Content

TPE Films and Sheets Market Size | Companies Analysis 2034

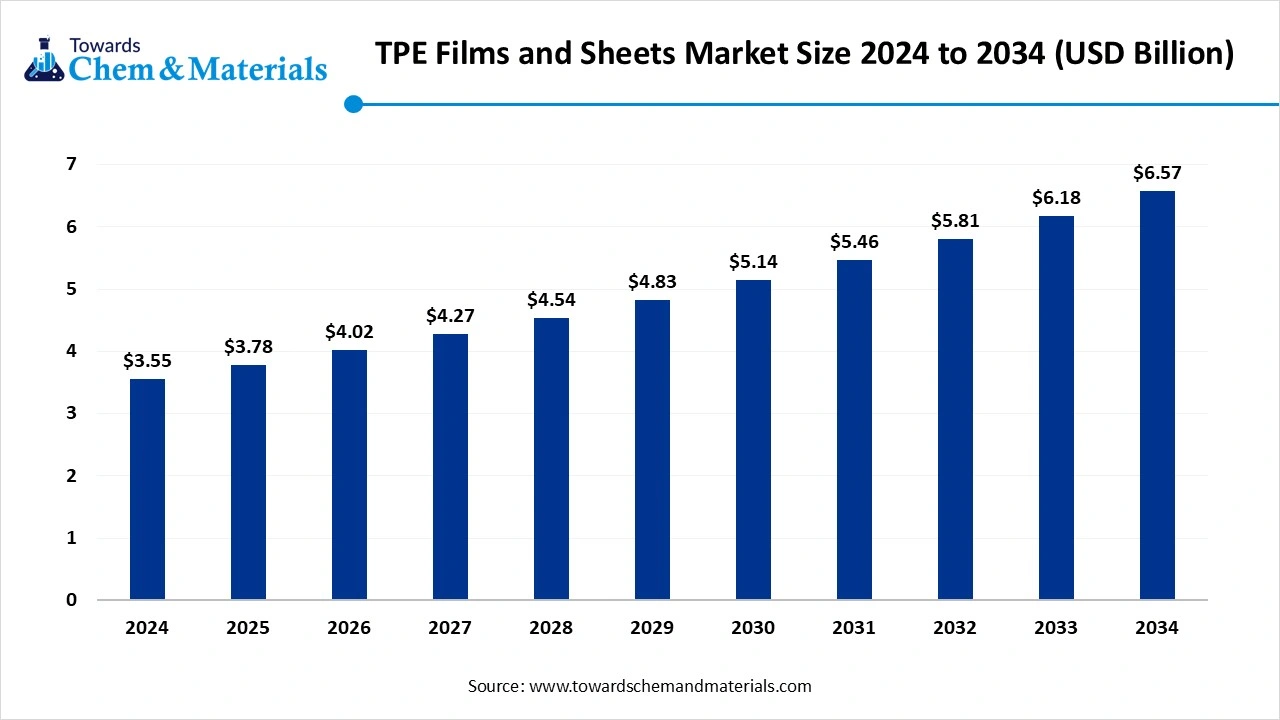

The global TPE films and sheets market size is calculated at USD 3.55 billion in 2024, grew to USD 3.78 billion in 2025, and is projected to reach around USD 6.57 billion by 2034. The market is expanding at a CAGR of 6.35% between 2025 and 2034. The growing demand in the medical sector due to its biocompatibility is the key factor driving market growth. Also, the ongoing trend towards sustainable solutions, coupled with the rapid urbanization fuelling infrastructure development, can fuel market growth further.

Key Takeaways

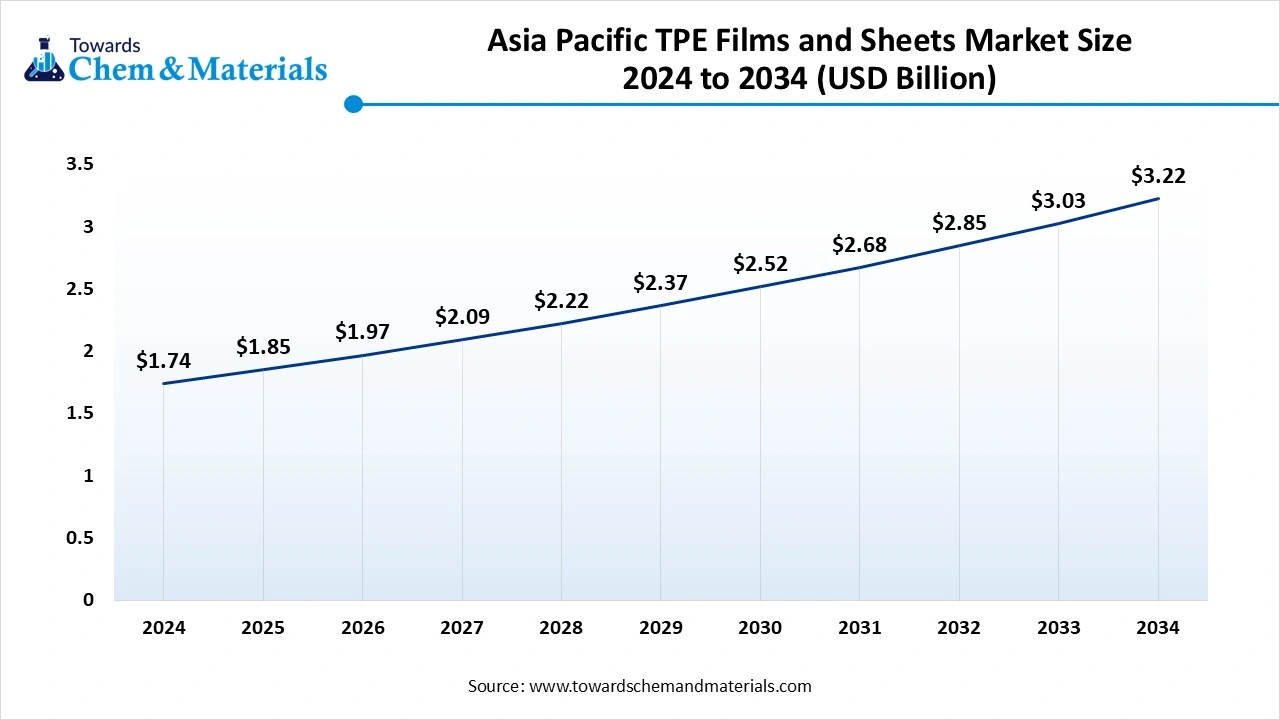

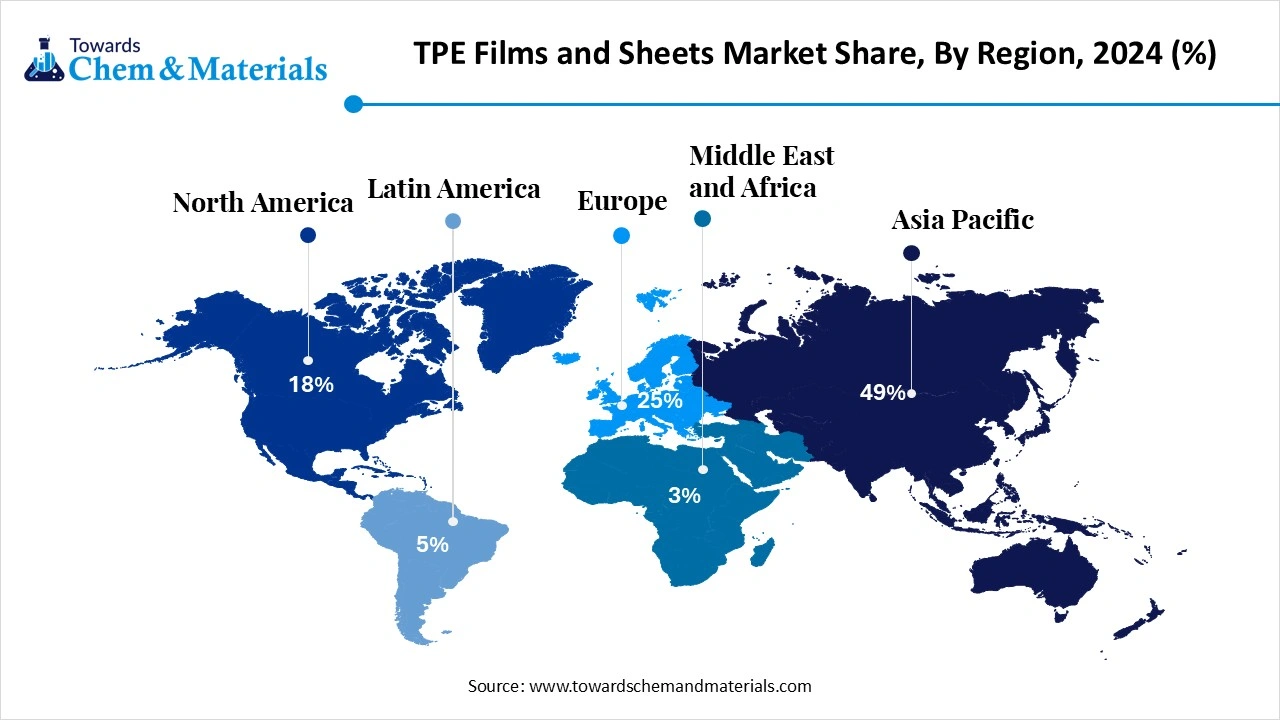

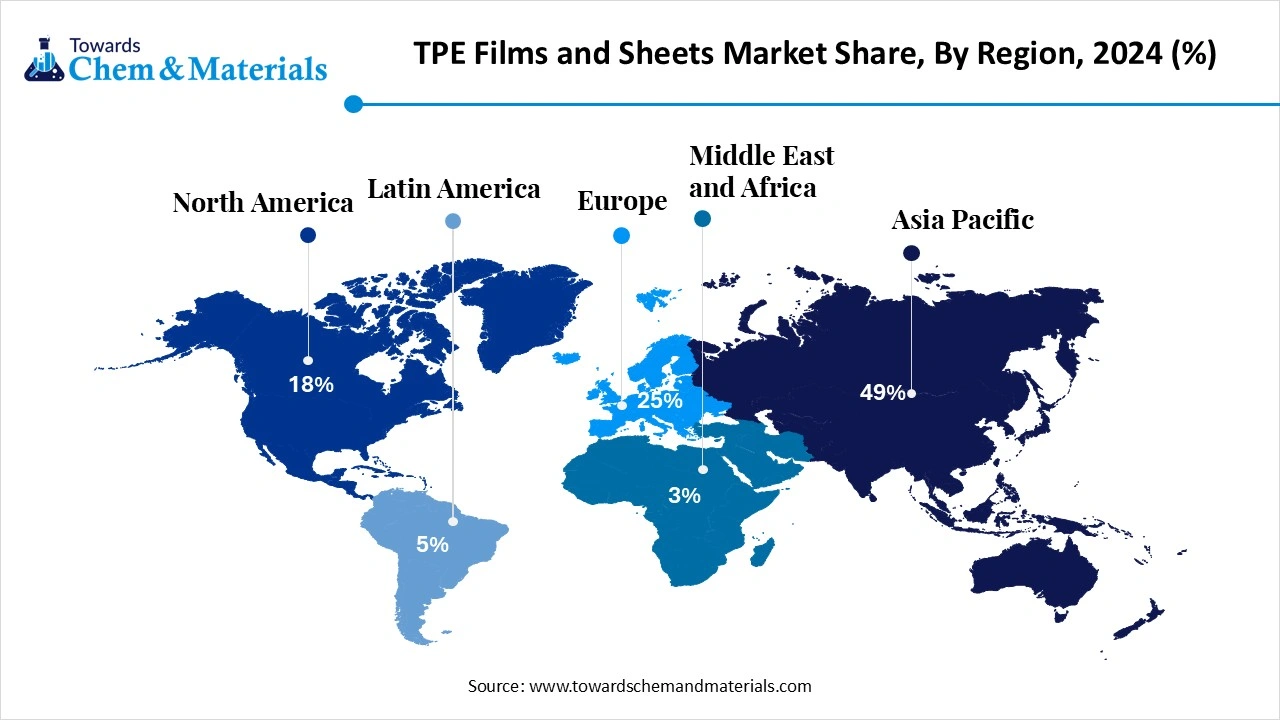

- By region, Asia Pacific dominated the market with a 49% share in 2024.

- By region, Europe is expected to grow at the fastest CAGR of 23% over the forecast period.

- By material family, the TPU segment dominated the market with a 38% share in 2024.

- By material family, the TPE-S (SEBS/SBS) segment is expected to grow at the fastest CAGR over the forecast period.

- By process, the cast/blown film extrusion segment held an approximate 46% market share in 2024.

- By process, the co-extrusion (multilayer) segment is expected to grow at approximately 21% market share in 2024.

- By application, the automotive interiors/exteriors segment dominated the market with a 31% share in 2024.

- By application, the healthcare & medical segment is expected to grow at the fastest CAGR of 22% during the

- projected period.

- By functional performance, the soft-touch / skin-contact segment held a 33% market share in 2024.

- By functional performance, the breathable/waterproof membranes segment is expected to grow at the fastest CAGR of 20% during the forecast period.

- By end use, the sheets segment held a 55% market share in 2024.

- By end use, the films' multilayer/laminates segment is expected to grow at the fastest CAGR of 27% over the projected period.

What are TPE Films and Sheets?

An expanding packaging sector, especially for flexible packaging, is a major market driver. TPE (thermoplastic elastomer) films and sheets are elastic, thermoprocessable web materials that combine rubber-like flexibility with thermoplastic processing. Typical families include TPU, TPE-S (SEBS/SBS), TPE-E (COPE), TPO, and TPV.

They are cast/blown as films or extruded/calendered as sheets, often co-extruded for multilayer structures. Key attributes are softness (Shore A–D), transparency, abrasion/chemical resistance, breathability, adhesion, and thermoformability serving automotive interior skins, medical drapes and device components, wearables, protective/optical layers, building membranes, and industrial gaskets/liners.

TPE Films and Sheets Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to the increasing shift towards barrier and multi-layer films with superior protective properties for medical, food, and industrial packaging. Also, an expanding urban population necessitates diverse and modern consumer goods, which depend on plastic films.

- Sustainability Trends: Increasing demand for recycled and bio-based materials by most consumers is the current sustainability trend in the market. Governments are also implementing stringent regulations on plastic waste, such as restrictions on single-use plastics, forcing market players to adopt eco-friendly solutions.

- Global Expansion: Market players are increasingly pursuing opportunities in emerging markets such as the BRIC economies, where increasing disposable income is boosting the demand for sophisticated packaging.

Key Technological Shifts in the TPE Films and Sheets Market:

The market is undergoing significant technological shifts fuelled by the growing need for improved performance, sustainability, and integrated functionality. Major advancements emphasising the development of cutting-edge material formulations are enhancing the production process by creating "smart" materials for high-tech use.

Companies such as SABIC launched its LEXAN polycarbonate film and sheet, obtained from renewable feedstock, as part of its TRUCIRCLE initiative for sustainable material alternatives.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.78 Billion |

| Expected Size by 2034 | USD 6.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Family, By Process, By Application, By Functional Performance, By End-Use, By Region |

| Key Companies Profiled | 3M, Avery Dennison, Berry Global, DingZing Advanced Materials, American Polyfilm, BASF, Lubrizol, Huntsman, Wanhua Chemical, Kraton, Kuraray, Hexpol TPE, Mitsui Chemicals |

Trade Analysis of TPE Films and Sheets Market: Import & Export Statistics

- In 2022, Germany and Italy exported $4.8 billion and $3.8 billion worth of plastic sheet rolls, respectively. (Source: www.exportimportdata.in)

- For 2023, India imported $334 million worth of self-adhesive plastic sheets and films from China, which accounted for 54% of its total imports in this category.(Source: trendeconomy.com)

Value Chain Analysis of Global TPE Films and Sheets Market:

- Feedstock Procurement : This process involves acquiring raw materials and different types of thermoplastic elastomers (TPEs) and other additives to create final products.

- Chemical Synthesis and Processing : This process refers to the whole value chain of creating the TPE material, from producing the initial raw polymers to converting them into a final product.

- Packaging and Labelling : This process includes the extensive use of thermoplastic elastomer films for protective and branding purposes.

- Regulatory Compliance and Safety Monitoring : This stage refers to the detailed framework of standards and rules that market players must follow to ensure their products are convenient for various applications.

TPE Films and Sheets Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| Europe | EU Regulation No 10/2011 on plastic materials is particularly relevant for TPE films and sheets intended for food contact applications. |

| North America | U.S. Food and Drug Administration (FDA) have specific regulations, such as Code of Federal Regulations (CFR) Title 21, for materials used in food contact and medical devices. |

| Asia-Pacific | Countries such as China and India are developing their own standards for food-contact materials. |

Market Opportunity

Increasing Application in the Agricultural Sector

The TPE films and sheets are experiencing an increase in use in agricultural applications like mulch films, greenhouse covering, and silage wrap, which is the major factor creating lucrative opportunities in the market. Furthermore, moisture-retentive and UV-resistant films are made from LLDPE and LDPE and are widely used to improve photosynthesis and control microclimates.

Market Challenge

Recycling Issues and Environmental Concerns

The environmental effect of non-biodegradable plastic waste is a major factor posing a challenge to market growth. Regulatory pressure to minimize single-use plastics and support sustainability is compelling market players to develop sustainable alternatives. Moreover, the high cost associated with biodegradable films and the lack of recycling infrastructure in emerging economies can hinder market growth further.

Segmental Insights:

Material Family Insight

Which Material Family Type Segment Dominated the Global TPE Films and Sheets Market in 2024?

The TPU segment dominated the market with a 38% share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable materials and the increasing demand for lightweight materials in vehicles. Additionally, the rising need for TPU films in medical applications such as tubing, medical drapes, and bedding can impact positive segment growth.

The TPE-S (SEBS/SBS) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing product demand from end-use industries such as automotive and medical, along with the push towards recyclable and sustainable materials. TPE-S, particularly medical-grade SEBS, is utilized for flexible medical devices due to its durability and biocompatibility.

Process Insight

How Much Share Did the Cast/Blown Film Extrusion Segment Held in 2024?

The cast/blown film extrusion segment held an approximately 46% market share in 2024. The dominance of the segment can be linked to the innovations in extrusion technologies coupled with the regulatory mandates for sustainability. TPE films and sheets are used for noise reduction in vehicle interiors, providing recyclable and lightweight options that support emissions reduction goals.

The co-extrusion (multilayer) segment is expected to grow at approximately 21% market share in 2024. The growth of the segment can be driven by the ongoing shift towards electric vehicles (EVs) and the increasing need for enhanced cabin comfort. Also, rapid advancements are leading to post-consumer recycled (PCR) and bio-based materials, which can be incorporated into co-extruded structures.

Application Insight

Which Application Segment Dominated the Global TPE Films and Sheets Market in 2024?

The automotive interiors/exteriors segment dominated the market with a 31% share in 2024. The dominance of the segment is owed to the growing need for sustainable materials, coupled with the vehicle aesthetics and performance. Automakers are increasingly using TPEs to replace heavier materials in EV vehicles.

The healthcare & medical segment is expected to grow at the fastest CAGR of 22% during the projected period. The growth of the segment is due to the growing demand for safer and high-performance medical devices and sustainable materials. Also, a rise in healthcare spending, especially in developing economies, is a major factor propelling the overall demand for medical packaging films.

Functional Performance Insight

How Much Share Did the Soft-Touch / Skin-Contact Segment Held in 2024?

The soft-touch / skin-contact segment held a 33% market share in 2024. The dominance of the segment can be attributed to the growing emphasis on safety, comfort, and sustainability, along with the increasing product demand in the medical sector. The shift towards EVs is spurring demand for lighter-weight materials to enhance overall energy efficiency.

The breathable/waterproof membranes segment is expected to grow at the fastest CAGR of 20% during the forecast period. The dominance of the segment can be credited to the expansion of the healthcare, construction, hygiene, and consumer good sectors, along with the increasing emphasis on recyclable TPE solutions. These films are valued for their sterilizability and biocompatibility, which makes them convenient for a variety of applications.

End-Use Insight

Which End Use Segment Dominated the Global TPE Films and Sheets Market t in 2024?

The sheets segment held a 55% market share in 2024. The dominance of the segment can be linked to the growing demand for versatile and durable materials, coupled with the technological innovations in the manufacturing process. Also, the versatility of TPE sheets makes them suitable for an extensive range of applications, such as lightweight automotive components and durable medical packaging solutions.

The film's multilayer/laminates segment is expected to grow at the fastest CAGR of 27% over the projected period. The growth of the segment can be driven by its ability to integrate multiple layers of polymers, enabling market players to engineer films with essential properties that fulfil application demands. Multi-layer films also enhance the film's mechanical strength and resilience against any external damage.

Regional Insights

Asia Pacific TPE Films and Sheets Market Size, Industry Report 2034

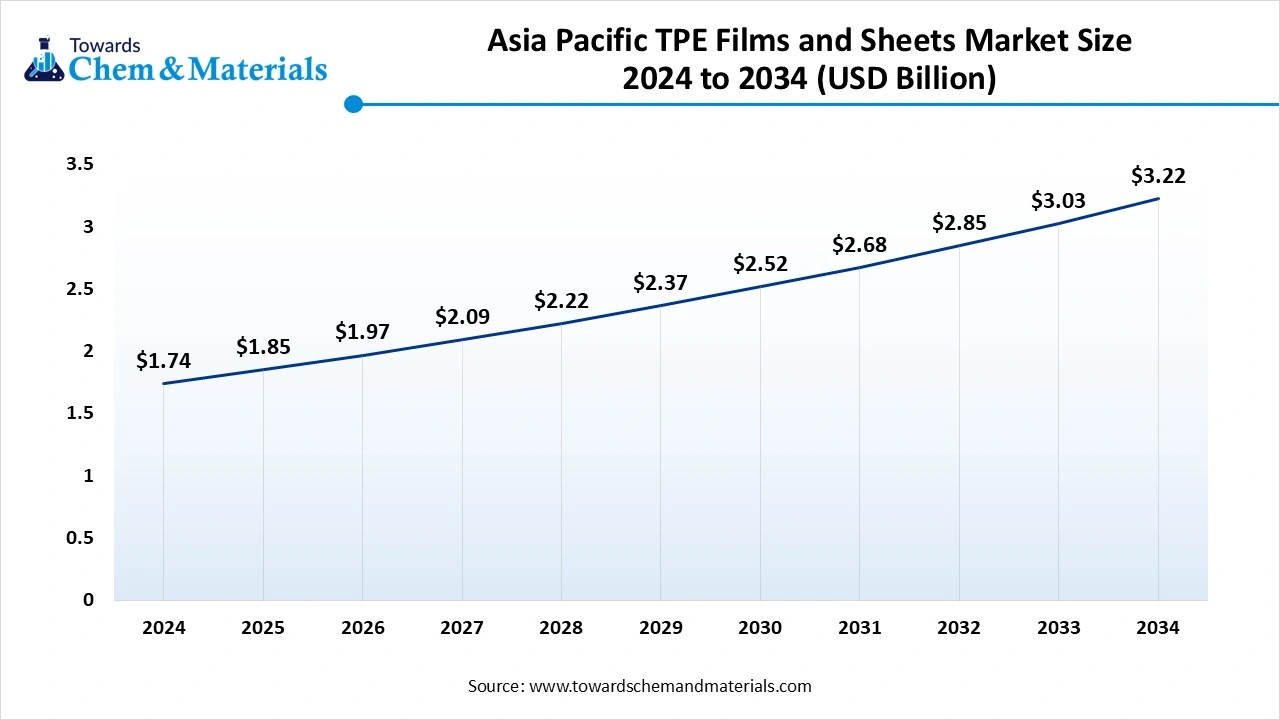

The Asia Pacific TPE films and sheets market size was valued at USD 1.74 billion in 2024 and is expected to reach USD 3.22 billion by 2034, growing at a CAGR of 6.36% from 2025 to 2034. Asia Pacific dominated the market with a 49% share in 2024.

The dominance of the region can be attributed to the growing product demand from major end-user industries such as healthcare and packaging, along with the rapid industrialization in the emerging economies. In addition, the surge in disposable incomes and changing lifestyles in developing economies are increasing consumer need for packaged goods.

China Global TPE Films and Sheets Market Trends

In the Asia Pacific, China led the market by holding the largest market share owing to its strong production capabilities, growing emphasis on sustainability, and expanding end-use industries. Also, China has a huge production base, which fuels the demand for TPE films and sheets in its extensive export-oriented industries.

Europe is expected to grow at the fastest CAGR of 23% over the forecast period.

The growth of the region can be credited to the growing demand for sustainable and biodegradable films, supported by stringent environmental regulations and an emphasis on minimizing plastic usage. Furthermore, the regional market is also witnessing a trend of major players acquiring smaller companies, which allows them to diversify product portfolios and expand their reach.

Germany Global TPE Films and Sheets Market Trends

In Europe, Germany dominated the market due to growing emphasis on high-performance and sustainable materials such as polyester films, coupled with the rise in packaging activities, especially for the food and beverage industries. Germany's strong industrial sector creates a substantial demand for plastic films and sheets for a range of applications.

Country-level Investments & Funding Trends for the Global TPE Films and Sheets Market:

- China: As the largest contributor in the region, China benefits from its massive manufacturing and export-oriented economy. The country is seeing a shift in investments toward recyclable and bio-based TPEs.

- India: This market is predicted to have the fastest growth rate in the region, fueled by foreign investments and supportive government initiatives like "Make in India".

Recent Developments

- In November 2024, ALUCOBOND, a global manufacturer of high–quality Aluminium Composite material sheets, introduced an advanced product labelled 'ALUCODUAL®. It is the current offering from the company for use in architectural applications where performance and design play an important role.(Source: www.rprealtyplus.com)

Top Vendors in TPE Films and Sheets Market & Their Offerings:

- Covestro: Covestro is a leading global producer of Thermoplastic Polyurethane (TPU) films, a high-performance type of Thermoplastic Elastomer (TPE).

- Mativ (Argotec): Mativ, through its brand Argotec, is a leading global producer of engineered polymer films, including thermoplastic polyurethane (TPU) films, which are a type of thermoplastic elastomer (TPE).

Other Players

- 3M

- Avery Dennison

- Berry Global

- DingZing Advanced Materials

- American Polyfilm

- BASF

- Lubrizol

- Huntsman

- Wanhua Chemical

- Kraton

- Kuraray

- Hexpol TPE

- Mitsui Chemicals

Segment Covered

By Material Family

- TPU

- TPE-S (SEBS/SBS)

- TPE-E (COPE)

- TPO

- TPV

By Process

- Cast/Blown Film Extrusion

- Sheet Extrusion / Calendering

- Co-extrusion (Multilayer)

- Thermoforming & Lamination

By Application

- Automotive Interiors/Exteriors

- Healthcare & Medical

- Consumer Electronics & Wearables

- Building & Construction Membranes

- Industrial & Protective

- Food Contact & Packaging

- Sports & Outdoor

By Functional Performance

- Soft-Touch / Skin-Contact

- Breathable / Waterproof Membranes

- Barrier / Chemical Resistance

- Optical / Transparent & Scratch-Resistant

- Adhesive / Tie-Layer

- Anti-Slip / Grip

By End-Use

- Sheets (Thermoformable Skins/Boards)

- Films Monolayer

- Films Multilayer/Laminates

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait