Content

Thermoplastic Elastomers (TPEs) Market Size, Share | CAGR of 5.22%

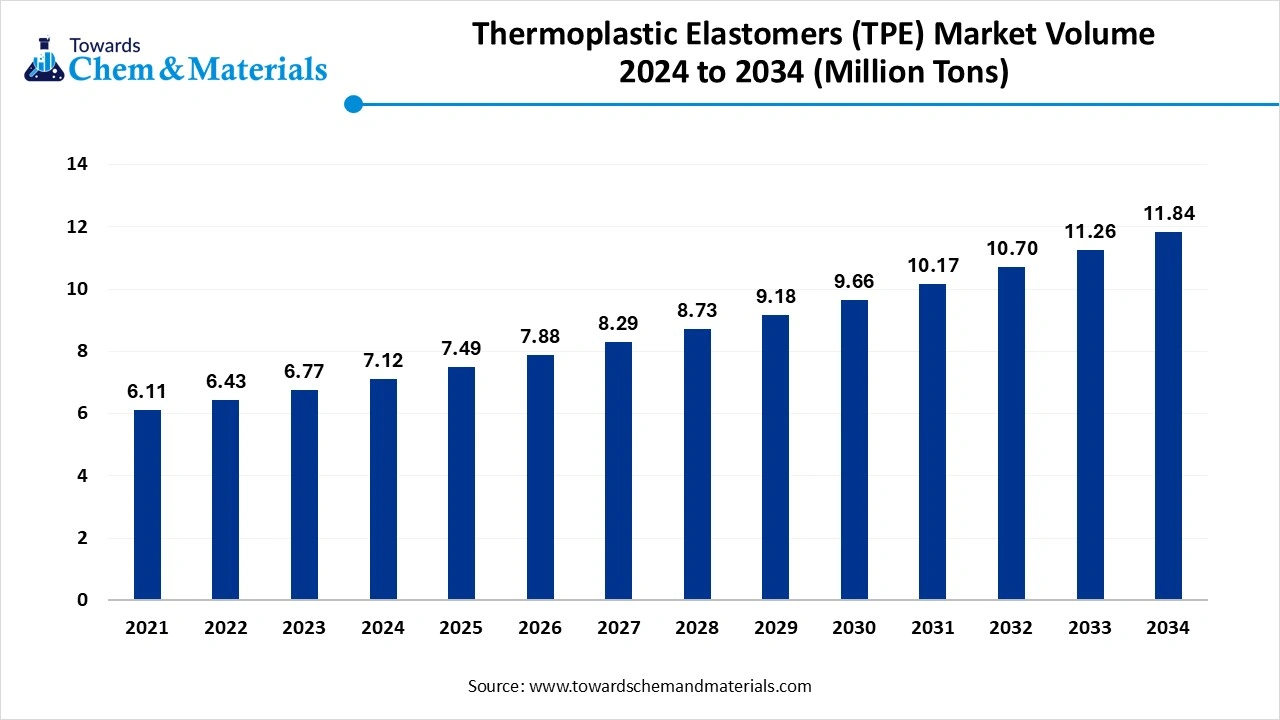

The global thermoplastic elastomers (TPEs) market volume was reached at 7.12 million tons in 2024 and is expected to be worth around 11.84 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.22% over the forecast period 2025 to 2034. The expanding need from the automotive industry has fueled industry potential in the current period.

Key Takeaways

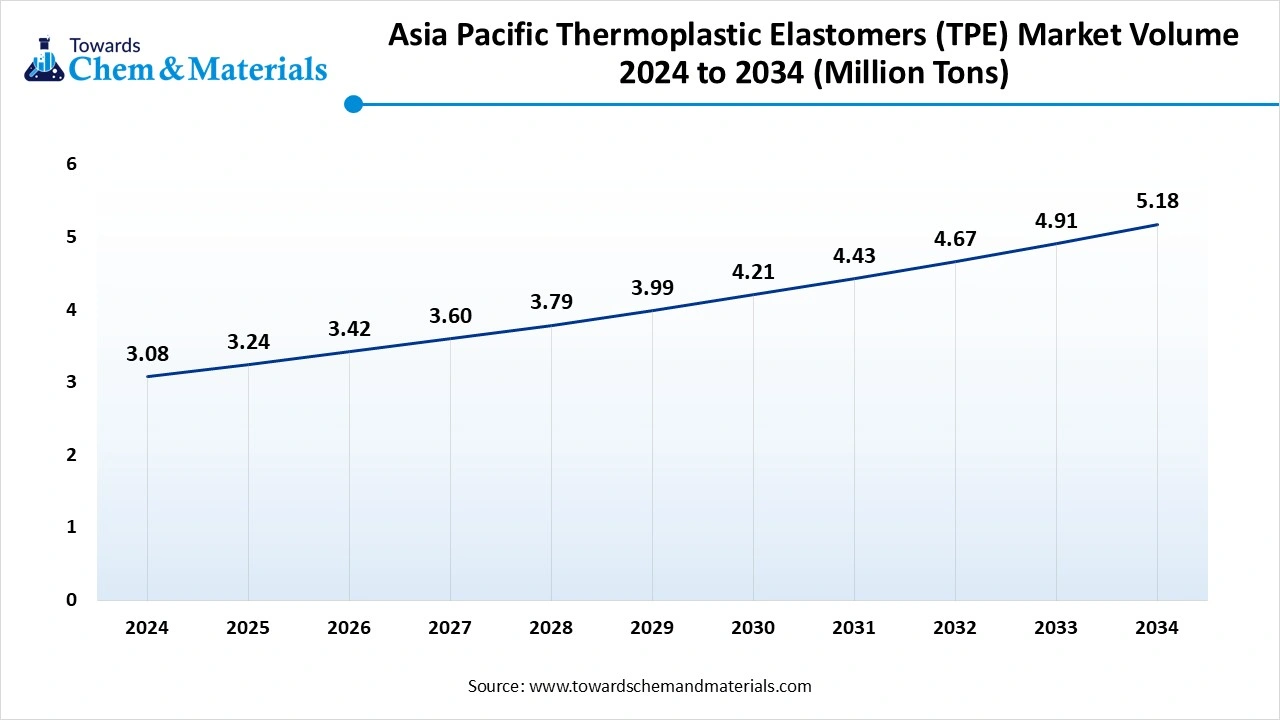

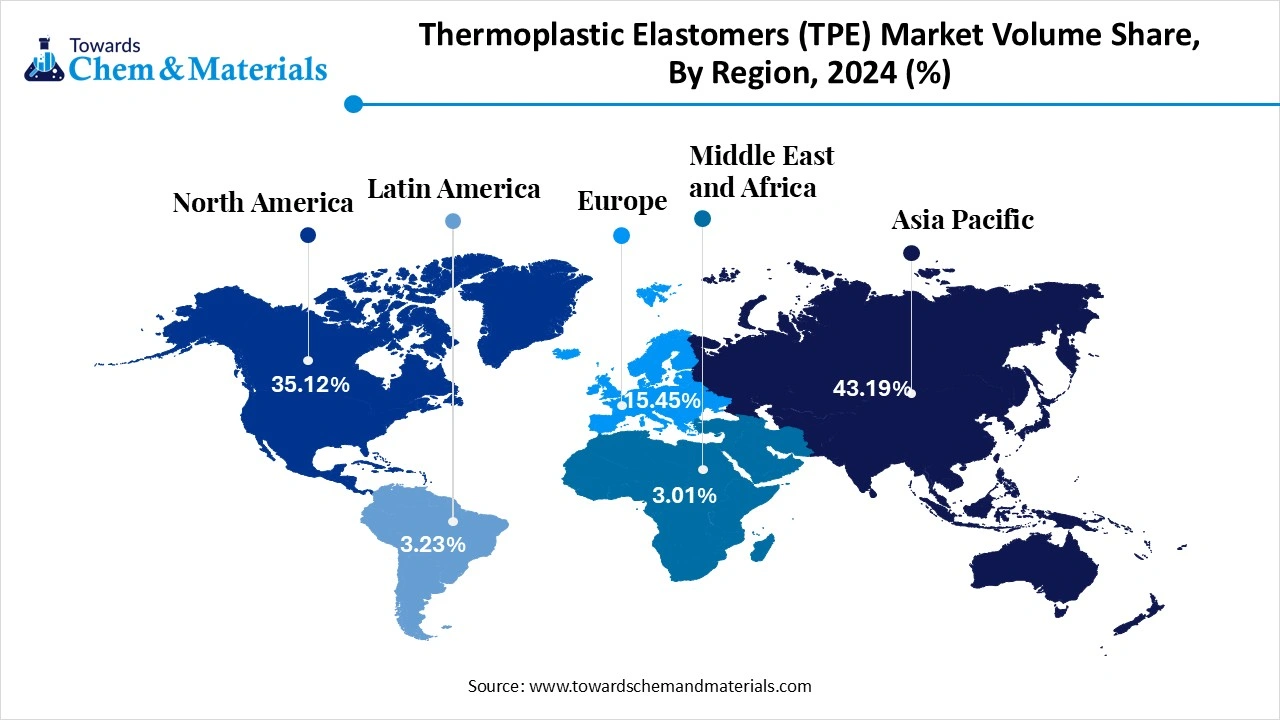

- The Asia Pacific thermoplastic elastomers (TPEs) market Volume is estimated at 3.24 million tons in 2025 and is expected to reach 5.18 million tons by 2034, growing at a CAGR of 5.33% from 2025 to 2034.

- The Asia Pacific thermoplastic elastomers (TPEs) market held the largest volume share of 43.19% of the global market in 2024.

- The North America thermoplastic elastomers (TPEs) market is expected to register the fastest CAGR of 5.17% over the forecast period by 2025-2034.

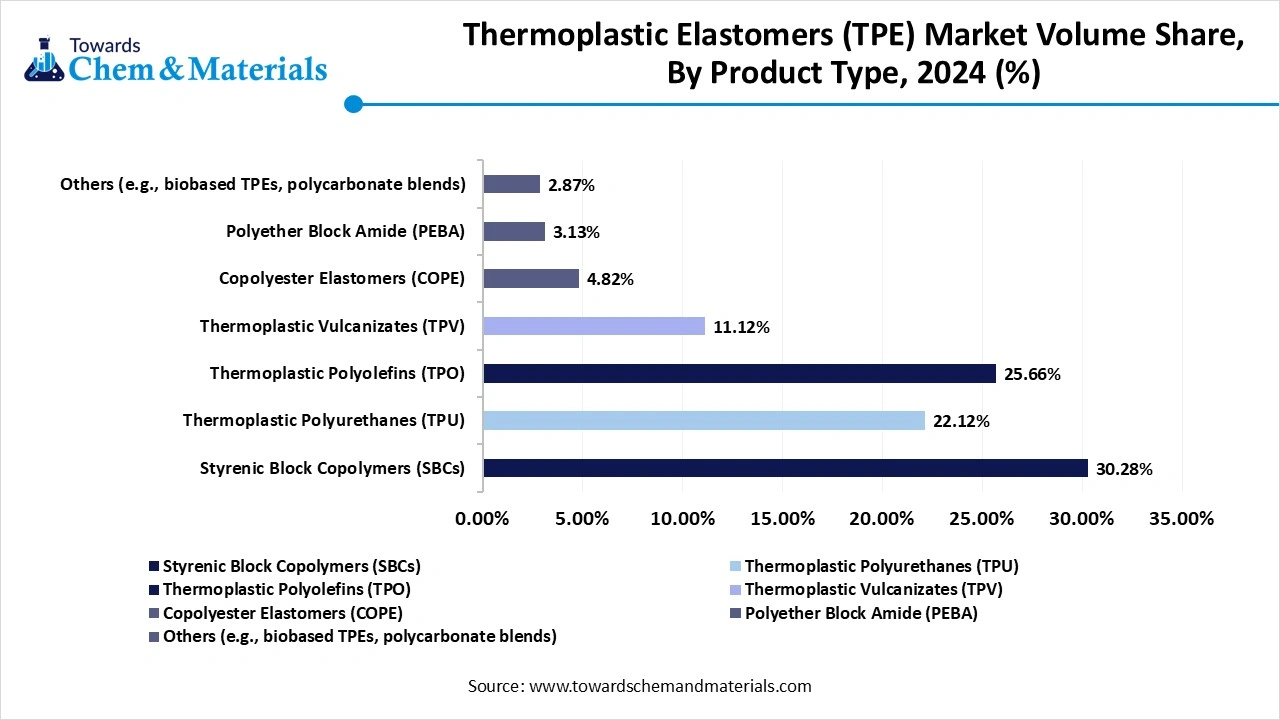

- By Product Type, the styrenic block copolymers (SBCs) segment dominated the market with the largest volume share of 30.28% in 2024.

- By Product Type, the thermoplastic polyurethanes segment is projected to grow at the fastest CAGR of 5.19% over the forecast period by 2025-2034.

- By end use industry, the automotive & transportation segment emerged as the top-performing segment in 2024, due to the increased need for lightweight, flexible, and durable material in these industries.

- By end use industry, the medical & healthcare segment is expected to lead the market in the coming years, due to TPE becoming crucial in devices where flexibility, safety, and compatibility become the properties.

- By processing method, the injection moulding segment led the thermoplastic elastomers (TPEs) market in 2024, because it is the most common and cost-effective method for producing TPE parts in large volumes.

- By processing method, the 3D printing segment captured the biggest portion of the market in 2024, because it allows custom, on-demand manufacturing of flexible and complex parts using TPEs.

- By sales channel, the direct sales segment led the thermoplastic elastomers (TPEs) market in 2024, because large TPE manufacturers prefer selling directly to automotive, medical, and industrial clients.

- By sales channel, the online segment is expected to grow at the fastest rate in the market during the forecast period, because it offers easier access to a wide variety of TPE products, especially for small and medium-sized manufacturers.

Market Overview

From Cars to Clinics: The Versatility of TPEs

Thermoplastic elastomers (TPEs) are a class of polymers that combine the properties of elastomers (rubber-like elasticity) and thermoplastics (easy processability. They soften upon heating and can be moulded multiple times, making them suitable for diverse applications across automotive, consumer goods, industrial, and medical sectors. Moreover, the increased need for lightweight, flexible, and durable materials is contributing to the industry's growth in recent years.

Which Factor Is Driving the Thermoplastic Elastomers (TPEs) Market?

The enlarged expansion of the automotive industry is spearheading the market growth in the current period. As TPEs are increasingly used in the application of the automotive industry, such as the car interiors, gaskets, and under-the-hood parts, where durability, flexibility, and lightweight material are the priority. Also, several automakers are actively trying to reduce vehicle weight due to fuel economy, which is likely to provide industry attention to the thermoplastic in the coming years.

Market Trends

- The sudden increased demand from medical healthcare applications has been driving industry growth in recent years. Furthermore, the TPE has become the ideal material for the manufacture of tubing and syringes in recent years.

- The increased demand for faster prototyping and flexible product design is contributing to the TPE industry's growth as TPE offers strength, flexibility, and easy customization.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 7.49 Million Tons |

| Expected Volume by 2034 | 11.84 Million Tons |

| Growth Rate from 2025 to 2034 | 5.22% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type , By End-Use Industry ,By Processing Method , By Sales Channel ,By Region |

| Key Companies Profiled | BASF SE, Dow Inc. , DuPont de Nemours, Inc. , Cargill, Incorporated , Evonik Industries AG , Solvay S.A. , Archer Daniels Midland Company (ADM) , Mitsubishi Chemical Corporation , Lanxess AG , Kuraray Co., Ltd. , Celanese Corporation, Mitsui Chemicals Inc., Toray Industries, Inc. , PTT Global Chemical Public Company Limited , Syensqo , Merck KGaA , Corbion , Stepan Company, Circa Group AS , Green Hills Software |

Market Opportunity

Sustainable TPE Solutions Gain Momentum with Global Policy Support

The development of the bio-based TPE is expected to create a lucrative opportunity for manufacturers in the coming years. Moreover, the global government pushes for green alternative usage to create beneficial advantages in the coming years. Also, several major brands have seen under the heavy promotion of their sustainable manufacturing practices in the past few years.

Market Challenge

Rising Production Costs Threaten the Growth of High-Performance TPEs

The higher production cost of the high-performance thermoplastic elastomers is anticipated to hinder the industry's potential during the forecast period. As these high-performance TPEs need high quality raw material with strict quality control and advanced equipment which can be costlier sometimes. These cost challenges can affect the new entrants and the mid-size business which is expected to hamper industry growth in the upcoming years.

Segmental Insights

Product Type

How did the Styrenic Block Copolymers Segment Dominate the Thermoplastic Elastomers (TPEs) Market in 2024?

The styrenic block copolymers segment held the largest share of the market in 2024, due to having properties such as affordability and easy processing. Moreover, the styrenic block copolymers are actively seen in use in applications such the consumer goods, adhesives, and even footwear. Furthermore, by offering flexibility, low temperature performance, and strength, the SBC has gained immense industry attention in recent years, as per the recent survey.

The thermoplastic polyurethanes segment is expected to grow at a notable rate during the predicted timeframe due to the significant durability of the segment. Also, having other properties like abrasion resistance and flexibility, the thermoplastic polyurethanes segment can gain significant industry attention in the coming years. Furthermore, the manufacturers of automotive interiors, sportswear, and consumer electronics are actively demanding thermoplastic polyurethanes in recent years, which can play a major role in the future industry expansion in the coming years.

Thermoplastic Elastomers (TPEs) Market Volume Share, By Product, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| Styrenic Block Copolymers (SBCs) | 30.28% | 2.16 | 30.74% | 3.64 | 5.99% |

| Thermoplastic Polyurethanes (TPU) | 22.12% | 1.57 | 21.14% | 2.50 | 5.29% |

| Thermoplastic Polyolefins (TPO) | 25.66% | 1.83 | 24.33% | 2.88 | 5.19% |

| Thermoplastic Vulcanizates (TPV) | 11.12% | 0.79 | 12.31% | 1.46 | 7.02% |

| Copolyester Elastomers (COPE) | 4.82% | 0.34 | 5.01% | 0.59 | 6.27% |

| Polyether Block Amide (PEBA) | 3.13% | 0.22 | 3.43% | 0.41 | 6.90% |

| Others (e.g., biobased TPEs, polycarbonate blends) | 2.87% | 0.20 | 3.04% | 0.36 | 6.50% |

| Total | 100% | 7.12 | 100% | 11.84 | 5.22% |

End Use Industry Insights

Why does the Automotive and Transportation Segment Dominate the Thermoplastic Elastomers (TPEs) Market by End Use Industry?

The automotive & transportation segment held the largest share of the thermoplastic elastomers (TPEs) market in 2024, due to the increased need for the lightweight, flexible, and durable material in these industries. The sudden surge in electric vehicles has provided a wider consumer base for the thermoplastic elastomers market in recent years. Moreover, by reducing the vehicle weight while improving the fuel efficiency, the thermoplastic elastomers have gained immense industry attention in recent years.

The medical and healthcare segment is expected to grow at a notable rate due to TPE becoming crucial in devices where flexibility, safety, and compatibility become the properties. Moreover, the TPE is being used in syringes, tubing, seals, and wearable devices in recent years, which has provided significant attention in the industry. Furthermore, having properties such as non-toxic, latex-free, and easy to sterilize, the TPE becomes the ideal material in patient-safe applications, as per the recent observation.

Processing Method Insights

Why Did the Injection Molding Segment Dominate the Thermoplastic Elastomers (TPEs) Market in 2024?

The injection molding segment dominated the market with the largest share in 2024, because it is the most common and cost-effective method for producing TPE parts in large volumes. This process is widely used for making automotive components, footwear, tools, and medical devices. It allows for high-speed production, precise shapes, and minimal material waste. TPEs are well-suited for injection molding due to their thermoplastic nature, making them easy to melt and reshape. Industries prefer this method for its efficiency, repeatability, and compatibility with complex designs. Because of its widespread use across multiple sectors, injection molding continues to be the dominant processing method for TPES.

The 3D printing segments are expected to grow at a notable rate because they allow custom, on-demand manufacturing of flexible and complex parts using TPEs. This method is ideal for prototyping, medical devices, wearables, and even footwear. TPEs' flexibility and durability make them perfect for soft, bendable 3D-printed objects. As industries seek faster product development and reduced material waste, 3D printing with TPEs offers a smart solution. Advancements in printing technology and expanding material choices are making it more accessible and scalable. With growing demand for personalized, lightweight, and eco-friendly products, 3D printing using TPEs is set to transform future manufacturing.

Sales Channel Insights

Why Did Direct Sales Segment Dominated The Thermoplastic Elastomers (TPEs) Market in 2024?

The direct sales segment held the largest share in 2024 because large TPE manufacturers prefer selling directly to automotive, medical, and industrial clients. This allows better control over pricing, bulk orders, and long-term contracts. Direct sales also provide technical support, faster delivery, and custom product options, which are important for industries that require specific TPE properties. Many large businesses prefer direct relationships with suppliers to ensure quality and timely supply. Since TPE is often used in critical applications, buyers trust direct engagement for reliability. As a result, direct sales remain the preferred and dominant channel in the TPE market.

The online platform segments are expected to grow at a notable rate because they offer easier access to a wide variety of TPE products, especially for small and medium-sized manufacturers. Digital platforms allow quick price comparison, transparent supply options, and convenient ordering without the need for intermediaries. As digitalization spreads and more buyers look for flexible sourcing options, online sales of specialty materials like TPEs are growing. These platforms also enable global reach and support for technical documentation and certifications. With the rise of e-procurement in industries, online and e-commerce channels are expected to become the most convenient and preferred method for purchasing TPES.

Regional Insights

The Asia Pacific thermoplastic elastomers (TPEs) market Volume was estimated at 3.08 million tons in 2024 and is anticipated to reach 5.18 million tons by 2034, growing at a CAGR of 5.33% from 2025 to 2034.

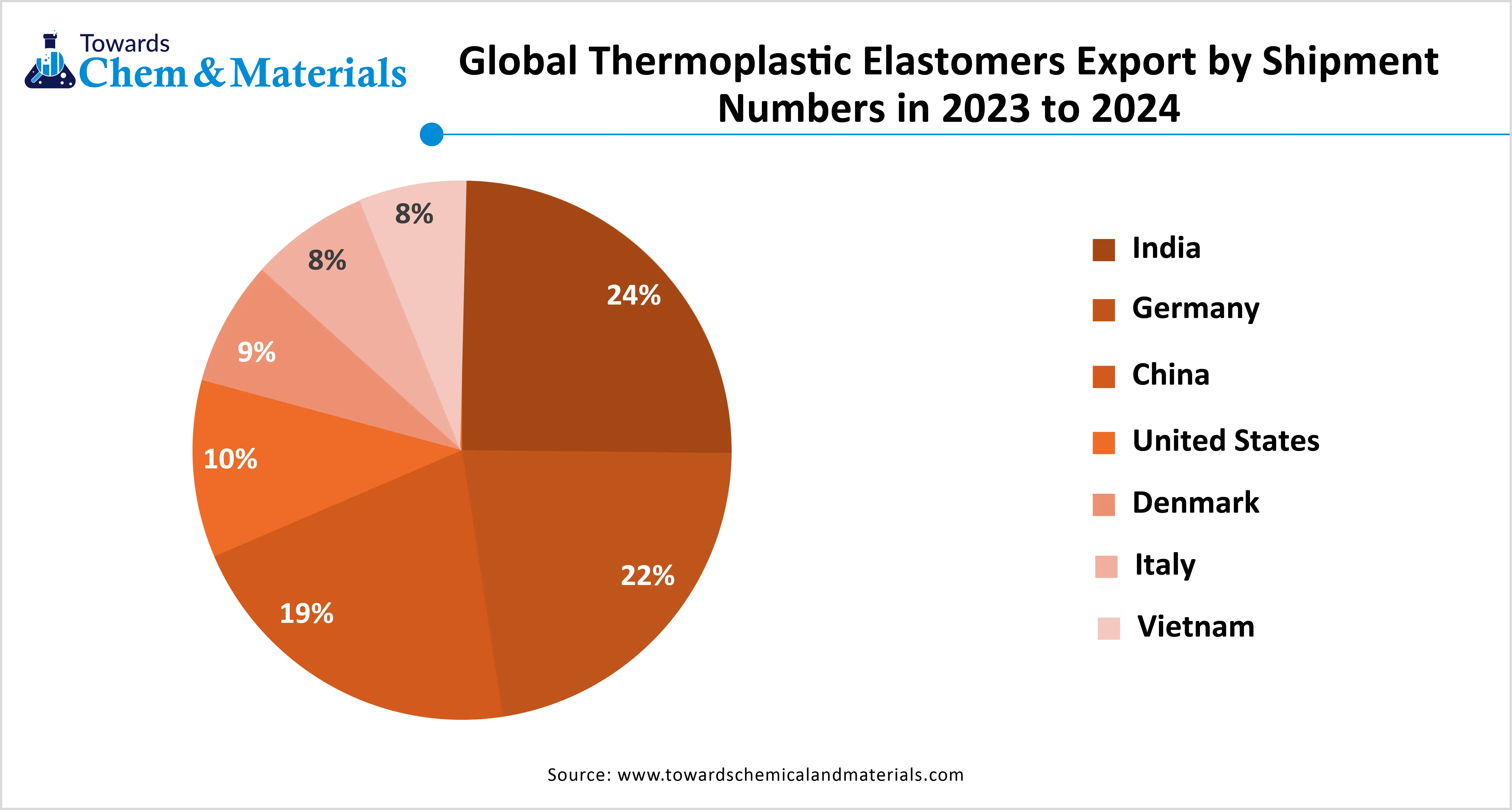

Asia Pacific dominated the market in 2024, akin to an enlarged manufacturing base. Also, the sectors such as the automotive, construction, and electronics are seen under the heavy need for thermoplastic elastomers in recent years. Furthermore, the regional countries like India, China, and Japan have had high benefits, such as lower manufacturing costs, and professionals are actively attracting manufacturers' perspective towards the region in the past few years.

Is China’s Green Initiative the Key to Thermoplastic Elastomers (TPEs) Market Dominance?

China maintained its dominance in the market owing to the country being considered the global manufacturing hub in the current period. Moreover, the government is contributing to the industry's growth in recent years by releasing the green initiative and light material use mandates. Also, the country is actively seen in putting heavy investment into the local manufacturing capacities, where the local manufacturer can gain a significant industry advantage in the coming years.

North America is expected to capture a major share of the market, owing to the increased use of thermoplastic elastomers in high-performance applications such as medical devices and 3D printing. Moreover, having strong research and development facilities has actively provided significant advantages to the market in recent years. Also, the need for durable and lightweight materials is expected to drive industry growth in the coming years.

Can the United States Dominate the TPE Industry with Customization and Innovation?

The United States is expected to rise as a dominant country in the region in the coming years, owing to the heavy demand for customized thermoplastic elastomers in recent years. Moreover, the country’s several manufacturing sectors are actively seeking heat resistance and biocompatible thermoplastic elastomers as per the country’s recent survey. Furthermore, with the release of supportive policies by the government, the industry is projected to witness significant growth in the upcoming years, as per recent observations.

Thermoplastic Elastomers (TPEs) Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| North America | 35.12% | 2.50 | 33.23% | 3.94 | 5.17% |

| Europe | 15.45% | 1.10 | 17.13% | 2.03 | 7.04% |

| Asia Pacific | 43.19% | 3.08 | 41.44% | 4.91 | 5.33% |

| Latin America | 3.23% | 0.23 | 4.43% | 0.52 | 9.60% |

| Middle East & Africa | 3.01% | 0.21 | 3.77% | 0.45 | 8.50% |

| Total | 100% | 7.12 | 100% | 11.84 | 5.22% |

Recent Developments

- In April 2025, Dupont unveiled their latest product line of TPE tubing. This newly launched TPE tubing is ultra-low temperature tubing named DuPont™ Liveo™, which can withstand low temperatures, as per the company's claim.(Source:www.dupont.com)

- In March 2024, the Avient Corporation introduced the latest adhesive thermoplastic elastomers. These launched elastomers are specifically designed for fabrics and are named as Versaflex™ TF, as per the report published by the company.(Source : www.specialchem.com)

Top Companies list

- BASF SE

- Dow Inc.

- DuPont de Nemours, Inc.

- Cargill, Incorporated

- Evonik Industries AG

- Solvay S.A.

- Archer Daniels Midland Company (ADM)

- Mitsubishi Chemical Corporation

- Lanxess AG

- Kuraray Co., Ltd. ,

- Celanese Corporation

- Mitsui Chemicals Inc.,

- Toray Industries, Inc. ,

- PTT Global Chemical Public Company Limited

- Syensqo

- Merck KGaA

- Corbion

- Stepan Company

- Circa Group AS

- Green Hills Software

Segment Covered

By Product Type

- Styrenic Block Copolymers (SBCs)

- Thermoplastic Polyurethanes (TPU)

- Thermoplastic Polyolefins (TPO)

- Thermoplastic Vulcanizates (TPV)

- Copolyester Elastomers (COPE)

- Polyether Block Amide (PEBA)

- Others (e.g., biobased TPEs, polycarbonate blends)

By End-Use Industry

- Automotive & Transportation

- Building & Construction

- Consumer Goods

- Footwear

- Medical & Healthcare

- Electrical & Electronics

- Industrial Machinery

- Packaging

- Sports & Leisure

- Others (e.g., agriculture, toys)

By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- 3D Printing

- Others (compression molding, rotational molding)

By Sales Channel

- Direct Sales (to OEMs)

- Distributors / Channel Partners

- Online / E-commerce

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE