Content

What is the Current Water Testing Equipment Market Size and Share?

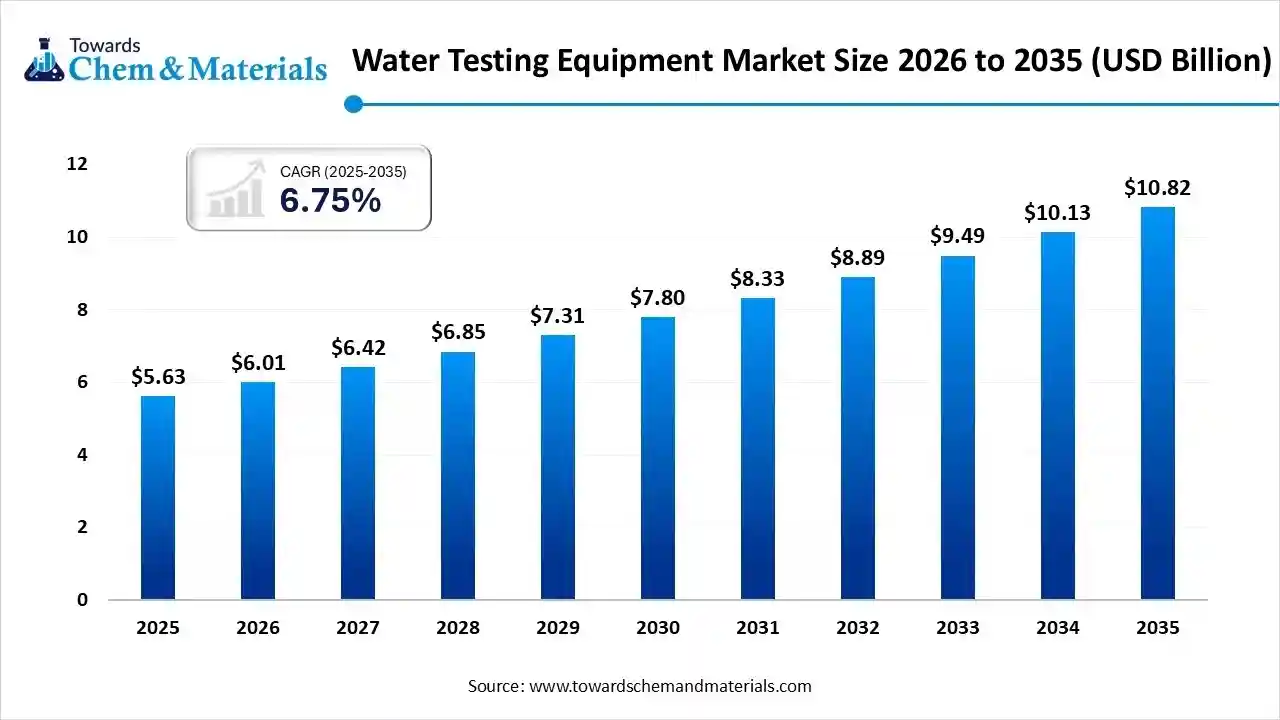

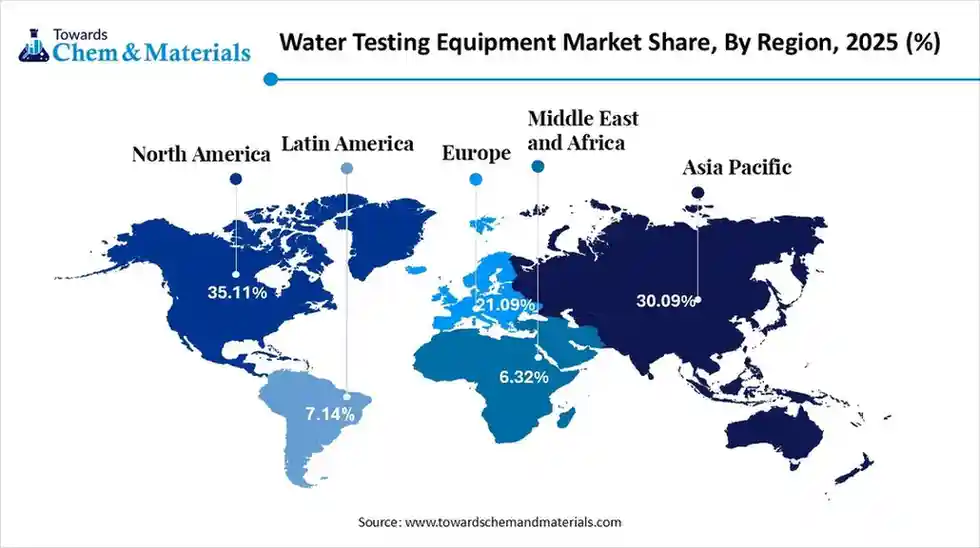

The global water testing equipment market size was estimated at USD 5.63 billion in 2025 and is predicted to increase from USD 6.01 billion in 2026 and is projected to reach around USD 10.82 billion by 2035, The market is expanding at a CAGR of 6.75% between 2026 and 2035. North America dominated the water testing equipment market with a market share of 35.11% the global market in 2025.The market is experiencing significant growth, which is driven by rising urbanization, industrialization, strict regulations, and growing health/environmental awareness.

Key Takeaways

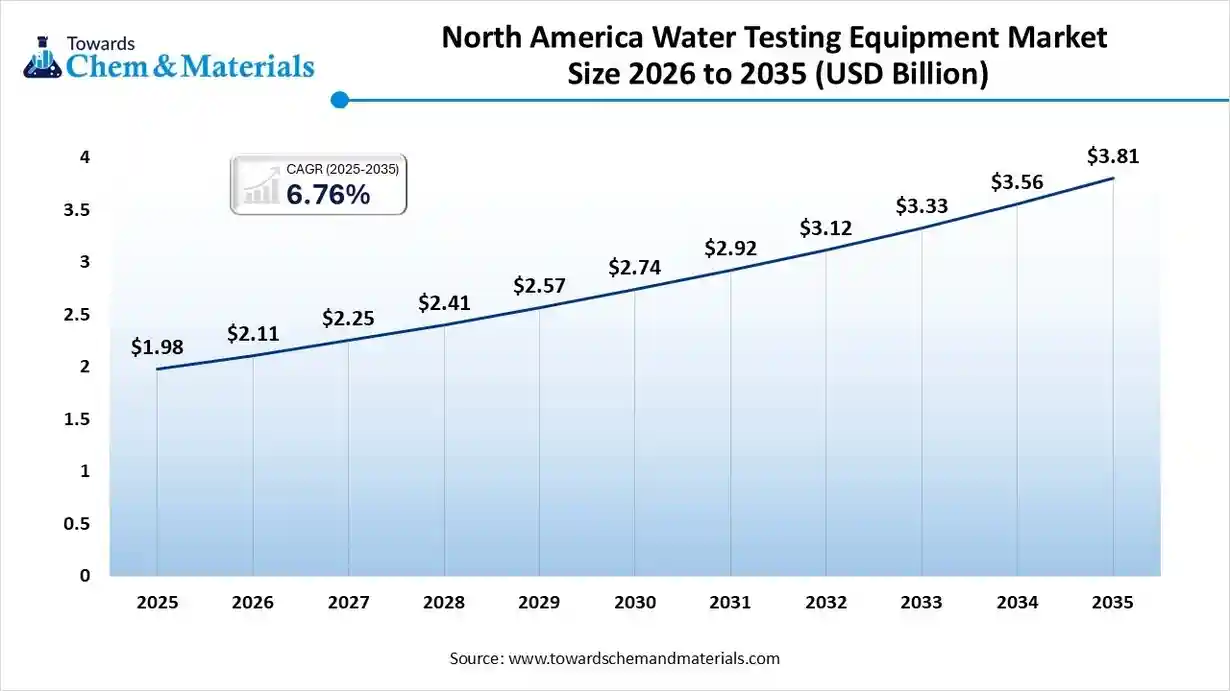

- By region, North America dominated the market with a share of 35.11% in 2025. The strict regulations and standards fuel the growth of the market.

- By region, the Middle East and Africa are expected to have fastest growth in the market in the forecast period between 2026 and 2035. The increasing investments from the government drive the growth of the market.

- By instrument, the spectrometers segment dominated the market with a share of 36.10% in 2025. The growing demand for precise detection drives the growth of the market.

- By instrument, the chromatographs segment is projected to grow at a CAGR between 2026 and 2035. The growing applications in the various sectors drive the growth of the market.

- By product, the benchtop segment dominated the market with a share of 71.21% in 2025. The growing compatibility with the advanced instruments fuels the growth of the market.

- By product, the portable and handheld segment is projected to grow at a CAGR between 2026 and 2035. The ease of use and handling increase the demand and growth.

- By test type, the physical segment dominated the market with a share of 57.10% in 2025. The cost-effectiveness makes it a preferred choice for the market.

- By test type, the chemical segment is projected to grow at a CAGR between 2026 and 2035. Growing environmental concerns and sustainability initiatives drive the growth.

- By technique, the electrochemistry segment dominated the market with a share of 43.05% in 2025. The real-time monitoring increases the demand for the market.

- By technique, the separation segment is projected to grow at a CAGR between 2026 and 2035. The wide application in advanced laboratories drives the growth of the market.

- By end-use, the industrial segment dominated the market with a share of 62.15% in 2025. Growing investments in the advanced industries and laboratories drive the growth.

- By end use, the private laboratories segment is projected to grow at a CAGR between 2026 and 2035. Increasing awareness and strong demand fuel the growth of the market.

Market Overview

What is the significance of the Water Testing Equipment Market?

The significance of the water testing equipment market lies in safeguarding public health, ensuring regulatory compliance, and enabling efficient industrial/agricultural processes by accurately measuring water quality for safe consumption, environmental protection, and product integrity, driven by rising clean water demand, stricter standards, and technological advancements in portable, rapid testing solutions.

This market is crucial for identifying contaminants, preventing waterborne diseases, and ensuring sustainable water management globally, impacting everything from municipal supplies to specialized industries like pharmaceuticals.

Water Testing Equipment Market Growth Trends:

- Regulatory Compliance: Stricter environmental and health regulations for water quality.

- Public Health Concerns: Growing awareness of waterborne diseases and contaminants.

- Technological Advancements: Adoption of smart monitoring, advanced analytics, and high-sensitivity instruments (like LC-MS/MS for PFAS)

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 5.63 Billion |

| Revenue Forecast in 2035 | USD 10.82 Billion |

| Growth Rate | CAGR 6.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Middle East and Africa |

| Segment Covered | By Instrument, By Product, By Test Type, By Technique, By End Use, By Regions |

| Key companies profiled | PerkinElmer Inc., Xylem Inc., Thermo Fisher Scientific, Inc., SGS SA, Emerson Electric Co., Honeywell International, Inc., Veralto, Veolia, Horiba Ltd., 3M Company, METTLER TOLEDO, PerkinElmer, Tintometer GmbH, Eurofins Scientific, IDEXX, Agilent Technologies, Inc., Shimadzu Corporation |

Key Technological Shifts In The Water Testing Equipment Market:

The market is shifting towards smart, portable, and automated solutions, driven by IoT integration, AI/ML analytics for real-time insights, and advanced sensor tech for greater accuracy. Key trends include the rise of real-time data analytics, cloud-based platforms, multi-parameter testing devices, and sophisticated lab techniques like HPLC-MS for trace contaminant analysis, all aiming for quicker, more reliable, and data-driven water quality management.

Trade Analysis Of Water Testing Equipment Market: Import & Export Statistics

- According to Global Export data, the world exported 474 shipments of Water Testing Kits from June 2024 to May 2025 (TTM). These exports were made by 157 exporters to 156 buyers, marking a 71% growth compared to the previous twelve months. Most of the water testing kits exported from around the world go to India, Vietnam, and Colombia.

- Globally, the top three exporters of water testing kits are the United States, India, and China. The United States leads with 487 shipments, followed by India with 306 shipments and China with 74 shipments.

- According to Germany export data, Germany exported 10 shipments of water testing equipment from February 2024 to January 2025 (TTM). These exports were made by 5 Germany exporters to 6 buyers, with a 400% growth compared to the previous twelve months. Most of Germany's water testing equipment exports go to Colombia, Indonesia, and Singapore.

- Globally, the top three exporters of water testing equipment are the United States, United Kingdom, and China. The United States leads with 79 shipments, followed by the United Kingdom with 75 shipments, and China with 57 shipments.

Water Testing Equipment Market Value Chain Analysis

- Manufacturing & Processing: Water testing equipment is developed through processes such as sensor calibration, photometric and electrochemical component assembly, reagent formulation, microcontroller integration, and quality verification for laboratory and field testing applications.

- Key Players: Thermo Fisher Scientific, Xylem Inc., Hanna Instruments, Hach Company.

- Quality Testing & Certification:Water testing equipment requires certifications ensuring analytical accuracy, environmental safety, and compliance with global water quality standards. Key certifications include ISO 9001 for quality systems, EPA and BIS standards, CE marking, and calibration traceability certifications.

- Key Players: ISO (International Organization for Standardization), EPA (Environmental Protection Agency), BIS (Bureau of Indian Standards), UL Solutions.

- Distribution to End-Use Industries:Water testing equipment is distributed to municipal water authorities, environmental monitoring agencies, industrial wastewater treatment plants, laboratories, and research institutions.

- Key Players: Danaher Corporation, Agilent Technologies, Xylem Inc.

Water Testing Equipment Regulatory Landscape: Global Regulations

| Region | Market Characteristics | Key Growth Drivers | Major End-Use Industries | Notable Notes |

| North America | Mature and technology-driven market with high adoption of advanced analytical instruments and automation | Stringent water quality regulations, aging water infrastructure, and strong municipal and industrial monitoring demand | Municipal water utilities, industrial manufacturing, environmental agencies, and laboratories | The U.S. dominates regional demand due to EPA-mandated testing standards and continuous upgrades in water treatment systems. |

| Europe | Highly regulated market with strong emphasis on environmental protection and compliance testing | EU Water Framework Directive; wastewater reuse initiatives; focus on sustainability | Municipal utilities, industrial wastewater treatment, and environmental monitoring bodies | Demand is driven by strict compliance requirements and widespread adoption of real-time and portable testing solutions. |

| Asia Pacific | Fastest-growing regional market with expanding infrastructure and rising pollution concerns | Rapid urbanization, industrial expansion, and government initiatives for clean water access | Municipal water authorities, industrial facilities, agriculture, and laboratories | China and India are key growth engines due to investments in water quality monitoring and smart city projects. |

| South America | Developing market with increasing focus on improving water safety and infrastructure | Public health initiatives, expansion of water treatment facilities, and regulatory modernization | Municipal water utilities, agriculture, food & beverage | Growth is gradual, supported by government-backed water monitoring and sanitation programs |

| Middle East & Africa | Emerging markets are characterized by water scarcity and growing desalination activities. | Desalination expansion; water reuse projects; rising industrial water demand | Desalination plants, municipal utilities, oil & gas, industrial users | Adoption of water testing equipment is increasing to ensure quality control in desalination and reuse applications |

Segmental Insights

Instrument Insights

Which Instrument Segment Dominated The Water Testing Equipment Market In 2025?

The spectrometers segment dominated the market, accounting for a 36% share in 2025. Spectrometers are widely used in water testing for the precise detection and quantification of contaminants. Their high sensitivity and accuracy make them essential in regulatory compliance testing, environmental monitoring, and industrial water quality assessment. Increasing pollution control norms are driving sustained demand for spectrometric instruments.

The chromatographs segment is projected to grow at a CAGR between 2026 and 2035 in the market. Chromatographs play a critical role in separating and analyzing complex chemical mixtures in water samples, particularly for pesticides, hydrocarbons, and trace organic pollutants. Their application is prominent in laboratory-based testing, pharmaceutical water validation, and environmental analysis. Advancements in chromatography techniques continue to enhance resolution, speed, and automation.

Product Insights

How Did the Benchtop Segment Dominated The Water Testing Equipment Market In 2025?

The benchtop segment dominated the market, accounting for a 71% share in 2025. Benchtop water testing equipment is primarily used in laboratories requiring high accuracy, multi-parameter testing, and advanced analytical capabilities. These systems are favored by research institutions, regulatory laboratories, and industrial quality control units. Their robustness, precision, and compatibility with advanced techniques support steady market demand.

The portable & handheld segment is projected to grow at a CAGR between 2026 and 2035 in the market. Portable and handheld water testing devices enable on-site and real-time analysis, making them ideal for field testing, emergency response, and decentralized monitoring. Their ease of use, compact design, and rapid results are driving adoption among environmental agencies, industries, and private testing laboratories, particularly in remote and resource-limited settings.

Test Type Insights

How Did the Physical Test Segment Dominated The Water Testing Equipment Market In 2025?

The physical tests segment dominated the market, accounting for a 57% share in 2025. Physical tests focus on parameters such as turbidity, temperature, conductivity, and total dissolved solids. These tests provide immediate insights into water quality and are commonly used for routine monitoring in municipal systems and industrial processes. The simplicity, speed, and cost-effectiveness of physical testing drive widespread adoption across end users.

The chemical tests segment is projected to grow at a CAGR between 2026 and 2035 in the market. Chemical tests evaluate water composition by measuring pH, dissolved oxygen, nutrients, metals, and chemical contaminants. These tests are critical for regulatory compliance, industrial discharge monitoring, and drinking water safety. Rising concerns over chemical pollution and stricter environmental standards are significantly boosting demand for chemical testing equipment.

Technique Insights

Which Technique Segment Dominated The Water Testing Equipment Market In 2025?

The electrochemistry technique segment dominated the market, accounting for a 43% share in 2025. Electrochemical techniques are extensively used for real-time monitoring of water parameters such as pH, dissolved oxygen, and ion concentration. These techniques offer high sensitivity, rapid response, and suitability for both field and laboratory applications. Their growing integration with digital sensors and automated systems supports increased adoption across industries.

The separation technique segment is projected to grow at a CAGR between 2026 and 2035 in the water testing equipment market. Separation techniques, including filtration and chromatographic separation, are essential for isolating specific contaminants from complex water matrices. These methods are widely applied in advanced laboratory testing, pharmaceutical water validation, and environmental research. Increasing demand for high-purity water analysis is driving innovation in separation-based testing solutions.

End Use Insights

Which End Use Segment Dominated The Water Testing Equipment Market In 2025?

The industrial segment dominated the market, accounting for a 62% share in 2025. Industrial end users rely on water testing equipment to monitor process water, wastewater discharge, and regulatory compliance across sectors such as power generation, chemicals, and manufacturing. Continuous monitoring requirements and strict environmental regulations are driving investments in advanced, automated water testing systems within industrial facilities.

The private laboratories segment is projected to grow at a CAGR between 2026 and 2035 in the water testing equipment market. Private laboratories utilize water testing equipment for commercial testing services, environmental assessments, and contract research. Growth in outsourced testing, increasing environmental awareness, and expanding industrial compliance requirements are supporting strong demand from private laboratories, particularly for high-throughput and multi-parameter analytical instruments.

Regional Analysis

The North America water testing equipment market size was valued at USD 1.98 billion in 2025 and is expected to reach USD 3.81 billion by 2035, growing at a CAGR of 6.76% from 2026 to 2035. North America dominated the market accounting for a 35% share in 2025. North America represents a mature and technology-driven market for water testing equipment, supported by stringent environmental regulations, advanced water infrastructure, and strong adoption across municipal, industrial, and laboratory applications. Regulatory bodies enforce strict standards, driving continuous demand for sophisticated analytical instruments, online monitoring systems, and portable testing devices across utilities and industries.

United States: Water Testing Equipment Market Growth Trends

The United States dominates the North American market due to robust regulatory oversight, widespread industrialization, and significant investments in water quality monitoring. Federal and state regulations mandate regular testing of drinking water and wastewater, encouraging the adoption of advanced instruments such as spectrometers, sensors, and microbial analyzers. The presence of leading manufacturers and well-established laboratory networks further strengthens market growth.

Middle East And Africa Growth Is Driven By Rising Awareness

The Middle East and Africa are expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growth of the market is driven by various factors, like growing demand for advanced water testing equipment, water scarcity, desalination dependency, and rising awareness of water quality management due to growing environmental concerns. Governments are increasingly investing in monitoring systems to ensure safe drinking water and compliance with environmental standards.

South Africa: Water Testing Equipment Market Growth Trends

South Africa is a key contributor to the MEA water testing equipment market, supported by increasing focus on water resource management and pollution control. The country faces challenges related to water scarcity and aging infrastructure, driving demand for reliable testing and monitoring solutions. Government-led water quality programs and industrial compliance requirements are boosting adoption across utilities and laboratories.

Europe: Water Testing Equipment Market: Sustainability Initiatives And Standards

Europe exhibits strong demand for water testing equipment, driven by comprehensive environmental policies, sustainability initiatives, and advanced wastewater treatment infrastructure. The region emphasizes compliance with water quality directives, pushing municipalities, industries, and research institutions to adopt high-precision testing solutions. Increasing focus on pollution control, groundwater protection, and industrial discharge monitoring supports consistent market expansion across European countries.

Germany: Water Testing Equipment Market Growth Trends

Germany plays a pivotal role in the European market, supported by its advanced industrial base and strict environmental compliance culture. The country emphasizes continuous monitoring of industrial wastewater, surface water, and drinking water quality. Strong investments in smart water management systems, coupled with technological innovation and research-driven laboratories, position Germany as a key adopter of advanced water testing instruments.

Asia Pacific: Water Testing Equipment Market: Government Support And Initiatives

Asia Pacific is a rapidly growing market for water testing equipment, fueled by urbanization, industrial growth, and rising concerns over water pollution. Governments across the region are strengthening water quality regulations and investing in monitoring infrastructure to address contamination challenges. Expanding municipal water systems, industrial wastewater treatment facilities, and environmental monitoring programs are key growth drivers.

India: Water Testing Equipment Market Growth Trends

India represents a high-growth market for water testing equipment due to increasing water pollution levels and expanding regulatory enforcement. Government initiatives focused on clean drinking water, river rejuvenation, and wastewater treatment are boosting demand for laboratory and field testing instruments. Rapid urban development, industrial expansion, and growing awareness of waterborne diseases further accelerate adoption across public and private sectors.

South America: Water Testing Equipment Market: Infrastructure Development Plans And Projects

South America shows steady growth in the water testing equipment market, supported by rising investments in water infrastructure and environmental monitoring. Increasing industrial activity and urban population growth are placing pressure on water resources, encouraging governments to implement stricter water quality standards. Demand is growing for cost-effective and portable testing solutions across municipal and industrial applications.

Brazil: Water Testing Equipment Market Growth Trends

Brazil leads the South American water testing equipment market due to its large industrial base and extensive water resources. The country is strengthening water quality monitoring to address industrial discharge, agricultural runoff, and urban wastewater challenges. Investments in water treatment plants and environmental laboratories, along with regulatory enforcement, are driving the adoption of analytical instruments and monitoring technologies.

Recent Developments

- In September 2025, Mahatma Gandhi University (MGU) launched a new Amoebic Research and Diagnostic Centre within its Inter-University Centre for Biomedical Research and Super Speciality Hospital (IUCBR & SSH). the facility aims to test water samples for the pathogens responsible for amoebic meningoencephalitis.(Source: timesofindia.indiatimes.com)

- In June 2025, Toray Industries subsidiary Toray Membrane Middle East LLC (TMME) starts its operations in the latest Middle East Water Treatment Technical Center in Dammam, Saudi Arabia. The units build to boost advanced water treatment solutions for the Middle East, local universities and customers to tackle regional water scarcity with membranes and sustainable technologies.(Source: smartwatermagazine.com)

- In April 2025, Bosch introduced a new range of professional electrical testing equipment tailored for trade and industry applications, including multimeters, clamp meters, moisture and thermal detectors, and various measuring instruments designed for precise electrical testing.(Source: www.bosch-presse.de)

Top players in the Water Testing Equipment Market & Their Offerings:

- Thermo Fisher Scientific: Thermo Fisher is a leading provider of water testing and analytical equipment, offering instruments for chemical, physical, and microbiological water analysis. Its solutions are widely used in environmental monitoring, industrial water testing, and regulatory compliance applications, supported by advanced laboratory technologies.

- Danaher Corporation: Danaher operates through brands such as Hach, Beckman Coulter, and Pall, providing comprehensive water testing instruments and monitoring solutions. The company’s equipment supports drinking water, wastewater, and industrial process water testing with a strong focus on accuracy and digital monitoring.

- Agilent Technologies: Agilent offers advanced analytical instruments used for trace-level water quality testing, including chromatography and spectroscopy systems. Its solutions are applied in environmental testing laboratories, municipal water utilities, and research institutions for contaminant detection and regulatory compliance.

- Xylem Inc.: Xylem provides water quality monitoring and testing equipment through brands like YSI and WTW. The company specializes in sensors, meters, and digital monitoring systems used for real-time water quality assessment in environmental and municipal applications.

- PerkinElmer Inc.: PerkinElmer supplies water testing instruments for organic and inorganic analysis, including mass spectrometry and optical technologies. Its equipment is used in environmental testing, industrial quality control, and research laboratories, ensuring compliance with global water safety standards.

Top Companies in the Water Testing Equipment Market

- PerkinElmer Inc.

- Xylem Inc.

- Thermo Fisher Scientific, Inc.

- SGS SA

- Emerson Electric Co.

- Honeywell International, Inc.

- Veralto

- Veolia

- Horiba Ltd.

- 3M Company

- METTLER TOLEDO

- PerkinElmer

- Tintometer GmbH

- Eurofins Scientific

- IDEXX

- Agilent Technologies, Inc.

- Shimadzu Corporation

Segments Covered

By Instrument

- TOC Meter

- pH Meter

- Dissolved Oxygen Meter

- Conductivity Meter

- Turbidity Meter

- Spectrometer

- Chromatograph

- Others

By Product

- Portable & Handheld

- Benchtop

By Test Type

- Physical Test

- Chemical Test

- Biological Test

By Technique

- Electrochemistry

- Separation Technique

- Atomic & Molecular Spectroscopy

By End Use

- Industrial

- Governmental Facilities

- Private Laboratories

- Others

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa