Content

Plastic Hot and Cold Pipe Market Size, Share & Industry Analysis

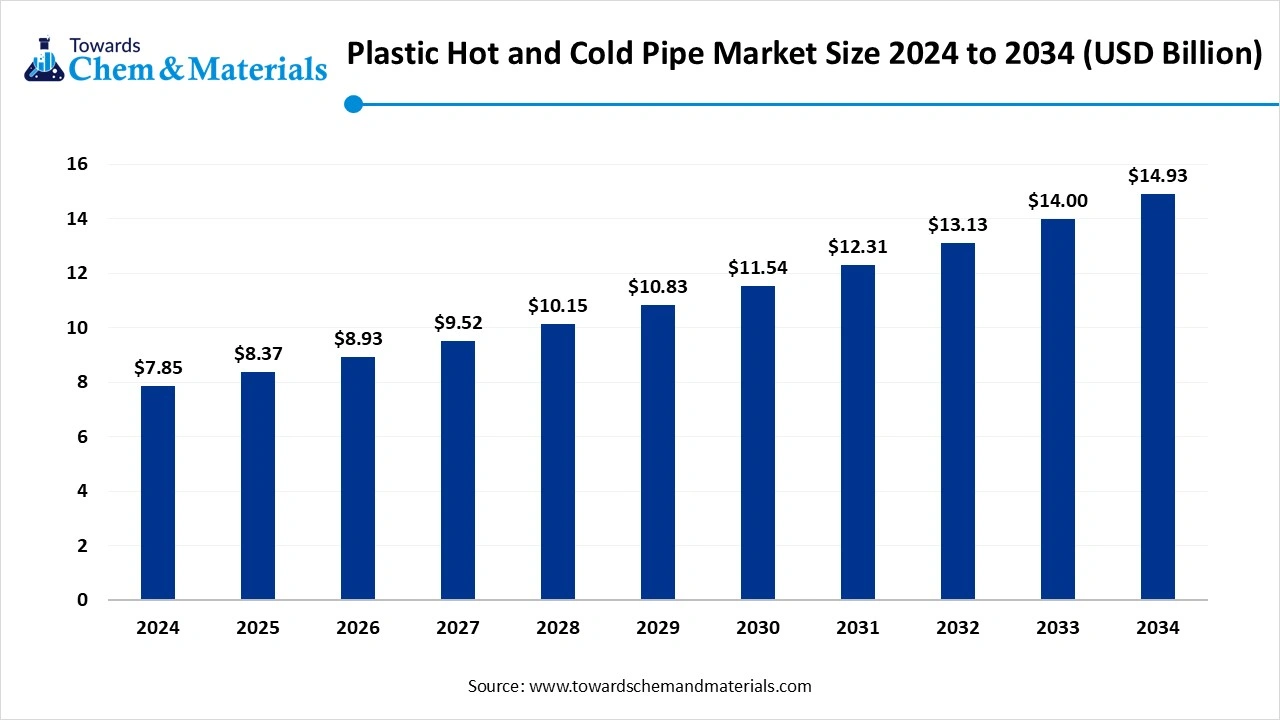

The global plastic hot and cold pipe-market size was valued at USD 7.85 billion in 2024, grew to USD 8.37 billion in 2025, and is expected to hit around USD 14.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.64% over the forecast period from 2025 to 2034. The growth of the market is driven by rapid urbanization and infrastructure development, which increases the demand for new construction and upgrades, driving the growth of the market.

Key Takeaways

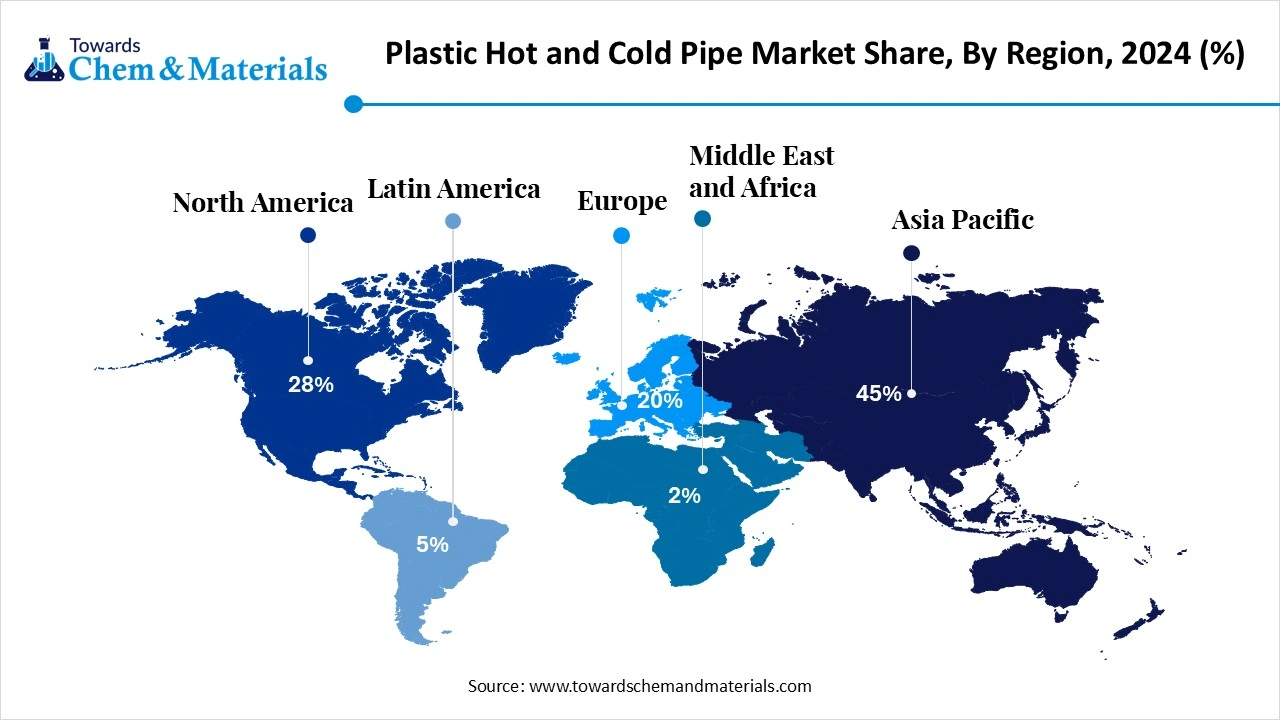

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 45% share in the market in 2024.

- By region, North America is expected to have significant growth in the market in the forecast period.

- By material, the PEX segment dominated the market in 2024. The PEX segment held approximately 30% share in the market in 2024.

- By material, the multilayer / composite segment is expected to grow significantly in the market during the forecast period.

- By product form, the straight rigid pipe segment dominated the market in 2024. The straight rigid pipes segment held approximately 60% share in the market in 2024.

- By product form, the pre-insulated pipes segment is expected to grow in the forecast period.

- By application, the cold potable water segment dominated the market in 2024. The cold potable water segment held approximately 40% share in the market in 2024.

- By application, the underfloor/radiant heating segment is expected to grow in the forecast period.

- By end-use industry, the residential segment dominated the market in 2024. The residential segment held approximately 50% share in the market in 2024.

- By end-use industry, the commercial segment is expected to grow in the forecast period.

- By joining method, the fusion segment dominated the market in 2024. The fusion segment held approximately 40% share in the market in 2024.

- By joining method, the mechanical (press-fit) segment is expected to grow in the forecast period.

What Is The Significance Of The Plastic Hot And Cold Pipe Market?

The growth of the market is driven by cost-effectiveness, durability, and a surge in global construction and infrastructure projects. The plastic hot and cold pipe plays a significant role in the market due to its corrosion resistance and durability.

The inherent resistance of plastic pipes to corrosion and their longer lifespan make them a preferred option over traditional materials like copper and steel for long-term applications in both hot and cold water systems. This drives the growth of the market.

Plastic Hot and Cold Pipe Market Outlook :

- Industry Growth Overview: Between 2025 and 2030, the plastic hot and cold pipe market is expected to witness significant growth, driven by demand for residential and commercial construction, especially for underfloor heating, portable water, and pumping applications. Due to rapid urbanization and infrastructure spending in the Asia Pacific and renovation in Europe and North America, the market remains a large share.

- Sustainability Trends: The market is shifting towards eco-friendly and sustainable use of recyclable products, like PEC, PPR, and PE-RT, which have properties like durability and high performance with reduced environmental impact. The adoption of circular economy practices and the development of biobased alternatives, aligning with the green building initiative, is a major trend.

- Global Expansion: The key players are playing a role by expanding manufacturing capacity across the Asia Pacific and Southeast Asia to meet the demand. The replacement of traditional pipes by plastic pipes is also a major contributor to market growth in Europe and North America.

Key Technological Shifts in Plastic Hot and Cold Pipe Market:

The key technological shifts in the market are driven by the rising demand and widespread adoption of PEX pipes and their variants, advanced manufacturing techniques like multilayer extrusion, and modified polymer and blending for the development of materials with high performance.

The integration of smart technologies and digitalization, like the integration of IoT, predictive maintenance through IoT sensors, and AI in monitoring and operations, also helps in process optimization and enhanced performance.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.37 Billion |

| Expected Size by 2034 | USD 14.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.64% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Product Form, By Application, By End-User Industry, By Region |

| Key Companies Profiled | Wavin, Polypipe Group , Pipelife , IPEX Inc. , Rifeng Group , Vinidex , Sekisui Chemical , Krah Pipes , Finolex Industries , Astral Poly Technik , Prince Pipes & Fittings , Nupi Industrie Italiane, Dura-Line , Aquatherm, Salsa |

Trade Analysis of Plastic Hot and Cold Pipe Market: Import & Export Statistics

- World shipped out 151,670 PVC pipe shipments from November 2023 to October 2024 (TTM). These exports were handled by 12,353 global exporters to 13,970 buyers, showing a growth rate of 16% over the previous 12 months.(Source: www.volza.com)

- Globally, Vietnam, China, and India are the top three exporters of PVC Pipes. Vietnam is the global leader in PVC Pipes exports with 141,149 shipments, followed closely by China with 66,676 shipments, and India in third place with 27,904 shipments.(Source: www.volza.com)

- India shipped out 9,931 PVC pipe shipments from October 2023 to September 2024 (TTM). These exports were handled by 1,106 Indian exporters to 2,310 buyers.(Source: www.volza.com)

- In 2024, companies involved in the trade of Plastic Pipes between India and the United States were: Advance Auto Parts, General Motors, and Cummins Jaw Warehouse.(Source : oec.world)

- Italy and Vietnam showed the fastest growth in supplying plastic pipes to India between 2022 and 2023(Source: oec.world)

Plastic Hot And Cold Pipe Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | ASTM International, NSF International, International Code Council | ASTM F876/F877 – Standards for crosslinked polyethylene | - Pipe performance (pressure/temperature) - Potable water safety - Installation standards |

NSF 61 certification is mandatory for potable water. State-level plumbing codes may vary (e.g., California has stricter standards). |

| European Union | ECHA (European Chemicals Agency) | EN ISO 15875 – Standard for PEX pipes | - Harmonized product standards - Safety for drinking water use - Energy efficiency for heating |

Mandatory product certification (CCC) applies to plumbing products. Local testing & approvals often required. |

| China | Bureau of Indian Standards (BIS), CPWD (Central Public Works Department) | GB/T 18992 – Chinese national standard for PEX pipes | - Pipe material quality - Building safety codes - Drinking water hygiene |

CE marking is required for pipes marketed in the EU. Compliance with the Construction Products Regulation (CPR) is also necessary. |

| India | MoEFCC (Ministry of Environment, Forest and Climate Change), BIS (for standards) | IS 15450 – Standard for multilayer composite pipes | - Material performance - Potable water compliance - Safety for hot/cold water systems |

BIS certification is mandatory for pipes. Ongoing updates to align with international ISO standards. |

| Japan | JIS (Japanese Industrial Standards), MLIT (Ministry of Land, Infrastructure, Transport and Tourism) | JIS K 6787 – Standard for multilayer composite pipes | - Pre-market approval - Durability and safety - Potable water safety |

Pipes for potable water must meet JWWA (Japan Water Works Association) approval. Japan has stricter durability testing. |

Segmental Insights

Material Insights

Which Material Segment Dominated The Plastic Hot And Cold Pipe Market In 2024?

The PEX segment dominated the market with approximately 30% share in 2024. PEX (cross-linked polyethylene) is widely used in hot and cold water piping due to its flexibility, corrosion resistance, and durability. It offers easy installation, energy efficiency, and long service life compared to traditional materials.

PEX pipes are particularly popular in residential applications for potable water distribution and radiant floor heating systems. Their ability to withstand high temperatures and pressure while maintaining cost efficiency makes them a preferred choice for modern plumbing solutions in both new constructions and retrofit projects.

The multilayer / composite segment expects significant growth in the market during the forecast period. Multilayer or composite pipes combine the strength of metals like aluminum with the flexibility and corrosion resistance of polymers. These pipes provide superior thermal stability, low linear expansion, and high mechanical strength, making them suitable for both hot and cold water systems.

They are commonly used in commercial buildings, industrial projects, and underfloor heating systems where durability and performance are critical. With growing demand for energy-efficient and reliable piping, multilayer pipes are gaining traction as a sustainable and long-lasting alternative in the market.

Product Form Insights

How Did Product Form Segment Dominated The Plastic Hot And Cold Pipe Market In 2024?

The straight rigid pipe segment dominated the market with approximately 60% share in 2024. Straight rigid pipes are designed for stable, long-distance installations where structural integrity is crucial. These pipes are often used in commercial and residential projects for potable water supply systems due to their ability to maintain form and reduce bending during installation. The demand for straight rigid pipes is growing in large-scale projects that require long-lasting and dependable solutions.

The pre-insulated pipes segment expects significant growth in the market during the forecast period. Pre-installed pipes are engineered to simplify installation by integrating insulation or fittings during manufacturing.

They are particularly popular in underfloor and radiant heating systems, where pre-fitted solutions help maintain uniformity and performance. With rising construction activity and emphasis on energy efficiency, pre-installed pipe systems are gaining market share, especially in high-volume housing and commercial development projects.

Application Insights

Which Application Segment Dominated The Plastic Hot And Cold Pipe Market In 2024?

The cold potable water segment dominated the market with approximately 40% share in 2024. Pipes designed for cold potable water distribution are essential for residential, commercial, and institutional use. These pipes must meet strict safety and hygiene standards, ensuring water purity without leaching harmful substances. Increasing urbanization and water infrastructure upgrades are driving demand for durable cold-water piping solutions that ensure efficiency and long-term safety in both new and renovated buildings.

The underfloor/radiant heating segment expects significant growth in the plastic hot and cold pipe market during the forecast period. Underfloor and radiant heating applications demand pipes that can withstand high temperatures, maintain flexibility, and provide efficient heat distribution. PEX and multilayer pipes are particularly suited due to their thermal stability and ability to resist scaling. With growing focus on sustainable building technologies and occupant comfort, the use of advanced piping solutions for underfloor heating continues to expand across both developed and emerging markets.

End-User Industry Insights

How Did the Residential Segment Dominated The Plastic Hot And Cold Pipe Market In 2024?

The residential segment dominated the market with approximately 50% share in 2024. The residential sector represents a major share of the market, driven by rising housing demand, urban infrastructure expansion, and renovation projects. Increasing adoption of energy-efficient underfloor heating systems in modern housing is further boosting demand. The trend toward sustainable construction materials also supports wider usage of advanced plastic pipes in residential developments globally.

The commercial segment expects significant growth in the plastic hot and cold pipe market during the forecast period.

Commercial buildings such as offices, shopping complexes, hotels, and healthcare facilities rely on robust and efficient piping solutions for both potable water distribution and heating systems. Multilayer and pre-installed pipe systems are particularly favored in this sector due to their durability, reduced maintenance, and ability to handle large-scale usage, driving the demand and growth of the market.

Joining Method Insights

Which Joining Method Segment Dominated The Plastic Hot And Cold Pipe Market In 2024?

The fusion segment dominated the market with approximately 40% share in 2024. Fusion joining involves heating and fusing pipe ends to create leak-proof, permanent joints. This method is highly reliable, ensuring seamless connections with excellent resistance to pressure and thermal stress. Fusion is often used in both residential and commercial settings where long-term durability and safety are priorities. With advancements in fusion equipment, this method is gaining wider adoption for modern plastic piping installations.

The mechanical (press-fit) segment expects significant growth in the plastic hot and cold pipe market during the forecast period. Mechanical or press-fit joining is a fast and convenient method where pipe fittings are mechanically pressed onto the pipe, creating a secure and watertight connection. This method significantly reduces installation time and labor costs, making it popular in large construction projects and retrofit applications, driving the growth and expansion of the market.

Regional Insights

Plastic Hot and Cold Pipe Market Size, Industry Report 2034

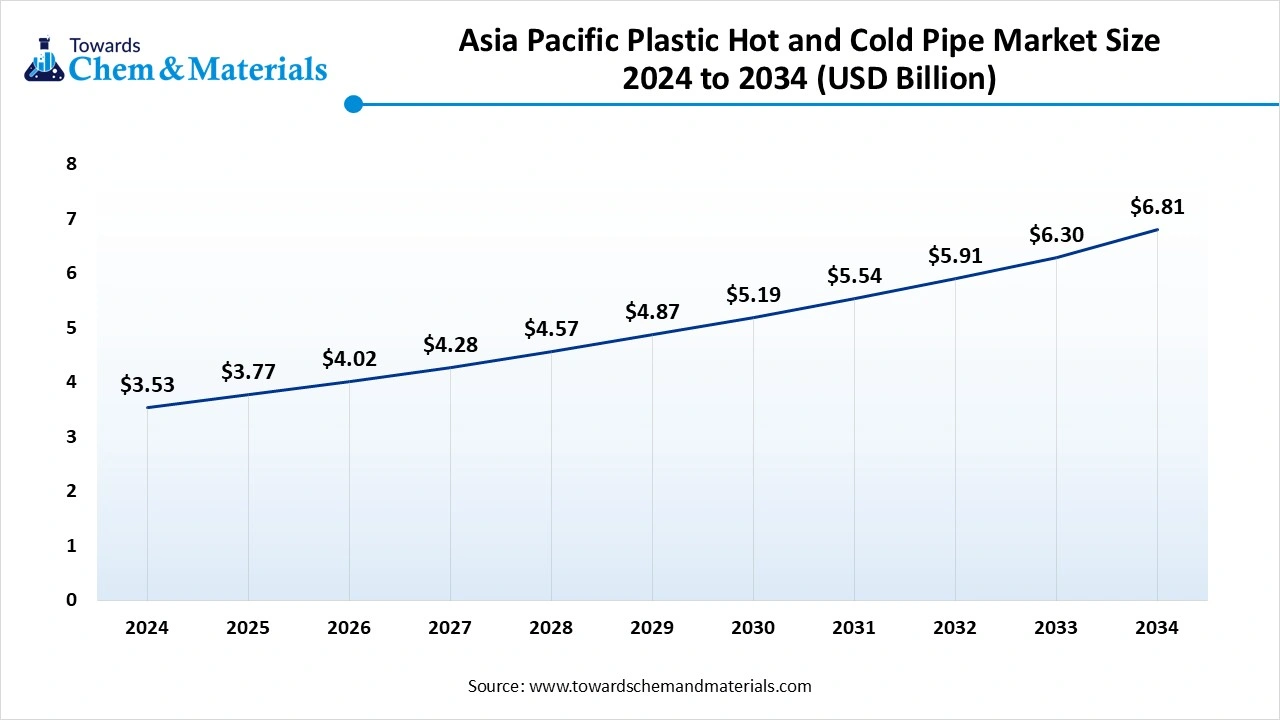

The Asia Pacific plastic hot and cold pipe market size was estimated at USD 3.53 billion in 2024 and is projected to reach USD 6.81 billion by 2034, growing at a CAGR of 6.79% from 2025 to 2034. Asia Pacific dominated the market with approximately 45% share in 2024.

The growth of the market is driven by a growing population and rapid urbanization, which drives demand for commercial and new residential buildings, which require advanced pumping systems, which drive the growth of the market in the region. The other key growth drivers of the market in the Asia Pacific region are the cost-effectiveness offered due to lightweight alternatives, government initiatives, and infrastructure development projects by the government, which drive the growth and expansion of the market in the region.

India Has Seen Significant Growth, Driven By Rapid Urbanization

The plastic hot and cold pipe market in India is expected to grow significantly, driven by rapid urbanization, infrastructure development, and government initiatives such as the Smart Cities Mission and the Jal Jeevan Mission. With the construction sector booming and increased adoption in agriculture for irrigation, the market is seeing sustained demand for durable, lightweight, and corrosion-resistant plastic pipes like PEX and CPVC. These factors and properties drive the growth and expansion of the market in the country.

North America Has Seen Significant Growth, Driven By The Increasing Adoption Of The Market

North America is expected to witness significant growth in the market in the forecast period. The growth of the market is driven by the increasing adoption of robust infrastructure development, with new and innovative systems, which fuel the growth of the market in the region. The technological advancements, like the integration of AI and automation with digital technologies to improve manufacturing efficiency, with enhanced product quality and reduced cost, further fuel the growth and expansion of the market in the region.

Country-Level Investments & Funding Trends For The Plastic Hot And Cold Pipe Market:

- India: Schemes like the Jal Jeevan Mission and Smart Cities Mission are driving demand for plastic pipes in water supply and sanitation.

- USA: The plumbing fixture manufacturer Moen extended its multi-year partnership with homebuilder Meritage Homes in October 2024, providing a reliable channel for its products.(Source: www.moen.com)

- Germany: Leading companies are engaging in mergers, acquisitions, and partnerships. For example, Wienerberger acquired QPS AS.

Plastic Hot And Cold Pipe Market Value Chain Analysis

- Chemical Synthesis and Processing: The plastic hot and cold pipes are produced using a process called extrusion, where plastic pellets are melted and forced through a die to create a continuous tube.

- Key players: Uponor, Rehau, Viega, Borealis, and Aliaxis Group.

- Quality Testing and Certification: The plastic hot and cold pipes require ISI Mark, ASTM D2846, and NSF International certification.

- Key players: ASTM International, NABCB, and UL Solutions

- Distribution to Industrial Users: The plastic hot and cold pipes are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: Supreme Industries, Finolex Industries, Vectus Industries, and Tristone Flowtech.

Recent Development

- In September 2025, Sintex by Welspun, a leading manufacturer of water storage solutions in India, announced the launch of antimicrobial CPVC pipes, ensuring enhanced quality, protection, and durability.(Source: www.babushahi.com)

Top Companies In Plastic Hot And Cold Pipe Market & Their Offerings:

- Uponor: A global pioneer in PEX and multilayer pipe systems, Uponor delivers solutions for potable water, underfloor heating, and radiant cooling in residential and commercial projects.

- Rehau: Specializes in polymer-based pipe systems, offering high-performance PEX and composite pipes widely applied in plumbing, heating, and infrastructure applications.

- Georg Fischer (GF Piping Systems): Provides an extensive portfolio of piping systems, including fusion-joining technologies, fittings, and advanced plastic piping for hot and cold-water distribution.

- JM Eagle: One of the largest plastic pipe manufacturers worldwide, producing PVC and PE pipes for potable water, plumbing, irrigation, and industrial applications.

- Aliaxis: Offers sustainable piping and water management systems, with a strong presence in hot and cold-water supply, sanitary applications, and building infrastructure.

Other Top Companies Are:

- Wavin

- Polypipe Group

- Pipelife

- IPEX Inc.

- Rifeng Group

- Vinidex

- Sekisui Chemical

- Krah Pipes

- Finolex Industries

- Astral Poly Technik

- Prince Pipes & Fittings

- Nupi Industrie Italiane

- Dura-Line

- Aquatherm

- Salsa

Segments Covered

By Material Type

- Cross-linked Polyethylene (PEX)

- Polypropylene Random Copolymer (PPR / PP-RCT)

- Chlorinated Polyvinyl Chloride (CPVC)

- Polyethylene of Raised Temperature (PE-RT)

- High-Density Polyethylene (HDPE)

- Polybutylene (PB)

- Multilayer / Composite (PEX-Al-PEX, PE-AL-PE, etc.)

- Others (specialty engineered plastics)

By Product Form

- Straight rigid pipes

- Coiled flexible pipes

- Pre-insulated pipes

By Application

- Cold potable water distribution

- Hot potable water distribution

- Central heating (radiators, loops)

- Underfloor/radiant heating

- Chilled water / HVAC circuits

- Solar thermal/renewable heating

- Swimming pool & recreational water

- Light industrial process water

By End-User Industry

- Residential

- Commercial (offices, retail, hospitality)

- Institutional (schools, hospitals, government)

- Industrial

- Infrastructure & utilities

- Agriculture

By Joining Method

- Fusion (butt, socket, electrofusion)

- Mechanical (compression, press-fit)

- Solvent weld (PVC/CPVC specific)

- Flanged / adapter connections

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait