Content

Precipitated Silica Market Size | Companies Analysis 2034

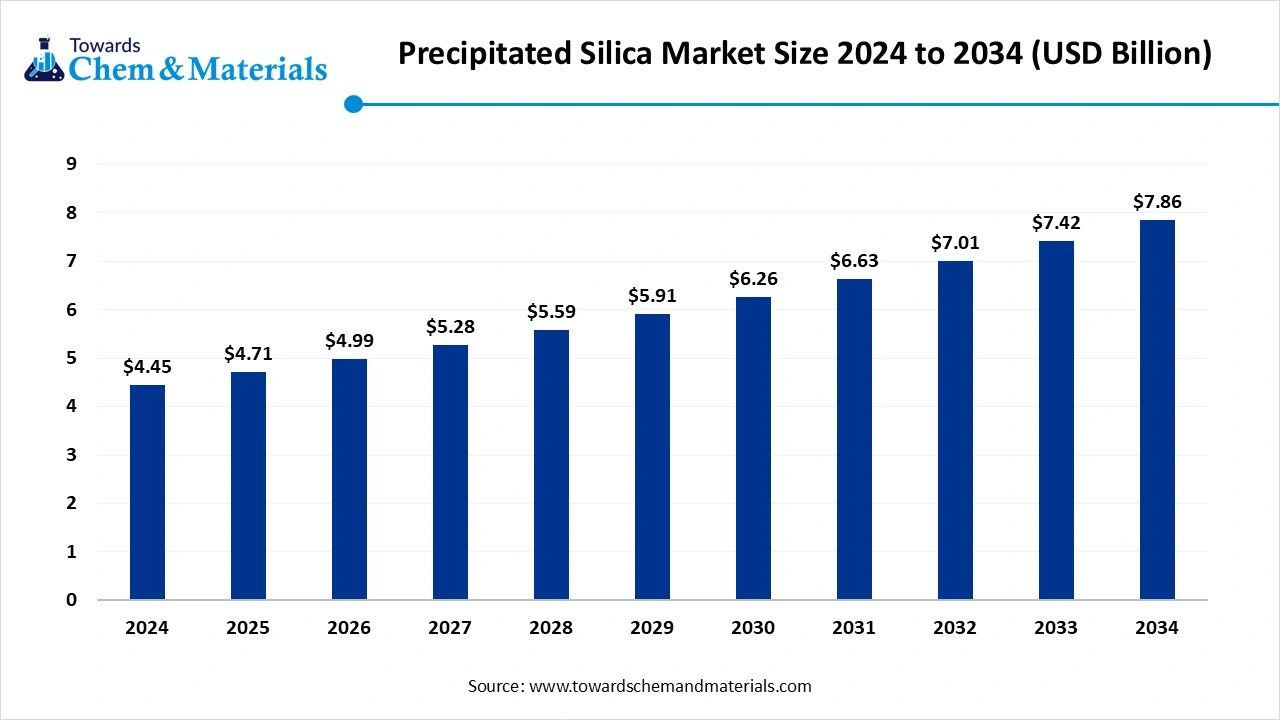

The global precipitated silica market size was valued at USD 4.45 billion in 2024 and is expected to hit around USD 7.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period from 2025 to 2034.The enlarged expansion of the automotive industry is immensely supporting capital growth and economic activity in the sector.

Key Takeaways

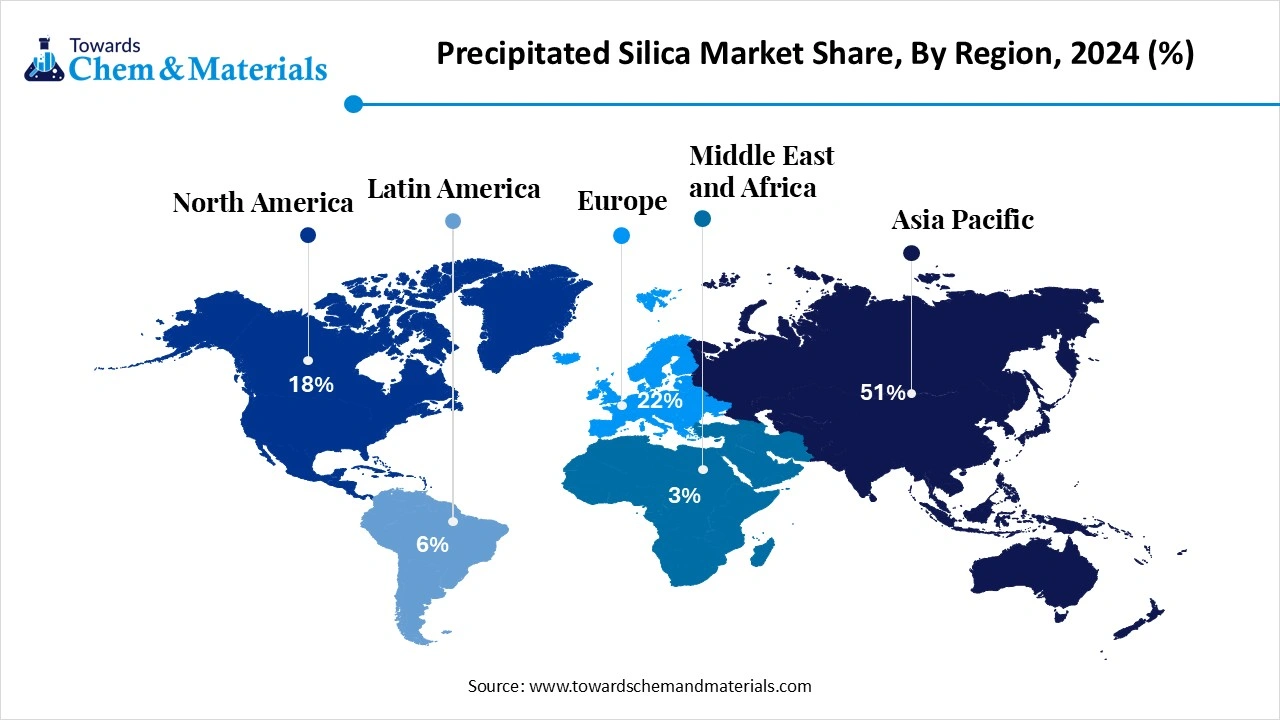

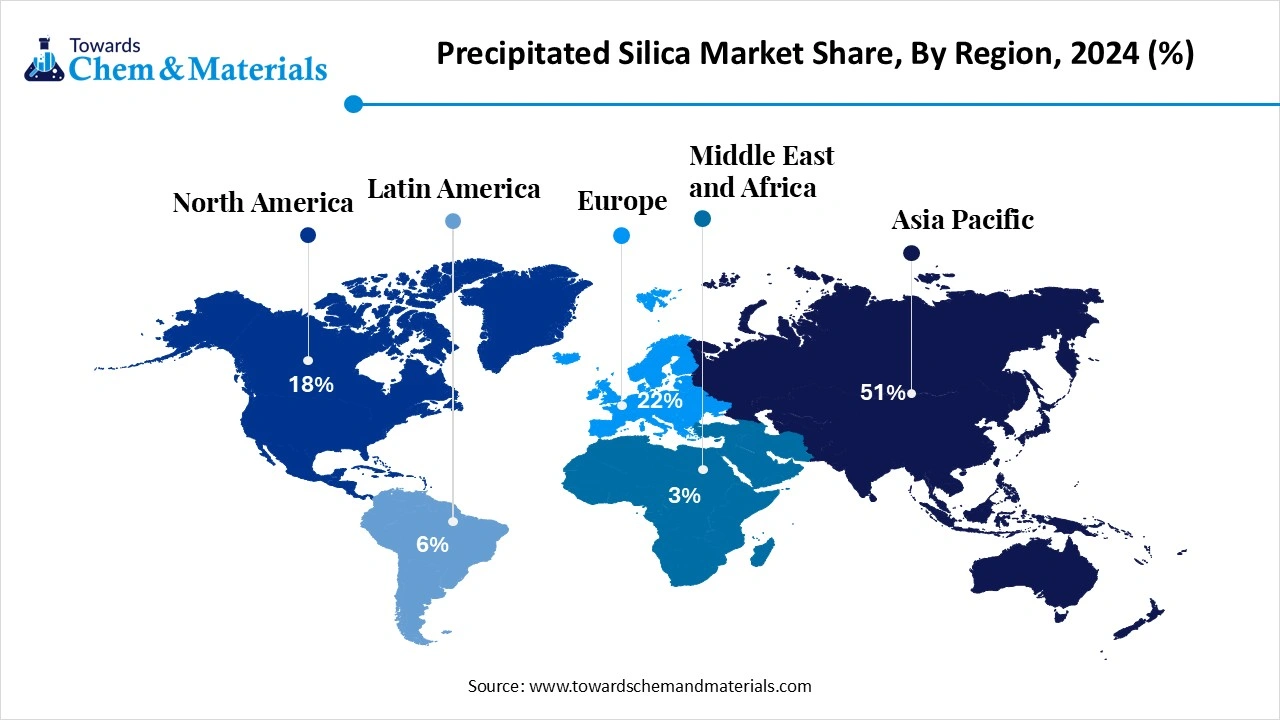

- The Asia Pacific precipitated silica market held the largest share of 51% of the global market in 2024.

- By application type, the tires segment held the largest market share of 63% in 2024.

- By product type, the highly dispersible silica segment held the largest market share of 52% in 2024.

- By form, the micropearl/granular segment held the largest market share of 58% in 2024.

- By function, the reinforcing filler segment held the largest market share of 61% in 2024.

- By purity type, the industrial grade segment held the largest market share of 78% in 2024.

- By end customer, the tire OEMs & tire rubber compounders segment held the largest market share of 59% in 2024.

What is Precipitated Silica?

Precipitated silica is an amorphous, synthetic silicon dioxide produced by reacting sodium silicate with acid under controlled conditions, yielding porous particles with tunable surface area and structure. It is used as a reinforcing filler in rubber (especially green tire tread), as an abrasive/thickener in oral care, as an anti-caking/flow aid in food and feed, and as a matting/anti-blocking agent in coatings, inks, films, and plastics.

Grades are engineered for dispersion, oil absorption, particle size, purity, and handling form (powder vs micropearl), supplied under industrial and food/pharma GMP environments via direct and distributor channels.

Precipitated Silica Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, by strengthening the rubber and controlling surface properties in plastics, personal care items, and paints, the precipitated silica has gained prominence in innovation-led discussions in recent years. Also, the automakers and tire makers are using precipitated silica for better performance and lighter weight in recent years.

- Sustainability Trends: the market is rapidly shifting towards eco-friendly production. Several manufacturers are using different tactics for cleaner production, such as some manufacturers are minimizing energy use and water in the production facilities, aiming to lower dust and worker exposure in the current period.

- Global Expansion: Regions like the Asia Pacific are totally focused on large-scale production with heavy exports of tires and industrial goods. Whereas the Europe and North America regions are seen under the heavy demand for the certified and premium grades of the precipitated silica in the past few years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.71 Billion |

| Expected Size by 2034 | USD 7.86 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Application, By Product Type, By Form, By Function, By Purity / Compliance Grade, By End Customer, By Region |

| Key Companies Profiled | Oriental Silicas Corporation (OSC), Madhu Silica , Tokuyama , Qingdao Makall Group , Shandong Link Silica , PPG , W. R. Grace , Tosoh , Shandong Hongda , Quemax (Zhejiang) , Brazil |

Key Technological Shifts in the Precipitated Silica Market:

The precipitated silica makers are increasingly integrating modern technology in the manufacturing facilities, which is lowering labor costs and speeding up production. Moreover, initiatives like engineered surface chemistry and handling ready format has raised awareness among ventures and corporate backers in the past few years.

Trade Analysis of the Precipitated Silica Market: Import & Export Statistics

- India has exported a heavy amount of precipitated silica, which is approximately 4,231 shipments from October 2023 to September 2024.(Source: www.volza.com)

- China’s synthetic rubber production touched 5.16 million tons in July 2024, as per the latest report published by the National Bureau of Statistics.(Source : www.sunsirs.com)

- The United States also exports a sophisticated amount of precipitated silica, with 812 shipments in the 2024 to 2025 period.(Source: www.volza.com )

Value Chain Analysis of the Precipitated Silica Market:

- Distribution to Industrial Users: Major manufacturers of precipitated silica have dedicated sales teams and chemical distributors linked to smaller industrial customers.

- Chemical Synthesis and Processing : Chemical synthesis and the processing of precipitated silica included steps such as the preparation and precipitation.

- Regulatory Compliance and Safety Monitoring : The safety and regulatory process of precipitated silica is totally focused on hazardous-free samples export as per the survey.

Precipitated Silica Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Occupational Safety and Health Administration (OSHA) | OSHA Crystalline Silica Standard | Occupational Exposure | These agencies are focused on protecting worker health and safety related to exposure to crystalline silica. |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | Risk Assessment | This agency manages the registration, evaluation, authorization, and restriction of chemicals under the REACH framework. |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law of the People's Republic of China | Environmental Compliance | The agencies enforce environmental protection laws covering manufacturing emissions and waste. |

| India | Central Pollution Control Board (CPCB) | BIS Standard IS 12076:1986 | Environmental protection | These agencies regulate environmental aspects, particularly for mining and manufacturing plants. |

Segmental Insights

Application Type Insights

How did the Tires Segment Dominate the Precipitated Silica Market in 2024?

The tires segment dominated the market in 2024 with 63% market share and is expected to sustain its position in the precipitated silica market during the forecast period, due to factors like improving grip, wet-weather braking, and rolling resistance. Furthermore, by providing the minimum fuel consumption factor while meeting the fuel efficiency rules, the tire makers are seen as replacing part of the carbon black with silica in the current period.

Product Type Insights

Why does the Highly Dispersible Silica Segment Dominate the Precipitated Silica Market?

The highly dispersible silica segment dominated the market in 2024 with 52% industry share and is expected to sustain its position in the market during the forecast period, akin to its better mixability without any clumps, while providing consistent performance with all batches. Furthermore, the HDS has gained major industry share in spaces like high-performance tires and advanced rubber parts in recent years. Also, with the increased need for quick mixing solutions and minimum scrap rate, the HDS is likely to maintain its dominance in the industry.

Form Insights

How did the Micropearl / Granular Segment dominate the Precipitated Silica Market in 2024?

The micropearl / granular segment dominated the market in 2024 with 58% industry share and is expected to sustain its position in the market during the forecast period, because they are easy to handle, dust-free, and scale-friendly on production lines. Compared with powder, granules flow better into dosing systems, reduce inhalation risks, and cut packaging losses. This lowers labor and safety costs while improving batch-to-batch consistency.

Function Insights

Why does Reinforcing Filler Segment Dominate the Precipitated Silica Market?

The reinforcing filler segment held 61% industry share of the precipitated silica market in 2024 because precipitated silica strengthens elastomers and plastics, increasing tensile strength, tear resistance, and abrasion life-essential for tires, belts, hoses, and technical rubber goods. Its role as a mechanical enhancer made it the go-to additive wherever durability matters.

The matting/ antiblock segment is expected to grow at a notable rate during the forecast period, because consumer packaging and film applications need surface appearance and processing ease. Silica grades that reduce gloss and prevent stuck layers in films are gaining traction. As packaging quality and surface feel become selling points, matting/anti-block silica will expand beyond niche uses into large-volume consumer applications.

Purity Insights

Why does the Industrial Grade Segment Dominate the Precipitated Silica Market?

The industrial grade segment held 78% market share of the precipitated silica market in 2024 due to large-volume, cost-sensitive uses-tires, construction, and rubber goods-where ultra-high purity isn't needed. Industrial grades deliver performance at lower cost for massive downstream demand.

The food/pharma grade segment is expected to grow at a notable rate during the forecast period, because regulators and brands require stricter safety, traceability, and cleaner supply chains. Applications in oral care, medicinal gels, nutraceuticals, and high-purity coatings need certified low-impurity silica. As consumer health concerns rise and manufacturers reformulate to meet clean-label and pharma standards, higher-value certified grades will capture more market share despite higher costs.

End Customer Insights

Why does the Tire OEMs & Tire Rubber Compounders Segment Dominate the Precipitated Silica Market?

The tire OEMs & tire rubber compounders segment held 59% industry share of the market in 2024 because they need huge, consistent silica volumes and have long-term tech partnerships with suppliers. These buyers specify exact silica grades for performance targets (fuel economy, wet grip) and work closely on formulation science. Large purchase contracts, predictable blending needs, and close R&D ties give tire makers pricing leverage and steady demand

The oral care formulations segment is expected to grow at a notable rate during the forecast period, because silica is an ideal abrasive and texturizer in toothpastes and gels-cleaning teeth without damaging enamel and improving mouthfeel. Consumers focus on dental health and whitening raises demand for gentle, effective abrasives that are safe and consistent.

Regional Insights

Asia Pacific Precipitated Silica Market Size, Industry Report 2034

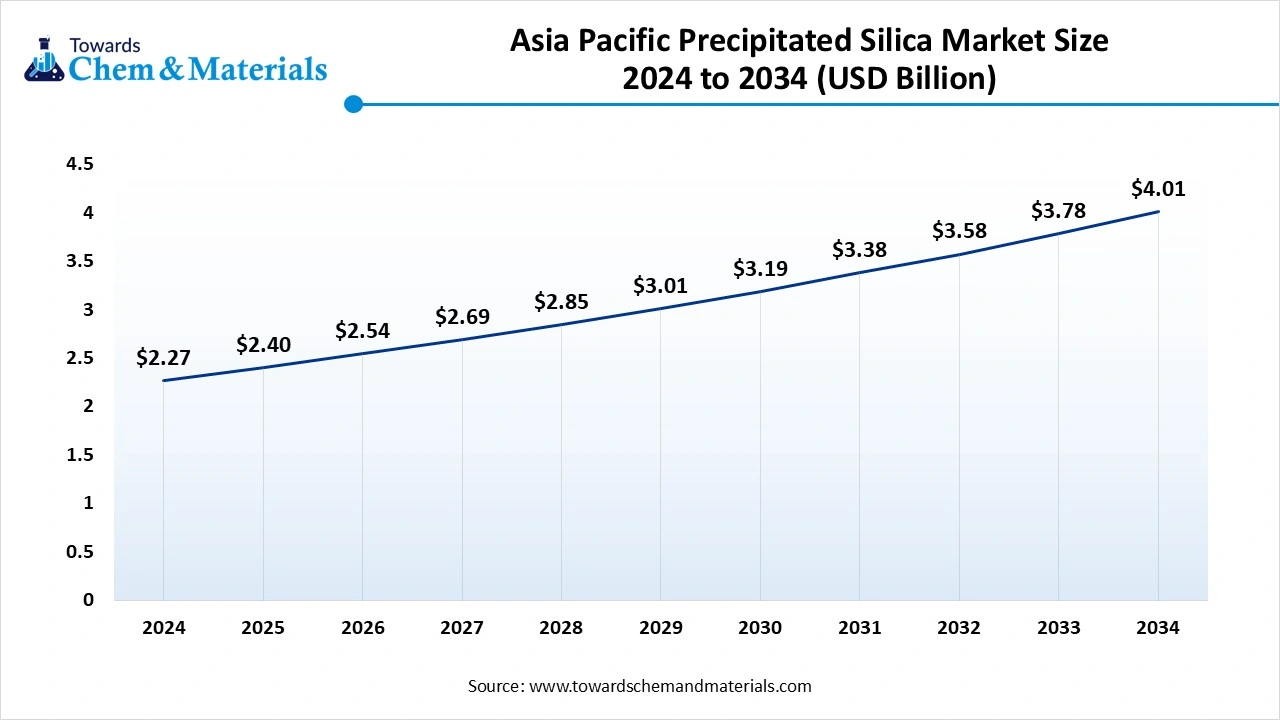

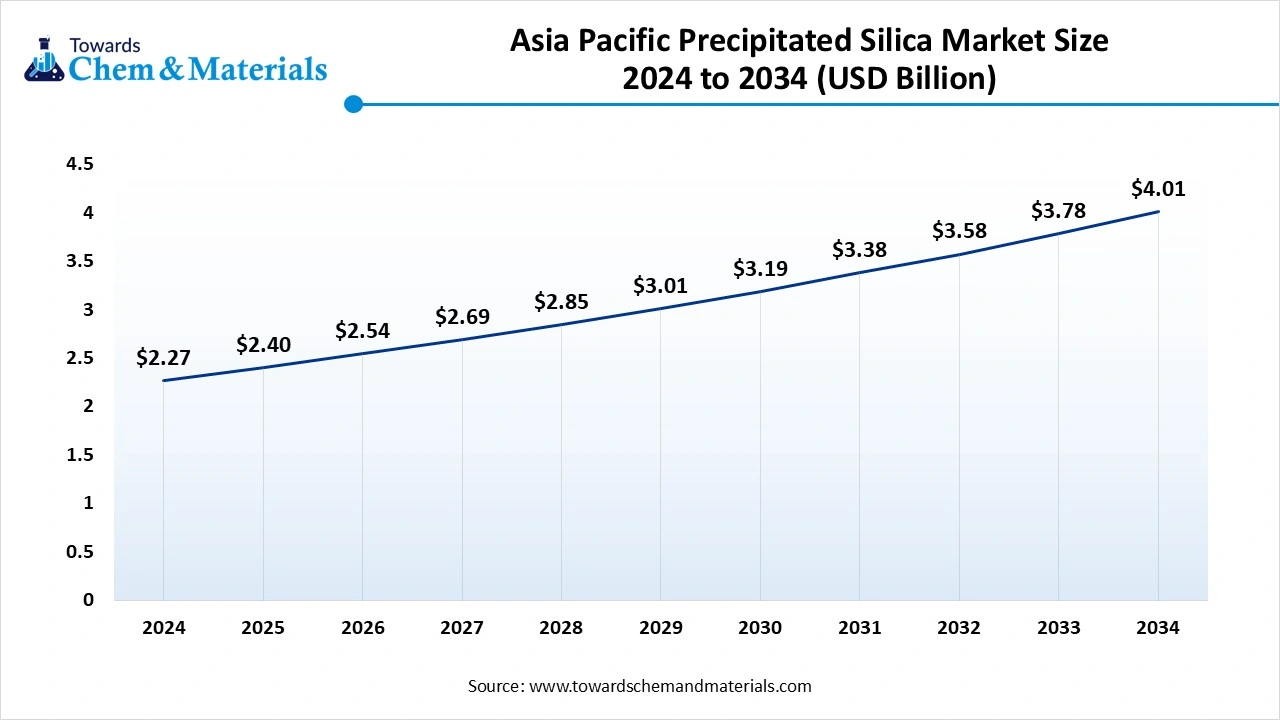

The Asia Pacific precipitated silica market market size was valued at USD 2.27 billion in 2024 and is expected to surpass around USD 4.01 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.86% over the forecast period from 2025 to 2034.

Asia Pacific dominated the market in 2024 with 51% market share, owing to the presence of the enlarged automotive and tire manufacturing infrastructure. Moreover, the heavy chemical manufacturing capacity of the region is playing a major role in the ongoing industry growth in recent years. Also, the regional countries like China, India, and Japan are seen in heavy tire plant establishments and abundant raw material supplies.

What Drives the China Supremacy in the Precipitated Silica Industry?

China maintained its dominance in the market owing to the country's being known for its heavy rubber goods manufacturing and export across the world. Furthermore, China is focusing on the establishment of local silica manufacturing owing to higher domestic consumption and ongoing need. Also, the manufacturers in China are producing customized silica according to the regional performance, like wear and heat, in recent years.

Europe Precipitated Silica Market Trends

Europe is expected to capture a major share of the market during the forecast period, akin to the country’s trends towards high-performance and specialty applications for the silica market. Also, the manufacturers in Europe are seen as investing heavily in sustainable production method discoveries in recent years. Furthermore, the premium polarities have been increasingly gaining popularity in the European industrial space in recent years.

Is Germany Becoming the Innovation Hub for Filler Technologies?

Germany is expected to emerge as a prominent country for the precipitated silica market in the coming years, as Germany has the world's strongest automotive industry, where silica demand has skyrocketed in recent years, as per the current observation. Also, several German chemical firms are seen under heavily investment in innovative technologies like filler technologies and others in the past few years.

Country-level Investments & Funding Trends for the Precipitated Silica Industry:

- Germany: Evonik Industries AG from Germany has decided to invest in precipitated silica production at the Charleston facility, as per the recent report.(Source: www.chemanalyst.com)

- China: The Wynca and Evonik Industries created a collaboration. The collaboration aims to produce fumed silica in China, as per the published report by the company.(Source: chemanager-online.com)

Recent Development

- In July 2025, Aksharchem released an important note that the company is planning to expand the precipitated silica production facility in Gujarat, India, as per a report published by the company.(Source: www.echemi.com)

Top Vendors in the Precipitated Silica Market & Their Offerings:

- Evonik Industries: Evonik Industries is a German specialty chemicals company, and one of the world's largest, as per the recent survey.

- Solvay: Solvay is a Belgian French multinational chemical company that specializes in essential chemicals like adhesives, hydrogen peroxide, and others.

- Quechen Silicon Chemical: Quechen Silicon Chemical is a Chinese company that researches, develops, and manufactures precipitated silica.

- Huber: J.M. Huber Corporation is a diversified company whose Engineered Materials division provides customized silica and silicate solutions.

Other Key Players

- Oriental Silicas Corporation (OSC)

- Madhu Silica

- Tokuyama

- Qingdao Makall Group

- Shandong Link Silica

- PPG

- W. R. Grace

- Tosoh

- Shandong Hongda

- Quemax (Zhejiang)

- Brazil

Segments Covered in the Report

By Application

- Tires

- Non-Tire Rubber

- Oral Care

- Food & Feed (Anti-caking)

- Coatings, Inks, Adhesives & Plastics

By Product Type

- Highly Dispersible Silica (HDS)

- Conventional Precipitated Silica (CPS)

- Oral Care & Food/Pharma Grades

- Specialty Functional (Matting/Anti-block/Carrier)

By Form

- Micropearl / Granular

- Powder

By Function

- Reinforcing Filler

- Abrasive / Rheology Modifier

- Anti-caking / Free-flow

- Matting / Anti-block

By Purity / Compliance Grade

- Industrial Grade

- Food / Pharma Grade

By End Customer

- Tire OEMs & Tier Rubber Compounders

- Oral Care Formulators

- Food & Feed Producers

- Film/Coatings/Plastics Converters

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait