Content

What is the Current Europe Ethanol Market Size and Share?

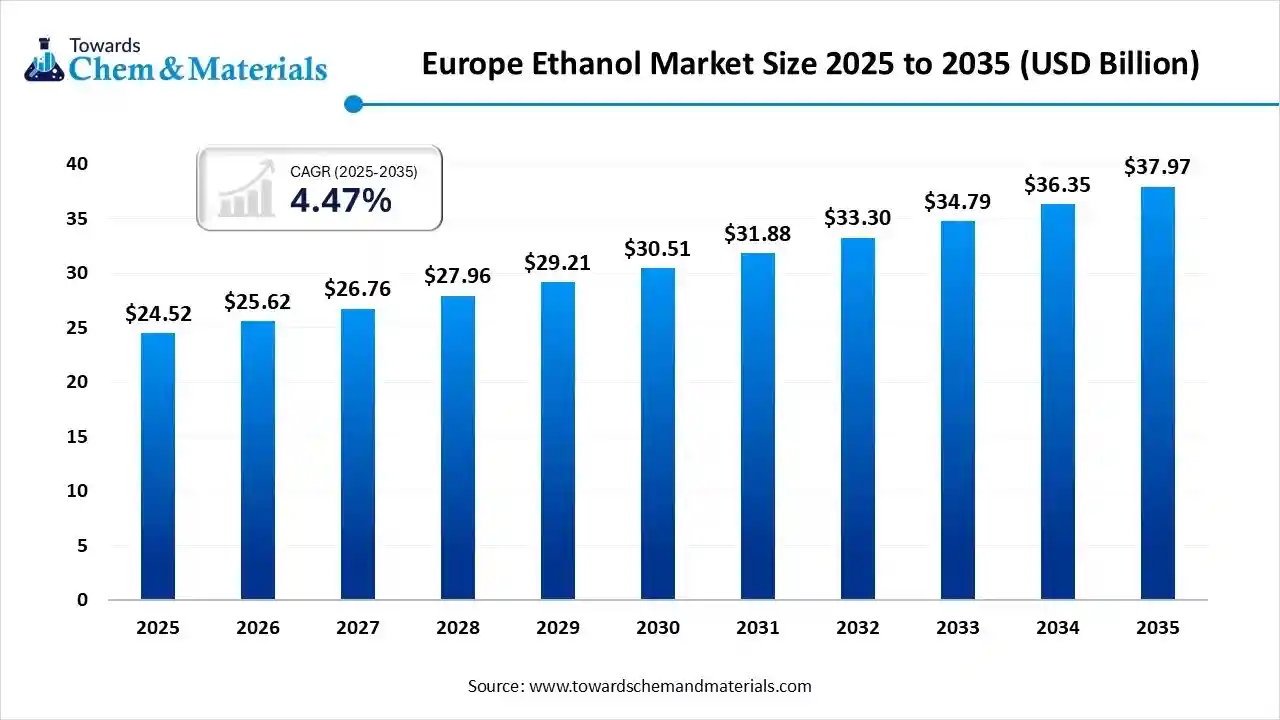

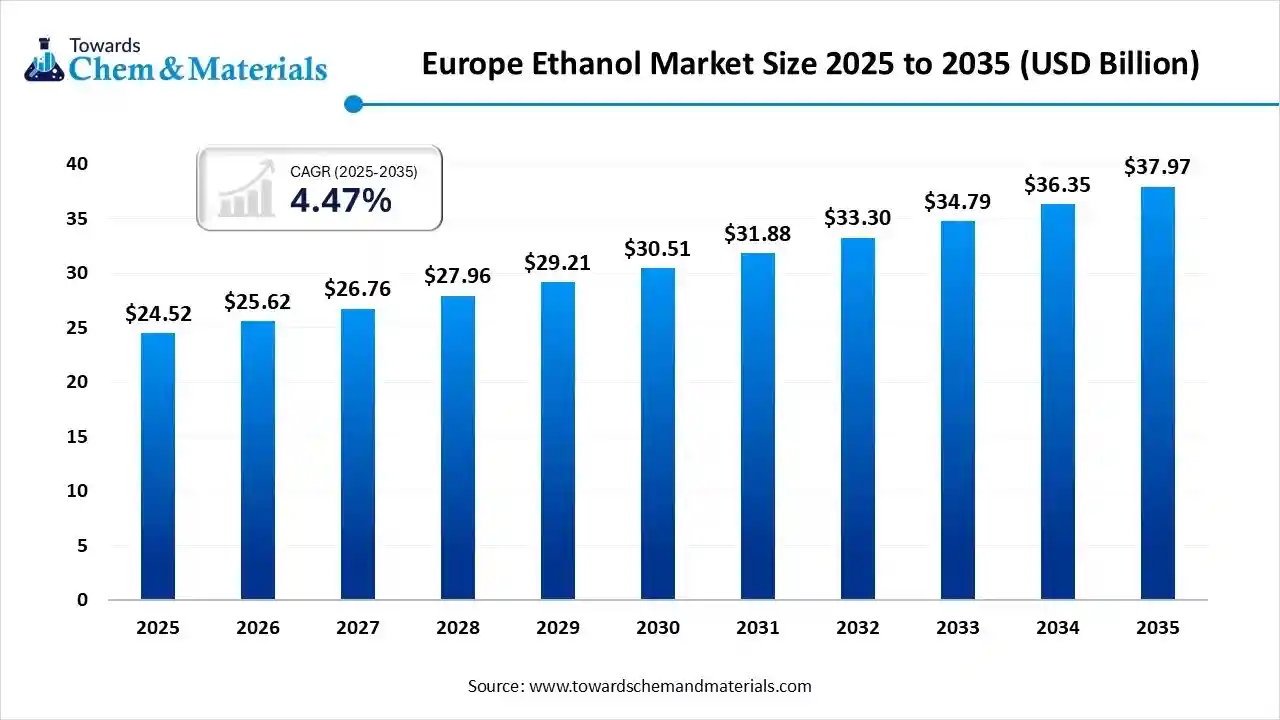

The Europe ethanol market size is calculated at USD 24.52 billion in 2025 and is predicted to increase from USD 25.62 billion in 2026 and is projected to reach around USD 37.97 billion by 2035, The market is expanding at a CAGR of 4.47% between 2026 and 2035. The growing adoption of E10 fuel and a strong focus on energy security drive the market growth.

Key Takeaways

- By feedstock, the renewable segment led the market in 2025.

- By feedstock, the non-renewable segment is growing at the fastest CAGR in the market during the forecast period.

- By type, the bioethanol segment led the market in 2025.

- By type, the extra neutral ethanol segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By grade, the fuel grade segment led the market in 2025.

- By grade, the pharmaceutical grade segment is growing at the fastest CAGR in the market during the forecast period.

- By end-use industry, the food & beverages segment led the market in 2025.

- By end-use industry, the pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period.

What Drives the Growth of the Europe Ethanol Market?

The Europe ethanol market growth is driven by a strong focus on achieving net-zero targets, the need for boosting energy security, increased blending of ethanol into gasoline, the growth of second generation ethanol, and the availability of feedstocks like crop residues & waste materials. The growing industrial activities and expansion of sectors like personal care, automotive, and pharmaceutical in the European region increase demand for ethanol. The expansion of renewable energy and the focus on greenhouse gas reduction increase the adoption of ethanol.

It is an organic compound and is also known as ethyl alcohol. It is produced from agricultural raw materials like sugar beets, corn, and sugarcane. It is highly flammable with a boiling point of 351K. It is widely used in alcoholic drinks as an active ingredient. Ethanol is used in various applications like cosmetics & beauty products, paints, cleansing products, biofuel, varnishes, antiseptics, hand sanitizers, lacquers, and pharmaceutical preparations. Ethanol lowers GHG emissions, improves air quality, and supports cleaner combustion.

Europe Ethanol Market Trends

- Focus on Energy Security: The increasing need to lower reliance on fossil fuel imports and the strong government focus on energy security, especially in countries like France, Germany, and Poland, increases demand for ethanol.

- Growing Automotive Sector: The growth of the automotive industry in European countries such as France, Spain, Germany, and Sweden, and the development in flex-fuel vehicles, enhance the demand for ethanol.

- Climate Goals: The strong focus on lowering carbon emissions, greenhouse gas emissions, and net-zero targets in countries like France and Germany increases demand for ethanol.

- Growing Industrialization: The growing expansion of industries like cosmetics, personal care, pharmaceuticals, paints, and food & beverages increases demand for ethanol to be used as a solvent, additives, and preservatives.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 25.62 Billion |

| Revenue Forecast in 2035 | USD 37.97 Billion |

| Growth Rate | CAGR 4.47% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Feedstock, By Type, By Grade, By End-Use Industry |

| Key companies profiled | CropEnergies AG, INEOS Group, ClonBio Group Ltd., Verbio SE, Vivergo Fuels Ltd.,Green Plains Inc., Tereos S.A. , ENVIEN Group , Domsjo Fabriker , Marquis Inc. , Sekab Biofuels & Chemicals AB , Kimia (U.K.), Agrola-Energy , Ethimex Ltd. , CREMER OLEO GMBH & Co. KG, Sasma B.V. , Archer-Daniels-Midland Company (ADM) , Cargill, Incorporated , Alcogroup SA , Valero Energy Corporation |

Key Technological Shifts in the Europe Ethanol Market

The Europe ethanol market is undergoing key technological shifts driven by the demand for minimizing environmental impact, performance efficiency, and reducing costs. The technological innovations, like nanotechnology, cellulosic ethanol, and advanced fermentation, support sustainability and energy security. One of the major shifts is the integration of artificial intelligence (AI) enhances sustainability and increases efficiency.

AI optimizes non-linear production processes like distillation and fermentation. AI easily predicts failures of equipment and enhances plant reliability. AI streamlines supply chain operations and forecasts fluctuations in demand. AI minimizes greenhouse gas emissions and lowers the generation of waste. AI analyzes the purity of the product and formulates optimal ethanol blends. Overall, AI focuses on achieving greater operational excellence and supports sustainability.

- For instance, the IFF company uses the XCELIS AI platform for the production of ethanol.

Trade Analysis of the Europe Ethanol Market: Import & Export Statistics

- Germany exported 2913 shipments of ethanol.

- Germany imported 2597 shipments of ethanol.

- Spain imported 203 shipments of ethanol.

- France imported 610 shipments of ethanol.

Europe Ethanol Market Value Chain Analysis

- Feedstock Procurement:The feedstock procurement is the sourcing of raw materials like barley, sugar beet, corn, starch molasses, grains, agricultural residues, sugar, and forestry residues.

- Key Players:- Lantmännen Agroetanol, AGRANA Beteiligungs-AG, Tereos, CropEnergies AG, ADM, ALCOGROUP SA

- Chemical Synthesis and Processing:The chemical synthesis and processing involve steps like feedstock preparation, hydrolysis, fermentation, distillation, dehydration, and denaturing.

- Key Players:- AGRANA Beteiligungs-AG, ALCOGROUP SA, CropEnergies AG, Tereos S.A., Cargill, Clariant, Abengoa Bioenergia

- Quality Testing and Certifications:The quality testing is an evaluation of properties like impurities, Gas Chromatography, visual appearance, impurities, boiling point, density, water content, and acidity, and certifications like International Sustainability & Carbon Certification and Renewable Energy Directive.

- Key Players:- SGS SA, Bureau Veritas, Intertek, TÜV SÜD, Kiwa, Eurofins Scientific

Inside European Countries: Ethanol Intelligence Table

| Country | Feedstock Available | Key Players |

| Germany |

|

|

| Poland |

|

|

| France |

|

|

| Belgium |

|

|

| Spain |

|

|

Segmental Insights

Feedstock Insights

Why Renewable Segment Dominates the Europe Ethanol Market?

The renewable segment dominated the Europe ethanol market in 2025. The strong focus on energy independence and the growing expansion of the pharmaceutical industry increase demand for renewable feedstock. The abundance of renewable feedstocks like sugar beet, corn, and wheat helps market growth. The cost-effectiveness, environmental benefit, and government support for renewable feedstock drive the overall market growth.

The non-renewable segment is the fastest-growing in the market during the forecast period. The presence of fossil-fuel-based feedstocks like coal, ethylene, & natural gas increases production of non-renewable ethanol. The strong focus on the production of high-purity ethanol and the rise in industrial ethanol production increase demand for non-renewable feedstocks. The growing industries like pharmaceutical and chemical increase the adoption of non-renewable feedstocks, supporting the overall market growth.

Type Insights

How did the Bioethanol Segment hold the Largest Share in the Europe Ethanol Market?

The bioethanol segment held the largest revenue share in the Europe ethanol market in 2025. The strong focus on energy security and the need to minimize reliance on fossil fuel imports increases demand for bioethanol. The stricter regulations on greenhouse gas emissions and a well-established agricultural base increase the production of bioethanol. The growing use of bioethanol in applications like pharmaceuticals, transportation, and cosmetics drives the overall market growth.

The extra neutral ethanol segment is experiencing the fastest growth in the market during the forecast period. The growing demand for medical wipes, sanitizers, and disinfectants increases the adoption of extra neutral ethanol. The EU’s Renewable Energy Directive and a strong focus on energy independence increase demand for extra neutral ethanol. The growing production of sprays, cosmetics, perfumes, and other personal care products requires extra neutral ethanol, supporting the overall market growth.

The neutral ethanol segment is growing significantly in the market. The Renewable Energy Directive (RED III) and focus on net-zero targets increase demand for neutral ethanol. The increasing demand for sustainable aviation fuel and the growing shipping sector increases demand for neutral ethanol. The growing production of personal care products, premium alcoholic beverages, and pharmaceuticals increases demand for neutral ethanol, supporting the overall market growth.

Grade Insights

Why Fuel Grade Segment Dominating the Europe Ethanol Market?

The fuel grade segment dominated the Europe ethanol market in 2025. The stricter EU climate policies for the transport sector and focus on minimizing greenhouse gas emissions increase the adoption of fuel grade ethanol. The strong focus on improving air quality and the need for boosting energy independence increase demand for fuel grade ethanol. The rise in consumption of flex-fuel vehicles and the focus on enhancing gasoline performance increase demand for fuel grade ethanol, driving the overall market growth.

The pharmaceutical grade segment is the fastest-growing in the market during the forecast period. The growing healthcare sector and the rise in development of pharmaceutical products increase demand for pharmaceutical-grade ethanol. The rising manufacturing of drugs, antiseptics, medicines, and disinfectants requires pharmaceutical-grade ethanol to act as a preservative, solvent, and excipient. The expansion of personalised medicine, biologics, and vaccines requires pharmaceutical-grade ethanol, supporting the overall market growth.

The industrial grade segment is growing significantly in the market. The development of cleaning products, hand sanitizers, and disinfectants requires industrial-grade ethanol. The production of paints, inks, cosmetics, coatings, and adhesives requires industrial-grade ethanol to act as a solvent. The increased manufacturing of chemicals like acetic acid and acetic acid requires industrial-grade ethanol, supporting the overall market growth.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Europe Ethanol Market?

The food & beverages segment held the largest revenue share in the Europe ethanol market in 2025. The strong focus on adding natural flavors in food products like fruits, vanilla, & herbs, and stricter quality standards in food processing, increases demand for ethanol. The increasing use of ethanol to develop tinctures, food flavorings, and essences drives the market growth.

The pharmaceuticals segment is experiencing the fastest growth in the market during the forecast period. The rise in development of topical medicines, oral solutions, and injectables increases demand for ethanol. The rapid growth in drug discovery, biotechnology, and vaccine research requires ethanol. The growing pharmaceutical production in countries like France, Germany, & Ireland, and the expansion of biopharmaceuticals, increases demand for ethanol, supporting the overall market growth.

The cosmetics segment is growing significantly in the market. The growing development of body & skincare products and focus on extending the shelf life of personal care products increases demand for ethanol. The increasing adoption of natural & organic cosmetics requires ethanol. The growing use of sanitizers, premium perfumes, and toners requires ethanol, supporting the overall market growth.

Country-Level Insights

Green Energy: France at the Centre of Europe’s Ethanol Surge

France is a key contributor to the market. The abundance of agricultural feedstocks like sugar beets, corn, and wheat increases the production of ethanol. The strong government support for ethanol production through initiatives like the Bioethanol Development Plan and the Energy Transition for Green Growth Act helps market growth. The consumer shift towards ethanol-rich fuels like E85 & E10 and the growing expansion of E85 pump stations drive the overall market growth.

Powering Progress: Germany Expanding Europe’s Ethanol Industry

Germany is a major contributor to the market. The strong government focus on minimizing the demand for emission fuels increases the adoption of biofuels. The strong presence of ethanol-blended fuel stations, production facilities, and biorefineries helps market growth. The availability of feedstocks like sugar beets and grains increases production of ethanol. The growing development of medicinal formulations and vaccine production increases demand for ethanol. The increasing shift towards E15-E70 blends supports the overall market growth.

From Fields to Future: Poland Redefines Europe's Ethanol Evolution

Poland is growing at a notable rate in the market. The availability of raw materials like rapeseed and corn increases the production of ethanol. The strong government policies for blending biofuels like ethanol with gasoline increase the production of ethanol. The increasing shift towards renewable energy sources and increasing investment in the development of blending & refining infrastructure increase the production of ethanol, supporting the overall market growth.

Recent Developments

- In January 2025, French ethanol consumption increases by 6% in 2024. The ethanol is made up of grains and sugar beets, and in 2024 total of 16 million hectoliters of ethanol was consumed. (Source: www.reuters.com)

- In September 2025, the Global Ethanol Association launched its initial program targeting the marine fuel sector in Switzerland. The initiative focuses on cleaner shipping operations and fuel supply security.(Source: www.offshore-energy.biz)

- In November 2025, France reached 4000 ethanol-rich E85 filling stations. It strengthens household purchasing power, and it contains bioethanol between 60% & 85%. E85 reduces CO2 emissions by 50% and helps in replacing the petrol component.(Source: biofuels-news.com)

Companies List

- CropEnergies AG: The leading European company manufactures technical and neutral ethanol to serve various applications like beverages, pharmaceuticals, fuels, biochemicals, and cosmetics.

- INEOS Group: The Germany-based company manufactures cellulosic ethanol and synthetic ethanol to be used in diverse applications like agriculture chemicals, perfumes, pharmaceuticals, perfumes, and solvents.

- ClonBio Group Ltd.: The Irish agribusiness company, leading producer of ethanol to support transport sector decarbonization and renewable energy source.

- Verbio SE: The European company is the leading producer of sustainable biofuels like bioethanol, verbioglycerine, animal feed, biodiesel, biomethane, and animal feed.

- Vivergo Fuels Ltd.: The UK-based company produces bioethanol from feed-grade wheat to lower reliance on fossil fuels and minimize greenhouse gas emissions.

Top Companies in the Europe Ethanol Market

- Green Plains Inc.

- Tereos S.A.

- ENVIEN Group

- Domsjo Fabriker

- Marquis Inc.

- Sekab Biofuels & Chemicals AB

- Kimia (U.K.)

- Agrola-Energy

- Ethimex Ltd.

- CREMER OLEO GMBH & Co. KG

- Sasma B.V.

- Archer-Daniels-Midland Company (ADM)

- Cargill, Incorporated

- Alcogroup SA

- Valero Energy Corporation

Segments Covered

By Feedstock

- Renewable

- Non-renewable

By Type

- Extra Neutral Ethanol (EN)

- Neutral Ethanol

- Bioethanol

- Others

By Grade

- Fuel Grade

- Pharmaceutical Grade

- Industrial Grade

- Others

By End-Use Industry

- Cosmetics

- Pharmaceuticals

- Chemicals

- Food & Beverages

- Automotive

- Others