Content

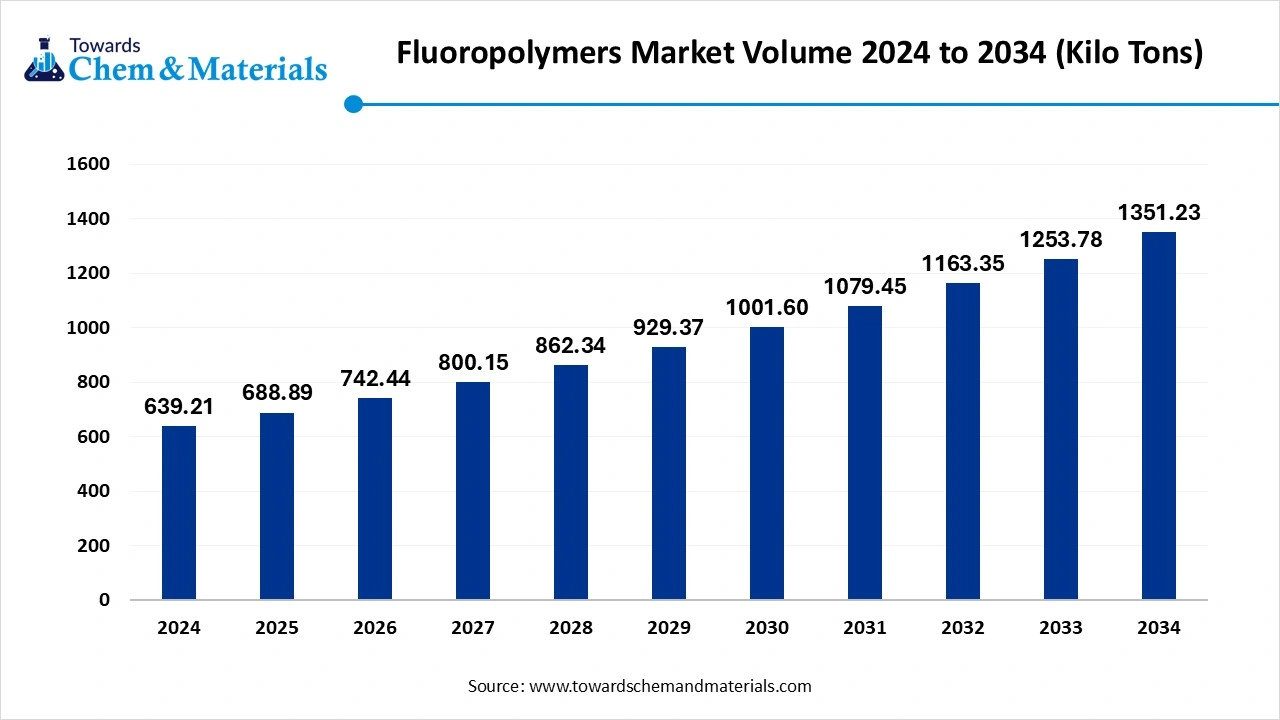

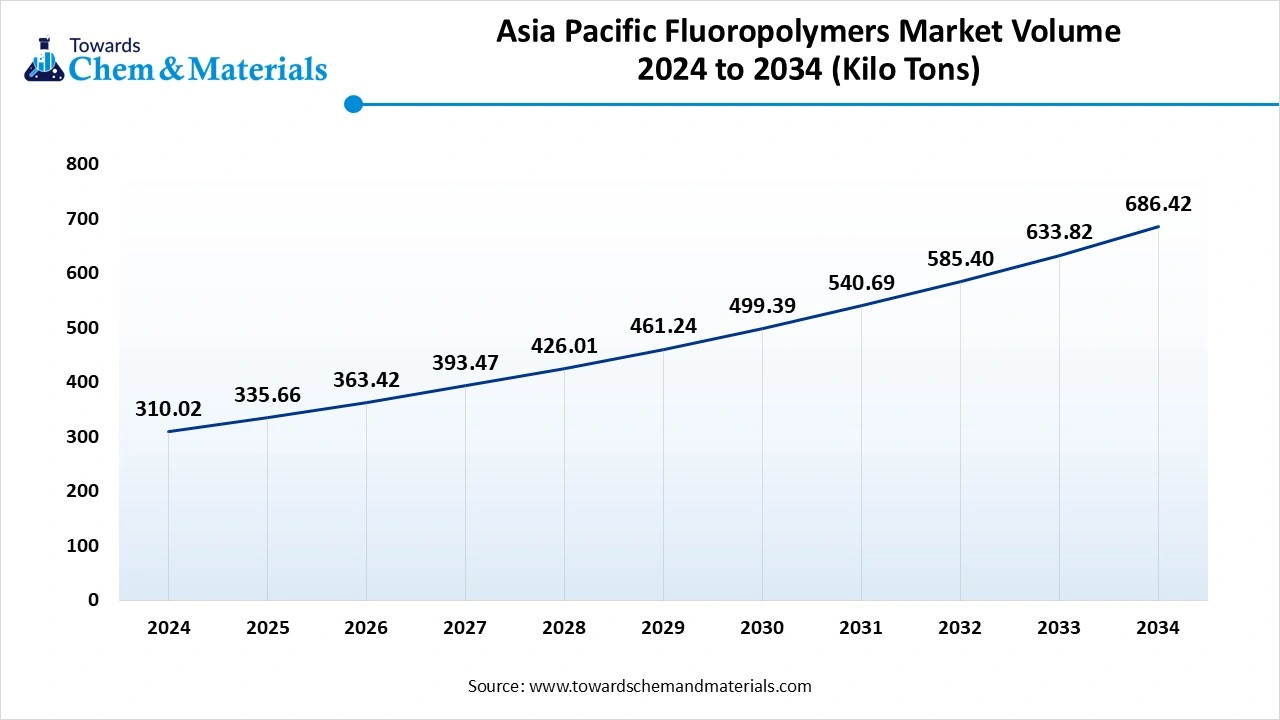

Fluoropolymers Market Volume and Growth 2025 to 2034

The global fluoropolymers market volume was valued at 639.21 kilo tons in 2024 and is expected to reach around 1351.23 kilo tons by 2034, growing at a CAGR of 7.77% from 2025 to 2034. The rapid growth in the automotive industry and the growing demand for high-performance materials across various industries drive the market growth.

Key Takeaways

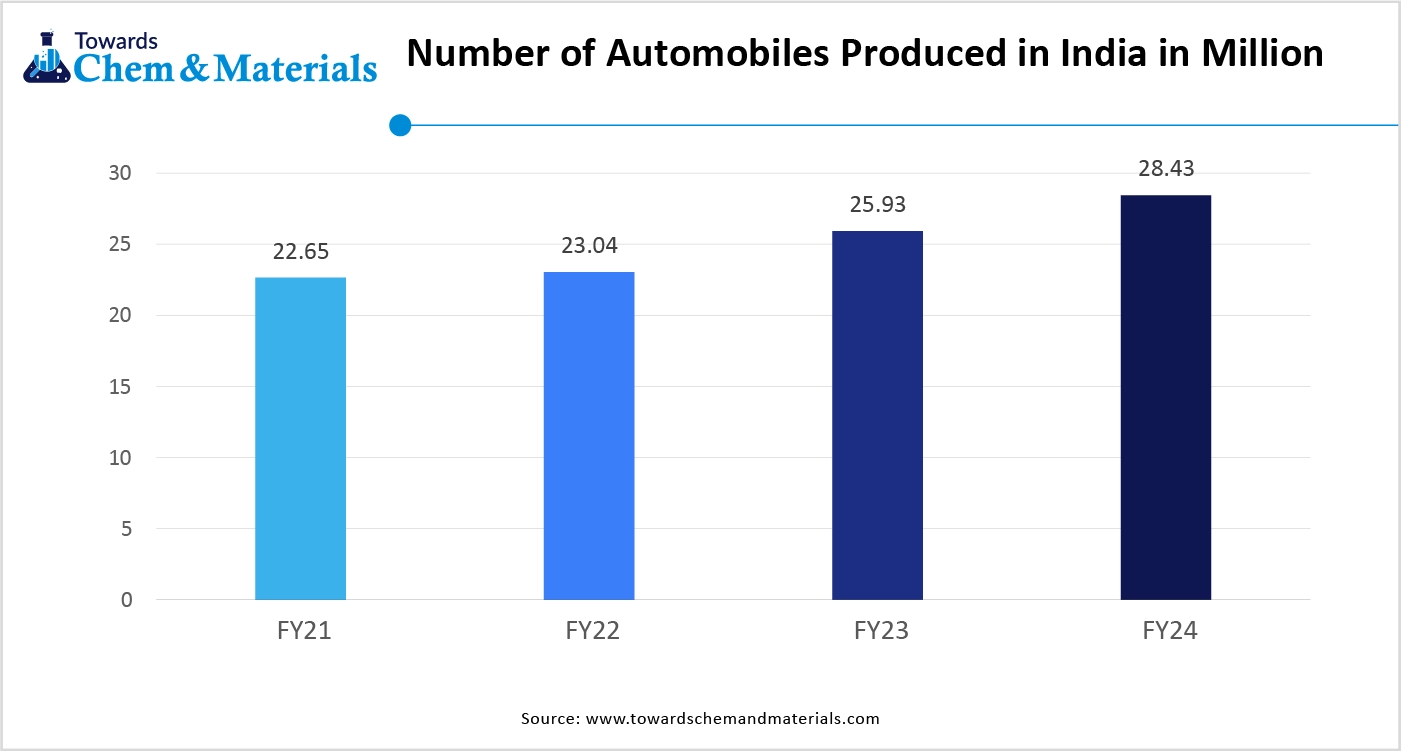

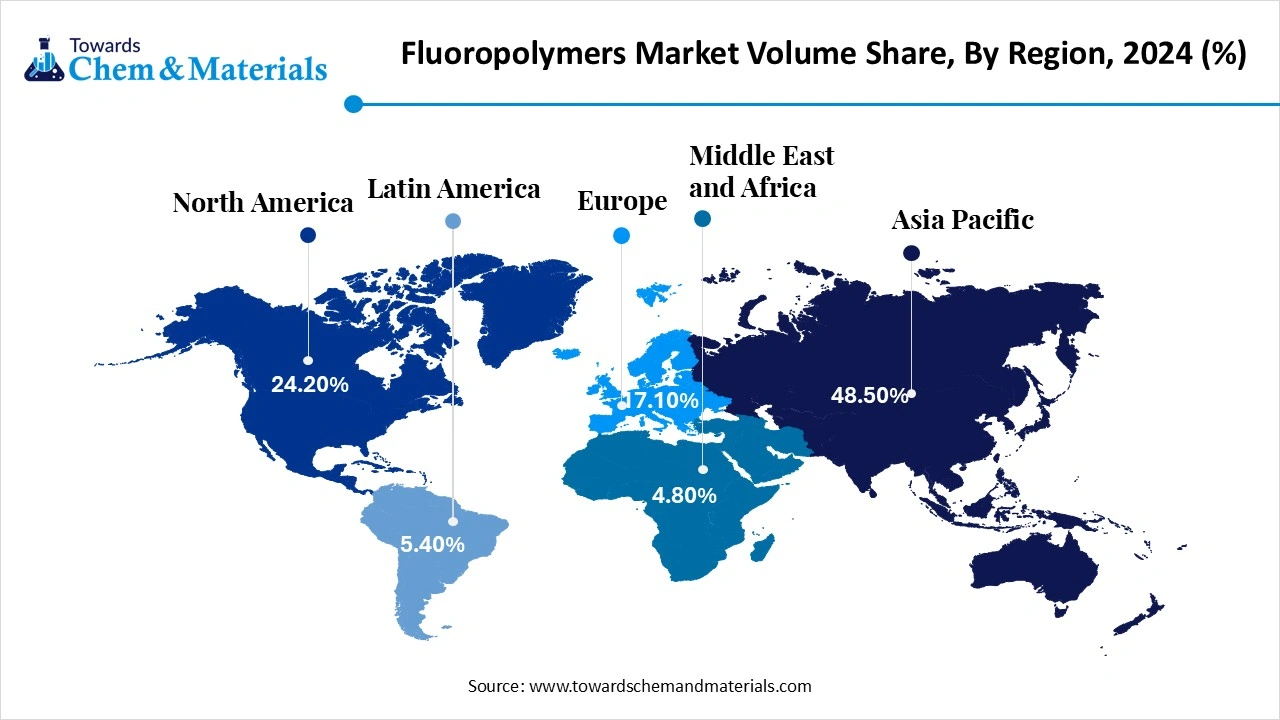

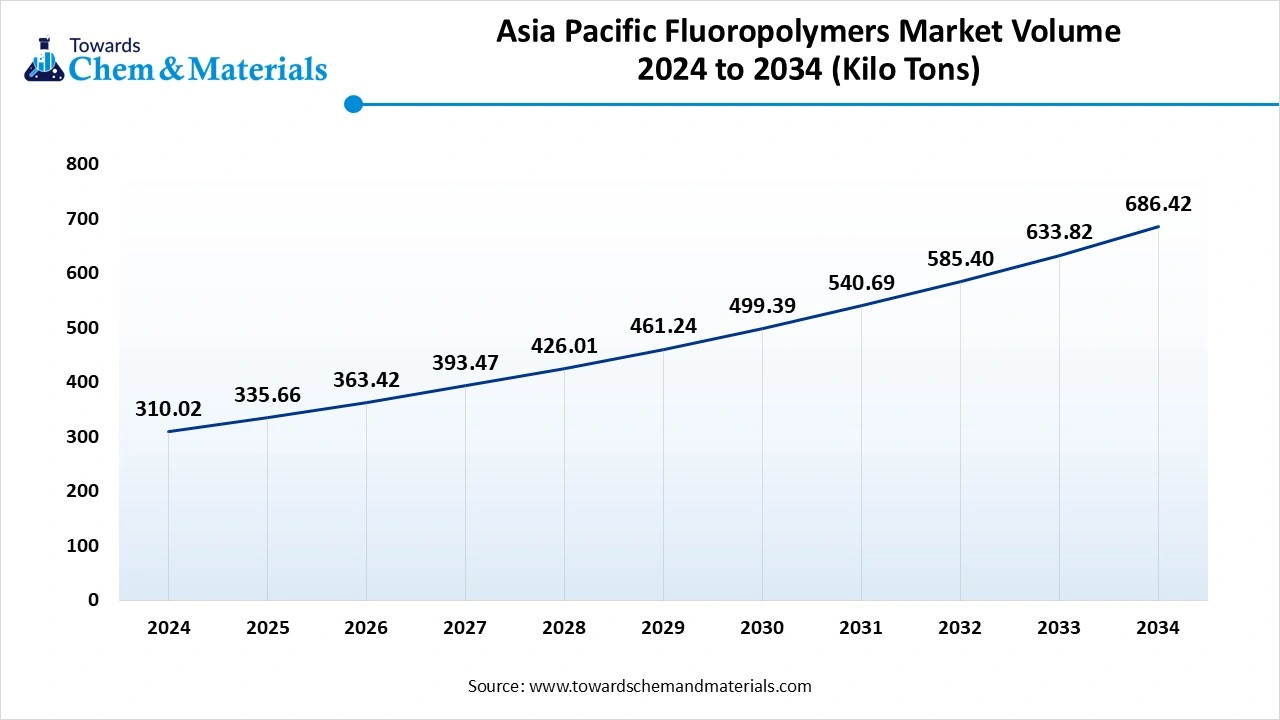

- The Asia Pacific fluoropolymers market is projected to grow from 335.66 Kilo Tons in 2025 to 686.42 Kilo Tons by 2034, at a CAGR of 8.27% from 2025 to 2034.

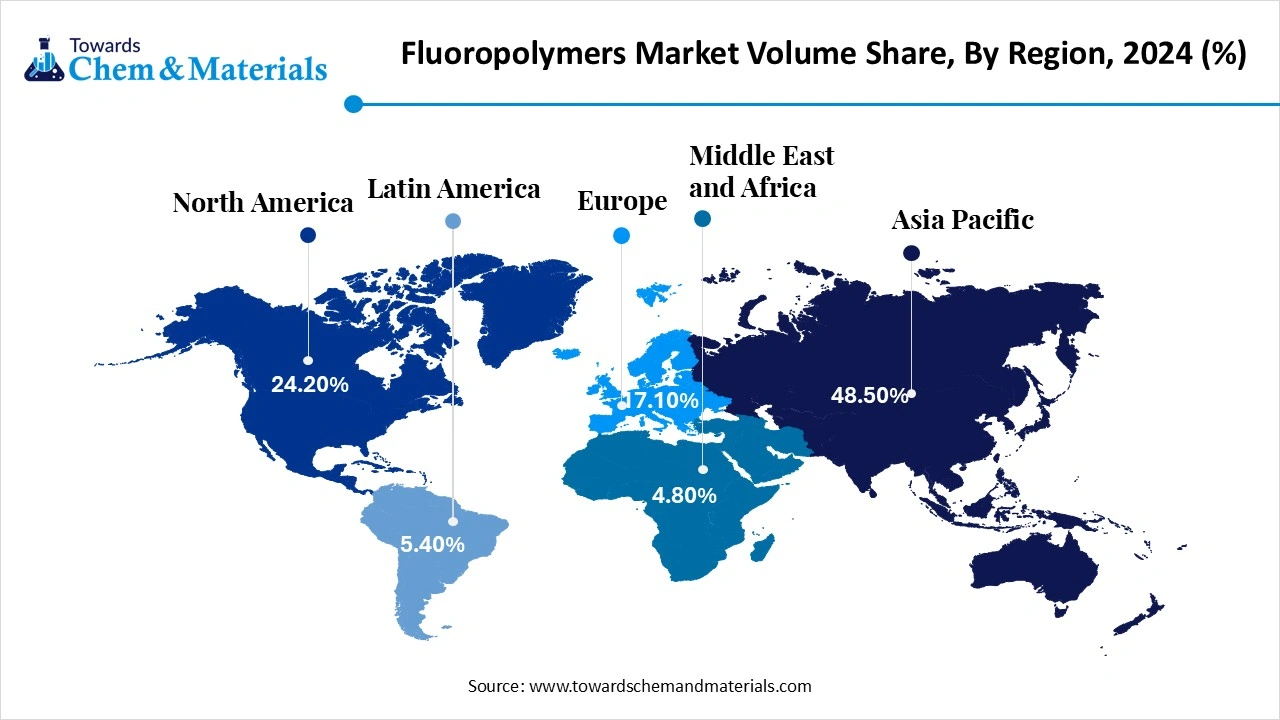

- The Asia Pacific dominated the fluoropolymers market with the largest volume share of 48.50% in 2024 and is anticipated to grow at the fastest CAGR of 8.27% during the forecast period.

- The Europe has held volume share of around 17.10% in 2024.

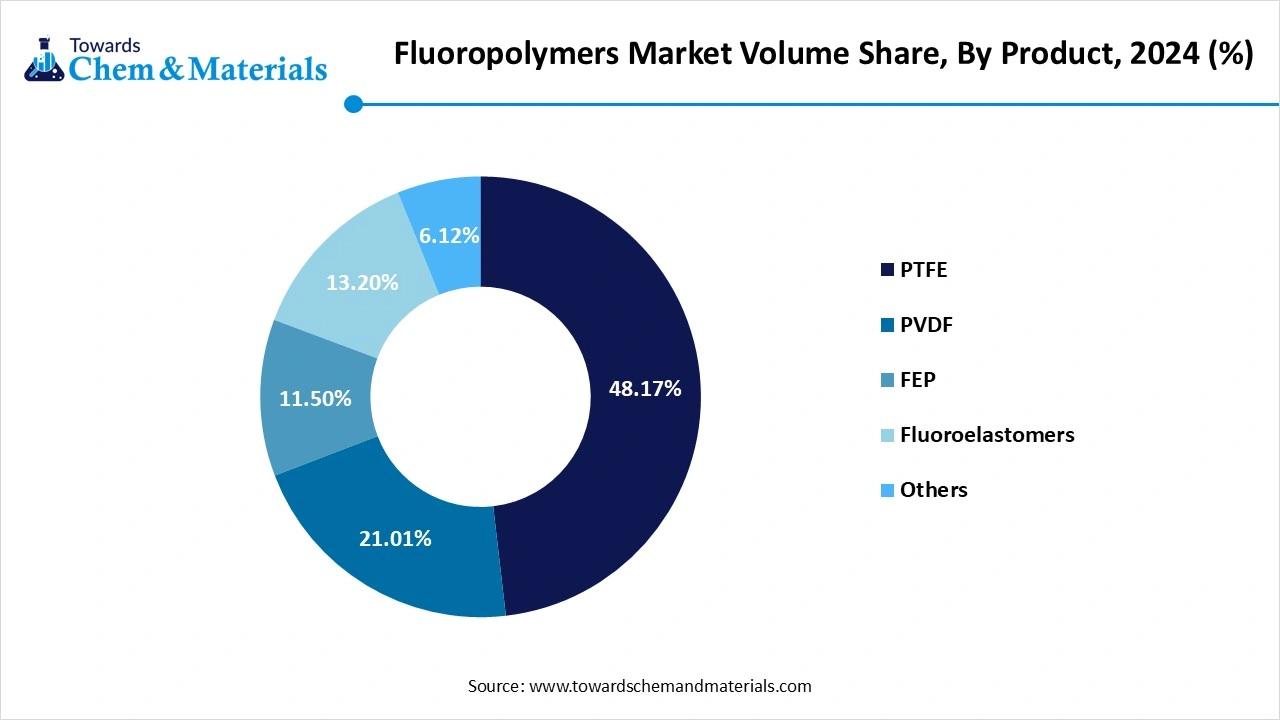

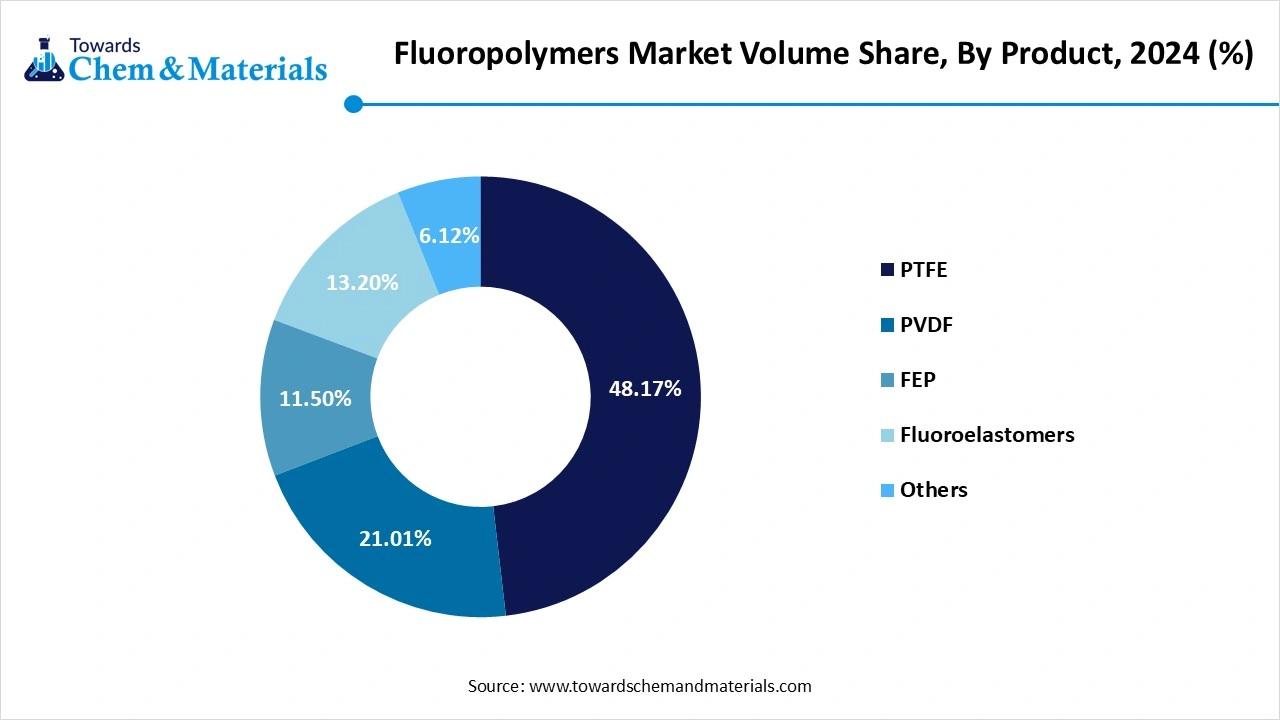

- By product, the Polytetrafluoroethylene (PTFE) led the segment with 48.17% of the market volume share in 2024.

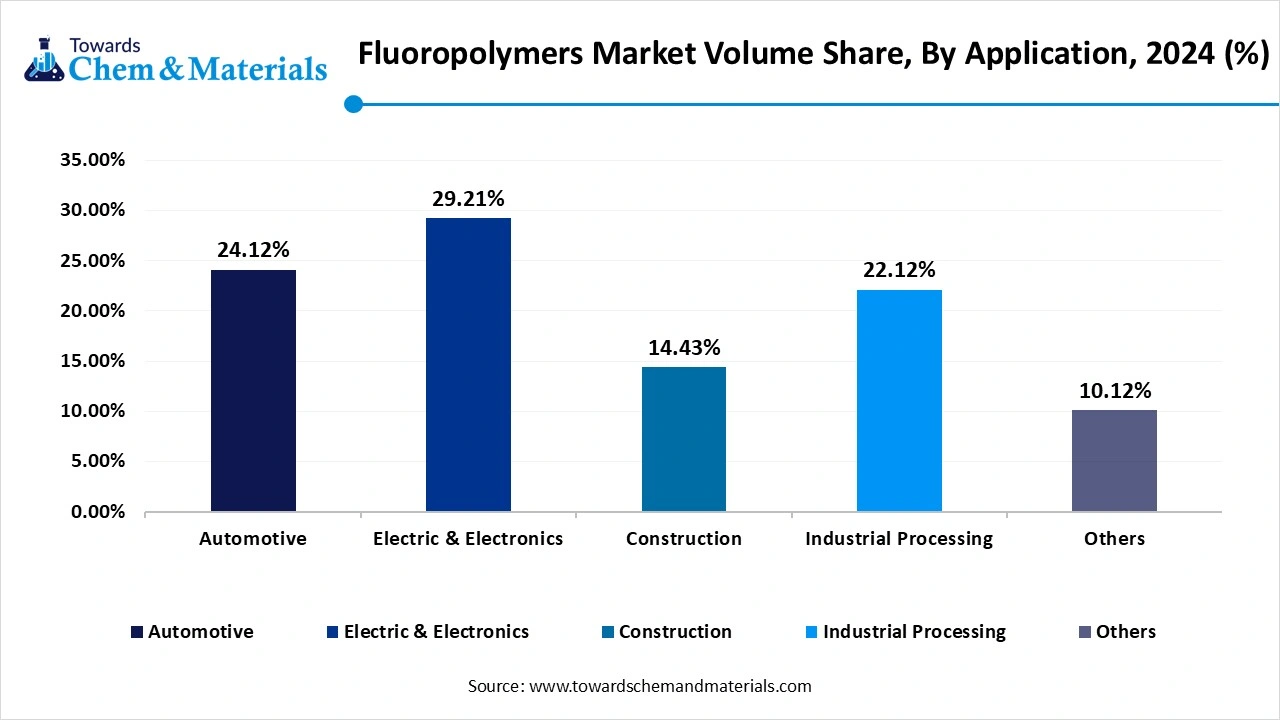

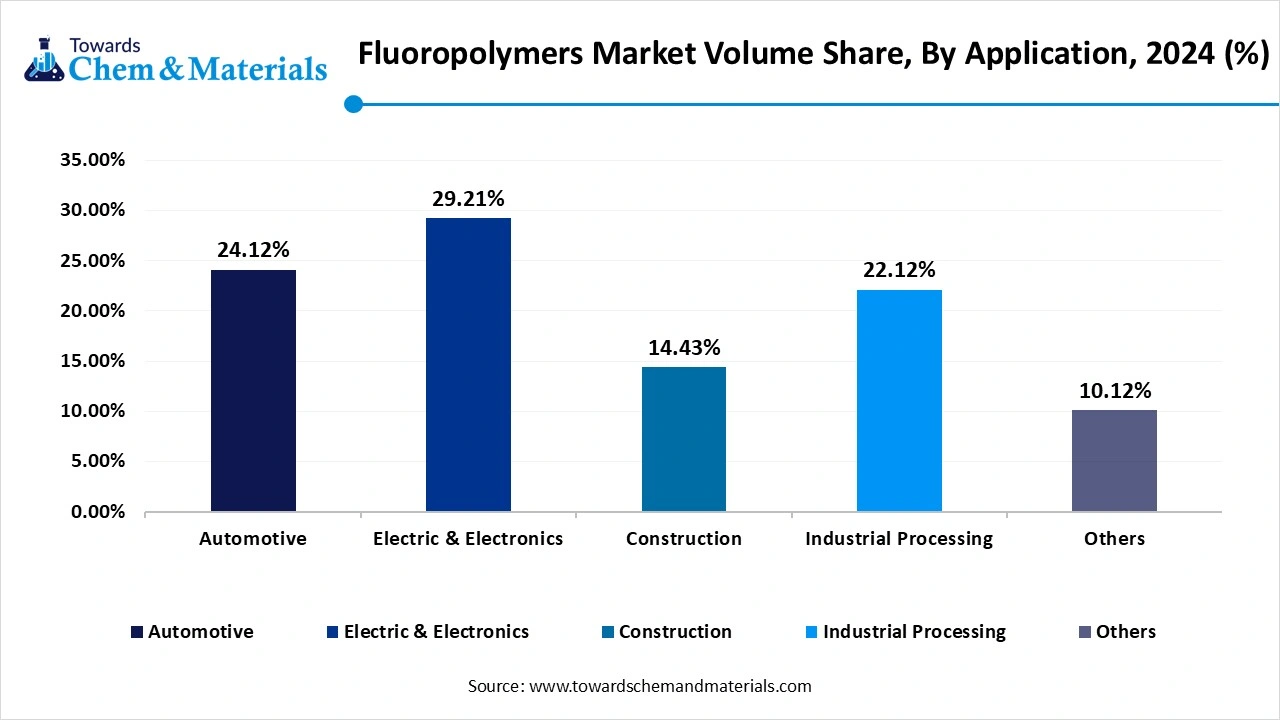

- By application, the electric & electronics segment dominated the market with a volume share of over 29.21% in 2024.

The Power of Fluoropolymers in Modern Industry

Fluoropolymers are a group of fluorocarbon-based polymers with strong carbon-fluorine bonds. They consist of properties like high chemical resistance, thermal resistance, and low friction. Fluoropolymers are found in various forms, like granules, melt processable, films, paste, and dispersion. Fluoropolymers are available in various types, including polytetrafluoroethylene, fluorinated ethylene propylene, polyvinylidene fluoride, and many more. Polytetrafluoroethylene is also known as Teflon and is widely used in industrial applications & cookware. Fluorinated ethylene propylene has high thermal stability and is widely used in chemical processing equipment & wire insulation. Polyvinylidene fluoride has higher chemical resistance and is widely used in electrochemical applications and the chemical industry.

The growing demand for high-performance materials in industries like electronics & automobile increases demand for fluoropolymers to enhance durability, reliability, and performance. The growing industrial applications like renewable energy, chemical processing, and semiconductor manufacturing increase demand for fluoropolymers. Factors like the rapid growth of the automotive industry, the rising demand from the construction sector, the growing adoption of sustainable practices, and the increasing demand for medical devices contribute to the overall growth of the fluoropolymers market.

- Japan exported $686 million of other fluoropolymers in 2023. (Source: oecworld)

- The European Union exported $977011.42K of fluoropolymers. (Source: witsworldbank)

- France exported $570483.20K of fluoropolymers in 2023. (Source: witsworldbank)

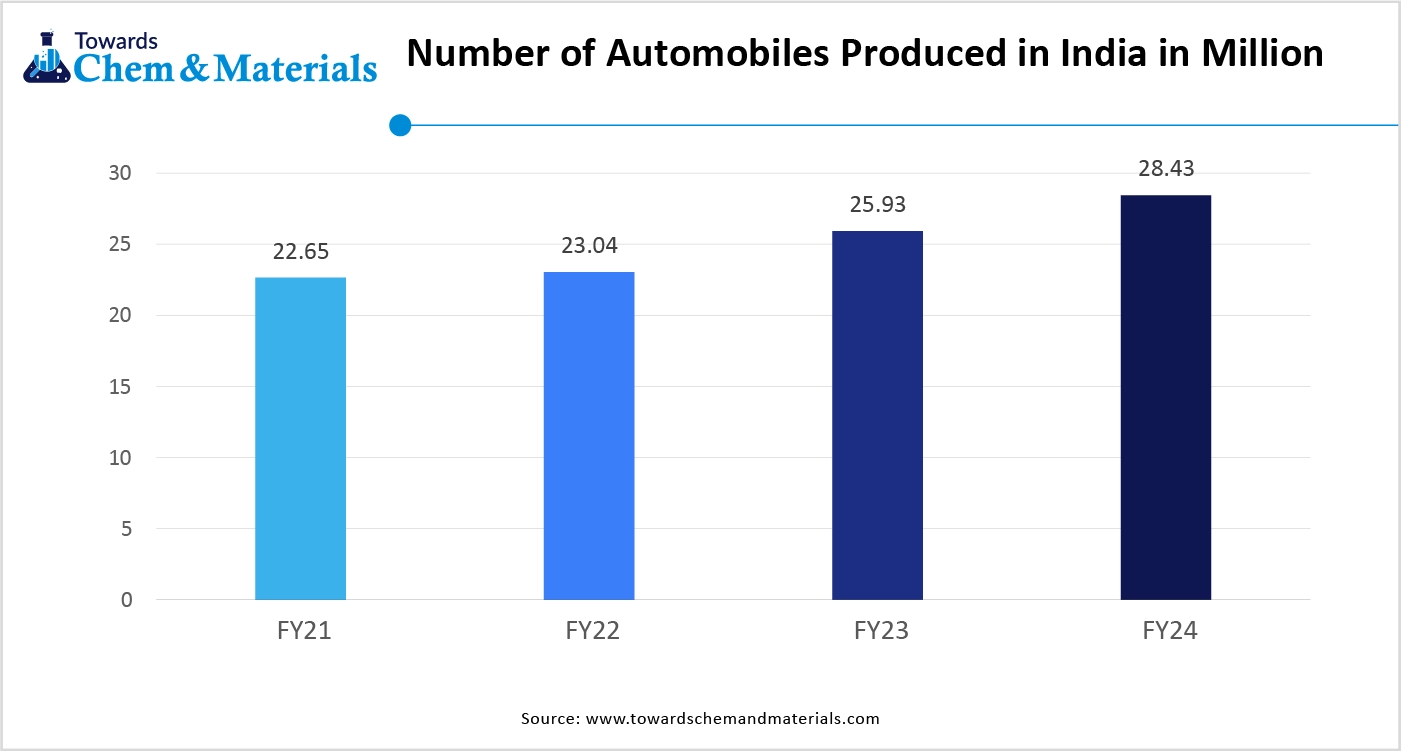

The Growing Demand From the Automotive Industry Drives Market Growth

The growing automotive industry and developments like electric vehicles & hybrid vehicles increase demand for fluoropolymers for various applications. The growing demand for improving vehicle performance increases demand for fuel hoses, electrical components, seals & engine parts, fueling demand for fluoropolymers. The growing demand for enhancing fuel efficiency and minimizing vehicle weight is fueling demand for fluoropolymers. To protect various automotive components, fluoropolymers are used to protect against vibrations, fluids, extreme weather conditions, and heat. The growing adoption of electric vehicles in various regions increases demand for various EV components and lithium-ion batteries, driving demand for fluoropolymers.

The growing focus on development and sustainability in the automotive sector increases the adoption of fluoropolymers. The growing demand for automotive components like hoses, gaskets, exterior surface coatings, fuel lines, and o-rings helps in market growth. The growing expansion automotive industry is a key driver for the fluoropolymers market growth.

Fluoropolymers Market Trends

- Technological advancements: The ongoing technological advancements to enhance properties like improving processing capabilities, high strength, and lower friction help in market growth. Companies focus on the development of sustainable and environmentally friendly processing methods. The integration with other materials, like nanoparticles, to enhance the performance of fluoropolymers.

- Growing expansion of renewable energy: The growing adoption of renewable energy in various regions increases demand for fluoropolymers to enhance the safety, durability, and efficiency of components. Fluoropolymers are widely used in solar thermal installations as coatings, photovoltaic panels, wind turbine blades, and fuel cells. The growing demand for renewable energy components like wiring, seals, and gaskets, and the demand for improving durability, insulation, and chemical resistance, uses fluoropolymers.

- Increasing demand for high-performance materials: The growing demand for high-performance materials like low friction, superior chemical resistance, and high thermal stability in various industries increases demand for fluoropolymers. The PVDF and FEP is widely used fluoropolymers across various industries.

- The growing demand from the healthcare industry: The growing advancements in various medical devices increase demand for fluoropolymers due to their unique properties. Fluoropolymers are widely used in healthcare applications like medical tubing, catheters, implantable medical devices, and surgical instruments.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 688.89 Kilo Tons |

| Market Volume by 2034 | 1351.23 Kilo Tons |

| Growth Rate | CAGR 7.77% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product , By Application, By Region |

| Key Companies Profiled | Daikin Industries, Solvay, AGC Chemicals, Gujarat Fluorochemicals, Kureha Corporation, Chemours, 3M, Arkema, Dongyue Group, Halopolymer |

Market Opportunity

Growing Expansion of the Electronic Industry

The growing demand for various electronics products and the increasing expansion of the electronics industry are fueling demand for fluoropolymers for various applications. The growing demand for high-performance electronic components and systems in areas like high-speed data transmission increases demand for fluoropolymers. The growing adoption of electronic devices increases the demand for safety fueling demand for fluoropolymers to maintain high insulation resistance.

The growing demand for various chemicals to protect electronic components from extreme weather conditions increases the demand for fluoropolymers. The growing trend of miniaturization of electronic devices increases demand for applications like semiconductor manufacturing, wire coatings, and insulating materials. Fluoropolymers offer an extra layer of safety and reduce wear & tear of electronic devices. The growing expansion of 5G technology and the development of advanced medical devices support the growth of the electronics industry. The growing expansion of the electronic industry creates opportunities for the growth of the fluoropolymers market.

Market Challenge

High Production Cost Shuts Down Expansion of the Fluoropolymers Market

Despite several benefits of fluoropolymers in various sectors, high production cost restricts the market growth. Factors like the high cost of raw materials and the complex synthesis process are responsible for the high production cost. The complex synthesis processes, like complex processing steps, specialized equipment, and intricate chemical reactions, increase the overall cost. Raw materials like hydrofluoric acid and fluorspar cost is high. The growing energy consumption and high-temperature reactions increase the overall cost. The requirement of infrastructure, specialized reactors, and equipment increases the operational cost. The complex manufacturing process, like paste extrusion, sintering, melt processing, and coating, increases the overall cost. The requirement of stringent quality control to ensure purity increases the production costs. High production costs hamper the growth of the fluoropolymers market.

Regional Insights

Why Did Asia Pacific Dominate The Fluoropolymers Market?

The Asia Pacific fluoropolymers market volume was reached at 310.02 Kilo Tons in 2024 and is expected to be worth around 686.42 Kilo Tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 8.27% over the forecast period 2025 to 2034. Asia Pacific dominated the fluoropolymers market in 2024.

The extensive manufacturing base in industries like industrial machinery, automotive, and electronics increases demand for fluoropolymers, helping in the market growth. The well-established electronic industry in countries like South Korea, China, and Japan increases demand for batteries, cables, fuel cells, wire, and photovoltaic modules, fueling demand for fluoropolymers. The rise in the development of infrastructure projects increases demand for fluoropolymers for various components like gaskets and seals, wiring. The rapid expansion of the construction industry in the region helps in the market growth. The growing adoption of sustainable developments increases demand for fluoropolymers. The strong government support for industrial growth increases demand for fluoropolymers. The rapid growth in industries like electrical, pharmaceutical, telecommunication, and electronics increases demand for fluoropolymers, driving the overall market growth.

China Fluoropolymers Market Trends, China dominated the fluoropolymers market in the Asia Pacific. The well-established manufacturing sector in industries like automotive and electronics helps in the market growth. The growing demand for applications like engine components, lithium-ion batteries, high-performance electronic materials, fuel systems, and electrical insulation increases demand for fluoropolymers. The strong government support and technological advancements like electric vehicles help in the market growth. Additionally, well-established supply chain networks and a growing number of domestic fluoropolymer manufacturers support the overall market growth.

- China exported $584 million of other fluoropolymers in 2023. (Source: oecworld)

- China exported 102603 shipments of Teflon. (Source: volza)

- China exported 4536 shipments of fluoroelastomers. (Source: volza )

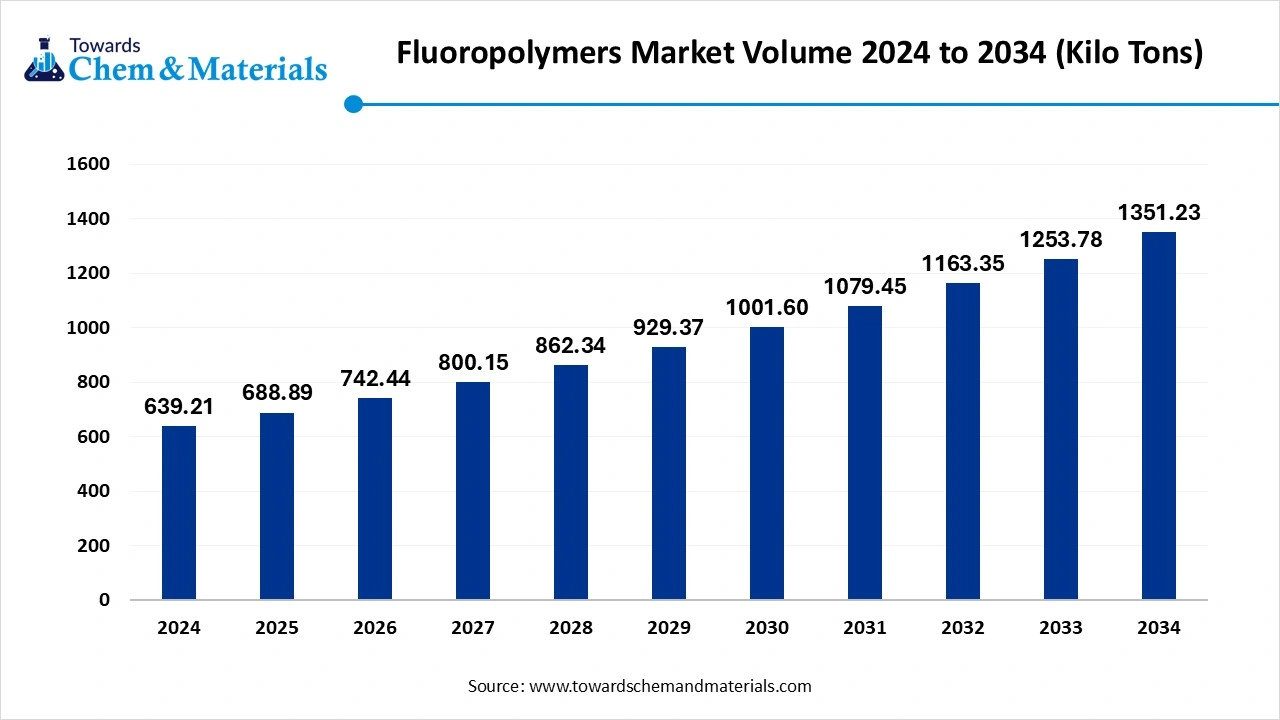

Why Is India Growing In The Fluoropolymers Market?

India is significantly growing in the fluoropolymers market. The growing expansion of the electronics manufacturing industry increases applications like LED lighting, printed circuit boards, and microelectronics, fueling demand for fluoropolymers. The strong focus on electric vehicles and government initiatives like Make in India helps in the market growth. The growing expansion of the renewable energy sector in nations increases demand for fluoropolymers. The rapid urbanization, fueling demand for various construction activities, increases demand for fluoropolymers for applications in seals, insulation, and coating. The growing expansion of various sectors like healthcare, electronics, construction, and automotive drives the overall market growth.

- India exported 106140 shipments of Teflon.(Source: volza)

- India exported 8239 shipments of fluoroelastomers. (Source: volza)

What is Driving Fluoropolymers Growth in North America?

North America is experiencing the fastest growth in the market during the forecast period. The growing automotive industry and rising demand for electric vehicles increase the demand for fluoropolymers. The well-established electronics and semiconductor manufacturing helps in the market growth. The strong industrial base in manufacturing increases demand for high-performance fluoropolymers. The growing technological innovation and research & development in areas like semiconductor fabrication increase demand for fluoropolymers. The strong focus on sustainable manufacturing practices is fueling demand for fluoropolymers for their chemical resistance and durability. The growing demand from high-end applications like medical device components, semiconductor fabrication, and fuel cell membranes drives the market growth. The growing demand from industries like aerospace, healthcare, defense, and industrial machinery contributes to the overall growth of the market.

United States Fluoropolymers Market Trends

The United States is a major contributor to the fluoropolymers market. The robust industrial base, like electronics, aerospace, automotive, and healthcare, increases demand for fluoropolymers. The growing technological advancements in fluoropolymers and the growing demand from high-end applications help in the market growth. The growing automotive and aerospace sector increases demand for fluoropolymers for applications like aircraft parts, fuel cells, and engine components. The growing infrastructure development, like airport infrastructure, and increasing investment in healthcare infrastructure, increases demand for fluoropolymers. The well-established processing and production capabilities of fluoropolymers support the market growth.

- The United States exported $640 million of other fluoropolymers in 2023.

(Source: oecworld ) - The United States exported 59776 shipments of Teflon. (Source: volza )

- The United States exported 4166 shipments of fluoroelastomers. (Source: volza )

Fluoropolymers Market Volume and Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume 2024 | Volume Share, 2034 (%) | Market Volume 2034 | CAGR (2025 - 2034) |

| North America | 24.20% | 154.69 | 22.90% | 309.43 | 7.18% |

| Europe | 17.10% | 109.30 | 16.20% | 218.90 | 7.19% |

| Asia Pacific | 48.50% | 310.02 | 50.80% | 686.42 | 8.27% |

| Latin America | 5.40% | 34.52 | 5.60% | 75.67 | 8.17% |

| Middle East & Africa | 4.80% | 30.68 | 4.50% | 60.81 | 7.08% |

| Total | 100.00% | 639.21 | 100.00% | 1351.23 | 7.77% |

Segmental Insights

Product Insights

The polytetrafluoroethylene segment dominated the fluoropolymers market in 2024. The growing demand from industries like chemical processing, automotive, electronics, food processing, and aerospace for various applications helps in the market growth. Polytetrafluoroethylene has exceptional chemical resistance and is widely used for a wide range of chemical processing applications, like coatings for equipment, vessels, and pipes. It can withstand high temperatures and has low friction coefficients. The growing demand for sliding, bearings, and gears components increases the demand for polytetrafluoroethylene. It has non-stick qualities and is ideal for anti-adhesion applications. The growing demand for gaskets, coatings, electrical, insulation, and other products drives the market growth. The growing demand from the Asia Pacific due to manufacturing expansion contributes to the overall market growth.

The polyvinylidene fluoride segment is growing at the fastest rate in the market during the forecast period. The growing demand for electric vehicles increases the demand for lithium-ion batteries helps in the market growth. The growing demand for coatings in various industries like industrial, construction, and automotive increases the demand for polyvinylidene fluoride. The growing demand for semiconductor applications and electronic components drives the market growth. The rise of renewable energy increases demand for solar panels, fueling demand for polyvinylidene fluoride. The development of various medical devices and the growing demand from the healthcare industry drive the market growth. Polyvinylidene fluoride has excellent chemical resistance, thermal stability, and UV resistance. It consists of good wear resistance and tensile strength. The growing demand from energy storage, automotive & electronics, and the development of sustainable PVDF coatings support the overall market growth.

Fluoropolymers Market Volume and Share, By Product, 2024-2034 (%)

| By Product | Volume Share, 2024 (%) | Market Volume 2024 |

Volume Share, 2034 (%) |

Market Volume 2034 | CAGR (2025 - 2034) |

| PTFE | 48.17% | 307.91 | 43.00% | 581.03 | 6.56% |

| PVDF | 21.01% | 134.30 | 24.50% | 331.05 | 9.44% |

| FEP | 11.50% | 73.51 | 12.00% | 162.15 | 9.19% |

| Fluoroelastomers | 13.20% | 84.38 | 14.50% | 195.93 | 9.81% |

| Others | 6.12% | 39.12 | 6.00% | 81.07 | 8.43% |

| Total | 100.00% | 639.21 | 100.00% | 1351.23 | 7.77% |

Application Insights

The industrial processing segment held the largest share of the fluoropolymers market in 2024. The growing industrial processing in various sectors like semiconductor, food processing, and pharmaceuticals helps in the market growth. The growing chemical processing and increasing demand for equipment like pipes, reactors, and valves increases demand for fluoropolymers. The growing pharmaceutical and semiconductor manufacturing industries increase demand for fluoropolymers. The growing demand for low-friction coefficients, chemical resistance, and thermal stability increases the demand for fluoropolymers. The growing manufacturing techniques like blow molding, extrusion, and injection molding increase demand for fluropolymers. The growing automotive applications and the increasing production of medical devices contribute to overall market growth.

The construction segment experiences the fastest growth in the market during the forecast period. The growing urbanization in various regions increases construction activities like residential, infrastructural, and commercial, fueling demand for fluoropolymers. The growing demand for visually appealing building aesthetics increases the demand for fluoropolymers for a wide range of finishes and colors. The growing demand for high-quality paints and coatings in infrastructure projects and buildings increases demand for fluoropolymers to enhance durability. Fluoropolymer like polyvinylidene fluoride is widely used in construction projects due to their properties, like integrity maintenance for a longer period and sustainability in harsh weather conditions. The growing development of infrastructure projects like bridges, roads, and many others increases demand for fluoropolymers. The growing demand for less maintenance construction buildings, fuel demand for fluoropolymers, drives the overall market growth.

Fluoropolymers Market Volume and Share, By Application, 2024-2034 (%)

| By Application | Volume Share, 2024 (%) | Market Volume 2024 | Volume Share, 2034 | Market Volume 2034 (%) | CAGR (2025 - 2034) |

| Automotive | 24.12% | 154.18 | 21.10% | 285.11 | 6.34% |

| Electric & Electronics | 29.21% | 186.71 | 30.11% | 406.86 | 8.10% |

| Construction | 14.43% | 92.24 | 16.66% | 225.11 | 9.33% |

| Industrial Processing | 22.12% | 141.39 | 23.02% | 311.05 | 8.20% |

| Others | 10.12% | 64.69 | 9.11% | 123.10 | 6.65% |

| Total | 100.00% | 639.21 | 100.00% | 1351.23 | 7.77% |

Fluoropolymers Market Recent Developments

- In June 2024, Medtronic launched Steerant aortic guidewire to support thoracic endovascular aortic repair and endovascular aneurysm repair. The Steerant is designed with polytetrafluoroethylene and has a 15 cm soft atraumatic tip. It offers protection for fragile aortic anatomy and provides the right balance of trackability and stiffness. (Source: massdevice )

- In April 2024, Rostec launched NEVAFLON fluoropolymers films for construction and other industries. The material consists of a wide range of applications in the aerospace and architecture industries. The film is a high-performance advanced multifunctional material and is used as roofing in construction. It is utilized to protect solar cells in industries like medicine and electronics. Film has a service life of more than 30 years, and the production waste is 100% recyclable. It has excellent light transmission, high-stress-strain properties, excellent chemical resistance, and fire safety. (Source: rostec )

- In August 2024, AGC revolutionizes fluoropolymer production with surfactant-free technology. The technology supports sustainable material production and provides a reliable & stable supply chain. Technology lowers the generation of fluorinated byproducts and offers exceptional properties like chemical resistance, heat resistance, durability, and cold resistance. (Source: chemanalyst )

Top Companies List

- Daikin Industries

- Solvay

- AGC Chemicals

- Gujarat Fluorochemicals

- Kureha Corporation

- Chemours

- 3M

- Arkema

- Dongyue Group

- Halopolymer

Segments Covered in the Report

By Product

- Polytetrafluoroethylene

- Polyvinylidene Fluoride

- FEP

- Fluoroelastomers

- Others

By Application

- Industrial Processing

- Construction

- Automotive

- Electric & Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait