Content

What is the Current Ion-Conductive Polymers Market Size and Share?

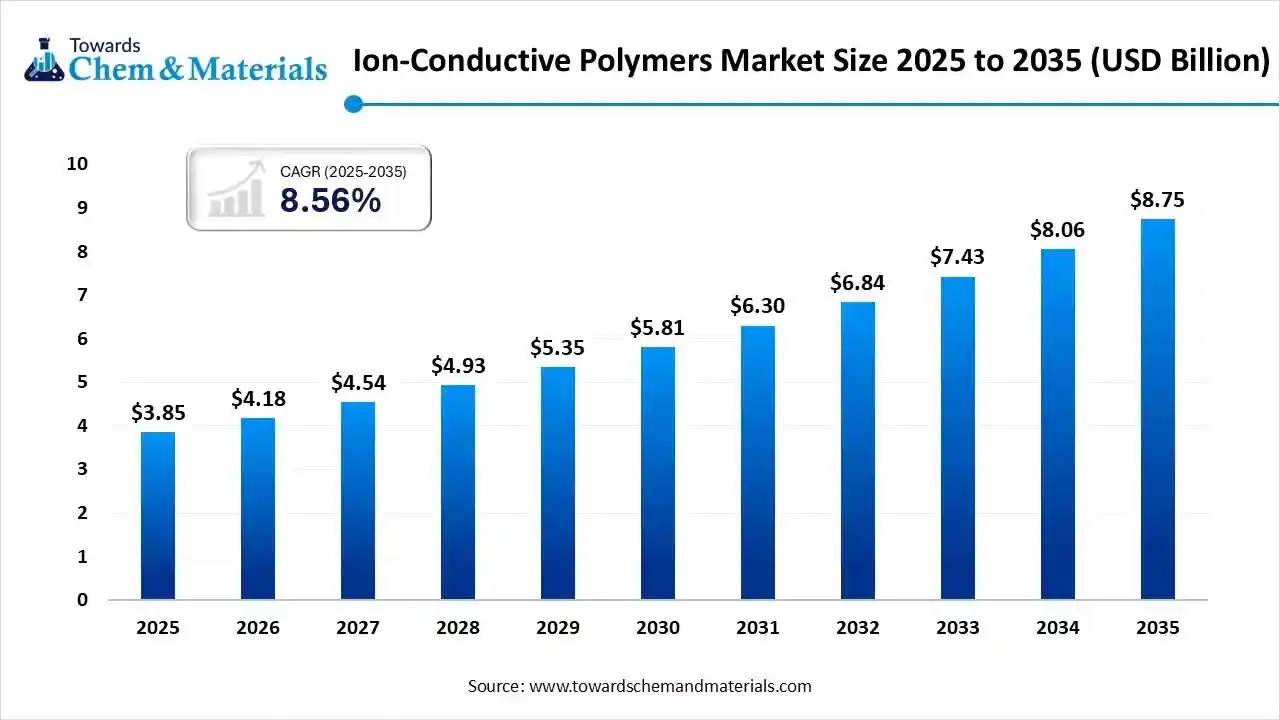

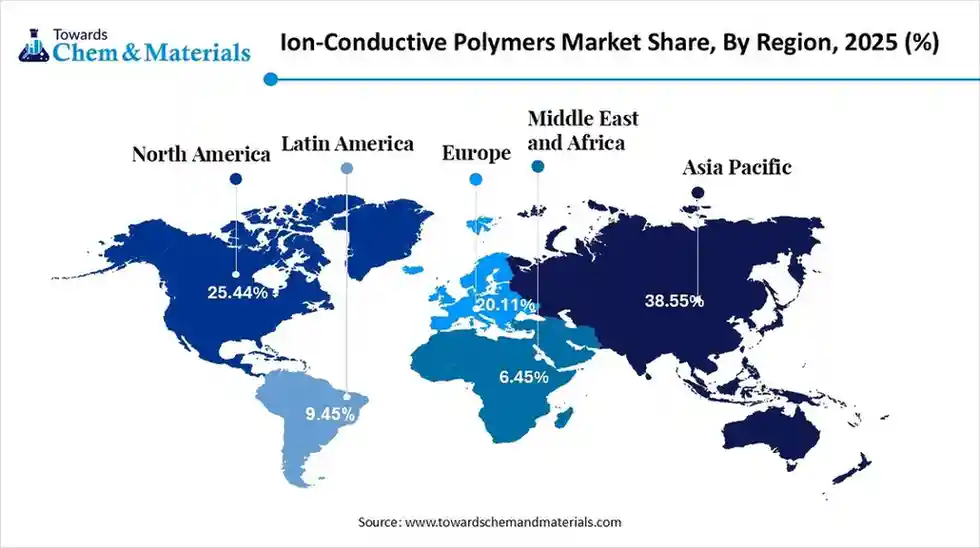

The global ion-conductive polymers market size was estimated at USD 3.85 billion in 2025 and is predicted to increase from USD 4.18 billion in 2026 and is projected to reach around USD 8.75 billion by 2035, The market is expanding at a CAGR of 8.56% between 2026 and 2035. Asia Pacific dominated the ion-conductive polymers market with a market share of 38.55% the global market in 2025.The miniaturization of electronic devices and the increased adoption of electric vehicles drive the market growth.

Key Takeaways

- By region, North America led the ion-conductive polymers market with the largest revenue share of over 38.55% in 2025. The ion-conductive polymers market in Canada is expected to grow at the fastest CAGR of 9.77% from 2026 to 2035.

- By product, the proton conductive polymers segment led the market with the largest revenue share of 69.61% in 2025.

- By product, the anion-conductive polymers segment is anticipated to grow at the fastest CAGR of 9.88% during the forecast period due to increased use in battery storage solutions.

- By end-use, the fuel cell segment led the market with the largest revenue share of 58.71% in 2025 due to increasing demand for power backup devices.

- By end-use, the batteries & supercapacitors segment is expected to expand at the fastest CAGR of 9.45% through the forecast period. due to the shift towards solar energy.

What are Ion-Conductive Polymers?

The ion-conductive polymers market growth is driven by the increasing need for energy storage, surging solar cell components demand, transition towards electric vehicles, focus on minimizing aerospace weight, rise in green energy, expansion of flexible electronics, and growing medical device development.

Ion-conductive polymers (ICPs) are solid & flexible materials that transfer electricity through mobile ions. The ICPs are inherently flexible, lightweight, and offer dual-conductivity. They provide tunable conductivity and excellent electrochemical performance. They offer benefits like biocompatibility, stability, cost-effectiveness, biorelevance, enhanced energy storage, safety, and processing ease.

Ion-conductive polymers are used in applications like energy storage, ion sensors, electro-optical devices, biomedical devices, fuel cells, wearable technology, and electrochromic displays. The examples of ICPs are PEO, polypyrroles, fluoropolymers, polyethylene, polypyrroles, and PVDF.

Ion-Conductive Polymers Market Trends:

- Rapidly Expanding Electronic Industry: The increasing advancements in electronics like miniaturization, wearable technology, and metal replacement stimulate demand for ICPs. The increasing demand for touch screens, portable devices, and flexible displays requires ICPs.

- Electric vehicle Rise: The transition towards PHEVs and BEVs booms demand for ion-conductive polymers to extend the lifecycle and safety of lithium-ion batteries. The focus on the development of lightweight electric vehicles requires ICPs.

- Growing Aerospace and Defense industry: The strong emphasis on the reduction of aircraft weight and expanding payload capacity increases demand for ICPs.

- Strong Energy Storage Demand: The rapid growth in the development of energy storage solutions like fuel cells, batteries, and supercapacitors fuels demand for ICPs to enhance ionic conductivity and power density.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 4.18 Billion |

| Revenue Forecast in 2035 | USD 8.75 Billion |

| Growth Rate | CAGR 8.56% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments Covered | By Product, By End Use, By Region |

| Key companies profiled | Heraeus Holding GmbH, Agfa Gevaert N.V., Merck KGaA., Solvay S.A., Ormecon Pvt Ltd, The Lubrizol Corporation, Henkel AG & Co. KGaA, 3M Company, NTK (Nagase ChemteX Corporation), Suzhou Ruihong Electronic Chemical Co., Ltd. |

Key Technological Shifts in the Ion-Conductive Polymers Market:

The ion-conductive polymers market is undergoing key technological advancements driven by the demand for conductivity, performance efficiency, functionality, flexibility, and safety. The key innovations are 3D printing, nanocomposites, solvent-free electrolytes, electrospinning, and eco-friendly materials that enhance conductivity, stability, and support greener manufacturing. One of the key transformations is the incorporation of AI optimizes material use.

AI rapidly discovers filler materials & polymer structures and easily identifies novel polymer electrolytes. AI predicts polymer properties like glass transition temperature & ionic conductivity, and optimizes production processes like printing, molding, extrusion, & coating. AI enhances scalability and develops environment-friendly polymers. AI lowers defects in polymers and develops high-performance SPEs. Overall, AI plays a significant role in ICPs and supports faster innovations in ICPs.

Ion-Conductive Polymers Market Value Chain Analysis

- Feedstock Procurement: Feedstock procurement is the process of raw material sourcing, like lithium salts, magnesium salts, polymer hosts, ammonium salts, inorganic fillers, plasticizers, fillers, and solvents.

- Key Players:- DuPont, Imerys, LG Chem, Borealis, ExxonMobil Chemical, INEOS

- Chemical Synthesis and Processing: The chemical synthesis and processing involve methods like chemical oxidative polymerization, spin coating, electrochemical polymerization, electrospinning, and template-assisted synthesis.

- Key Players:- Solvay S.A., Mitsubishi Chemical Corporation, Covestro AG, 3M Company, Heraeus Holding GmbH

- Quality Testing and Certifications: The quality testing involves functional tests of properties like elongation, ionic conductivity, thermal stability, flexibility, structure, chemical structure, mechanical stability, and capacitance. The certification for ICPs is ISO 9001, IEC 62133, UL 2849, RoHS, and BIS.

- Key Players:- TUV Rheinland, Chem-Tech Laboratories, SGS, Elca Labs, Intertek

Mapping Nation-Wise Contribution of Ion-Conductive Polymers

| Country | Key Regulations | Key ICPs Produced | Application |

| United States |

|

|

|

| China |

|

|

|

| Germany |

|

|

|

| United Kingdom |

|

|

|

Segmental Insights

Product Insights

Why Proton Conductive Polymers Segment Dominates the Ion-Conductive Polymers Market?

The proton conductive polymers (PCPs) segment dominated the ion-conductive polymers market share of 69.61% in 2025. The increasing need for the transportation of protons in fuel cells and the focus on balancing conductivity increase demand for PCPs. The excellent chemical stability, processability, mechanical stability, and cost-effectiveness of PCPs accelerate market expansion. The shift towards clean energy resources and the increasing use of smartphones increases demand for PCPs. The growth in the development of the next-generation energy storage system and the increasing need for biosensors require PCPs, driving the overall market growth.

The anion-conductive polymers segment is anticipated to grow at the fastest CAGR of 9.88% during the forecast period. The increased production of hydrogen and expansion in the production of wearable electronic devices increase demand for anion-conductive polymer. The strong focus on lowering leakage in batteries and rapid acceleration in e-textiles requires anion-conductive polymers. The hybridization, high stability, ease of processing, and superior conductivity of anion-conductive polymers support the overall market growth.

End Use Insights

Which End Use Held the Largest Share in the Ion-Conductive Polymers Market?

The fuel cell segment held the largest revenue share in the ion-conductive polymers market share of 58.71% in 2025. The shift towards green energy solutions and a strong focus on minimizing pollution requires a fuel cell that uses ICPs. The faster development of large-scale power systems and power backup systems increases the adoption of fuel cells. The low gas permeability, excellent proton conductivity, and high thermal stability of fuel cells accelerate market expansion. The increasing use of fuel cells in clean energy, transportation, and stationary power systems drives the overall growth of the market.

The batteries & supercapacitors segment is expected to expand at the fastest CAGR of 9.45% through the forecast period. The transition towards solar energy and increasing ownership of electric vehicles boosts demand for batteries & supercapacitors. The continued growth in development of lightweight electronic devices and advancements in energy storage increase the adoption of batteries & supercapacitors. The progress in development of medical devices like portable monitors & pacemakers and large-scale grid storage requires batteries & supercapacitors, supporting the overall market growth.

Regional Insights

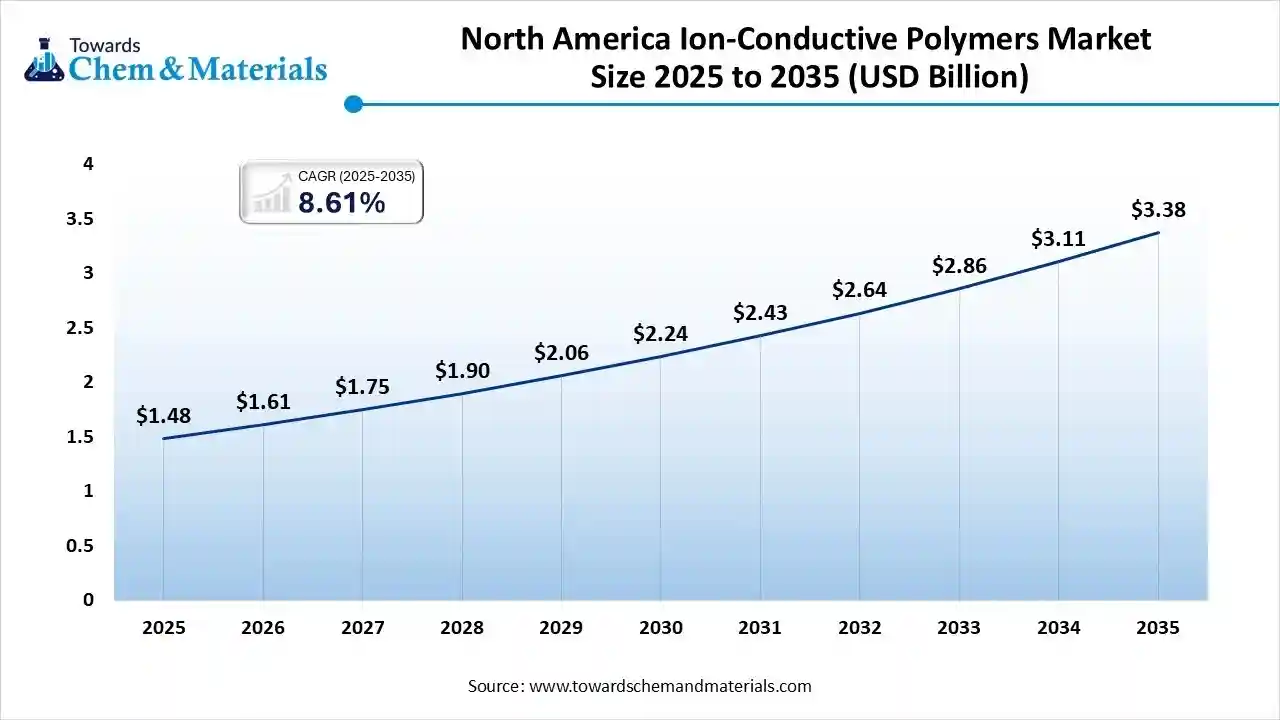

The North America ion-conductive polymers market size was valued at USD 1.48 billion in 2025 and is expected to surpass around USD 3.38 billion by 2035, expanding at a compound annual growth rate (CAGR) of 8.61% over the forecast period from 2026 to 2035. North America dominated the market in 2025. The strong focus on the utilization of renewable energy resources and the expansion of the electric vehicle customer base increase demand for ICPs.

The prominent presence of semiconductor manufacturing and the increased penetration of implantable devices require ICPs. The robustly developed automotive industry and government policies for lightweight material use elevate demand for ICPs. The major cutting-edge electronics infrastructure and well-established research facilities increase demand for ICPs. The presence of key players like Lubrizol, Solvay, 3M, Heraeus Group, and Celanese drives the overall market growth.

Catalyzing Conductivity: United States at the Forefront of ICPs

The United States is a key contributor to the market in the North America region. The expanded use of smart devices and increasing investment in high-performance battery technologies increase demand for ICPs. The strong presence of the aerospace sector and the transition towards decarbonization fuel demand for ICPs. The heavy investment in the production of batteries and an extensively established IT manufacturing base creates demand for ICPs. The robust governmental backing for green technology and focus on smart fabrics development require ICPs, supporting the overall market growth.

Asia Pacific Ion-Conductive Polymers Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The largest consumer electronics manufacturing base and robust expansion of the automotive industry, especially in countries like India, Japan, & China, create higher demand for ICPs. The increasing investment in the development of hydrogen infrastructure and a well-established industrial foundation in countries like South Korea & China increases demand for ICPs. The progressing cutting-edge applications like wearable electronics, IoT, and solar power drive the overall market growth.

Powering Tomorrow: Japan’s Rise in Ion-Conductive Polymers Innovation

Japan is rapidly growing in the market. The strong automotive manufacturing hub and shift towards sustainable energy solutions increase demand for ICPs. The increased utilization of lightweight materials in smart textiles and the heavy investment in the development of production facilities increase the adoption of ICPs. The increasing demand for advanced electronic devices and a strong focus on the adoption of renewable energy require ICPs, supporting the overall market growth.

Europe Ion-Conductive Polymers Market Trends

Europe is growing at a notable rate in the market. The stringent EU emission standards and growing development of electric vehicle components like EMI shielding, batteries, and others create demand for ICPs. The strong government support for the green energy shift through initiatives like REPowerEU and the high smartphone adoption rate increase demand for ICPs. The increased miniaturization of advanced electronic components and the development of flexible devices require ICPs, supporting the overall growth of the market.

United Kingdom Power in Ion-Conductive Polymers

The United Kingdom is growing substantially in the market. The transition towards lightweight vehicles and acceleration in the miniaturization of powerful electronic devices creates demand for ICPs. The booming energy storage sector and increased development of biomedical devices require ICPs. The growing use of ICPs across new applications like advanced electronics, robotics, and green energy supports the overall market growth.

Middle East & Africa Ion-Conductive Polymers Market Trends

The Middle East & Africa are growing at a substantial rate in the market. The growing utilization of lithium-ion batteries and high-flexible display demand in the region increases demand for ICPs. The growing use of lightweight materials across sectors like electronics and automotive creates huge demand for ICPs. The major financial investment in renewable energy and the high adoption rate of electric cars increase demand for ICPs, driving the overall market growth.

How the UAE is Shaping the Ion-Conductive Polymers Landscape

The United Arab Emirates is growing in the market. The strong government focus on the development of advanced telecom and smart city projects increases the adoption of ICPs. The robust investment in the solar energy sector and innovations in flexible electronics require ICPs. The growing healthcare sector expansion and active government involvement in sustainable technologies increase the adoption of ICPs, supporting the overall market growth.

South America Ion-Conductive Polymers Market Trends

South America is growing significantly in the market. The growing use of electric mobility solutions and the rising expansion of smart textiles increase demand for ICPs. The expanding technological manufacturing infrastructure in countries like Brazil and major government backing for sustainable technologies require ICPs. The increasing investment in the industrial base and green energy goals requires ICPs, driving the overall market growth.

Advanced Material Science: Brazil's Contribution to ICPs Growth

Brazil is growing at a significant rate in the market. The accelerated adoption of IoT devices and the higher scaling of renewable energy increase demand for ICPs. The strong focus on green initiatives and the increasing use of advanced sensors requires ICPs. The excellent manufacturing infrastructure and rapid deployment of EVs’ batteries require ICPs. The burgeoning wind energy and solar energy create huge demand for ICPs, supporting the overall market growth.

Recent Developments

- In March 2024, Toray launched an ion-conductive polymer membrane for batteries. The membrane is useful for lithium metal, solid-state, and air batteries. The membrane provides ion conductivity via hopping conduction and remains non-porous.(Source: www.toray.com)

- In November 2025, Piersica launched PRION polymer for lithium-ion batteries. The polymer enhances voltage stability, mechanical durability, conductivity, and thermal resilience. The polymer consists of an amorphous molecular structure and offers high mechanical strength.(Source: https://chargedevs.com )

Top Companies List

- Heraeus Holding GmbH: The German-based company develops products like medical devices, sensors, electronic components, and others to serve diverse industrial bases like aerospace, electronics, telecom, automotive, pharma, and energy.

- Agfa Gevaert N.V.: The Belgian multinational company develops ion-conductive polymers through its ORGACON portfolio to support various electronic applications like touch screens, sensors, flexible displays, switches, and automotive panels.

- Merck KGaA: The science and technology company supplies research-grade substances, high-purity raw materials, and precursor chemicals to produce ion-conductive polymer.

- Solvay S.A.: The company provides specialty materials, polymers, and membranes to support various applications like lithium-ion batteries, fuel cells, and electrolyzers.

- Ormecon Pvt Ltd: The India-based company develops ICPs polymers like polyaniline to serve diverse industries like electronics, automotive, and defense.

Other Companies List

- Heraeus Holding GmbH

- Merck KGaA

- Ormecon Pvt Ltd

- Solvay S.A.

- Agfa Gevaert N.V.

- The Lubrizol Corporation

- Henkel AG & Co. KGaA

- 3M Company

- NTK (Nagase ChemteX Corporation)

- Suzhou Ruihong Electronic Chemical Co., Ltd.

Segments Covered

By Product

- Proton Conductive Polymers

- Anion Conductive Polymers

By End Use

- Fuel Cells

- Batteries & Supercapacitors

- Sensors & Electrochemical Devices

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa