Content

U.S. Plastic Lidding Films Market - Size, Share & Industry Analysis

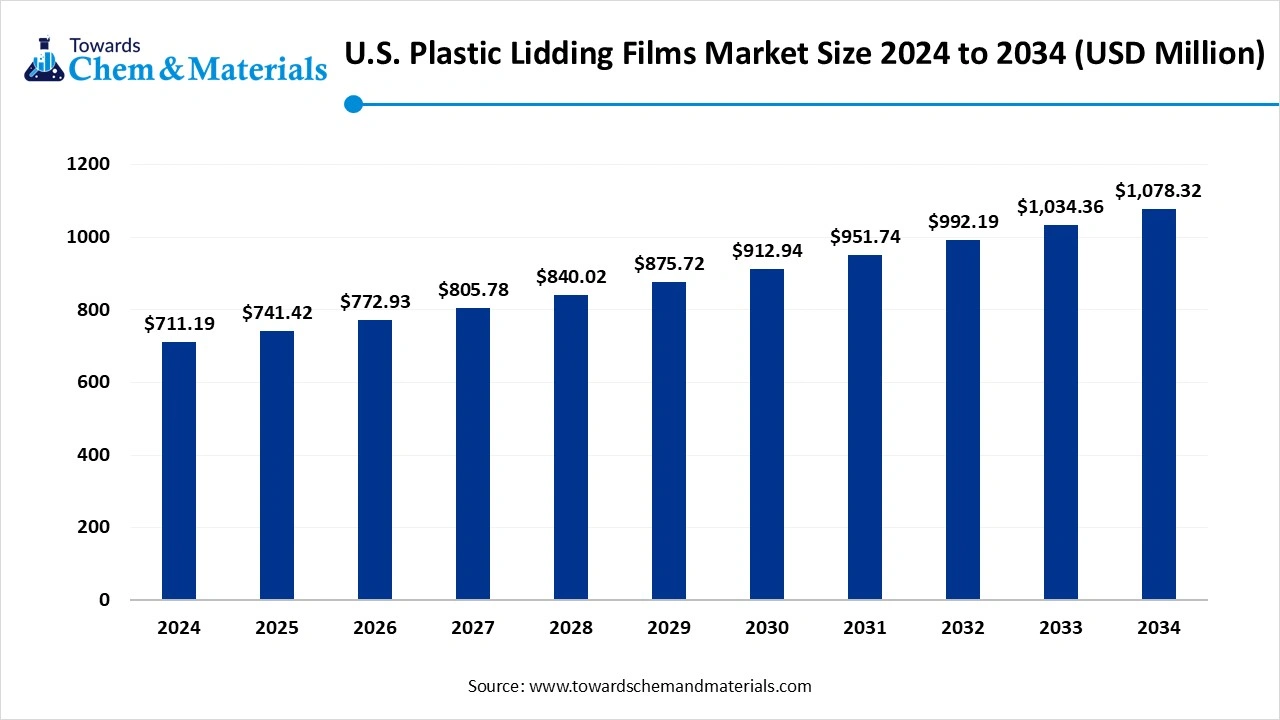

The U.S. plastic lidding films market size was valued at USD 711.19 million in 2024, grew to USD 741.42 million in 2025, and is expected to hit around USD 1,078.32 million by 2034, growing at a compound annual growth rate (CAGR) of 4.25% over the forecast period from 2025 to 2034. The growing demand for ready-to-eat meals is the key factor driving market growth. Also, the growing popularity of online grocery shopping, coupled with the increasing preference for bio-based films, can fuel market growth further.

Key Takeaways

- By material, the polyethylene terephthalate (PET) segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the growing demand for ready-to-eat and convenient food options.

- By material, the multi-layer & bioplastic films segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing preference for sustainable packaging.

- By product type, the non-resealable films segment held approximately 45% market share in 2024. The dominance of the segment can be linked to the rising consumer inclination towards single-use packaging.

- By product type, the resealable lidding films segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for sustainability and convenience.

- By sealing method, the heat-seal films segment held approximately 65% market share in 2024. The dominance of the segment is owed to the ongoing shift towards recyclable and mono-material alternatives, coupled with the advancements in film production.

By sealing method, the pressure-sensitive films segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to increasing regulation and consumer preference for sustainable packaging. - By application, the dairy packaging segment dominated the market with approximately 35% share in 2024. The dominance of the segment can be attributed to the growing demand for extended shelf life, fueled by good barrier properties.

- By application, the ready-to-eat meals segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for plastic lidding films from single-person households.

- By end-use industry, the food & beverages segment held approximately 70% market share in 2024. The dominance of the segment can be linked to the growing adoption of sustainability initiatives.

- By end-use industry, the pharmaceuticals & healthcare segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by growing demand for high-performance packaging solutions.

Technological Advancements Are Expanding Market Growth

The U.S. plastic lidding films market refers to the production and application of flexible plastic films used to seal and protect containers, trays, and cups for food, beverages, pharmaceuticals, and household products. These films provide barrier protection, tamper resistance, heat sealability, and product visibility, helping extend shelf life and ensure food safety.

- Market growth is driven by rising demand for convenience foods, sustainable packaging trends, and innovations in recyclable & bio-based lidding films. Innovations in polymer science, especially in materials such as PET, are expected to drive market expansion soon.

What Are the Key Trends Influencing the U.S. Plastic Lidding Films Market?

- The growing demand for lidding films from the dairy industry is the latest trend in the market. Market players are rapidly moving towards more attractive and safe packaging solutions to support the shelf life of products. Also, this film offers complete protection against oxygen, moisture, and light to keep the freshness of products.

- The small and medium-sized market players are also adopting lidding films, which can increase their demand, specific to industry needs. In addition, this growing demand can attract more manufacturers towards producing lidding films, which can further lead to market expansion.

- The ongoing advancements in material science and processing methods, such as innovative barrier technologies, heat-resistant PET, and digital printing, are improving lidding film performance and other abilities. The growth in e-commerce has also increased the demand for protective packaging.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 741.42 Million |

| Expected Size by 2034 | USD 1,078.32 Million |

| Growth Rate from 2025 to 2034 | CAGR 4.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material, By Product Type, By Sealing Method, By Application, By End-Use Industry |

| Key Companies Profiled | Amcor plc, Sealed Air Corporation, Berry Global Inc., Mondi Group, Sonoco Products Company, Winpak Ltd. (Canada-based, strong U.S. presence), Bemis Company, Inc. (Now part of Amcor), Constantia Flexibles Group, Uflex Ltd., Schur Flexibles Group, Huhtamaki Oyj, Toray Plastics (America), Inc., ProAmpac Holdings Inc., Plastopil Inc., Flair Flexible Packaging Corporation |

Market Opportunity

Increase in High-Barrier Film Applications

The market players are focusing on R&D of high barrier lidding films because of an increase in consumer demand for greater freshness and visibility in packaged food. Furthermore, these types of coatings give clarity by preventing condensation, which makes products more appealing in refrigerated displays. High-barrier films can protect against moisture, oxygen, and contaminants, which are necessary for extending the shelf life of products.

Market Challenge

Competition from Alternative Materials

Non-plastic alternatives, like aluminum lidding and mono-material-based packaging, are gaining traction, particularly in premium market segments, which is a major factor hindering market expansion. This trend is further propelled by regulatory pressures and consumer preferences. Moreover, the higher manufacturing costs of bio-based lidding films can limit their adoption in price-sensitive sectors.

Country Insight

U.S. Plastic Lidding Films Market Trends

The Midwest & South region dominated the market with a 50% share in 2024. The dominance of the region can be attributed to the technological innovations in film properties such as hermetic and anti-fog sealings, coupled with the consumer preference for sustainability and convenience. In addition, these regions have a strong presence of food manufacturers and retailers who are major consumers of lidding films.

The west region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for convenience food, along with sustainable packaging solutions. Furthermore, Advancements in film manufacturing, like easy-peel features and anti-fog, breathable, are improving the product performance by fulfilling certain consumer demands in the region.

Segmental Insight

Material Insight

Which Material Type Segment Dominated the U.S. Plastic Lidding Films Market in 2024?

The polyethylene terephthalate (PET) segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for ready-to-eat and convenient food options, with the ongoing preference for PET's barrier properties. Additionally, PET films provide excellent gas and moisture barrier qualities, which are important for extending the shelf life of food.

The multi-layer & bioplastic films segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing preference for sustainable packaging and the surge in regulatory incentives for recyclable content. Also, this film gives high barrier qualities to preserve food freshness, which can minimize spoilage by fulfilling the demand for food products.

Product Type Insight

Why Non-Resealable Films Segment Dominated The U.S. Plastic Lidding Films Market In 2024?

The non-resealable films segment held largest market share in 2024. The dominance of the segment can be linked to the rising consumer inclination towards single-use packaging and the increase in demand for eye-catching custom packaging solutions. These films can offer permanent seals, providing tamper evidence, which is crucial for pharmaceutical and food products, ensuring product integrity and safety.

The resealable lidding films segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for sustainability and convenience, along with the consumer preference for extended shelf-life products. Furthermore, this type of film offers customizable barrier properties that safeguard perishable goods from moisture, oxygen, and other factors.

Sealing Method Insight

How Much Share Did the Heat-Seal Films Segment Held in 2024?

The heat-seal films segment held a largest market share in 2024. The dominance of the segment is owed to the ongoing shift towards recyclable and mono-material alternatives, coupled with the advancements in film production, which leads to enhanced performance such as anti-fog properties. In addition, brands are heavily investing in texture and custom printing effects to make their products stand out.

The pressure-sensitive films segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to increasing regulation and consumer preference for sustainable packaging and the expansion of organized retail channels such as hypermarkets and supermarkets. Moreover, the deployment of lidding films into closed-loop systems is becoming part of product development.

Application Insight

Which Application Segment Dominated the U.S. Plastic Lidding Films Market in 2024?

The dairy packaging segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for extended shelf life, fuelled by good barrier properties and tamper-evidence. Additionally, plastic lidding films provide exceptional barrier qualities, safeguarding dairy products such as cheese, yogurt, and cream from oxygen, moisture, and light.

The ready-to-eat meals segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for plastic lidding films from single-person households and urban working professionals. Furthermore, the ongoing trend towards convenience foods and the rapid scale-up towards e-grocery channels further boost the highly efficient lidding films.

End-Use Industry Insight

Which End use Industry Segment Dominated the U.S. Plastic Lidding Films Market in 2024?

The food & beverages segment held largest market share in 2024. The dominance of the segment can be linked to the growing adoption of sustainability initiatives, along with the demand for package differentiation through smart features. Additionally, advancements in polymer science are leading to innovative film structures with enhanced functionality, like antimicrobial properties and hermetically sealable films.

The pharmaceuticals & healthcare segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by growing demand for high-performance, sterile packaging solutions to maintain product efficacy and safety. Furthermore, these films are essential for creating tamper-evident seals, which assure healthcare professionals and consumers of product integrity.

U.S. Plastic Lidding Films Market Value Chain Analysis

- Feedstock Procurement: It is the process of acquiring the raw plastic materials required to produce film for pharmaceuticals, sealing food, and other products.

- Chemical Synthesis and Processing: It is the initial production stage where raw polymer pellets are chemically synthesized and processed into the finished film.

- Packaging and Labelling: It refers to the functions that improve product appeal, offer crucial information, and ensure the product safety and integrity through lidding films.

- Regulatory Compliance and Safety Monitoring: This stage focuses on ensuring product integrity, preventing contamination, and protecting consumer health.

Recent Developments

- In May 2025, Lacerta introduced a new seal N' Flip packaging solution, which reduces plastic use up to 50%. The latest design changes the script of conventional packaging and is expected to minimize the overall packaging costs by up to 25%.(Source: www.globenewswire.com)

U.S. Plastic Lidding Films Market Top Companies

- Amcor plc

- Sealed Air Corporation

- Berry Global Inc.

- Mondi Group

- Sonoco Products Company

- Winpak Ltd. (Canada-based, strong U.S. presence)

- Bemis Company, Inc. (Now part of Amcor)

- Constantia Flexibles Group

- Uflex Ltd.

- Schur Flexibles Group

- Huhtamaki Oyj

- Toray Plastics (America), Inc.

- ProAmpac Holdings Inc.

- Plastopil Inc.

- Flair Flexible Packaging Corporation

Segments Covered

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polyamide (Nylon)

- Multi-Layer & Specialty Films (EVOH, Bioplastics)

By Product Type

- Resealable Lidding Films

- Non-Resealable Lidding Films

- Dual-Ovenable & Microwaveable Films

- High-Barrier Films

By Sealing Method

- Heat-Seal Lidding Films

- Pressure-Sensitive Lidding Films

- Cold-Seal Lidding Films

By Application

- Food Packaging

- Dairy (Yogurt, Cheese, Cream)

- Ready-to-Eat Meals

- Meat, Poultry & Seafood

- Fresh Produce

- Bakery & Confectionery

- Beverages (Juices, Single-Serve Cups)

- Pharmaceuticals & Healthcare

- Household Products

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Household & Consumer Goods

- Industrial Packaging