United States is a key contributor to the water treatment chemicals market. The stricter water regulations on water quality standards and a focus on upgrading old water infrastructure increase demand for water treatment chemicals. The high consumption of water and increasing concerns about water require water treatment chemicals. The growing expansion of the oil & gas industry and the rise in agricultural activities require water treatment chemicals, supporting the overall growth of the market.

- The United States exported 1075 shipments of flocculant.(Source: www.volza.com)

- The United States exported 949 shipments of corrosion inhibitors.(Source: www.volza.com)

- The United States exported 1617 shipments of defoamer.(Source: www.volza.com)

Asia Pacific Water Treatment Chemicals Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The stricter regulations on water discharge and increasing awareness about water pollution increase demand for water treatment chemicals. The growing expansion of industries like oil & gas, manufacturing, and power generation increases the adoption of water treatment chemicals. The high government investment in municipal water treatment and the consumption of clean water require water treatment chemicals, driving the overall growth of the market.

China Water Treatment Chemicals Market Trends

China is rapidly growing in the water treatment chemicals market. The expansion of industries like petrochemicals, textiles, power generation, and electronics increases demand for water treatment chemicals. The stricter regulations on water pollution and increasing water scarcity problems increase the adoption of water treatment chemicals. The strong government support for water reuse and the shift towards green water treatment chemicals support the overall growth of the market.

- China exported 1743 shipments of flocculant.(Source: www.volza.com)

- China exported 2186 shipments of defoamer.(Source: www.volza.com)

Europe Water Treatment Chemicals Market Trend

Europe is growing at a notable rate in the market. The stricter regulations on water quality and the growing prevalence of waterborne diseases increase demand for water treatment chemicals. The increasing residential & commercial water treatment and aging water treatment infrastructure increases demand for water treatment chemicals, supporting the overall market growth.

Germany Water Treatment Chemicals Market Trends

Germany is growing in the water treatment chemicals market. The stricter regulations on wastewater discharge and a strong focus on water reuse increase the adoption of water treatment chemicals. The growing modernization of municipal water infrastructure and increasing food processing require water treatment chemicals. The growing industries like automotive and chemical manufacturing require water treatment chemicals, supporting the overall market growth.

Recent Developments

- In July 2024, Kurita America collaborated with Solugen to manufacture bio-based chemicals for industrial water treatment. The product range consist of carbon-negative products and focuses on lowering CO2 emissions.(Source: www.pcimag.com)

- In April 2024, Gradient launched CURE chemicals for water and wastewater treatment. The product range includes over 300 formulations for process chemicals, antiscalants & cleaners, corrosion & scale inhibitors, coagulants & flocculants, and biocides. The chemicals reduce the environmental footprint and enhance process efficiency.(Source: www.gradiant.com )

- In December 2023, Samyang launched two new industrial water treatment equipment, Trilite RO and Trilite EDI. The Trilite RO removes organic matter & salt, and Trilite EDI produces ultrapure & pure water through electricity.(Source: www.indianchemicalnews.com)

Top Companies List

- SUEZ: The French-based company specializes in waste recovery & recycling and water cycle management solutions and offers various non-chemical & chemical solutions for industrial & municipal water.

- BASF SE: The German-based largest chemical producer company and offers services like clean industrial process water, pure raw water for drinking, & treat wastewater streams.

- Ecolab: The sustainability leader offers services & products like treatments, cleaners, and sanitizers for the energy & water industry.

- Solenis: The specialty chemical company offers water solutions for applications like wastewater, raw water treatment, boiler water, and influent.

- Nouryon: The specialty chemical company present in Amsterdam offers chemicals like metal precipitants, synthetic polymers, and scale inhibitors for water treatment.

Other Companies List

- Kemira

- Baker Hughes Company

- Dow

- SNF

- Cortec Corporation

- Johnson Matthey

- Green Water Treatment Solutions

- Bosch Somicon ME FZC

- Veolia

- Kurita Europe GmbH

- Solvay S.A.

- Cortec Corporation

Segments Covered

By Product

- Coagulants & Flocculants

- Biocide & Disinfectant

- Defoamer & Defoaming Agent

- pH & Adjuster & Softener

- Scale & Corrosion Inhibitor

- Others

By End-Use

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Municipal

- Food & Beverage

- Pulp & Paper

- Others

By Application

- Raw Water Treatment

- Water Desalination

- Cooling

- Boiler

- Effluent Water Treatment

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait