Content

What is the Current Europe Biopolymers Market Size and Share?

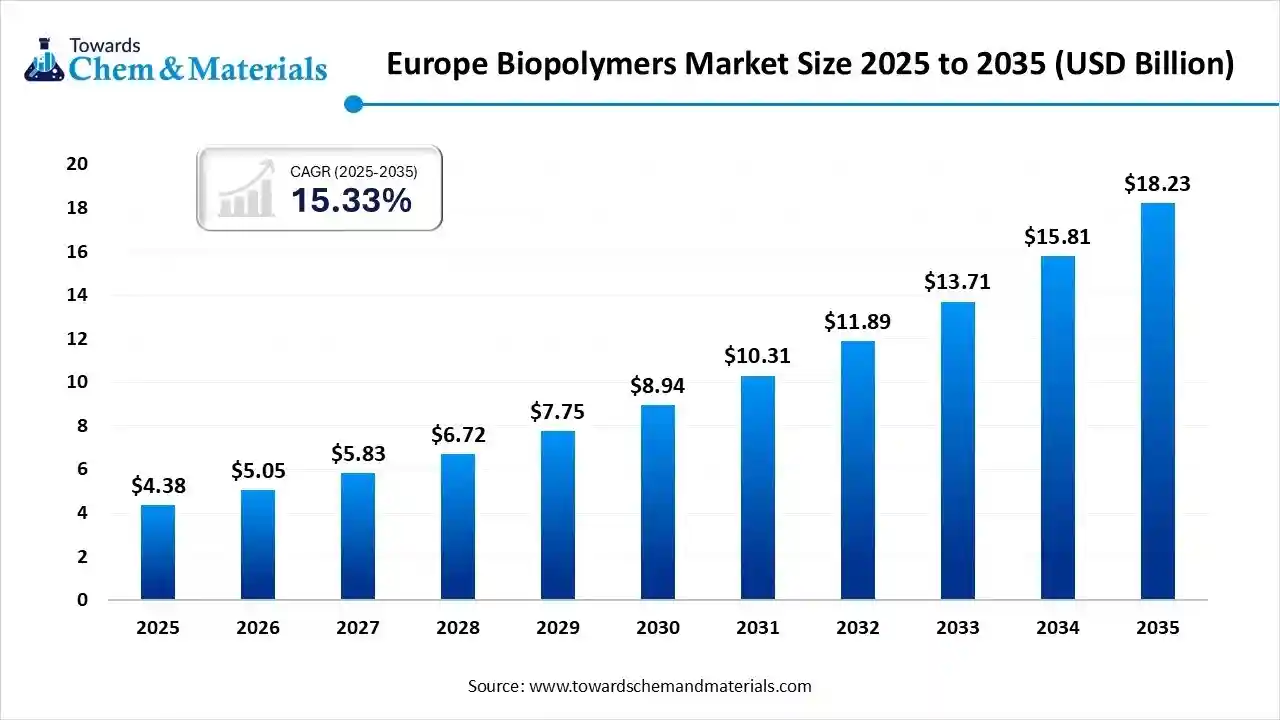

The global Europe biopolymers market size is calculated at USD 4.38 billion in 2025 and is predicted to increase from USD 5.05 billion in 2026 and is projected to reach around USD 18.23 billion by 2035, The market is expanding at a CAGR of 15.33% between 2026 and 2035. Growing consumer demand for sustainable products is the key factor driving market growth. Also, rapid implementation of strict environmental regulations and policies, coupled with the technological innovations that enhance material performance, can fuel market growth further.

Key Takeaways

- By product, the bio-PE segment dominated the market with the largest share in 2025.

- By product, the bio-PET segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the bottle segment held the largest market share in 2025.

- By application, the films segment is expected to grow at the fastest CAGR over the forecast period.

- By end use, the packaging segment dominated the market with the largest share in 2025.

- By end use, the automotive segment is expected to grow at the fastest CAGR over the projected period.

What are Biopolymers?

The market involves the trade of polymers from biodegradable or renewable sources, fuelled by packaging needs, EU sustainability goals, and consumer demand. These materials, also called bioplastics, serve as a sustainable alternative to traditional fossil-fuel-based plastics.

Europe Biopolymers Market Trends

- The rapid implementation of sustainable practices in the personal care industry is the latest market trend driving positive market growth. Biopolymer packaging provides sustainable solutions for blister packs, pill bottles, and medical device packaging.

- The ongoing innovations in feedstock development, such as fermentation-based production methods and synthetic biology, like microbial fermentation for PHA, are paving the way for scalable and cost-effective biopolymer manufacturing, leading to market growth soon.

- The shift towards non-biodegradable and bio-based plastics is another major trend driving market expansion.

- The businesses in the region are seeking durable and high-performance substitutes that are compatible with current recycling infrastructure.

- Biopolymers are increasingly being used in different industries such as consumer goods, medical equipment, orthopaedic devices, and drug delivery systems. The market is expected to expand as many companies are adopting circular economy principles by producing eco-friendly products.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 5.05 Billion |

| Revenue Forecast in 2035 | USD 18.23 Billion |

| Growth Rate | CAGR 15.33% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | Product Insights, By Application, By End-use |

| Key companies profiled | BASF SE, Archer Daniels Midland Company, DuPont de Nemours, Inc., bio-tec Biologische Naturverpackungen GmbH & Co. KG, Novamont S.p.A. (Versalis S.p.A.), BiologiQ, Inc., Ecovia Renewables Inc., BioPolymer GmbH & Co KG, Solanyl Biopolymers Inc., Biopolymer Industries |

How Cutting Edge Technologies Are Revolutionizing The Europe Biopolymers Market?

Advanced technologies are transforming the market by optimizing sustainability, performance, and cost-efficiency through genetic engineering, enzymatic recycling, and AI-driven bioreactors. Furthermore, these technologies are making biopolymers more prevalent in comparison to conventional plastics, thereby expanding their range of applications.

Trade Analysis of Europe Biopolymers Market Import & Export Statistics:

Exports

- In 2023, Germany exported $126M of Natural Polymers, making it the 8th largest exporter of Natural Polymers in the world.

- In 2023, the main destinations of Germany's Natural Polymers exports were: Italy ($16.7M), France ($14.2M), Poland ($13M), the United States ($8.25M), and China ($8.13M).

Imports

- In 2023, Germany imported $227M of Natural Polymers, becoming the 3rd largest importer of Natural Polymers in the world.

- In 2023, Germany imported Natural Polymers primarily from China ($63.6M), France ($46.8M), Sweden ($26.3M), Austria ($25.8M), and Italy ($13.4M).

- France exported $739 worth of natural and modified natural polymers to Qatar in 2024.

Europe Biopolymers Market Value Chain Analysis

- Feedstock Procurement : It is the process of sourcing bio-based and renewable materials, used as a key ingredient for producing bioplastics, with a growing emphasis on waste streams and sustainability.

- Major Players: BASF SE, Novamont S.p.A.

- Chemical Synthesis and Processing: It is an important stage of the value chain that emphasizes converting renewable feedstocks into high-performance polymers using various chemical methods.

- Major Players: Arkema S.A., Versalis S.p.A.

- Packaging and Labelling: It is the primary application stage in the market. Biopolymers are used for different packaging applications such as bags, pouches, rigid trays, and personal care products.

- Major Players: Mondi Group, Amcor Limited.

- Regulatory Compliance and Safety Monitoring: This stage ensures that the biopolymer meets the strict standards set by regulatory bodies such as the European Commission and the European Food Safety Authority (EFSA).

- Major Players: NatureWorks LLC, DuPont de Nemours, Inc.

Europe Biopolymers Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | Packaging and Packaging Waste Regulation (PPWR): This regulation sets recyclability requirements for all packaging and supports the use of bio-based materials. |

| Germany | At the forefront of circular economy initiatives and bio-based packaging, with proactive policies and funding for innovation. There is strong market demand for certified compostable products. |

| United Kingdom | Following Brexit, the UK government has generally not exempted biodegradable plastics from policies aimed at reducing single-use plastics. For compostable plastics, the preference is for their use in closed-loop systems. |

Segmental Insights

Product Insights

How Much Share Did the Bio-PE Segment Held in 2025?

The bio-Polyethylene segment dominated the market with the largest share in 2025. The dominance of the segment can be attributed to the growing awareness regarding plastic pollution, which fuels demand for biodegradable, bio-based products in textiles, packaging, and consumer goods. Bio-PE is considered a major pathway to minimize carbon footprints.

The bio-PET segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the corporate commitments to circular economy initiatives. Bio-PET provides similar performance to traditional PET, which makes it a key solution for films and textiles. The biodegradable polyesters segment held a major market share in 2025. The growth of the segment can be fuelled by the ongoing shift towards using renewable, plant-based raw materials such as sugarcane and wood residues to create polyesters, which decreases the reliance on finite fossil fuel resources.

The growth of the polylactic acid (PLA) segment can be boosted by its exceptional printability, clarity, and thermoforming properties. PLA's sustainable and lightweight profile aligns with the EV sector's goals, creating new avenues for the segment further.

Application Insights

Which Application Type Segment Dominated the Europe Biopolymers Market in 2025?

The bottle segment held the largest market share in 2025. The dominance of the segment can be linked to the growing consumer demand for Green Deal and sustainable packaging solutions, pushing brands to adopt alternatives such as PLA. Bottles made from PLA are used across different industries.

The films segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing technological innovations in the production process and strict government regulations. These films offer key benefits compared to petroleum-based plastics.

The fibers segment held a major market share in 2025. The growth of the segment can be boosted by substantial R&D investments, propelling advancements in materials such as PHA and PLA for fibers in textiles and packaging.

The growth of the seed coating segment can be propelled by increasing demand for low-input and organic seed treatment solutions, which aligns with consumer and policy trends. Also, market players are investing in integrated seed treatments.

End-Use Insights

How Much Share Did the Packaging Segment Held in 2025?

The packaging segment dominated the market with the largest share in 2025. The dominance of the segment is owed to the growing consumer awareness regarding corporate sustainability initiatives. In addition, major brands and corporations are adding circular economy principles to their business.

The automotive segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to rising consumer demand for sustainable cars and rapid innovations in material science. R&D by major companies is making biopolymers more scalable.

The consumer goods segment held a significant market share in 2025. Consumers are rapidly searching for brands that align with their values, pushing market players to add biopolymers in product design and packaging to improve their brand image. The growth of the agriculture segment can be propelled by the ongoing development of high-performance biopolymers with better barrier & mechanical properties, which make them viable for different agricultural uses.

Country Insights

How did the Germany Thrive in the Europe Biopolymers Market in 2025?

Germany dominated the market with the largest share in 2025. The dominance of the country can be attributed to the growing environmental awareness, which drives the demand for biodegradable, bio-based products across various industries. Also, the country's large automotive and production sectors are major consumers adopting biopolymers for greener and lighter components.

Which is the Fastest Growing Country in the Region?

The United Kingdom (UK) is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be credited to its shifts towards sustainable packaging, automotive, and textile solutions, coupled with the green initiatives fuelling the adoption despite higher initial costs. Companies in the region are also increasingly emphasizing reducing their carbon footprint, driving market growth soon.

France expects the notable growth over the forecast period. The growth of the country can be driven by the rapid investments in biopolymer processing technologies and infrastructure. Moreover, innovations in biopolymer manufacturing are improving material properties such as heat resistance, strength, and biodegradability.

Recent Developments

- In October 2025, Braskem launches bio-based product innovations at K 2025. Braskem's partnership with Dutch innovators Bottle Up and Eurobottle brings bio-based materials into practical, reusable designs.(Source: www.braskem.com.br )

- In June 2025, Ineos Olefins & Polymers Europe will introduce cutting-edge recycled plastic production in France. The company has launched new product grades specifically designed to meet stringent EU regulatory requirements for various applications.(Source: www.plasticstoday.com)

Market Companies

- BASF SE: BASF SE is a major European leader in biopolymers, known for its ecovio® and ecoflex® compostable plastics, focusing on sustainable packaging, agriculture, and consumer goods, supporting the circular economy with strong R&D and AI-driven production.

- Archer Daniels Midland Company: ADM is a major player in sustainable ingredients, leveraging its agricultural base to provide bio-based solutions, including bio-resins like propylene glycol (Archer RC™) for coatings, serving Europe's growing demand for sustainable materials.

Top Companies in the Europe Biopolymers Market

- BASF SE

- Archer Daniels Midland Company

- DuPont de Nemours, Inc.

- bio-tec Biologische Naturverpackungen GmbH & Co. KG

- Novamont S.p.A. (Versalis S.p.A.)

- BiologiQ, Inc.

- Ecovia Renewables Inc.

- BioPolymer GmbH & Co KG

- Solanyl Biopolymers Inc.

- Biopolymer Industries

Segments Covered in the Report

By Product

- Biodegradable Polyesters

- Bio-PE

- Bio-PET

- Polylactic Acid (PLA)

- Polyhydroxyalkanoate (PHA)

- Others

By Application

- Bottle

- Films

- Fibers

- Seed Coating

- Medical Implants

- Vehicle Components

- Others

By End-use

- Packaging

- Consumer Goods

- Automotive

- Agriculture

- Textiles & Others