Content

U.S. Polyvinylidene Chloride (PVDC) Coated Films Market - Size, Share & Industry Analysis

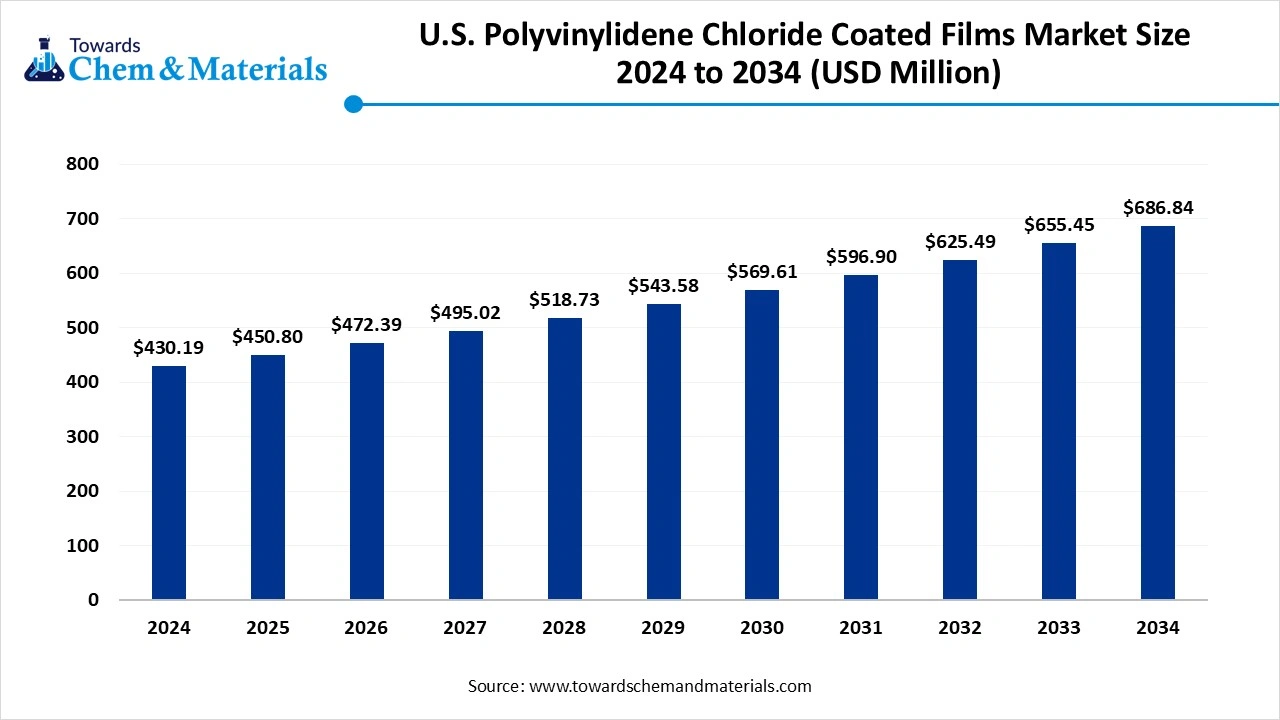

The U.S. polyvinylidene chloride (PVDC) coated films market size was valued at USD 430.19 million in 2024, grew to USD 450.80 million in 2025, and is expected to hit around USD 686.84 million by 2034, growing at a compound annual growth rate (CAGR) of 4.79% over the forecast period from 2025 to 2034. The growing labelling of personal care products and increasing consumption of packaged foods drive the market growth.

Key Takeaways

- By substrate type, the BOPP & PET films segment held approximately a 55% share in the U.S. polyvinylidene chloride (PVDC) coated films market in 2024 due to the increasing need for convenience packaging.

- By substrate type, the PE films segment is expected to grow at the fastest CAGR in the market during the forecast period due to the superior barrier properties.

- By application, the food & beverage packaging segment held approximately a 60% share in the market in 2024 due to increasing consumption of packaged food.

- By application, the pharmaceuticals & healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for medicine.

- By coating method, the single-side coated segment held approximately a 65% share in the market in 2024 due to the strong focus on maintaining pharmaceutical integrity.

- By coating method, the double-side coated segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rise in lamination.

- By thickness, the 20-40 microns segment held approximately a 50% share in the market in 2024 due to the growing demand for high-speed packaging.

- By thickness, the <20 microns segment is expected to grow at the fastest CAGR in the market during the forecast period due to its adequate strength.

- By distribution channel, the direct sales segment held approximately a 55% share in the U.S. polyvinylidene chloride (PVDC) coated films market in 2024 due to the availability of product customization.

- By distribution channel, the distributors segment is expected to grow at the fastest CAGR in the market during the forecast period due to the faster delivery time.

What are U.S. Polyvinylidene Chloride (PVDC) Coated Films?

U.S. PVDC coated films are plastic films made up of a thin layer of polyvinylidene chloride and offer a high barrier against gases, chemicals, moisture, and fragrances. It provides benefits like preservation of the product, extended shelf life, maintaining product quality, preserving freshness, and preventing contamination. It is widely used in applications like cosmetic packaging, food packaging, personal care packaging, and pharmaceutical capsules & tablets.

Factors like stricter regulations on product safety, ongoing innovations in recyclable & sustainable film structures, increasing demand for processed & packaged food, and growing need for pharmaceutical packaging contribute to the growth of the U.S. polyvinylidene chloride (PVDC) coated films market.

- From April 2024 to March 2025, the United States exported 174 shipments of polyvinyl chloride film.(Source: www.volza.com)

- From October 2023 to September 2024, the United States exported 595 shipments of BOPP film.(Source: www.volza.com)

- Costco Wholesale Corp is the leading supplier of PVC films in the United States. (Source: www.volza.com)

Growing Personal Care Sector Drives the Market Growth

The strong focus on self-care and increasing preference for grooming in women’s & men's increases demand for personal care products. The growing utilization of various personal care products, like cosmetics, creams, and lotions, increases the adoption of PVDC coated films for packaging. The strong focus on preventing product degradation and extending the shelf life of the product increases demand for PVDC coated films.

The need for preservation of the fragrance of personal care products and the increasing need for labelling of products increase demand for PVDC coated films. The growing demand for product wraps, sachets, and sample pouches in personal care products increases the adoption of PVDC coated films. The focus on maintaining overall product quality and increasing consumer awareness about product safety increases the adoption of PVDC coated films. The growing personal care sector is a key driver for the growth of the U.S. polyvinylidene chloride (PVDC) coated films market.

Market Trends

- Strong Regulatory Support: The stringent food safety regulations and strong regulatory standards increase the adoption of PVDC coated films for enhancing the safety of the products.

- Growing Food Packaging Demand: The increasing consumption of packaged food and the growing food processing sector increase demand for PVDC coated films for preventing contamination and extending the shelf life of products.

- Growing Packaging Format Expansion: The growing availability of various packaging formats like bags, wraps, pouches, and lidding films increases demand for PVDC coated films.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 450.80 Million |

| Expected Size by 2034 | USD 686.84 Million |

| Growth Rate from 2025 to 2034 | CAGR 4.79% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Substrate Type, By Application, By Coating Method, By Thickness, By Distribution Channel |

| Key Companies Profiled | Sealed Air Corporation, DuPont de Nemours, Inc., Innovia Films Ltd. (U.S. operations), Cosmo Films Ltd. (North America presence), Jindal Poly Films Limited, Vibac Group S.p.A., Klöckner Pentaplast (U.S. subsidiary), Toray Plastics (America), Inc., Treofan America, Inc., Amcor Plc (U.S. operations), Mondi Group (North America packaging division), Winpak Ltd. (U.S. operations) |

Market Opportunity

Growing Pharmaceutical Industry Surges Demand for PVDC Coated Films

The increasing production of various pharmaceutical products and the growing pharmaceutical industry across the United States increase demand for PVDC coated films. The focus on preventing the degradation of pharmaceutical products and enhancing the efficacy of drugs increases demand for PVDC coated films. The increasing production of unit-dose medications and moisture-sensitive drugs increases the adoption of PVDC coated films. The stricter packaging regulations in the United States and increasing demand for blister packs increase the adoption of PVDC coated films.

The growing prevalence of chronic diseases and the expansion of the healthcare sector increase demand for PVDC coated films for protective packaging of various pharmaceutical products. The focus on protecting drugs and extending the shelf life of medications increases the adoption of PVDC coated films. The growing pharmaceutical industry creates an opportunity for the growth of the U.S. polyvinylidene chloride (PVDC) coated films market.

Market Challenge

High Production Cost Halts Market Expansion

Despite several benefits of the PVDC coated films in various industries across the United States, the high production cost restricts the market growth. Factors like exact coating thickness, extensive capital investment, complex manufacturing process, environmental regulations, high investment in R&D, and volatility in raw material prices are responsible for the high production cost. The multi-step manufacturing process and the need for advanced technology increase the cost.

The precise thickness of the coating and the tight quality control require a high cost. The fluctuations in the prices of raw materials like crude oil and petrochemicals increase the cost. The need for specialized machinery and high investment in eco-friendly processes increases the cost. The high production cost hampers the growth of the market.

Segmental Insights

Substrate Type Insights

Why did the BOPP & PET Films Segment Dominate the U.S. Polyvinylidene Chloride (PVDC) Coated Films Market?

The BOPP & PET films segment dominated the market in 2024. The growing demand for convenience packaging and a strong focus on sustainable packaging increase demand for BOPP & PET films. The availability of excellent oxygen barrier properties and a focus on a premium look increase the adoption of BOPP & PET films. The cost-effectiveness and high mechanical strength increase demand for BOPP & PET films. The growing demand for BOPP & PET films in sectors like labelling, food & beverages, and personal care drives the market growth.

The PE films segment is the fastest-growing in the market during the forecast period. The growing demand for pharmaceuticals, dry foods, and hygiene products increases the adoption of PE films. The low cost of materials and superior barrier properties increase demand for PE films. The growing demand for high-quality packaging and increasing consumption of pharmaceutical products increases demand for PE films. The increasing production of food wraps and semi-rigid pouches increases the adoption of PE films, supporting the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the U.S. Polyvinylidene Chloride (PVDC) Coated Films Market?

The food & beverage packaging segment held the largest revenue share in the market in 2024. The growing focus on extending the shelf life and enhancing the visual appeal of food products increases the adoption of PVDC coated films. The need for maintaining original taste and increasing food wrapping applications increases the adoption of PVDC coated films. The need for preventing spoilage of food & beverages and the rise in convenience foods increase the adoption of PVDC coated films. The increasing consumption of packaged food & growing food processing industry drive the overall market growth.

The pharmaceuticals & healthcare segment is experiencing the fastest growth in the market during the forecast period. The increasing consumption of medicine and growing prevalence of chronic diseases increase demand for PVDF coated film packaging. The increasing manufacturing of biopharmaceutical products and the focus on maintaining the integrity of pharmaceutical products increase demand for PVDF coated films. The increasing production of unit-dose medications and the growing packaging of drugs increase demand for PVDF coated films, supporting the overall growth of the market.

Coating Method Insights

What made Single-Side Coated Segment Dominate the U.S. Polyvinylidene Chloride (PVDC) Coated Films Market?

The single-side coated segment dominated the market in 2024. The increasing packaging of food items like cheese, snacks, and meat increases demand for single-side coated films. The strong focus on maintaining the integrity of pharmaceuticals and affordability increases the adoption of single-side coated films. The increasing development of blister film components and the growing need for standard lamination equipment increase demand for single-side coated films, supporting the overall market growth.

The double-side coated segment is the fastest-growing in the market during the forecast period. The focus on maintaining the freshness of perishable foods and the need to minimize food waste increases demand for double-side coated films. The increasing demand for blister packaging and the growth in lamination increase the demand for double-side coated films. The growing premium packaging and the growing cosmetic industry increase demand for double-side coated films, supporting the overall growth of the market.

Thickness Insights

How the 20-40 Microns Segment Held the Largest Share in the U.S. Polyvinylidene Chloride (PVDC) Coated Films Market?

The 20-40 microns segment held the largest revenue share in the market in 2024. The need to extend the shelf life of perishable food products and focus on lowering material usage increases demand for 20-40 microns films. The increasing production of semi-rigid pouches and pharmaceutical blister packaging increases demand for 20-40 microns films. The focus on achieving high-barrier protection and increasing production of high-speed packaging increases demand for 20-40 micron films, driving the overall growth of the market.

The <20 microns segment is experiencing the fastest growth in the market during the forecast period. The strong focus on maintaining the integrity of pharmaceuticals and the need for superior protection increases demand for <20 microns films. The growing applications in household and commercial spaces increase the adoption of <20 microns films. The presence of adequate strength and an increasing manual packaging process increases the adoption of <20 microns films. The high flexibility and growing demand for efficient hygiene packaging increase the adoption of <20 microns films, supporting the overall market growth.

Distribution Channel Insights

How Direct Sales Segment Dominated the U.S. Polyvinylidene Chloride (PVDC) Coated Films Market?

The direct sales segment dominated the market in 2024. The strong focus on direct communication and increasing product customization increases the adoption of direct sales. The availability of technical expertise and the need for faster delivery increase demand for direct sales. The strong focus on working closely with pharmaceutical converters and the growing demand for complex products increase the adoption of direct sales, driving the overall market growth.

The distributors segment is the fastest-growing in the market during the forecast period. The need for guidance on optimal use and focus on building stronger relationships increases demand for distributors. The availability of a variety of products and the growing demand for handling complexity in logistics increase the adoption of distributors. The smaller order quantities and price competitiveness increase demand for distributors. The faster delivery time and strong support in choosing the correct product increase the adoption of distributors, supporting the overall market growth.

U.S. Polyvinylidene Chloride (PVDC) Coated Films Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for PVDC coated films is vinyl chloride, vinylidene chloride, & other monomers for PVDC coating and EVA, PET, & PE for substrate film.

- Chemical Synthesis & Processing: The chemical synthesis and processing involve steps like polymerization, base film preparation, coating application, drying & curing, & post-processing.

- Quality Testing and Certification: The quality testing involves testing of qualities like coating integrity, physical test, material identification, oxygen transmission rate, & moisture transmission rate testing, and certification includes FDA & EMA.

Recent Developments

- In October 2023, Solvay launched PVDC barrier coating, Diofan Ultra736, for pharmaceutical blister films. The coating consists of an ultra-high water vapor barrier and is fluorine-free. The coating lowers the carbon footprint and is used for solid-dose drug preparations. It applies to paper and plastic substrates and offers high transparency.(Source: thepackman.in)

U.S. Polyvinylidene Chloride (PVDC) Coated Films Market Top Companies

- Sealed Air Corporation

- DuPont de Nemours, Inc.

- Innovia Films Ltd. (U.S. operations)

- Cosmo Films Ltd. (North America presence)

- Jindal Poly Films Limited

- Vibac Group S.p.A.

- Klöckner Pentaplast (U.S. subsidiary)

- Toray Plastics (America), Inc.

- Treofan America, Inc.

- Amcor Plc (U.S. operations)

- Mondi Group (North America packaging division)

- Winpak Ltd. (U.S. operations)

Segments Covered

By Substrate Type

- Polyethylene (PE) Films

- Polypropylene (BOPP) Films

- Polyethylene Terephthalate (PET) Films

- Polyvinyl Chloride (PVC) Films

- Others (Nylon, Paper-Based Substrates)

By Application

- Food & Beverage Packaging

- Meat, Poultry & Seafood

- Bakery & Confectionery

- Dairy Products

- Snacks & Ready-to-Eat Meals

- Beverages

- Pharmaceuticals & Healthcare (blister packs, medical device packaging)

- Personal Care & Cosmetics

- Industrial & Specialty Packaging

By Coating Method

- Single-Side Coated Films

- Double-Side Coated Films

By Thickness

- <20 microns

- 20–40 microns

- 40 microns

By Distribution Channel

- Direct Sales (Film Manufacturers to Converters)

- Distributors & Packaging Suppliers