Content

What is the Current Specialty Polymer Market Volume and Share?

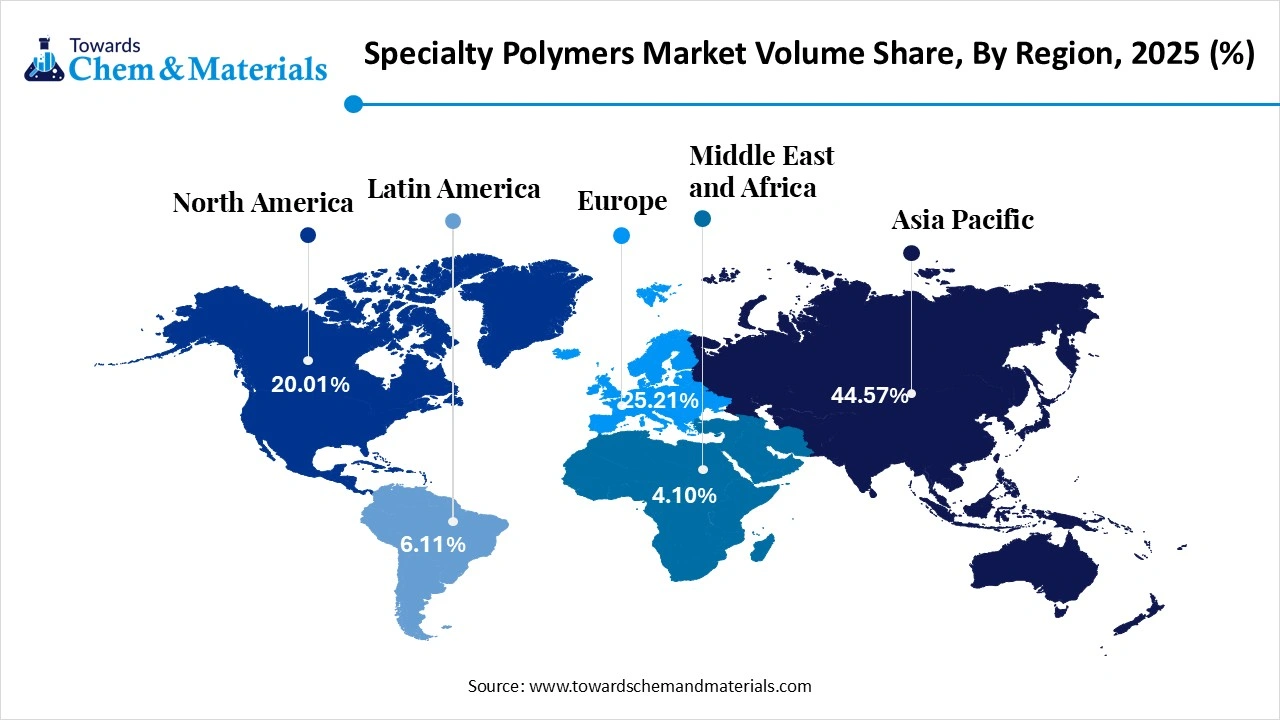

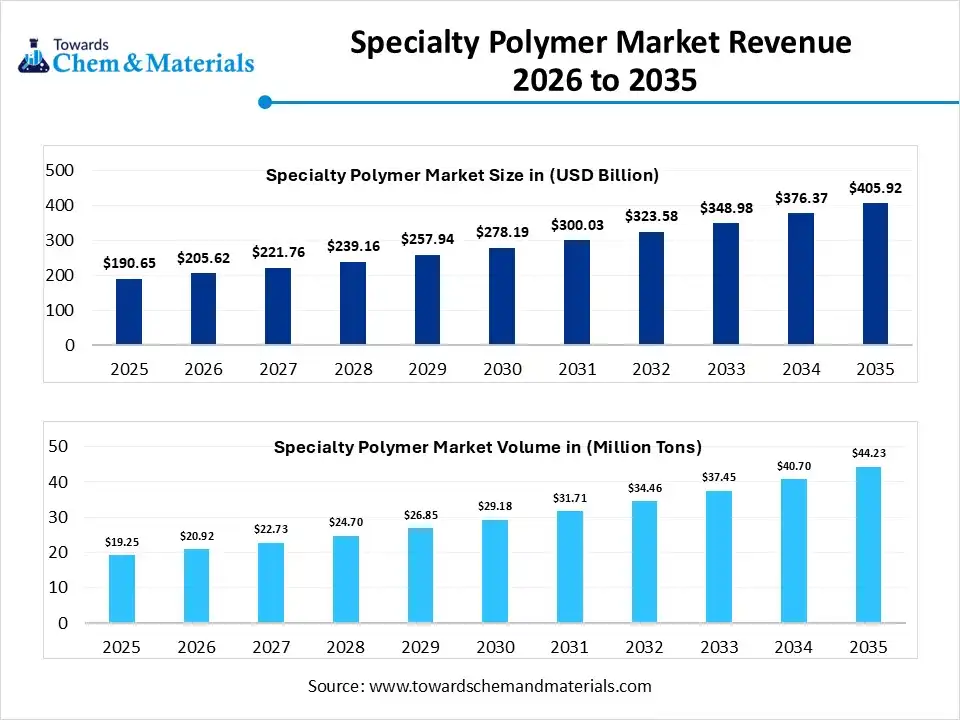

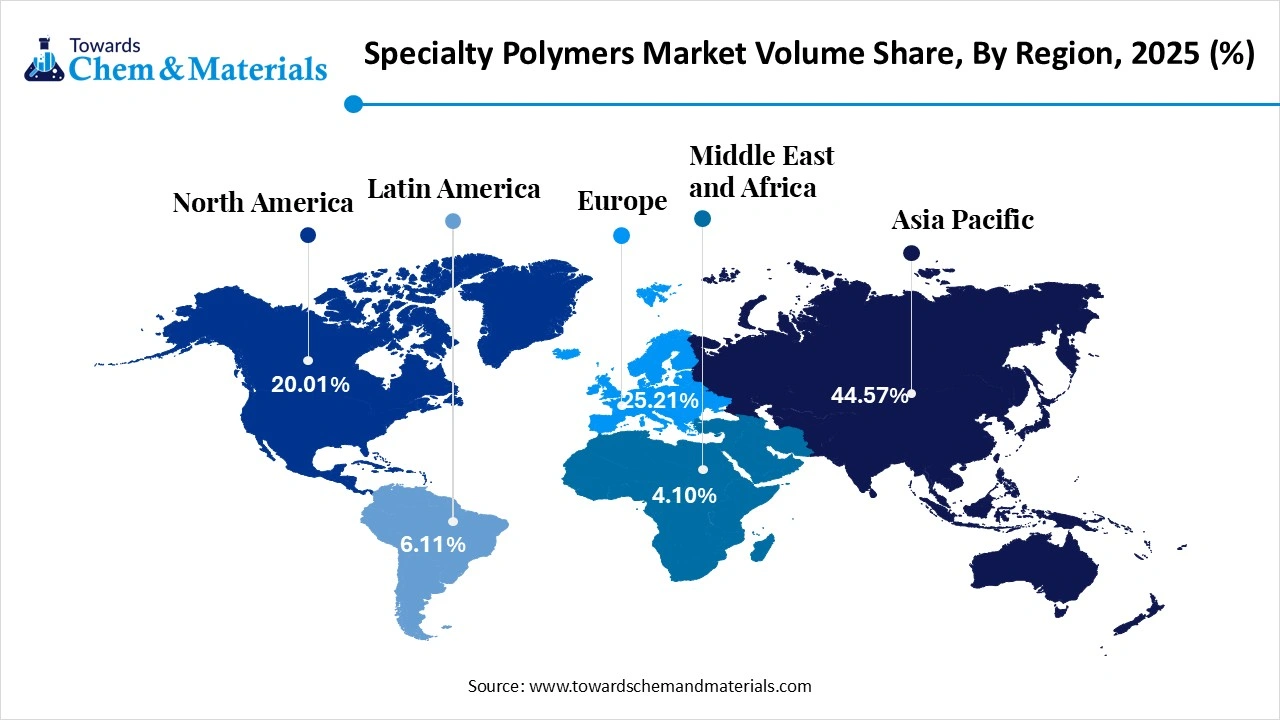

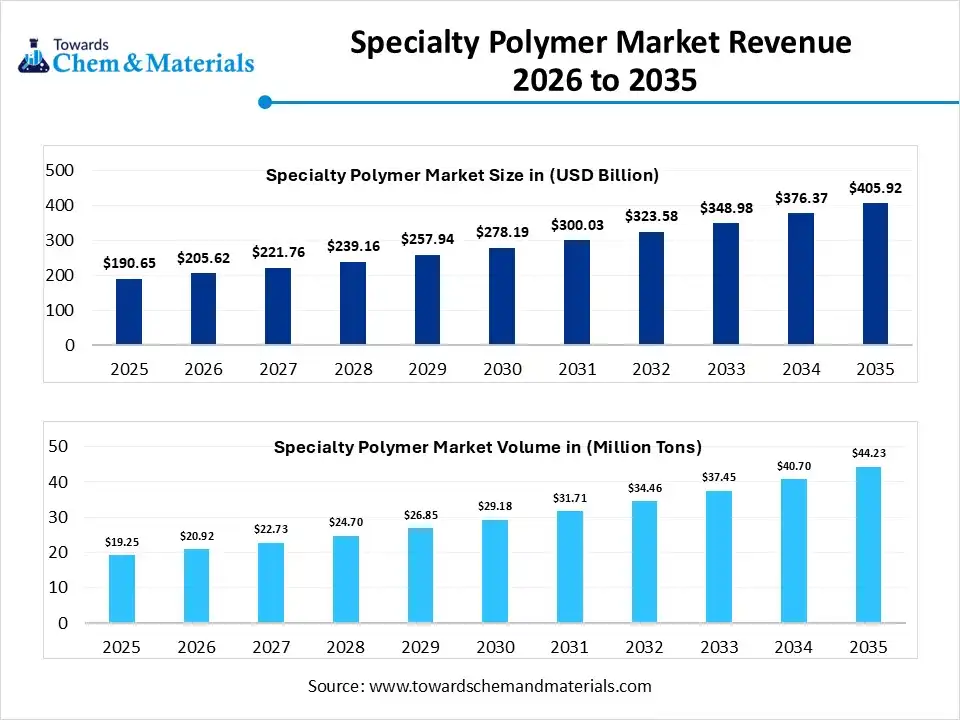

The global ppecialty polymer market size was estimated at USD 190.65 billion in 2025 and is expected to increase from USD 205.62 billion in 2026 to USD 405.92 billion by 2035, growing at a CAGR of 7.85% from 2026 to 2035. In terms of volume, the market is projected to grow from 19.25 million tons in 2025 to 44.23 million tons by 2035. growing at a CAGR of 8.67% from 2026 to 2035. Asia Pacific dominated the specialty polymer market with the largest volume share of 44.57% in 2025. The growing demand across various end-user industries like electronics, construction, automotive, and healthcare drives the growth of the market.

Key Takeaways

- The Asia Pacific specialty polymersmarket held the largest Volume Share of 44.57% of the global market in 2025.

- The North America specialty polymers market is expected to register the fastest CAGR of 7.80% over the forecast period by 2026-2035

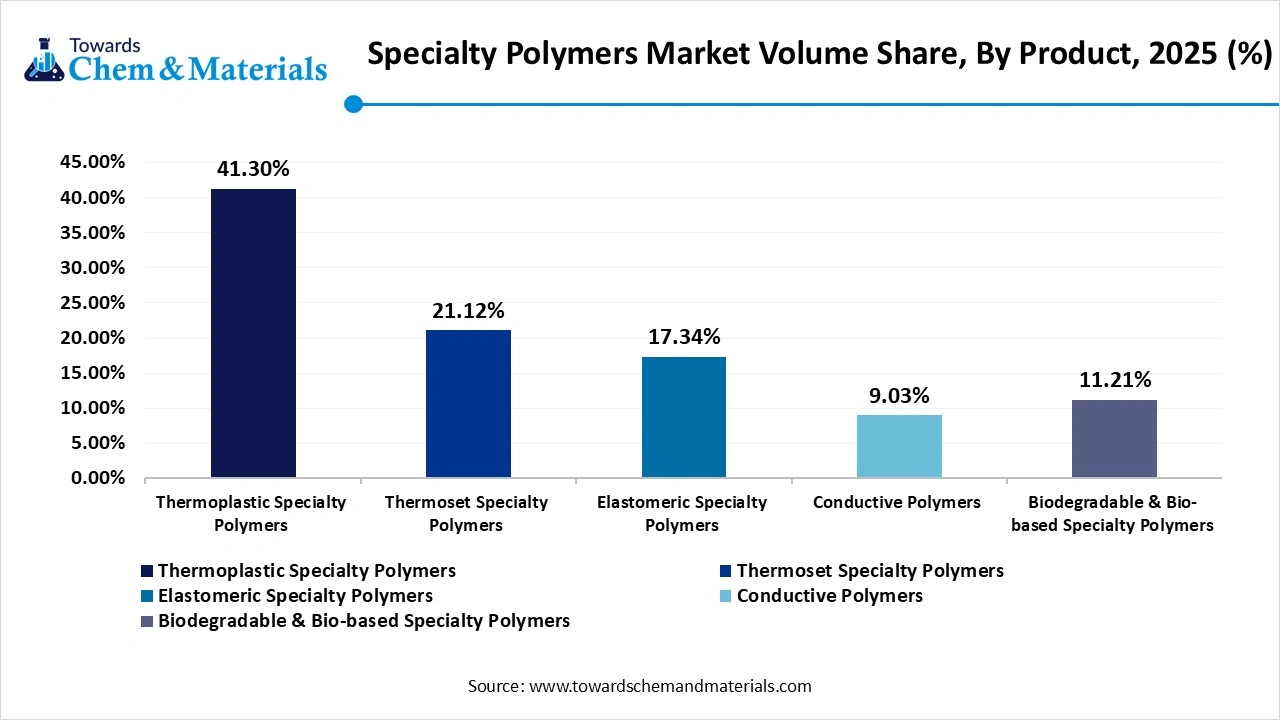

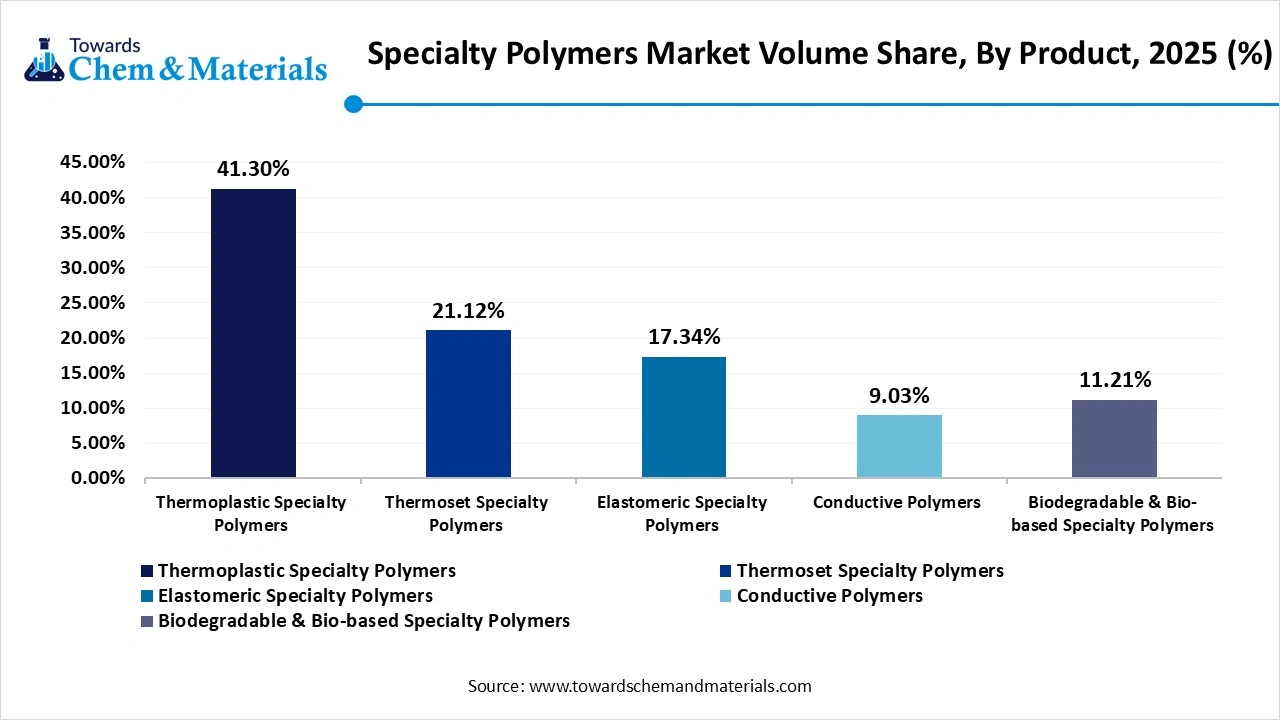

- By Product Type, the thermoplastic specialty polymers segment dominated the market with the largest Volume Share of 41.30% in 2025.

- By Product Type, the biodegradable & bio-based specialty polymers segment is projected to grow at the fastest CAGR of 11.59% over the forecast period by 2026-2035

- By functionality, the high-temperature resistant segment held a 31% share in the market in 2025 due to the rising demand across the aerospace industry.

- By processing method, the injection molding segment held a 44% share in the market in 2025 due to the increasing demand across the consumer goods and electronics industry.

- By end user industry, the automotive & transportation segment held a 26% share in the market in 2025 due to the rise in electric vehicle adoption.

The Hidden Power of Specialty Polymer Across Industries

Specialty polymer is a type of polymer designed to exhibit specific properties to fulfill the requirements of various industries. Specialty polymer withstands harsh conditions like corrosive chemicals, high temperatures, and extreme pressures. Specialty polymer have excellent tensile strength, fatigue resistance, a high strength-to-weight ratio, excellent impact resistance, and high stiffness. It offers excellent chemical resistance to solvents, acids, and bases.

Specialty polymer possesses high temperature resistance and low thermal expansion coefficients. The growing automotive industry increases demand for specialty polymer for the production of exterior & interior parts of vehicles, and enhancing fuel efficiency.

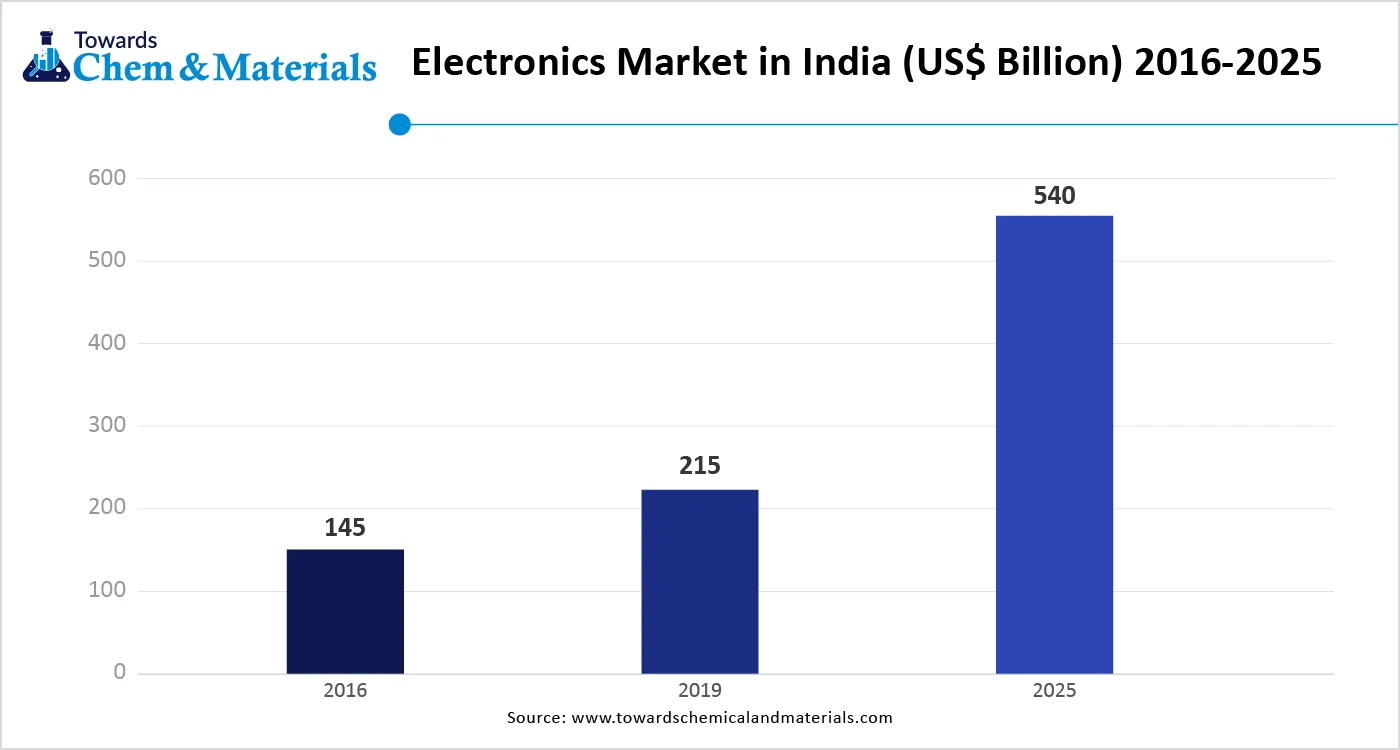

The increasing adoption of smart devices, the rise in 5G, and the integration of IoT in electronic devices increase the adoption of specialty polymer. Factors like growing demand across the healthcare sector, rising construction activities, technological advancements in specialty polymer, increasing demand for lightweight materials across various industries, and the rising expansion of renewable energy contribute to the specialty polymer market growth.

- Japan exported 5323 shipments of polyphenylene sulfide.(Source: ww.volza.com)

- Malaysia exported 3366 shipments of polyphenylene sulfide.(Source: ww.volza.com)

- Germany exported $2.64B of polyamides in 2023. (Source: oec.world)

- Japan exported $222M of phenolic resins in 2023.(Source: oec.world)

- The Netherlands exported $102M of polylactic acid in 2023.(Source: oec.world)

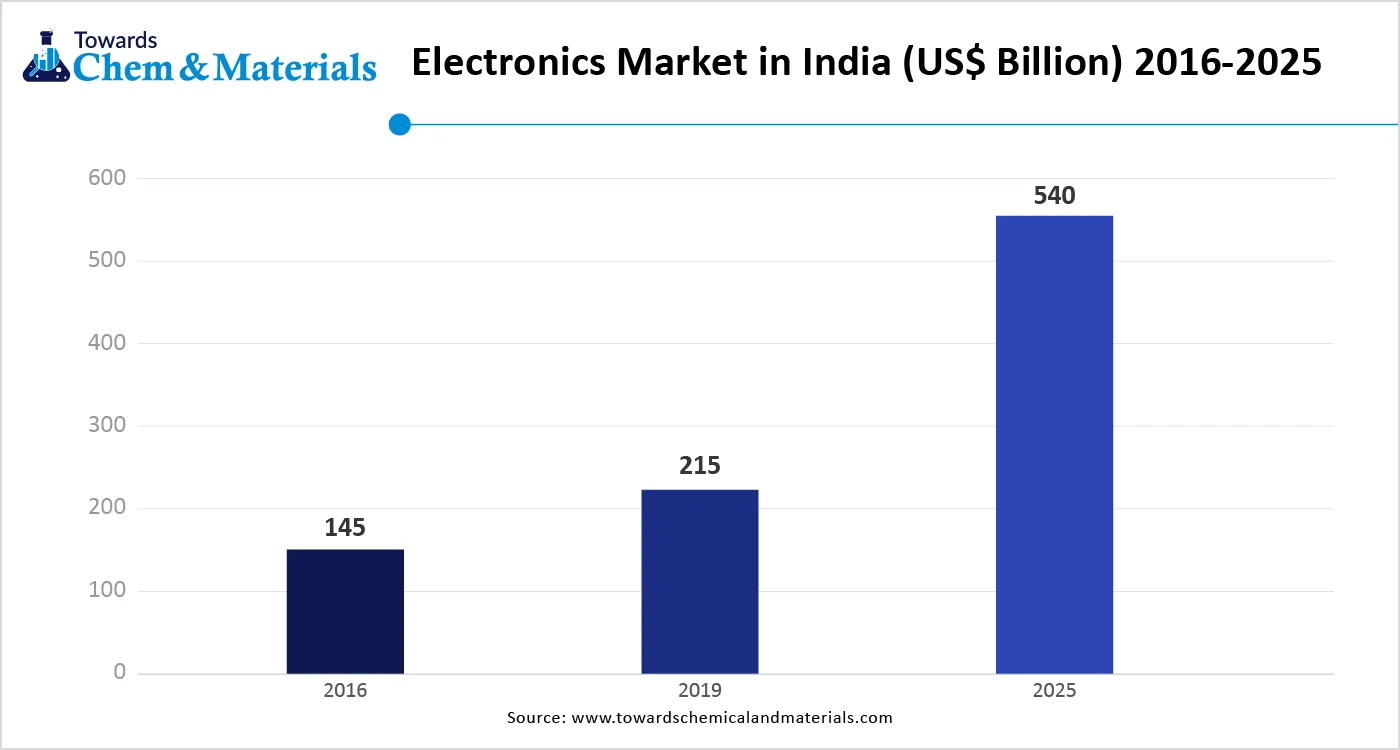

The Growing Electronic Industry Surge Demand for Specialty Polymer

The growing adoption of various electronic devices like smartphones, laptops, computers, and many more increases the demand for specialty polymer. The increasing manufacturing of advanced electronic devices fuels demand for specialty polymer for the production of components like insulators, housings, connectors, and circuit boards. The growing focus on miniaturizing electronic devices increases demand for specialty polymers like PET, polyimides, and polycarbonates for maintaining performance and resisting damage. The increasing expansion of technologies like the Internet of Things and the growing availability of 5G technology fuel demand for specialty polymer for handling data processing and connectivity. The focus on the development of energy-efficient electronic devices increases the adoption of specialty polymer. The growing electronic industry is a key driver for the specialty polymer market.

Market Trends

What are the Trends in the Specialty Polymer Market?

- Increasing Demand for Medical Devices & Implants: The growing prevalence of chronic conditions increases demand for medical devices and implants. The increasing development of advanced medical implants and devices increases the adoption of specialty polymer for biocompatibility.

- Advancements in Electronic Devices: The growing advancements, like the miniaturization of electronic devices, including laptops, computers, smartphones, and many more, increase demand for specialty polymer for providing thermal stability and electrical insulation to electronic components.

- Growing Aerospace Industry: The growing aerospace industry increases production of aircraft components like wings, engines, landing gear, fuel systems, and many more that require specialty polymer due to high strength-to-weight ratio, high temperature resistance, and chemical compatibility.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 205.62 Billion / 20.92 Million Tons |

| Market Size by 2035 | USD 405.92 Billion / 44.23 Million Tons |

| Growth rate | CAGR 7.85% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Functionality, By Processing Method, By End-Use Industry, By Region |

| Key Profiled Companies | BASF SE, Arkema Group, Solvay S.A., DuPont de Nemours, Inc., Covestro AG, Evonik Industries AG, SABIC, Victrex plc, DSM Engineering Materials, Mitsubishi Chemical Group, Celanese Corporation, Toray Industries, Inc., Ensinger GmbH, Daikin Industries, Ltd., 3M Company, Lubrizol Corporation, Eastman Chemical Company, Kuraray Co., Ltd., RTP Company, PolyOne (now Avient Corporation) |

Market Dynamics

Market Drivers

The specialty polymer market is driven by rising demand for high-performance materials that offer superior mechanical strength, chemical resistance, thermal stability, and lightweight properties compared to commodity plastics. Growing adoption across automotive, aerospace, electronics, medical devices, and industrial applications is reinforcing market expansion. Electrification of vehicles, miniaturization of electronic components, and increased use of advanced medical materials are increasing demand for engineered polymers with precise functional characteristics. Regulatory pressure to improve energy efficiency and reduce emissions is also accelerating substitution of metals and traditional materials with specialty polymers. In addition, ongoing innovation in polymer chemistry and processing technologies is supporting development of application-specific grades.

Market Restraints

The specialty polymer market faces restraints related to high production costs and complex manufacturing processes, which limit adoption in cost-sensitive applications. Dependence on specialty monomers and additives can expose manufacturers to raw material supply constraints and price volatility. Stringent regulatory requirements for safety, biocompatibility, and environmental compliance increase development timelines and certification costs. Limited recyclability of certain specialty polymers also raises sustainability concerns. In some end-use industries, long qualification cycles slow market penetration of new polymer grades.

Market Opportunities

Significant opportunities exist in emerging applications such as electric vehicles, renewable energy systems, advanced electronics, and high-performance medical devices. Growth in lightweighting and durability requirements is increasing demand for specialty polymers in structural and functional components. Development of bio-based and recyclable specialty polymers is opening new avenues aligned with circular economy initiatives. Advances in additive manufacturing are expanding use of specialty polymers in complex, customized parts. Rapid industrialization and technology adoption in Asia Pacific and the Middle East are further creating long-term growth opportunities.

Market Challenges

The specialty polymer market faces challenges in balancing performance innovation with cost efficiency and sustainability expectations. Scaling production of advanced polymer formulations while maintaining consistent quality requires significant capital investment and technical expertise. Competition from alternative materials, including advanced composites and metals, can limit substitution in certain applications. Regulatory uncertainty and evolving environmental standards add complexity to global commercialization. Managing intellectual property protection while collaborating across global value chains also remains a critical challenge for specialty polymer manufacturers.

Value Chain Analysis

- Raw Materials and Feedstock Sourcing: This involves sourcing petrochemical feedstocks to produce monomers, additives, catalysts, and specialty additives like flame retardants and plasticizers.

- Key Players: BASF SE, Dow Inc., SABIC, ExxonMobil, Evonik Industries, and Arkema S.A.

- Research and Development: It focuses on polymer synthesis, molecular modification, and compounding to enhance properties such as thermal stability, electrical conductivity, chemical resistance, and biocompatibility.

- Key Players: Evonik Industries, Solvay S.A., Arkema, 3M, DuPont, Victrex plc, and Covestro AG.

- Manufacturing and Polymerization: This involves high-precision, small-batch manufacturing, including polymerization, compounding, and pelletizing.

- Key Players: BASF, Solvay, Arkema, Evonik, Celanese Corporation, Toray Industries, and Mitsubishi Chemical Group.

- Logistics, Distribution, and Technical Support: Logistics for specialty polymers requires specialized handling, storage, and transport, often focusing on maintaining purity and stability.

- Key Players: BASF, Solvay, Brenntag, and Univar Solutions.

- Conversion, End-Use Application, and Commercialization: In this specialty, polymers are processed by converters via injection molding, extrusion, or 3D printing into final components.

- Key Players: Tesla, Bosch, Samsung, Philips, Medtronic, Ensinger GmbH, RTP Company, and Kingfa Science & Technology.

Segmental Insights

Product Type Insights

How Thermoplastic Specialty Polymers Segment Dominated the Specialty Polymer Market?

The thermoplastic specialty polymers segment dominated the specialty polymer market in 2024. The growing production of electronic devices increases demand for thermoplastic for design flexibility and insulating properties. The rising automotive industry increases demand for thermoplastic for the development of parts like engine components, bumpers, and dashboards, helping the market growth. Thermoplastic specialty polymer has strong mechanical properties and is resistant to various chemicals. It possesses high heat resistance, strength, and ease of processing. The increasing demand for medical devices and the automotive industry drives the growth of the market.

The bio-based specialty polymers segment is the fastest-growing in the market during the forecast period. The increasing consumer preference for eco-friendly and sustainable products increases demand for bio-based specialty polymers. The growing packaging applications, like containers, films, and others, increase the adoption of bio-based specialty polymers, helping the market growth. Bio-based polymers are biodegradable and lower the carbon footprint. The medical applications, like drug delivery systems, tissue engineering, and other applications, increase demand for bio-based polymers. The growing construction activities support the overall growth of the market.

Specialty Polymer Market By Product Type , 2025-2035 (%)

| By Product Type | Market Volume Share, 2025 (%) | Market Volume (Million Tons)2025 | Market Volume Share, 2035 (%) | Market Volume (Million Tons)2035 | Market CAGR (2026-2035) |

| Thermoplastic Specialty Polymers | 41.30% | 7.95 | 37.98% | 15.89 | 7.61% |

| Thermoset Specialty Polymers | 21.12% | 4.07 | 18.29% | 8.23 | 6.90% |

| Elastomeric Specialty Polymers | 17.34% | 3.34 | 17.55% | 7.56 | 8.12% |

| Conductive Polymers | 9.03% | 1.74 | 13.88% | 6.38 | 13.37% |

| Biodegradable & Bio-based Specialty Polymers | 11.21% | 2.16 | 12.30% | 5.21 | 11.59% |

Functionality Insights

Why did the High-Temperature Resistant Segment Dominate the Specialty Polymer Market?

The high-temperature resistant segment dominated the specialty polymer market in 2024. The growing production of aircraft components like insulation, engine parts, and seals increases demand for high-temperature resistant materials. The increasing adoption and production of electric vehicles increases demand for heat-resistant materials for engine components, battery systems, and power electronics, helping the market growth. Heat-temperature resistant offers thermal stability and excellent chemical resistance. The growing production of electronic components like circuit boards and semiconductors increases demand for high-temperature resistant materials. The increasing industrial manufacturing drives the overall growth of the market.

The biocompatible segment is experiencing the fastest growth in the market during the forecast period. The growing chronic conditions increase demand for biocompatible materials for medical implants and medical devices. The increasing production of medical devices like surgical instruments, stents, and prosthetics fuels demand for biocompatible materials, helping the market growth. The growing demand for drug delivery systems increases the demand for biocompatible materials. The increasing healthcare spending and shift towards minimally invasive procedures increase demand for biocompatible materials. The major companies like Arkema, Evonik Industries, and 3M support the overall growth of the market.

Processing Method Insights

How Injection Molding Segment Dominates the Specialty Polymer Market?

The injection molding segment dominated the specialty polymer market in 2024. The growing demand in various industries like packaging, consumer goods, automotive, and electronics helps the market growth. Injection molding offers high-volume production and has a low cost per unit. It creates complex shapes with high precision and is highly scalable. Injection molding produces minimal waste and is a highly automated process. The growing versatility of injection molding drives the overall growth of the market.

The 3D printing segment is the fastest growing in the market during the forecast period. The growing creation of complex designs and the on-demand production of customized parts increases demand for 3D printing. The increasing demand for 3D printing in sectors like prosthetics and medical devices helps in the market growth. 3D printing reduces lead times and offers faster prototyping. It is a cost-effective process and shortens production cycles. The growing expansion of 3D printing in sectors like automotive, construction, aerospace, medical, and consumer goods drives the market growth.

End-Use Industry Insights

Which End-User Segment Dominated the Specialty Polymer Market in 2024?

The automotive & transportation segment dominated the specialty polymer market in 2024. The growing production of vehicles in various regions increases demand for specialty polymer. The increasing demand for reducing vehicle weight and improving fuel efficiency increases demand for specialty polymer, helping the market growth. The growing focus on improving overall vehicle safety and vehicle complex design is fueling demand for specialty polymer. The increasing production of automotive exterior components like fenders, side-view mirrors, bumpers, & body panels, and interior components like door panels, upholstery, dashboards, & seats increases demand for specialty polymer. The growing automotive production, including electric and traditional vehicles, drives the overall growth of the market.

The medical & healthcare segment is experiencing the fastest growth in the market during the forecast period. The increasing medical implants, like dental implants, orthopaedic devices, and cardiovascular implants, increase the demand for specialty polymer. The growing development of drug delivery systems, surgical instruments, and prosthetics increases the adoption of specialty polymer, helping the market growth. The increasing demand for medical packaging, including pharmaceuticals and medical devices, fuels demand for specialty polymer. The increasing rate of chronic diseases and growing healthcare spending increases demand for specialty polymer for the development of medical devices. The rising demand for IV bags, gloves, disposable syringes, and catheters fuels demand for specialty polymer, supporting the overall growth of the market.

Regional Insights

Why Asia Pacific Dominates the Specialty Polymer Market?

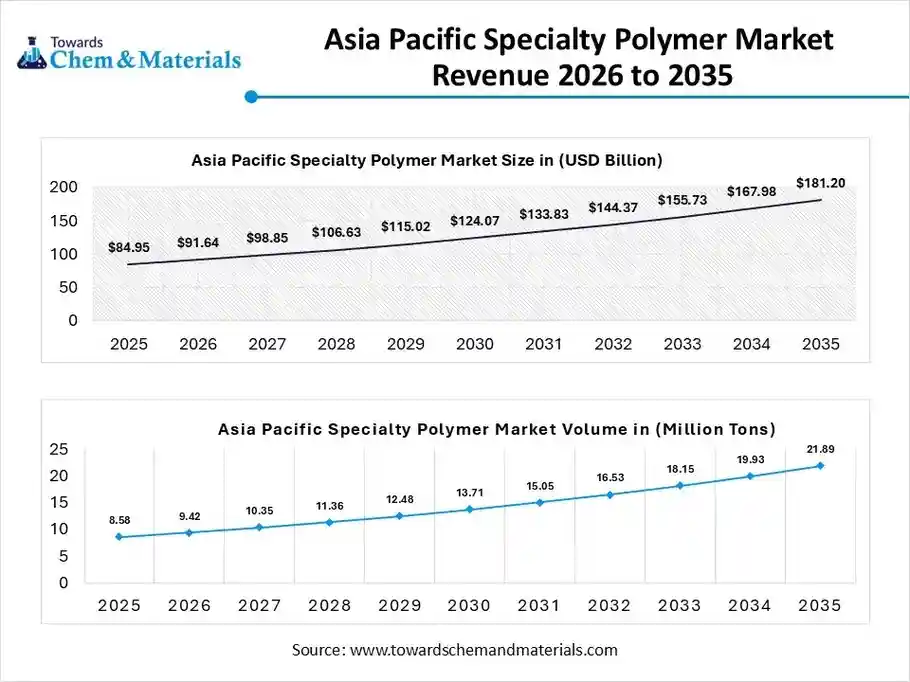

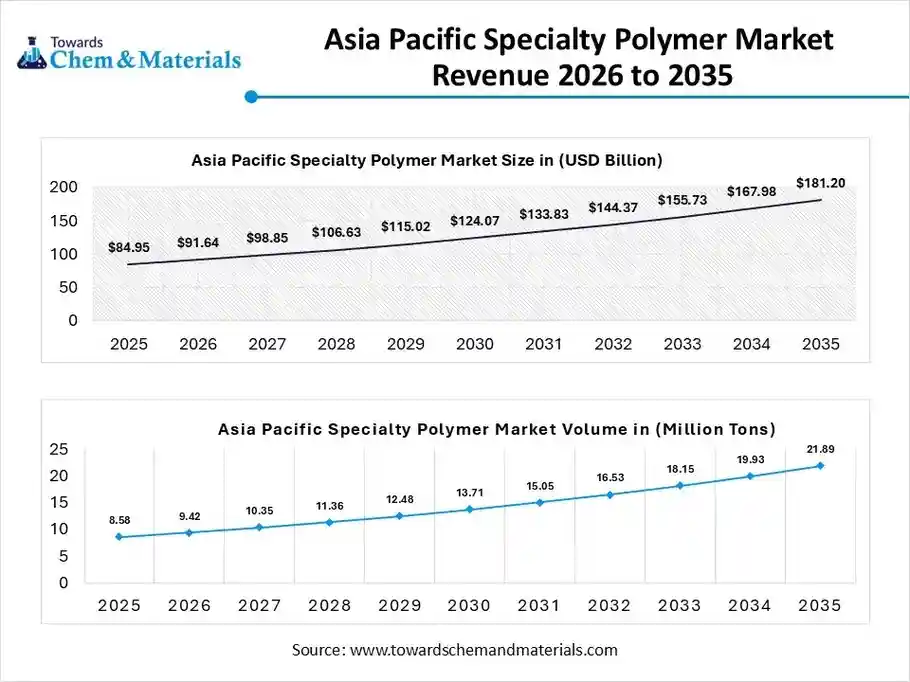

The Asia Pacific specialty polymer market size was valued at USD 84.95 billion in 2025 and is expected to be worth around USD 181.20 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.87% over the forecast period from 2026 to 2035.

The Asia Pacific specialty polymer volume was estimated at 8.98 million tons in 2025 and is projected to reach 22.91 million tons by 2035, growing at a CAGR of 9.82% from 2026 to 2035. Asia Pacific dominated the market in 2025; the region is observed to sustain the position during the forecast period. The rapid industrial growth in the region fuels demand for specialty polymer for various industries. The increasing expansion of the automotive industry and growing vehicle manufacturing help the market growth. The growing adoption of advanced electronic devices and increased electronics manufacturing is boosting demand for specialty polymer for various applications. The rapid growth in infrastructure development and increasing construction activities fuel demand for specialty polymer. The increasing consumer spending on goods & services increases demand for specialty polymer. The strong government support for industrial development drives the overall growth of the market.

China’s Specialty Polymer Market Trend

China is a key contributor to the specialty polymer market. The rapid industrialization and growing manufacturing in various industries increase the demand for specialty polymer. The strong government support for electric vehicles boosts demand for specialty polymer. The increasing disposable incomes and rising spending on consumer goods increase demand for specialty polymer. The growing demand across key industries like construction, automotive, and electronics supports the overall growth of the market.

- China exported 63 shipments of polyether ether ketone.(Source: www.volza.com)

- China exported $1.84B of polyamides in 2023. (Source:oec.world)

- China exported $233M of phenolic resins in 2023. (Source:oec.world)

How is North America Growing in the Specialty Polymer Market?

North America is significantly growing in the specialty polymer market during the forecast period. The increasing production of vehicles like hybrid vehicles and electric vehicles increases demand for specialty polymer to produce high-performance & lightweight components. The increasing adoption of various electronic devices like laptops, smartphones, and many more is fueling demand for specialty polymer, helping the market growth. The growing expansion of the healthcare industry increases demand for specialty polymer for the development of drug delivery systems, medical devices, and medical implants. The growing demand across various applications like construction, aerospace, textiles, and packaging drives the market growth.

Specialty Polymer Market By Region, 2025-2035 (%)

| By Region | Market Volume Share, 2025 (%) | Market Volume (Million Tons)2025 | Market Volume Share, 2035 (%) | Market Volume (Million Tons)2035 | Market CAGR (2026-2035) |

| North America | 20.01% | 3.85 | 18.67% | 7.68 | 7.80% |

| Europe | 25.21% | 4.85 | 22.89% | 10.00 | 7.11% |

| Asia Pacific | 44.57% | 8.58 | 49.00% | 20.13 | 9.82% |

| Latin America | 6.11% | 1.18 | 7.33% | 3.22 | 10.71% |

| Middle East & Africa | 4.10% | 0.79 | 2.11% | 2.26 | 5.35% |

United States Specialty Polymer Market Trends

The United States is significantly growing in the market. The strong investment in research & development of specialty polymer helps in the market growth. The growing technologies like nanotechnology & 3D printing increase demand for specialty polymer. The growing expansion of the construction industry is fueling demand for specialty polymer to enhance the performance & durability of construction activities. The rising demand across key industries like automotive, healthcare, electronics, and renewable energy drives the overall growth of the market.

- The United States exported 1697 shipments of polyphenylene sulfide.(Source: www.volza.com)

- The United States exported $2.61B of polyamides in 2023. (Source:oec.world)

- The United States exported $226M of phenolic resins in 2023. (Source: oec.world)

Recent Developments

- In September 2025, Syensqo, a global leader in specialty polymers and advanced materials, will make its first appearance at K 2025, the world's leading plastics and rubber trade fair, under its new name, following its spin-off from Solvay in December 2023. Building on a legacy of more than 160 years of scientific exploration, Syensqo will showcase innovations addressing global megatrends during K 2025, which was held in Düsseldorf, Germany.(Source: www.plasticstoday.com)

- In September 2025, materials firm Niche Polymer LLC acquired four U.S. resin powder plants from LyondellBasell Industries for an undisclosed price.(Source: www.plasticsnews.com)

Top Companies List

- BASF SE

- Arkema Group

- Solvay S.A.

- DuPont de Nemours, Inc.

- Covestro AG

- Evonik Industries AG

- SABIC

- Victrex plc

- DSM Engineering Materials

- Mitsubishi Chemical Group

- Celanese Corporation

- Toray Industries, Inc.

- Ensinger GmbH

- Daikin Industries, Ltd.

- 3M Company

- Lubrizol Corporation

- Eastman Chemical Company

- Kuraray Co., Ltd.

- RTP Company

- PolyOne (now Avient Corporation)

Segments Covered

By Product Type

- Thermoplastic Specialty Polymers

- Polyphenylene Sulfide (PPS)

- Polyether Ether Ketone (PEEK)

- Polyamide (PA) – specialty types

- Liquid Crystal Polymers (LCP)

- Polyetherimide (PEI)

- Polyaryletherketone (PAEK)

- Polyimide (PI)

- Thermoset Specialty Polymers

- Epoxy Resins

- Phenolic Resins

- Polyurethane (PU) – specialty grades

- Elastomeric Specialty Polymers

- Fluoroelastomers

- Silicone Elastomers

- Thermoplastic Elastomers (TPEs)

- Conductive Polymers

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Poly(3,4-ethylenedioxythiophene) (PEDOT)

- Biodegradable & Bio-based Specialty Polymers

- Polylactic Acid (PLA)

- Polybutylene Succinate (PBS)

- Polyhydroxyalkanoates (PHA)

By Functionality

- Conductive

- High-Temperature Resistant

- UV Resistant

- Corrosion Resistant

- Biocompatible

- Fire Retardant

By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Thermoforming

- 3D Printing / Additive Manufacturing

By End-Use Industry

- Automotive & Transportation

- Electric Vehicles

- Powertrain Components

- Fuel Systems

- Electronics & Electrical

- Wire & Cable Insulation

- Semiconductors

- Displays

- Medical & Healthcare

- Implants

- Drug Delivery Systems

- Diagnostic Devices

- Aerospace & Defense

- Interior Components

- Structural Composites

- Packaging

- Barrier Films

- Biodegradable Packaging

- Building & Construction

- Pipes and Fittings

- Insulation

- Seals & Adhesives

- Industrial

- Pumps & Valves

- Wear-resistant Components

- Consumer Goods

- Sports Equipment

- Home Appliances

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait