Content

Elastomers Market Market Size, Share, Analysis and Forecast 2034

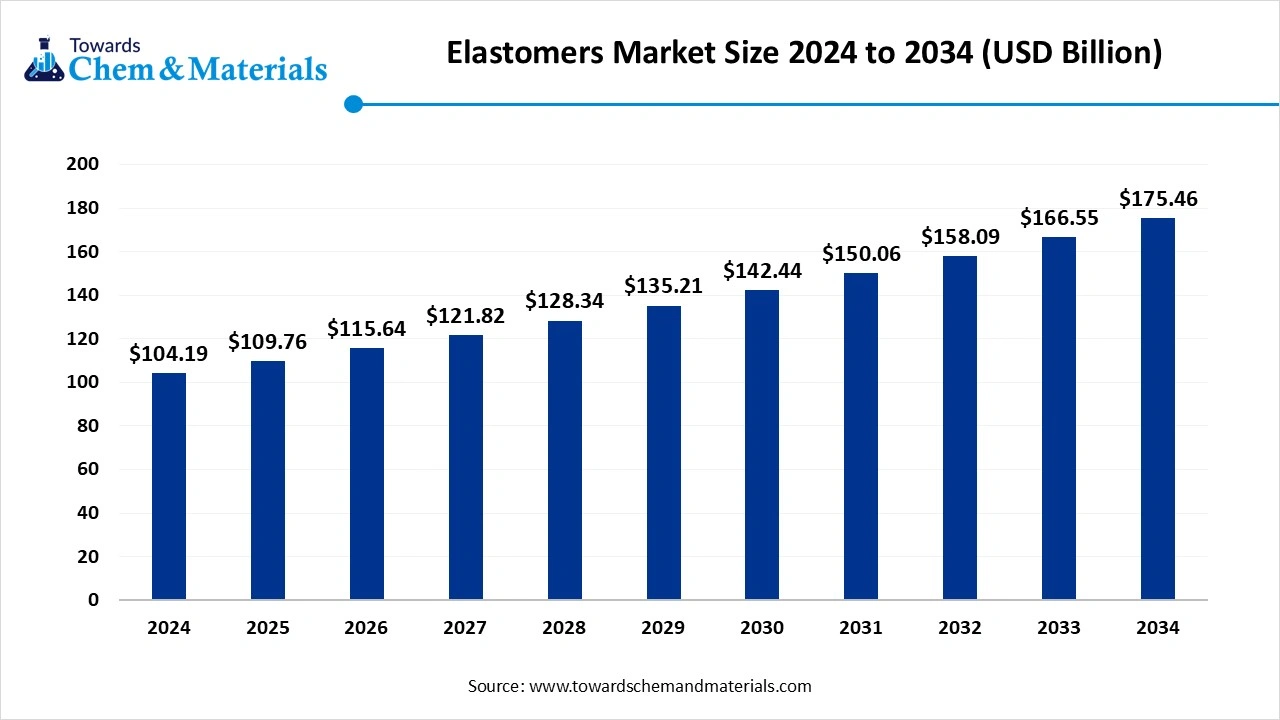

The global elastomers market size was reached at USD 104.19 billion in 2024 and is expected to be worth around USD 175.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% over the forecast period 2025 to 2034. The growing demand for versatile and durable material with growing benefits fuels the growth of the market.

Key Takeaways

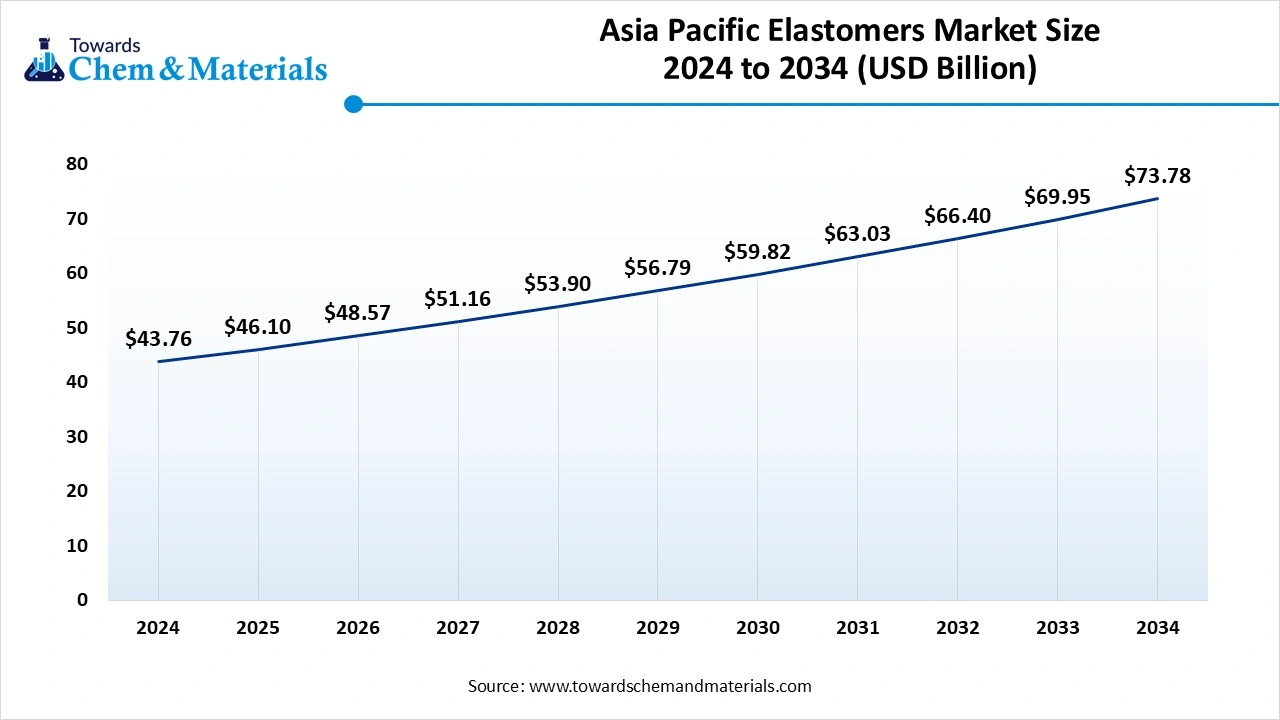

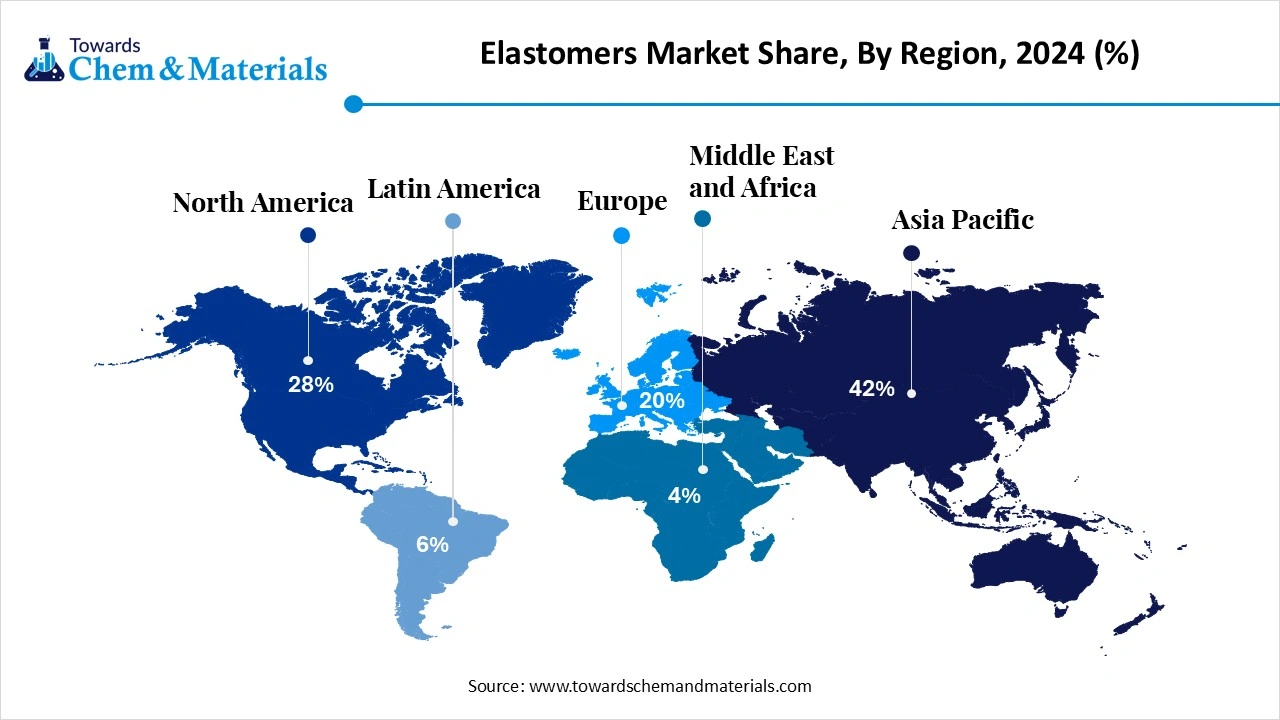

- The Asia Pacific elastomers market size was estimated at USD 43.76 billion in 2024 and is expected to reach USD 73.78 billion by 2034, growing at a CAGR of 5.36% from 2025 to 2034

- By region, North America is expected to have notable growth in the market. the growth is driven by the growing demand from various industries due to its application.

- By type, thermoset elastomers segment dominated the market in 2024, under these, the styrene-butadiene rubber (SBR) segment dominated the market with having 18% share in the market in 2024. The cost-effectiveness drives the demand.

- By type, Thermoplastic Elastomers (TPE) segment is expected to experience the fastest growth in the market during the forecast period, under these, the thermoplastic polyurethane (TPU) segment is expected to grow significantly in the market. The flexibility offered by the material fuels the growth of the market.

- By processing method, the injection molding segment dominated the market in 2024. The injection molding segment held a 30% share in the market in 2024. The efficiency and high-quality production increase the demand for the market.

- By processing method, the 3D printing segment is expected to grow in the forecast period. the durability and excellent elasticity offering boosts the growth.

- By application, the automotive & transportation segment dominated the market in 2024. The automotive & transportation segment held a 35% share in the market in 2024. The growth is driven due to its benefits support the growth.

- By application, the medical & healthcare segment is expected to grow in the forecast period. The growing application and demand for increasing medical device use fuel the growth.

- By end use, the automotive OEM segment dominated the market in 2024. The automotive OEM segment held a 28% share in the market in 2024. The growing demand for the development of vehicle components fuels the growth.

- By end use, the medical device manufacturers segment is expected to grow in the forecast period. The biocompatibility and manufacturers' demand fuel the growth.

Market Overview

Rising Demand for Durable Materials: Elastomers Market to expand

Elastomers are polymers with viscoelasticity (both viscosity and elasticity) and weak intermolecular forces, generally exhibiting low Young’s modulus and high failure strain. They can be stretched considerably and return to their original shape. Elastomers are widely used in automotive, industrial, construction, electronics, and healthcare sectors due to their excellent flexibility, durability, and resistance to environmental conditions.

What Are The Key Growth Drivers Responsible For The Growth Of The Elastomers market?

The key growth drivers that help in the growth of the market are the growing demand from the automotive and construction industries due to their benefits and properties, which increase the growth of the market. The other key drivers are the rapid industrialization, with increased disposable income, and urbanization, sustainability, stringent regulation, and growing medical applications with technologically advanced production procedures further boost and promote the growth of the market.

Market Trends

- Focus on sustainability and biobased elastomer due to the rising focus on environmentally friendly products, and focus on recyclable and biodegradable material drives the growth.

- The advancement of performance of elastomer and rising demand for high-performance elastomer with advanced properties like high thermal strength and stability drive the growth.

- The growth in thermoplastic elastomers due to growing attention to their flexibility and elasticity of rubber drives the demand for the market.

- The growing application in various industries like automotive, consumer goods, and construction fuels the growth.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 104.19 Billion |

| Expected Size by 2034 | USD 175.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Processing Method, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Dow Inc., ExxonMobil Chemical, BASF SE, SABIC , LG Chem, DuPont , Kraton Corporation, Arlanxeo (Saudi Aramco) , JSR Corporation, Sinopec , Covestro AG, Lanxess AG, Mitsui Chemicals, Zeon Corporation, Evonik Industries , Versalis (ENI Group), Trinseo, Asahi Kasei Corporation , UBE Industries, Wanhua Chemical Group |

Market Opportunity

What Are The Key Growth Opportunities Responsible For The Growth Of The Elastomers Market?

The key growth opportunities responsible for the growth of the market are the growing demand and use of sustainable and eco-friendly materials by consumers and the increasing adoption of sustainable practices and solutions by industries, aligning with the growing environmental concern supports the growth of the market. The growing consumer preferences for sustainable products are increasing the use of biobased materials to create environmental impact, especially by the environmentally conscious consumers, fueling the growth of the market by creating great opportunities.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Elastomers Market?

The key challenges that hinder the growth of the market are the fluctuations in raw material prices, especially the petrochemicals used to produce synthetic elastomers, and the need and demand for high-performance biobased alternatives by consumers limit the growth of the market due to limited availability. The complex and advanced production process requires high investments, which also limits the growth and results in a hindrance to the expansion of the market.

Regional Insights

How Did Asia Pacific Dominate The Elastomers Market in 2024?

The Asia Pacific elastomers market size was estimated at USD 43.76 billion in 2024 and is anticipated to reach USD 73.78 billion by 2034, growing at a CAGR of 5.36% from 2025 to 2034.

Asia Pacific dominated the elastomers market in 2024. The growth of the market is driven by the growing industrialization, urbanization, and increasing demand for lightweight and durable materials increases the demand and growth of the market. The rapid advancements in technology and the development of bio-based elastomers, and expanding applications contribute to the growth of the market in the region. The growth of the market and demand is also increasing in the region due to demand for sustainable materials, with rising environmental concerns aligning with the sustainable and environmental solutions boosts the growth of the market in the region.

India Is Experiencing Significant Growth in the Elastomers Market

The growth of the market in India is driven by the increasing demand for elastomer from various industries, especially automotive, for tires, gaskets, seals, and various interior and exterior components fuels the growth of the market. the expanding consumer goods industry and shift towards use of sustainable materials due to growing adoption boosts the growth and expansion of the market in the country.

- The world shipped out 1,071 Elastomer shipments from October 2023 to September 2024 (TTM). These exports were made by 241 world exporters to 218 buyers, showing a growth rate of 111% over the previous 12 months.

(Source: www.volza.com) - Globally, Spain, Thailand, and Vietnam. The top three exporters of Elastomer are. Spain is the global leader in Elastomer exports with 418 shipments, followed closely by Thailand with 365 shipments, and Vietnam in third place with 317 shipments.(Source: www.volza.com)

North America Is Experiencing Growth Driven by the Growing Demand From Various Industries

North America is expected to experience notable growth in the elastomers market during the forecast period. The growth of the market is driven by the growing demand for elastomers, which are technically advanced with increased and improved efficiency from sectors like automotive and healthcare, thus increasing the growth of the market in the region. The growing medical application, due to the developed medical infrastructure and use of medical devices that are biocompatible elastomers, increases the demand for the market. The growing demand for S innovation and technologically advanced elastomers with enhanced properties boosts the growth of the market.

The U.S. Has Seen Significant Growth, Driven By Technological Advancements

The growth of the market is driven by the growing demand from various sectors like automotive, medical, and electronics. The key properties offered, like flexibility, biocompatibility, and ease of sterilization, especially from the medical sector of the country, boost the growth and expansion of the market. The key players also play a crucial role in the growth of the market in countries like DuPont de Nemours, Inc., BASF SE, Arkema SA, Covestro AG, and LyondellBasell Industries NV.

Segmental Insights

Type Insights

Which Type Segment Dominates The Elastomers Market in 2024?

The thermoset elastomers segment dominated the market in 2024. The growth is driven due to its properties, offered as durability, heat resistance, and stability in various operations, which increases the demand and growth of the market. Styrene-Butadiene Rubber (SBR) segment held the largest market share in the market due to its combination of abrasion resistance, aging stability, flexibility, and cost-effectiveness. Primarily used in tires, SBR enables longer tread life and improved durability. It also supports diverse applications like adhesives, gaskets, and hoses due to its mechanical resilience. These advantages maintain strong demand and position SBR as a leading and fast-growing elastomer type globally.

The Thermoplastic Elastomers (TPE) segment is expected to experience the fastest growth in the market during the forecast period. The growth of the market is driven by the growing demand and high production volume. The key properties like versatility, dual nature, elasticity, and processability increase the growth. The Thermoplastic Polyurethane (TPU) segment is expected to hold the largest market share, TPU’s blend of rubber-like elasticity and plastic-like toughness. Valued in industries such as automotive, footwear, electronics, and industrial manufacturing, TPU offers high abrasion resistance, flexibility, chemical and weather durability, and ease of processing via molding or extrusion. Its versatility and performance in lightweight EV parts, athletic shoe soles, medical tubing, and flexible electronics—fuel robust demand globally.

Processing Method Insights

How Will Injection Molding Segment Dominate The Elastomers Market In 2024?

The injection molding segment dominated the elastomers market in 2024. Injection molding is a widely adopted processing method in the market due to its precision, efficiency, and scalability. It enables the production of complex, high-quality elastomer components with excellent dimensional accuracy and surface finish. This method is ideal for manufacturing seals, gaskets, medical parts, and automotive components. Its ability to support high-volume production with minimal waste and consistent performance makes it a preferred choice across industries, driving demand and supporting market growth in this segment.

The 3D printing segment expects significant growth in the market during the forecast period. 3D printing is an emerging processing method in the market, offering flexibility, rapid prototyping, and customization capabilities. It enables the production of complex geometries and functional parts without the need for molds, making it ideal for low-volume manufacturing and design iteration. Elastomers used in 3D printing provide excellent elasticity, durability, and resilience, supporting applications in medical devices, footwear, automotive components, and wearable technology. This innovation-driven method is fueling growth and expanding possibilities in elastomer manufacturing.

Application Insights

Which Application Segment Dominates the Elastomers Market in 2024?

The automotive & transportation segment dominated the elastomers market in 2024. The automotive and transportation application segment is a major driver in the thermoplastic polyurethane (TPU) type of the market. TPU is widely used in vehicle interiors and exteriors, including door panels, headliners, bumpers, and trim components, thanks to its high elasticity, abrasion resistance, and durability. It also contributes to lightweighting efforts, improving fuel efficiency, and meeting stricter emissions standards. The growing adoption of electric vehicles further accelerates demand for TPU components in wiring harnesses, acoustic panels, and protective films.

The medical & healthcare segment expects significant growth in the market during the forecast period. The growth his driven, owing to TPU’s excellent biocompatibility, flexibility, and resistance to chemicals and sterilization. It is widely used in medical tubing, catheters, wound dressings, and wearable devices. These properties support safer, more comfortable, and durable medical products. Rising demand for advanced wound care, minimally invasive devices, and home-based healthcare solutions continues to boost TPU adoption, supporting strong market growth in this segment.

End-Use Industry Insights

How Did the Automotive OEM Segment Dominate the Elastomers Market in 2024?

The automotive OEM segment dominated the elastomers market in 2024. The segment is a major contributor, as manufacturers increasingly incorporate elastomers into vehicle components for enhanced performance and durability. Elastomers are used in seals, gaskets, bushings, hoses, and vibration dampers due to their flexibility, weather resistance, and noise reduction properties. As OEMs focus on lightweighting, fuel efficiency, and electric vehicle production, the demand for high-performance elastomer materials continues to rise, driving market expansion in this segment.

The medical device manufacturers segment expects significant growth in the market during the forecast period.

The market plays a significant role, as these materials are essential for producing flexible, durable, and biocompatible components. Elastomers are widely used in catheters, tubing, seals, connectors, and wearable medical devices due to their sterilization resistance and patient safety. With growing demand for minimally invasive procedures, advanced diagnostics, and home healthcare, medical device manufacturers increasingly rely on elastomers, supporting sustained growth and innovation in this market segment.

Recent Developments

- In July 2025, Siraya Tech, the California-based material maker and 3D printer manufacturer Peopoly, a sister company has released Rebound PEBA 95A, which is a nylon elastomer filament. This is designed to meet the growing demand by the consumer of high-performance flexible materials.(Source: all3dp.com)

Top Companies List

- Dow Inc.

- ExxonMobil Chemical

- BASF SE

- SABIC

- LG Chem

- DuPont

- Kraton Corporation

- Arlanxeo (Saudi Aramco)

- JSR Corporation

- Sinopec

- Covestro AG

- Lanxess AG

- Mitsui Chemicals

- Zeon Corporation

- Evonik Industries

- Versalis (ENI Group)

- Trinseo

- Asahi Kasei Corporation

- UBE Industries

- Wanhua Chemical Group

Segments Covered

By Type (Volume, Kilotons; Revenue, USD Million, 2024 - 2034)

- Thermoset Elastomers

- Natural Rubber (NR)

- Styrene-Butadiene Rubber (SBR)

- Nitrile Butadiene Rubber (NBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Polybutadiene Rubber (BR)

- Butyl Rubber (IIR)

- Chloroprene Rubber (CR)

- Fluoroelastomers (FKM)

- Silicone Rubber (VMQ)

- Thermoplastic Elastomers (TPE)

- Styrenic Block Copolymers (SBC)

- Thermoplastic Polyurethane (TPU)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyolefins (TPO)

- Thermoplastic Copolyesters (COPE)

- Thermoplastic Polyamides (PEBA)

By Processing Method (Volume, Kilotons; Revenue, USD Million, 2024 - 2034)

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Calendering

- 3D Printing

By Application (Volume, Kilotons; Revenue, USD Million, 2024 - 2034)

- Automotive & Transportation

- Building & Construction

- Industrial Machinery

- Electrical & Electronics

- Consumer Goods

- Medical & Healthcare

- Footwear

- Adhesives & Sealants

- Sports & Leisure

- Aerospace & Defense

By End-Use Industry (Volume, Kilotons; Revenue, USD Million, 2024 - 2034)

- Automotive OEM

- Aftermarket

- Construction Firms

- Electronics Manufacturers

- Medical Device Manufacturers

- Footwear Brands

- Packaging Companies

- Energy & Oilfield

- Household Appliance Manufacturers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait