Content

What is the Current Asia Pacific Biopolymers Market Size and Share?

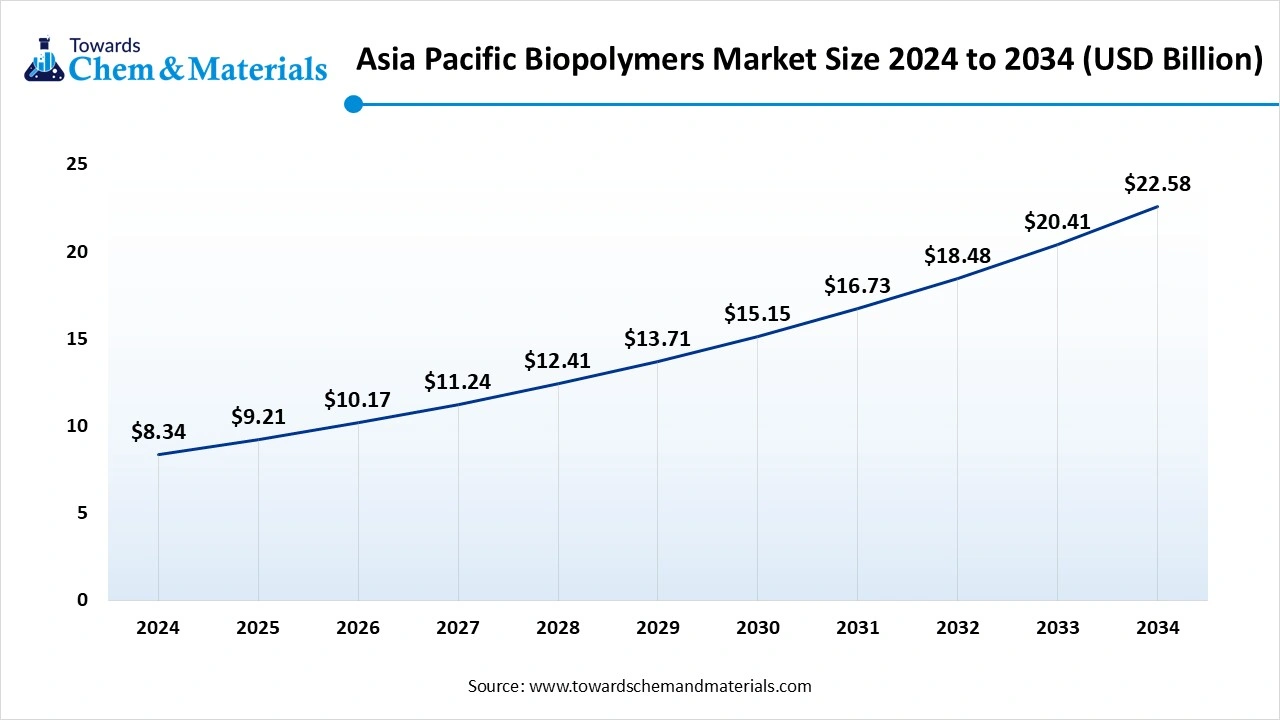

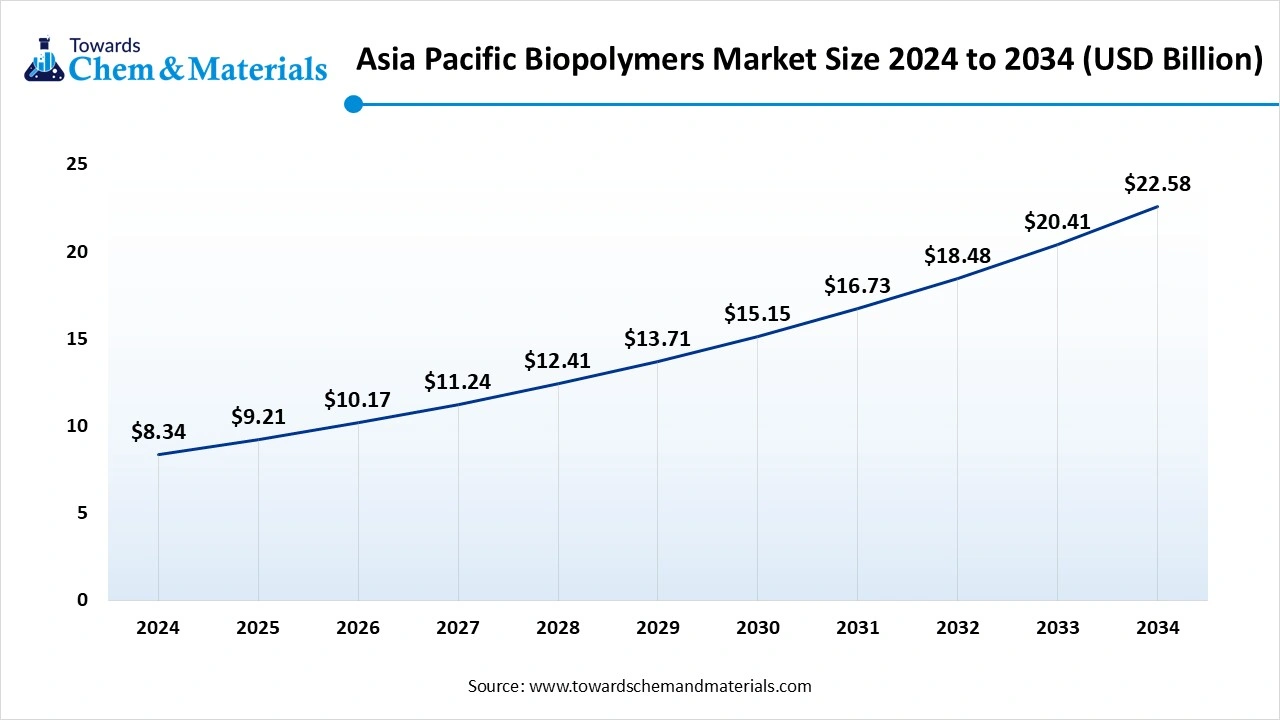

The Asia Pacific biopolymers market size is calculated at USD 5.66 billion in 2025 and is predicted to increase from USD 6.60 billion in 2026 and is projected to reach around USD 26.39 billion by 2035, The market is expanding at a CAGR of 16.65% between 2026 and 2035. The market is experiencing significant growth, driven by factors like abundant feedstock, strong government support for sustainable alternatives, and increasing consumer demand for eco-friendly products.

Key Takeaways

- By product type, the polylactic acid segment held the largest revenue share of 36% in 2025 in terms of value.

- By biodegradability type, the biodegradable biopolymers segment led the market with the largest revenue share of 62% in 2025.

- By application, the packaging segment led the market with the largest revenue share of 54% in 2025.

- By distribution channel, the direct sales segment accounted for the largest revenue share of 48% in 2025.

Market Overview

What Is The Significance Of The Asia Pacific Biopolymers Market?

The significance of the Asia Pacific biopolymers market lies in its status as the largest and fastest-growing regional market, driven by rapid industrialisation, increasing consumer demand for sustainable products, and government support for eco-friendly alternatives.

Key factors include a large population, growing economies, strict environmental regulations, and the expansion of end-use industries like e-commerce, food packaging, agriculture, and healthcare. This creates a massive opportunity for growth and innovation in biopolymer production and application in the region.

Asia Pacific Biopolymers Market Growth Trends:

- Sustainability focus: Growing consumer awareness of carbon footprints and government initiatives to reduce plastic waste are major drivers.

- Government support: Strong government efforts are actively promoting sustainable alternatives to traditional plastics.

- Abundant raw materials: The region has access to plentiful, cost-effective feedstocks like sugarcane, cassava, and corn.

- Rapid industrialisation: Rapid industrial and urbanization growth across the region is increasing demand for sustainable solutions.

- Consumer awareness: Rising consumer awareness of environmental impact is increasing demand for eco-friendly products.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 6.60 Billion |

| Revenue Forecast in 2035 | USD 26.39 Billion |

| Growth Rate | CAGR 16.65% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product Type, By Biodegradability Type, By Application, By Distribution Channel, By Region |

| Ky companies profiled | Mitsubishi Chemical Group (Japan),NatureWorks Asia Pacific (Thailand),TotalEnergies Corbion PLA (Thailand), PTT MCC Biochem (Thailand),Hisun Biomaterials (China),Kingfa Sci. & Tech. (China),DuPont de Nemours, Inc., Biome Bioplastics, Futamura Group, Teijin Limited, Kaneka Corporation, SKC Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., CJ CheilJedang , BASF SE, Braskem |

Key Technological Shifts In The Asia Pacific Biopolymers Market:

Key technological shifts in the Asia Pacific biopolymers market include the adoption of 3D printing, advancements in AI-driven and smart manufacturing, the development of biopolymers with improved properties, and innovations in biopolymer processing technologies to make them more cost-effective and widely accessible. These advancements are driven by increasing demand for sustainable materials and supported by a push for a circular economy in countries like China.

Trade Analysis Of the Asia Pacific Biopolymers Market: Import & Export Statistics

- From April 2025 to March 2025 (TTM), India shipped 15 biopolymer shipments. These were sent by 4 Indian exporters to 5 buyers, showing a 36% increase compared to the previous twelve months.

- Most Indian biopolymer exports go to Indonesia, Sri Lanka, and Nepal.

- Globally, the top three biopolymer exporters are the United States, the United Kingdom, and India. The U.S. leads with 4,831 shipments, followed by the UK with 40 shipments and India with 28 shipments.

- According to China biopolymer export data, China has 11 suppliers exporting to 9 global buyers. ZHUHAI KINGFA BIOMATERIAL CO LTD, ZHUHAI KINGFA BIOMATERIAL CO, and SHENZHEN ESUN INDUSTRIAL CO. LTD. account for 75% of China's biopolymer exports.

- ZHUHAI KINGFA BIOMATERIAL CO LTD is the largest Chinese biopolymer supplier, making up 54% of exports with 13 shipments. ZHUHAI KINGFA BIOMATERIAL CO follows with 17% and 4 shipments, while SHENZHEN ESUN INDUSTRIAL CO. LTD. accounts for 4% with 1 shipment.

Asia Pacific Biopolymers Market Value Chain Analysis

- Chemical Synthesis and Processing: Biopolymers in the Asia Pacific are produced from renewable feedstocks such as corn, sugarcane, cassava, and starch through processes like fermentation, polymerisation, and compounding. Major products include PLA, PHA, starch blends, and bio-based polyesters, which are processed using extrusion, injection moulding, and blow moulding for end-use applications.

- Key players NatureWorks LLC, TotalEnergies Corbion, Mitsubishi Chemical Group, Toray Industries Inc., Hisun Biomaterials.

- Quality Testing and Certification: Biopolymers are tested for biodegradability, compostability, mechanical strength, and environmental safety under standards such as ASTM D6400, EN 13432, ISO 17088, and regional green material guidelines.

- Key players: TÜV Austria, SGS, UL Solutions, Intertek.

- Distribution to Industrial Users: Biopolymers are distributed across packaging, agriculture, textile, and consumer goods industries through regional distributors, converters, and manufacturing partners across China, India, Japan, South Korea, and Southeast Asia.

- Key players: NatureWorks LLC, TotalEnergies Corbion, Mitsubishi Chemical Group, Toray Industries Inc.

Biopolymers Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| China | Ministry of Ecology & Environment (MEE); State Administration for Market Regulation (SAMR); Standardisation Administration of China (SAC) | GB/T standards for biodegradable plastics (e.g., GB/T 41010-2021) and related product standards | Degradability definitions & test methods; labelling and identification of biodegradable products; limits on hazardous substances | National standards for “degradability and identification” came into force (implementation from June 2022) and set strict biodegradability and content rules for compostable/biodegradable plastics. |

| India | Ministry of Environment, Forest & Climate Change (MoEFCC); Central Pollution Control Board (CPCB); Bureau of Indian Standards (BIS) | Plastic Waste Management Rules (amendments 2021–2022); draft/ tentative BIS specifications for compostable/biodegradable plastics (IS/ISO 17088 alignment) | EPR & waste management compliance; compostability standards; bans on single-use conventional plastics | PWM rules and draft notifications require biodegradable/compostable products to conform to BIS/ISO compostability specs and assign responsibilities under EPR. IS/ISO 17088 is referenced for compostable packaging. |

| Japan | Ministry of the Environment (MOE); METI; Japan BioPlastics Association (JBPA) | BiomassPla certification / JBPA guidelines; national biomass & circularity strategies; relevant JIS standards | Biobased content verification (14C method), compostability & industrial processing rules; public procurement preferences | Japan uses the BiomassPla system (biobased content cert) and is active in standardisation discussions on mass-balance methods and compostable verification. National strategy supports bio-attributed plastics. |

| South Korea | Ministry of Environment (MoE); Korean Agency for Technology & Standards (KATS) | K-REACH (chemical registration), national standards for compostability & labelling (aligning with ISO/ASTM) | Chemical safety of bio-additives, labelling, EPR & waste handling | Korea emphasises K-REACH compliance for polymer additives and growing alignment with international compostability/biobased standards; EPR and recycling infrastructure are improving rapidly. |

| Australia & New Zealand | Department of Climate Change, Energy, the Environment and Water (Australia); Standards Australia; Australasian Bioplastics Association | AS 4736 (compostable—industrial) and AS 5810 (home compostable); ISO harmonised norms (e.g., ISO 17088, ISO 17556/PF) | Certification for industrial & home composting, labelling rules, and feedstock traceability | Certified compostable claims in AU/NZ rely on AS 4736 / AS 5810; the national compostable packaging strategy stresses certification + collection/processing capacity. |

Segmental Insights

Product Type Insights

How Did the Polylactic Acid Segment Dominated The Asia Pacific Biopolymers Market In 2025?

The polylactic acid segment dominated the Asia Pacific biopolymers market, accounting for approximately 36% share in 2025. PLA holds a leading position in the market due to its wide availability, compostability, and suitability for food packaging and disposable applications. Its use is rapidly growing in rigid packaging, thermoformed containers, and films, supported by policies promoting compostable plastics and rising consumer awareness toward sustainable alternatives in urban markets.

The polyhydroxyalkanoates segment is expected to experience significant growth in the during the forecast period. PHA is gaining momentum due to its full biodegradability in marine and soil environments, making it attractive for regions facing severe plastic pollution. In the Asia Pacific, PHA demand is increasing for agricultural films, food packaging, and biomedical applications due to its superior environmental compatibility and performance properties.

The bio-polyethene segment has seen notable growth in the market. Bio-PE is witnessing strong growth in the Asia Pacific because it can be directly integrated into existing polyethene processing and recycling streams. Countries like Japan and South Korea are investing in advanced bio-based material supply chains to reduce fossil fuel dependence while maintaining product performance similarities with conventional plastic materials.

Biodegradability Type Insights

Which Biodegradability Type Segment Dominated The Asia Pacific Biopolymers Market In 2025?

The biodegradable biopolymers segment dominated the market, accounting for approximately 62% share in 2025. Biodegradable biopolymers dominate growth due to strict regulations on plastic waste and rising environmental awareness. Countries like China, India, and South Korea are accelerating adoption through policy support and infrastructure development for industrial composting, driving demand for biodegradable alternatives across the packaging and agriculture sectors.

The non-biodegradable biopolymers segment is expected to experience significant growth in the Asia Pacific biopolymers market during the forecast period. Non-biodegradable biopolymers, such as bio-based polyethene and bio-based PET, are gaining importance as sustainable drop-in replacements for fossil plastics. In the Asia Pacific, they are widely used in bottles, automotive parts, and durable packaging, especially where recyclability and long product life are prioritised over biodegradability.

Application Insights

How Did the Packaging Segment Dominated The Asia Pacific Biopolymers Market In 2025?

The packaging segment dominated the market, accounting for approximately 54% share in 2025. Bio-PE is witnessing strong growth in the Asia Pacific because it can be directly integrated into existing polyethene processing and recycling streams. Countries like Japan and South Korea are investing in advanced bio-based material supply chains to reduce fossil fuel dependence while maintaining product performance similarities with conventional plastic materials.

The medical & healthcare products segment is expected to experience significant growth in the Asia Pacific biopolymers market during the forecast period. Biopolymers are increasingly used in medical implants, drug delivery systems, sutures, and disposable medical devices due to their biocompatibility and biodegradability. Their application aligns with the shift toward safer, sustainable, and patient-friendly materials in advanced healthcare systems.

The agriculture segment has seen notable growth in the market. In agriculture, biopolymers are used in mulch films, plant pots, seed coatings, and controlled-release fertiliser packaging. The agrarian economies of India, China, and Southeast Asia are driving significant demand due to the need for eco-friendly solutions that reduce soil pollution caused by conventional plastic films. Biodegradable agricultural plastics eliminate the need for film collection, lowering long-term environmental impact.

Distribution Channel Insights

Which Distribution Channel Segment Dominated The Asia Pacific Biopolymers Market In 2025?

The direct sales segment dominated the market, accounting for approximately 48% share in 2025. Direct sales dominate the large-scale supply of biopolymers to packaging manufacturers, healthcare product companies, and agricultural solution providers. This channel is preferred for bulk procurement, customised material supply, and technical integration support, especially for high-performance applications.

The online B2B platforms segment is expected to experience significant growth in the Asia Pacific biopolymers market during the forecast period. Online B2B platforms are growing as an emerging distribution channel, especially for small and medium manufacturers seeking flexible sourcing options. Growth is supported by digitalisation in procurement and increasing cross-border trade within the Asia Pacific markets.

The distributors & traders segment has seen notable growth in the market. Distributors and traders play a crucial role in connecting manufacturers with downstream industries, especially in developing countries where local production is limited. This channel is essential for expanding biopolymer availability in countries like Vietnam, the Philippines, and India’s tier 2 and tier 3 industrial hubs.

Country Insights

China: Asia Pacific Biopolymers Market Growth Trends

China is the dominant market in the region, combining large-scale production, growing domestic demand, and strong policy support to curb plastic pollution. Government targets and industrial incentives have encouraged investment in PLA, PHA, and bio-based polymer plants. China’s vast packaging, e-commerce, and disposable foodservice markets provide immediate demand, while exporters leverage local feedstock availability and scale to serve regional and global biopolymer value chains.

India: Asia Pacific Biopolymers Market Growth Trends

India is a fast-emerging market for biopolymers, propelled by single-use plastic bans, growing sustainability awareness, and abundant agricultural feedstock like sugarcane and cassava. Adoption is strongest in compostable packaging, disposable tableware, and agricultural mulch films. Local manufacturing is expanding through joint ventures and technology transfer, though scaling composting infrastructure and cost-competitiveness versus conventional plastics remain key enablers for broader uptake.

Japan: Asia Pacific Biopolymers Market Growth Trends

Japan’s biopolymers market is characterised by technologically advanced, high-performance bio-based materials for packaging, medical devices, and speciality applications. Demand is driven by circular economy policies, corporate sustainability commitments, and innovation in PLA blends and bio-polyesters with improved heat resistance. Japanese firms focus on high-value, performance-grade biopolymers and recycling/composting systems to support industrial adoption in food packaging and healthcare sectors.

South Korea: Asia Pacific Biopolymers Market Growth Trends

South Korea’s market growth is led by strong government policies on waste reduction, corporate sustainability initiatives, and rapid industrial adoption in packaging and consumer goods. Korean manufacturers invest in high-quality PLA, bio-PE, and PHA R&D to meet domestic OEM and export specifications. The country’s advanced manufacturing base and circular economy pilots support integration of biopolymers into mainstream packaging and industrial applications.

Recent Developments

- In February 2025, NatureWorks announced the launch of Ingeo 3D300, an engineered 3D printing grade designed for faster print speeds up to 300 mm/second without sacrificing quality. This new biopolymer, like other Ingeo products, is derived from annually renewable resources and aims to provide high performance with minimal stringing and enhanced cost efficiency by reducing print times.(Source: www.businesswire.com )

- In December 2025, Starbucks Japan introduced biodegradable straws made from polyhydroxyalkanoate (PHA) as part of its sustainability efforts to reduce single-use plastic waste across the Asia Pacific. This initiative supports Starbucks' global objective to halve its waste footprint by 2030. (Source: stories.starbucks.com)

- In November 2025, Natnov Bioscience, an Odisha-based startup, is utilising seafood processing waste such as shrimp, crab, and fish shells to create biopolymers. These biopolymers are used to produce bioplastics for food packaging, pharmaceuticals, agriculture, cosmetics, and water purification, with the bioplastic items currently in the process of being released to the market.(Source: timesofindia.indiatimes.com)

Top Players In The Asia Pacific Biopolymers Market & Their Offerings:

Toray Industries Inc. (Japan)

Corporate Information

- Toray Industries was founded in 1926.

- Headquarters: Nihonbashi Mitsui Tower, Chuo ku, Tokyo, Japan.

- As of March 31, 2025: Paid in capital ~ 147,873 million yen; consolidated employees (including subsidiaries) ~ 47,914; consolidated revenue ~ 2,563.3 billion yen; core operating income ~ 142.8 billion yen.

History and Background

- Toray began in 1926 as a manufacturer of viscose rayon fiber/yarn its original business.

- Over decades, it expanded from basic fibers to synthetic fibers (nylon, polyester, acrylic), and further into advanced materials: resins/plastics, films, fine chemicals, carbon fiber composites, membranes, medical & environmental materials, etc.

- On the fiber front: one milestone in 1941 Toray succeeded in the synthesis and melt spinning of Nylon 6 fiber using its proprietary technology.

Key Developments and Strategic Initiatives

- Toray defines long term vision of sustainable development: under its “Sustainability Vision 2050,” the Group aims for a net zero emissions world, sustainable resource management, restored environment, and healthy lives for all.

- Its current medium term roadmap is Project AP-G 2025, covering fiscal 2023–2025. Under this program, Toray aims to achieve “innovation and resilience management value creation for new momentum.”

Mergers & Acquisitions

- A major past acquisition was the U.S. carbon fiber company Zoltek Companies, Inc. Toray acquired Zoltek in 2013/2014, bolstering its carbon fiber and composite materials portfolio.

- Through acquiring Zoltek, Toray strengthened its position globally in large-tow carbon fibers, expanding its reach beyond Japan and traditional markets.

Partnerships & Collaborations

- Under its sustainability efforts, Toray recycles discarded fishing nets recovering nylon, reprocessing to recycled nylon fibers, under its brand to produce recycled nylon fiber materials. This reflects collaborations with recycling companies and fishing net manufacturers.

- Toray collaborates with apparel companies: e.g. with UNIQLO supplying fibers derived from PET bottles, and jointly developing recycled fiber products including down filled clothing, leveraging Toray’s innovations in fiber recycling and automated collection/processing.

Product Launches / Innovations

- Carbon fibre: Toray’s TORAYCA™ carbon fibers are among the most advanced globally. Recently (November 2023) it developed TORAYCA™ T1200, claimed as the world’s highest strength carbon fiber (tensile strength ~8.0 GPa).

- Also in early 2025, Toray announced TORAYCA™ M46X, a high modulus carbon fiber offering ~20% higher strength while maintaining high modulus, enhancing performance for aerospace, industrial, auto, and other demanding applications.

Key Technology Focus Areas

- Membranes & water treatment: Toray has longstanding expertise in separation membranes used in water treatment, purification, desalination, and in medical (e.g. dialysis), environmental, and biotech applications.

- Environmental / sustainability materials: Under AP-G 2025, Toray is pushing expansion into “Sustainability Innovation” including bio-based / recycled fibers & resins, water treatment, membrane based technologies, low-carbon materials, and circular economy solutions.

R&D Organisation & Investment

- Toray’s core R&D hub is its “Technology Center,” which drives research and technological development across business sectors.

- Under AP G 2025, Toray plans total R&D expenditure of ¥220 billion over the three-year period (FY 2023–2025).

- Over 80% of this R&D spend is targeted at its growth oriented businesses: Sustainability Innovation (SI) and Digital Innovation (DI).

SWOT Analysis

Strengths:

- Long legacy (since 1926) and deep expertise in fibers, chemicals, plastics, composites, membranes diversified advanced materials portfolio.

- Global scale: large workforce, many subsidiaries/affiliates, global footprint enabling supply chain reach, global manufacturing & sales.

- Strong in high value, high performance materials: carbon fiber composites, advanced polymers, membranes markets with high entry barriers, demand for performance & quality.

Weaknesses / Challenges:

- Diversified business means complexity: managing many segments (fibers, chemicals, composites, medical, environmental) risks of overextension and resource dilution.

- Some legacy segments (e.g. basic fibers/textiles) may face low margins and global competition/commodity like pressure; Toray itself recognizes need for structural reform in lower-growth businesses under AP-G 2025.

Opportunities:

- Growing global demand for lightweight, high strength materials in aerospace, automotive (EVs), renewable energy (wind, hydrogen), infrastructure carbon fiber composites and advanced materials are well suited.

- Rising environmental/regulatory pressures pushing for sustainability, recyclability Toray’s SI business and recycled/bio material development could capture growing “green-materials” market.

Threats / Risks:

- Raw material price volatility (chemicals, polymers) and energy costs can affect margins, especially for high performance materials.

- Economic downturns or slowdown in sectors like aerospace, automotive can reduce demand for high-end composites or specialty materials.

- Competition from other advanced-materials firms globally, including alternative technologies (e.g. metal composites, new plastics), or from companies in regions with lower cost base.

Recent News & Strategic Updates

- Project AP-G 2025: Launched 2023 Toray’s medium term strategic roadmap focusing on sustainable growth, innovation, structural reform, and prioritizing high-growth fields (SI & DI).

- Carbon Fiber Expansion & New High Strength Fiber: In November 2023 Toray announced development of TORAYCA™ T1200 world’s highest-strength carbon fiber. In January 2025, they also announced TORAYCA™ M46X (high modulus carbon fiber) indicating a push into higher-end composite applications (aerospace, hydrogen tanks, performance industries).

Other Top Players Are

- Mitsubishi Chemical Group (Japan): Mitsubishi Chemical is a key player in bio-based and biodegradable polymers, offering materials such as bio-polycarbonate, bio-polyesters, and sustainable engineering plastics. Its products are widely used in automotive, electronics, packaging, and consumer goods across the Asia Pacific region.

- NatureWorks Asia Pacific (Thailand): NatureWorks operates its Ingeo™ PLA production facility in Thailand, supplying biodegradable polylactic acid resins to the Asia Pacific region. Its biopolymers are used in packaging, textiles, disposable products, and 3D printing applications.

- TotalEnergies Corbion PLA (Thailand): With its manufacturing plant in Thailand, TotalEnergies Corbion is a major supplier of high-performance PLA biopolymers for the Asia Pacific markets. Its products are used in food packaging, consumer goods, agricultural films, and durable biodegradable applications.

- PTT MCC Biochem (Thailand): A joint venture between PTTGC and Mitsubishi Chemical, this company specialises in bio-based polybutylene succinate (PBS). Its biopolymers target sustainable packaging, agricultural films, and moulded products.

- Hisun Biomaterials (China): Hisun is one of Asia’s leading PLA producers, offering biodegradable polymer resins used in disposable cutlery, flexible packaging, and compostable consumer products, supporting China’s growing bioeconomy sector.

- Kingfa Sci. & Tech. (China): Kingfa produces bio-based and biodegradable plastics such as PLA and PBAT blends. The company plays a key role in supplying sustainable materials for packaging, automotive, and industrial applications across China and Southeast Asia.

- DuPont de Nemours, Inc.

- Biome Bioplastics

- Futamura Group

- Teijin Limited

- Kaneka Corporation

- SKC Co., Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

- CJ CheilJedang

- BASF SE

- Braskem

Segments Covered

By Product Type

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-Based Biopolymers

- Bio-Polyethene (Bio-PE)

- Bio-Polyethene Terephthalate (Bio-PET)

- Bio-Polyamides

- Cellulose-Based Biopolymers

By Biodegradability Type

- Biodegradable Biopolymers

- Non-Biodegradable Bio-Based Polymers

By Application

- Packaging

- Food Packaging

- Beverage Packaging

- Flexible Packaging

- Agriculture

- Mulch Films

- Seed Coatings

- Consumer Goods

- Textiles

- Automotive Components

- Medical & Healthcare Products

By Distribution Channel

- Direct Sales (Manufacturers)

- Distributors & Traders

- Online B2B Platforms

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa