Content

U.S. Adhesives and Sealants Market Size and Growth 2025 to 2034

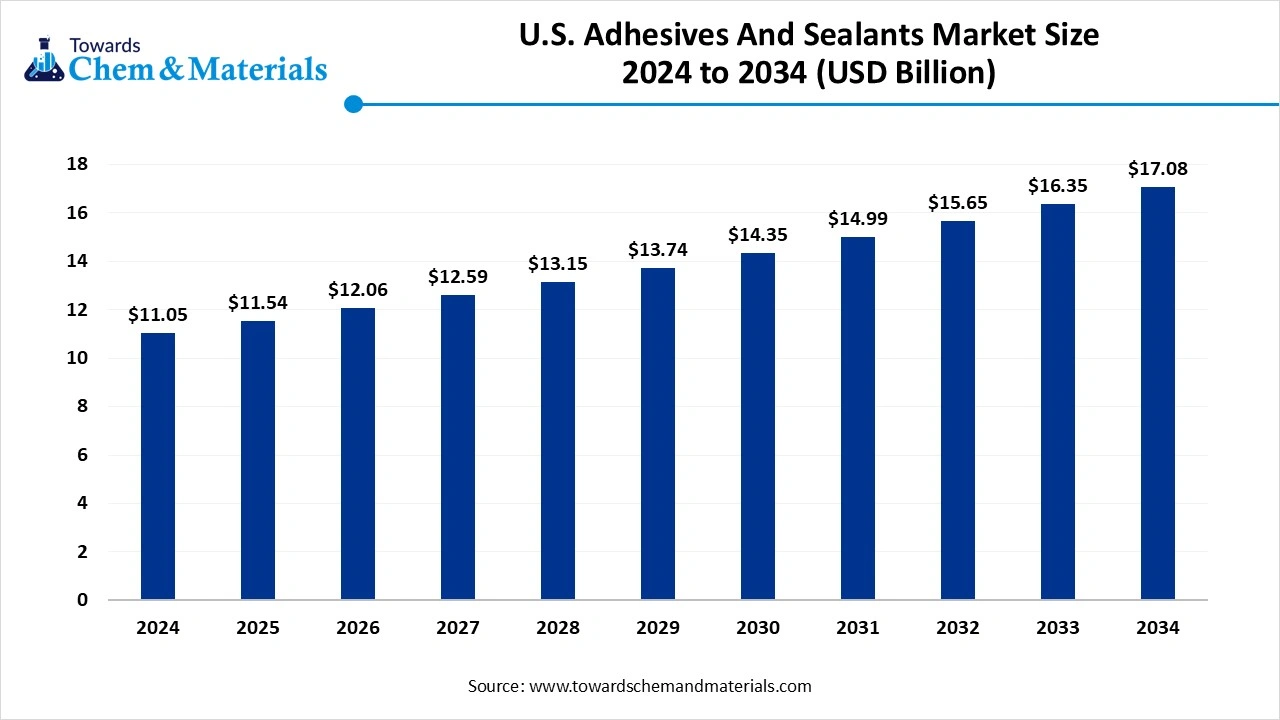

The U.S. adhesives and sealants-market size was valued at USD 11.05 billion in 2024, grew to USD 11.54 billion in 2025, and is expected to hit around USD 17.08 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period from 2025 to 2034. The growing automotive industry and the rise in infrastructure development drive the growth of the market.

Key Takeaways

- By market type, the adhesives segment held a 72% share in the U.S. adhesives & sealants market in 2024 due to the increasing construction activities.

- By market type, the sealants segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of lightweight vehicle components.

- By product form, the water-borne/emulsion segment held a 30% share in the market in 2024 due to the stricter environmental regulations.

- By product form, the UA/EB curable segment is expected to grow at the fastest CAGR in the market during the forecast period due to increasing demand for needles & catheters.

- By end-use industry, the construction & building segment held a 29% share in the market in 2024 due to the increasing construction of housing projects.

- By end-use industry, the electronics & automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing adoption of consumer electronics.

Power of U.S. Adhesives & Sealants in Manufacturing, Industries & Beyond

U.S. adhesives and sealants are chemical formulations used to join, protect, bond, or seal surfaces in various applications. Adhesive bonds objects together, whereas sealants fill joints & seams. The various types of adhesives & sealants present in the United States are epoxy, polyurethane, cyanoacrylate, acrylic, silicone, and VAE. Adhesive & sealants secure bonding, offer smooth finishes, reduce rework, extend product life, and protect from environmental hazards.

They are widely used in applications like weatherproofing doors & windows, preventing leaks in engines, bonding plastic or metal frames in smartphones, and securing packaging materials. Factors like growing infrastructural and residential construction activities, rise in electric vehicles, expansion of the packaging industry, growth in home improvement projects, increasing adoption of lightweight vehicle materials, and growing demand for household appliances contribute to the growth of the U.S. adhesives and sealants market.

- From October 2023 to September 2024, the United States exported 127,278 shipments of adhesives with a growth rate of 11% from the previous 12 months.(Source: www.volza.com)

- The United States exported 4,762 shipments of Adhesives Sealants.(Source: www.volza.com)

- PPG Advanced Surface Technologies LLC is the leading supplier of pressure-sensitive adhesive in the United States.(Source: www.volza.com)

Growing Automotive Industry Surges Demand for Adhesives & Sealants

The growing automotive industry and increasing production of vehicles increase demand for adhesives & sealants for bonding purposes. The strong focus on enhancing fuel efficiency and minimizing the weight of vehicles increases demand for adhesives & sealants.

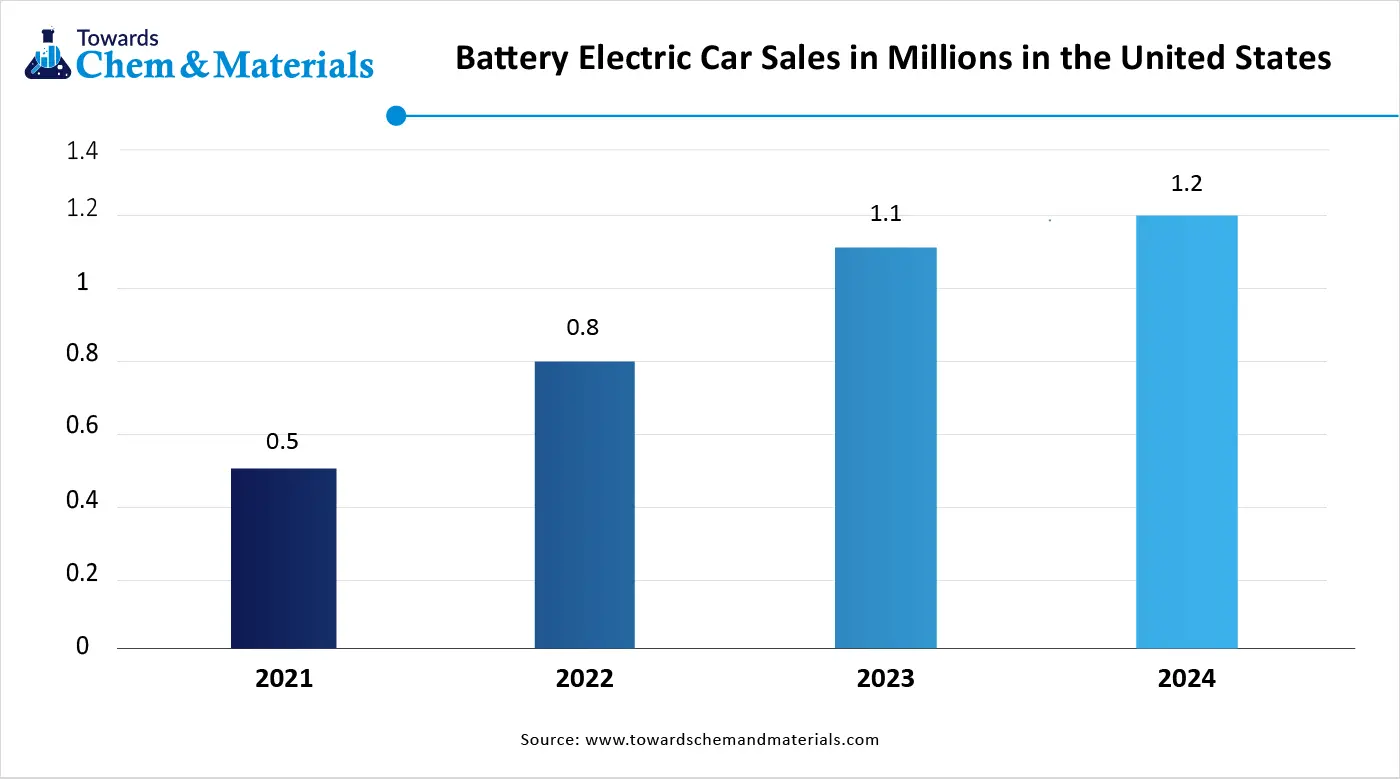

The rise in manufacturing of electric vehicles and focus on the reduction of noise requires adhesives & sealants for bonding insulation materials, sealing battery packs, and ensuring structural stability. The focus on enhancing vehicle safety increases the adoption of adhesives. The growing demand for customization of vehicles and the need for vehicle repair increases demand for adhesives & sealants.

The focus on creating a comfortable cabin environment for passengers and enhancing battery performance requires adhesives & sealants. The growing demand for autonomous vehicles increases the adoption of adhesives & sealants for bonding cameras & sensors. The growing automotive industry is a key driver for the growth of the U.S. adhesives & sealants market.

Market Trends

- Growth in E-Commerce: The rapid expansion of e-commerce and rise in online shopping increases demand for adhesives & sealants for durable & secure packaging. The strong focus of e-commerce on sustainable packaging and enhancing the integrity of products increases the adoption of adhesives & sealants.

- Growing Healthcare Sector: The growing advancements in healthcare technology and increasing demand for medical equipment increase the adoption of adhesives. The growth in the adoption of wearable devices increases demand for adhesives for handling moisture and securely bonding.

- Growing Renewable Energy Adoption: The increasing adoption of renewable energy resources like solar & wind energy increases demand for adhesives for assembling solar panels, creating durable bonds, and assembling wind turbines.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 11.54 Billion |

| Expected Size by 2034 | USD 17.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Market Type, By Product Form, By End-Use Industry |

| Key Companies Profiled | 3M, Henkel , H.B. Fuller , Sika Bostik (TotalEnergies) , The Dow Chemical Company, RPM International Inc. , Avery Dennison , Huntsman Corporation , Eastman Chemical Company , Arkema , Wacker Chemie ,Momentive Performance Materials , Carlisle Companies Incorporated , Ashland , Franklin International , Soudal , LORD Corporation , Tesa SE , Illinois Tool Works (ITW) |

Market Opportunity

Growing Packaging Demand Unlocks Market Opportunity

The growing expansion of the packaging industry and increasing demand for packaging increase the adoption of adhesives for enhancing structural integrity. The growing need for assembling boxes and the high demand for corrugated cardboard in packaging require adhesives. The rise in adoption of packaged goods increases demand for adhesives & sealants to extend shelf life and enhance the protection of products.

The rise in online shopping and growing consumption of packaged foods increases demand for adhesives & sealants. The focus on enhancing the aesthetic appeal of packaging and the adoption of sustainable packaging requires adhesives & sealants. The increasing packaging of liquid food products and pharmaceutical products requires adhesives & sealants. The growing manufacturing of flexible, paper, and board packaging increases demand for adhesives. The growing packaging demand creates an opportunity for the growth of the U.S. adhesives & sealants market.

Market Challenge

Fluctuations in Raw Material Prices Threaten Market Growth

With several applications of adhesives and coatings in various industries in the United States, the raw material price fluctuations restrict the market growth. Factors like supply chain disruptions, environmental regulations, and petrochemical dependence are responsible for raw material price fluctuations. The fluctuating cost of feedstocks like resins, solvents, and polymers directly affects the market.

The volatility in crude oil costs and high dependence on petrochemicals increase the cost. Supply chain disruptions due to factors like port congestion, trade restrictions, shipping delays, and geopolitical events increase raw materials costs. The stringent environmental regulations, like OSHA and EPA, increase raw materials costs. The fluctuations in raw material prices hamper the growth of the U.S. adhesives & sealants market.

Regional Insights

South U.S. Adhesives and Sealants Market Trends

The South region dominated the U.S. adhesives & sealants market in 2024. The growing investment in infrastructure project development and increasing construction activities increases demand for adhesives & sealants. The high investment in vehicle production and the growing manufacturing of various vehicles increases demand for adhesives & sealants.

The rising development of commercial construction projects and large-scale infrastructure increases the adoption of adhesives & sealants. The strong presence of key industries like automotive, construction, and packaging increases demand for adhesives & sealants, driving the overall growth of the market.

West U.S. Adhesives and Sealants Market Trends

The West region is experiencing the fastest growth in the market during the forecast period. The growing construction activities in states like Arizona, Washington, Texas, and Nevada increase demand for adhesives & sealants. The growing expansion of the automotive industry and increasing production of lightweight vehicle materials increase demand for adhesives & sealants.

The increasing development of lightweight aircraft components and rising government investment in infrastructure projects increase demand for adhesives & sealants. The growing adoption of consumer electronics and rapid growth in e-commerce increase demand for adhesives & sealants, supporting the overall growth of the market.

Segmental Insights

Market Type Insights

Why did the Adhesives Segment Dominate the U.S. Adhesives & Sealants Market?

The adhesives segment dominated the U.S. adhesives & sealants market in 2024. The growing development of commercial & residential construction activities and the expansion of infrastructure projects increase demand for adhesives & sealants. The increasing manufacturing of electric & traditional vehicles and the rising demand for consumer goods increase demand for adhesives & sealants.

The increasing development of autonomous vehicles and the focus on miniaturization of electronic devices increase the adoption of adhesives & sealants. The growing manufacturing in industries like electronics, automotive, & packaging increases the adoption of adhesives & sealants, driving the overall growth of the market.

The sealants segment is the fastest-growing in the market during the forecast period. The growing production of vehicles and the focus on enhancing the aesthetic appeal of vehicles increase demand for sealants. The increasing manufacturing of lightweight aircraft components and government investment in infrastructure development increase demand for sealants. The growing adoption of electronic devices like smartphones, computers, & laptops, and the focus on upgrading infrastructure, increases demand for sealants, supporting the overall growth of the market.

Product Form Insights

How the Water-Borne or Emulsion Segment Held the Largest Share in the U.S. Adhesives & Sealants Market?

The water-borne or emulsion segment held the largest revenue share in the U.S. adhesives & sealants market in 2024. The stringent environmental regulations and focus on lowering VOC emissions increase demand for water-borne/emulsion. The growing construction activities and increasing demand for packaged food & beverages increase demand for water-borne or emulsion. The increasing manufacturing of automotive and the customization of adhesives increase the adoption of water-borne or emulsion, driving the overall market growth.

The UV/EB curable segment is experiencing the fastest growth in the market during the forecast period. The growing manufacturing of electronics and production of medical devices increases demand for UV/EB curable materials. The increasing manufacturing of semiconductors and the rise in electric vehicles increase demand for UV/EB curable materials. The increasing utilization of needles & catheters and the growing adoption of pharmaceuticals & food increase demand for UV/EB curable materials, supporting the overall market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the U.S. Adhesives & Sealants Market?

The construction & building segment dominated the U.S. adhesives & sealants market in 2024. The rapid urbanization and growing construction of residential & housing projects increase demand for adhesives & sealants. The increasing development of flooring, façade panel installation, window glazing, tiling, insulation, and curtain wall systems in construction projects increases the adoption of adhesives & sealants. The high investment in infrastructure development and focus on green buildings increases the adoption of adhesive & sealants. The strong focus on energy-efficient buildings and the development of metro cities increases demand for adhesives & sealants, driving the overall growth of the market.

The electronics & automotive segment is the fastest-growing in the market during the forecast period. The growing miniaturization of electronic components and the expansion of 5G networks increase demand for adhesives & sealants. The increasing adoption of consumer electronics and the rising integration of electronics with automotive increases demand for adhesives & sealants. The rise in the adoption of electric vehicles and the manufacturing of lightweight vehicle parts increases demand for adhesives & sealants. The stricter vehicle emission regulations and focus on securing battery packs of electric vehicles increase demand for adhesives & sealants, supporting the overall growth of the market.

U.S. Adhesives and Sealants Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement includes petrochemical-based feedstocks like monomer, ethylene, natural gas liquids, propylene, synthetic rubbers, and natural sources like casein & gelatin.

- Chemical Synthesis and Processing: The chemical synthesis and processing of adhesives & sealants in the United States involves steps like selection of raw materials, formulation & mixing, curing process, and regulatory considerations.

- Key Players: H.B. Fuller, Sika, Dow, Huntsman, 3M, Henkel, RPM International

- Waste Management and Recycling: The waste management & recycling involves reduction of source, utilization of solvent-free formulations, designing sustainable products, recycling bonded components, and safe disposal.

Recent Developments

- In July 2025, Polyglass launched next-gen roofing adhesives, PG 350 LV and PG SFA, for cold-applied systems. The adhesive supports green building practices, and PG 350 LV reduces VOC emissions. PG SFA is free from isocyanate & solvent and suitable for environments like enclosed places, hospitals, & schools.(Source: polyglass.us)

- In July 2025, Forza expands its adhesive manufacturing facility in Iowa. The plant provides adhesives for industries like industrial, construction, foam, transportation, marine, and insulation. The expanded facility has a manufacturing facility and testing & R&D lab.(Source: www.plantservices.com)

- In September 2024, DuPont launched Great Stuff Wide Spray Foam sealant. The sealant is useful in applications like joints, irregular surfaces, air-sealing seams, hard-to-reach spaces, and large gaps. The sealant is easy to apply and consists of a shake-&-spray design. The packaging kit of the product consists of 18-ounce sealant cans, two blue fan nozzles, and two white cone nozzles.(Source: finance.yahoo.com)

U.S. Adhesives and Sealants Market Top Companies

- 3M

- Henkel

- H.B. Fuller

- Sika Bostik (TotalEnergies)

- The Dow Chemical Company

- RPM International Inc.

- Avery Dennison

- Huntsman Corporation

- Eastman Chemical Company

- Arkema

- Wacker Chemie

- Momentive Performance Materials

- Carlisle Companies Incorporated

- Ashland

- Franklin International

- Soudal

- LORD Corporation

- Tesa SE

- Illinois Tool Works (ITW)

Segments Covered

By Market Type

- Adhesives

- Sealants

By Product Form

- Solvent-borne

- Water-borne / Emulsion

- Hot melt

- Reactive hot melt

- UV/EB curable

- Paste / Cream

- Tape (adhesive converted product)

- Film / Sheet

- Dispersion

By End-Use Industry

- Construction & Building

- Automotive

- Aerospace & Defense

- Packaging

- Woodworking & Furniture

- Electronics & Electrical

- Medical & Healthcare

- Industrial Assembly & General Manufacturing

- Marine & Shipbuilding

- Energy

- Footwear & Apparel

- Transportation (rail, off-highway)

- Consumer & DIY

- Printing & Graphics