Content

Bio-Based Polymers Market Size and Growth 2025 to 2034

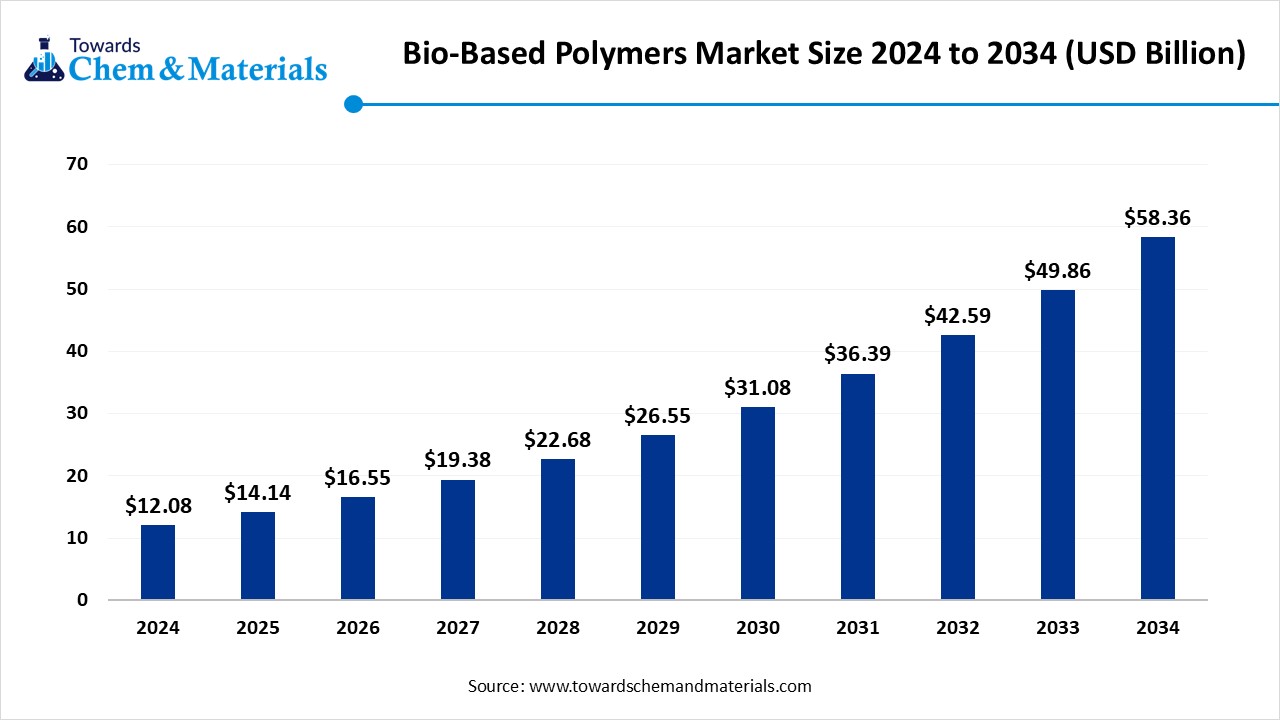

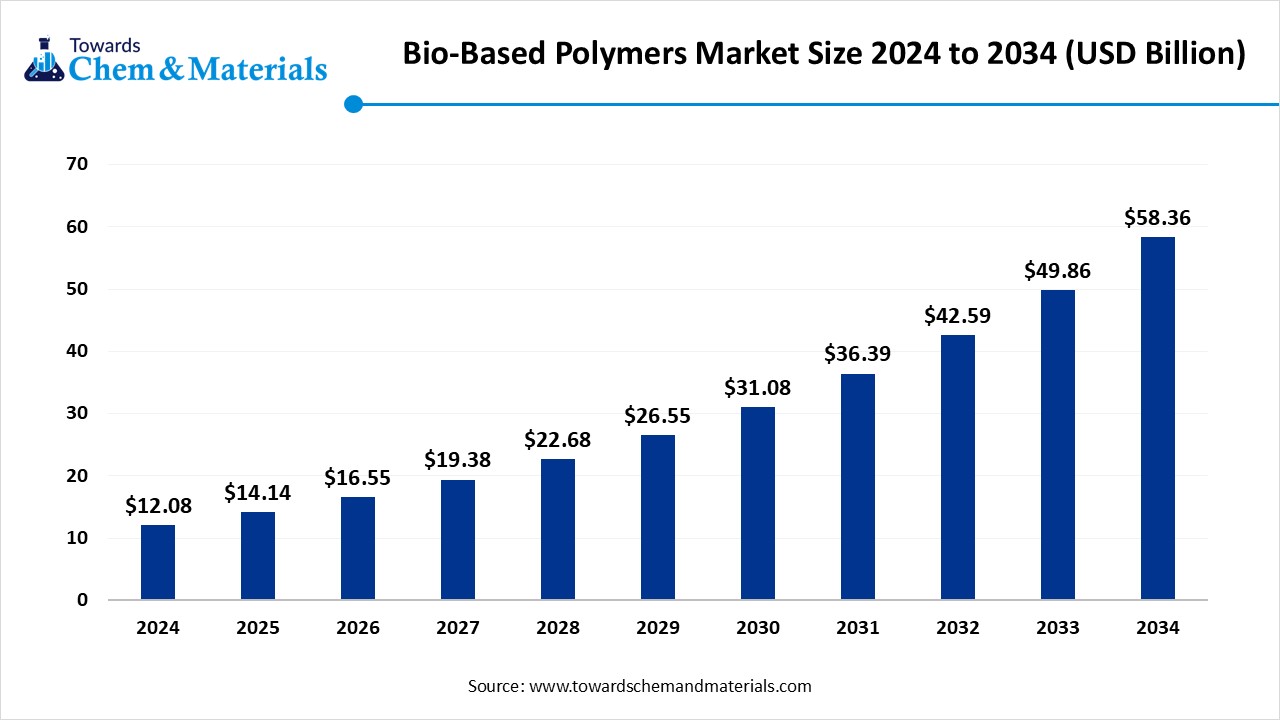

The global bio-based polymers market size was reached at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period 2025 to 2034. The supportive regulation, growing environmental concerns, and increasing demand for sustainable products drive the market growth.

Key Takeaways

- By region, Europe held approximately a 40% share in the bio-based polymers market in 2024 due to the bans on single-use plastics.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the presence of abundant raw materials.

- By type, the polylactic acid segment held approximately a 35% share in the market in 2024 due to the ongoing advancements in PLA production.

- By type, the polyhydroxyalkanoates segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for sustainable packaging.

- By feedstock source, the plant-based segment held approximately a 60% share in the market in 2024 due to the availability of corn starch and sugarcane.

- By feedstock source, the waste & residue-based segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for reducing landfill waste.

- By processing technology, the fermentation & polymerization segment held approximately a 50% share in the market in 2024 due to the focus on reducing reliance on fossil fuels.

- By processing technology, the enzymatic process segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on flexibility in monomer selection.

- By end-use industry, the food & beverage packaging segment held approximately a 40% share in the market in 2024 due to the strong focus on improving fuel efficiency.

- By end-use industry, the automotive OEMs segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for packaged foods.

- By distribution channel, the direct sales segment held approximately a 55% share in the market in 2024 due to the growing demand for customized solutions.

- By distribution channel, the online specialty chemical platforms segment is expected to grow at the fastest CAGR in the market during the forecast period due to the wide availability of various materials.

Role of Bio-Based Polymers in a Sustainable Future and a Greener Earth

Bio-based polymers are materials made up of renewable resources like microorganisms, plants, and algae. The renewable resources, like agricultural waste, corn, and sugarcane, are used for the development of bio-based polymers. These materials can be biodegradable or non-biodegradable. Bio-based polymers support sustainability goals, reduce dependence on fossil fuels, and minimize carbon footprint. They offer improved or similar performance compared to petroleum-based polymers. Bio-based polymers include elastomers, plastics, and resins.

They are widely used in industries like textiles, biomedical, packaging, and agriculture. The growing environmental concerns and focus on reducing carbon footprint increase demand for bio-based polymers. The stricter government regulations and growing consumer demand for eco-friendly products increase the adoption of bio-based polymers. Factors like the growing development of new sustainable products and increasing demand across industries like automotive, agriculture, healthcare, packaging, and textiles contribute to the growth of the bio-based polymers market.

- The world exported 370 shipments of polybutylene succinate.(Source: www.volza.com)

Who are the Leading Exporters of Polylactic Acid in 2023?

| Country | Export |

| United States | 166M |

| Netherlands | 102M |

| Thailand | 91.1M |

The Growing Automotive Industry Drives Market Growth

The growing automotive industry in developing countries and the rapid adoption of personal vehicles increase demand for bio-based polymers. The focus on the development of lightweight vehicles and enhancing fuel efficiency increases demand for bio-based polymers. The stringent environmental regulations and focus on reducing carbon footprint in the automotive industry increase demand for bio-based polymers. The increasing development of vehicles' interior components like seat cushions, door panels, and dashboards, increases the adoption of bio-based polymers.

The manufacturing of exterior components like spoilers, bumpers, and body panels increases the adoption of bio-based polymers like bio-based polyethylene and bio-based polypropylene. The increasing need for under-the-hood components like fuel lines and air ducts increases demand for bio-based polyamides. The developments of components like floor mats, headliners, and sun visors increase demand for bio-based polymers. The growing automotive industry is a key driver for the growth of the bio-based polymers market.

Market Trends

- Growing Consumer Demand for Sustainable Products: The growing consumer focus on minimizing plastic pollution and increasing demand for sustainable products increases the adoption of bio-based polymers. The increasing environmental awareness and focus on reducing carbon footprint increase demand for sustainable products.

- Growth in Construction Activities: The rapid urbanization and growing construction activities increase demand for bio-based polymers for construction applications like flooring, structural components, insulation, and roofing.

- Increasing Adoption of Sustainable Packaging: The growing plastic pollution increases demand for sustainable packaging like films, food containers, and beverage bottles that require bio-based polymers.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 14.14 billion |

| Expected Size by 2034 | USD 58.36 billion |

| Growth Rate from 2025 to 2034 | CAGR 17.06% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Type, By Feedstock Source, By Processing Technology, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Dow, NatureWorks LLC , Braskem , BASF SE, TotalEnergies Corbion bv , Novamont SpA , Biome Bioplastics, PTT Global Chemical Public Company Limited , Mitsubishi Chemical Holding Corporation Biotec , Mapei S.p.A, SOLVAY , DAIKIN , Toray Industries, Inc. , KURARAY CO., LTD. , Dupont , Plantic |

Market Opportunity

Expansion of the Healthcare Sector Surge Demand for Bio-Based Polymers

The growing demand for healthcare services and increasing expansion of the healthcare sector in various regions increase the adoption of bio-based polymers in various applications. The growing environmental concerns due to medical waste increase demand for bio-based polymers for the development of medical devices. The focus on improving patient outcomes, like reducing infection risks, shortening recovery time, and minimizing pain, increases demand for bio-based polymers.

The development of medical devices like catheters, scaffolds, sutures, and implants increases the adoption of bio-based polymers.

The strong focus on the development of a controlled-release drug delivery system increases demand for bio-based polymers. The increasing need for regenerative medicine and wound healing increases demand for bio-based polymers for the development of hydrogels. The increasing utilization of minimally invasive procedures increases the adoption of bio-based polymers for the development of devices like stents & catheters. The growing expansion of the healthcare sector creates an opportunity for the growth of the bio-based polymers market.

Market Challenge

High Production Costs Shut Down Expansion of Bio-Based Polymers Market

With the several benefits of bio-based polymers in diverse industries, the high production cost restricts the market growth. Factors like less volume of production, fluctuations in the feedstock prices, and intensive manufacturing processes increases the production cost.

The fluctuations in raw material prices like sugarcane, lignocellulosic, waste oils, corn starch, and biomass directly affects market growth. The complex and energy-intensive manufacturing processes like polymerizing, extracting, and refining requires high cost. The lower volume of production and development of infrastructure increases the cost of production. The high production cost hamper the growth of the bio-based polymers market.

Segmental Insights

Type Insights

Why did the Biodegradable Polymers Segment Dominate the Bio-Based Polymers Market in 2024?

The biodegradable polymers segment dominated the market in 2024. The increasing environmental impact of plastic and stricter regulations for lowering plastic waste increase demand for biodegradable polymers. The increasing consumer demand for sustainable products and the growing packaging industry increase demand for biodegradable polymers. The presence of key players like Evonik, NatureWorks, and Corbion drives the overall market growth.

Global Bio-Based Polymers Market Revenue, By Type, 2024-2034 (USD Billion)

| By Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Biodegradable Polymers | 4.59 | 5.47 | 6.52 | 7.77 | 9.25 | 11.02 | 13.12 | 15.61 | 18.57 | 22.09 | 26.26 |

| Non-Biodegradable Bio-Based Polymers | 7.49 | 8.67 | 10.03 | 11.61 | 13.43 | 15.53 | 17.97 | 20.78 | 24.02 | 27.77 | 32.1 |

How Polylactic Acid Segment Held the Largest Share in the Bio-Based Polymers Market?

The polylactic acid (PLA) segment held the largest revenue share as a sub-segment. The growing versatility of PLA, like rigid packaging, films, and fibers, helps market growth. The growing consumer demand for eco-friendly products and easily available plant feedstocks increases the production of PLA. The growing advancements in PLA production and increasing demand across applications like biomedical, packaging, and textiles support the overall market growth.

The polyhydroxyalkanoates (PHA) segment is seen to grow rapidly as a sub-segment. The growing plastic pollution and increasing demand for sustainable packaging are increasing the adoption of polyhydroxyalkanoates. The growing demand for various packaging, like cutlery, films, and containers, increases the adoption of PHA. The increasing companies' investment in the production of PHA and the growing demand for PHA across applications like food service, medicine, packaging, and agriculture drive the market growth.

Feedstock Source Insights

How the Plant-Based Segment Held the Largest Share in the Bio-Based Polymers Market in 2024?

The plant-based segment held the largest revenue share in the market in 2024. The growing production of bio-based polymers from plant-based resources like sugarcane, corn starch, and others helps market growth. The focus on reducing carbon footprint and the need to lower reliance on fossil fuels increases demand for plant-based materials. The growing plant-based applications in agriculture, biomedical, packaging, and personal care drive the overall growth of the market.

The waste & residue-based segment is experiencing the fastest growth in the market during the forecast period. The focus on lowering long-term waste accumulation and the need to lower carbon footprints increases the adoption of waste & residue-based polymers. The growing consumer demand for green products like consumer goods & packaging increases the adoption of waste & residue-based polymers. The focus on reducing landfill waste and enhancing resource efficiency increases the adoption of waste & residue-based polymers, supporting the overall growth of the market.

Processing Technology in 2024

Why did the Fermentation & Polymerization Segment Dominate the Bio-Based Polymers Market in 2024?

The fermentation & polymerization segment dominated the market in 2024. The increasing demand for the synthesis of PHA increases the demand for the fermentation process for the conversion of sugars from renewable resources. The growing production of bio-based polymers like PHA & PLA increases the adoption of polymerization techniques. The increasing focus on controlling polymer properties and structure increases the adoption of polymerization techniques. The focus on reducing the environmental impact of plastic and reliance on fossil fuels increases demand for fermentation technology. The ongoing advancements in polymerization & fermentation drive the overall growth of the market.

The enzymatic processes segment is the fastest-growing in the market during the forecast period. The focus on flexibility in polymer structure design and monomer selection increases demand for enzymatic processes. The increasing operations under milder conditions, like neutral pH & moderate temperatures, increase demand for enzymatic processes. The growing utilization of renewable resources like food waste, biomass, and agricultural waste in enzymatic processes supports the overall growth of the market.

End-Use Industry in 2024

Which End-Use Industry Held the Largest Share in the Bio-Based Polymers Market in 2024?

The food & beverage packaging segment held the largest revenue share in the market in 2024. The increasing demand for nutritional foods and focus on quick-service restaurants increases demand for food & beverage packaging. The growing demand for fresh produce, ready-to-eat meals, and drinks increases the adoption of food & beverage packaging. The increasing demand for packaged & processed foods fuels demand for packaging. The growing production of various packaging formats like cups, bottles, trays, and films drives the overall growth of the market.

Global Bio-Based Polymers Market Revenue, By End-Use Industry, 2024-2034 (USD Billion)

| By End-Use Industry | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Food & Beverage Packaging | 3.62 | 4.21 | 4.90 | 5.70 | 6.62 | 7.70 | 8.95 | 10.41 | 12.1 | 14.06 | 16.34 |

| Retail & E-Commerce | 1.81 | 2.15 | 2.55 | 3.02 | 3.58 | 4.25 | 5.04 | 5.97 | 7.07 | 8.38 | 9.92 |

| Textile & Apparel | 1.69 | 1.97 | 2.28 | 2.65 | 3.08 | 3.58 | 4.17 | 4.84 | 5.62 | 6.53 | 7.59 |

| Automotive OEMs | 1.93 | 2.25 | 2.62 | 3.04 | 3.54 | 4.12 | 4.79 | 5.57 | 6.47 | 7.53 | 8.75 |

| Agriculture & Horticulture | 1.45 | 1.68 | 1.95 | 2.27 | 2.63 | 3.05 | 3.54 | 4.11 | 4.77 | 5.53 | 6.42 |

| Healthcare | 1.57 | 1.88 | 2.25 | 2.69 | 3.22 | 3.85 | 4.6 | 5.49 | 6.56 | 7.83 | 9.34 |

The automotive OEMs segment is experiencing the fastest growth in the market during the forecast period. The focus of the automotive industry is on enhancing fuel efficiency and lowering carbon footprint increases demand for bio-based polymers. The increasing development of lightweight vehicles and advancements in the production of vehicles increase demand for bio-based polymers. The growing development of exterior components, under-the-hood components, and interior components increases the adoption of bio-based polymers, supporting the overall growth of the market.

Distribution Channel in 2024

Why did the Direct Sales Segment Dominate the Bio-Based Polymers Market in 2024?

The direct sales segment dominated the market in 2024. The focus on building relationships with large industrial buyers increases the adoption of direct sales. The growing demand for customized solutions and focus on transparency over pricing strategies increases the adoption of direct sales. The increasing consumer demand for responsive & personalised customer service and the need for streamlining supply chains increase the adoption of direct sales, driving the overall growth of the market.

The online specialty chemical platforms segment is the fastest-growing in the market during the forecast period. The easy accessibility and availability of a wide variety of bio-based materials increase the adoption of online specialty chemicals platforms. The availability of detailed information about the product and easy connection with buyers & suppliers increases demand for online specialty chemical platforms, supporting the overall growth of the market.

Regional Insights

Europe Bio-Based Polymers Market Trends

Europe dominated the market in 2024. The presence of the European Green Deal and restrictions on single-use plastics increases demand for bio-based polymers. The strong government support for the development of bio-based polymers and well-established recycling infrastructure help the market growth. The increasing environmental concerns and growing demand for consumer goods products increase the adoption of bio-based polymers. The growing demand for bio-based polymers across end-user industries like textiles, automotive, packaging, and consumer goods drives the overall market growth.

Germany Bio-Based Polymers Market Trends

Germany is a major contributor to the market. The stricter environmental regulations and strong government support for the adoption of bio-based polymers help the market growth. The strong presence of the automotive industry increases demand for bio-based polymers. The growing consumer awareness about environmental concerns and focus on sustainability increases demand for bio-based polymers. The strong presence of advanced bio-based polymers manufacturing capabilities and a well-developed packaging industry supports the overall growth of the market.

Global Bio-Based Polymers Market Revenue, By Regional, 2024-2034 (USD Billion)

| By Regional | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 2.66 | 3.10 | 3.61 | 4.2 | 4.90 | 5.71 | 6.65 | 7.75 | 9.03 | 10.52 | 12.26 |

| Europe | 4.23 | 4.92 | 5.73 | 6.67 | 7.76 | 9.03 | 10.51 | 12.23 | 14.23 | 16.55 | 19.26 |

| Asia-Pacific | 3.87 | 4.60 | 5.46 | 6.49 | 7.71 | 9.16 | 10.88 | 12.92 | 15.33 | 18.20 | 21.60 |

| Latin America | 0.72 | 0.84 | 0.98 | 1.13 | 1.32 | 1.53 | 1.77 | 2.06 | 2.39 | 2.77 | 3.21 |

| Middle East & Africa | 0.6 | 0.69 | 0.78 | 0.88 | 1.00 | 1.13 | 1.27 | 1.44 | 1.62 | 1.82 |

2.04 |

Asia Pacific Bio-Based Polymers Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing industrialization in the region increase demand for bio-based polymers. The presence of abundant raw materials and strong manufacturing infrastructure for bio-based polymers helps market growth. The strong government support for the use of conventional plastics and growing environmental concerns increase demand for bio-based polymers. The growing sectors like textiles, construction, packaging, and automotive components increase demand for bio-based polymers. The presence of major players like NatureWorks and BASF supports the overall growth of the market.

China Bio-Based Polymers Market Trends

China is a key contributor to the bio-based polymers market. The large production capacity and strong government support for bio-based materials increase the adoption of bio-based polymers. The growing industrialization increases demand for sustainable materials like bio-based polymers. The focus on lowering reliance on fossil fuels and increasing utilization of renewable resources increases demand for bio-based polymers. The growing demand for bio-based polymers in applications like textiles, construction, packaging, and agriculture drives the overall market growth.

- China exported $46.7M of polylactic acid in 2024.(Source: oec.world)

Recent Developments

- In April 2024, EPS launched bio-based polymers, PC-Mull 815, for wood coatings. The polymer offers high block resistance and chemical resistance. The bio-based polymer is applicable for wood finishes and furniture.(Source: www.coatingsworld.com )

- In July 2025, Itaconix launched a plant-based polymer, Bio*Asterix range for paints & coatings. The range consists of 3 products and is used to make polymeric binders. The products are environmentally friendly and contribute to sustainability.(Source: www.proactiveinvestors.co.uk)

- In September 2023, Mitsubishi Chemical Group launched BioPBS™ for EN TEA Teabag pouches. The polymer has high flexibility & low-temperature sealability and is applicable in food product packaging.(Source: www.mcgc.com)

Bio-Based Polymers Market Top Companies

- Dow

- NatureWorks LLC

- Braskem

- BASF SE

- TotalEnergies Corbion bv

- Novamont SpA

- Biome Bioplastics

- PTT Global Chemical Public Company Limited

- Mitsubishi Chemical Holding Corporation

- Biotec

- Mapei S.p.A

- SOLVAY

- DAIKIN

- Toray Industries, Inc.

- KURARAY CO., LTD.

- Dupont

- Plantic

Segments Covered

By Type

- Biodegradable Polymers

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-Based Plastics

- Polybutylene Succinate (PBS)

- Non-Biodegradable Bio-Based Polymers

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Bio-Polypropylene (Bio-PP)

- Bio-Polyamides (Bio-PA)

By Feedstock Source

- Plant-Based (corn, sugarcane, potato, cassava)

- Cellulose & Wood-Based

- Algae-Based

- Waste & Residue-Based

By Processing Technology

- Fermentation & Polymerization

- Enzymatic Processes

- Chemical Synthesis from Bio-Based Monomers

- Blending with Conventional Polymers

By End-Use Industry

- Food & Beverage Packaging

- Retail & E-Commerce

- Textile & Apparel

- Automotive OEMs

- Agriculture & Horticulture

- Healthcare

By Distribution Channel

- Direct Sales (B2B)

- Resin Distributors

- Online Specialty Chemical Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait