Content

Asia Pacific Green Materials Market Size and Growth 2025 to 2034

The Asia Pacific green materials market volume was reached at 12.70 million tons in 2024 and is expected to be worth around 205.45 million tons by 2034, growing at a compound annual growth rate (CAGR) of 18.29% over the forecast period 2025 to 2034.The global shift towards eco-friendly materials has fueled the industry's potential in

Key Takeaways

- By material type, the bioplastic segment led the Asia Pacific green materials market in 2024 and expected to sustain its position during the forecast period due to it serves as a sustainable alternative to traditional plastics.

- By material type, the natural fibers and bio-composites segment is expected to grow at a notable rate in the market during the forecast period, because they are strong, lightweight, and made from renewable resources like hemp, jute, and flax.

- By end use, the packaging segment emerged as the top-performing segment in 2024, owing to the increased need for eco-friendly packaging from sectors such as e-commerce and food and beverage in recent years.

- By end use, the automotive & transportation segment is likely to experience notable growth during the expected period, owing to increased demand for lightweight vehicles and electric vehicles.

- By processing technology, the injection molding segment dominated the market in 2024, due to its being considered the most efficient method for shaping green materials into wider forms.

- By processing technology, the 3D printing (bio filament) segment is expected to grow significantly over the forecast period, as 3D printing has the flexibility and ability to use recycled and plant-based materials.

- By source type, in 2024, the plant-based segment emerged as the top consumer of the Asia Pacific green materials market in 2024, because it offers renewable, easily available raw materials like corn, sugarcane, and starch.

- By source type, the waste-derived segment is likely to witness the most rapid growth in the market in the years ahead, as industries seek more sustainable and circular production methods.

Market Overview

From Waste to Worth: Green Materials Revolution Across the Asia Pacific

The Asia Pacific green materials market refers to the production, distribution, and use of environmentally sustainable materials derived from renewable sources or designed for recyclability, biodegradability, and low environmental impact across various industries such as packaging, construction, automotive, electronics, textiles, and consumer goods. These materials help reduce carbon emissions, dependence on fossil resources, and landfill waste.

Which Factor Is Driving the Growth of the Asia Pacific Green Materials Market?

The sudden increase in government support for the sustainability adoption in heavy industries is spearheading the industry growth in the current period. Furthermore, the regional governments of countries such as India, China, and Japan have been heavily promoting green materials and providing several benefits to the eco-friendly manufacturing companies, such as tax reduction and attractive subsidies, in recent years. Furthermore, the expansion of the market created immense industry opportunities for the local eco-friendly raw material manufacturers in the current period.

Market Trends

- The increased demand for bioplastic packaging is driving industry growth in the current period. Several retailers and food companies have been shifting towards compostable and plant-based packaging in recent years in the region.

- The increased adoption of green materials in the automotive industry has contributed to the growth of the industry in recent years. Moreover, the manufacturers are using these materials for the reduction of the vehicle weight due to the fuel efficiency over the years.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 45.32 Million Tons |

| Expected Volume by 2034 | 205.45 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 18.29% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material Type, By End-Use Industry, By Processing Technology, By Source Type, By Regional Subdivision |

| Key Companies Profiled | Toray Industries Inc., Mitsubishi Chemical Group, NatureWorks LLC (Thailand JV), TotalEnergies Corbion (Thailand), Teijin Limited, Kaneka Corporation, BASF SE (APAC operations), DuPont (China Innovation Center), Indorama Ventures (rPET), Reliance Industries Ltd (India), Green Dot Bioplastics (APAC), Lotte Chemical, FKuR Kunststoff GmbH (Asia JV), Braskem (Asia Pacific operations), Solvay (Asia Pacific), Covestro AG (Bio-based line), Kingfa Sci. & Tech (Bio-materials), Tianan Biologic (China) |

Market Opportunity

Boosting Regional Economics Through Localized Production

The production and sourcing of raw materials locally is expected to create significant opportunities for manufacturers in the upcoming years. Moreover, the region has a heavy source of renewable raw materials where manufacturers can cut the high price by buying these locally during the forecast period. Moreover, by these initiatives, manufacturers can create local employment, which can support regional growth in the coming years, as per industry expectations.

Market Challenge

Green Innovations Hampered by Expense and Access

The high cost of green material is expected to hinder industry growth in the upcoming years, as green materials are seen in a higher cost than the conventional material in the region. Furthermore, the costs behind these costs are factors such as limited supply, small production, and costly technologies. These factors have hindered industry growth and created growth barriers for the new entrants and the mid-sized businesses in recent years, as per the regional survey.

Country-Wise Insights

India and China

India and China regions is dominated the Asia Pacific green materials market in the current period, akin by factors such as the heavy manufacturing facilities and the stronger government push for an eco-friendly environment in recent years. Moreover, both countries have the presence of major manufacturing companies that are actively seen under the heavy usage of green materials in their manufacturing facilities in recent years. Furthermore, China is observed to have a heavy investment in research and development, while India is actively promoting biodegradable materials in their region as per the recent regional surveys.

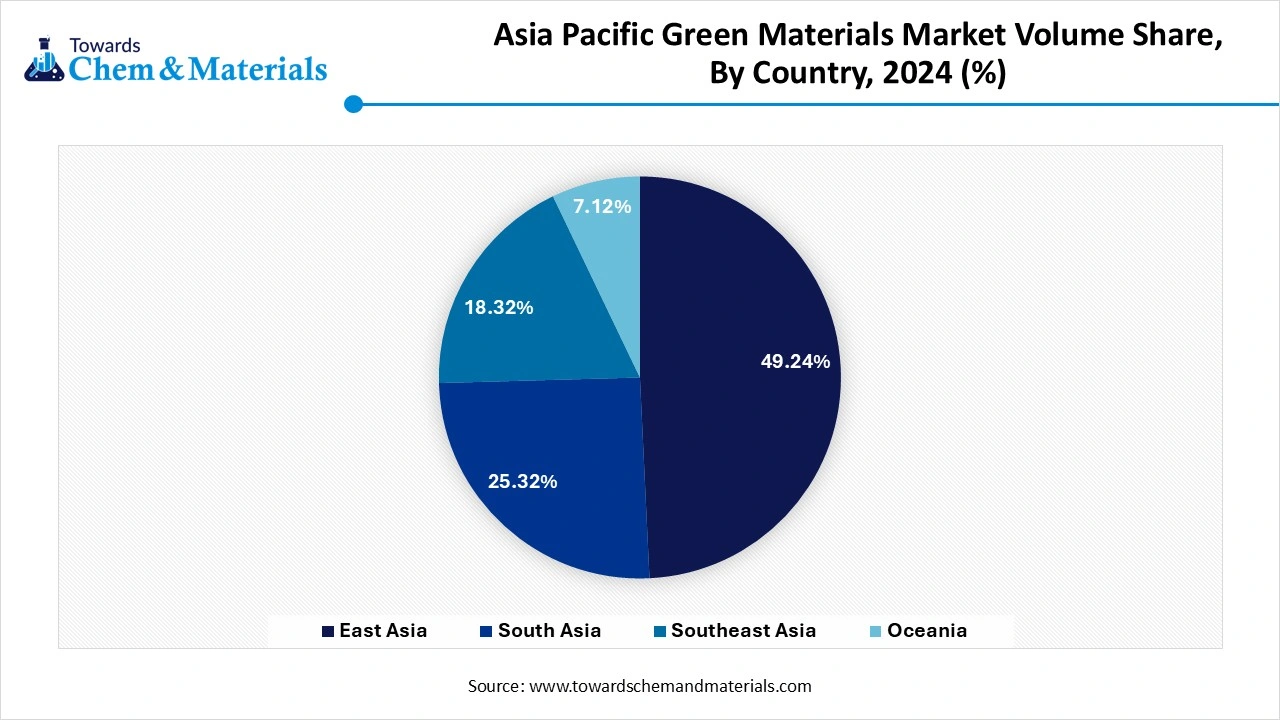

Asia Pacific Green Materials Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| East Asia | 49.24% | 6.25 | 52.41% | 107.68 | 37.19% |

| South Asia | 25.32% | 3.22 | 22.12% | 45.45 | 34.22% |

| Southeast Asia | 18.32% | 2.33 | 17.45% | 35.85 | 35.51% |

| Oceania | 7.12% | 0.90 | 8.02% | 16.48 | 38.06% |

| Total | 100% | 12.70 | 100% | 205.45 | 32.10% |

Material Type Insights

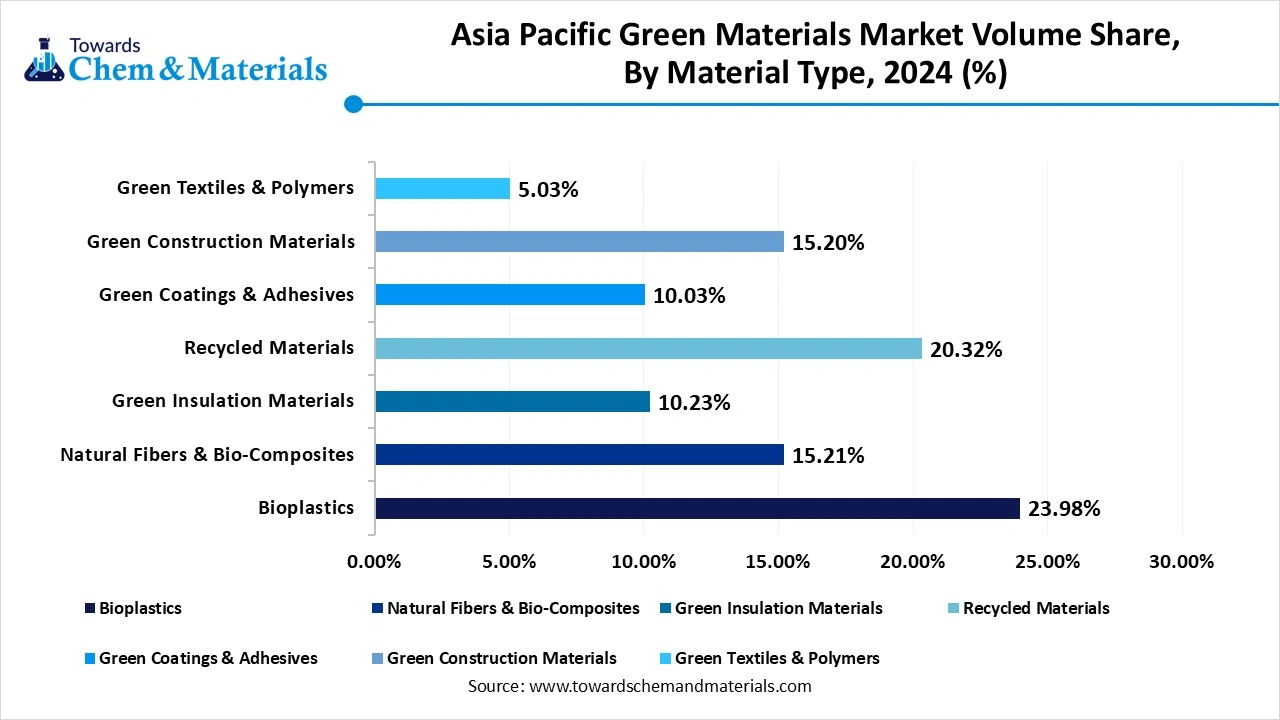

How the Bioplastic Segment Dominated the Asia Pacific Green Materials Market in 2024?

The bioplastic segment held the largest share of the market in 2024 and expected to sustain its position in the market during the forecast period, because it serves as a sustainable alternative to traditional plastics. They are made from renewable sources like corn starch or sugarcane and are widely used in packaging, consumer goods, and agriculture. Many companies are replacing fossil-based plastics with bioplastics to reduce their environmental impact. Governments are also encouraging the shift through bans on single-use plastics and promoting biodegradable options. Bioplastics are versatile, cost-effective, and easier to adopt across industries, making them the top choice in the green materials market today.

The natural fibers and bio-composites segment is seen to grow at a notable rate during the predicted timeframe, because they are strong, lightweight, and made from renewable resources like hemp, jute, and flax. These materials are being increasingly used in automotive parts, furniture, and construction. As industries look to reduce carbon emissions and plastic use, bio-composites offer a perfect eco-friendly solution. They also help reduce material weight, which is crucial for transportation and energy savings. With ongoing research and improved processing technologies, natural fibres and bio-composites are expected to become more affordable and widely used in the coming years.

Asia Pacific Green Materials Market Volume Share, By Material Type, 2024-2034 (%)

| By Material Type | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Bioplastics | 23.98% | 3.05 | 24.03% | 49.37 | 36.28% |

| Natural Fibers & Bio-Composites | 15.21% | 1.93 | 17.21% | 35.36 | 38.13% |

| Green Insulation Materials | 10.23% | 1.30 | 12.12% | 24.90 | 38.84% |

| Recycled Materials | 20.32% | 2.58 | 18.23% | 37.45 | 34.61% |

| Green Coatings & Adhesives | 10.03% | 1.27 | 9.03% | 18.55 | 34.66% |

| Green Construction Materials | 15.20% | 1.93 | 13.34% | 27.41 | 34.28% |

| Green Textiles & Polymers | 5.03% | 0.64 | 6.04% | 12.41 | 39.04% |

| Total | 100% | 12.70 | 100% | 205.45 | 32.10% |

End Use Industry Insights

Why Do Packaging Segments Dominate the Asia Pacific Green Materials Market by End Use Industry?

The packaging segment held the largest share of the Asia Pacific green materials market in 2024, owing to the increased need for eco-friendly packaging from sectors such as e-commerce and food and beverage in recent years. Moreover, the major brands are actively shifting their manufacturing and packaging facilities from plastic to biodegradable materials such as films, paper-based materials, and compostable materials in the current period.

The automotive and transportation segment is expected to grow at the fastest rate during the forecast period, owing to increased demand for lightweight vehicles and electric vehicles. Several automakers are actively seen in using green materials to reduce their vehicle weight, which provides greater fuel efficiency. Also, the material such as the bio-based foams, natural fiber composites, and recycled plastics are being used in the different types of vehicle parts like seats dash dashboards, and door panels. With the increased vehicle adoption, the segment is expected to gain major industry share in the coming years.

Processing Technology Insights

Why Did the Injection Molding Segment Dominate the Asia Pacific Green Materials Market in 2024?

The injection molding segment dominated the market with the largest share in 2024 due to its being considered the most efficient method for shaping the green materials into wider forms. Also, by having factors such the quick packaging and cost effectiveness, the injection molding has gained immense industry attention in recent years. Also, several packaging, automotive, and consumer goods manufacturers have heavily preferred the injection molding method owing to its accuracy and scalability in recent years.

The 3D printing (bio filaments) segment is expected to grow at a rapid rate during the forecast period, as 3D printing has the flexibility and ability to use recycled and plant-based materials. Moreover, for those manufacturers who have small batch production, 3D printing has been referred to as the ideal solution in recent years. Also, the manufacturers such the healthcare, fashion, and construction sectors are actively seen in the usage of the 3D printing process technology in recent years.

Source Type Insights

Why is the Plant-Based Segment Dominating the Asia Pacific Green Materials Market in 2024?

The plant-based segment held the largest share of the market in 2024 because it offers renewable, easily available raw materials like corn, sugarcane, and starch. These resources are widely used to produce bioplastics, bio-composites, and natural fibres. Industries prefer plant-based sources because they are familiar, scalable, and cost-effective. With clear environmental benefits and strong government support, plant-based green materials are currently the most popular and reliable option in the market. They're used in packaging, agriculture, textiles, and more, making them the leading source for eco-friendly alternatives.

The waste-derived segment is observed to grow at a notable rate during the forecast period as industries seek more sustainable and circular production methods. Using waste materials like food scraps, agricultural residues, or industrial by-products to create green materials helps reduce landfills and pollution. This approach supports zero-waste goals and helps companies lower their environmental footprint. As technologies for processing waste into valuable materials improve, waste-derived sources will become more economical and scalable. This trend aligns with global efforts to build a circular economy and reduce resource consumption, making waste-derived green materials a future growth area.

Recent Development

- In April 2024, the Navrattan Group is planning to introduce green cement. This will be launch in India with greater durability as per the report published by the company recently.(Source: www.businesstoday.in)

- In May 2025, CleanHub created a partnership with Green Worms. Also, these partnerships aim to establish the large material recovery unit in India. Moreover, the company's goal is to reduce carbon pollution in the coming years, as outlined in the report published by the company recently.(Source : blog.cleanhub.com)

Top Companies List

- Toray Industries Inc.

- Mitsubishi Chemical Group

- NatureWorks LLC (Thailand JV)

- TotalEnergies Corbion (Thailand)

- Teijin Limited

- Kaneka Corporation

- BASF SE (APAC operations)

- DuPont (China Innovation Center)

- Indorama Ventures (rPET)

- Reliance Industries Ltd (India)

- Green Dot Bioplastics (APAC)

- Lotte Chemical

- FKuR Kunststoff GmbH (Asia JV)

- Braskem (Asia Pacific operations)

- Solvay (Asia Pacific)

- Covestro AG (Bio-based line)

- Kingfa Sci. & Tech (Bio-materials)

- Tianan Biologic (China)

Segment Covered

By Material Type

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-based Plastics

- Cellulose-based Plastics

- Bio-PET

- Bio-PE

- Bio-PBS

- Others (Bio-PA, Bio-PP)

- Natural Fibers & Bio-Composites

- Hemp

- Flax

- Kenaf

- Jute

- Coir

- Bagasse

- Green Insulation Materials

- Cellulose

- Sheep Wool

- Cotton (Recycled Denim)

- Cork

- Aerogels (Bio-based)

- Recycled Materials

- Recycled Plastics

- Recycled Metals (Aluminum, Steel)

- Recycled Glass

- Reclaimed Rubber

- Green Coatings & Adhesives

- Waterborne Coatings

- UV-curable Coatings

- Powder Coatings (low-VOC)

- Bio-based Adhesives (Soy, Lignin, Casein-based)

- Green Construction Materials

- Bamboo

- Recycled Concrete Aggregates

- Fly Ash

- Green Cement

- Wood-Plastic Composites

- Green Textiles & Polymers

- Organic Cotton

- Lyocell/Tencel

- Recycled Polyester (rPET)

- Bio-Nylon

- Natural Dyes & Binders

By End-Use Industry

- Packaging

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Consumer Goods

- Agriculture

- Textile & Apparel

- Healthcare & Medical Devices

- Industrial Machinery

- Energy (Solar, Wind Turbine Components)

By Processing Technology

- Injection Molding

- Extrusion

- Thermoforming

- Blow Molding

- Compression Molding

- 3D Printing (Bio-based Filaments)

- Fiber Processing (for Bio-composites)

By Source Type

- Plant-Based

- Animal-Based

- Mineral-Based

- Waste-Derived (Post-Consumer, Industrial Scrap)

- Marine-Based (Algae, Chitosan)

By Regional Subdivision

- East Asia (China, Japan, South Korea, Taiwan)

- Southeast Asia (Indonesia, Vietnam, Thailand, Malaysia, Philippines, Singapore)

- South Asia (India, Bangladesh, Sri Lanka, Pakistan)

- Oceania (Australia, New Zealand)