Content

What is the Current Asia Pacific Ethanol Market Size and Share?

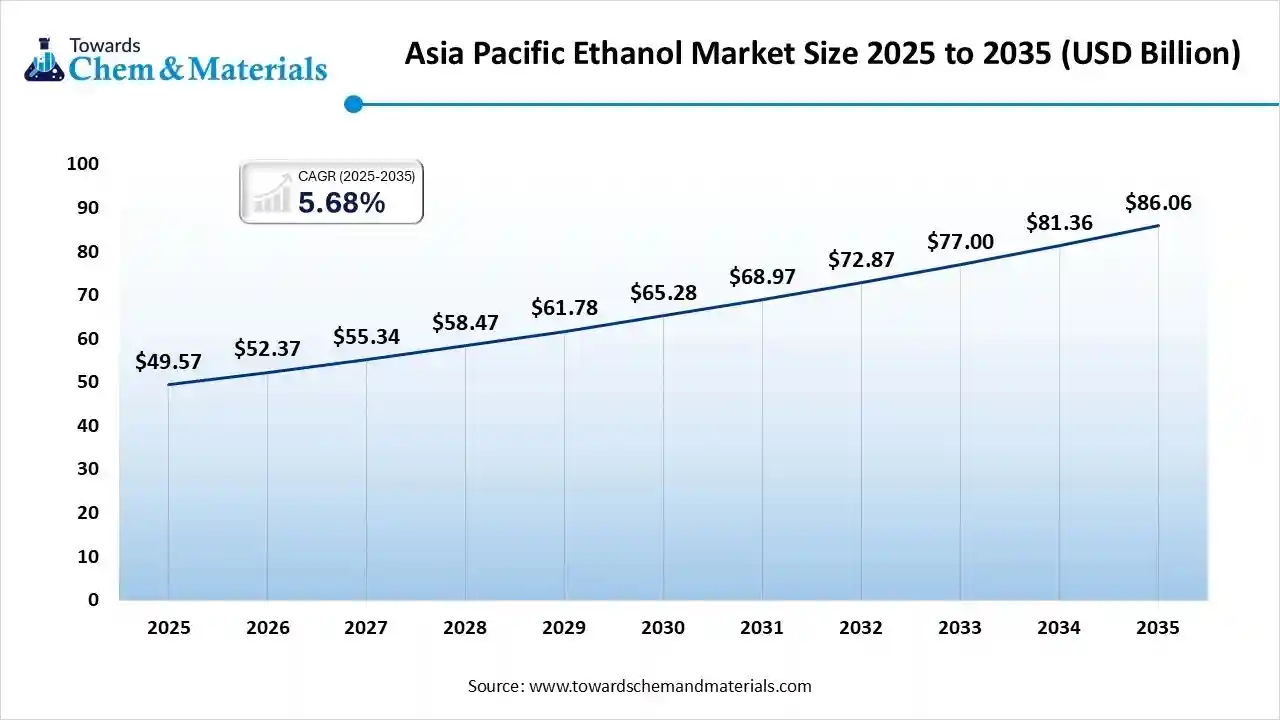

The Asia Pacific Ethanol market size is calculated at USD 49.57 billion in 2025 and is predicted to increase from USD 52.39 billion in 2026 and is projected to reach around USD 86.13 billion by 2035, The market is expanding at a CAGR of 5.68% between 2026 and 2035. Extensive availability of feedstocks such as sugarcane and corn is a key factor driving market growth. Also, supportive government policies coupled with the ongoing advancements in ethanol production technology can fuel market growth further.

Key Takeaways

- By feedstock, the sugar-based ethanol segment led the market with the largest revenue share of 44% in 2025.

- By production process, the fermentation-based ethanol segment led the market with the largest revenue share of 86% in 2025.

- By grade, the fuel-grade ethanol segment accounted for the largest revenue share of 61% in 2025.

- By application, the fuel & fuel blending segment dominated with the largest revenue share of 58% in 2025.

What is Ethanol?

The market is driven by government mandates for ethanol blending to reduce dependence on fossil fuels, enhance energy security, and lower carbon emissions. The Asia Pacific ethanol market includes the production, distribution, and consumption of ethanol used across fuel blending, industrial solvents, beverages, pharmaceuticals, cosmetics, and chemical intermediates. Ethanol in Asia is primarily produced from agricultural feedstocks such as sugarcane, molasses, corn, rice, wheat, cassava, and increasingly from cellulosic and waste-based sources.

Asia Pacific Ethanol Market Trends

- The rapid integration of technologies is the major trend in the market. Digital and technological advancements are taking place rapidly in the ethanol sector. Energy optimization and operational transparency are being enhanced with the launch of AI-based fermentation monitoring.

- The growing demand for special solutions is another major trend in the market. The market is rapidly becoming more digitalized, sustainable, and efficient. Biorefineries are being automated, which will have a positive impact on market growth soon.

- The ongoing collaboration between automotive fuel producers, ethanol manufacturers, and renewable energy-based companies is improving competitiveness, particularly with governments toward increased biofuel blending needs.

- The growing use of greener procedures and the use of renewable energy sources are helping the market to minimize carbon footprint with the innovations in biofuel technology; as a result, the market is becoming more ecologically friendly.

- Many countries in the region are implementing ambitious renewable energy targets to decrease their dependence on fossil fuels and minimize overall carbon emissions. Governments are also supporting bioethanol as a fuel substitute in the transportation sector.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 52.39 Billion |

| Revenue Forecast in 2035 | USD 86.13 Billion |

| Growth Rate | CAGR 5.68% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Feedstock, By Production Process, By Grade, By Application |

| Key companies profiled | POET LLC, Green Plains Inc., China Resources Alcohol Group, COFCO Corporation, Henan Tianguan Group, Praj Industries Ltd., Shandong Haiyang Chemical, Wilmar International Ltd., Thai Alcohol Co., Ltd., Mitr Phol Group, EID Parry (India), Balrampur Chini Mills Limited, Dalmia Bharat Sugar, BioEnergy Corporation of Thailand, BPCL Biofuels, Sinopec (ethanol blending & distribution) |

How Cutting Edge Technologies are revolutionizing the Asia Pacific Ethanol Market?

Advanced technologies are transforming the market by enhancing sustainability and efficiency through advancements such as innovative fermentation processes and 2nd-generation cellulosic ethanol. Furthermore, major market players are investing in these technologies to increase overall production efficiency and scale to meet increasing product demand.

Trade Analysis of Asia Pacific Ethanol Market Import & Export Statistics:

Export

- In September 2025, China's exports of unmodified ethanol experienced a sharp decline of 66.64% from the previous month, totaling 1,362.50 tons. The average export price for the month was $820.30 per ton. Papua New Guinea was the primary destination for these exports, importing the largest share at 380 tons, at an average price of $786.53 per ton.

Imports

- In September 2025, China's imports of unmodified ethanol declined by 15.64% from the previous month to 27.31 tons, with an average import price of USD 7,116.05 per ton. Georgia was the primary source of imports at 18.14 tons at an average price of USD 2,352.60 per ton.

- India's ethanol alcohol imports showed significant growth between June 2024 and May 2025 (TTM). India imported a total of 704 shipments, marking a 48% growth rate compared to the previous twelve-month period.

- In May 2025, India imported 59 shipments of Ethanol Alcohol. This figure represents a year-on-year decline of -10.6% compared to May 2024, but a significant sequential increase of 97% from the previous month, April 2025.

Asia Pacific Ethanol Market Value Chain Analysis

- Feedstock Procurement: It refers to the sourcing and supply chain management of waste materials and raw agricultural products used to produce ethanol. This process is crucial for producing ethanol at lower expenses.

- Major Players: Wilmar International, Praj Industries Ltd.

- Chemical Synthesis and Processing : It refers to the advanced manufacturing methods for next-generation (2G) bioethanol from non-food biomass, along with the use of ethanol as a main chemical in the manufacturing of various industrial derivatives.

- Major Players: Mitsubishi Chemical Group, Reliance Industries.

- Packaging and Labelling :This stage addresses the important logistical, safety, regulatory, and branding aspects of distributing ethanol. It emphasizes the materials, processes, and regulations governing them.

- Major Players: Amcor, Gerresheimer AG.

- Regulatory Compliance and Safety Monitoring :It refers to the adherence to complex web laws, safety protocols, and standards established by national and regional bodies to ensure safe use of ethanol.

- Major Players: Reliance Industries, Neste

Asia Pacific Ethanol Market 's Regulatory Landscape: Regulations

| Country/Region | Key Regulations |

| India | India has one of the most ambitious and successful programs, having achieved its goal of 20% ethanol blending in petrol (E20) nationwide in early 2025, five years ahead of the original 2030 target |

| China | China announced a nationwide E10 (10% ethanol) mandate for 2020 to utilize surplus "aged grain" stocks, but the implementation has been eased due to feedstock constraints and other factors. |

| Japan | Japan primarily meets its biofuel targets by using bio-ETBE (ethyl tert-butyl ether) rather than direct ethanol blending, due to concerns about vehicle compatibility with higher ethanol concentrations. |

Segmental Insights

Feedstock Insights

How Much Share Did the Sugar-Based Ethanol Segment Held in 2025?

The sugar-based ethanol segment dominated the market with a 44% share in 2025. The dominance of the segment can be attributed to the growing demand for cleaner transportation fuels and a surge in energy security concerns. Cleaner transportation fuels are considered more efficient in terms of energy and yield.

The cellulosic & advanced ethanol segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to robust availability of non-food feedstocks, along with the rapid technological innovations in the manufacturing processes. This segment also provides a substantial reduction in greenhouse gas emissions.

The grain-based ethanol segment held a major market share in 2024. The growth of the segment can be fuelled by growing energy demand from developing countries in the region, coupled with the heavy investments in cutting-edge technologies.

The growth of the root & tuber-based ethanol segment can be driven by ongoing advancements in fermentation technology and feedstock conversion, which are making bioethanol production more cost-effective and efficient. These crops thrive in tropical environments and need less water than others.

Production Process Insights

Which Production Process Type Segment Dominated the Asia Pacific Ethanol Market in 2025?

The fermentation-based ethanol segment held an 86% market share in 2025. The dominance of the segment can be linked to the increasing energy demand from population growth and the rise in emphasis on minimizing fossil fuel reliance and carbon emissions.

The cellulosic/biochemical conversion segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing adoption of flex-fuel vehicles and growing concerns regarding air pollution and climate change. The synthetic/catalytic routes segment held a major market share in 2024. The growth of the segment can be boosted by government policies for blending ethanol and gasoline, along with the environmental concerns that favor cleaner fuels.

Grade Insights

How Much Share Did the Fuel-Grade Ethanol Segment Held in 2025?

The fuel-grade ethanol segment dominated the market with a 61% share in 2025. The dominance of the segment is owed to the rapid advancements in ethanol production technologies, which have made the overall process more cost-effective and efficient, making ethanol a more competitive option for the fuel market.

The pharmaceutical & cosmetic grade segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to a surge in hygiene and health awareness, coupled with the growing need for high-purity ethanol. Ethanol is a crucial ingredient in personal care products.

The industrial-grade ethanol segment held a significant market share in 2024. The growth of the segment can be boosted by the expansion of industrial sectors such as construction, coatings, and chemical manufacturing. Governments also give tax breaks and subsidies to optimise bioethanol production and infrastructure development.

The growth of the beverage-grade ethanol segment can be propelled by rapid innovations in fermentation and distillation technologies, along with the growing product quality and efficiency. The use of various feedstocks, such as grains and rice, contributed to segment expansion further.

Application Insights

Which Application Type Segment Dominated the Asia Pacific Ethanol Market in 2025?

The fuel & fuel blending segment held a 58% market share in 2025. The dominance of the segment can be attributed to the increasing need for cleaner transportation driven by increasing disposable incomes in emerging economies such as China and India.

The chemical & bio-based products segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the ongoing government support for bio-based production. Businesses are also rapidly emphasizing green production methods.

The industrial solvents & intermediates segment held a major market share in 2024. The growth of the segment is due to the increasing use of ethanol in an extensive range of applications, such as cosmetics, paints, and pharmaceuticals. Countries are expanding their domestic ethanol production to fulfil growing demand.

The growth of the pharmaceuticals & healthcare segment can be fuelled by the region's growing research and biopharmaceutical industry, coupled with the rising need for disinfectants. Ethanol is a vital ingredient in drug formulations, serving as a preservative and solvent.

Country Insight

How did the China Thrive in the Asia Pacific Ethanol Market in 2025?

China dominated the market with a large share of 32% in 2025. The dominance of the country can be attributed to the robust economic growth, which leads to a higher fuel demand along with the government mandates for fuel blending. Also, there is an increasing consumer demand for cleaner fuels to reduce air pollution in major cities in the country.

Which is the Fastest Growing Country in the Region?

India is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be credited to the increasing environmental concerns and the demand for energy security, which is optimizing the need for more clean transportation alternatives. In addition, the country's extensive agricultural landscape offers a steady supply of feedstock, particularly to produce ethanol.

Japan is expected to grow at a notable CAGR over the forecast period. The growth of the country can be driven by a robust non-fuel demand from sectors such as pharmaceuticals and cosmetics, and government support for biofuels and renewable energy. The country is actively opting for cleaner fuel solutions to combat climate change and reduce air pollution.

Recent Developments

- In April 2025, Madhya Pradesh introduced biofuel schemes to fuel sustainability. This new initiative emphasizes advanced biofuels, providing financial incentives and supporting the circular economy, which aims to reduce fossil fuel reliance and improve rural livelihoods.(Source: www.energetica-india.net)

Market Companies

- POET LLC: POET LLC has a presence in the Asia Pacific ethanol market as a key global producer, though the market is dominated by regional players like Jilin Fuel Ethanol (CNPC) and driven by local demand.

- Green Plains Inc.: Green Plains Inc. is a US-based biorefining company with a strong focus on the domestic market, not a significant direct player in the Asia Pacific ethanol market.

Top Companies in the Asia Pacific Ethanol Market

- China Resources Alcohol Group

- COFCO Corporation

- Henan Tianguan Group

- Praj Industries Ltd.

- Shandong Haiyang Chemical

- Wilmar International Ltd.

- Thai Alcohol Co., Ltd.

- Mitr Phol Group

- EID Parry (India)

- Balrampur Chini Mills Limited

- Dalmia Bharat Sugar

- BioEnergy Corporation of Thailand

- BPCL Biofuels

- Sinopec (ethanol blending & distribution)

Segments Covered

By Feedstock

- Sugar-Based Ethanol

- Sugarcane juice

- Molasses

- Grain-Based Ethanol

- Corn

- Rice

- Wheat

- Sorghum

- Root & Tuber-Based Ethanol

- Cassava

- Sweet potato

- Cellulosic & Advanced Ethanol

- Agricultural residues

- Forestry waste

- Municipal solid waste–based ethanol

By Production Process

- Fermentation-Based Ethanol

- Cellulosic / Biochemical Conversion

- Synthetic / Catalytic Routes (Limited)

By Grade

- Fuel Grade Ethanol

- Industrial Grade Ethanol

- Beverage Grade Ethanol

- Pharmaceutical & Cosmetic Grade Ethanol

By Application

- Fuel & Fuel Blending

- E5, E10, E20 and higher blends

- Industrial Solvents & Intermediates

- Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Chemical & Bio-Based Products