Content

What is the Polyamide Market Size and Volume?

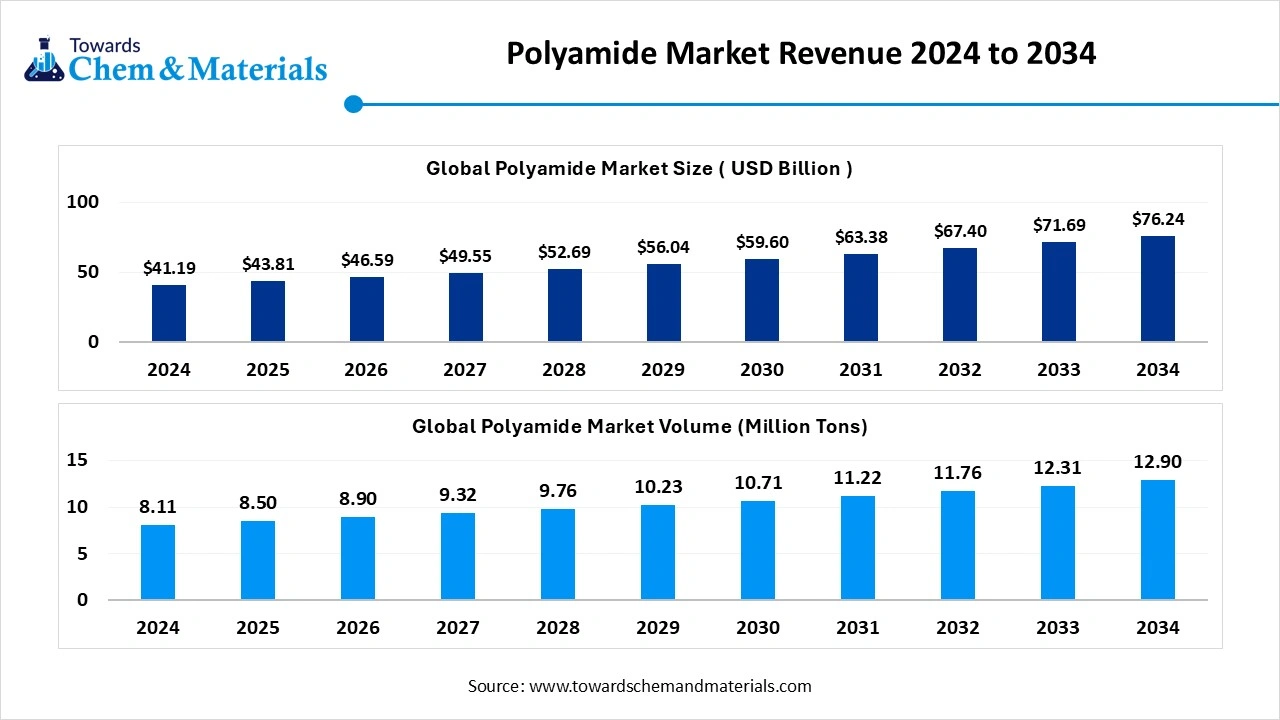

The global polyamide market is experiencing rapid growth, with volumes expected to increase from 8.50 million tons in 2025 to 12.90 million tons by 2034, representing a robust CAGR of 4.75% over the forecast period.

The global polyamide market size is accounted at USD 43.81 billion in 2025 and predicted to increase from USD 46.59 billion in 2026 to approximately USD 76.24 billion by 2034, expanding at a CAGR of 6.35% from 2025 to 2034. The growing demand from various end-user industries like electronics, automotive, electricals, and textiles drives the growth of the market.

Key Takeaways

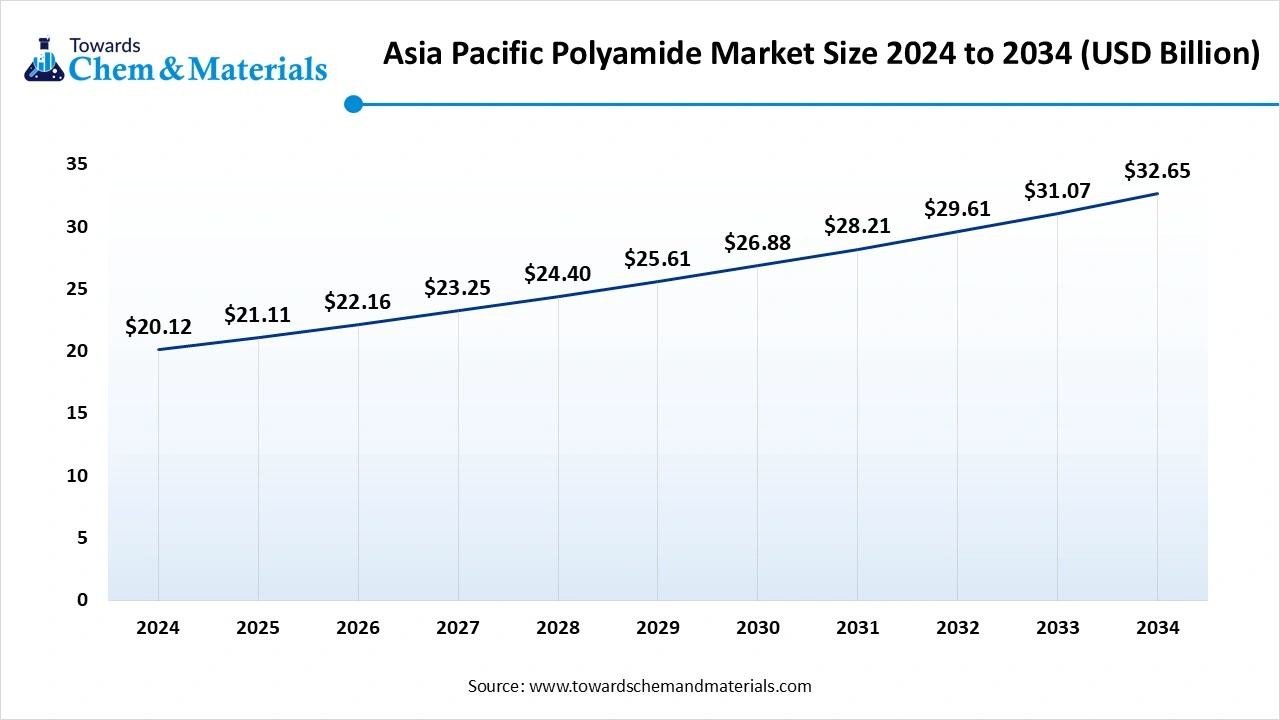

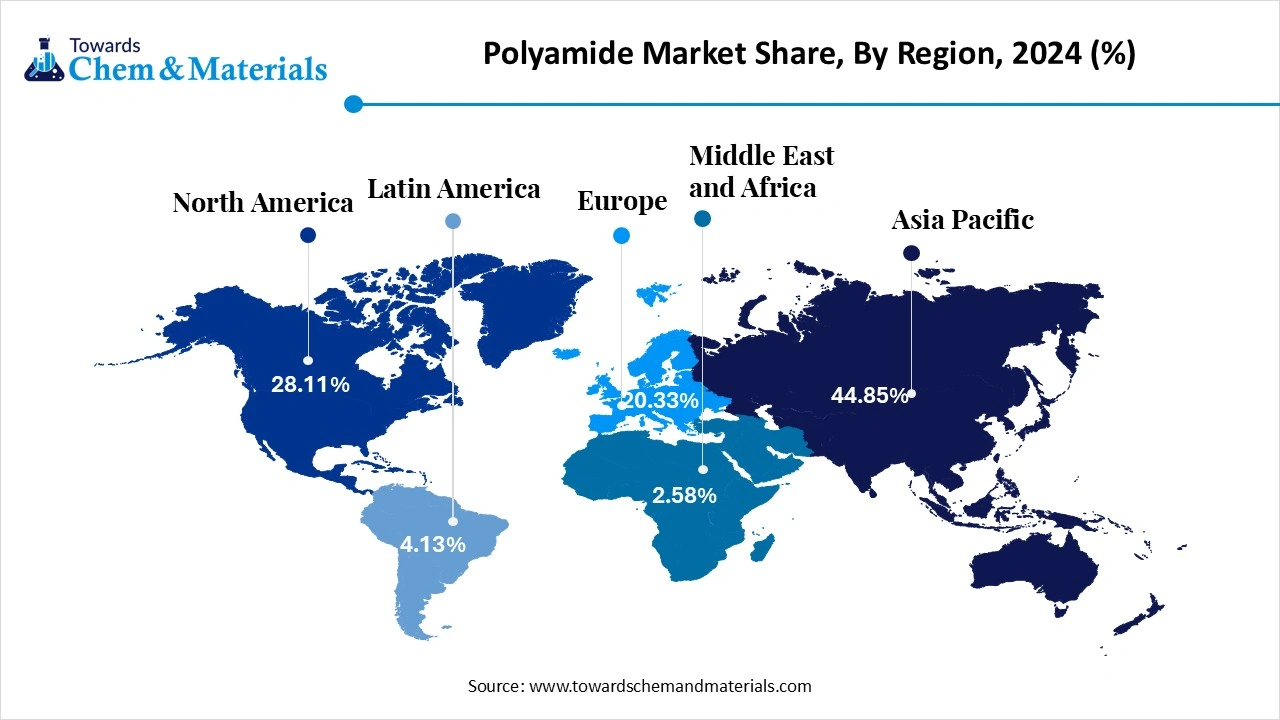

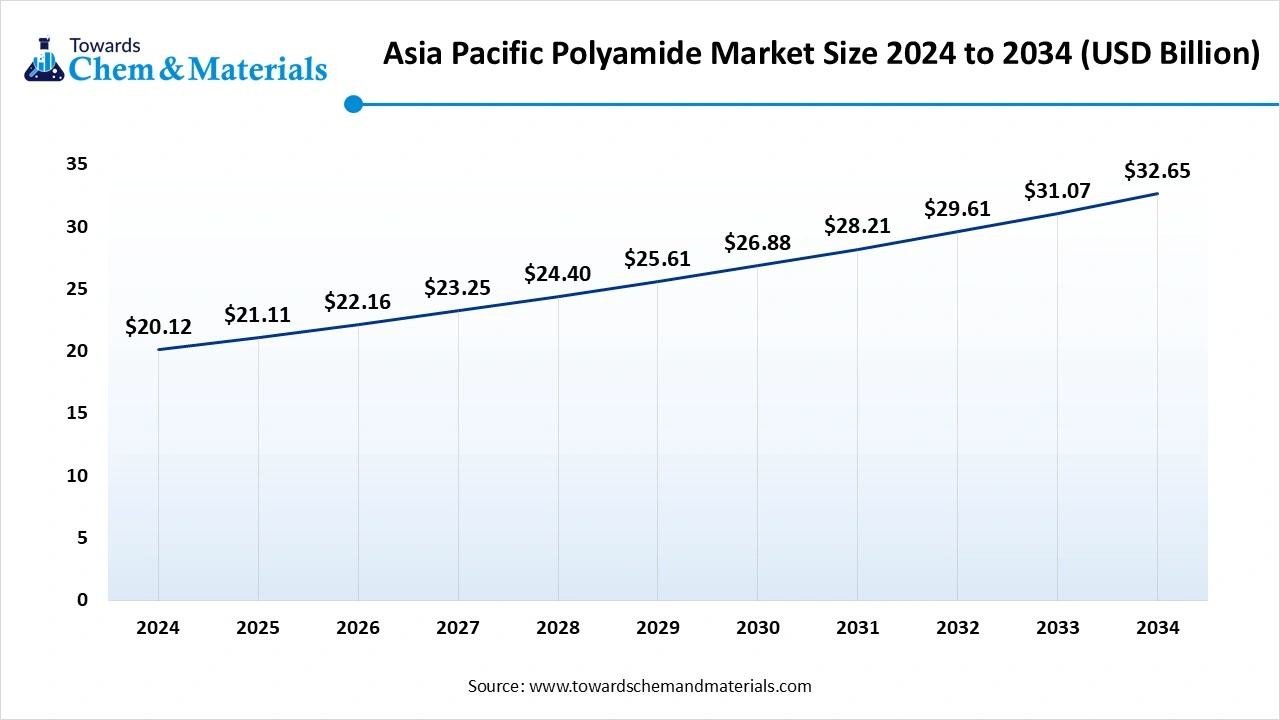

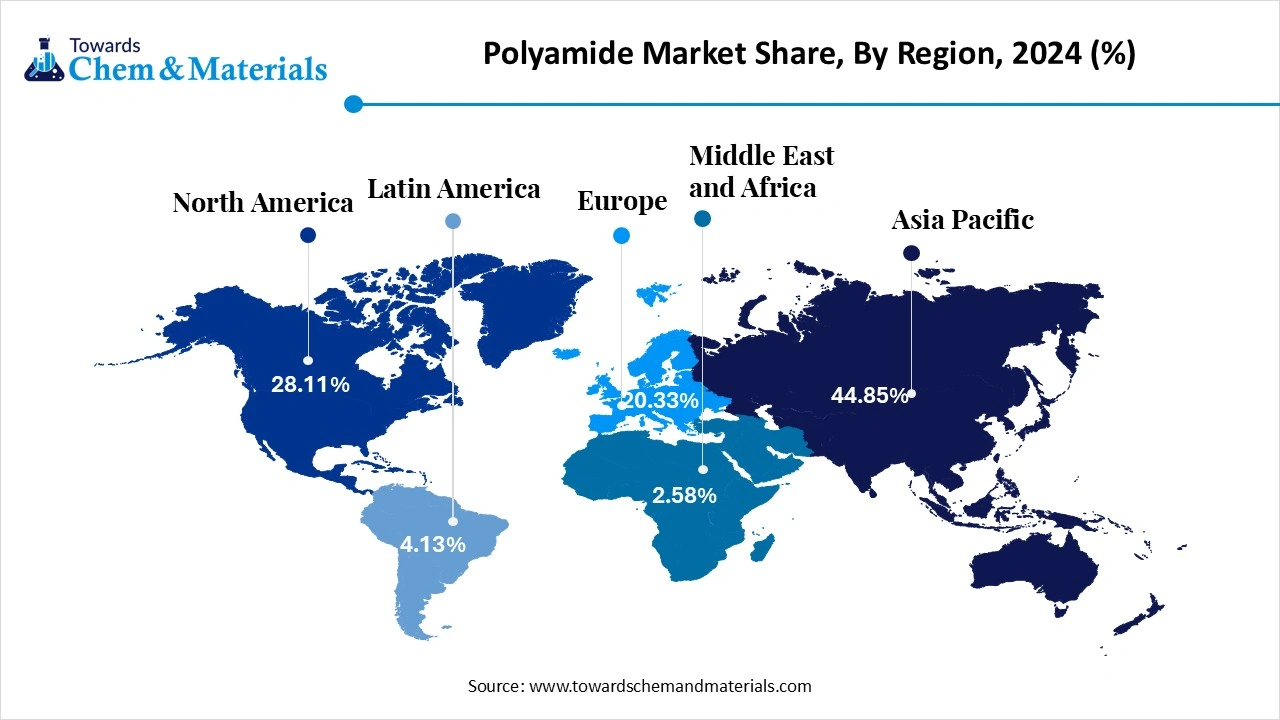

- Asia Pacific polyamide market dominated and accounted for the largest revenue share of over 44.85% in 2024 and is anticipated to grow at the fastest CAGR of 5.15% over the forecast period.

- By product, the polyamide 6 product segment recorded the largest market revenue share of over 52.85% in 2024.

- By product, the Bio-based polyamide is projected to grow at the fastest CAGR of 11.2% during the forecast period.

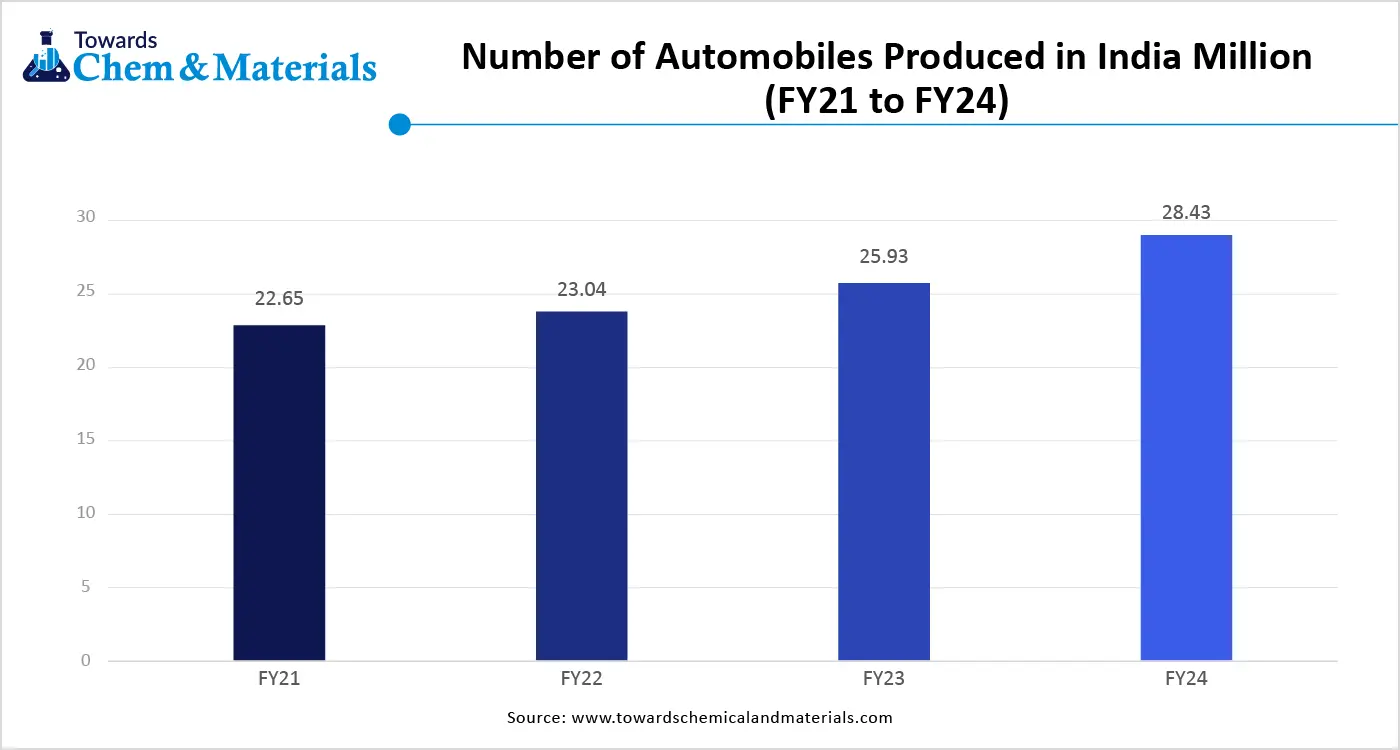

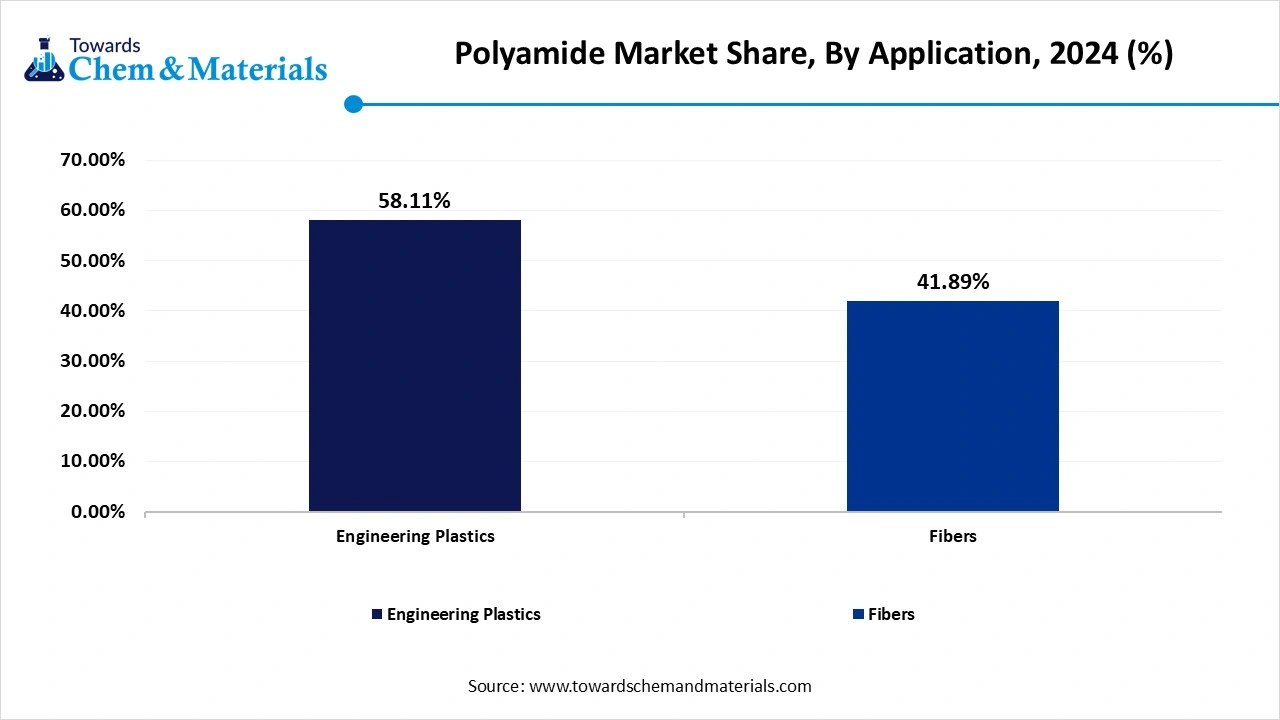

- By application, the engineering plastics segment recorded the largest market share of over 58.11% in 2024.

- By application, the fibers segment is anticipated to experience the highest CAGR of 4.75% during the forecast period.

The Role of Polyamides Across Industries and a Sustainable Future

Polyamide is a polymer that consists of repeating amide linkages within its molecular chains. It’s also known as nylon and linkages formed by a condensation reaction between carboxylic acid groups and amino groups. Polyamide offers high abrasion resistance, exceptional strength, high wear resistance, and enhanced durability. Polyamides can occur naturally, like silk and wool. It can be produced through a synthetic process like solid-phase synthesis and step-growth polymerization that includes aramids and nylons. This kind of polyamide is widely used in the automotive industry, kitchen utensils, textiles, sportswear, and carpets.

Polyamides are used in various industries like medical devices, textiles, packaging, and plastics. The growing expansion of the automotive industry increases demand for polyamide for various components, like wheel covers, intake manifolds, fuel caps, and engine covers. The growing demand for electronic devices like laptops, computers, smartphones, and smartwatches fuels demand for polyamides. The growing production of industrial filaments, carpets, and apparel helps in the market growth. Factors like the development of bio-based polyamides, advancements in recycling technologies, 3D printing, and growing demand across various industries like packaging, textile, & electronics contribute to the overall growth of the market.

- Germany exported $2.64 billion of polyamides in 2023.(Source: oec.world)

- From November 2023 to October 2024, the world exported 2,165,646 shipments of polyamides.(Source: Volza)

- NAGASE VIETNAM CO LTD is a leading supplier of polyamide in Japan.(Source: volza)

- China exported 2,025,885 shipments of polyamides.(Source: Volza)

- Turkey exported 1,348,658 shipments of polyamides.(Source: volza)

Growing Automotive Sector Drives Polyamide Market Growth

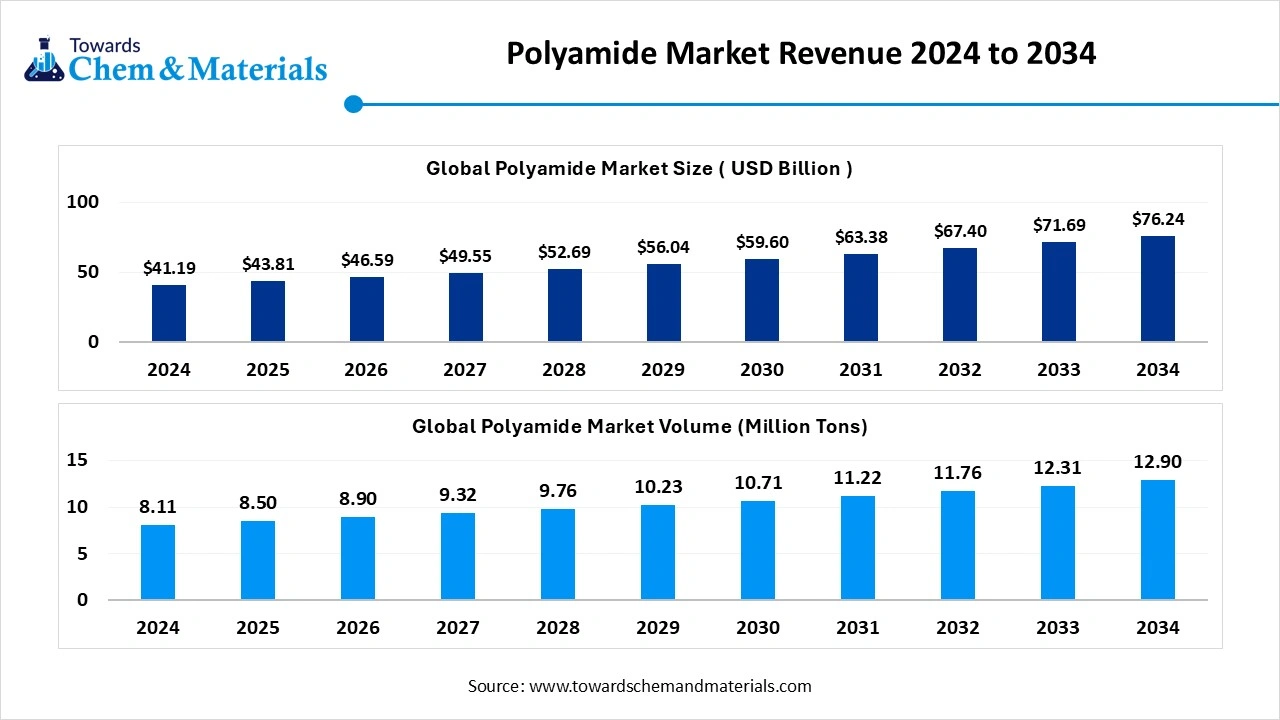

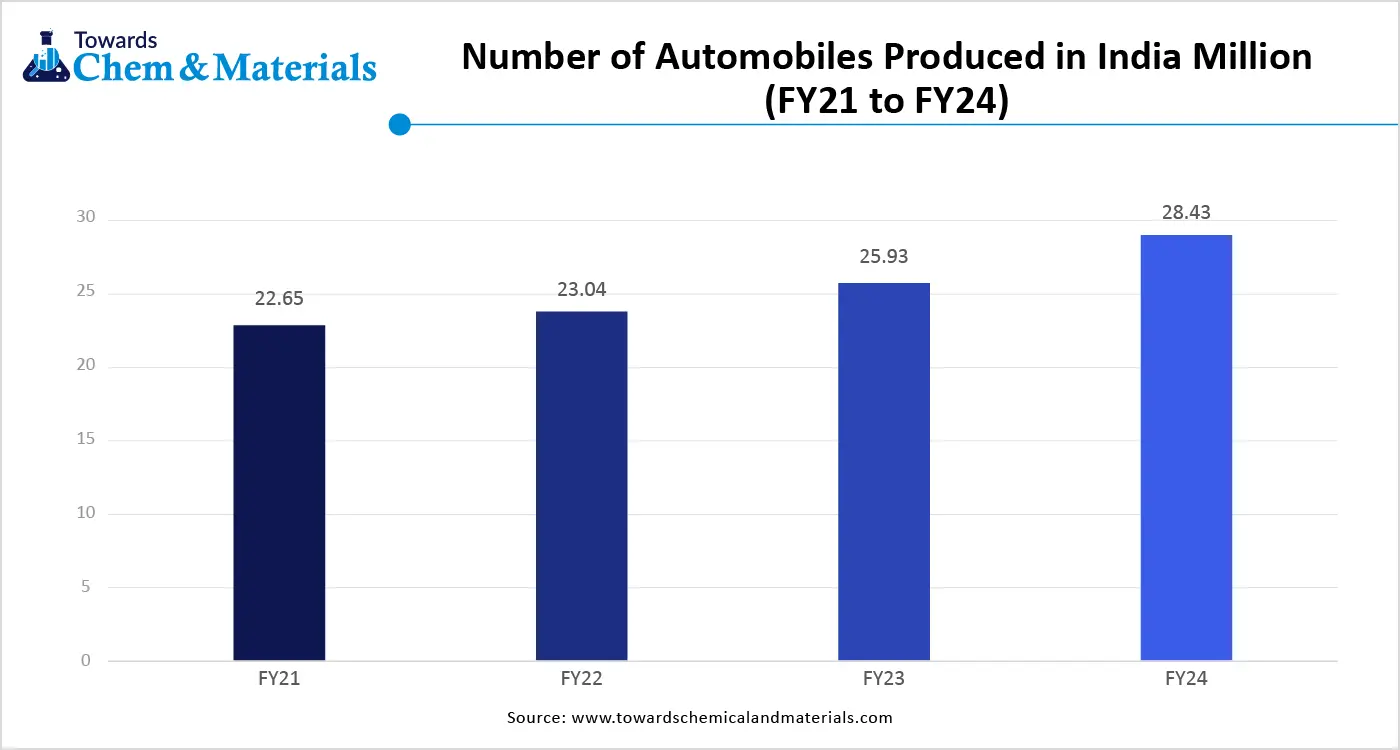

The growing automotive industry and rising production of vehicles increase demand for polyamide for various applications. The increasing demand for lightweight vehicle materials is fueling demand for polyamide. The growing demand for high heat resistance and durability materials in various automotive systems like fuel systems, electrical connectors, engine components, and others, increases the adoption of polyamide.

The growing production of various automotive parts like fuel tanks, door handles, wheel covers, engine covers, airbag containers, and mirror housing increases demand for polyamides. The increasing environmental regulations and fuel efficiency standards in the automotive sector increase demand for polyamides. The growing technological advancements in polyamides increase utilization in the automotive sector. The growing demand for hybrid vehicles and electric vehicles is fueling demand for high-performance polyamides for various automotive components like under-hood parts, battery cases, and electrical connectors. The growing expansion of the automotive industry is a key driver for the market growth.

Market Trends

- Growing Textile & Apparel Industry: The growing expansion of the textile & apparel industry increases demand for polyamide due to properties like high wear resistance, durability, and elasticity. The growing demand for athleisure, sportswear, activewear, industrial filaments, and carpets fuels demand for polyamide.

- Growing Focus on Bio-Based Polyamides: The growing environmental concerns and focus on sustainability increase the adoption of bio-based polyamides. The growing focus on the development of bio-based polymers offers excellent properties like excellent impact strength, lower moisture absorption, and high chemical resistance.

- Technological Advancements in Polyamides: The ongoing technological advancements in polyamides like additive manufacturing, high-performance polyamides development, and recycling technologies help in the market growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 46.59 Billion |

| Expected Size by 2034 | USD 76.24 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Evonik AG, Solvay, DSM-Firmenich, DuPont, BASF, Arkema, Domo Chemicals, Lanxess, TORAY INDUSTRIES, INC., Koch IP Holdings, LLC., Celanese Corporation, Ascend Performance Materials, Advansix, Huntsman International LLC, Advansix, Mitsui Chemicals |

Market Opportunity

The Growing Electronic Sector Unlocks Opportunity for the Polyamide Market

The growing expansion of the electronic industry and the rising adoption of various electronic devices increase demand for polyamide. The growing demand for various electronic devices like TVs, smartphones, laptops, computers, and wearable devices increases demand for polyamide for various applications. The growing trend of miniaturized electronic devices fuels demand for high-performance polyamide materials. The growing technological advancements in electronic devices and increasing utilization of sustainable materials fuel demand for polyamide. The increasing demand for lightweight and excellent electrical insulation materials in electronic devices increases the demand for polyamide. The rising demand for connectors, printed circuit boards, sensors, and housing in various electronic applications fuels demand for polyamide. The growing electronic industry is a key driver for the growth of the market.

Market Challenge

High Production Costs Limit Expansion of Polyamide Market

Despite several benefits of the polyamide in various industries, high production cost restricts the market growth. Factors like the need for specialized equipment, complex synthesis processes, and high raw materials costs are responsible for high production costs. The complex synthesis processes, like multiple processing steps and intricate chemical reactions, increase the overall cost. The high raw materials costs, including additives & monomers responsible for the high cost. The need for specialized equipment for various processes, like extensive processing steps, polymerization, and purification, increases the cost. Supply chain disruptions, problems such as shortages and transportation delays, increase the production cost. The stricter environmental regulations increase the production cost. The high production cost hampers the growth of the market.

Segmental Insights

Product Insights

How Polyamide 6 Dominated the Polyamide Market?

The polyamide 6 segment led the polyamide market in 2024. The growing demand for automotive components like brakes, seals, engine manifolds, and clutches increases demand for polyamide. It consists of high impact resistance and ductility. Polyamide 6 has high abrasion & chemical resistance and is widely used for applications like industrial parts, conveyor belts, and automotive components. It is affordable and lightweight in nature, which enhances fuel efficiency.

The growing demand across industries like aerospace, packaging, textile & apparel, and construction helps in the market growth. The growing demand for switches, connectors, and semiconductor chips in the electrical & electronics industry supports the overall growth of the market.

The bio-based polyamide segment is the fastest-growing in the market during the forecast period. The growing adoption of renewable energy sources increases demand for bio-based polyamide. The stringent environmental regulations and growing technological advancements in bio-based polyamide help in the market growth. The growing consumer demand for eco-friendly products increases demand for bio-based polyamides. The growing demand from the textile industry to produce activewear, clothing, and fabrics increases demand for bio-based polyamide. The increasing demand from the packaging and automotive industries drives the overall growth of the market.

Application Insights

Why did Engineering Plastics Dominate the Polyamide Market?

The engineering plastics segment dominated the polyamide market in 2024. The growing demand for high chemical resistance, excellent strength, high heat resistance, and excellent stiffness engineering plastics helps in the market growth. The increasing demand for lightweight materials in the aerospace & automotive industry increases demand for engineering plastics. The increasing demand for housing, circuit boards, insulators, connectors, and protective components in electronic devices like TVs, smartphones, and computers fuels demand for engineering plastic. The growing demand for consumer goods, appliances such as dishwashers, refrigerators, helmets, washing machines, and protective gear, drives the overall growth of the market.

The fibers segment experiences the fastest growth in the market during the forecast period.

The growing demand for home textiles like carpets, upholstery, and curtains increases the demand for fibers. The rising demand for polyamide fibers like nylon in textile applications, including industrial fabrics, carpets, and apparel, helps in the market growth. The increasing demand for hosiery, sportswear, and lingerie in the apparel industry increases demand for polyamide fibers. The growing demand for technical fibers in various industries like industrial applications, automotive, and aerospace supports the overall growth of the market.

Regional Insights

Which Region Dominated the Polyamide Market in 2024?

The Asia Pacific polyamide market is expected to increase from USD 21.11 billion in 2025 to USD 32.65 billion by 2034, growing at a CAGR of 4.96% throughout the forecast period from 2025 to 2034.

Asia Pacific dominated the polyamide market in 2024. The growing urbanization and industrialization in the region increase demand for polyamide. The growing expansion of the automotive industry increases demand for polyamide for various automotive components, like interior components, engine parts, and fuel lines. The rise of electric vehicles helps in the market growth. The growing production of various textiles like outdoor gear, sportswear, and activewear increases demand for polyamides. The rising demand for high-performance fabrics and the growing textile & apparel industry drive the market growth. The growing production, exportation, and distribution of polyamides help the market growth. The growing expansion of diverse industries like electronics, industrial components, food packaging, and textiles drives the overall growth of the market.

China Polyamide Market Trends

China is a major contributor to the polyamide market. The substantial investment in a manufacturing hub increases demand for polyamides. The strong presence of electronics manufacturing helps in the market growth. The well-established automotive industry increases demand for polyamides for fuel lines, manifolds, and engine covers. The high availability of raw materials and a well-established supply chain for polyamides help the market growth. The strong focus on electric vehicles increases demand for polyamides for applications like electric motor components & battery housing. Additionally, growing demand from the textile industry supports the overall growth of the market.

- China exported $1.84 billion of polyamides in 2023.(Source: oec.world)

- China exported $2.03 billion of polyamides in 2024.(Source: oec.world )

- China exported $176 million of polyamides in March 2025.(Source: oec.world )

India Polyamide Market Trends

India is significantly growing in the polyamide market. The growing production of various textiles like athletic wear, fabrics, and other products increases demand for polyamides. The growing expansion of the automotive industry and the growing demand for lightweight automotive materials help in the market growth. The presence of key polyamide manufacturing hubs in states like Tamil Nadu, Maharashtra, and Gujarat drives the market growth. The growing demand for appliances and consumer goods increases the demand for polyamide. The rising adoption of consumer electronics contributes to the overall growth of the market.

- India exported $83.6 million of polyamide fabric in 2023.(Source: oec.world)

- India exported $92.9 million of polyamide in 2023.(Source: oec.world )

- India exported $27.3 million of polyamide: nylons in 2023.(Source: oec.world)

- JPFL Films Pvt Ltd invested Rs. 120 crores in Biaxially Oriented Polyamide Nylon Films in Nasik with the Make in India initiative.(Source: oec.world)

Why is North America the Fastest Growing in the Polyamide Market?

North America experiences the fastest growth in the market during the forecast period. The growing expansion of the automotive industry and increasing demand for fuel-efficient vehicles increases demand for polyamides. The growing expansion of the packaging industry helps in the market growth. The growing demand for appliances and consumer electronics increases the demand for polyamides for structural components, housing, and connectors. The extensive manufacturing infrastructure and well-established supply chain networks help the market growth. The easy access to raw materials and growing demand from the electrical industry for dimensional stability, insulation, & flame retardancy increases demand for polyamide. Furthermore, growing demand from the packaging industry drives the overall growth of the market.

What are the Growth Factors for the Polyamide Market in the United States?

The United States is a major player in the polyamide market. The growing demand from the aerospace & automotive industries helps in the market growth. The well-established manufacturing hub for textiles, automotive, and electronics increases demand for polyamides. The presence of strong supply chains and well-established manufacturing infrastructure helps in the market growth. The availability of raw materials like hexamethylenediamine & adipic acid increases the production of polyamide. The growing demand from the electrical & electronics industry drives the overall growth of the market.

- The United States exported $2.61 billion of polyamides in 2023(Source:oec.world)

- The United States exported $2.79 billion of polyamides in 2024.(Source:oec.world )

- The United States exported $203 million of polyamides in April 2025.(Source: oec.world)

- The United States exported $69.3 million of polyamide fabric in 2024.(Source: oec.world)

Recent Developments

- In April 2025, BASF launched the first Loopamid plant facility for recycled polyamide 6 production. The plant is present in Shanghai, China, with a 500 metric tons annual capacity. The Loopamid is based on textile waste, and textile-to-textile recycling of polyamide 6 technology is used.(Source: finance.yahoo.com)

- In June 2024, Fulgar launched Q-GEO biobased polyamide yarn. 46% of the fibre is produced from non-edible corn and offers many technical characteristics. It lowers the environmental footprint, minimizes greenhouse gas emissions, and reduces water use.(Source: knittingindustry.com)

- In July 2024, Syensqo launched polyamide grades with attributed recycled content. The polyamide is made up of post-industrial & post-consumer sources and is attributed via the mass balance method. This polyamide has applications in consumer goods & household appliances like food processors & slow cookers, kitchen robot chassis, drip & single-serve coffee makers, oven & air fryers, razor brackets, and kitchen utensils. Omnix FC 6000 ECHO HPPA is high performance polyamide.(Source: sustainableplastics)

- In July 2024, LyondellBasell launched a new polyamide compound, Schulamid ET100, for automotive applications. It has excellent melt flow characteristics and is applicable for complex parts like window and door frames in the automotive sector. The polyamide reduces floating fibers, surface defects, and stress marks. They reduce volatile organic compound emissions and lower vehicle carbon emissions.(Source: sustainableplastics)

Top Companies List

- Evonik AG

- Solvay

- DSM-Firmenich

- DuPont

- BASF

- Arkema

- Domo Chemicals

- Lanxess

- TORAY INDUSTRIES, INC.

- Koch IP Holdings, LLC.

- Celanese Corporation

- Ascend Performance Materials

- Advansix

- Huntsman International LLC

- Advansix

- Mitsui Chemicals

Segments Covered

By Product

- Polyamide 6

- Bio-Based Polyamide

- Polyamide 66

- Specialty Polyamide

By Application

- Engineering Plastics

- Electricals & Electronics

- Packaging

- Automotive

- Consumer Goods & Appliances

- Fibers

- Textile

- Carpet

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait