Content

What is the Current Europe Specialty Polymers Market Size?

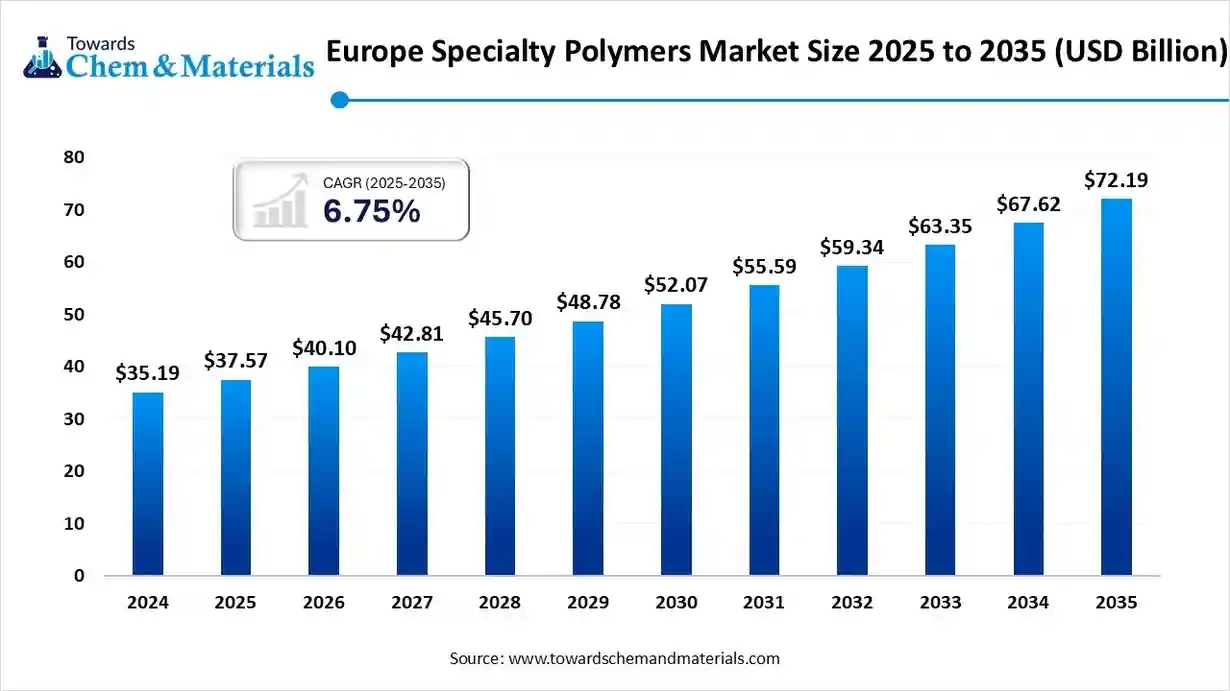

The Europe specialty polymers market size accounted for USD 37.57 billion in 2025 and is predicted to increase from USD 40.10 billion in 2026 to approximately USD 72.19 billion by 2035, growing at a CAGR of 6.75% from 2025 to 2035.The growth of the market is driven by strong demand from various sectors due to its properties, which drives the growth of the market.

Key Takeaways

- By product type, the engineering thermoplastics segment dominated the market with a share of 32% in 2024.

- By product type, the biodegradable / bio-based polymers segment is expected to grow significantly in the market during the forecast period.

- By functionality, the high-performance polymers segment dominated the market with a share of 35% in 2024.

- By functionality, the sustainable polymers segment is expected to grow in the forecast period.

- By end-use industry, the automotive & transportation segment dominated the market with a share of 31% in 2024.

- By end-use industry, the healthcare & medical devices segment is expected to grow in the forecast period.

- By technology, the polymer blending & alloying segment dominated the market with a share of 41% in 2024.

- By technology, the additive manufacturing polymers segment is expected to grow in the forecast period.

- By processing method, the injection molding segment dominated the market with a share of 47% in 2024.

- By processing method, the extrusion & film casting segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Europe Specialty Polymers Market?

The significance of the Europe specialty polymers market lies in its role as a key driver for growth and innovation across major sectors like automotive, healthcare, electronics, and construction. It is driven by the demand for high-performance, lightweight materials that improve fuel efficiency, enhance durability, and enable advanced features, while also being shaped by strong innovation, strategic partnerships, and a growing focus on sustainability within the region.

Europe Specialty Polymers Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the Europe speciality polymer market is expected to grow steadily, driven by increasing demand from high-performance industries such as automotive, aerospace, electronics, and healthcare. The region’s focus on lightweighting, durability, and thermal stability is accelerating the adoption of engineering plastics, thermoplastic elastomers, and high-performance polymers.

- Sustainability Trends: Sustainability is playing a transformative role in reshaping the speciality polymer landscape. Manufacturers are emphasising the development of bio-based and recyclable polymers to align with the EU Green Deal and circular economy goals. Low-carbon feedstocks, chemical recycling, and life-cycle assessment frameworks are increasingly integrated into R&D.

- Regional Expansion & Innovation: Leading chemical companies and material innovators in Europe are expanding their speciality polymer portfolios through strategic investments and collaborations. Firms are focusing on advanced formulations for 3D printing, medical devices, and electric mobility components.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 40.10 Billion |

| Expected Size by 2034 | USD 72.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Functionality, By End-use Industry, By Technology, By Processing Method |

| Key Companies Profiled | LyondellBasell Industries N.V, REHAU Group, RadiciGroup, EMS-Chemie Holding AG, Arkema S.A. , Solvay S.A. , BASF SE , Evonik Industries AG , Covestro AG , DSM Engineering Materials (Envalior) , SABIC Europe , LANXESS AG , Celanese Corporation , Victrex plc , Lubrizol Corporation , Röhm GmbH , Kuraray Europe GmbH , Borealis AG , Ensinger GmbH |

Key Technological Shifts In The Europe Specialty Polymers Market:

Key technological shifts in the Europe specialty polymers market include the integration of advanced technologies like Artificial Intelligence and IoT for production, a major push towards sustainability through bio-based, biodegradable, and recycled polymers, and innovations in material science and processing, such as nanotechnology and 3D printing. These shifts are driven by the need for lightweight, high-performance materials in sectors like automotive and electronics and align with the circular economy goals.

Trade Analysis Of the Europe Specialty Polymers Market: Import & Export Statistics

The European Union exported 77 shipments of Polymer Profiles between March 2023 and February 2024.

| Statistic | Value |

| Shipments (Mar '23 – Feb '24) | 77 |

| EU Exporters | 41 |

| Buyers | 34 |

- Most of the Polymer Profiles exported from the European Union go to Ukraine, Kazakhstan, and Russia.

Globally, the top three exporters of Polymer Profiles are China, Germany, and Argentina. China leads the world in - Polymer Profiles exports with 4,934 shipments, followed by Germany with 4,319 shipments, and Argentina taking the third spot with 3,392 shipments.

- The European Union exported a total of 11,311 shipments of synthetic polymers. These exports involved a large network of traders; 1,329 different exporters based in the European Union were responsible for sending the shipments. The shipments were received by 1,244 buyers located in various other countries.

- Most of the Synthetic Polymer exports from the European Union go to Ukraine, Uzbekistan, and Kazakhstan.

- Globally, the top three exporters of Synthetic Polymer are Vietnam, the European Union, and Brazil. Vietnam leads the world in Synthetic Polymer exports with 22,620 shipments, followed by the European Union with 15,656 shipments, and Brazil taking the third spot with 14,286 shipments.

Europe Specialty Polymers Market Value Chain Analysis

- Chemical Synthesis and Processing : Specialty polymers are produced through advanced polymerisation, compounding, and chemical modification processes to enhance properties like heat resistance, electrical insulation, and mechanical strength for niche industrial applications.

- Key players BASF SE, Arkema S.A., Solvay S.A., Evonik Industries AG, Covestro AG.

- Quality Testing and Certification : Specialty polymers undergo testing for molecular weight, tensile strength, chemical resistance, and thermal stability under ISO 9001, REACH, and RoHS compliance standards.

- Key players: SGS, TÜV SÜD, Intertek, Bureau Veritas.

- Distribution to Industrial Users : Specialty polymers are distributed to automotive, aerospace, electronics, and construction industries through direct sales channels and distribution networks.

- Key players: BASF SE, Solvay S.A., Arkema S.A., Evonik Industries AG.

Europe Specialty Polymers Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Standards | Focus Areas | Notable Notes |

| European Union (pan-EU) | European Commission / ECHA / CEN / CENELEC | REACH (Registration, Evaluation, Authorisation & Restriction of Chemicals); CLP; Ecodesign for Sustainable Products Regulation (ESPR); Food contact plastics rules (EU 10/2011 & Framework Reg. 1935/2004); RoHS / WEEE / ELV (sectoral) | Chemical safety & restrictions; hazard classification; product-level sustainability, circularity & reparability; food-contact compliance; restrictions on hazardous additives (flame retardants, phthalates, PFAS) | REACH is primary — drives SVHC lists, authorisation and group restrictions; ESPR (in force) pushes ecodesign, durability/recycled content and digital product data. |

| Germany | UBA (Federal Environment Agency), BAM, DIN | National transposition of EU regs + strict enforcement; DIN standards for polymer testing | Emphasis on substitution of hazardous additives; demanding product testing and ecolabeling | Strong enforcement of REACH restrictions; industrial users often face stricter BANS and early adoption of ESPR measures. |

| France | Ministry for Ecological Transition, ADEME, AFNOR | Transposes EU chemical rules; national circular economy & waste rules; food contact enforcement | Food-contact approvals, recycled content targets, waste-to-resource | Active rollout of measures for recycled content and product passports under ESPR. |

| United Kingdom (GB) | HSE / Office for Product Safety & Standards (UK REACH) | UK REACH (post-Brexit REACH regime); UK product safety rules; national standards | Chemical registration for the GB market; dual EU/UK compliance is often needed for exporters | Companies selling into both the EU and GB must maintain separate REACH compliance (EU REACH + UK REACH). |

| Italy / Spain / Netherlands | National Environment Ministries / Standards bodies (UNI / AENOR / NEN) | EU framework transposed; national product/building material standards (CE/CPR for construction polymers) | Construction & infrastructure polymers (fire, durability); product CE marking for certain polymer products | Southern EU markets lead in reuse/recycling adoption for construction polymers and require tighter fire & durability testing. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The Europe Specialty Polymers Market In 2024?

The engineering thermoplastics segment dominated the market with a share of 32% in 2024. Engineering thermoplastics such as polyamides, polycarbonates, and PEEK are widely used across Europe for their superior strength, heat resistance, and dimensional stability. Demand is high from the automotive and electrical sectors, especially for lightweight and durable components that improve performance and sustainability. Germany leads production and R&D activities in this category.

The biodegradable / bio-based polymers segment expects significant growth in the market during the forecast period. Biodegradable and bio-based polymers are gaining traction due to Europe’s strict sustainability regulations and the EU Green Deal. Derived from renewable sources such as corn starch and sugarcane, these polymers are replacing traditional plastics in packaging, agriculture, and medical applications. The UK and Spain are key markets focusing on scaling bio-refinery and green material technologies.

The thermoplastic elastomers segment has seen notable growth in the market. Thermoplastic elastomers (TPEs) combine flexibility, resilience, and processability, making them ideal for automotive interiors, consumer goods, and medical devices. In Europe, demand is fueled by EV production and ergonomic product design. Manufacturers are adopting recyclable TPE formulations to align with regional sustainability and circular economy goals.

Functionality Insights

How Did the High Performance Segment Dominated The Europe Specialty Polymers Market In 2024?

The high-performance polymers segment dominated the market with a share of 35% in 2024. High-performance polymers offer exceptional thermal and chemical resistance, supporting critical applications in aerospace, automotive, and healthcare. European producers focus on advanced fluoropolymers, PEEK, and PPS grades. Germany remains a hub for high-performance polymer manufacturing, driven by precision engineering and aerospace innovations.

The sustainable polymers segment expects significant growth in the market during the forecast period. Sustainable polymers, developed using renewable or recycled feedstocks, are central to Europe’s decarbonization efforts. These materials are increasingly adopted in consumer packaging, electronics casings, and textile coatings. Spain and the UK are advancing recycling integration and bio-based polymer adoption, reflecting the growing push toward eco-efficient materials.

The electrical & electronic polymers segment has seen notable growth in the market. These polymers are engineered for conductivity, insulation, and flame retardancy, catering to Europe’s expanding electronics and EV markets. Thermally stable and lightweight polymers support printed circuit boards, connectors, and housings. Demand is growing in Germany and the UK, driven by the semiconductor and renewable energy sectors.

End-Use Industry Insights

Which End Use Industry Segment Dominated The Europe Specialty Polymers Market In 2024?

The automotive & transportation segment dominated the market with a share of 31% in 2024. Automotive OEMs and Tier-1 suppliers in Europe increasingly rely on specialty polymers for weight reduction, fuel efficiency, and durability.

Engineering thermoplastics and TPEs are used for under-the-hood, interior, and structural applications. Germany leads, supported by electric mobility and sustainability-focused design mandates.

The healthcare & medical devices segment expects significant growth in the Europe specialty polymers market during the forecast period. Specialty polymers play a vital role in biocompatible implants, catheters, and diagnostic equipment. Europe’s ageing population and medical innovation foster the adoption of polymeric materials with sterilisation resistance and transparency. The UK and Germany are key centres for medical-grade polymer research and device production.

The electronics & electrical segment has seen notable growth in the market. Specialty polymers enable miniaturisation and performance enhancement in electronics. Flame-retardant, conductive, and heat-resistant materials are widely used in connectors, insulators, and cables. The sector’s growth in Europe is tied to renewable energy expansion and increased automation across industries.

Technology Insights

How Did Polymer Blending And Alloying Segment Dominated The Europe Specialty Polymers Market In 2024?

The polymer blending & alloying segment dominated the market with a share of 41% in 2024. Blending technologies enables property customisation, combining performance attributes such as strength and elasticity. European companies employ blending to create lightweight materials for transportation and packaging. This method supports cost-effectiveness and recyclability, promoting adoption in Germany’s and Spain’s polymer innovation hubs.

The additive manufacturing polymers segment expects significant growth in the market during the forecast period. Additive manufacturing is transforming Europe’s polymer landscape, particularly in aerospace, medical, and automotive sectors. High-performance thermoplastics like PEEK and PEI are used for rapid prototyping and small-batch production. The UK and Germany lead R&D in specialised polymer filaments for additive manufacturing.

The bio-polymer synthesis technologies segment has seen notable growth in the market. Bio-polymer synthesis through fermentation and enzymatic processes is expanding across Europe to support renewable material initiatives. This technology reduces carbon footprint and enhances biodegradability. Spain and France are investing in biotechnological polymer routes for sustainable material innovation and EU compliance.

Processing Method Insights

Which Processing Method Segment Dominated The Europe Specialty Polymers Market In 2024?

- The injection molding segment dominated the market with a share of 47% in 2024. Injection molding dominates the processing landscape, enabling high-precision production of complex automotive, electronic, and healthcare components. European manufacturers integrate automated and energy-efficient systems to improve productivity and waste reduction. Germany’s strong molding infrastructure supports high-performance polymer component production.

- The extrusion & film casting segment expects significant growth in the Europe specialty polymers market during the forecast period. Extrusion and film casting are widely used for producing sheets, films, and coatings for packaging and industrial use. Sustainable polymers like PLA and bio-PE are increasingly processed using these techniques in Europe to meet recyclable packaging standards and industrial material demand.

- The blow molding segment has seen notable growth in the market. Blow molding supports lightweight hollow products such as bottles, tanks, and containers. European producers leverage advanced blow molding for biopolymer and engineering-grade thermoplastic products. Demand is strong in packaging and automotive applications, with ongoing innovation focused on recyclable and biodegradable materials.

Country Insights

Germany: Europe Specialty Polymers Market Trends: Innovation And Sustainability Initiatives

Germany dominates the European specialty polymer market with 28% share in 2024, driven by its robust automotive, electronics, and healthcare industries. The country’s emphasis on lightweight materials, recyclability, and high-performance engineering polymers supports innovation and sustainability. Key manufacturers focus on advanced thermoplastics and elastomers for EV components, medical devices, and precision engineering applications, strengthening Germany’s leadership in high-value polymer production.

Spain: Europe Specialty Polymers Market Analysis

Spain’s specialty polymer market is expanding due to rising demand from the construction, packaging, and renewable energy sectors. The nation’s focus on sustainable manufacturing and adoption of bio-based and recyclable polymers aligns with the EU circular economy directives. Local companies and multinational producers are investing in advanced materials that enhance performance and reduce environmental impact across industrial applications.

United Kingdom: Europe Specialty Polymers Market Trends

The UK specialty polymer market is characterised by innovation in the medical, defence, and aerospace sectors. Post-Brexit, the country has prioritised domestic polymer R&D and strategic collaborations to boost material innovation. Growing adoption of fluoropolymers, high-performance thermoplastics, and biodegradable polymers supports the UK’s transition toward greener technologies and advanced manufacturing solutions.

Recent Developments

- In October 2025, Syensqo has introduced first certified circular content portfolio of high-performance elastomers and lubricant fluids, incorporating up to 29% post-industrial recycled hydrofluoric acid using a mass balance system. These materials, including Tecnoflon® FKM/FFKM elastomers and Fomblin® M lubricant fluids.(Source:www.plasticstoday.com)

- In June 2025, Wacker will open a new high-speed production line for hybrid polymers at its Nünchritz facility in Germany. This new facility will produce silane-terminated polymers for high-performance adhesives and sealants used in construction and industrial applications, utilising environmentally friendly alpha-silane technology.(Source: www.european-coatings.com)

Top Players In The Europe Specialty Polymers Market & Their Offerings:

INEOS Group Holdings S.A.

Corporate Information

- INEOS is a global manufacturer of petrochemicals, specialty chemicals and oil products.

- It operates around 154 sites in 27 countries, employs about 24,500 people, and reports annual revenues of approximately US$55 billion.

- Founded in May 1998, via acquisition of a single chemical business in Antwerp for £84 million, employing ~400 people at that time.

- Despite the “Holdings S.A.” name here, the group is privately owned (by Sir Jim Ratcliffe and associates).

History and Background

- 1998: INEOS was formed by purchasing BP’s ethylene oxide facility in Antwerp for £84 million.

- Through the 2000s: Rapid growth through acquisitions of chemical businesses (olefins, derivatives) for example, the purchase of BP Innovene for ~$9 billion in 2005.

- More recently: Diversification of businesses including specialty chemicals, automotive (via INEOS Automotive), and sports/consumer interests. (Though beyond core chemicals).

Key Developments and Strategic Initiatives

- Sustainability push: Through a subsidiary INOVYN, INEOS announced a > €2 billion investment in green hydrogen production in Europe.

- Emissions reduction: Example, At its Hull manufacturing site, the company invested £30 million to convert operations (from natural gas to clean hydrogen) and cut CO₂ emissions by ~75%.

- Energy & feedstock security: A long-term natural gas supply agreement (8 years) with Covestro AG in Europe from 2027, aiming to enhance industrial competitiveness and energy reliability.

Mergers & Acquisitions

- Sale: In December 2024, INEOS Enterprises agreed to sell its composites business (unsaturated polyester resins, vinyl ester resins, gelcoats) to KPS Capital Partners for ~€1.7 billion.

- Acquisition: The Jubail 2 project in Saudi Arabia (with partners Saudi Aramco & Total) for building plants (~$2 billion investment) for acrylonitrile, LAO, PAO.

Partnerships & Collaborations

- With Covestro: Long-term natural gas supply agreement (Europe).

- With governments / public bodies: Projects like HyNet North West hydrogen & CCS in the UK.

- With shipping/transport players: Launch of the first European built offshore CO₂ carrier in collaboration with Royal Wagenborg.

Product Launches / Innovations

- Through INOVYN: Building of a 20 MW electrolyser in Norway for green hydrogen to reduce CO₂ emissions by ~22,000 tonnes/year and supply hydrogen to transport sector.

- Chemicals: New downstream plants in Saudi Arabia for acrylonitrile, LAO, PAO representing next-gen building blocks for carbon fibre, engineering polymers.

Key Technology Focus Areas

- Green hydrogen / clean energy transition: Large investments in electrolysis, hydrogen network integration, green feedstock.

- Carbon capture, utilization & storage (CCUS): Projects to store CO₂ offshore, novel transport infrastructure (CO₂ carriers).

- Advanced materials / specialty chemicals: Development of high-value downstream polymers (e.g., acrylonitrile, LAO/PAO) for lightweight composites, advanced engineering plastics, carbon fibre.

R&D Organisation & Investment

- INEOS emphasises internal R&D via subsidiaries (e.g., INOVYN for hydrogen, INEOS Nitriles for acrylonitrile production) and large-scale industrializing of new technologies.

- Example: The Hull project (£30 million) shows capital investment into site-level innovation and emissions reduction.

SWOT Analysis

Strengths

- Broad global footprint and vertically integrated operations in petrochemicals and specialty chemicals (large scale, diversified).

- Strong commitment to sustainability and energy transition, giving competitive advantage for future-proof markets.

- Ability to invest in large-scale infrastructure (hydrogen plants, new specialty chemical plants) and to secure long-term feedstock/energy supplies.

- Flexible business model (private ownership allowing long-term horizon, less constrained by quarterly reporting).

Weaknesses

- Heavy reliance on feedstock/energy markets and global petrochemical cyclicality (commodity risk, feedstock cost exposure).

- Large debt/investment commitments may pressurize financial performance (especially in downturns).

- Private ownership may reduce transparency for investors/analysts compared to public peers.

- Diversification into non-core areas (e.g., automotive, sports) may distract focus from chemicals business.

Opportunities

- Growing demand for advanced materials (engineering polymers, composites, lightweighting) in automotive, aerospace, construction, wind energy.

- Transitioning to low-carbon and circular economy: green hydrogen, CCUS, renewable feedstocks open new business models.Geographic expansion (Middle East, Asia) where feedstock/energy cost advantages exist and growth is high (as seen in Saudi Arabia investments).

- Partnerships to stabilise feedstock/energy supply (as with Covestro) to lock-in competitive advantage.

Threats

- Regulatory and environmental risk: Stricter emissions regimes, carbon pricing, feedstock constraints, and public scrutiny on chemical manufacturing.

- Cyclicality of petrochemical markets: downturns in chemicals, plastics demand, overcapacity risk.

- Feedstock/energy volatility: natural gas prices, LNG, feedstock supply disruptions impact margins.

- Transition risk: If newer, disruptive materials/technologies outpace current capabilities, may require faster adaptation/investment.

Recent News & Strategic Updates

- INEOS and Covestro entered a long‐term natural gas supply agreement (starting 2027) to enhance European industrial competitiveness and energy security.

- INEOS completed a £30 million investment at its Hull site, converting part of manufacturing to hydrogen and cutting CO₂ emissions by ~75%.

Other Top Players Are

- LyondellBasell Industries N.V.: Produces specialty polyolefins, polypropylene compounds, and advanced composites tailored for automotive, construction, and packaging markets across Europe.

- REHAU Group: Offers polymer-based solutions for construction, automotive, and industrial sectors. REHAU’s specialty materials include high-durability thermoplastics designed for energy-efficient and sustainable applications.

- RadiciGroup: Manufactures high-performance engineering polymers such as polyamides and specialty blends used in automotive, electrical, and industrial applications, emphasising recyclability and sustainable production.

- EMS-Chemie Holding AG: Specialises in specialty polyamides and polymer blends for automotive, electronics, and industrial uses, offering customised materials with high heat and chemical resistance.

- Arkema S.A.

- Solvay S.A.

- BASF SE

- Evonik Industries AG

- Covestro AG

- DSM Engineering Materials (Envalior)

- SABIC Europe

- LANXESS AG

- Celanese Corporation

- Victrex plc

- Lubrizol Corporation

- Röhm GmbH

- Kuraray Europe GmbH

- Borealis AG

- Ensinger GmbH

Segments Covered:

By Product Type

- thermoplastic elastomers (tpes)

- styrenic block copolymers (sbcs, sebs)

- thermoplastic polyurethanes (tpu)

- fluoropolymers

- polytetrafluoroethylene (ptfe) and pvdf

- fep, pfa, and etfe for corrosion and heat resistance

- engineering thermoplastics

- polyamide (pa 6, pa 66, pa 12)

- polyphenylene sulfide (pps) and peek

- conductive & antistatic polymers

- polyaniline (pani) and polypyrrole (ppy)

- conductive carbon-black–filled polymers

- biodegradable / bio-based polymers

- pla and pha blends

- bio-based polyesters and polyurethanes

By Functionality

- high-performance polymers

- high temperature, flame-retardant, and wear-resistant materials

- aerospace-grade and chemical-resistant compounds

- electrical & electronic polymers

- dielectric and insulating polymers for evs and cables

- conductive and emi shielding materials

- barrier & specialty coating polymers

- gas, chemical, and moisture barrier coatings

- optical films and surface protection systems

- sustainable polymers

- recyclable and renewable formulations

- bio-circular content integration

By End-use Industry

- automotive & transportation

- lightweight structural and under-the-hood components

- ev battery enclosures and cable insulation

- electronics & electrical

- connectors, insulation, and encapsulation compounds

- pcb substrates and sensors

- healthcare & medical devices

- catheters, tubing, diagnostic housings

- bio-compatible elastomers and sterilizable plastics

- building & construction

- sealants, coatings, and insulation foams

- structural composites and adhesives

- energy & industrial applications

- wind turbine blades and solar encapsulants

- industrial coatings and anti-corrosion linings

By Technology

- polymer blending & alloying

- high-performance thermoplastic alloys

- polymer compatibilizers and hybrid composites

- reactive & controlled polymerization

- raft, atrp, and metallocene catalysis

- tailored molecular-weight distribution control

- additive manufacturing polymers

- 3d printing thermoplastics (peek, nylon, tpu)

- photopolymer resins and powder-bed fusion materials

- bio-polymer synthesis technologies

- enzyme-catalyzed polymerization

- fermentation-based monomer synthesis

By Processing Method

- injection molding

- complex geometry components

- medical-grade and electronic parts

- extrusion & film casting

- tubing, sheets, and films for packaging and cables

- blow molding

- automotive ducts and containers

- compression & rotational molding

- high-strength, thick-walled composites