Content

What is the Industrial Water Treatment Chemicals Market Size and Share?

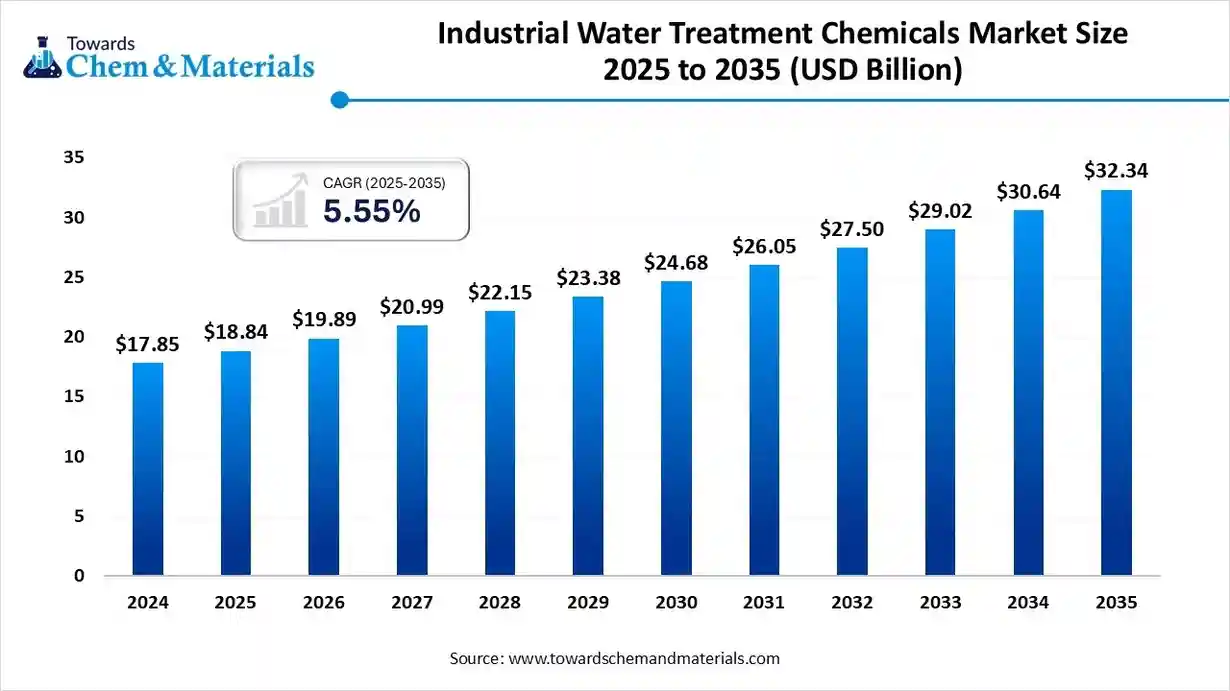

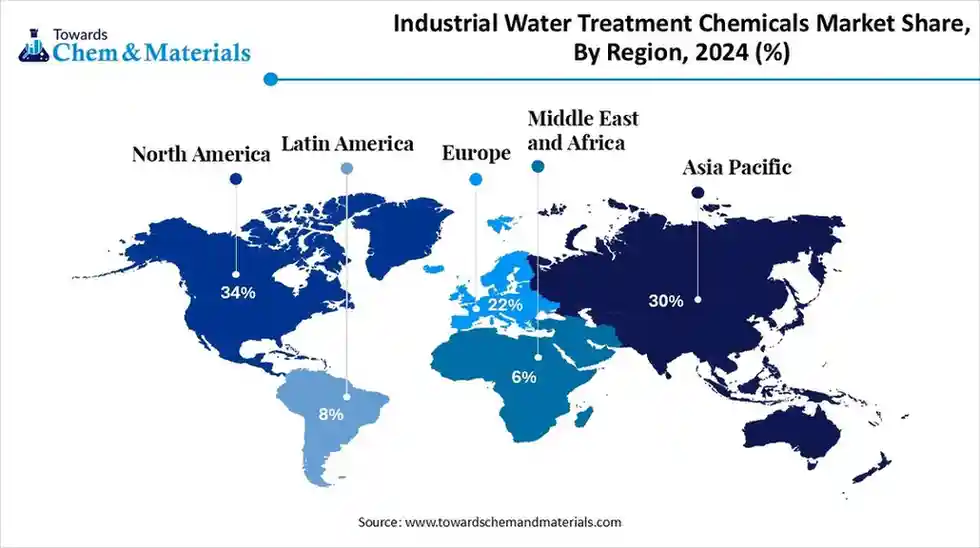

The global industrial water treatment chemicals market size is estimated at USD 18.84 billion in 2025, it is predicted to increase from USD 19.89 billion in 2026 to approximately USD 32.34 billion by 2035, expanding at a CAGR of 5.55% from 2025 to 2035. North America dominated the industrial water treatment chemicals market with a market share of 34% the global market in 2024. The growth of the market is driven due to growing focus on industrial water reuse, circularity and ZLD strategies that increase demand for speciality polymers, antiscalants and biocides.

Key Takeaways

- By region, North America dominated the market with a share of 34% in 2024.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period.

- By product type, the corrosion inhibitors segment dominated the market with a share of 22% in 2024.

- By product type, the biocides & disinfectants segment is expected to grow significantly in the market during the forecast period.

- By formulation, the liquid segment dominated the market with a share of 72% in 2024.

- By formulation, the high-strength concentrates segment is expected to grow in the forecast period.

- By functional chemistry, the organic corrosion inhibitors segment dominated the market with a share of 24% in 2024.

- By functional chemistry, the biocidal chemistries segment is expected to grow in the forecast period.

- By end-use industry, the power generation segment dominated the market with a share of 28% in 2024.

- By end-use industry, the semiconductor/electronics manufacturing segment is expected to grow in the forecast period.

- By distribution channel, the direct sales/field & OEM contracts segment dominated the market with a share of 55% in 2024.

- By distribution channel, the online / e-commerce & marketplaces segment is expected to grow in the forecast period.

- By manufacturer type, the global speciality chemical companies segment dominated the market with a share of 45% in 2024.

- By manufacturer type, the contract blenders / CDMOs segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Industrial Water Treatment Chemicals Market?

The significance of the industrial water treatment chemicals market lies in its role in ensuring industrial sustainability, operational reliability, and environmental compliance. These chemicals are crucial for protecting equipment from damage like scaling and corrosion, purifying water for industrial processes, and treating wastewater to meet strict environmental regulations. The market's growth is driven by expanding industrialisation, increasing water scarcity, and the demand for innovative, eco-friendly solutions, making it a cornerstone of modern industry and resource management.

Industrial Water Treatment Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industrial water treatment chemicals market is projected to grow steadily, driven by rising industrialisation, tightening water discharge regulations, and increasing water scarcity. Industries such as power generation, oil & gas, food & beverage, and manufacturing are expanding their use of water treatment chemicals to ensure operational efficiency and compliance.

- Sustainability Trends: Sustainability is reshaping the market as companies transition toward eco-friendly, biodegradable, and low-toxicity formulations. There is increasing adoption of green corrosion inhibitors, bio-based coagulants, and non-phosphorus scale control agents. Water reuse and recycling programs are being integrated into industrial facilities to reduce freshwater consumption and environmental impact.

- Global Expansion & Innovation: Major chemical manufacturers are expanding their presence across emerging markets and investing in innovation to develop high-performance, sustainable treatment solutions. Strategic collaborations between technology providers and chemical companies are driving advancements in membrane-compatible chemicals and hybrid treatment systems.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 19.89 Billion |

| Expected Size by 2035 | USD 32.34 Billion |

| Growth Rate from 2025 to 2035 | CAGR 4.24% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2035 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Product Type , By Formulation, By Functional Chemistry, By End-User Industry, By Distribution Channel, By Manufacturer Type, By Region |

| Key Companies Profiled | Veolia Water Technologies (France), ChemTreat, Inc. (USA), Thermax Limited (India), Lonza Group AG (Switzerland), Ecolab , Kemira , Solenis SNF Floerger , Kurita Water Industries , BASF , Buckman , Nouryon , Ashland , Calgon Carbon , Cabot Corporation , Solvay , AkzoNobel , Evonik Industries , 3M , Hach (chemical & reagents division) , PeroxyChem / hydrogen peroxide & oxidant suppliers , Kuraray (specialty polymers & ion-exchange media) , Degussa / speciality water-treatment additives |

Key Technological Shifts In The Industrial Water Treatment Chemicals Market:

Key technological shifts in the industrial water treatment chemicals market include a shift toward sustainable and biodegradable chemicals, the integration of digitalisation, like smart dosing and AI monitoring, and the development of specialised formulations for specific applications and advanced processes like desalination and zero liquid discharge (ZLD). The push for ZLD systems is driving demand for chemicals that are compatible with these advanced processes, which aim to recycle and reuse all wastewater, supporting a circular economy.

Trade Analysis Of Industrial Water Treatment Chemicals Market: Import & Export Statistics

- India shipped out 3 water treatment chemical shipments from Jul 2023 to Jun 2024 (TTM). These exports were handled by 1 Indian exporter to 2 buyers, showing a growth rate of 200% over the previous 12 months.

Most of the Water Treatment Chemicals exported from India go to Bangladesh, Colombia, and Vietnam. (Source: www.volza.com) - The world shipped out 4,841 water treatment chemical shipments from Jun 2024 to May 2025 (TTM). These exports were handled by 552 world exporters to 840 buyers, showing a growth rate of 29% over the previous 12 months.

Most of the Water Treatment Chemical exports from the World go to Vietnam, Bangladesh, and the Philippines.

- Globally, India, Vietnam, and Thailand are the top three exporters of Water Treatment chemicals. India is the global leader in Water Treatment chemicals exports with 3,699 shipments, followed closely by Vietnam with 2,647 shipments, and Thailand in third place with 1,454 shipments.(Source: www.volza.com)

Industrial Water Treatment Chemicals Market Value Chain Analysis

- Chemical Synthesis and Processing : Industrial water treatment chemicals are formulated through the synthesis and blending of coagulants, flocculants, corrosion inhibitors, scale inhibitors, and biocides to ensure water purity and equipment protection across industries.

- Key players Ecolab Inc., Kemira Oyj, Solenis LLC, BASF SE, Kurita Water Industries Ltd

- Quality Testing and Certification : These chemicals undergo testing for concentration, pH stability, toxicity, and environmental compliance under standards such as ISO 9001, ISO 14001, and EPA regulations for water safety.

- Key players: SGS, Intertek, TÜV SÜD, Bureau Veritas.

- Distribution to Industrial Users : Industrial water treatment chemicals are supplied to power generation, oil & gas, food & beverage, and manufacturing sectors through distributors and direct industrial contracts.

- Key players: Ecolab Inc., Solenis LLC, ChemTreat Inc., Veolia Water Technologies

Industrial Water Treatment Chemicals Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | - Clean Water Act (CWA) - Safe Drinking Water Act (SDWA) - Toxic Substances Control Act (TSCA) - EPA Biocidal Products Regulation (FIFRA) |

- Water discharge permits (NPDES) - Chemical registration & safety - Biocide approval and labelling - Industrial effluent management |

The CWA governs wastewater discharge standards and effluent limits for industries using treatment chemicals. TSCA mandates pre-manufacture notifications (PMNs) for new chemicals. Biocides like chlorine or glutaraldehyde require FIFRA registration. |

| European Union | European Chemicals Agency (ECHA) | - REACH (EC No. 1907/2006) - Biocidal Products Regulation (BPR, EU 528/2012) - Water Framework Directive (2000/60/EC) |

- Substance registration and risk evaluation - Biocide authorisation - Water quality and discharge control |

The REACH framework regulates registration and safety of treatment chemicals. BPR ensures only authorised biocides are marketed. EU’s WFD sets water quality targets for industrial effluents. PFAS phase-out and phosphate bans are ongoing. |

| China | Ministry of Ecology and Environment (MEE) | - Measures for Environmental Management of New Chemical Substances (MEE Order No. 12) - GB Standards for Industrial Water Discharge - Pollutant Discharge Permit System (2019) |

- Chemical registration and hazard evaluation - Industrial effluent standards - Local agent representation |

MEE mandates new chemical registration before manufacture or import. Industrial water treatment plants must comply with GB 8978 and newer pollutant discharge permits for COD, ammonia, and heavy metals. |

| India | Central Pollution Control Board (CPCB) Ministry of Environment, Forest and Climate Change (MoEFCC) |

- Environment (Protection) Act, 1986 - Water (Prevention and Control of Pollution) Act, 1974 - Hazardous Waste Management Rules, 2016 - Proposed Chemicals (Management and Safety) Rules, 2020 |

- Effluent discharge monitoring - Hazardous chemical registration - Industrial wastewater reuse - Import and labelling compliance |

Industrial water treatment operations require consent to operate from CPCB/SPCB. Draft CMSR 2020 will establish REACH-like registration for imported treatment chemicals. Strict penalties apply for untreated discharge. |

| Australia | Department of Climate Change, Energy, the Environment and Water (DCCEEW) AICIS (Australian Industrial Chemicals Introduction Scheme) |

- AICIS Chemical Registration Scheme (2020) - Water Quality Guidelines (ANZG) |

- Chemical safety and import registration - Water quality monitoring and reuse standards |

AICIS replaced NICNAS, regulating the import/manufacture of water treatment chemicals. ANZG guidelines provide industry-specific discharge limits. |

| Middle East (e.g., GCC) | GCC Standardisation Organisation (GSO) National Environmental Authorities (e.g., MEWA, UAE MOCCAE) |

- GSO 149/2014 (Industrial Wastewater Standards) - National Environmental Regulations |

- Industrial wastewater discharge - Desalination brine management - Biocide use in cooling systems |

GCC nations enforce strict limits for TDS, COD, and biocide residues in wastewater. Focus is on reuse and zero-liquid-discharge systems in the oil & gas and power sectors. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The Industrial Water Treatment Chemicals Market In 2024?

The corrosion inhibitors segment dominated the market with a share of 22% in 2024. Corrosion inhibitors protect industrial systems such as boilers, cooling towers, and pipelines from rust and metal degradation. Their demand is rising due to stringent maintenance standards in the oil & gas, power, and chemical processing industries. Formulations now increasingly focus on eco-friendly, non-toxic chemistries to meet sustainability and environmental compliance goals.

The biocides & disinfectants segment expects significant growth in the industrial water treatment chemicals market during the forecast period. Biocides and disinfectants are critical for controlling microbial contamination in industrial water systems. They ensure equipment longevity and process safety, especially in power generation and food processing sectors. The market is shifting toward advanced oxidising biocides and biodegradable formulations to reduce toxicity and improve biofilm removal efficiency.

The scale inhibitors/antiscalants segment has seen notable growth in the market. Scale inhibitors prevent mineral deposits that affect heat exchangers, cooling systems, and desalination units. The demand is growing with the expansion of water-intensive industries and zero-liquid discharge systems. Modern formulations use polymeric and phosphonate-free chemistries for sustainable water management and improved process efficiency.

Formulation Insights

How did Liquid Segment dominate the Industrial Water Treatment Chemicals Market in 2024?

- The liquid segment dominated the market with a share of 72% in 2024. Liquid formulations dominate due to ease of dosing, high solubility, and compatibility with automated feed systems. They are preferred in power plants, manufacturing facilities, and municipal treatment applications for continuous water conditioning. Innovation focuses on concentrated and pre-mixed solutions that minimise handling risks and ensure consistent treatment efficiency.

- The high-strength concentrates segment is expected to experience significant growth in the industrial water treatment chemicals market during the forecast period. High-strength concentrates are gaining traction for offering lower transportation and storage costs with enhanced performance per unit volume. These concentrated chemistries reduce packaging waste and align with sustainability goals. They are particularly favoured by OEMs and large industrial operators seeking cost-efficient, scalable dosing systems.

- The powder / granular segment has seen notable growth in the market. Powder and granular formulations offer extended shelf life and ease of storage, making them suitable for remote facilities and emergency dosing. They are popular in small-scale industrial plants and localised water treatment applications. Growing innovations in quick-dissolve granules enhance application flexibility and reduce maintenance downtime.

Functional Chemistry Insights

Which Functional Chemistry Segment Dominated The Industrial Water Treatment Chemicals Market In 2024?

- The organic corrosion inhibitors segment dominated the industrial water treatment chemicals market with a share of 24% in 2024. Organic inhibitors, including amines and azoles, are widely used due to their compatibility with multi-metal systems and environmental safety. They form protective films on metal surfaces, preventing corrosion under varying pH conditions. Rising adoption in electronics manufacturing and HVAC water systems supports steady market growth.

- The biocidal chemistries segment expects significant growth in the market during the forecast period. Biocidal chemistries encompass oxidising agents like chlorine dioxide and non-oxidising compounds such as glutaraldehyde. They prevent microbial-induced corrosion and biofouling across industrial cooling and process water systems. Innovations emphasise dual-action biocides that balance efficacy with reduced environmental impact and compliance with global biocide regulations.

- The inorganic inhibitors/neutralisers segment has seen notable growth in the market. Inorganic inhibitors, including phosphates and silicates, offer cost-effective protection in high-pressure and high-temperature applications. They remain integral to power generation and refinery systems where metal integrity is critical. However, the shift toward phosphate-free, eco-certified alternatives is reshaping this segment’s development landscape.

End-User Industry Insights

How did the Power Generation Segment dominate the Industrial Water Treatment Chemicals Market in 2024?

- The power generation segment dominated the market with a share of 28% in 2024. The power industry is a major consumer of water treatment chemicals to prevent scaling, corrosion, and biological fouling in boilers and cooling systems. Increasing reliance on high-efficiency thermal plants and renewable hybrid setups fuels chemical demand. Focus is shifting toward advanced conditioning formulations for closed-loop cooling circuits.

- The semiconductor/electronics manufacturing segment expects significant growth in the industrial water treatment chemicals market during the forecast period. Semiconductor manufacturing demands ultra-pure process water, requiring precise use of inhibitors and disinfectants. Water purity is crucial for wafer cleaning, cooling, and etching processes. With Asia Pacific’s booming semiconductor production, speciality water treatment chemicals ensuring zero contamination are seeing accelerated growth.

- The oil & gas / upstream & refining segment has seen notable growth in the market. Water treatment in oil & gas operations addresses scaling, corrosion, and microbial challenges in drilling, extraction, and refining. Chemicals improve operational reliability and prevent equipment downtime. Increasing offshore exploration and water reuse initiatives drive demand for high-performance, environmentally compliant formulations.

Distribution Channel Insights

Which Distribution Channel Segment Dominated The Industrial Water Treatment Chemicals Market In 2024?

The direct sales/field & OEM contracts segment dominated the industrial water treatment chemicals market with a share of 55% in 2024. Direct sales remain dominant due to the need for technical service, on-site monitoring, and performance assurance. Large chemical companies prefer long-term OEM and field service contracts with industrial clients to ensure consistent product performance and loyalty.

The online / e-commerce & marketplaces segment expects significant growth in the market during the forecast period. Digital sales channels are expanding, offering smaller industrial buyers easier access to standard water treatment formulations. E-commerce platforms provide competitive pricing and quick delivery. The trend is supported by the growing digitalisation of industrial procurement systems.

The industrial distributors/wholesalers segment has seen notable growth in the industrial water treatment chemicals market. Distributors play a vital role in reaching regional and mid-scale industries. They provide technical guidance, local storage, and quick supply. Strategic partnerships with global producers help maintain supply chain resilience and regional market penetration.

Manufacturer Type Insights

How did Global Speciality Chemical Companies dominate the Industrial Water Treatment Chemicals Market in 2024?

The global speciality chemical companies segment dominated the market with a share of 45% in 2024. Major players dominate through integrated production, R&D, and service capabilities. They offer comprehensive portfolios and customised chemical blends for various industries. Sustainability-driven product innovation and smart monitoring integration are key differentiators in this segment.

The contract blenders / CDMOs segment expects significant growth in the industrial water treatment chemicals market during the forecast period. Contract blenders and CDMOs support private-label manufacturing and tailored chemical blending. They serve niche applications, offering flexibility and cost efficiency. Rising outsourcing by OEMs and regional water service firms boosts demand for these specialised service providers.

The regional/local chemical manufacturers segment has seen notable growth in the market. Local producers cater to specific industrial clusters with cost-effective and fast-delivery solutions. Their agility helps address local water quality variations and regulatory compliance. Increasing collaboration with global firms enhances product standards and market competitiveness.

Regional Insights

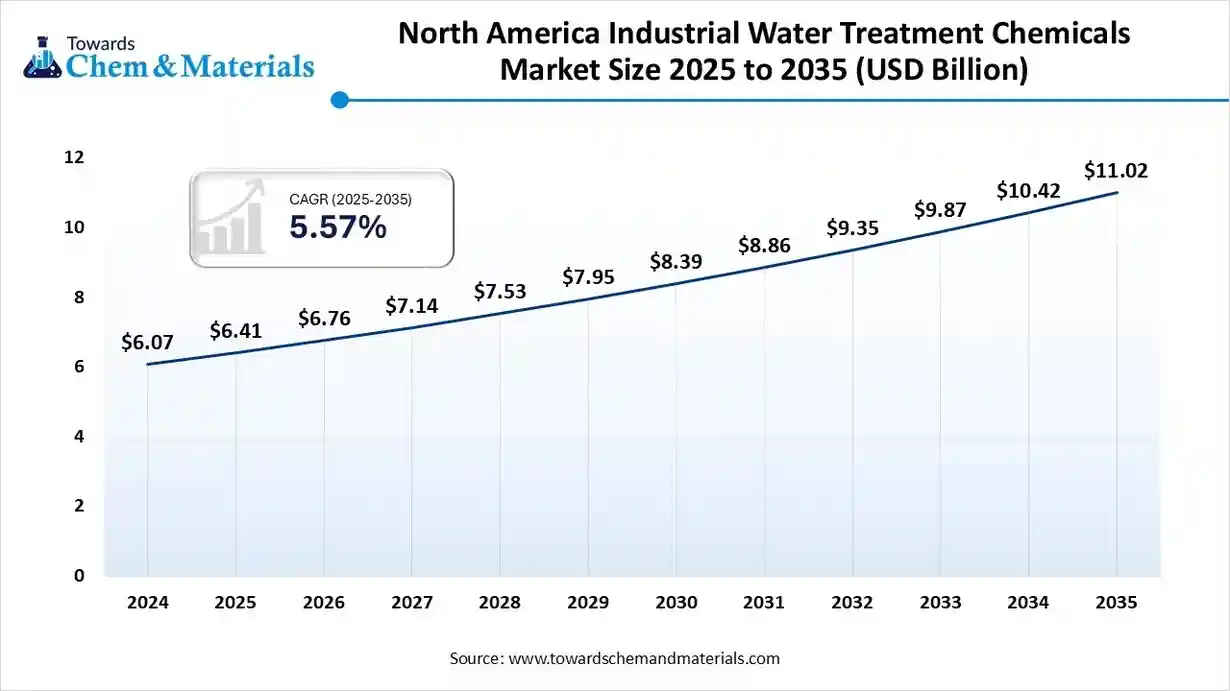

The North America industrial water treatment chemicals market size was valued at USD 6.41 billion in 2025 and is expected to reach USD 11.02 billion by 2035, growing at a CAGR of 5.57% from 2025 to 2035. North America dominated the market with a share of 34% in 2024. North America represents a major market for industrial water treatment chemicals due to stringent environmental regulations and extensive industrial infrastructure.

The region focuses on sustainable water management and chemical innovation to support industries such as oil & gas, power generation, and manufacturing, ensuring efficient operations and compliance with EPA water quality standards.

Canada Has Seen Significant Growth In The Industrial Water Treatment Chemicals Market Due To Increased Demand.

Canada’s industrial water treatment sector benefits from the growing demand in pulp & paper, mining, and oil sands industries. The nation emphasises eco-friendly formulations, including biodegradable corrosion inhibitors and green biocides, as part of its environmental stewardship and commitment to reducing industrial water pollution.

Asia Pacific Industrial Water Treatment Chemicals Market:

Asia Pacific is expected to have significant growth in the market in the forecast period. Asia Pacific leads the global market owing to large-scale industrialisation, expanding manufacturing sectors, and rising investment in water recycling. Countries like China, India, and Japan are increasingly adopting high-performance antiscalants and corrosion inhibitors to combat water stress and enhance process efficiency across industries such as power and semiconductors.

Industrial Water Treatment Chemicals Market Trends: In India

India’s water treatment chemicals market is expanding rapidly due to urbanisation, infrastructure growth, and environmental compliance initiatives. The government’s “Make in India” and industrial corridor programs have spurred the adoption of advanced treatment chemicals in thermal power plants, refineries, and electronics manufacturing facilities.

South America: Robust Chemical Solutions

South America’s growth in this market is supported by the oil & gas and mining industries, which require robust chemical solutions for wastewater management. Countries are adopting corrosion and scale control technologies to support environmental sustainability, particularly in regions facing water scarcity challenges.

Brazil: The Growth Is Driven By The Demand From Industries

Brazil dominates South America’s market with strong demand from the petrochemical, food processing, and pulp & paper sectors. The country’s rising investments in industrial water infrastructure and sustainability-driven practices are increasing the adoption of high-performance biocides and organic corrosion inhibitors.

Europe: Industrial Water Treatment Chemicals Market Trends

Europe remains a mature market for industrial water treatment chemicals, driven by strict EU regulations and the widespread use of green chemistries. Industries emphasise closed-loop water systems, bio-based corrosion inhibitors, and advanced microbial control technologies to minimise environmental impact and operational costs.

Germany: Industrial Water Treatment Chemicals Market For High-Efficiency Solution

Germany is at the forefront of Europe’s market, emphasising innovation in chemical formulations and water reuse technologies. The strong manufacturing base and government incentives for sustainability drive demand for high-efficiency corrosion and scale inhibitors across industrial facilities.

Middle East & Africa (MEA): Industrial Water Treatment Chemicals Market Trends

The MEA region shows increasing adoption of industrial water treatment solutions due to expanding petrochemical, desalination, and power generation projects. The emphasis is on advanced corrosion prevention and antiscalant chemistries suited for high-salinity environments and challenging water conditions.

Egypt Has Seen Growth Driven By The Growing Investments.

Egypt’s industrial growth, particularly in energy and desalination plants, supports demand for reliable water treatment chemicals. Strategic investments in industrial modernisation and water infrastructure are propelling the use of efficient disinfectants and inhibitors to improve water quality and equipment longevity.

Recent Developments

- In September 2025, IIT Madras-incubated start-up JSP Enviro successfully installed a next-generation wastewater treatment technology across various industries in Tamil Nadu. The company is now focused on scaling up this indigenously developed, sustainable effluent treatment technology throughout India.(Source: www.pib.gov.in)

- In January 2025, DuPont Water Solutions received the 2025 BIG Innovation Award for advancements in water purification and conservation, specifically for their IntegraFlux LEAP MBBR IFD system, which offers a sustainable and efficient solution for wastewater treatment. (Source: www.indianchemicalnews.com)

- In March 2025, Memsift Innovations and the Murugappa Group launched the GOSEP™ a new ultrafiltration membrane for industrial water treatment. This product is designed to address complex wastewater challenges with enhanced performance and efficiency.(Source: chemindigest.com)

Top Players in the Industrial Water Treatment Chemicals Market & Their Offerings:

Dow Chemical Company (USA)

Corporate Information

- Name: Dow Inc. (Ticker: DOW, NYSE) the successor of The Dow Chemical Company after restructuring.

- Headquarters: Midland, Michigan, USA.

- Business: A global materials science company serving customers in high growth markets such as packaging, infrastructure, mobility, and consumer applications.

History and Background

- The Dow Chemical Company has its origins in the late 19th century (founded 1897 by Herbert H. Dow). Over the decades it grew into a diversified global chemical company (not all details here).

- A major milestone: In 2008, Dow acquired Rohm & Haas Company for about US$18.8 billion, expanding its specialty chemicals and membranes business (including water treatment relevant assets).

Key Developments and Strategic Initiatives

- Sustainability / Water & Nature Strategy: In May 2024, Dow announced expanded “Protect the Climate” targets that include specific water & nature milestones: by 2030 the company’s top 20 water dependent sites will have water stewardship plans; by 2035 all sites will; by 2050 the company will partner to conserve 50,000 acres of habitat.

- Portfolio rationalization / asset sales: For example, the sale of the flexible packaging laminating adhesives business to Arkema S.A. in May 2024 to focus on core, high value downstream businesses.

Mergers & Acquisitions

- Acquisition of Rohm & Haas (2008) boosted its specialty materials, including ion exchange resins and membranes relevant for water treatment.

- The 2017 Dow DuPont merger and 2019 split created the current structure: Dow Inc. focusing on materials science.

- Divestitures: sale of certain adhesive businesses (as above) to streamline portfolio.

Partnerships & Collaborations

- Collaboration for freshwater conservation: At its Terneuzen (Netherlands) manufacturing site, Dow worked with local water utility Evides Industriewater and other partners to reuse municipal wastewater streams, reducing freshwater intake and lowering energy/chemical demand.

- Strategic infrastructure joint venture with Macquarie (see above) for U.S. Gulf Coast assets.

Product Launches / Innovations

- In the water treatment domain, the Rohm & Haas acquisition allowed expansion of Dow’s ion exchange resins and membrane manufacturing (e.g., a large expansion in Edina, Minnesota).

- The company’s broader innovation focus: materials science solutions aligned with sustainability, circular economy, safer materials as per their 2023 “INtersections” sustainability report.

Key Technology Focus Areas

- Materials science technologies: polymer science, ion exchange technologies, membrane separation, specialty chemicals.

- Water treatment / reuse: water stewardship, recycling and reuse of industrial water, technologies reducing freshwater intake and chemical/energy use.

R&D Organisation & Investment

- Dow has long emphasised R&D and innovation in its materials science business (though specific R&D budget figures are less publicly disclosed in the sources I located).

- Its 2023 sustainability/innovation report (“INtersections”) shows the company’s focus on innovation, customer centred solutions, and sustainability.

SWOT Analysis

Strengths

- Global scale, deep materials science expertise, diversified portfolio across high growth markets (packaging, infrastructure, mobility).

- A presence in water treatment chemicals and technologies (ion exchange, membranes) tied to its specialty materials capabilities.

- Established sustainability commitments and partnerships in water reuse and nature/conservation, which bolster credibility and long term differentiation.

- Ability to optimise portfolio, divest non core assets, and refocus capital (e.g., asset sales/infrastructure partnerships).

Weaknesses

- Exposure to commodity chemicals and upstream energy/ feedstock cost volatility (which can compress margins).

- Recent announcements of cost cutting, asset shutdowns, workforce reductions indicate operational stress in some regions (particularly Europe).

- Possibly less focused on pure water treatment chemicals than some dedicated players whose entire business is water treatment chemicals (which may offer niche advantages).

Opportunities

- Growing global demand for industrial and municipal water treatment solutions, regulatory pressures for water reuse and circular economy in water.

- Innovation in advanced membranes, ion exchange materials, polymers for water and wastewater treatment, and industrial scale water reuse/zero liquid discharge (ZLD) solutions.

- Sustainability and nature positive operations provide opportunities to partner with customers and communities on water/resilience programs (e.g., its water & nature strategy).

- Divestment of less profitable assets allows capital to be redeployed into higher margin growth areas (e.g., downstream materials, specialty chemicals, water related solutions).

Threats

- Macroeconomic weakness (slowing demand for building/infrastructure materials) and high energy/ feedstock costs could continue to impact profitability (as indicated by recent losses).

- Geographic/regional exposure risks: European operations appear to face structural cost/energy issues and regulatory pressures (asset shutdowns announced).

- Competitive landscape: There are many specialized water treatment chemical companies (biocides, coagulants, polymers) that may compete more directly in certain niches.

- Regulatory/ESG risks: Since the business is materials/chemicals oriented, environmental, health and safety regulatory burdens (and reputational risks) remain significant.

Recent News & Strategic Updates

- In May 2025, Dow announced the sale of a 40 % equity stake in its infrastructure entity (“Diamond Infrastructure Solutions”) to Macquarie for ~$2.4 billion in initial proceeds, with the option to raise to ~$3 billion. This move aligns with unlocking value from non product producing assets.

- In January 2025, Dow announced a plan to deliver US$1 billion in cost savings (through workforce reductions and direct cost cuts).

Other Top Companies

- Veolia Water Technologies (France): Offers integrated water treatment chemicals and services through its Hydrex® brand, providing coagulants, scale inhibitors, and disinfectants for industrial wastewater management.

- ChemTreat, Inc. (USA): A subsidiary of Danaher Corporation, ChemTreat develops water treatment chemicals for cooling towers, boilers, and wastewater systems, focusing on process optimisation and cost efficiency.

- Thermax Limited (India): Supplies a comprehensive range of boiler and cooling water treatment chemicals, along with performance monitoring systems for industrial sectors such as power, steel, and petrochemicals.

- Lonza Group AG (Switzerland): Offers biocides and speciality chemicals for microbial control in industrial water systems, cooling towers, and manufacturing facilities, with a strong emphasis on regulatory compliance and sustainability.

- Ecolab

- Kemira

- Solenis

- SNF Floerger

- Kurita Water Industries

- BASF

- Buckman

- Nouryon

- LANXESS

- Ashland

- Calgon Carbon

- Cabot Corporation

- Solvay

- AkzoNobel

- Evonik Industries

- 3M

- Hach (chemical & reagents division)

- PeroxyChem / hydrogen peroxide & oxidant suppliers

- Kuraray (specialty polymers & ion-exchange media)

- Degussa / speciality water-treatment additives

Segments Covered:

By Product Type

- corrosion inhibitors

- film-forming amines / filming inhibitors

- phosphate- and non-phosphate formulations

- scale inhibitors / antiscalants

- phosphonates

- polymeric antiscalants

- biocides & disinfectants

- oxidizing biocides (chlorine, chlorine dioxide)

- non-oxidizing biocides (isothiazolinones, glutaraldehyde)

- coagulants & flocculants

- aluminium / ferric salts

- polyacrylamides (pams) & cationic/anionic polymers

- ph adjusters / neutralizers

- acids (sulfuric, hydrochloric)

- caustics (caustic soda, soda ash)

- antifoaming / defoamers

- silicone-based, mineral oil, eo/po polymers

- oxygen scavengers / reductants

- sulfite-based, hydrazine alternatives

- dispersants / threshold inhibitors

- specialty polymers & organics

- others (chelants, odor control, colorants)

By Formulation

- Liquid (solns/concentrates ready-to-dilute)

- Powder / Granular

- High-strength Concentrates (bulk blends)

- Tablets / Compressed Dosing (e.g., chlorine tablets)

- Emulsions / Slurries

- Other formats (cartridges, impregnated media)

By Functional Chemistry

- Organic corrosion inhibitors (amines, imidazolines)

- Inorganic inhibitors/neutralisers (phosphates, silicates)

- Polymeric antiscalants/dispersants

- Biocidal chemistries

- Coagulant (inorganic) chemistries

- Speciality organics & chelants

- Anti-foam / surfactant chemistries

- Other functional chemistries

By End-User Industry

- Power Generation (boiler/steam cycle & cooling towers)

- Oil & Gas / Upstream & Refining

- Chemical & Petrochemical

- Food & Beverage / Beverage Processing

- Pulp & Paper

- Metals & Mining

- Pharmaceuticals & Biotech

- Semiconductor / Electronics Manufacturing

- Others (textiles, automotive, industrial parks)

By Distribution Channel

- Direct Sales / Field & OEM Contracts

- Industrial Distributors / Wholesalers

- OEM Bundled Supply (equipment + chemicals)

- Online / E-commerce & Marketplaces

- Trading Companies / Commodity Brokers

- Other channels (tenders, third-party procurement)

By Manufacturer Type

- Global Speciality Chemical Companies

- Regional / Local Chemical Manufacturers

- OEMs & System Integrators (in-house chem supply)

- Contract Blenders / CDMOs (private-label blends)

- Private Label / Industrial Retail Brands

- Other players (research labs, startups)

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

-

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA