Content

What is the Current Polylactic Acid Market Size and Share?

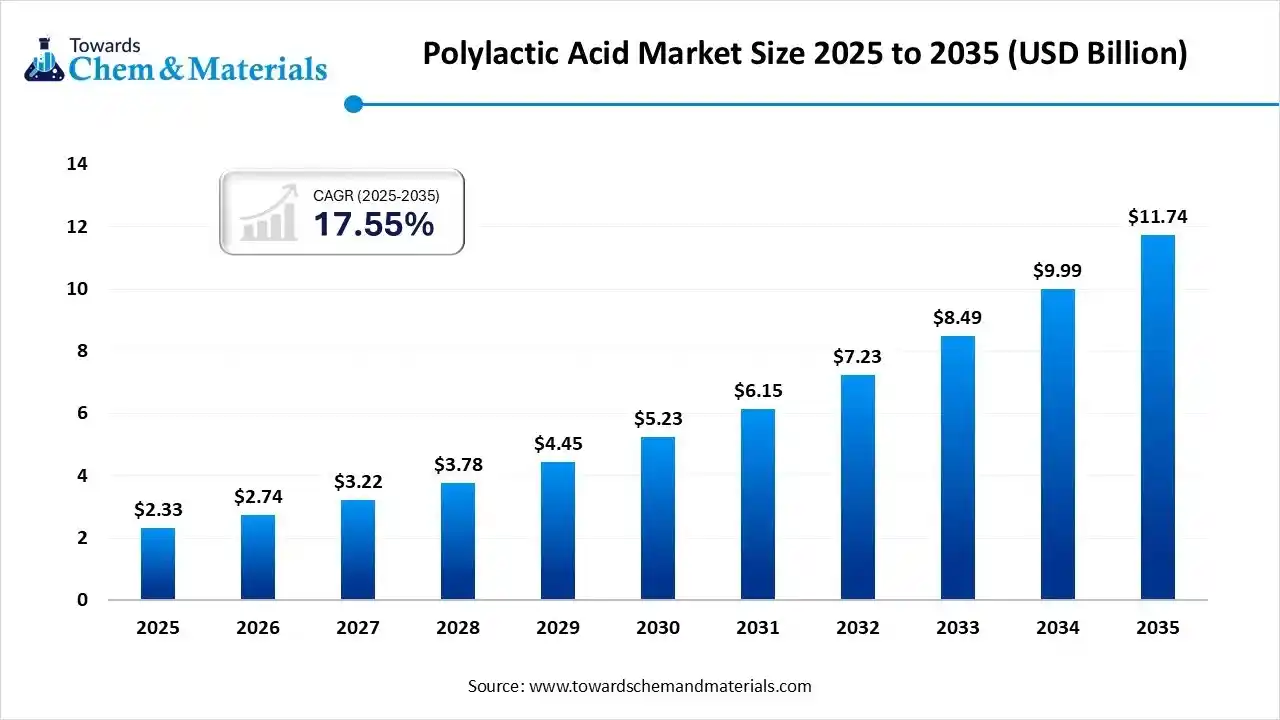

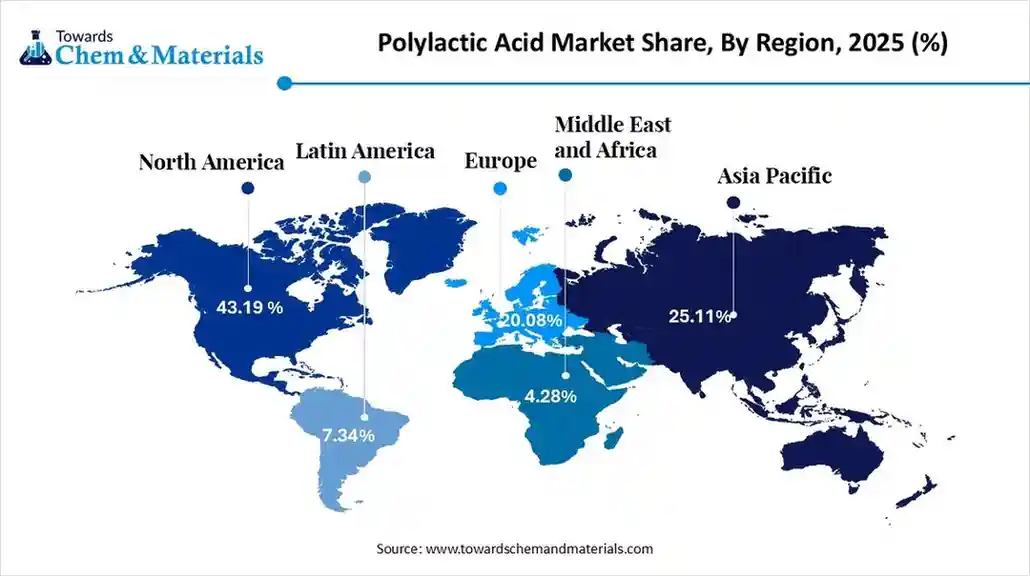

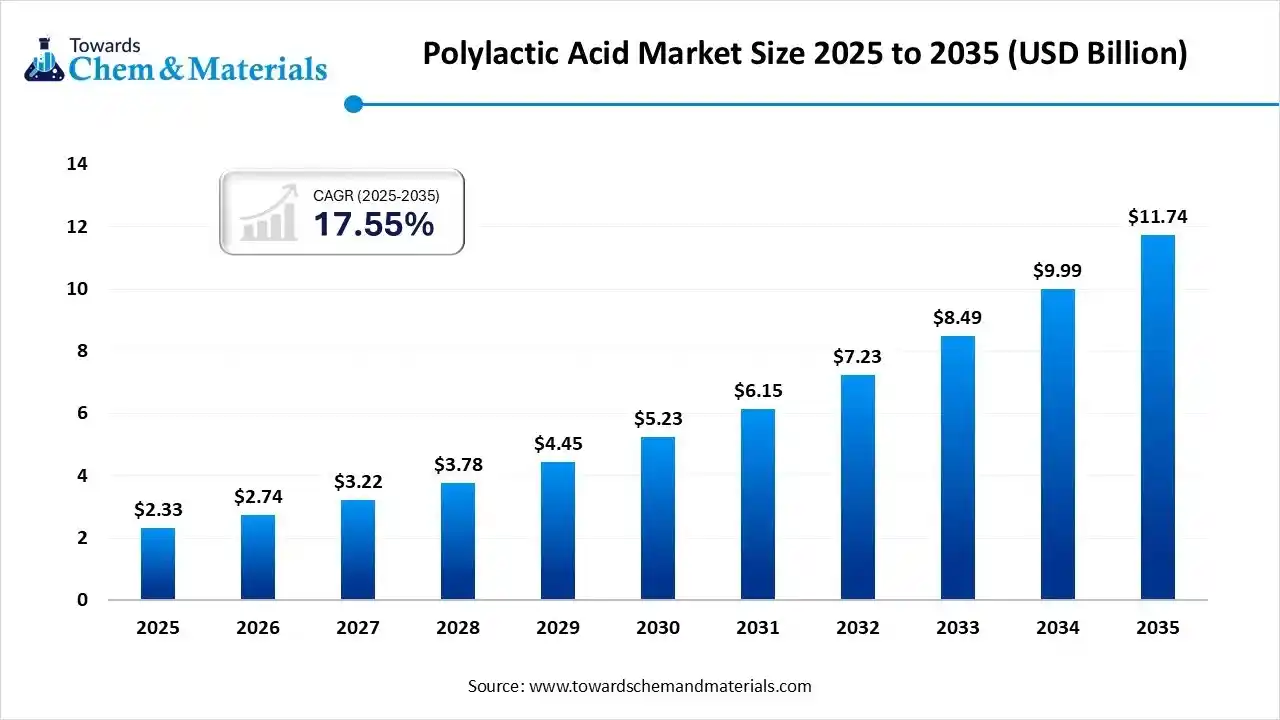

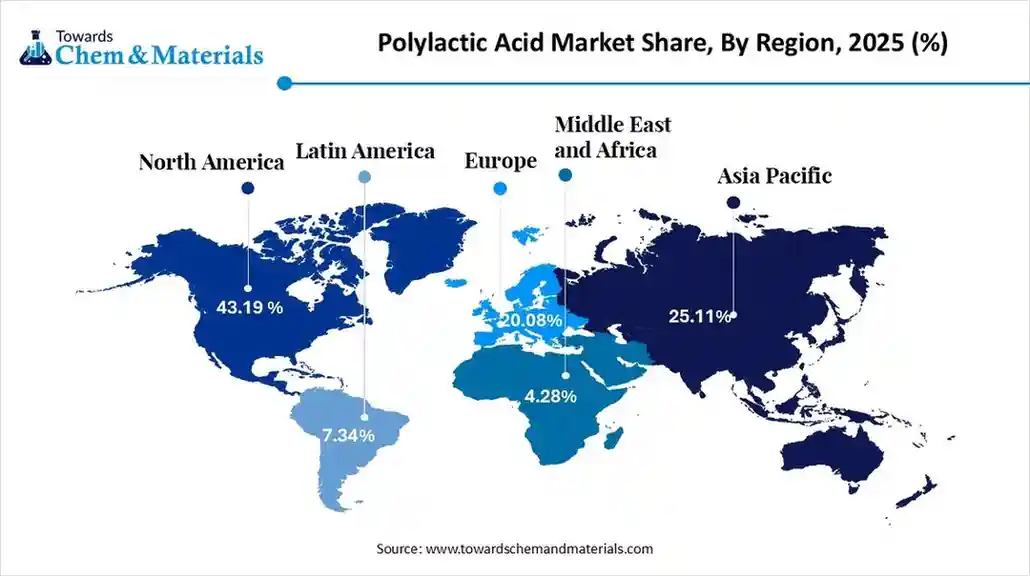

The global polylactic acid market size is calculated at USD 2.33 billion in 2025 and is predicted to increase from USD 2.74 billion in 2026 and is projected to reach around USD 11.74 billion by 2035, The market is expanding at a CAGR of 17.55% between 2026 and 2035. North America dominated the polylactic acid market with a market share of 43.19% the global market in 2025. The growth of the market is driven by rising consumer and industry demand for sustainable and eco-friendly products, especially in packaging, fueling the growth of the market.

Key Takeaways

- North America dominated the global polylactic acid market with the largest revenue share of 43.19% in 2025.

- By raw materials, the corn starch segment accounted for the largest revenue share of 66.11% in 2025.

- By application, the rigid thermoform segment dominated with the largest revenue share of 46.19% in 2025.

- By end use, the packaging segment dominated with the largest revenue share of 38.42% in 2025.

Market Overview

What Is The Significance Of The Polylactic Acid Market?

The significance of the polylactic acid market lies in its role as a sustainable alternative to petroleum-based plastics, driven by environmental concerns, regulations, and consumer demand for eco-friendly products. PLA is a biodegradable, renewable plastic derived from plant starches that is widely used in packaging, textiles, and medical devices due to its similar functional properties to conventional plastics, but with a reduced environmental footprint.

Polylactic Acid Market Trends:

- Environmental concerns: Growing awareness of plastic pollution from petroleum-based products is leading consumers and companies to seek biodegradable alternatives like PLA.

- Government support: Policies such as bans on single-use plastics, landfill taxes, and funding for green technologies are encouraging the adoption of PLA.

- Evolving consumer preferences: A significant portion of consumers are willing to pay more for products with sustainable packaging, and a growing number of companies are adopting eco-friendly solutions to meet this demand.

- Technological advancements: Continuous research and development are leading to improved PLA production techniques and higher-performance grades of the material, which expand its potential applications in more demanding industries.

- Industry growth: The expansion of e-commerce has increased the need for packaging, and PLA is a major beneficiary of this trend as companies shift to sustainable options.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 2.74 Billion |

| Revenue Forecast in 2035 | USD 11.74 Billion |

| Growth Rate | CAGR 17.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Raw Material, By Application, By End-use, By Region |

| Key companies profiled | TotalEnergies Corbion (Netherlands), Hisun Biomaterials (China), Futerro (Belgium), Sulzer Ltd (Switzerland), Unitika Ltd (Japan), JIANGSU SUPLA BIOPLASTICS CO., LTD., COFCO, Jiangxi Keyuan Biopharm Co., Ltd., Shanghai Tong-jie-liang Biomaterials Co., LTD., Zhejiang Hisun Biomaterials Co., Ltd., BASF SE, Danimer Scientific, Mitsubishi Chemical America, Inc. |

Key Technological Shifts In The Polylactic Acid Market:

Technological advancements in PLA compounding are expanding applications in automotive and electronics. PLA demand in 3D printing is expected to double by 2030 due to the rise in rapid prototyping industries. Government policies banning single-use plastics are significantly accelerating PLA market expansion.

Trade Analysis Of Polylactic Acid Market: Import & Export Statistics

- The world exported 1,043 shipments of Polylactic Acid from June 2025 to May 2025 (TTM). These exports were made by 99 exporters to 110 buyers, marking a 304% growth rate compared to the previous twelve months.

- Most of the Polylactic Acid exports from the world go to Vietnam, India, and Turkey.

- Globally, the top three exporters of Polylactic Acid are China, Thailand, and Germany. China leads with 1,096 shipments, followed by Thailand with 346 shipments and Germany with 67 shipments.

- According to Polylactic Acid export data, there are a total of 170 Polylactic Acid suppliers worldwide, exporting to 202 buyers globally. From June 2025 to May 2025, 110 suppliers were active, with GUANGDONG INSLOGIC CO., LTD., GUANGDONG SANTAI TRADING CO., LTD., and GUANGDONG INSLOGIC CO., LTD. accounting for 75% of the world's total Polylactic Acid exports.

- GUANGDONG INSLOGIC CO. LTD. is the leading supplier, constituting 32% of the total with 276 shipments.

- Following closely is GUANGDONG SANTAI TRADING CO., LTD., with a 25% share, or 213 shipments.

- GUANGDONG INSLOGIC CO. LTD. ranks third with 19% of the total, totalling 166 shipments.

Polylactic Acid Market Value Chain Analysis

- Chemical Synthesis and Processing : Polylactic acid is produced from renewable feedstocks such as corn starch, sugarcane, and cassava through fermentation of sugars into lactic acid, followed by ring-opening polymerisation to form PLA resin. The polymer is then processed via extrusion, injection moulding, thermoforming, and blow moulding into films, fibres, and packaging products.

- Key players NatureWorks LLC, TotalEnergies Corbion, Hisun Biomaterials, Futerro, Danimer Scientific

- Quality Testing and Certification :PLA products are tested for biodegradability, compostability, mechanical strength, and thermal performance under standards such as ASTM D6400, EN 13432, and ISO 17088. These certifications ensure compliance with industrial and home composting requirements..

- Key players: TÜV Austria, SGS, UL Solutions, Intertek.

- Distribution to Industrial Users :PLA materials are supplied to packaging, textile, agriculture, medical device, and 3D printing industries through polymer distributors, converters, and OEM supply contracts..

- Key players: NatureWorks LLC, TotalEnergies Corbion, Futerro, Hisun Biomaterials..

Polylactic Acid Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| North America (USA, Canada) | US FDA, US EPA, Environment and Climate Change Canada (ECCC) | FDA 21 CFR for food contact materials, EPA Sustainable Materials Management Program, Canada Environmental Protection Act (CEPA) | Biodegradability standards, food-contact safety, life-cycle emissions | PLA used in food packaging must comply with FDA food-contact clearance; compostability claims require ASTM D6400 certification. |

| Europe | European Commission, European Chemicals Agency (ECHA), CEN | EU Packaging & Packaging Waste Directive, REACH Regulation, EN 13432 compostability standard | Circular economy compliance, compostability, chemical safety | PLA products marketed as compostable must meet EN 13432 standards; strong focus on reducing single-use plastic waste. |

| Asia Pacific | Ministry of Environment (Japan), China MEE, BIS India | Japan Green Purchasing Law, China Plastic Pollution Control Action Plan, BIS standards for biodegradable plastics | Eco-labelling, plastic waste reduction, and bio-based material promotion | Countries like Japan and South Korea provide policy support for bioplastics adoption, particularly in packaging and agriculture. |

| Latin America | Brazil National Environment Council (CONAMA), Mexico SEMARNAT | National Solid Waste Policy (Brazil), Mexico’s General Law for Waste Prevention | Plastic waste management, bio-based material promotion | Growing adoption of bioplastics due to stricter plastic waste laws in Brazil and Chile. |

| Middle East & Africa | SASO (Saudi Arabia), UAE Ministry of Climate Change and Environment, South African Bureau of Standards (SABS) | Saudi Biodegradable Plastics Regulation, UAE Single-Use Plastics Policy | Biodegradability, single-use plastic alternatives | GCC countries are promoting biodegradable polymers through mandatory standards and import compliance regulations. |

Segmental Insights

Raw Material Insights

How Did The Corn Starch Segment Dominate The Polylactic Acid Market In 2025?

The corn starch segment dominated the polylactic acid market with a share of 66.11% in 2025. Corn starch is the most widely used raw material for PLA production due to its large availability, established supply chain, and cost-effectiveness. It offers high fermentation efficiency, leading to consistent lactic acid output for polymerisation. The use of corn starch also supports large-scale commercial production.

The sugarcane segment expects significant growth in the market during the forecast period. Sugarcane-based PLA is gaining strong traction because of its high sugar yield and lower greenhouse gas emissions during cultivation. Sugarcane-based PLA has better carbon footprint performance due to carbon absorption during crop growth. Its increasing adoption is supported by the expanding bio-economy and circular economy initiatives worldwide.

The cassava segment has seen notable growth in the market. Cassava is emerging as an alternative feedstock, particularly in Southeast Asia and parts of Africa, due to its low cultivation cost and adaptability to poor soil conditions Cassava-based PLA is being explored to reduce dependency on corn and sugarcane, supporting regional bio-based material production and rural economic development.

Application Insights

Which Application Segment Dominated The Polylactic Acid Market In 2025?

The rigid thermoform segment dominated the polylactic acid market with a share of 46.19% in 2025. Rigid thermoformed PLA products are widely used in food packaging applications such as trays, containers, and disposable cutlery. Rising demand from ready-to-eat food, supermarket packaging, and quick-service restaurants is driving the growth of PLA rigid thermoform applications globally.

The films and sheets segment expects significant growth in the market during the forecast period. PLA films and sheets are extensively used in flexible packaging, agricultural mulch films, and protective packaging applications. PLA-based films also offer good printability, transparency, and biodegradability, making them ideal for food packaging, wrapping, and industrial protective uses.

The bottles segment has seen notable growth in the market. PLA bottles are increasingly adopted for beverages, personal care products, and consumer good packaging due to their biodegradable and renewable nature. Despite challenges related to heat resistance and strength, continuous technological advancements are improving PLA bottle performance, supporting its penetration in premium and eco-friendly product segments.

End Use Insights

How Did The Packaging Segment Dominate The Polylactic Acid Market In 2025?

The packaging segment dominated the polylactic acid market with a share of 38.42% in 2025. Packaging is the largest end-use segment for the PLA market, driven by the global transition toward eco-friendly materials. Increasing government regulations on single-use plastics and rising environmental awareness among consumers are key factors accelerating PLA adoption across the global packaging industry.

The agriculture segment expects significant growth in the market during the forecast period. In agriculture, PLA is used in mulch films, plant pots, and controlled-release fertiliser coatings. PLA-based agricultural products are biodegradable, eliminating the need for post-use retrieval. With the growing focus on sustainable farming and eco-friendly agricultural practices, this segment is expected to witness steady growth.

The automotive and transportation segment has seen notable growth in the market. The automotive and transportation segment is emerging as a promising application area for PLA due to increasing demand for lightweight and sustainable materials. Automotive manufacturers are increasingly adopting bio-based materials to reduce carbon emissions and improve vehicle sustainability credentials, supporting the gradual growth of PLA usage in this sector.

Regional Insights

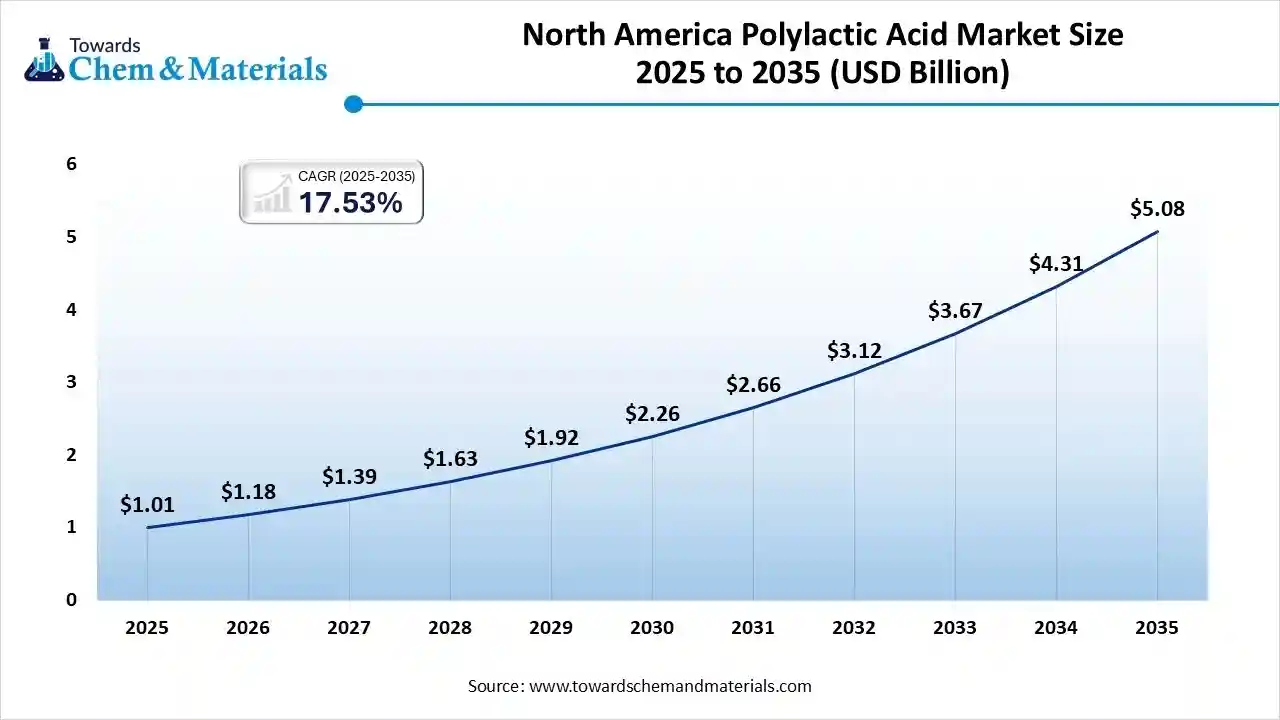

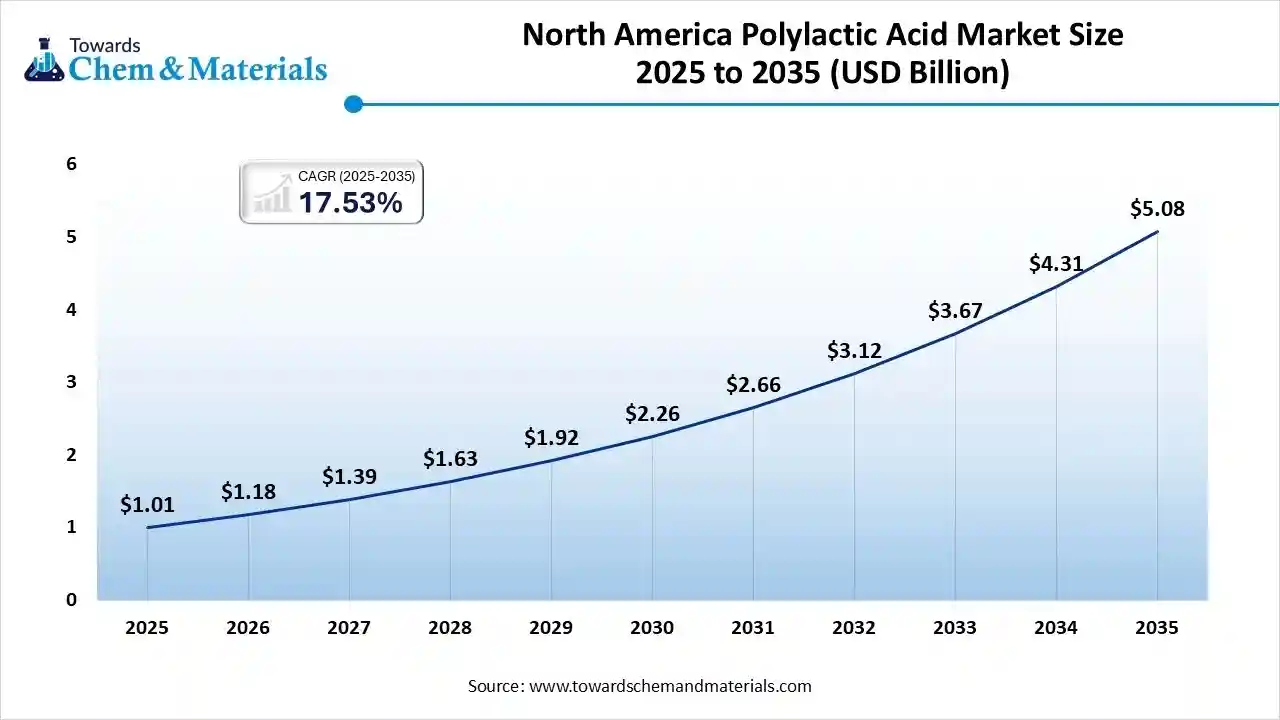

The North America adhesives and sealants market size was valued at USD 1.01 billion in 2025 and is expected to reach USD 5.08 billion by 2035, growing at a CAGR of 17.53% from 2026 to 2035. North America dominates the polylactic acid market with a share of 43.19% in 2025.

North America holds a significant share in the PLA market due to advanced bioplastic technology infrastructure and high awareness of sustainable alternatives. The presence of key PLA manufacturers and research-based developments in biopolymers strengthens the regional market. Favourable policies supporting renewable materials and corporate sustainability commitments from major brands further drive adoption.

The U.S. Has Seen Growth Driven By The Growing Production Facilities

The U.S. is a leading contributor to the North American PLA market due to the presence of established PLA manufacturers and large-scale production facilities. The food packaging, disposable tableware, and medical sectors are the key consumers. Growing investments in compostable materials and industrial composting infrastructure support higher adoption of PLA. Additionally, strong funding for biopolymer research by government and private players is accelerating innovation and commercialisation.

Asia Pacific Is Experiencing Growth Due To Growing Awareness And Demand.

Asia Pacific is expected to experience fastest growth in polylactic acid in the forecast period. Due to strong growth in sustainable packaging, rising environmental regulations, and increasing consumer awareness regarding biodegradable plastics. Government bans on single-use plastics and incentives for green materials are also strengthening regional demand. The region benefits from abundant agricultural feedstock like corn and sugarcane, supporting cost-effective PLA production.

India: Polylactic Acid Market Growth Trends

India is emerging as a high-potential market for polylactic acid due to growing restrictions on conventional plastic usage and rising adoption of compostable materials. The packaging and food service industries are major end users, driven by e-commerce and food delivery platforms. Government initiatives like the single-use plastic ban and “Swachh Bharat” mission are encouraging industries to shift towards biodegradable polymers like PLA. Domestic manufacturing is gaining traction, supported by increasing investments in biopolymer plants and research institutions.

Europe Polylactic Acid Market Growth Is Driven By The Increasing Adoption

Europe is a major market for polylactic acid, driven by stringent environmental regulations and strong circular economy policies. The European Union’s focus on reducing carbon emissions and plastic waste has resulted in increased adoption of biodegradable plastics across the packaging, agriculture, and consumer goods sectors. High consumer preference for sustainable products also plays a critical role in regional growth.

Germany: Polylactic Acid Market Growth Trends

Germany is one of the largest PLA markets in Europe due to its strong industrial base and leadership in sustainable manufacturing technologies. The country’s packaging and automotive industries are increasingly incorporating bio-based plastics. Strong government policies promoting circular economy practices and recycling infrastructure further support PLA adoption. Germany’s advanced R&D ecosystem also contributes to innovation in PLA-based materials and applications.

South America's Growth Is Driven By The Large Feedstock Availability

South America is gradually emerging as a growing PLA market due to increasing environmental awareness and agricultural feedstock availability. Countries like Brazil and Argentina benefit from abundant sugarcane and corn, which are essential raw materials for PLA production. The packaging and agricultural film sectors are key demand drivers. Regional governments are increasingly focusing on reducing plastic pollution, which supports the future growth of biodegradable polymers.

Brazil: Polylactic Acid Market Growth Trends

Brazil holds strong potential in the PLA market due to its large sugarcane production, which provides a sustainable feedstock for bio-based polymers. The food packaging and consumer goods sectors are the main application areas. Government regulations on plastic waste reduction and the expansion of green manufacturing initiatives are fueling the demand for biodegradable materials. Brazil’s strong agricultural base positions it as a future hub for bioplastics production.

Middle East & Africa (MEA) Market Growth Is Driven By Sustainability Initiatives

The Middle East & Africa region is still at a developing stage in the PLA market, but shows rising interest due to increasing sustainability initiatives and waste management reforms. Countries are gradually adopting biodegradable alternatives in the packaging and food service sectors. Growing environmental awareness and government-led sustainability programs, especially in the Gulf region, are expected to support steady market growth.

United Arab Emirates (UAE): Polylactic Acid Market Growth Trends

The UAE is leading the adoption of sustainable materials in the Middle East due to strong sustainability goals under its national environmental strategies. The government’s push toward smart and sustainable cities is increasing the use of biodegradable packaging materials like PLA. The hospitality and retail food sectors are major demand drivers. Investments in green manufacturing and waste management infrastructure further support market development.

Recent Developments

- In May 2025, Balrampur Chini Mills Limited (BCML) launched 'Balrampur Bioyug', India's first industrial-scale polylactic acid (PLA) brand. The brand is centred around a fully integrated facility in Kumbhi, Uttar Pradesh, which will convert sugarcane derivatives directly into PLA using renewable energy and is expected to be operational by October 2026 with an annual capacity of 80,000 tonnes.(Source: agrospectrumindia.com)

- In April 2025, TotalEnergies Corbion and Useon partnered to advance EPLA (Expanded PLA) foam technology, offering an industrially compostable, plant-based substitute for expanded polystyrene (EPS). This technology utilises TotalEnergies Corbion's Luminy® PLA bioplastics, made from non-GMO sugarcane, processed via Useon's direct bead foaming method.(Source: www.chemanalyst.com)

- In October 2025, Sulzer and TripleW collaborated to launch the world's first industrial-scale production of polylactic acid (PLA) bioplastic derived entirely from food waste. This process utilises food industry waste streams to create lactic acid, which is then converted into PLA for applications in consumer products like packaging and fabrics.(Source: www.ofimagazine.com)

Top Players in the Polylactic Acid Market & Their Offerings:

NatureWorks LLC (USA)

Corporate Information

- Name: NatureWorks LLC

- Headquarters: Minnetonka / Plymouth, Minnesota, USA

- Manufacturing Facility: Blair, Nebraska, USA (150,000 metric tons/year capacity)

- Ownership: Jointly owned by Cargill, Inc. and PTT Global Chemical.

- Key Product: Ingeo™ biopolymer (PLA)

R&D / Applications Facility: Ingeo Applications Development Facility in Savage, MN.

History and Background

- NatureWorks began in 1989 as a Cargill research project, exploring plant derived carbohydrates for sustainable plastics.

- Early on, Cargill formed a joint venture with Dow Chemical (Cargill-Dow LLC) to commercialize PLA.

- In 2002, NatureWorks’ first large-scale PLA manufacturing plant began operations in Blair, Nebraska.

- In 2005, Cargill bought out Dow’s stake, making NatureWorks fully under Cargill’s control.

Key Developments and Strategic Initiatives

- Integrated Thailand Plant: In 2021, NatureWorks got final shareholder authorization to build a fully integrated

- Ingeo PLA complex in Thailand (lactic acid, lactide, polymer).

- Construction Milestone: In February 2023, a cornerstone-laying ceremony was held at the Thailand site (Nakhon Sawan), targeting completion in H2 2025.

- Next Phase: In October 2023, NatureWorks announced that the plant construction is on track, with production expected to begin in 2025.

Mergers & Acquisitions

- Dow Exit: Cargill acquired Dow’s stake in their joint-venture, renaming the business NatureWorks LLC.

- No major M&A activity: There’s no publicly reported major acquisition of other biopolymer companies by

- NatureWorks; instead, their growth seems to hinge on organic investment and capacity expansion.

Partnerships & Collaborations

- Engineering / Construction Partners (Thailand): For the Nakhon Sawan facility, NatureWorks selected Jacobs for detailed engineering and IAG for project management, procurement, etc.

- TTCL Public Company Limited: Chosen as the general contractor for the Thailand complex.

- Supply Chain / Brand Collaborations: NatureWorks works with converters, brand owners, and retailers globally to bring Ingeo-based products (e.g., packaging, coffee capsules, 3D printing) to market.

Product Launches / Innovations

- Ingeo Extend Platform: This is a newer PLA grade platform designed for faster compostability (up to 8× faster) and improved manufacturing efficiency (especially in biaxial film).

- Ingeo 3D300: A 3D printing-specific grade introduced by NatureWorks for faster print speeds and high surface quality.

- Low carbon feedstocks research: They’re developing fermentation routes (e.g., methane to lactic acid) to improve sustainability.

Key Technology Focus Areas

- Fermentation: Converting plant-derived sugars (or even greenhouse gases) into lactic acid, the monomer for PLA.

- Polymerization / Lactide Chemistry: NatureWorks optimizes how lactic acid is turned into lactide and then polymerized into Ingeo.

- Lifecycle / Circular Economy: They emphasize cradle-to-cradle thinking, compostability, and chemical recycling of PLA.

R&D Organisation & Investment

- The new R&D center in Plymouth, MN (opened 2022) is focused on advanced biopolymer research including next-gen fermentation and lifecycle innovation.

- Investment in fermentation labs: In 2016, they opened a fermentation lab for developing commercial-scale methane-to-lactic-acid processes.

SWOT Analysis

Strengths:

- First-mover advantage: One of the earliest commercial-scale PLA producers.

- Strong backing / ownership: Supported by Cargill and PTT Global Chemical, giving financial strength & access to feedstock.

- Integrated operations: With the upcoming fully integrated facility in Thailand, they will control lactic acid - lactide - PLA.

- Diverse product portfolio: Ingeo grades tailored for packaging, 3D printing, fibers, compostable applications, etc.

- Sustainability credentials: Low-carbon, biobased material; strong LCA orientation.

Weaknesses:

- Capital intensive: Building integrated plants (like in Thailand) requires massive investment.

- Feedstock risk: Dependence on renewable plant sugars (corn, sugarcane) could pose supply / price volatility.

- End-of-life challenges: While compostable, PLA needs industrial composting; home composting is not always feasible.

- Competition: Growing competition from other PLA producers and alternative bioplastics.

Opportunities:

- Geographic expansion: Asian facility expands reach into ASEAN and APAC markets.

- New application segments: Growth in 3D printing, compostable packaging (coffee pods, tea bags), hygiene / nonwovens.

- Circular economy integration: Chemical recycling, composting, and next-gen feedstocks (e.g., methane) can open new business models.

- Partnerships: Potential to collaborate with large consumer brands to scale Ingeo in mainstream products.

Threats:

- Regulatory risk: Changes in environmental regulations, composting standards, or bio feedstock policies could impact business.

- Raw material competition: Demand for bio-feedstock might increase competition with food or other bioindustries.

- Technological risk: If novel bioplastics (e.g., PHA) or more efficient recycling emerge, PLA’s competitiveness may be challenged.

- Market perception: Concerns around “biodegradable plastics greenwashing” could affect adoption.

Recent News & Strategic Updates

- Thailand PLA Plant Construction: The new Thailand complex (75,000 tpa) is under construction, with full start-up expected in 2025.

- Cornerstone Ceremony: In Feb 2023, NatureWorks held a ceremonial event to mark progress in building the Nakhon Sawan facility.

- Safety Recognition: The Nebraska and Minnesota facilities have received industry safety awards, highlighting operations excellence.

Other Top Players Are

- TotalEnergies Corbion (Netherlands): A joint venture between TotalEnergies and Corbion, the company produces high-performance PLA under the Luminy® PLA brand. Its products are used in food packaging, medical applications, consumer products, and durable goods due to their enhanced thermal and mechanical performance.

- Hisun Biomaterials (China): Hisun Biomaterials is a major PLA producer in Asia, supplying PLA resins for disposable tableware, packaging films, and biodegradable bags. The company focuses on large-scale production and meeting the growing demand for sustainable packaging in emerging economies.

- Futerro (Belgium): Futerro offers integrated PLA solutions, including lactic acid production and PLA resin manufacturing. The company supports applications in agricultural films, food packaging, and industrial compostable materials.

- Sulzer Ltd (Switzerland): Sulzer is a key technology provider in the PLA value chain, supplying processing equipment and technologies for lactic acid and PLA polymerisation. It enables large-scale industrial production for global PLA manufacturers.

- Unitika Ltd (Japan): Unitika produces PLA resins and fibres used in packaging, textiles, and biomedical applications, contributing to sustainable alternatives for petroleum-based plastics.

- JIANGSU SUPLA BIOPLASTICS CO., LTD.

- COFCO

- Jiangxi Keyuan Biopharm Co., Ltd.

- Shanghai Tong-jie-liang Biomaterials Co., LTD.

- Zhejiang Hisun Biomaterials Co., Ltd.

- BASF SE

- Danimer Scientific

- Mitsubishi Chemical America, Inc.

Segments Covered:

By Raw Material

- Corn starch

- Sugarcane

- Cassava

- Others

By Application

- Rigid thermoform

- Film & sheets

- Bottles

- Others

By End-use

- Packaging

- Agriculture

- Automotive & transportation

- Electronics

- Textile

- Consumer goods

- Bio-medical

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa