Content

What is the Current Petrochemical Recycling Market Size and Volume?

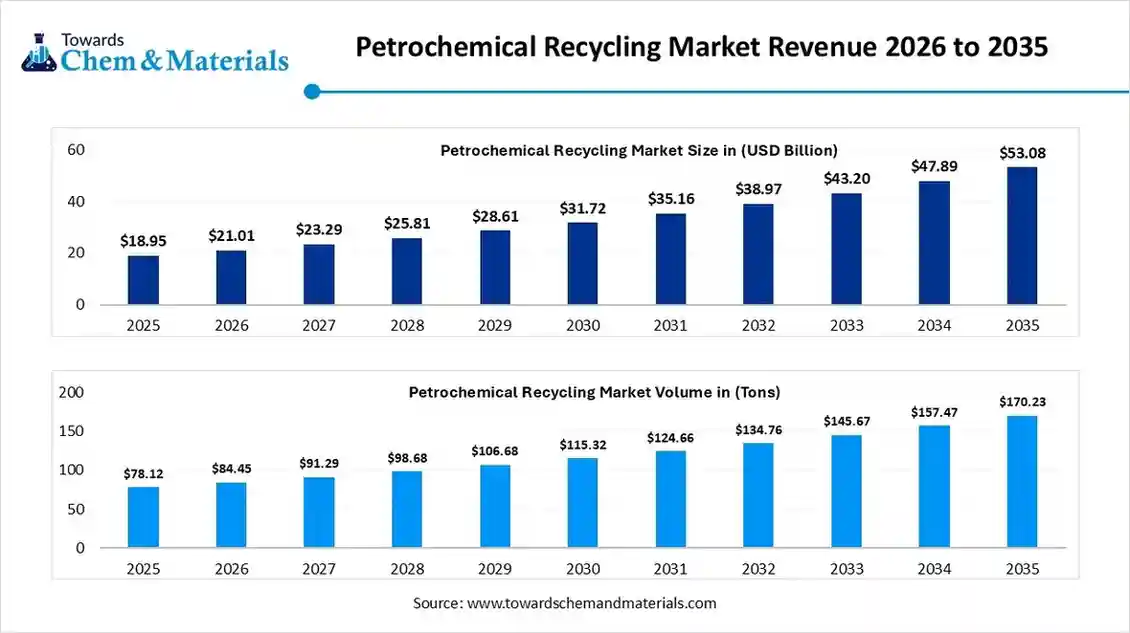

The global petrochemical recycling market size was estimated at USD 18.95 billion in 2025 and is expected to increase from USD 21.01 billion in 2026 to USD 53.08 billion by 2035, growing at a CAGR of 10.85% from 2026 to 2035.

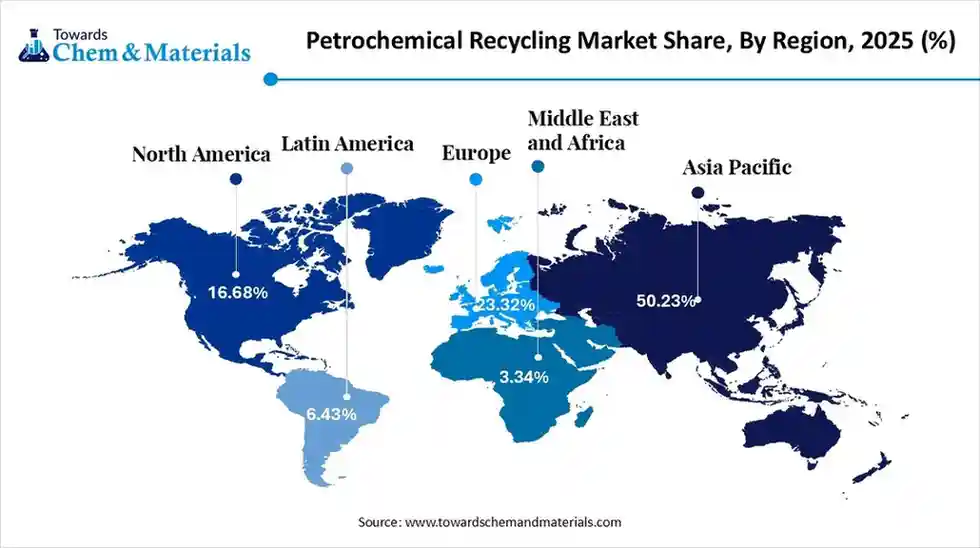

The global petrochemical recycling market volume was approximately 78.12 million tons in 2025 and is projected to reach approximately 170.23 million tons by 2035 growing at a CAGR of 8.10% from 2026 to 2035. Asia Pacific dominated the petrochemical recycling market with the largest volume share of 50% in 2025. The growth of the market is driven by the urgent plastic waste crisis, strict government regulations & circular economy goals, growing consumer demand for sustainability, and corporate commitments.

Key Takeaways

- By region, Asia Pacific led the petrochemical recycling market with the largest volume share of over 50% in 2025. The growing support and sustainability initiatives drive the growth.

- By region, North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growing adoption and awareness fuel growth.

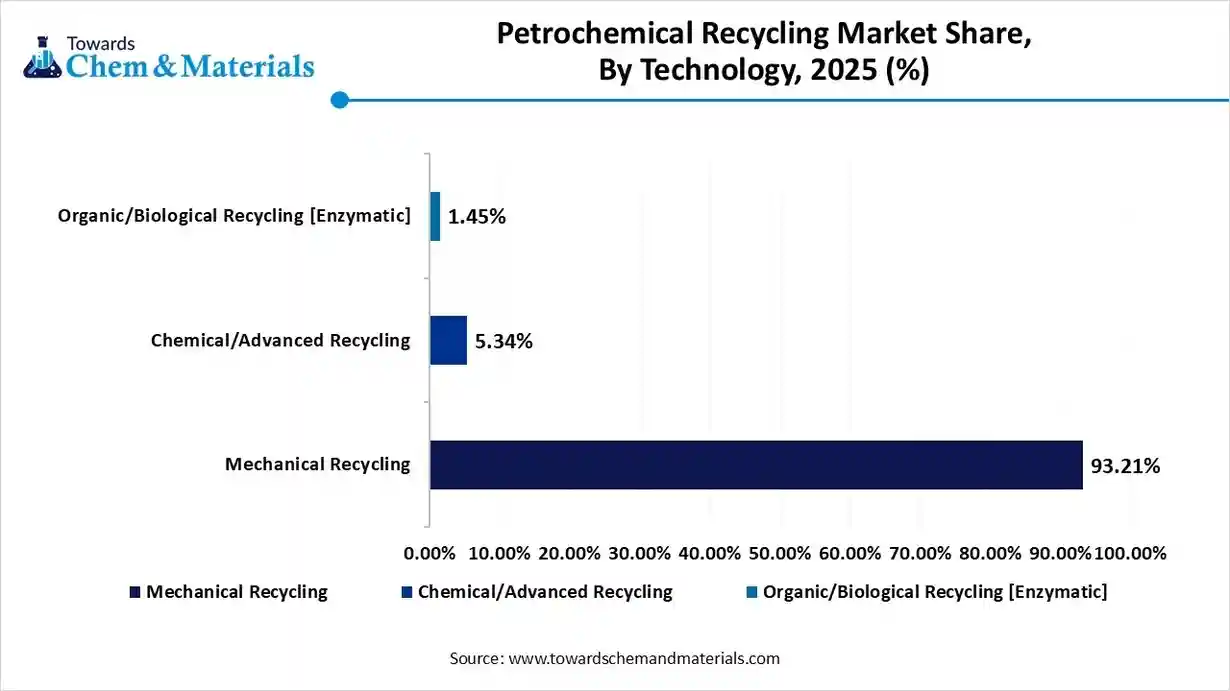

- By technology, the mechanical recycling segment led the market with the largest volume share of 93% in 2025. It is cost-effective and widely used for relatively clean driving growth.

- By technology, the chemical/advanced recycling segment is projected to grow at a CAGR between 2026 and 2035. Growing demand for circular feedstocks and regulatory support drives growth.

- By chemical process, the pyrolysis segment led the market with the largest volume share of 40% in 2025. Pyrolysis is gaining traction due to its ability to handle mixed plastic waste streams.

- By chemical process, the depolymerization segment is projected to grow at a CAGR between 2026 and 2035. Increasing brand commitments to closed-loop recycling are driving the adoption.

- By feedstock polymer, the polyethylene segment accounted for the largest volume share of 42% in 2025. Its high usage in packaging and consumer products increases the demand.

- By feedstock polymer, the mixed plastic waste segment is projected to grow at a CAGR between 2026 and 2035. This helps in reducing landfills, which increases the growth of the market.

- By application, the chemical feedstock segment dominated with the largest volume share of 45% in 2025. Growing regulatory pressure to reduce carbon intensity is encouraging petrochemical producers to adopt recycled feedstocks.

- By application, the new polymer production segment is projected to grow at a CAGR between 2026 and 2035. Brand-owner sustainability commitments and recycled content mandates are accelerating demand.

- By end-use industry, the packaging segment dominated the market and accounted for the largest volume share of 38% in 2025, increasingly used in flexible and rigid packaging, supporting the circular economy.

- By end-use industry, the textiles and apparel segment is projected to grow at a CAGR between 2026 and 2035. Rising demand for sustainable fashion and circular textiles is driving adoption.

Market Overview

What is the significance of the Petrochemical Recycling Market?

The petrochemical recycling market is significant as it addresses the plastic waste crisis, promotes a circular economy, reduces reliance on virgin fossil fuels, and meets growing demand for high-quality recycled content, enabling industries like packaging, automotive, and electronics to achieve sustainability goals through advanced chemical recycling that breaks down plastics into base chemicals for new products. It's crucial for sustainable growth, cutting emissions, and securing material supply chains.

Petrochemical Recycling Market Growth Trends:

- Environmental Pressure: Rising plastic pollution and government mandates (Extended Producer Responsibility) are forcing sustainable solutions.

- Technological Advancement: Chemical recycling (pyrolysis, gasification) handles mixed/contaminated plastics that mechanical recycling can't, creating high-quality outputs.

- Policy Support: Supportive regulations and producer responsibility schemes boost demand for recycled content.

- Demand for Circularity: Industries seek ways to close the loop, with petrochemical recycling offering a scalable alternative to landfilling/incineration

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 21.01 Billion / 84.45 Million tons |

| Revenue Forecast in 2035 | USD 53.08 Billion / 170.23 Million Tons |

| Growth Rate | CAGR 10.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Technology, By Chemical Recycling Process, By Feedstock Polymer Type, By Application, By End-Use Industry, By Region |

| Key companies profiled | Quantafuel (Norway/USA), Mura Technology (UK), Nexus Circular (Canada/Global), Plastic Energy (UK/USA/Global), BASF SE , Agilyx Corporation (USA), SABIC (Saudi Basic Industries Corporation) , Dow Inc., ExxonMobil Corporation, LyondellBasell Industries N.V. , Shell plc ,Eastman Chemical Company , INEOS Group, Neste Corporation , TotalEnergies SE , Indorama Ventures Public Company Limited , Chevron Phillips Chemical Company , Reliance Industries Limited , Braskem S.A. , LG Chem, Ltd. , SK Geo Centric (SK Innovation) , Borealis AG , Brightmark LLC , PureCycle Technologies, Inc |

Key Technological Shifts In The Petrochemical Recycling Market:

The petrochemical recycling market is undergoing a significant transformation driven by the rise of the circular economy, stringent environmental regulations, and innovations in advanced recycling methods. The key technological shifts include a transition from traditional mechanical recycling to advanced (chemical) recycling technologies and widespread digitalization of the value chain.

- The market involves the industrial-scale processes used to convert plastic waste and hydrocarbon residues back into basic chemical building blocks, monomers, or liquid feedstocks (such as pyrolysis oil or syngas).

Trade Analysis Of Petrochemical Recycling Market: Import & Export Statistics

- According to India Export data, India shipped 28 shipments of Petrochemicals via 7 Indian exporters to 9 buyers. Most of these exports go to the United States, Kenya, and Vietnam.

- Globally, the leading petrochemical exporters are Vietnam, Malaysia, and China. Vietnam tops the list with 6,941shipments, followed by Malaysia with 902 shipments and China with 599 shipments.

- According to Global Export data, from June 2024 to May 2025 (TTM), the world exported 3,401 shipments of Petrochemicals.

- These exports handled by 102 exporters to 133 buyers, representing a 22% increase over the previous twelve months. The main destinations for global Petrochemicals exports are Vietnam, the United States, and Uzbekistan.

Petrochemical Recycling Market Value Chain Analysis

- Recycling Technology and Processing: Petrochemical recycling involves processes such as plastic waste collection and sorting, depolymerization, pyrolysis, gasification, solvent-based purification, and chemical conversion to recover monomers and hydrocarbon feedstocks suitable for new petrochemical production.

- Key players: BASF SE, SABIC, Eastman Chemical Company, ExxonMobil Chemical

- Quality Testing and Certification :Petrochemical recycling operations require certifications ensuring feedstock traceability, recycled content validation, process safety, and environmental compliance. Key certifications include ISCC PLUS, ISO 14001 environmental management standards, mass balance certification, and REACH compliance.

- Key players: ISCC (International Sustainability and Carbon Certification), ISO (International Organization for Standardization), TÜV SÜD, UL Solutions

- Distribution to Industrial Users: Recycled petrochemical feedstocks and polymers are supplied to packaging manufacturers, automotive OEMs, consumer goods producers, construction material manufacturers, and chemical processors seeking circular economy solutions.

- Key players: LyondellBasell Industries, Dow Inc., Covestro AG.

Petrochemical Recycling Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA & Canada) | U.S. EPA; U.S. DOE; Environment and Climate Change Canada (ECCC); State Environmental Agencies (e.g., CalRecycle) | Resource Conservation and Recovery Act (RCRA), EPA National Recycling Strategy, Clean Air Act / Clean Water Act State-level recycled content mandates (e.g., California) Canada Clean Fuel Standard (CFS) |

Classification of recycled petrochemical streams Permitting for pyrolysis/chem recycling facilities Air, water emissions & hazardous waste management Incentives for low-carbon feedstocks |

RCRA influences whether process residues/outputs are waste or product, affecting permitting and cost. EPA’s National Recycling Strategy supports chemical recycling infrastructure. State mandates (e.g., California) incentivize recycled content in plastics. |

| Europe | European Commission; ECHA; European Environment Agency (EEA); Member State Environment Authorities | EU Waste Framework Directive REACH Regulation, Packaging & Packaging Waste Regulation (PPWR), Industrial Emissions Directive (IED) |

Waste hierarchy + chemical recycling recognition Registration & hazard classification of recycled outputs Permitting & Best Available Techniques (BAT) for recycling facilities | The EU is actively defining chemical recycling as recycling under the Waste Framework Directive amendments, which affects counting towards recycling targets. REACH applies to recycled polymers and monomer streams. |

| Asia Pacific | China Ministry of Ecology & Environment (MEE); National Development and Reform Commission (NDRC); Japan METI/MOE; India MoEFCC/CPCB; Korean MoE | China Cleaner Production & Solid Waste Laws Japan Waste Management & Public Cleansing Law, India Plastic Waste Management Rules (PWM) Korea Waste Control Act / K-REACH |

Recognition of chemical recycling pathways Permitting & environmental compliance for reactors Hazardous by-product management Industry standards for recycled resin quality |

China and Japan are drafting clearer frameworks for chemical recycling; India’s PWM Rules & K-REACH affect polymer feedstock handling and hazard reporting. |

| South America | Brazil IBAMA / ANTT; Argentina Ministry of Environment; Chile Ministry of Environment | National Solid Waste Policies Waste & Recycling Laws; emerging chemical recycling guidelines |

Permitting for recycling and by-product handling, Waste characterization & emissions | Brazil’s National Solid Waste Policy supports recycling infrastructure, but chemical recycling regulatory details are still emerging. South American frameworks often follow EU/OECD best practices |

| Middle East & Africa | UAE Ministry of Climate Change & Environment (MOCCAE); Saudi SASO; South African DFFE | National Environmental Regulations: Emerging plastic waste reduction initiatives | Permitting & environmental compliance Pilot chemical recycling / plastic initiatives |

Gulf states and South Africa are developing policies to encourage recycling infrastructure; chemical recycling rules are nascent and often aligned with broad environmental laws. |

Segmental Insights

Technology Insights

How Did The Mechanical Recycling Segment Dominate The Petrochemical Recycling Market In 2025?

The mechanical recycling segment dominated the market with a share of 93% in 2025. Mechanical recycling remains the most established technology in the market, involving sorting, washing, shredding, and reprocessing plastic waste into secondary raw materials. It is cost-effective and widely used for relatively clean, single-polymer streams such as PET and HDPE. However, polymer degradation and limited output quality restrict its use in high-performance applications.

The chemical/advanced recycling segment is projected to grow at a CAGR between 2026 and 2035 in the market. Chemical or advanced recycling technologies convert plastic waste back into monomers or basic chemicals through thermal or catalytic processes. This method enables the processing of mixed, contaminated, or multilayer plastics unsuitable for mechanical recycling. Growing demand for circular feedstocks and regulatory support for recycled content are accelerating investments in chemical recycling infrastructure.

Petrochemical Recycling Market Volume and Share, By Technology, 2025 (%)

| By Technology | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Mechanical Recycling | 93.21% | 72.82 | 153.82 | 7.77% | 90.36% |

| Chemical/Advanced Recycling | 5.34% | 4.17 | 12.46 | 11.56% | 7.32% |

| Organic/Biological Recycling [Enzymatic] | 1.45% | 1.13 | 3.95 | 7.10% | 2.32% |

| Total | 100.00% | 78.12 | 170.23 | 8.10% | 100.00% |

Chemical Process Insights

Which Chemical Process Segment Dominates The Petrochemical Recycling Market In 2025?

The pyrolysis segment dominated the market with a share of 40% in 2025. Pyrolysis involves thermally decomposing plastic waste in an oxygen-free environment to produce pyrolysis oil, gas, and char. The oil can be used as a petrochemical feedstock or refined into fuels. Pyrolysis is gaining traction due to its ability to handle mixed plastic waste streams and its compatibility with existing refinery and cracker infrastructure.

The depolymerization segment is projected to grow at a CAGR between 2026 and 2035 in the market. Depolymerization chemically breaks polymers into their original monomers using solvents, heat, or catalysts. This process is particularly effective for condensation polymers such as PET and nylon, producing high-purity monomers suitable for virgin-grade polymer production. Increasing brand commitments to closed-loop recycling are driving the adoption of depolymerization technologies globally.

Feedstock Polymer Insights

How Did The Feedstock Polymer Segment Dominate The Petrochemical Recycling Market In 2025?

The polyethylene segment dominated the market with a share of 42% in 2025. Polyethylene is a dominant feedstock in petrochemical recycling due to its high usage in packaging and consumer products. Recycling polyethylene into chemical feedstocks supports the production of new polymers with reduced fossil dependency. Advances in chemical recycling technologies are improving the conversion efficiency of polyethylene waste into high-value hydrocarbons.

The mixed plastic waste segment is projected to grow at a CAGR between 2026 and 2035 in the market. Mixed plastic waste represents a significant opportunity for petrochemical recycling, as it includes multilayer and contaminated plastics typically excluded from mechanical recycling. Chemical recycling processes such as pyrolysis and gasification are particularly suited for this feedstock, helping reduce landfill volumes while enabling material recovery from complex waste streams.

Application Insights

Which Application Segment Dominates The Petrochemical Recycling Market In 2025?

The chemical feedstock segment dominated the market with a share of 45% in 2025. Recycled outputs from petrochemical recycling are increasingly used as chemical feedstocks for steam crackers and refineries. This application supports the production of basic chemicals such as ethylene and propylene, enabling circular material flows. Growing regulatory pressure to reduce carbon intensity is encouraging petrochemical producers to adopt recycled feedstocks.

The new polymer production segment is projected to grow at a CAGR between 2026 and 2035 in the market. Petrochemical recycling enables the production of new polymers with properties comparable to virgin materials. Recycled monomers and oils are integrated into polymerization processes to manufacture plastics for demanding applications. Brand-owner sustainability commitments and recycled content mandates are accelerating demand for polymers derived from recycled petrochemical inputs.

End-Use Industry Insights

How Did The Packaging Segment Dominate The Petrochemical Recycling Market In 2025?

The packaging segment dominated the market with a share of 38% in 2025. The packaging industry is the largest end user of petrochemical recycling outputs due to high plastic consumption and regulatory pressure for recycled content. Food-grade and high-quality recycled polymers produced via chemical recycling are increasingly used in flexible and rigid packaging, supporting circular economy targets and reducing reliance on virgin plastics.

The textiles and apparel segment is projected to grow at a CAGR between 2026 and 2035 in the market. In the textile and apparel industry, petrochemical recycling supports the production of recycled synthetic fibers such as polyester and nylon. Chemical recycling allows the recovery of monomers from complex textile waste, including blended fabrics. Rising demand for sustainable fashion and circular textiles is driving adoption across global apparel value chains.

Regional Insights

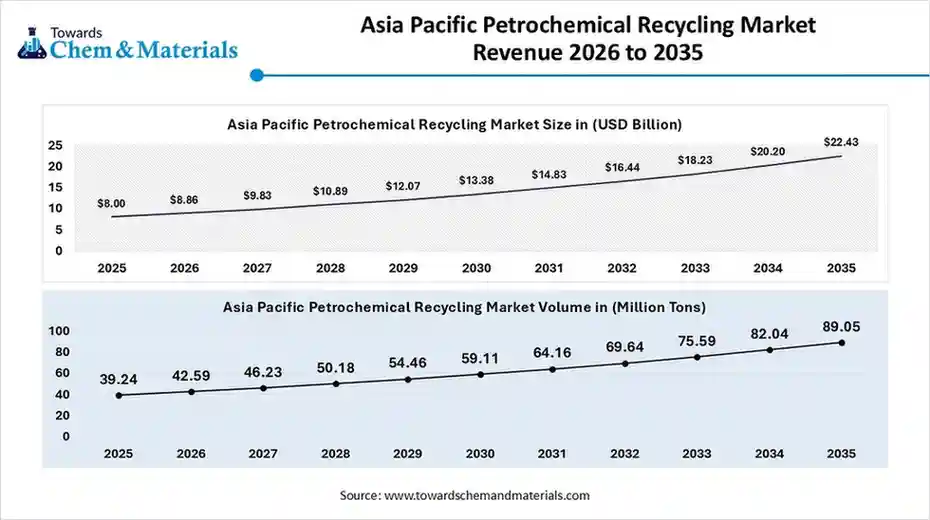

The Asia Pacific petrochemical recycling market size was valued at USD 8.00 billion in 2025 and is expected to be worth around USD 22.43 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 10.87% over the forecast period from 2026 to 2035.

The Asia Pacific petrochemical recycling market volume was estimated at 39.24 million tons in 2025 and is anticipated to reach 89.05 million tons by 2035, growing at a CAGR of 8.54% from 2026 to 2035.

Asia Pacific dominated the market with a share of 50% in 2025. Asia Pacific is the fastest-growing petrochemical recycling market, supported by rising plastic consumption, increasing waste generation, and evolving regulatory frameworks. The region is witnessing growing adoption of chemical recycling to complement mechanical recycling, particularly for multilayer plastics and contaminated waste streams.

China: Petrochemical Recycling Market Growth Trends

China’s market is expanding rapidly as the country strengthens plastic waste regulations and promotes circular manufacturing. Investments in pyrolysis and solvent-based recycling technologies are increasing, supported by domestic petrochemical giants seeking recycled feedstock to reduce dependence on virgin fossil-based raw materials.

North America Petrochemical Recycling Market Growth Is Driven By The Strong Regulatory Presence

North America expects the fastest growth in the market during the forecast period. North America represents a mature and innovation-driven petrochemical recycling market, supported by strong regulatory pressure on plastic waste reduction and rising corporate sustainability commitments. The region leads in advanced recycling technologies such as pyrolysis, depolymerization, and gasification, driven by investments from major petrochemical producers and circular economy initiatives.

United States: Petrochemical Recycling Market Growth Trends

The U.S. market is driven by large-scale pilot and commercial projects focused on chemical recycling of mixed and hard-to-recycle plastics. Strong participation from oil & gas majors, favorable state-level incentives, and growing demand for recycled feedstock in packaging and automotive applications are accelerating market expansion.

Europe Petrochemical Recycling Market: Stringent Environmental Regulations Drive Growth.

Europe is a global leader in petrochemical recycling due to stringent environmental regulations, extended producer responsibility (EPR) frameworks, and ambitious EU circular economy targets. The region emphasizes chemical recycling integration with existing petrochemical infrastructure, supporting recycled content mandates across packaging, consumer goods, and industrial applications.

Germany: Petrochemical Recycling Market Growth Trends

Germany plays a central role in Europe’s petrochemical recycling market, driven by advanced waste collection systems and strong R&D capabilities. The country hosts multiple chemical recycling demonstration plants and collaborations between recyclers and chemical companies, focusing on closed-loop recycling and feedstock recovery for high-value polymers.

South America Petrochemical Recycling Market: Improved and Developed Infrastructure Drives Growth

South America’s market is emerging, driven by increasing awareness of plastic pollution and gradual regulatory developments. The region is exploring chemical recycling as a solution for low-quality plastic waste, with pilot projects gaining traction alongside improving waste management infrastructure.

Brazil: Petrochemical Recycling Market Growth Trends

Brazil leads the South American market due to its large plastic consumption base and expanding recycling ecosystem. Growing collaboration between petrochemical companies, recyclers, and packaging brands is supporting investments in advanced recycling technologies to meet sustainability and recycled-content commitments.

Middle East & Africa Petrochemical Recycling Market: Large Production Capacity Drives The Growth

The Middle East & Africa region is at a nascent stage in petrochemical recycling but shows strong long-term potential due to its large petrochemical production capacity. Governments and national oil companies are increasingly investing in advanced recycling to support circular economy goals and diversify feedstock sources.

Saudi Arabia: Petrochemical Recycling Market Growth Trends

Saudi Arabia is emerging as a key market for petrochemical recycling, driven by national sustainability strategies and investments from major petrochemical producers. The country is focusing on chemical recycling technologies integrated with existing refining and petrochemical complexes to convert plastic waste into valuable feedstocks.

Petrochemical Recycling Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 16.68% | 13.03 | 32.92 | 10.85% | 19.34% |

| Europe | 23.32% | 18.22 | 37.98 | 8.50% | 22.31% |

| Asia Pacific | 50.23% | 39.24 | 82.07 | 8.54% | 48.21% |

| South America | 6.43% | 5.02 | 12.14 | 10.30% | 7.13% |

| Middle East & Africa | 3.34% | 2.61 | 5.12 | 7.79% | 3.01% |

Recent Developments

- In August 2025, Tubis expanded its presence in German chemical recycling by launching its first commercial-scale pyrolysis facility. Tubis also broke ground on a second facility at the same time.(Source: www.chemanalyst.com)

- In June 2025, INEOS Olefins & Polymers launched its first commercial-scale production of virgin-quality recycled plastics in Lavera, southern France. The product launched is called pyrolysis oil, which will be used to manufacture recycled polymers.(Source: www.hydrocarbonengineering.com)

- In September 2025, SATORP, a joint venture of Saudi Aramco and TotalEnergies, signed a 30-year agreement with a consortium led by Marafiq, Veolia, and Lamar to create the Middle East's largest industrial water recycling initiative in Jubail Industrial City.(Source: www.zawya.com)

- In June 2025, Versalis, Eni's chemical company, launched its first demonstration plant for the chemical recycling of mixed plastic waste at its site in Mantua, Italy.(Source: www.reuters.com)

Top players in the Petrochemical Recycling Market & Their Offerings:

- Plastic Energy (UK/USA/Global): Plastic Energy specializes in advanced chemical recycling technologies that convert mixed plastic waste into TACOIL™ feedstock a raw material suitable for repolymerization into new polymers such as polyethylene (PE) and polypropylene (PP). The company operates multiple facilities and partners with global resin producers to scale circular supply chains.

- Agilyx Corporation (USA): Agilyx develops proprietary depolymerization technology to convert difficult-to-recycle plastics (such as polystyrene and mixed polyolefins) into high-quality pyrolysis oils and monomers. Its outputs serve as feedstocks for new plastic production while reducing reliance on virgin fossil resources.

- Quantafuel (Norway/USA): Quantafuel uses catalytic conversion and pyrolysis technologies to transform mixed plastic waste into synthetic oils and intermediates. Its outputs are utilized in repolymerization and industrial chemical applications.

- Mura Technology (UK): Mura’s HydroPRS™ technology uses hydrothermal processing to break down mixed plastics into circular feedstocks. These are then supplied to polymer producers to reduce reliance on fossil feedstocks and support sustainable manufacturing.

- Nexus Circular (Canada/Global): Nexus Circular provides advanced recycling solutions that recover monomers and recycled feedstocks from polyolefin and PET waste. Its technologies support closed-loop recycling and integrated circular plastics strategies.

Other Top Players Are

- Quantafuel (Norway/USA)

- Mura Technology (UK)

- Nexus Circular (Canada/Global)

- Plastic Energy (UK/USA/Global)

- BASF SE

- Agilyx Corporation (USA)

- SABIC (Saudi Basic Industries Corporation)

- Dow Inc.

- ExxonMobil Corporation

- LyondellBasell Industries N.V.

- Shell plc

- Eastman Chemical Company

- INEOS Group

- Neste Corporation

- TotalEnergies SE

- Indorama Ventures Public Company Limited

- Chevron Phillips Chemical Company

- Reliance Industries Limited

- Braskem S.A.

- LG Chem, Ltd.

- SK Geo Centric (SK Innovation)

- Borealis AG

- Brightmark LLC

- PureCycle Technologies, Inc

Segments Covered

By Technology

- Mechanical Recycling

- Chemical/Advanced Recycling

- Organic/Biological Recycling (Enzymatic)

By Chemical Recycling Process

- Pyrolysis (Thermal and Catalytic)

- Gasification

- Depolymerization (Chemolysis/Hydrolysis/Glycolysis)

- Solvolysis (Solvent-based Dissolution)

- Hydrocracking

By Feedstock Polymer Type

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Mixed Plastic Waste (Multi-layer and Contaminated)

By Application

- Chemical Feedstock (Naphtha, Aromatics, Olefins)

- New Polymer Production (Circular Plastics)

- Fuel Production (Diesel, Gasoline, Marine Fuels)

- Waxes and Specialty Chemicals

By End-Use Industry

- Packaging

- Food and Beverage Packaging

- Consumer Goods Packaging

- Industrial Packaging

- Automotive and Transportation

- Building and Construction

- Electronics and Electrical

- Textiles and Apparel

- Healthcare and Pharmaceuticals

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa