Content

What is the Current U.S. Biopolymers Market Size and Share?

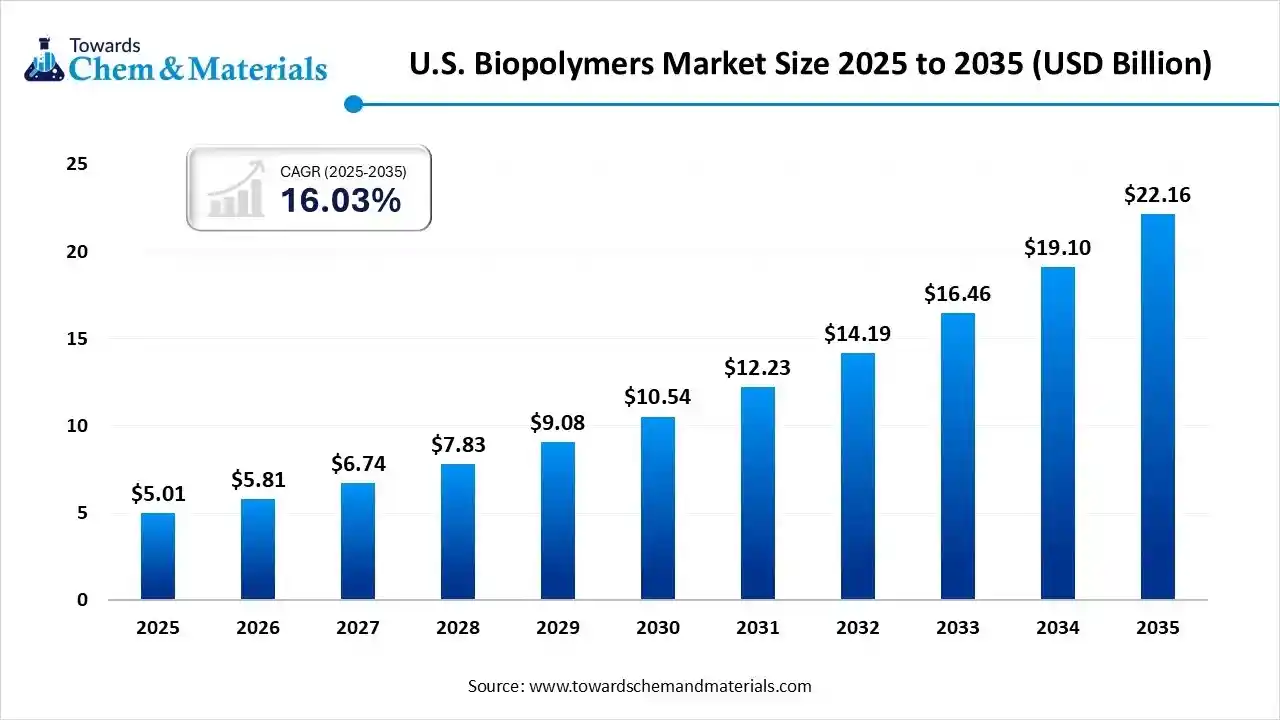

The U.S. biopolymers market size is calculated at USD 5.01 billion in 2025 and is predicted to increase from USD 5.81 billion in 2026 and is projected to reach around USD 22.16 billion by 2035, The market is expanding at a CAGR of 16.03% between 2026 and 2035. The global shift towards plastic dependence reduction has fueled sector growth in the past few years.

Key Takeaways

- By polymer type, the polysaccharide-based biopolymers segment dominated the market in 2025.

- By application, the packaging segment dominated the market in 2025.

- By product form, the flexible packaging segment dominated the market in 2025.

- By biodegradability, the biodegradable/compostable biopolymers segment dominated the market in 2025.

Organic Materials, Big Impact: Biopolymers Reshape Global Demand

The special plastic, which is made from living things such as algae, plants, and microbes instead of oil or petroleum called a biopolymer. Also, these biopolymers included PHA, PLA, and biobased PET as per the latest information. Moreover, the increasing demand for these types of polymers is the sectors such as the fibres, packaging, and medical items is expected to lead robust revenue growth across the sector in the coming period.

U.S. Biopolymers Market Trends

- The establishment of the local waste hubs is actively maintaining and enhancing the financial stability of the industry nowadays in the United States. Also, these local waste hubs have been seen in collecting food processing residues, restaurant oil, and agricultural waste and turning them into feedstock. Also, these feedstocks are further transported into the biopolymer plant.

- The integration into electronics and smart products has supported the capital growth and economic activity in the sector in recent years. Also, several major brands in the United States have been conducting trials that biopolymers can handle heat or mechanical stress in the current period.

- The sudden shift towards traceable and low-carbon materials is driving the substantial financial gains in the manufacturing sector. Also, these diversions are heavily impacting large retailers, consumer brands, and major food chains in the United States nowadays.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 5.01 Billion |

| Revenue Forecast in 2035 | USD 22.16 Billion |

| Growth Rate | CAGR 16.03% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Polymer Type, By Application / End Use Industry, By Product Form / Usage Format, By Biodegradability / Sustainability Profile |

| Key companies profiled | BASF SE, Braskem, DuPont de Nemours, Inc, Novamont S.p.A., BioLogiQ Inc., BioPolymer GmbH & Co KG, Solanyl Biopolymers Inc., BioPolymer Industries, Inc. |

When Microbes Become Manufacturers: The Rise of Custom Polymers

Technology advancement has played a major role in the industry's potential in recent years. The use of advanced bioengineering to design microbes that produce custom polymer structures has elevated earning potential for producers in recent years. Instead of copying existing plastics, scientists are programming microorganisms to make new types of materials with improved flexibility, strength, heat resistance, or recyclability.

Value Chain Analysis of the U.S. Biopolymers Market:

- Distribution to Industrial Users: The distribution of the U.S. biopolymers market to industrial users is dominated by the packaging sector, with significant applications also found in textiles, automotive, medical, and agriculture. The distribution channel primarily directs sales from manufacturers to industrial buyers who require customization and technical support

- Key Players: NatureWorks LLC and BASF SE

- Chemical Synthesis and Processing:The U.S. biopolymers market relies on specific chemical synthesis (fermentation and polymerization) and processing technologies (extrusion and injection molding) to convert renewable biomass into sustainable materials.

- Key players include NatureWorks, Braskem, and Danimer Scientific, who specialize in these production methods

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring for the market are managed by a framework of federal agencies, each addressing different aspects of the product lifecycle and claims. The primary agencies involved are the Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA)

U.S. Biopolymers Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

|

United States |

Environmental Protection Agency (EPA) | USDA BioPreferred Program | Reducing Petroleum Dependence |

Segmental Insights

Polymer Insights

How did the Polysaccharide-Based Biopolymers Segment Dominate the U.S. Biopolymers Market in 2025?

The polysaccharide-based biopolymers segment dominated the market in 2025 owing to factors such as affordability, regulatory acceptance, and scalability in the current period. Also, the huge production facilities of cellulose, starch, and alginate have actively contributed to the polysaccharide-based biopolymer industry growth in recent years.

The polylactic acid segment is expected to grow fastest, owing to its compatibility with traditional equipment. Moreover, having mechanical strength and clarity, the polylactic acid is expected to create its demand in sectors such as the rigid packaging, 3D printing materials, and fibers in the United States for the future period.

The polyhydroxyalkanoates (PHA) segment is also notably growing, akin to its microbial fermentation-based production, which allows controlled material tuning in recent years. Also, greater investment in industrial biotechnology is majorly supporting the growth of the segment in the current period.

Application Insights

Why does the Packaging Segment Dominate the U.S. Biopolymers Market?

The packaging segment dominated the market in 2025, akin to its enormous material throughput, strict sustainability requirements, and broad end-use coverage across food, retail, logistics, and consumer goods in the past few years. Biopolymers integrate easily into existing converting lines, enabling cost-efficient adoption for films, coatings, thermoformed products, and pouches.

The automotive & transportation segment is expected to grow at a fastest CAGR due to lightweighting priorities, stringent sustainability targets, and rapid EV manufacturing expansion in the U.S. Moreover, bio-based materials reduce life-cycle emissions and support compliance with federal and state-level environmental standards.

The medical and healthcare segment is also notably growing, akin to the increasing need for biocompatibility, controlled degradation capability, and suitability for advanced therapeutic applications nowadays. Also, these materials support drug-delivery platforms, absorbable implants, scaffolds, and wound-care products with reduced complication risk.

Product Form Insights

How did the Flexible Packaging Segment Dominate the U.S. Biopolymers Market in 2025?

The flexible bioplastics segment dominated the market in 2025 owing to its high volume demand, cost-efficient logistics, and strong alignment with sustainability commitments in the United States retail and food sectors in recent times. Biopolymer films and coatings integrate seamlessly into current extrusion and lamination systems, enabling smooth commercialization as per the observation.

The rigid items segment is expected to grow at the fastest CAGR. As industries transition to durable, renewable content materials with improved mechanical and thermal performance. Innovations in PLA, PHA, and cellulose composites are enabling applications in food-service ware, consumer products, durable packaging, and electronics housings.

The fibers and textiles segment is also notably growing, akin to the trend towards performance-enhanced materials and low-carbon clothing. Furthermore, by offering controlled moisture management while reducing microplastic shedding, the fibers sector has attracted a sophisticated consumer base in recent years.

Biodegradability Insights

How did the Biodegradable Segment Dominate the U.S. Biopolymers Market in 2025?

The biodegradable segment dominated the market in 2025 due to its alignment directly with municipal composting programs, extended producer responsibility policies, and retailer-driven waste-reduction goals. Their ability to degrade in controlled environments makes them suitable for food contact materials, single-use items, and agricultural applications.

The bio-based but non-biodegradable biopolymers segment is expected to grow at the fastest CAGR, because they deliver high mechanical strength, thermal stability, and long-term durability while providing significant carbon-reduction benefits. These materials integrate seamlessly into closed-loop recycling systems, supporting the United States in the present time.

Recent Developments

- In September 2024, Braskem unveiled bio-circular polypropylene in the United States. Also, this newly launched polypylene is sustainable, and it's made by recycled material like used cooking oil and other as per the company's claim.(Source: www.indianchemicalnews.com)

Top Vendors in the U.S. Biopolymers Market & Their Offerings:

- BASF SE: As the largest chemical producer globally, BASF uses innovation to create a diverse portfolio of advanced chemical products, including high-performance materials and ingredients relevant to biopolymer applications.

- Braskem: A global leader in human and animal nutrition and the world's premier agricultural origination and processing company, which produces starches, sugars, and other materials that serve as feedstocks for the bioplastics industry.

- DuPont de Nemours, Inc: A global innovation leader with technology-based materials and solutions across various sectors, offering expertise in performance polymers and advanced materials used in many industries, including those looking for more sustainable options.

- Novamont S.p.A.: an Italian company that is a global leader in the production of third-generation bioplastics (Mater-Bi), focusing on biodegradable and compostable materials derived from renewable sources to provide solutions for single-use products and waste management.

Top Companies in the U.S. Biopolymers Market

- Novamont S.p.A.

- DuPont de Nemours, Inc

- Braskem

- BASF SE

- BioLogiQ Inc.

- BioPolymer GmbH & Co KG

- Solanyl Biopolymers Inc.

- BioPolymer Industries, Inc.

Segments Covered

By Polymer Type

- Polysaccharide-based biopolymers (starch blends, cellulose-derived, etc.)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Bio PE / Bio PET / Bio-based Polyethylene Terephthalate

- Other bio-based / biodegradable polymers (PBS, PBAT, bio polyamides, etc.)

By Application / End Use Industry

- Packaging (food, beverage, consumer goods packaging)

- Consumer Goods & Retail Packaging

- Automotive & Transportation (biopolymer-based parts, components)

- Medical & Healthcare (biopolymers for medical devices, disposable items)

- Agriculture & Horticulture (mulch film, seedling trays, bio plastic agricultural uses)

- Textiles, Electronics, Others

By Product Form / Usage Format

- Flexible packaging/films / sheets/bags

- Rigid items (bottles, containers, molded parts)

- Fibers & Textiles

- Specialty / Composite Parts (automotive, industrial parts, medical items)

By Biodegradability / Sustainability Profile

- Biodegradable / Compostable Biopolymers

- Bio-based but non-biodegradable Biopolymers (e.g. Bio-PE, Bio-PET)