Content

What is the Current Natural Gas Liquid Market Size and Volume?

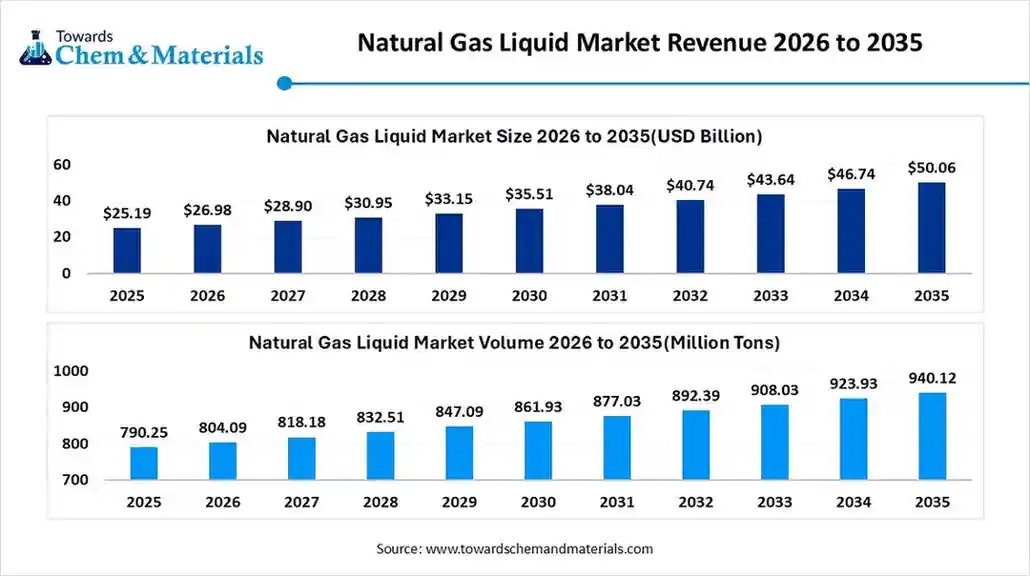

The global natural gas liquid market size was estimated at USD 25.19 billion in 2025 and is expected to increase from USD 26.98 billion in 2026 to USD 50.06 billion by 2035, growing at a CAGR of 7.11%. In terms of volume, the market is projected to grow from 790.25 million tons in 2025 to 940.12 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 1.75% over the forecast period 2026 to 2035. The North America dominated natural gas liquid market with the largest volume share of 37.10 % in 2025. The extensive demand for petrochemicals and emphasis on enhancing energy security drive the market growth.

The natural gas liquid market is growing due to the increasing need for heating fuels, rapid development of aerosol propellants, growing energy needs, extensive industrial activities, expansion of petrochemical plants, global decarbonization goals, NGL export infrastructure expansion, and development of modular fractionation. the Natural gas liquid (NGL) are hydrocarbon byproducts that are built from hydrogen & carbon. The manufacturing process of NGL includes two steps, like extraction and fractioning into components. NGL are widely used in applications like plastic production, cooking fuel, gasoline blending, refinery feedstock, vehicle fuel, blowing agent, synthetic rubber, and oil sands recovery.

Key Takeaways

- By region, North America led the natural gas liquid market with the largest volume share of over 37.10% in 2025.

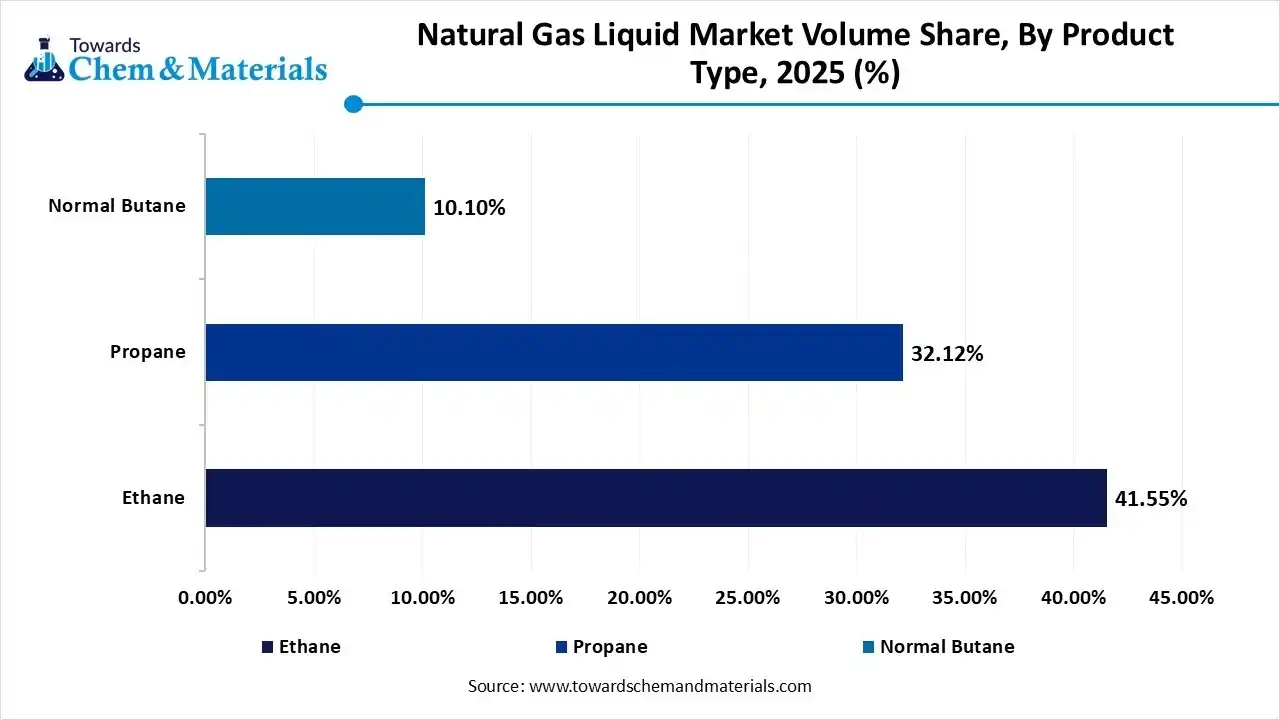

- By product type, the ethane segment led the market with the largest volume share of 41% in 2025.

- By source, the natural gas processing plants segment led the market with the largest volume share of 85% in 2025.

- By application, the petrochemical feedstock segment segment accounted for the largest volume share of 57% in 2025.

- By end user, the industrial sector segment dominated with the largest volume share of 48% in 2025.

Natural Gas Liquid Market Trends:

- Surge Demand for Petrochemicals:- The increased utilization of petrochemicals across sectors like automotive, packaging, and consumer goods increases demand for NGL. The development of diverse polymers and higher fiber production requires NGL.

- Growing Heating Application:- The increasing use of heating equipment like grills, furnaces, & dryers across industrial and residential applications increases demand for NGL to lower emissions.

- Push Towards Cleaner Energy Resources:- The ongoing decarbonization efforts across the world and increased demand for the generation of power require natural gas liquid.

- Industrial Expansion:- The rising industrial operations scale across diverse regions, and the industrial shift from coal increases demand for NGL. The growing oil & gas operations and strong industrial focus on lowering GHG emissions increase the adoption of NGL.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 26.98 Billion / 804.09 Million Tons |

| Revenue Forecast in 2035 | USD 50.06 Billion / 940.12 Million Tons |

| Growth Rate | CAGR 7.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Segment Covered | Product Type Insights, Source Insights, Application Insights, End-User Insights, Regional Insights |

| Key companies profiled | Shell plc, BP plc, TotalEnergies, ExxonMobil Corporation, Chevron Corporation, Enterprise Products Partners L.P., ONEOK, Inc., Targa Resources Corp., Energy Transfer LP, MPLX LP, Saudi Aramco, QatarEnergy, Phillips 66, ConocoPhillips Company, Western Midstream Partners, LP, EnLink Midstream, LLC, Antero Midstream Corporation, Keyera Corp., Pembina Pipeline Corporation, PetroChina Company Limited |

Key Technological Shifts in the Natural Gas Liquid Market:

The natural gas liquid market is undergoing key technological shifts driven by the demand for pipeline integrity, performance efficiency, enhanced extraction, and increased utilization. The key technological advancements are machine learning, smart pipelines, big data, advanced catalysts, advanced sensing, and IoT support growing energy demand and enhance utilization. One of the major shifts is that the incorporation of AI lowers emissions and enhances efficiency.

AI identifies drilling places and optimizes the management of the reservoir. Artificial Intelligence helps in precise process control and monitors the complex fractioning process. AI easily predicts the behavior of the reservoir and monitors the overall infrastructure of NGL. AI detects failures of equipment and offers facilities remote monitoring. Overall, AI is a smarter and proactive way of performing NGL operations.

Trade Analysis of Natural Gas Liquid Market: Import & Export Statistics

- Qatar exported $31.6B of propane, liquefied in 2023.

- China imported $15.7B of propane, liquefied in 2023.

- Mexico imported 1,145 shipments of natural gas liquid.

- Russia exported 23,738 shipments of ethane.

- Russia exported 2,775 shipments of isobutane.

- The United States exported 47,761 shipments of propane.

Natural Gas Liquid Market Value Chain Analysis

- Chemical Synthesis and Processing: The chemical synthesis and processing are carried out through two steps: NGL recovery involves cryogenic expansion, absorption, & adsorption, and the second step is fractioning to form individual purity products.

- Key Players:- Sasol, BASF, Chevron, Shell, ExxonMobil, TotalEnergies

- Quality Testing and Certifications: The quality testing is an examination of attributes like relative density, carbon dioxide content, hydrocarbon dew point, moisture content, vapor pressure, and sulfur compounds. The certifications for NGL are GCI, ISO, CWI, and ASTM.

- Key Players:- SGS, TUV NORD, Cotecna Group, Intertek Group, TUV Rheinland, Bureau Veritas

- Compound Formulation and Blending : The compound formulation is the segregation of diverse pure hydrocarbon components, and blending is the process of mixing separated hydrocarbon components, in particular proportions, to develop products like LPG, diluents, & others.

- Key Players:- Enterprise Products Partners L.P., BP, MPLX, ExxonMobil, Williams Companies, NGL Energy Partners LP

Key NGL Types and Their Applications

| Type | Molecular Formula | Uses | Mainly Produced Region |

| Isobutane | C4H10 |

|

|

| Propane | C3H8 |

|

|

| Pentane Plus | C5H12 |

|

|

| Ethane | C2H6 |

|

|

Segmental Insights

Product Type Insights

Why Ethane Segment Dominates the Natural Gas Liquid Market?

The ethane segment dominated the natural gas liquid market with a 41% share in 2025 and is expected to maintain dominance during the forecast period. The rise in the development of automotive components and the high availability of shale gas increase the production of ethane. The increasing demand for ethylene across applications like textiles and expanding packaging activities increases demand for ethane. The cost-effectiveness, versatility, and high efficiency of ethane drive the market growth.

The isobutane segment is significantly growing in the market. The rise in production of sustainable refrigerants and the development of high-octane fuel increase demand for isobutane. The increasing need for specialty polymers and the revolution of shale gas increases demand for isobutane. The growing demand for consumer goods and the increasing use of aerosol propellant boost demand for isobutane, supporting the overall growth of the market.

Natural Gas Liquid Market Volume and Share, By Product Type 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 |

| Ethane | 41.55% | 328.35 | 415.91 | 2.39% |

| Propane | 32.12% | 253.83 | 283.07 | 1.10% |

| Normal Butane | 10.10% | 79.82 | 89.78 | 1.18% |

| Isobutane | 6.12% | 48.36 | 56.88 | 1.63% |

| Natural Gasoline [Pentane Plus] | 10.11% | 79.89 | 94.48 | 1.69% |

Source Insights

How are Natural Gas Processing Plants Segment Dominating the Natural Gas Liquid Market?

The natural gas processing plants segment dominated the natural gas liquid industry with an 85% share in 2025 and is expected to maintain dominance during the forecast period. The intensified extraction of shale gas and increasing demand for high-quality natural gas fuels the development of natural gas processing plants. The rising demand for petrochemical feedstock and the rise in industrial heating activities require natural gas processing plants. The global expansion of natural gas processing plants drives the overall growth of the market.

The crude oil refineries segment is growing at a notable rate in the market. The escalating industrial growth and rise in feedstock diversification increase demand for crude oil refineries. The increased consumption of plastic products and higher demand for petrochemicals require crude oil refineries. The transition towards cleaner-burning fossil fuels and investment in NGL processing increases the adoption of crude oil refineries, supporting the overall growth of the market.

Application Insights

Which Application Dominated the Natural Gas Liquid Market?

The petrochemical feedstock segment dominated the natural gas liquid market with a 57% share in 2025 and is expected to maintain dominance during the forecast period. The upward growth in the packaging industry and the increased production of fertilizers increase demand for petrochemical feedstock. The increasing need for ethylene and rapid growth in industrial activities fuel demand for petrochemical feedstock. The automotive parts production and escalating demand for synthetic rubber require petrochemical feedstock, driving the overall growth of the market.

The transportation fuel segment is growing at a notable rate in the market. The focus on minimizing harmful pollutant emissions and enhancing logistic operations requires NGL. The increased use of long-haul trucks and the growing demand for low-cost fuel increase the adoption of NGL. The strong focus on enhancing combustion efficiency and extensive development of NGL-powered vehicles support the overall growth of the market.

End-User Insights

Why the Industrial Sector Segment Dominates the Natural Gas Liquid Market?

The industrial sector segment dominated the market with a 48% share in 2025 and is expected to maintain dominance during the forecast period. The strong focus on energy security in industrial applications and the upward trajectory of the food processing sector increase demand for NGL. The strong industrial focus on lowering emissions and the rise in drying activities require NGL. The increasing use of solvents and the booming manufacturing industry drive the overall growth of the market.

The commercial sector is significantly growing in the market. The government support for energy transition in commercial spaces and increasing commercial energy demand requires NGL. The increasing need for water heating in commercial spaces and the growing use of detergents require NGL. The growing use of NGL in commercial spaces like hotels, hospitals, laundromats, recreational facilities, schools, and restaurants supports the overall growth of the market.

Regional Insights

The North America natural gas liquid market size was valued at USD 12.62 billion in 2025 and is expected to surpass around USD 25.12 billion by 2035, expanding at a compound annual growth rate (CAGR) of 7.13% over the forecast period from 2026 to 2035. North America dominated the natural gas liquid market with a 37.10% share in 2025. The North America natural gas liquid market size was estimated at 293.18 million tons in 2025 and is projected to reach 334.24 million tons by 2035, growing at a CAGR of 1.32% from 2026 to 2035.

The well-established natural gas processing plants and the vast shale gas reserves help market expansion. The growing demand for petrochemicals and the increasing focus on energy independence increase demand for natural gas liquid. The strong presence of midstream networks and a well-established export terminal increases demand for natural gas liquid. The increasing use of hydraulic fracturing and higher adoption of ethane drive the overall growth of the market.

United States: A Key Producer of Liquid Natural Gas

The United States is a key contributor to the market. The abundant reserves of shale gas and strong focus on domestic production increase demand for NGL. The increasing use of horizontal drilling and cost-effective feedstock increases the production of NGL. The transition towards cleaner-burning fuels and increasing demand for plastic require NGL, supporting the overall growth of the market.

- The United States exported 1,880 shipments of ethane.

Asia Pacific Natural Gas Liquid Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing need for electricity and the shift from coal to gas increase demand for NGL. The increasing use of synthetic rubber and the rapid growth in plastic manufacturing require NGL. The rise in investment in petrochemical plants and a strong focus on using better heating fuels increase demand for NGL. The strengthening chemical production presence and focus on energy security increase demand for NGL, supporting the overall growth of the market.

Energy Growth: China's Fueling Role in NGL Production

China is a major contributor to the market. The strong emphasis on coal replacement and enhancing household wealth increases demand for NGL. The increased production of propylene and the government backing for cleaner fuels create demand for NGL. The surge of manufacturing operations and the expansion of NGL infrastructure help market growth. The development of unconventional gas reserves and regasification capacity expansion supports the overall market growth.

- China exported $342M of propane, liquefied in 2024.

Europe Natural Gas Liquid Market Trends

Europe is growing at a notable rate in the market. The focus on lowering reliance on Russian gas and shifting towards cleaner fuel alternatives increases the production of NGL. The continued growth in petrochemical demand and the increasing and increased use of lightweight material in automotive production increases the adoption of NGL. The heavy investment in expanding NGL import terminals and supportive regulations for NGL support the overall growth of the market.

United Kingdom Contribution to the NGL Sector

The United Kingdom plays a pivotal role in the market. The rapid growth in the petrochemical industry and the increasing use of cleaner fuels in transportation sectors increase demand for NGL. The increased adoption of cleaner energy resources in the residential sector and well-developed import infrastructure increases demand for NGL. The ongoing development in extraction technology supports the overall growth of the market.

Middle East & Africa Natural Gas Liquid Market Trends

The Middle East & Africa are growing in the market. The ample reserves of natural gas in nations like Nigeria, Saudi Arabia, & Iran, and large-scale investment in NGL petrochemical plants, help market expansion. The growing power generation push towards cleaner energy sources boosts demand for NGL. The major investment in NGL pipeline networks and ongoing NGL capacity expansion drives the overall market growth.

Global Natural Gas Liquid Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 37.10% | 293.18 | 329.89 | 1.32% | 35.09% |

| Europe | 10.23% | 80.84 | 89.78 | 1.17% | 9.55% |

| Asia Pacific | 27.33% | 215.98 | 273.86 | 2.67% | 29.13% |

| South America | 5.23% | 41.33 | 46.07 | 1.21% | 4.90% |

| Middle East & Africa | 20.11% | 158.92 | 200.53 | 2.62% | 21.33% |

Power Progress: Saudi Arabia’s Role in Natural Gas Liquids

Saudi Arabia is growing substantially in the market. The rise in the development of low-carbon solutions and expanding industrial activities increases demand for NGL. The focus on oil replacement in electricity generation and growing projects like Jafurah unconventional reserves boosts the production of NGL. The focus on building midstream infrastructure and the manufacturing surge support the overall market growth.

South America Natural Gas Liquid Market Trends

South America is growing significantly in the market. The significant resources of natural gas and a strong focus on minimizing dependence on hydropower increase demand for NGL. The growing demand for energy in industrial applications and the presence of unconventional shale gas increase the adoption of NGL. The growing development of NGL facilities and increasing investment in upstream operations drive the overall growth of the market.

Expanding Natural Gas Liquid Presence in Brazil

Brazil is growing at a substantial rate in the market. The strong presence of pre-salt reserves and power generation growth increases demand for NGL. The strong focus on strengthening energy security and diversification of energy supply increases demand for NGL. The rapid expansion of NGL import capacity supports the overall growth of the market.

Recent Developments

- In February 2025, Coldstream Energy collaborated with Archrock to launch the NGL recovery solution, MaCH4. The solution lowers VOC emissions and is a cost-efficient solution. The solution is a virtual pipeline and supports upstream and midstream operators. The solution offers benefits like higher performance of the engine and increased NGL revenues.(Source: www.businesswire.com)

- In August 2025, Furui Energy launched Brazil’s first bio-LNG project. The biogas processing capacity of the project is 200000 m3/d and uses advanced liquefaction technology. (Source: www.lngindustry.com )

- In November 2025, BLYB launched refinery ethane use to enhance the integration and efficiency of feedstock. The refinery's ethane producing capacity of facility is 330000 tons, and enhances ethylene yield. The facility refines gases like low-cut gas, coke oven dry gas, and light hydrocarbon gas.(Source: www.lyondellbasell.com)

Top Companies List

- ExxonMobil Corporation:- The multinational petrochemical and energy company produces natural gas to serve industries like steel, chemical manufacturing, electricity generation, and transportation.

- Shell plc:- The company operates large-scale liquefaction plants, manages an NGL shipping fleet, and provides NGL to diverse industries.

- BP plc:- The integrated energy company focuses on the processing and production of natural gas liquids like propane, pentanes, ethane, and others to serve various industrial users.

- TotalEnergies:- The multi-energy company uses natural gas liquids for diverse applications like industrial use, energy security, and cleaner mobility.

Top Companies in the Natural Gas Liquid Market

- Shell plc

- BP plc

- TotalEnergies

- ExxonMobil Corporation

- Chevron Corporation

- Enterprise Products Partners L.P.

- ONEOK, Inc.

- Targa Resources Corp.

- Energy Transfer LP

- MPLX LP

- Saudi Aramco

- QatarEnergy

- Phillips 66

- ConocoPhillips Company

- Western Midstream Partners, LP

- EnLink Midstream, LLC

- Antero Midstream Corporation

- Keyera Corp.

- Pembina Pipeline Corporation

- PetroChina Company Limited

Segments Covered

By Product Type

- Ethane

- Propane

- Normal Butane

- Isobutane

- Natural Gasoline (Pentane Plus)

By Source

- Natural Gas Processing Plants

- Crude Oil Refineries

By Application

- Petrochemical Feedstock

- Residential and Commercial Fuel (Heating & Cooking)

- Industrial Fuel and Processing

- Transportation Fuel (Autogas)

- Gasoline and Refinery Blendstock

- Aerosol Propellants and Refrigerants

By End-User

- Industrial Sector

- Residential Sector

- Commercial Sector

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa