Content

Oil & Gas Market Size and Growth 2025 to 2034

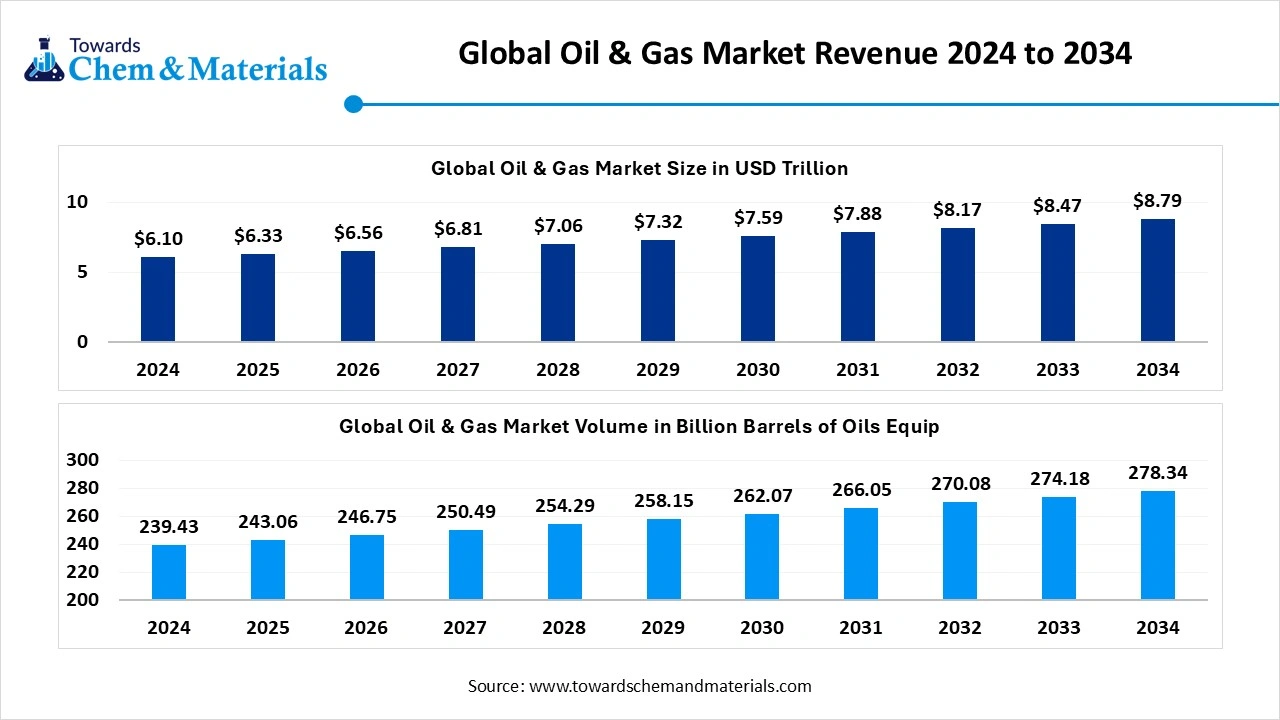

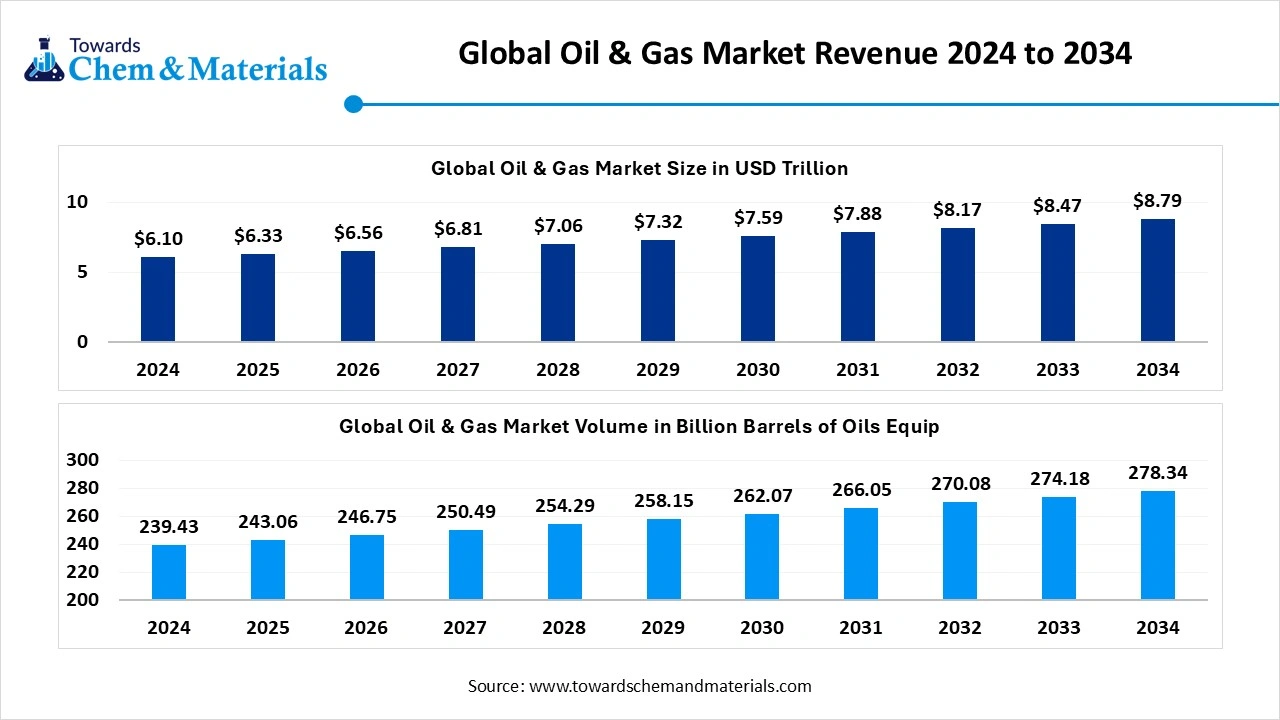

The global Oil & Gas-market size was valued at USD 6.10 Trillion in 2024, grew to USD 6.33 Trillion in 2025, and is expected to hit around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034. The increased global need for energy has accelerated industry potential in recent years.

Key Takeaways

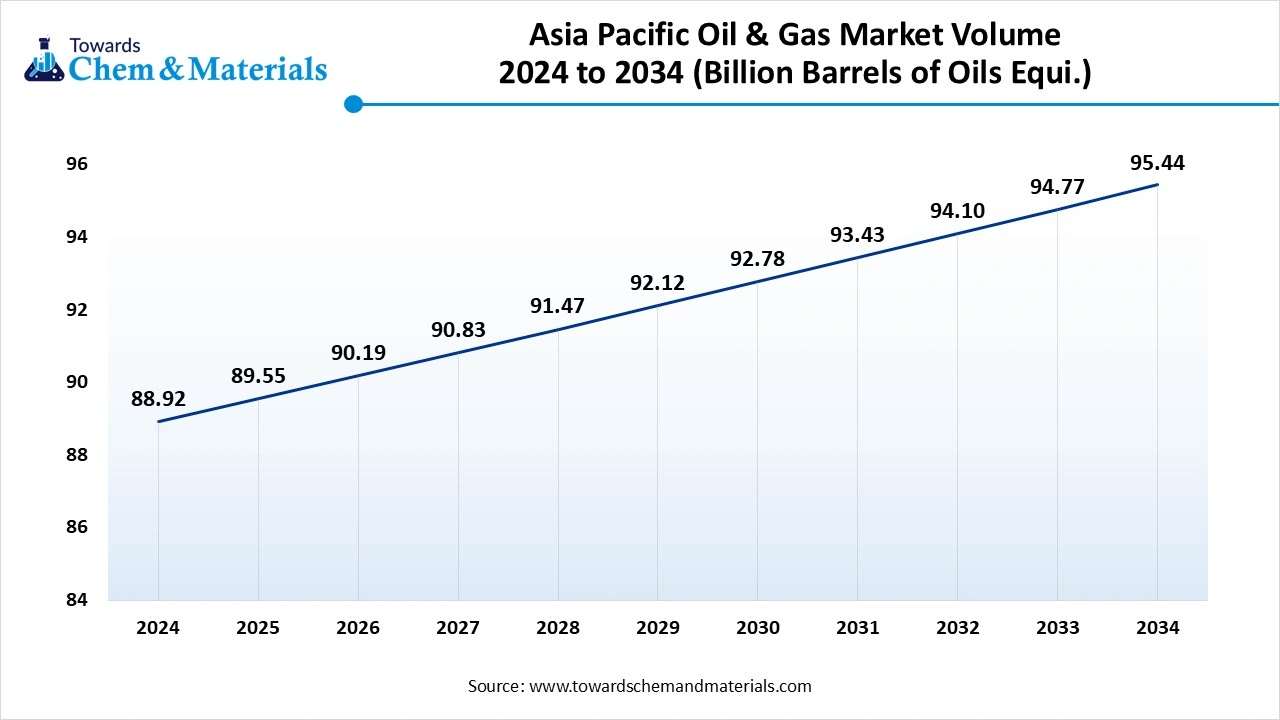

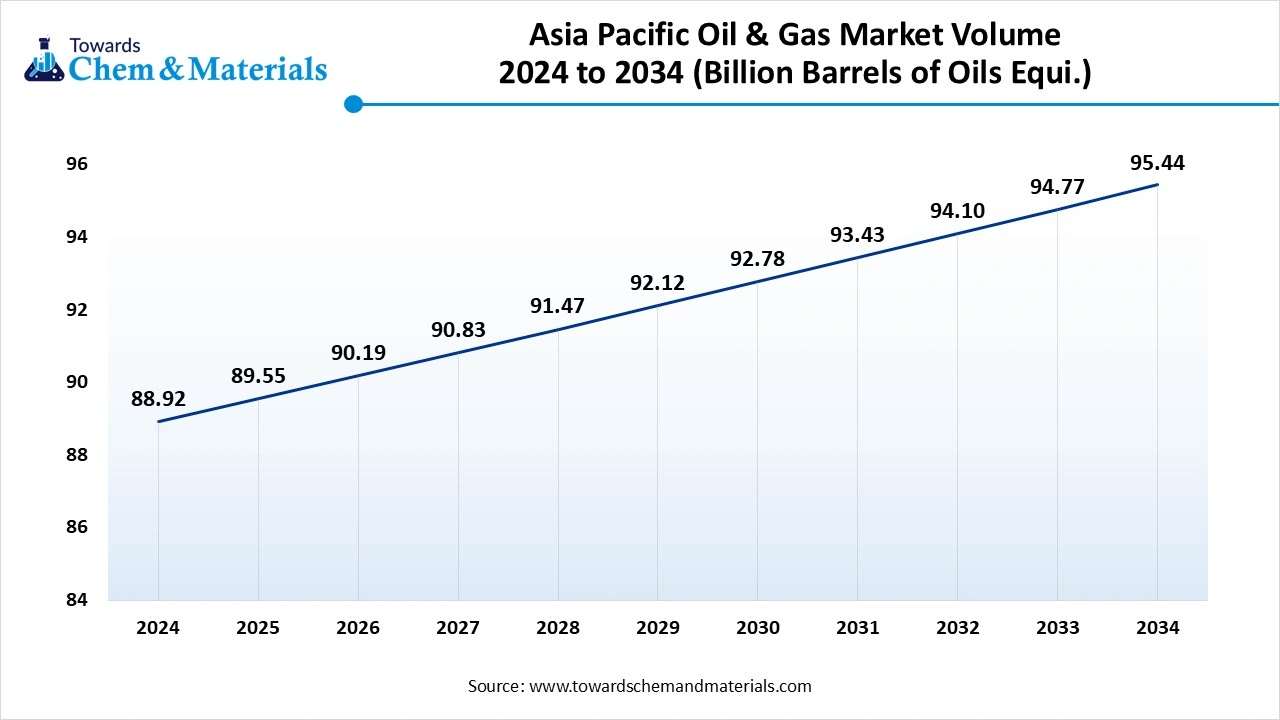

- The Asia Pacific oil and gas market size was estimated at 88.92 Billion Barrels of Oils Equi. in 2024 and is projected to reach 94.77 Billion Barrels of Oils Equi. by 2034, growing at a CAGR of 0.71% from 2025 to 2034.

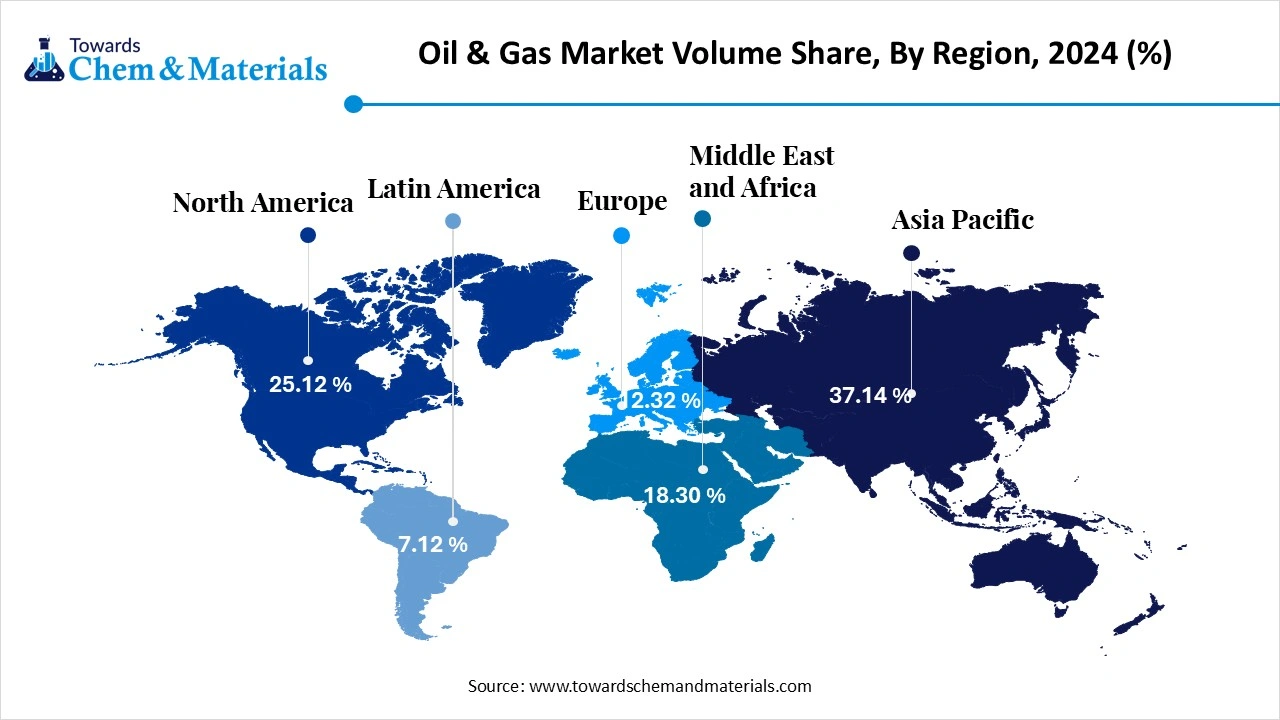

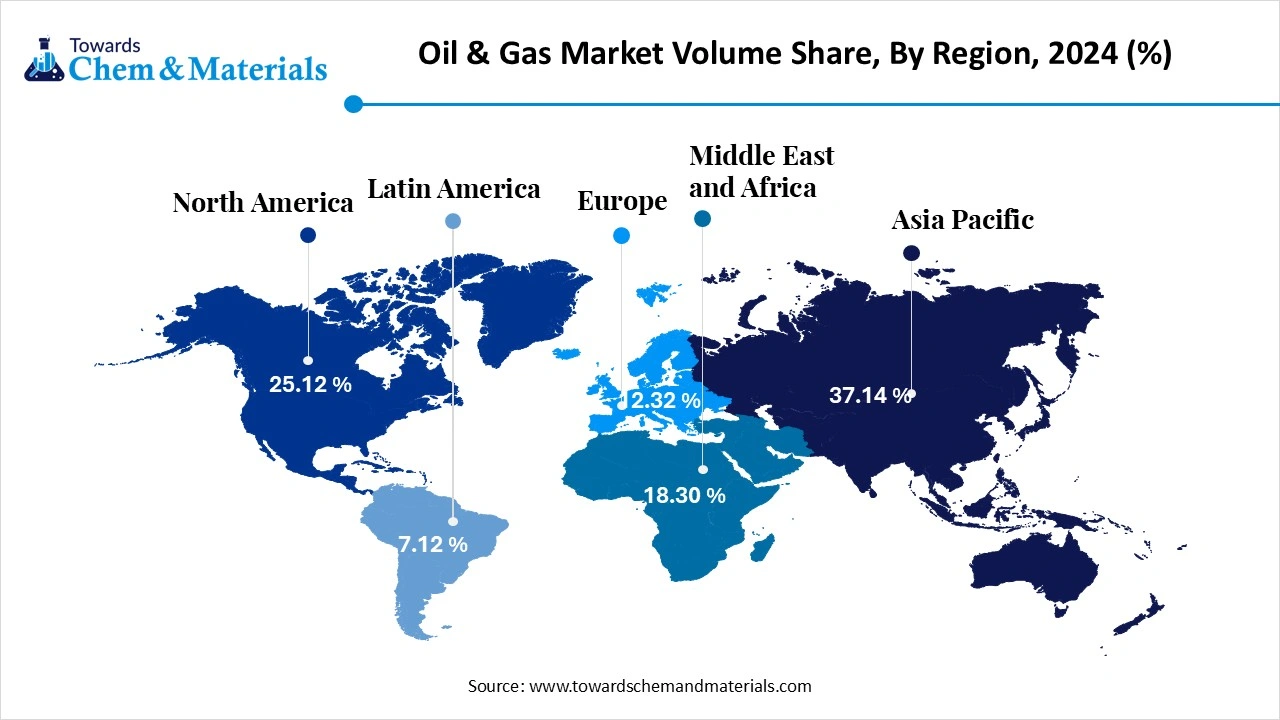

- Asia Pacific dominated the oil and gas market and accounted for the largest revenue share of over 37.14% in 2024.

- The Oil and Gas market in North America is projected to grow at the fastest CAGR of 26.12% over the forecast period. owing to the sudden increase in demand for energy for heavy applications in recent years.

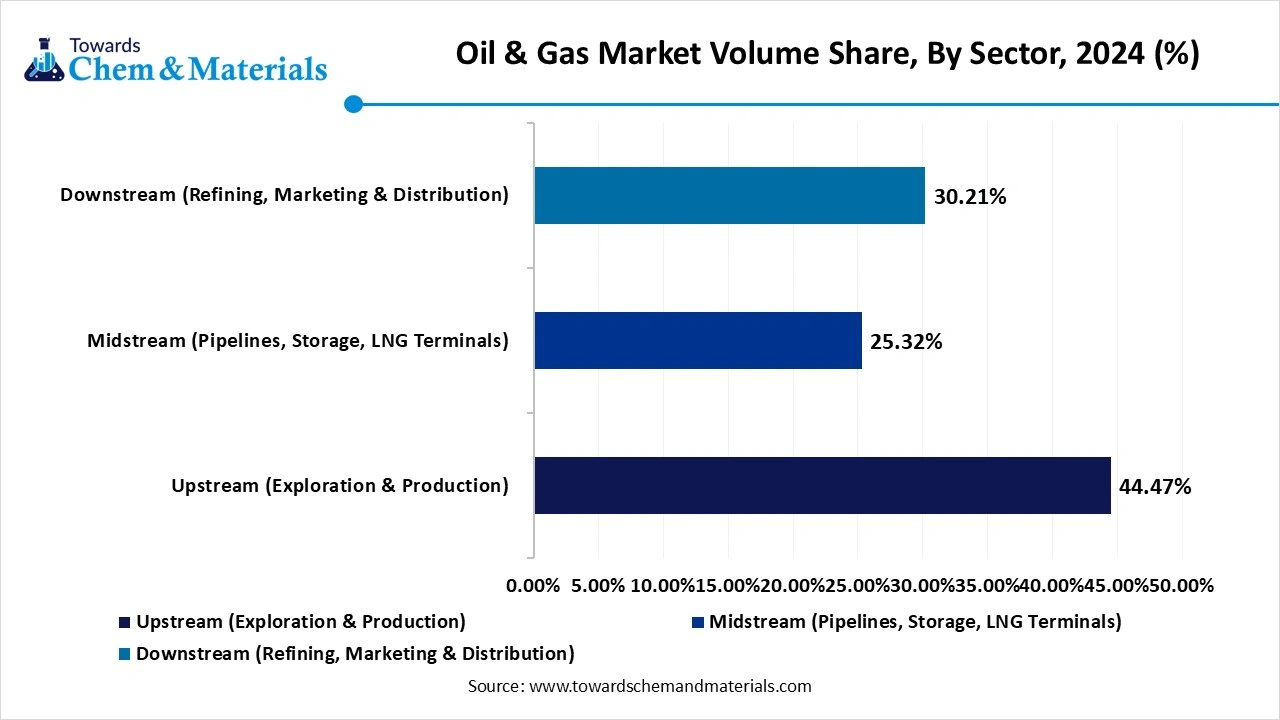

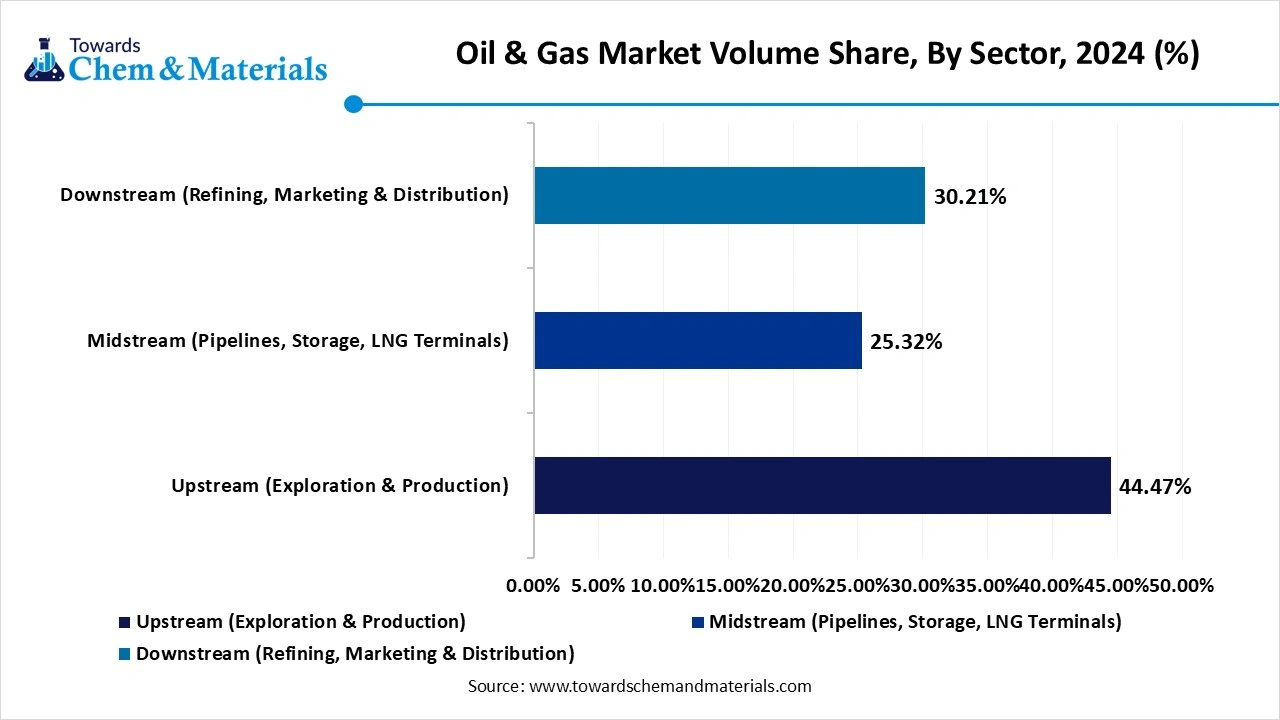

- By sector type, the upstream segment is expected to grow at the fastest rate in the market during the forecast period, akin to increased discoveries of new basins and untapped reserves in the past few years.

- By sector type, the Upstream (Exploration & Production) segment dominated the market with the largest volume share of 44.47% in 2024.

- By sector type, the Downstream (Refining, Marketing & Distribution) segment is projected to grow at the fastest CAGR of 2.73% over the forecast period by 2025-2034.

- By resource type, the LNG segment is expected to lead the market in the coming years, due to the sudden increased need for cleaner fuel than coal and oil in recent years.

- By extraction technique, the onshore drilling segment led the market in 2024 with 50% market share, due to having unique properties such as the easier, cost-effective & considered more common than the offshore drilling

- By extraction technique, the unconventional segment is expected to capture the biggest portion of the market in the coming years, because the unconventional methods have succeeded in finding new sources of oil and gas, which were previously seen as difficult to extract.

- By end use, the transportation segment led the market in 2024 with 40% industry share, because it is the most efficient and widely used method for producing ATH from bauxite.

- By end use, the petrochemical manufacturing segment is expected to grow at the fastest rate in the market during the forecast period, because most of the oil produced is used to power vehicles.

- By deployment type, the onshore segment led the market in 2024 with 60% industry share, because most oil and gas equipment and facilities, like drilling rigs and refineries, are located on land.

- By deployment type, the subsea segment is expected to capture the biggest portion of the market in the coming years, because more oil and gas fields are being discovered in deep waters.

- By technology type, the hydraulic fracturing segment led the oil & gas market in 2024 with 35% industry share, because it made it possible to extract oil and gas from shale and tight rock formations.

- By technology type, the AI & Predictive maintenance segment is expected to grow at the fastest rate in the market during the forecast period, because it helps oil and gas companies prevent breakdowns and improve efficiency.

- By distribution channel, the direct supply segment led the market in 2024 with 52% industry share, because large buyers like power plants, refineries, and industries prefer to get oil and gas directly from producers.

- By distribution channel, the oilfield services companies’ segment is expected to grow at the fastest rate, because producers are outsourcing more work to specialized experts.

Market Overview

From Exploration to Distribution: Inside the Oil & Gas Value Chain

The oil & gas market covers the exploration, extraction, refining, transportation, storage, and distribution of hydrocarbons, primarily crude oil and natural gas. This sector serves as a backbone of global energy supply, influencing industries, economies, and geopolitics. The market spans upstream (exploration & production), midstream (transportation & storage), and downstream (refining & distribution) segments.

Key drivers include energy demand growth, advancements in drilling technologies (e.g., hydraulic fracturing, deepwater drilling), decarbonization trends, and strategic investments in LNG and hydrogen as transitional fuels. Increasing automation, digitization, and environmental regulations are reshaping operations, with a growing emphasis on emissions control, cleaner fuels, and energy diversification.

Which Factor Is Driving the Oil & Gas Market?

The global need for energy is spearheading the industry growth in the current period. Moreover, oil & gas are considered the major fuel option in the heavy manufacturing industries or their machinery. Furthermore, even with the release of renewable energy, oil and gas remain crucial due to factors such as reliability and easy transportation in recent years, as per the latest market survey.

Market Trends

- The sudden shift towards digital technology has contributed to the industry's growth in the past few years. The oil and gas producing companies are actively using digital tools like data analytics, sensors, and AI to improve efficiency.

- The increased need for liquified natural gas is driving the industry's potential. Moreover, the developed regions are seen shifting to LNG owing to reducing air pollution and eco-friendly environmental initiatives in their region.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 243.06 Billion Barrels of Oils Equi. |

| Expected Volume by 2034 | 278.34 Billion Barrels of Oils Equi. |

| Growth Rate from 2025 to 2034 | 1.52% CAGR |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Sector, By Resource Type, By Extraction Technique, By End Use, By Deployment Type, By Technology, By Distribution Channel, By Region |

| Key Companies Profiled | ExxonMobil Corporation, Royal Dutch Shell Plc, Chevron Corporation, BP Plc , TotalEnergies SE , Saudi Aramco, PetroChina Co. Ltd. , Gazprom , Equinor ASA , ENI S.p.A., ConocoPhillips , Rosneft Oil Company , Schlumberger Ltd. , Halliburton Company, Baker Hughes Company , China National Offshore Oil Corporation (CNOOC) , Lukoil PJSC , Occidental Petroleum Corporation (Oxy), Woodside Energy Group Ltd. , Reliance Industries Limited (RIL) |

Market Opportunity

Power Plants and Refineries Lead the Charge in CCS Integration

The increased need for carbon capture and storage is expected to create significant opportunities for manufacturers during the forecast period. Moreover, several oil refinery companies are actively investing the carbon capture technologies from the refineries and power plants, akin to the increased eco-friendly initiatives by regional governments. Also, by offering cost-effective carbon-capturing solutions, the manufacturer can gain immense industry attention in the upcoming years.

Market Challenge

Price Fluctuations Pose Major Risk to Energy Market Expansion

The volatility of the oil and gas pricing is anticipated to hamper the industry growth during the forecast period, as the rising global geopolitical tension and trade wars can affect the global oil pricing in the coming years. Also, this volatility can create growth barriers for the new entrants and mid-sized businesses, which have limited oil and gas storage in the coming period.

Regional Insights

The Asia Pacific Oil and Gas market size is estimated at 88.92 Billion Barrels of Oils Equi in 2025 and is anticipated to 95.44 Billion Barrels of Oils Equi by 2034, growing at a CAGR of 0.71% from 2025 to 2034.

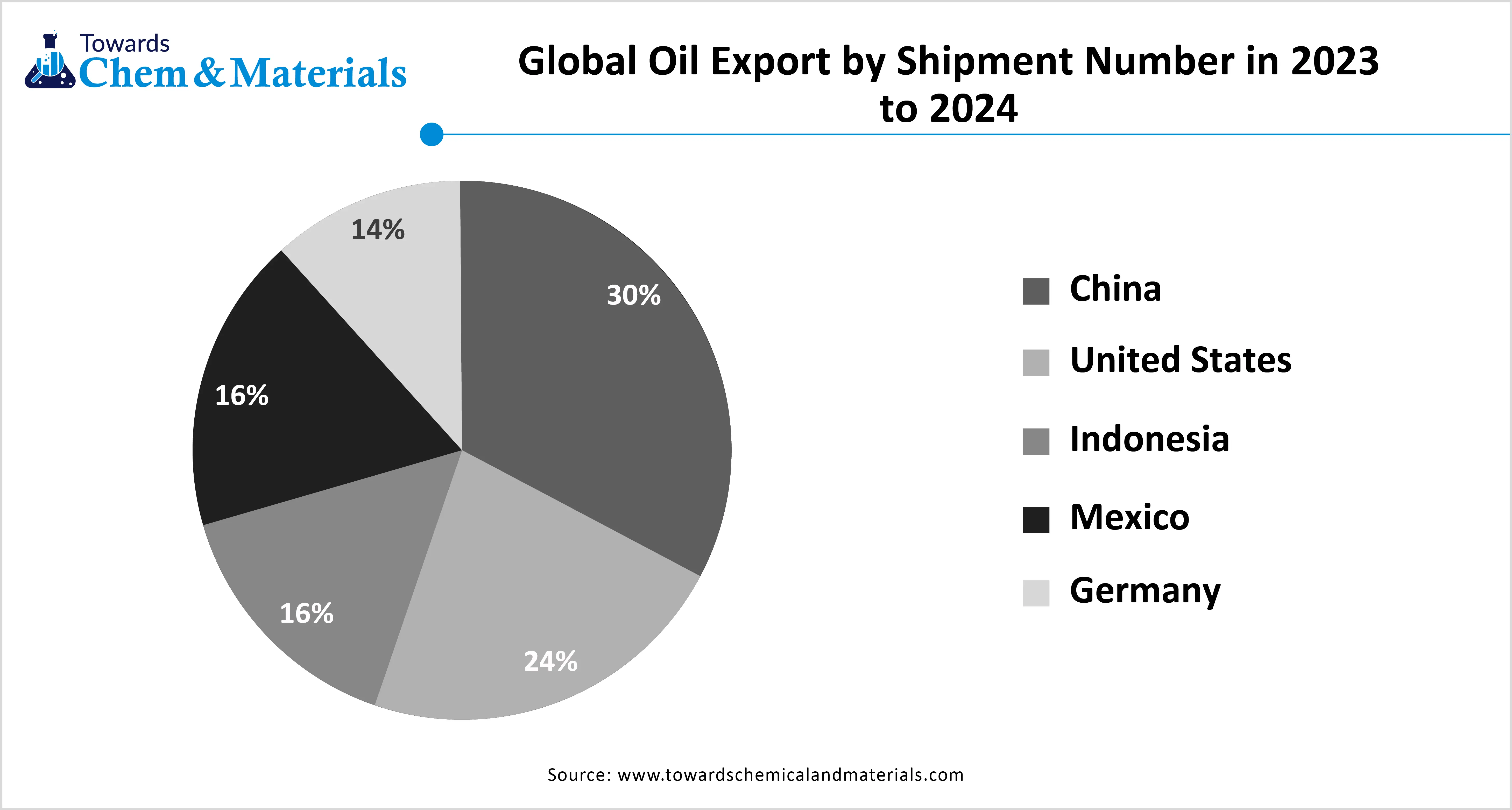

Asia Pacific is expected to capture a major share of the market during the forecast period in 2024, owing to the increased need for oil and gas from the regional countries. The regional countries such as India, China, and Indonesia have heavy manufacturing infrastructure that relies the reliability on these oil and gas. Furthermore, the region is observed as putting heavy investment in deep-water exploration and gas infrastructure in the recent period.

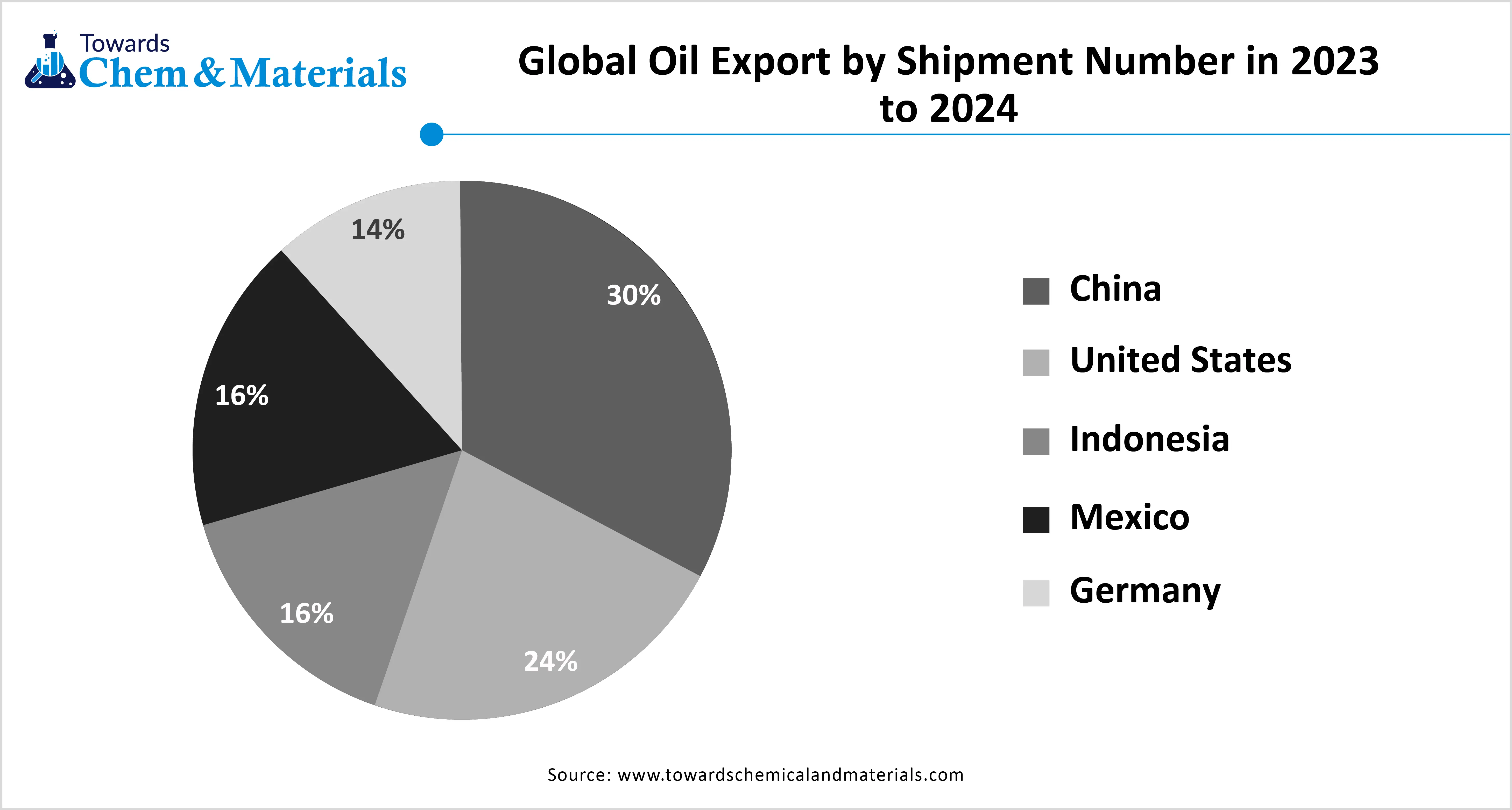

China’s Shale and Offshore Investments Redefine Regional Power?

China is expected to rise as a dominant country in the region in the coming years, owing to the country’s heavy investment in shale gas and offshore drilling. Furthermore, the country is actively representing the region for the energy future. Also, the country is seen under the heavy development of the pipelines and LNG terminals for the increasing demand for shale gas and oil in recent years.

How are the UAE and South Africa Leading the Charge in Oil & Gas Exports?

UAE and South Africa maintained their dominance in the oil & gas market, owing to the country; s being known as the heavy oil and gas presence and top exporters of crude oil and gas in recent years. Moreover, the UAE has seen the development of the energy infrastructure and diversification into liquified natural gas and petrochemicals, where South Africa has abundant coal and gas reserves in the modern era, as per the recent survey.

Middle East & Africa is expected to capture a major share of the market during the forecast period, akin to the wide availability of oil and gas reserves in the current period. Moreover, the region is gaining the industry's attention owing to factors such as the low production cost and the heavy export infrastructure in recent years. Also, the regional countries such as Saudi Arabia, UAE, and Nigeria are seen under the heavy update of their refineries in the past few which contributed to industry growth in recent years.

Oil & Gas Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| North America | 25.12% | 60.14 | 26.12% | 72.70 | 2.13% |

| Europe | 12.32% | 29.50 | 12.50% | 34.79 | 1.85% |

| Asia Pacific | 37.14% | 88.92 | 34.05% | 94.77 | 0.71% |

| South America | 7.12% | 17.05 | 8.12% | 22.60 | 3.18% |

| Middle East & Africa | 18.30% | 43.82 | 19.21% | 53.47 | 2.24% |

| Total | 100% | 239.43 | 100% | 278.34 | 1.52% |

Segmental Insights

Sector Insights

How did the Upstream Segment Dominate the Oil & Gas Market in 2024?

The upstream segment held the largest share of the market in 2024, due to sudden increased activities in the oil & gas discoveries and extraction across the world. Furthermore, it is considered the starting point of the oil and gas supply chain. Also, the buy reducing the heavy fuel requirement to transport or refine, the upstream segment has gained immense industry attention in recent years.

The midstream segment is expected to grow at a notable rate during the predicted timeframe due to a sudden increase in the need for transportation, processing of oil and gas, and storage worldwide. Furthermore, the several countries energy demand has increased, and countries are actively investing in the mid streams than just drilling, which is likely to create huge opportunities for the segment in the upcoming years.

Oil & Gas Market Volume Share, By Sector Insights, 2024-2034 (%)

| By Sector | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| Upstream (Exploration & Production) | 44.47% | 106.47 | 37.56% | 104.54 | -0.20% |

| Midstream (Pipelines, Storage, LNG Terminals) | 25.32% | 60.62 | 29.32% | 81.61 | 3.36% |

| Downstream (Refining, Marketing & Distribution) | 30.21% | 72.33 | 33.12% | 92.19 | 2.73% |

| Total | 100% | 239.43 | 100% | 278.34 | 1.52% |

Resource Type Insights

Why does the Crude Oil Segment Dominate the Oil & Gas Market by Resource Type?

The crude oil segment held the largest share of the oil & gas market in 2024, due to its being considered the most used energy source for heavy industries globally. Moreover, the entire transportation industry is heavily relying on fuels made from crude oil, such as ships, planes, and trucks, across the world. This reliance has maintained dominance of the segment in recent years, as per the observation.

The LNG segment is expected to grow at a notable rate due to the sudden increased need for cleaner fuel than coal and oil in recent years. Moreover, the government's implementation of the clean fuel initiative can create huge industry opportunities in the upcoming years. Furthermore, having the ability to easily transport across oceans and large quantities of storage options is contributing to the segment growth in recent years.

Extraction Technique Insights

Why Did the Onshore Drilling Segment Dominate the Oil & Gas Market in 2024?

The onshore drilling segment dominated the market with the largest share in 2024, due to having the unique properties such as the easier, cost-effective & considered more common than the offshore drilling. Furthermore, most of the oil and gas resources were discovered on land, which has maintained the dominance of the onshore drilling segment in recent years.

The unconventional segment is expected to grow at a notable rate in the coming years, because the unconventional methods have succeeded in finding new sources of oil and gas, which were previously seen as difficult to extract. Also, several regions are actively shifting their oil and gas finding the activities to unconventional methods to fulfill the energy requirement in recent years.

End Use Insights

Why Did the Transportation Segment Dominate the Oil & Gas Market in 2024?

The transportation segment held the largest share of the market in 2024, because most of the oil produced is used to power vehicles. Cars, buses, trucks, airplanes, and ships all depend on fuels like gasoline, diesel, and jet fuel made from oil. With millions of vehicles on the road every day, especially in growing countries, transportation creates constant demand for oil. This sector uses more oil than electricity, industry, or heating. Even though electric vehicles are rising, most of the world still runs on oil-based transportation, which is why this segment has remained the largest user of oil and gas.

The petrochemical manufacturing segment is expected to grow at a notable rate during the forecast period, because oil and gas are key ingredients for making plastics, chemicals, fertilizers, and packaging materials. As demand for consumer goods, electronics, and construction materials rises, so does the need for petrochemicals. Many countries are investing in petrochemical plants to process oil and gas into high-value products. Unlike transportation, which may shift to electric alternatives, petrochemicals will still need hydrocarbons. This makes petrochemical use a stable and growing part of the oil and gas market, especially in Asia and the Middle East.

Deployment Type Insights

Why Did the Onshore Segment Dominate the Oil & Gas Market in 2024?

The onshore segment dominated the market with the largest share in 2024 because most oil and gas equipment and facilities, like drilling rigs and refineries, are located on land. Building and operating equipment onshore is easier, safer, and less expensive than in deep water. Most oil-producing countries have land-based fields that have been used for decades. Onshore operations also offer quicker setup and easier access for maintenance.

The subsea segment is expected to grow at a significant rate during the forecast period, because more oil and gas fields are being discovered in deep waters. These offshore reserves require advanced subsea systems to extract and transport resources safely. Technology has improved to allow drilling in very deep parts of the ocean, where big oil reserves exist.

Technology Type Insights

Why Did the Hydraulic Fracturing Segment Dominate the Oil & Gas Market in 2024?

The hydraulic fracturing segment held the largest share of the market in 2024, because it made it possible to extract oil and gas from shale and tight rock formations. This technology boosted oil and gas production in countries like the United States, turning them into major energy exporters. Fracking increased access to previously untapped resources, helping meet global energy demand. It allowed companies to produce more energy at lower costs.

The AI & predictive maintenance segment is expected to grow at a notable rate because it helps oil and gas companies prevent breakdowns and improve efficiency. These technologies use data to predict when equipment might fail, allowing repairs before big problems happen. This saves money, avoids downtime, and keeps operations running smoothly.

Distribution Channel Insights

Why Did the Direct Supply Segment Dominate the Oil & Gas Market in 2024?

The direct supply segment held the largest share of the oil & gas market in 2024, because large buyers like power plants, refineries, and industries prefer to get oil and gas directly from producers. Direct deals ensure a stable supply, better pricing, and fewer middlemen. For national oil companies and major producers, selling directly to customers reduces costs and builds long-term partnerships.

The oilfield services companies’ segment is expected to grow at a significant rate during the forecast period, because producers are outsourcing more work to specialized experts. These service firms handle drilling, maintenance, equipment installation, digital monitoring, and advanced technologies. As exploration moves to deeper, more complex areas, producers rely on service companies to manage operations safely and efficiently.

Recent Developments

- In July 2025, Cameroon’s SNH is planning to establish the refinery Lolabé. Also, the estimated cost of the project is 115 billion FCFA, and the refinery will start in June 2028, as per the report published by the company.(Source: energycapitalpower.com)

- In March 2025, China's oil company CNOOC is expected to establish an upgraded oil refinery complex. Moreover, this complex can produce 120,000 barrels per day, as per the company's claim.(Source: oilprice.com)

Oil and Gas Market Top Companies

- ExxonMobil Corporation

- Royal Dutch Shell Plc

- Chevron Corporation

- BP Plc

- TotalEnergies SE

- Saudi Aramco

- PetroChina Co. Ltd.

- Gazprom

- Equinor ASA

- ENI S.p.A.

- ConocoPhillips

- Rosneft Oil Company

- Schlumberger Ltd.

- Halliburton Company

- Baker Hughes Company

- China National Offshore Oil Corporation (CNOOC)

- Lukoil PJSC

- Occidental Petroleum Corporation (Oxy)

- Woodside Energy Group Ltd.

- Reliance Industries Limited (RIL)

Segment Covered

By Sector

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining, Marketing & Distribution)

By Resource Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Petroleum Products

By Extraction Technique

- Conventional Drilling

- Unconventional (Shale, Tight Oil, Oil Sands)

- Offshore Drilling

- Onshore Drilling

By End Use

- Power Generation

- Industrial

- Transportation

- Residential & Commercial

- Petrochemical Manufacturing

By Deployment Type

- Onshore

- Offshore

- Subsea

By Technology

- Seismic Imaging & Surveying

- Enhanced Oil Recovery (EOR)

- Hydraulic Fracturing

- Horizontal Drilling

- Remote Monitoring & Automation

- AI & Predictive Maintenance

By Distribution Channel

- Direct Supply

- Third-Party Vendors

- Oilfield Services Companies

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE