Content

What is the Current Lithium Metal Battery Materials Market Size and Volume?

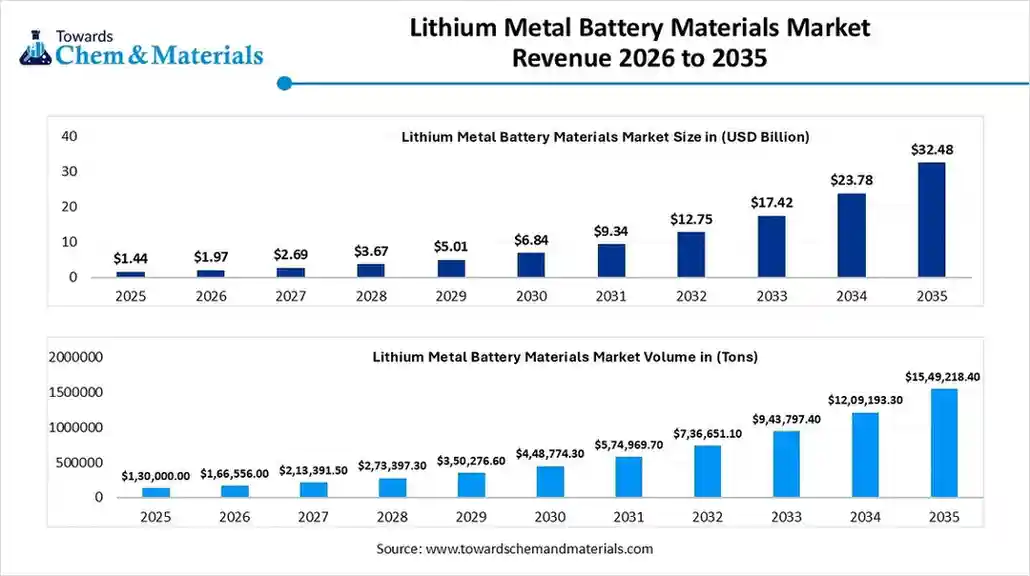

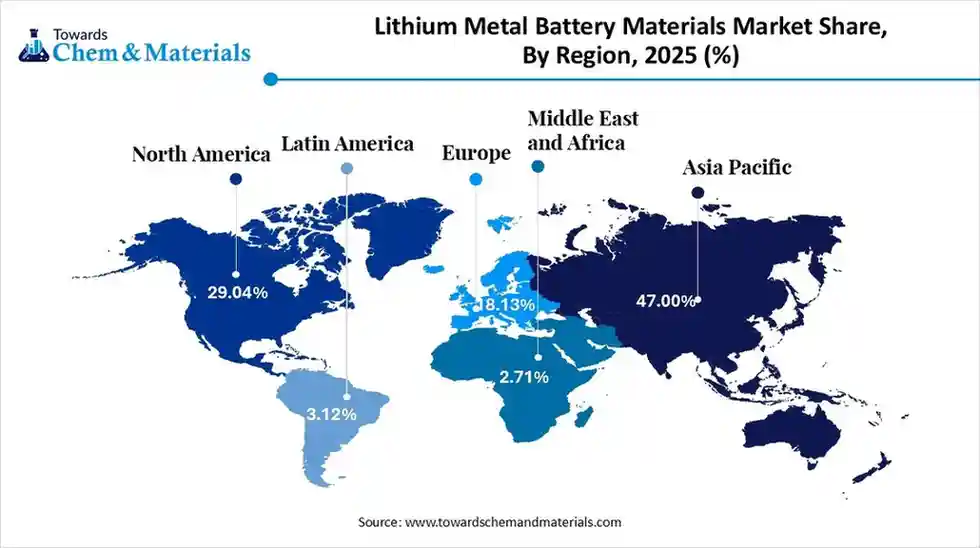

The global lithium metal battery materials market size was estimated at USD 1.44 billion in 2025 and is expected to increase from USD 1.97 billion in 2026 to USD 32.48 billion by 2035, growing at a CAGR of 36.56% from 2026 to 2035. Asia Pacific dominated the lithium metal battery materials market with the largest revenue share of 47.00% in 2025.

The global lithium metal battery materials market volume was estimated at 130,000.0 tons in 2025 and is projected to reach 1,549,218.4 tons by 2035, growing at a CAGR of 36.53% from 2026 to 2035. Asia Pacific dominated the lithium metal battery materials market with the largest volume share of 47.00% in 2025. The rising use of consumer electronics and the surging development of electric vehicles drive the market growth.

Key Takeaways

- By region, Asia Pacific led the petrochemical recycling market with the largest volume share of over 47.00% in 2025.

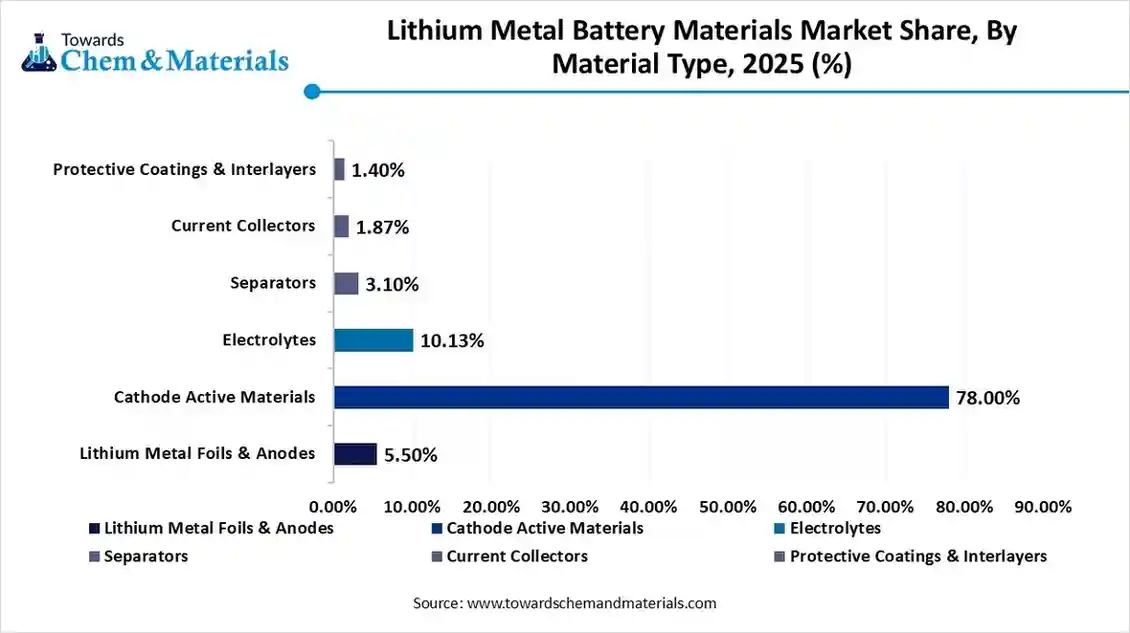

By region, Europe is growing at the fastest CAGR in the market during the forecast period due to the transition towards renewable energy resources. - By material type, the cathode active materials segment led the market with the largest volume share of 78% in 2025, due to the explosion of ESS.

- By material type, the protective coatings & interlayers segment is growing at the fastest CAGR in the market during the forecast period due to its capability of accommodating volume changes.

- By cathode chemistry, the lithium nickel manganese cobalt oxide (NMC) segment led the market with the largest volume share of 34% in 2025, due to the balanced performance and improved safety.

- By cathode chemistry, the lithium sulfur (Li-S) segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increased development of long-endurance aircraft.

- By electrolyte type, the liquid electrolytes segment accounted for the largest volume share of 46% in 2025, due to the excellent ionic conductivity.

By electrolyte type, the solid-state electrolytes segment is expected to grow at the fastest CAGR in the market during the forecast period due to the excellent energy density. - By battery type, the rechargeable lithium metal batteries segment dominated with the largest volume share of 41% in 2025, due to the growing use across the electronics industry.

- By electrolyte type, the solid-state lithium metal batteries segment is expected to grow at the fastest CAGR in the market during the forecast period due to the faster charging capabilities.

- By end-use industry, the automotive & transportation segment dominated the market and accounted for the largest volume share of 42% in 2025, due to increased use of electric mobility solutions.

- By end-use industry, the energy & utilities segment is expected to grow at the fastest CAGR in the market during the forecast period due to the expanding renewable energy.

What are Lithium Metal Battery Materials?

The lithium metal battery materials market growth is driven by the government's focus on clean energy sources, increasing penetration of EVs, huge demand for grid storage, escalating consumer demand for electronic gadgets, increased use of robotics, huge dependence on solar energy, and rapid growth in the development of energy storage systems.

Lithium metal battery materials consist of pure metallic lithium for the production of batteries. The materials include cathode, separator, anode, and electrolytes. These materials are lightweight and offer a longer shelf life. The material offers benefits like excellent energy density, fast charging, high durability, superior cell voltage, and excellent power. The lithium metal battery materials are widely used in electric flight, electronic devices, electric vehicles, and medical devices.

Lithium Metal Battery Materials Market Trends:

- Electric Vehicle Upswing:- The strong focus on achieving longer ranges and a huge adoption rate of electric vehicles creates higher demand for lithium metal battery materials to enhance the performance of the battery.

- Expanding Consumer Electronics Sector:- The increasing use of wearable electronic devices and the rise in miniaturization of electronics require lithium metal battery materials for longer life and safety.

- Need for Backup Power System:- The increased use of backup power systems in sectors like data centers, automation, and healthcare increases demand for lithium metal battery materials due to low maintenance and faster charging capacity.

- Solid-State Electrolyte (SSE) Surge:- The strong focus on the replacement of flammable liquid electrolytes and the need for blocking dendrite growth increases demand for SSE. The SSE offers thermal stability, enhanced safety, and longer life.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 1.97 Billion / 166,556.0 Tons |

| Revenue Forecast in 2035 | USD 32.48 Billion / 1,549,218.4 Tons |

| Growth Rate | CAGR 36.56% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Cathode Chemistry, By Electrolyte Type, By Battery Type, By End-Use Industry, By Region |

| Key companies profiled | Livent Corporation, Tianqi Lithium Corporation, Ganfeng Lithium Co., Ltd., SQM (Sociedad Química y Minera de Chile), Albemarle Corporation, Umicore, BASF SE, POSCO Chemical, Mitsubishi Chemical Group, Toray Industries, Inc., Sumitomo Metal Mining Co., Ltd., Johnson Matthey, LG Chem, Panasonic Holdings Corporation, Samsung SDI, CATL (Contemporary Amperex Technology Co., Limited), Solid Power, Inc., QuantumScape Corporation, SES AI Corporation, Ilika plc |

Key Technological Shifts in the Lithium Metal Battery Materials Market:

The lithium metal battery materials market is undergoing key technological shifts driven by the demand for sustainability, faster charging, and safety. The innovations like digital twins, novel cathodes, nanomaterials, nanostructuring, and dry electrode printing support performance optimization. The major technological shift is the integration of artificial intelligence optimizes the manufacturing process.

AI easily discovers new materials and accelerates the screening of novel materials. Artificial Intelligence develops solid electrolytes and detects microscopic flaws. AI helps in optimizing manufacturing process parameters and minimizes downtime of equipment. AU supports automated sorting and enhances the recovery of metals. Overall, AI works as a catalyst in the production of lithium metal battery materials.

Trade Analysis of Lithium Metal Battery Materials Market: Import & Export Statistics

- South Korea exported 1,436 shipments of lithium cobalt oxide.

- The United States exported 2,581 shipments of electrolyte.

- The United States exported 3,035 shipments of lithium metal batteries.

- India imported 365 shipments of lithium metal.

Lithium Metal Battery Materials Market Value Chain Analysis

- Feedstock Procurement: Feedstock procurement is the process of acquiring raw materials like lithium, cobalt, graphite, nickel, silicone, electrolyte, manganese, and phosphorus.

- Key Players:- Ganfeng Lithium, Tianqi Lithium, Mineral Resources, Albemarle Corporation, SQM

- Chemical Synthesis and Processing: Chemical synthesis and processing for anode materials involves steps like metallurgical methods, solution-based methods, PVD, & host material integration, and for cathode materials includes steps like solid-state reaction & solution-based methods.

- Key Players:- BASF SE, POSCO, Albemarle, LG Energy Solution, Umicore, Tanaka Chemical Corporation

- Quality Testing and Certifications: Quality testing measures attributes like shock, energy storage capacity, ion chromatography, internal resistance, vibration, mobility, internal flaws, & material strength. The certifications for lithium metal battery materials are IEC 62133, CE Marking, BIS, ISO, and RoHS.

- Key Players:- Intertek Group plc, TUV Rheinland AG, Bureau Veritas SA, SGS SA, TUV SUD AG

Country-Wise Regulations for Lithium Metal Battery Materials

| Country | Key Regulations |

| United States |

|

| South Korea |

|

| Germany |

|

| Saudi Arabia |

|

Segmental Insights

Material Type Insights

Why is the Cathode Active Materials Segment Dominating the Lithium Metal Battery Materials Market?

The cathode active materials (CAMs)segment dominated the lithium metal battery materials market with a 78% share in 2025. The upswing of electric vehicles and the increasing use of long-range batteries increase the adoption of CAMs. The higher need for renewable energy storage and the rise in manufacturing of grid-scale energy storage systems require CAMs. The high-performance, balance-safety, and sustainability of CAM drive the overall market growth.

The protective coatings & interlayers segment is experiencing the fastest growth in the market during the forecast period. The strong focus on regulating lithium ions flow, and the growing development of solid-state batteries, requires protective coatings & interlayers. The increasing need for accommodating volume changes and focus on improving ionic transport requires protective coatings & interlayers. The growing demand for enhancing the performance of lithium deposition supports the overall market growth.

Lithium Metal Battery Materials Market Volume and Share, By Material Type, 2025 (%)

| By Material Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Lithium Metal Foils & Anodes | 5.50% | 7,150.0 | 94,502.3 | 33.22% | 6.10% |

| Cathode Active Materials | 78.00% | 101,400.0 | 1,190,884.2 | 31.48% | 76.87% |

| Electrolytes | 10.13% | 13,169.0 | 146,401.1 | 30.68% | 9.45% |

| Separators | 3.10% | 4,030.0 | 49,575.0 | 32.16% | 3.20% |

| Current Collectors | 1.87% | 2,431.0 | 30,984.4 | 32.68% | 2.00% |

| Protective Coatings & Interlayers | 1.40% | 1,820.0 | 36,871.4 | 39.69% | 2.38% |

Cathode Chemistry Insights

How did the Lithium Nickel Manganese Cobalt Oxide Segment hold the Largest Share of the Lithium Metal Battery Materials Market?

The lithium nickel manganese cobalt oxide (NMC) segment held the largest share of approximately 34% share in the lithium metal battery materials market in 2025. The strong focus on enhancing the thermal stability of batteries and boosting the energy storage of batteries requires NMC. The increased adoption of electric cars and the high adoption rate of smartphones require NMC. The growth in the utilization of power tools requires NMC. The high energy density, improved stability, balanced performance, and reasonable safety of NMC drives the overall growth of the market.

The lithium sulfur (Li-S) segment is experiencing the fastest growth in the market during the forecast period. The focus on minimizing battery production cost and increasing the use of lightweight materials in the defense sector boosts the adoption of Li-S. The production of renewable energy storage and focus on decarbonization goals increase the adoption of Li-S. The abundance, sustainability, and low cost of lithium sulfur support the overall growth of the market.

Electrolyte Type Insights

Why the Liquid Electrolytes Segment Dominates the Lithium Metal Battery Materials Market?

The liquid electrolytes segment dominated the lithium metal battery materials market with approximately 46% share in 2025. The cost-efficiency, excellent ionic conductivity, and high scalability of liquid electrolytes help market expansion. The growing use of batteries in electronic devices requires liquid electrolytes. The superior electrode wettability and formulation flexibility of liquid electrolytes drive the overall growth of the market.

The solid-state electrolytes segment is the fastest-growing in the market during the forecast period. The increased utilization of grid storage and the rising popularity of electric vehicles increase demand for solid-state electrolytes. The enhanced safety, longer stability, and high energy storage capacity of solid-state electrolytes help market expansion. The superior safety, faster charging, and extended lifespan of solid-state electrolytes support the overall market growth.

Battery Type Insights

How did the Rechargeable Lithium Metal Batteries Segment hold the Largest Share of the Lithium Metal Battery Materials Market?

The rechargeable lithium metal batteries segment held the largest share of approximately 41% share in the lithium metal battery materials market in 2025. The growing demand for longer-range EVs and increased use of laptops increases demand for rechargeable lithium metal batteries. The ongoing development of portable gadgets and government support for green technology require rechargeable lithium metal batteries. The high capacity and higher energy storage of rechargeable lithium metal batteries drive the overall market growth.

The solid-state lithium metal batteries segment is experiencing the fastest growth in the market during the forecast period. The growing need for faster charging in electric vehicles and focus on higher durability of batteries increases the adoption of solid-state lithium metal batteries. The increasing use of implantable medical devices and the huge demand for efficient storage systems require solid-state lithium metal batteries. The focus on the utilization of clean energy resources and expanding the automotive sector requires solid-state lithium metal batteries, supporting the overall market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the Lithium Metal Battery Materials Market?

The automotive and transportation segment dominated the lithium metal battery materials market with approximately 42% share in 2025. The stricter emission regulations in the automotive industry and consumer transition towards electric vehicles increase demand for lithium metal battery materials. The expanding charging infrastructure of EVs and the rise in manufacturing of electric cars require lithium metal battery materials. The rapid growth in the utilization of hybrid vehicles and strong government backing for electric mobility create demand for lithium metal battery materials, driving the overall market growth.

The energy & utilities segment is the fastest-growing in the market during the forecast period. The huge generation of wind energy and a focus on a balanced supply of electricity increase demand for lithium metal battery materials. The increased utilization of solar power in the residential sector and focus on lowering carbon emissions increase the adoption of lithium metal battery materials. The growing installation of renewable energy in large-scale projects supports the overall market growth.

Regional Insights

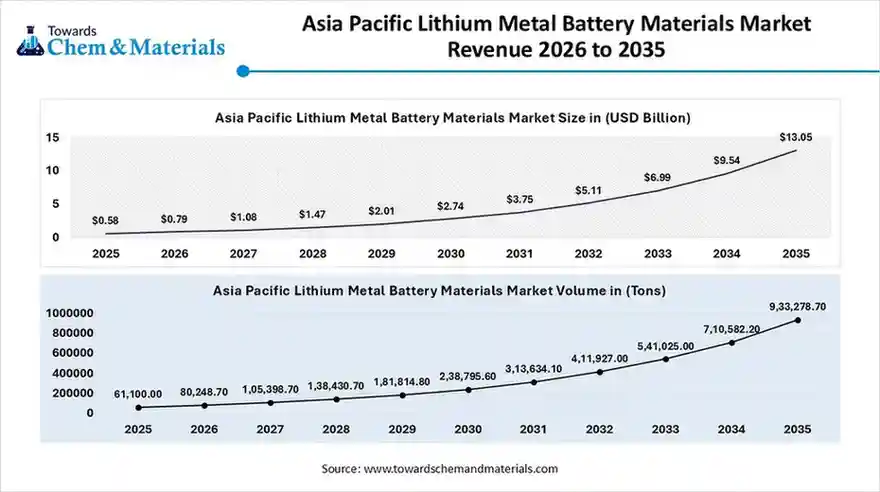

The Asia Pacific lithium metal battery materials market size was valued at USD 0.58 billion in 2025 and is expected to be worth around USD 13.05 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 36.53% over the forecast period from 2026 to 2035.

The Asia Pacific lithium metal battery materials market volume was estimated at 61,100.0 million tons in 2025 and is projected to reach 933,278.7 million tons by 2035, growing at a CAGR of 31.34% from 2026 to 2035.

Asia Pacific dominated the lithium metal battery materials market with approximately 47.00% share in 2025. The significant presence of lithium reserves and the higher adoption rate of electric vehicles help market expansion. The increased production of smart electronic devices and the rise in the development of renewable energy storage increase demand for lithium metal battery materials. The government incentives for EV production and a strong base for the extraction of raw materials drive the overall growth of the market.

Energy Storage: China’s Role in Lithium Metal Battery Materials Production

China is a major contributor to the market. The well-developed EV charging infrastructure and growing production of batteries help market expansion. The massive presence of data centers and government supportive policies for new energy vehicles increases demand for lithium metal battery materials. The strong growth in the development of renewable energy projects and the increasing use of LFP batteries support the overall market growth.

- China exported 5,244 shipments of electrolyte.

Lithium Metal Battery Materials Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 29.04% | 37,752.0 | 420,148.0 | 30.70% | 27.12% |

| Europe | 18.13% | 23,569.0 | 340,983.0 | 34.57% | 22.01% |

| Asia Pacific | 47.00% | 61,100.0 | 710,626.5 | 31.34% | 45.87% |

| Latin America | 3.12% | 4,056.0 | 49,110.2 | 31.93% | 3.17% |

| Middle East & Africa | 2.71% | 3,523.0 | 28,350.7 | 26.07% | 1.83% |

Europe Lithium Metal Battery Materials Market Trends

Europe is experiencing the fastest growth in the market during the forecast period. The ongoing electrification of transport vehicles and shift towards the utilization of renewable energy resources increase demand for lithium metal battery materials. The government backing for raw material production and well-established hard-lock lithium deposits boost market expansion. The increasing investment in the development of battery manufacturing plants and the focus on lowering the import of batteries from Asian battery producers drive the overall market growth.

Germany at the Centre of Lithium Metal Battery Materials Innovation

Germany is a key contributor to the market. The rapid electrification of the automotive industry and government subsidies for the manufacturing of batteries increase demand for lithium metal battery materials. The strong focus on automation of electronics and the increasing need for energy storage create demand for lithium metal battery materials. The development of advanced anodes and material processing expansion supports the overall growth of the market.

North America Lithium Metal Battery Materials Market Trends

North America is growing at a notable rate in the market. The strong consumer interest in electric vehicles and the huge demand for grid-scale energy storage increase the adoption of lithium metal battery materials. The well-established cell production facilities and focus on lowering dependence on battery materials help the expansion of the market. The ongoing technological advancement in lithium extraction and increasing investment in recycling facilities support the overall growth of the market.

Presence of Lithium Metal Battery Materials in the United States

The United States is rapidly growing in the market. The government initiatives for battery component manufacturing and focus on the security of energy increase demand for lithium metal battery materials. The rapid expansion of battery storage projects and consumer electronics development requires lithium metal battery materials. The increased production of solid-state batteries and advanced battery recycling infrastructure supports the overall growth of the market.

Middle East & Africa Lithium Metal Battery Materials Market Trends

The Middle East & Africa are growing in the market. The increasing investment in the development of battery plants and the surging growth of solar energy projects increase demand for lithium metal battery materials. The increased sales of electric vehicles and advancements in battery technology require lithium metal battery materials. The expanding BESS and the surge in the development of smart city projects require lithium metal battery materials, driving the overall growth of the market.

Saudi Arabia’s Rise in Lithium Metal Battery Materials Manufacturing

Saudi Arabia is growing at a significant rate in the market. The rise in production of electric vehicles and the growing interest in wind energy projects create a huge demand for lithium metal battery materials. The increasing investment in EV charging bases and the focus on domestic battery production increase demand for lithium metal battery materials. The growing development of lithium hydroxide plants supports the overall market growth.

South America Lithium Metal Battery Materials Market Trends

South America is growing substantially in the market. The increasing use of portable electronic devices and the increasing use of cleaner energy resources create demand for lithium metal battery materials. The strong focus on energy transition and rapid electrification of vehicles requires lithium metal battery materials. The abundance of lithium sources and the cost-effective extraction process drive the market growth.

Next-Gen Batteries: Brazil’s Contribution to Lithium Metal Battery Materials

Brazil is growing significantly in the market. The government's investment in electric vehicles and the higher need for energy storage increase demand for lithium metal battery materials. The growing investment from companies like BYD in the mining of lithium and the richness of lithium deposits support the overall growth of the market.

Recent Developments

- In April 2025, Lyten started production of battery-grade lithium-metal in the United States. The batteries are widely used in applications like EVs, satellites, defense, energy storage, micromobility, and drones.(Source: lyten.com)

- In April 2025, Chinese and Finnish firms launched Finland’s cathode active material (CAM) plant. The annual production capacity of the plants is 60000 tonnes and is located in Kotka city. The project supports the clean energy transition and offers CAM for battery production.(Source: english.news.cn)

- In October 2025, Steller, a European project, launched anode foil production for lithium metal batteries. The per-year capacity of the plant is 60 kilometers, and anodes are useful for batteries like Gen 4b/4c/5.(Source: www.electrive.com)

Top Companies List

- Albemarle Corporation:- The specialty chemicals company supplies high-purity lithium hydroxide & lithium carbonate and manufactures advanced battery material for electric vehicles.

- SQM (Sociedad Química y Minera de Chile):- The company is the leading producer of lithium hydroxide & lithium carbonate and supports the development of lithium-metal batteries and lithium-ion batteries.

- Livent Corporation:- The company develops high-purity lithium metal for the production of lithium-ion batteries, aerospace materials, and non-rechargeable batteries.

- Ganfeng Lithium Co., Ltd.:- The company is a leading manufacturer of battery-grade lithium metal to serve diverse industrial applications like consumer electronics, electric vehicles, and energy storage.

- Tianqi Lithium Corporation:- The energy materials company develops products like lithium hydroxide, anhydrous lithium chloride, lithium carbonate, and lithium metal to support industries like energy storage and electric vehicles.

Top Lithium Metal Battery Materials Market Companies List

- Livent Corporation

- Tianqi Lithium Corporation

- Ganfeng Lithium Co., Ltd.

- SQM (Sociedad Química y Minera de Chile)

- Albemarle Corporation

- Umicore

- BASF SE

- POSCO Chemical

- Mitsubishi Chemical Group

- Toray Industries, Inc.

- Sumitomo Metal Mining Co., Ltd.

- Johnson Matthey

- LG Chem

- Panasonic Holdings Corporation

- Samsung SDI

- CATL (Contemporary Amperex Technology Co., Limited)

- Solid Power, Inc.

- QuantumScape Corporation

- SES AI Corporation

- Ilika plc

Segments Covered

By Material Type

- Lithium Metal Foils & Anodes

- Cathode Active Materials

- Electrolytes

- Separators

- Current Collectors

- Protective Coatings & Interlayers

By Cathode Chemistry

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lithium Sulfur (Li–S)

- Lithium Cobalt Oxide (LCO)

- High-Nickel & Advanced Cathode Materials

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel & Hybrid Electrolytes

- Polymer Electrolytes

- Sulfide-Based Electrolytes

- Oxide-Based Electrolytes

By Battery Type

- Lithium Metal Primary Batteries

- Rechargeable Lithium Metal Batteries

- Solid-State Lithium Metal Batteries

- Lithium–Sulfur Batteries

- Lithium–Air (Li–O₂) Batteries

By End-Use Industry

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics OEMs

- Energy & Utilities

- Healthcare & Medical Devices

Industrial Manufacturing

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa