Content

Plastic Lidding Films Market Size and Share 2034

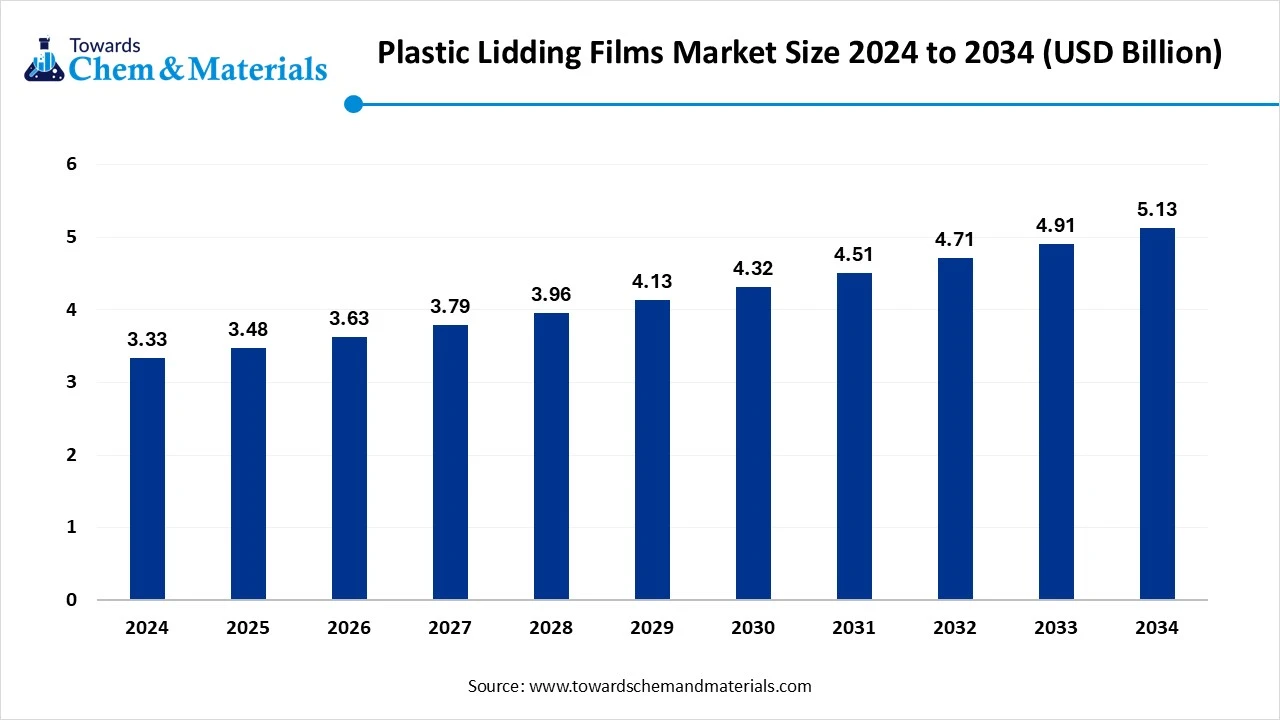

The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034. The market's growth is driven by the increasing production and use of the material by various industries, which in turn fuels market development.

Key Takeaways

- By region, Europe dominated the market in 2024. The Europe region held a 35% share in the market in 2024. The strong focus of the regulatory bodies on sustainability amid growing environmental concerns further fuels the growth of the market in the region

- By region, Asia Pacific expected to have significant growth in the market in the forecast period. The key growth drivers of the market are urbanization and lifestyle changes.

- By material, the pet films segment dominated the market in 2024. The pet films segment held a 35% share in the market in 2024. Their compatibility with various sealing technologies and recyclability enhances their demand.

- By material, the multi-layer/specialty films segment is expected to grow significantly in the market during the forecast period. They cater to applications requiring protection against oxygen, moisture, and contamination.

- By product type, the peelable lidding films segment dominated the market in 2024. The peelable lidding films segment held a 40% share in the market in 2024. Their demand is growing with the rise of single-serve and on-the-go food packaging.

- By product type, the dual-ovenable & self-venting films segment is expected to grow in the forecast period. These films are ideal for ready-to-eat meals and frozen foods, where heat resistance and steam release are essential.

- By application, the dairy packaging segment dominated the market in 2024. The dairy packaging segment held a 30% share in the market in 2024. The films provide strong seals, extended shelf life, and tamper evidence.

- By application, the ready-to-eat meals & frozen foods segment is expected to grow in the forecast period. Ready-to-eat meals and frozen foods increasingly rely on lidding films for convenience, durability, and heat-resistance.

- By end use, the food processing & packaging companies segment dominated the market in 2024. The food processing & packaging companies segment held a 60% share in the market in 2024. These businesses require reliable sealing solutions to maintain freshness, extend shelf life, and meet safety standards

- By end use, the pharmaceutical manufacturers segment is expected to grow in the forecast period. Their hygienic, lightweight, and customizable features increase the demand for the product.

- By distribution, the direct supply to the OEMs segment dominated the market in 2024. The direct supply to the OEMs segment held a 55% share in the market in 2024. Food companies adopting automated lines increasingly prefer direct sourcing.

- By distribution, the converters & packaging manufacturers segment is expected to grow in the forecast period. They cater to a broad client base, from small food businesses to large processors.

Market Overview

Rising Demand For Durable Materials: Plastic Lidding Films Market To Expand

The plastic lidding films market covers the production and usage of flexible, thin polymer films used to seal trays, cups, containers, and other packaging formats for food, beverages, pharmaceuticals, and consumer goods. These films offer barrier protection, heat-sealing capability, tamper resistance, and product visibility, while also extending shelf life.

Common polymers include PET, PE, PP, and specialty multi-layer laminates. Growth is driven by rising demand for ready-to-eat meals, convenience packaging, increased use in dairy and beverage segments, and sustainability initiatives promoting recyclable and bio-based lidding solutions.

What Are The Key Growth Drivers That Support The Growth Of the Plastic Lidding Films Market?

The market for plastic lidding films is primarily driven by the rising demand for convenient, shelf-stable packaged foods, which is fueled by urbanization and lifestyle shifts in developing countries. Major factors include efforts to prolong product shelf life, growth in retail and e-commerce channels, and innovations like anti-fog features and easy-peel designs. Additionally, changing regulations and consumer preferences for sustainable packaging are encouraging the development of recyclable and mono-material films.

Market Trends

- Focus on High-Barrier Films : Films with advanced barrier properties are gaining popularity as they effectively protect products from moisture and oxygen, thereby extending shelf life.

- Rise of PET and Polypropylene (PP): These materials are increasingly used due to their excellent mechanical strength, thermal resistance, and sealing capabilities, especially in high-speed packaging processes.

- Growth in Bio-Based Films : The market for bio-based, biodegradable films is rapidly expanding, driven by sustainability efforts.

- Increased Penetration in the region : The growing retail infrastructure in the regions is boosting demand for lidding films.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.48 Billion |

| Expected Size by 2034 | USD 5.13 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.42% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Material, By Product Type, By Application, By End-Use Industry, By Distribution Model, By Region |

| Key Companies Profiled | Amcor Plc , Berry Global Inc., Constantia Flexibles, Cosmo Films Ltd., Jindal Poly Films, Mondi Plc, Plastopil Hazorea, Sealed Air Corporation, Toray Plastics (America), Inc., Uflex Ltd., Winpak Ltd., Taghleef Industries |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Plastic Lidding Films Market?

The plastic lidding film market presents opportunities driven by the increasing demand for extended shelf-life packaging, particularly for perishable and convenience foods. Growing demand also exists for sustainable, bio-based lidding films to satisfy eco-conscious consumers and comply with strict regulations.

Additionally, expanding into e-commerce, personal care, and pharmaceutical markets, enhancing anti-fog and high-barrier features for better product visibility and protection, and developing resealable formats for snacks and convenience items are key growth areas.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Plastic Lidding Films Market?

The primary challenges in the market involve growing regulatory pressure on plastic use and waste, a move towards sustainable packaging such as biodegradable or recyclable films, environmental concerns related to plastics, difficulties in maintaining effective seal integrity across various products and trays, increasing raw material costs, and heightened awareness among consumers and producers about proper recycling and disposal methods.

Regional Insights

How Did Europe Dominate The Plastic Lidding Films Market In 2024?

Europe dominated the plastic lidding films market in 2024. The market has seen significant growth in the region, which is driven by the increasing demand for the material by various industries due to rapid industrialization in the region.

The strong focus of the regulatory bodies on sustainability amid growing environmental concerns further boosts the growth of the market in the region. The other key growth drivers are the consumer demand for sustainable packaging, E-grocery, and meal kits demand in the expansion of online grocery shopping, which increases the demand for lidding films, advanced recycling infrastructure, and product innovation in the market. The key players in the region further fuel the growth and expansion of the market.

The UK Has Seen Significant Growth, Driven By a Growing Manufacturing Hub.

The UK has seen significant growth in the market. The growth of the market is driven by the growing manufacturing hub, which increases the manufacturers ' adoption of advanced automated technologies and software for improving the production efficiency of the film, which fuels the growth of the market.

Other key growth drivers are the growing demand for convenience and freshness for improving product visibility, shelf appeal, and extended shelf life, high barriers to properties, sustainability, and regulations, and growing e-commerce and online grocery shopping in the region, further fueling the growth and expansion of the market in the country.

Asia Pacific Is Experiencing Growth Driven By The Growing Market In The Region

Asia Pacific is expected to experience significant growth in the plastic lidding films market in the forecasted period. The key growth drivers of the market are urbanization and lifestyle changes, and demand for on-the-go food formats further fuels the growth. The demand for packaged foods and economic growth due to rising disposable income contribute to higher consumer purchasing power and a greater demand for packaged food products, which fuels the growth and expansion of the market.

Segmental Insights

Material Insights

Which Material Type Segment Dominated The Plastic Lidding Films Market In 2024?

The pet films segment dominated the plastic lidding films market in 2024. PET films are widely used in the market due to their excellent clarity, strength, and barrier properties. They are preferred in food packaging applications where visibility and product freshness are critical. Their compatibility with various sealing technologies and recyclability enhances their demand. PET-based lidding films are primarily adopted for dairy and convenience food packaging, offering a cost-effective and sustainable choice for manufacturers.

The multi-layer/specialty films segment is expected to experience significant growth in the market during the forecast period. Multi-layer and specialty films combine different materials to deliver enhanced barrier performance, durability, and heat resistance. They cater to applications requiring protection against oxygen, moisture, and contamination.

These films are tailored for advanced packaging needs such as ready-to-eat meals and frozen foods. Their versatility allows them to meet diverse requirements like dual ovenable or self-venting properties, making them a premium choice for food processing and packaging companies.

Product Type Insights

How Did Peelable Lidding Films Segment Dominate the Plastic Lidding Films Market In 2024?

The peelable lidding films segment dominated the market in 2024. Peelable lidding films dominate in applications where consumer convenience and safety are prioritized. These films allow easy opening without compromising product integrity, making them highly suitable for dairy cups, yogurt, and portion packs. Their demand is growing with the rise of single-serve and on-the-go food packaging. Peelable films also support branding opportunities with printable surfaces, strengthening their role in enhancing customer experience in competitive food packaging markets.

The dual-ovenable & self-venting films segment is expected to experience significant growth in the market during the forecast period. Dual ovenable and self-venting lidding films are engineered for convenience, enabling food to be cooked directly in microwaves or conventional ovens. These films are ideal for ready-to-eat meals and frozen foods, where heat resistance and steam release are essential. Their adoption is rising in urban households and quick-service meal packaging. By ensuring both functionality and safety, these films are transforming consumer expectations for packaged meal solutions.

Application Insights

Which Application Segment Dominated The Plastic Lidding Films Market In 2024?

The dairy packaging segment dominated the market in 2024. Dairy packaging is a significant application area for plastic lidding films, particularly for sealing yogurt, cream, cheese, and milk-based products. The films provide strong seals, extended shelf life, and tamper evidence, which are crucial in this segment.

As dairy products often require transparent and hygienic packaging, PET and peelable films dominate. Growth in dairy consumption and demand for portion-sized packs continues to boost usage in this sector.

The ready-to-eat meals & frozen foods segment is expected to experience significant growth in the market during the forecast period. Ready-to-eat meals and frozen foods increasingly rely on lidding films for convenience, durability, and heat-resistance.

Dual ovenable and self-venting films are particularly valuable here, allowing products to be directly heated. This segment benefits from the rise in busy lifestyles, urbanization, and consumer preference for quick and packaged meal options. Strong barrier properties and compatibility with automation also support the widespread adoption of lidding films in this application.

End-Use Industry Insights

Why Did The Food Processing & Packaging Companies Segment Dominated The Plastic Lidding Films Market In 2024?

The food processing & packaging companies segment dominated the market in 2024. Food processing and packaging companies represent the primary end users of plastic lidding films. These businesses require reliable sealing solutions to maintain freshness, extend shelf life, and meet safety standards. Lidding films support large-scale automated packaging lines and ensure consistency in product presentation. Their adaptability across dairy, frozen foods, and ready meals makes them an indispensable packaging material for manufacturers aiming to meet evolving consumer demands.

The pharmaceutical manufacturers segment is expected to experience significant growth in the market during the forecast period. Pharmaceutical manufacturers are increasingly adopting lidding films for packaging sensitive products requiring strong seals, barrier protection, and tamper evidence. Multi-layer specialty films offer superior safety and durability for medical and healthcare packaging. The sector values lidding films for their hygienic, lightweight, and customizable features. Rising pharmaceutical production and global emphasis on safe medicine delivery further strengthen demand for lidding films in healthcare applications.

Distribution Channel Insights

Why Did The Direct Supply To The OEMs Segment Dominated The Plastic Lidding Films Market In 2024?

The direct supply to the OEMs segment dominated the market in 2024. Direct supply to original equipment manufacturers (OEMs) ensures that packaging machinery is paired with films designed for high efficiency and compatibility. This channel offers cost savings, reduced downtime, and quality consistency. Food companies adopting automated lines increasingly prefer direct sourcing to align machinery with the specific sealing and performance needs of lidding films, driving growth in this distribution segment.

The converters & packaging manufacturers segment is expected to experience significant growth in the plastic lidding films market during the forecast period. Converters and packaging manufacturers act as a vital distribution channel by customizing plastic lidding films into formats tailored for end-use industries. They cater to a broad client base, from small food businesses to large processors. By offering printing, lamination, and specialized sealing solutions, converters add value to the films, making this channel essential for serving diverse application requirements across the food packaging landscape.

Plastic Lidding Films Market Value Chain Analysis

- Chemical Synthesis and Processing : The plastic lidding films are synthesised and processed through blow film extrusion and cast film extrusion.

- Key players : Tilak Polypack and Cosmo Films, Bostik, Avonflex Pvt Ltd, KM Packaging.

- Quality Testing and Certification : The plastic lidding films require ISO and BRC Global Standards.

- Key players: ASTM International, Campden BRI, and British Plastics Federation (BPF)

- Distribution to Industrial User : The plastic lidding films are distributed to the packaged food and beverages, pharmaceutical and healthcare, and personal care industries.

- Key players: Amcor, Berry Global Inc., Cosmo Films Ltd., and Uflex Ltd.

Recent Developments

- In June 2025, KM Packaging announced K-Peel 4G, a new mono PET lidding film with a low seal initiation point. It can seal through contamination and achieves clean peels at temperatures as low as 110°C with a dwell time of 0.3 seconds.(Source: www.packagingstrategies.com)

- In June 2025, RKW Horizon represents the latest generation of eco-friendly PE plastic films, utilizing advanced MDO technology. Paired with RKW ProTec sealing films, they offer a recyclable and sustainable packaging solution suitable for various formats and industries. Building on the success of the RKW Horizon® MDO-PE product line, the RKW Group introduces new benchmarks in sustainability and functionality for flexible packaging. The expanded range now features MDO-PE films with an embedded EVOH barrier.(Source: www.emballagedigest.fr)

Plastic Lidding Films Market Top Companies

- Amcor Plc

- Berry Global Inc.

- Constantia Flexibles

- Cosmo Films Ltd.

- Jindal Poly Films

- Mondi Plc

- Plastopil Hazorea

- Sealed Air Corporation

- Toray Plastics (America), Inc.

- Uflex Ltd.

- Winpak Ltd.

- Taghleef Industries

Segments Covered

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Ethylene Vinyl Alcohol (EVOH) & Polyamide (Nylon)

- Multi-Layer / Specialty Films

By Product Type

- Dual-Ovenable Lidding Films

- Specialty Barrier Lidding Films

- Peelable Lidding Films

- Non-Peelable/Lock-Seal Films

- Self-Venting Films

By Application

- Food & Beverages

- Dairy Products (yogurt, cheese, milk cups)

- Ready-to-Eat Meals & Frozen Foods

- Meat, Poultry & Seafood Packaging

- Beverages & Snacks

- Pharmaceutical & Medical Packaging

- Consumer Goods & Industrial Packaging

By End-Use Industry

- Food Processing & Packaging Companies

- Pharmaceutical Manufacturers

- Retail & Supermarkets

- Consumer Goods Producers

By Distribution Model

- Direct Supply to OEMs (Food & Pharma Companies)

- Converters & Packaging Manufacturers

- Distributors & Retail Packaging Suppliers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait