Content

What is the Current Specialty Oilfield Chemicals Market Size and Share?

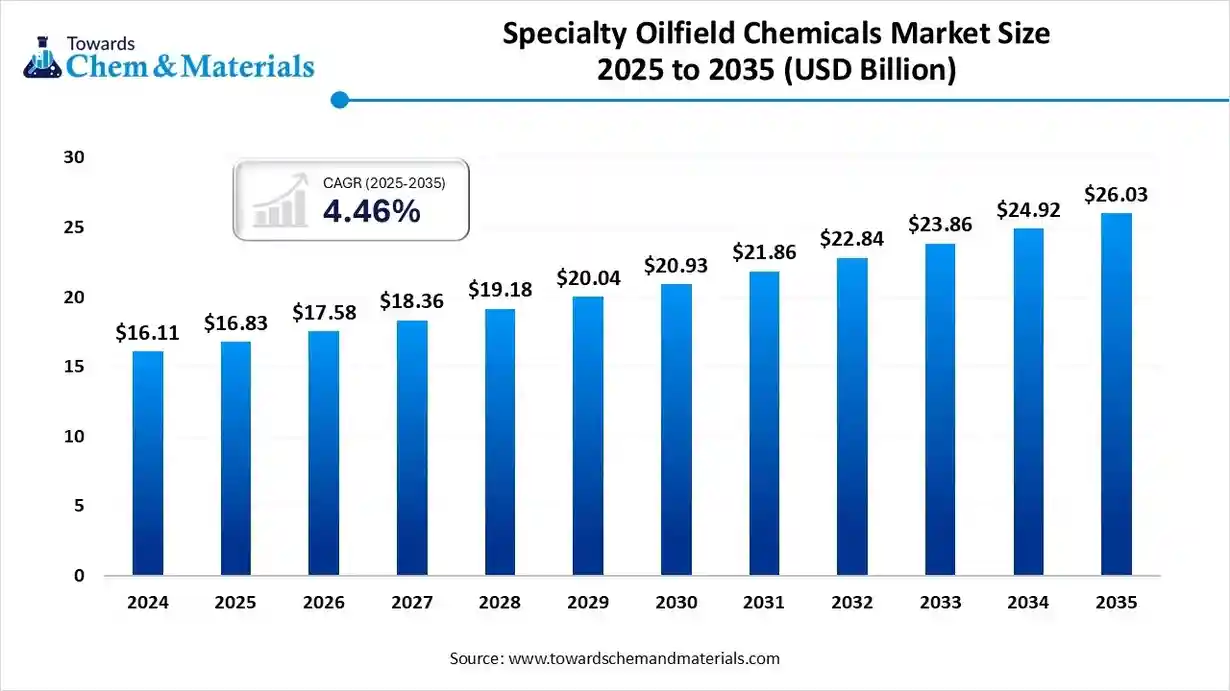

The global specialty oilfield chemicals market size is calculated at USD 16.83 billion in 2025 and is predicted to increase from USD 17.58 billion in 2026 and is projected to reach around USD 26.03 billion by 2035, The market is expanding at a CAGR of 4.46% between 2026 and 2035. Asia Pacific dominated the specialty oilfield chemicals market with a market share of 45.50% the global market in 2025.The growing exploration of oil & gas and increasing petroleum demand drive the market growth.

Key Takeaways

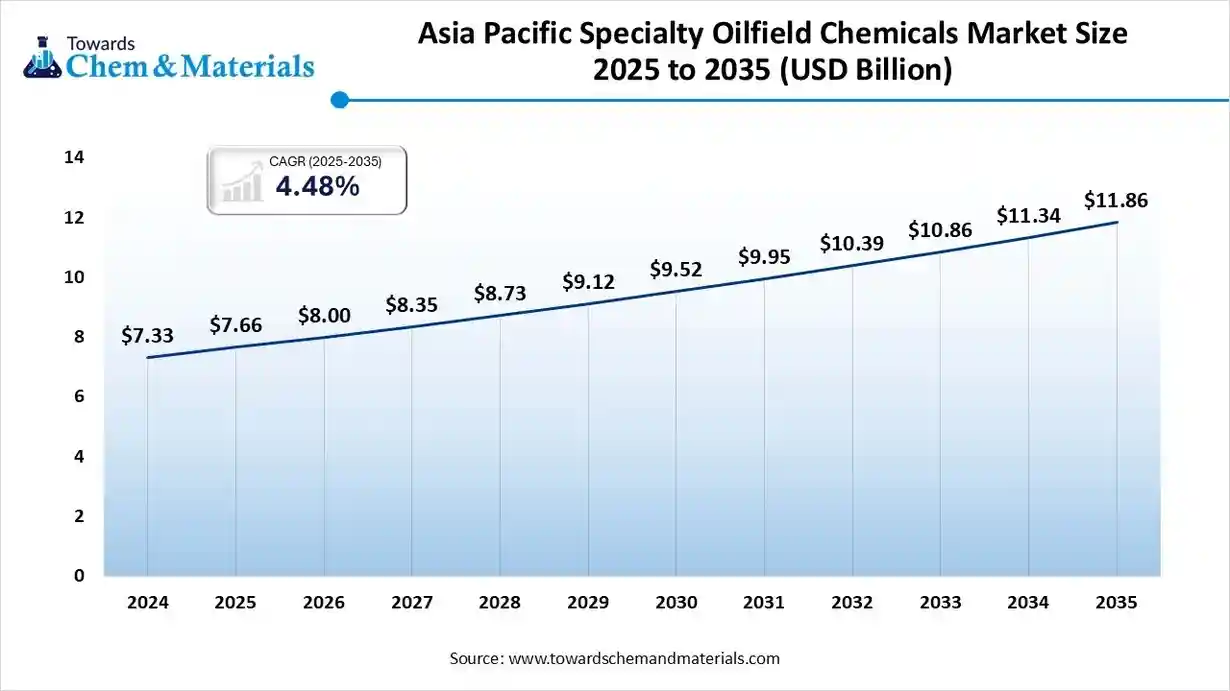

- By region, Asia Pacific held a 45.50% share of the market in 2025.

- By region, Middle East & Africa is growing at a 6.5% CAGR in the market during the forecast period.

- By type, the corrosion & scale inhibitors segment held a 35.50% share in the market in 2025.

- By type, the surfactants segment is expected to grow at a 5.5% CAGR in the specialty oilfield chemicals market during the forecast period.

- By application, the production chemicals segment held a 40.40% share in the market in 2025.

- By application, the enhanced oil recovery segment is expected to grow at a 5.7% CAGR in the market during the forecast period.

- By end-use industry, the onshore segment held a 65.80% share in the market in 2025.

- By end-use industry, the offshore segment is expected to grow at a 5.8% CAGR in the specialty oilfield chemicals market during the forecast period.

Factors Driving the Growth of the Specialty Oilfield Chemicals Industry

The specialty oilfield chemicals industry is growing because global production and exploration activities continue to rise, especially in regions with expanding offshore and onshore operations. According to the International Energy Agency’s 2023 outlook, upstream investment increased for the second consecutive year, driving stronger demand for chemicals used in drilling, cementing, and reservoir management. Deepwater and ultra-deepwater exploration is also expanding, and these environments require high-performance chemicals that can withstand extreme pressure and temperature conditions.

Enhanced oil recovery remains an important driver, particularly in mature fields, where operators use polymers, surfactants, and water-treatment chemicals to maximise recovery rates. The United States Energy Information Administration notes that unconventional reserves, including shale formations, continue to account for a growing share of global output, thereby increasing the use of specialty chemicals to improve well efficiency and reduce operational challenges. The broader shift toward more complex reservoirs and advanced extraction techniques continues to strengthen demand across the specialty oilfield chemicals market.

What are Specialty Oilfield Chemicals?

Specialty oilfield chemicals are chemical formulations developed to solve technical challenges that occur during production, exploration, and drilling in the oil and gas industry. These chemicals help maintain stable operations in harsh field environments by improving fluid performance, stabilising well conditions, and supporting efficient extraction. According to the United States Energy Information Administration, more complex reservoirs and higher output from unconventional wells have increased the need for specialised chemical treatments to maintain production efficiency.

These chemicals also play an important role in protecting equipment from scale buildup, corrosion, and fouling, which helps reduce downtime and extends the lifespan of pipelines and well infrastructure. International regulatory agencies, including the American Petroleum Institute, highlight that corrosion-related failures remain a major operational risk, making corrosion control and flow assurance chemicals essential across global oilfields.

Current Trends in Specialty Oilfield Chemicals Market

- Industry Growth Overview: Between 2025 and 2034, the specialty oilfield chemicals market is projected to grow steadily as demand rises for high-performance products used in enhanced oil recovery, drilling fluids, production chemicals and deepwater operations. Increasing exploration activity in challenging geological environments is strengthening the need for chemicals that can withstand high pressures, extreme temperatures and complex reservoir conditions. Growth is particularly supported by expanding oil and gas production in Asia Pacific, Europe and North America, where operators are prioritising efficiency, corrosion control and flow assurance across upstream assets.

- Sustainability Trends: Sustainability is reshaping the development landscape as manufacturers shift toward biodegradable additives, natural surfactants and low-toxicity chemical formulations. Companies are increasingly investing in bio-based ingredients that reduce environmental exposure without compromising technical performance.

- For example, leading suppliers have introduced plant-derived fracturing additives and PFAS-free product portfolios that align with stricter environmental regulations. Adoption of green chemistry is helping producers meet compliance requirements while supporting the decarbonisation goals of major operators.

- Global Expansion: Leading companies are expanding into high-growth regions to meet rising energy demand and support regulatory compliance for advanced chemical formulations. Asia Pacific, the Middle East and Africa, and North America are attracting investments in production facilities, distribution hubs and technical service centres to improve supply resilience. Global expansion also includes partnerships with local service providers, which helps align chemical blends with regional reservoir characteristics, water quality parameters and environmental standards. This localisation strategy is improving performance consistency and strengthening global market penetration.

- Major Investors: Investment is being driven by multinational oilfield service companies, chemical manufacturers and integrated energy firms that are increasing their focus on advanced chemical technologies. Companies such as SLB, Baker Hughes Company, Ecolab Inc., BASF SE and Halliburton continue to invest in research, formulation laboratories and field-testing capabilities to support next-generation chemicals. These investments aim to improve operational uptime, reduce maintenance costs and enhance the overall efficiency of drilling and production operations.

- Startup Ecosystem: The startup ecosystem is expanding with companies developing microbial-based formulations, nano-enabled additives and real-time chemical monitoring technologies. These startups are introducing solutions that improve well integrity, optimise chemical dosing and reduce environmental impact through precision treatment. Many emerging firms are also collaborating with universities and oilfield service providers to commercialise new green chemistries and digital monitoring tools. This innovation ecosystem is helping accelerate the shift toward safer, more sustainable, and more efficient oilfield chemical solutions.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 17.58 Billion |

| Expected Size by 2035 | USD 26.03 Billion |

| Growth Rate from 2025 to 2035 | CAGR 4.46% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Segment Covered | By Type, By Application, By End-Use, By Region |

| Key Companies Profiled | Baker Hughes Company, Halliburton Company, Schlumberger Limited, BASF SE, Clariant AG, Dow Inc., Nouryon., Solvay SA , Croda International Plc , Innospec Inc. , Kemira Oyj , Lubrizol Corporation , Huntsman Corporation , Stepan Company , Arkema S.A. , |

Key Technological Shifts in the Specialty Oilfield Chemicals Market:

The specialty oilfield chemicals landscape is undergoing major technological changes as the industry moves toward sustainability, digitalization, and greater automation. Oil and gas companies are placing greater emphasis on reducing environmental impact and improving operational efficiency, which has increased interest in advanced chemical formulations and cleaner production methods. Global energy agencies have noted that digital tools and low-emission technologies are becoming essential for upstream operations, and this shift is influencing how chemical solutions are developed and deployed in the field.

One of the most significant transformations is the adoption of artificial intelligence, which helps optimise field operations and accelerate the creation of new chemical formulations. AI systems can analyse large volumes of complex reservoir, production, and fluid data, enabling operators to predict performance issues and select the most effective chemical treatments. This leads to lower operational costs and better decision-making in critical areas such as corrosion control, scale prevention, and flow assurance. For instance, Halliburton uses LOGIX Autonomous Drilling, an AI-enabled platform for real-time decision making and automated drilling.

Trade Analysis of Specialty Oilfield Chemicals Market: Import & Export Statistics

- Recent shipment-level customs data shows active global trade in key specialty oilfield chemical categories such as demulsifiers, corrosion inhibitors, scale inhibitors, surfactants and biocides. These chemicals play a central role in upstream and midstream operations, including well stimulation, flow assurance, reservoir management and production optimisation.

- Mexico recorded 251 export shipments of demulsifiers, reflecting the country’s expanding role as a supplier of separation chemicals used in crude oil treatment. This activity supports regional oil producers that require efficient demulsifier blends for improved water-oil separation.(Source : www.volza.com)

- The United States reported 949 export shipments of corrosion inhibitors, which indicates strong production capability and global dependability for chemicals that protect equipment and pipelines from corrosion. These inhibitors are critical across onshore and offshore assets and remain essential for long-term asset integrity.

(Source: www.volza.com) - The United States also imported 65 shipments of scale inhibitors, highlighting its reliance on specialised formulations sourced internationally to control mineral scaling in wells and production systems. Scale inhibitors help maintain flow efficiency in conditions with high salinity, temperature and pressure.(Source: www.volza.com)

- China continues to dominate global surfactant trade with 33,416 export shipments, reinforcing its position as one of the largest global suppliers of surfactant chemicals used in drilling fluids, stimulation fluids and enhanced oil recovery systems. These high-volume surfactant exports support upstream operations across developing and developed economies.(Source: www.volza.com )

- Mexico also exported 7,777 shipments of biocides, showing its strong export base for microbial-control chemicals used to protect drilling fluids, storage tanks and pipelines from harmful bacterial activity. Biocides are critical for maintaining production reliability and preventing operational downtime.(Source: www.volza.com )

- Overall, these trade flows demonstrate rising global demand for high-performance specialty oilfield chemicals, with robust participation from major exporting countries such as the United States, China and Mexico. Import patterns in large oil-producing regions confirm ongoing reliance on specialised, performance-critical chemical formulations that support efficient and safe oilfield operations.

Specialty Oilfield Chemicals Market Value Chain Analysis

- Feedstock Procurement :Feedstock procurement involves securing raw materials such as naphtha, natural gas liquids, vegetable oils, sugars, and fats that serve as the base for specialty chemical production. Stable sourcing is essential because fluctuations in global energy and agricultural markets can affect cost and supply reliability.

- Key Players: Clariant AG, Huntsman Corporation, BASF SE, Solvay S.A., Dow

- Chemical Synthesis and Processing :Chemical synthesis and processing cover industrial methods such as amidation, saponification, polymerization, and quaternization that convert raw feedstocks into functional specialty oilfield chemicals. These processes require controlled reaction conditions and advanced equipment to achieve consistent quality and performance.

- Key Players: Dow, Solvay SA, Huntsman Corporation, Nouryon, BASF SE, Clariant AG

- Quality Testing and Certification :Quality testing evaluates product characteristics, including phase separation, viscosity, density, composition, and contamination, to ensure reliable field performance. Certification through standards such as ISO 9001, API specifications, and ISO 14001 confirms compliance with quality and environmental requirements.

- Key Players: Bureau Veritas, TUV NORD, SGS SA, Intertek Group plc

Specialty Oilfield Chemicals Types Classification

| Type | Function | Application | Examples |

| Corrosion Inhibitors |

|

|

|

| Surfactants |

|

|

|

| Scale Inhibitors |

|

|

|

| Biocides |

|

|

|

Segmental Insights

Type Insights

Why the Corrosion and Scale Inhibitors Segment Dominates the Specialty Oilfield Chemicals Sector?

The corrosion and scale inhibitors segment dominated the specialty oilfield chemicals sector, accounting for 35.50% in 2025. The growing need to protect equipment such as storage tanks, pipelines, and other components in oil & gas operations drives demand for corrosion & scale inhibitors. The strong focus on preventing pipeline buildup and premature equipment replacement requires the use of corrosion & scale inhibitors. The growing oil & gas operations, like cementing, enhanced oil recovery, drilling, and production, require corrosion & scale inhibitors, driving the overall market growth.

The surfactants segment is expected to grow at a 5.5% CAGR in the market during the forecast period. The growing exploration and production of oil activities increases surfactant production. The strong focus on reducing the interfacial tension between oil & water and on optimizing extraction processes requires surfactants. The development of high-performance surfactants and innovations such as nanosurfactants support overall market growth.

The demulsifiers segment is significantly growing in the market.

The strong focus on preventing equipment fouling and enhancing operational efficiency requires the use of demulsifiers. The growing automotive industry and increasing use of lubricants require demulsifiers. The growing production of crude oil and rising demand for petroleum products are driving the market for demulsifiers, thereby boosting overall market growth.

Application Insights

Which Application Held the Largest Revenue Share in the Specialty Oilfield Chemicals Industry?

The production chemicals segment held the largest revenue share of 40.40% in the market in 2025. The growing operations, such as demulsification, corrosion prevention, and scale inhibition, require production chemicals. The strong focus on optimizing the oil extraction process and extending equipment lifespan requires production chemicals. The ongoing maintenance and initial extraction processes require production chemicals, which drive overall market growth.

The enhanced oil recovery (EOR) segment is expected to grow at a 5.7% CAGR in the market during the forecast period. The depletion of conventional oil reserves and the need to enhance oil recovery rates require EOR. The increasing use of alkalis, polymers, and surfactants in EOR helps market growth. The availability of various EOR techniques, such as chemical, gas injection, thermal, and advanced EOR, supports overall market growth.

The drilling fluids segment is growing rapidly in the sector. The growing demand for oil & gas, along with innovations such as deep & horizontal drilling, increases demand for drilling fluids. The growing offshore and onshore drilling activities require drilling fluids. The increasing number of drilling operations in shale gas and deepwater require drilling fluids that support overall market growth.

End-Use Insights

How the Onshore Segment Dominated the Specialty Oilfield Chemicals Market?

The onshore segment dominated the specialty oilfield chemicals market, accounting for 65.80% in 2025. The growing development of unconventional reserves, such as shale oil & gas, increases demand for onshore operations. The onshore locations' ease of access and lower operational costs help market growth. The high volume of new onshore drilling and innovations such as hydraulic fracturing drive market growth.

The offshore segment is the fastest-growing in the market with a 5.8% CAGR during the forecast period. The growing depletion of onshore reserves and the increasing exploration of ultra-deepwater & deepwater are increasing demand for offshore operations. The growing investment in and expansion of offshore projects in the Asia Pacific, the Gulf of Mexico, & West Africa support the overall market growth.

Regional Insights

The Asia Pacific specialty oilfield chemicals market size was valued at USD 7.66 billion in 2025 and is expected to reach USD 11.86 billion by 2035, growing at a CAGR of 4.48% from 2026 to 2035. Asia Pacific dominated the specialty oilfield chemicals market in 2025, accounting for a 45.50% percent share. The region’s leadership is supported by rising oil and gas production in countries such as Australia, China, and India, where upstream activities have expanded steadily over the past few years. According to data from the International Energy Agency,Asia’s natural gas demand has continued to increase as countries shift toward cleaner fuels, which further strengthens the need for chemical solutions that support drilling, production stability, and well treatment.

Growing energy consumption and rising investment in exploration and production projects

also drive market demand. National energy ministries across India and China have increased funding for new exploration blocks, enhanced recovery programs, and modernised field operations. These developments require high-performance chemicals, such as corrosion inhibitors, demulsifiers, and scale-control agents, to maintain reliability and efficiency across diverse geological conditions.

China's Commanding Role in the Production of Specialty Oilfield Chemicals

China is a major contributor to the specialty oilfield chemicals industry because of its expanding recovery, drilling, and production activities across both conventional and unconventional fields. According to the National Energy Administration, China has increased investment in domestic oil and gas development to improve energy security, underscoring the need for chemicals that enhance drilling efficiency, reservoir treatment, and enhanced recovery operations. These activities require a consistent supply of surfactants, corrosion inhibitors, demulsifiers, and other specialised formulations.

Strong government support for modernising the oil and gas sector is also driving market growth. National programs aimed at improving upstream technologies, reducing operational risks, and increasing domestic output have created a favorable environment for the adoption of advanced chemicals. China’s abundant coal reserves further support feedstock availability for petrochemical-based chemical production, strengthening the local supply chain.

Middle East & Africa Specialty Oilfield Chemicals Market Trends

The Middle East and Africa are experiencing the fastest growth in the specialty oilfield chemicals market, with a projected CAGR of 6.5 percent during the forecast period. The region holds some of the world’s largest proven oil and gas reserves, and data from OPEC shows that countries such as Saudi Arabia, the United Arab Emirates, Kuwait, and Iraq consistently rank among the top global producers. This high level of upstream activity increases the need for chemicals that support drilling stability, production enhancement, and well maintenance.

Well-developed enhanced oil recovery programs in countries like the UAE and Saudi Arabia further drive the market.

National oil companies in these countries use polymers, surfactants, and corrosion control agents to improve recovery rates in mature fields. Government investment plans such as Saudi Aramco’s long-term field development strategy and ADNOC’s EOR programs continue to expand the use of specialty chemicals across large-scale operations.

Beyond Crude: Saudi Arabia’s Rise in Specialty Oilfield Chemicals

Saudi Arabia is a key contributor to the specialty oilfield chemicals sector due to its large oil reserves and ongoing upstream activity. The country is home to the Ghawar Field, which is recognised by the U.S. Energy Information Administration as one of the largest conventional oil fields in the world. The scale of recovery, exploration, and production operations in Saudi Arabia creates strong and consistent demand for chemicals that enhance drilling efficiency, improve reservoir performance, and protect equipment from corrosion and scale formation.

The strong presence of oilfield service companies in major energy hubs such as Riyadh, Dhahran, and Al Khobar further supports market expansion. These cities host regional headquarters, research centres, and service facilities for both national and international companies, which helps accelerate the supply of specialised chemicals and technical support across different fields. Saudi Aramco’s ongoing investment programs aimed at maximising output and improving field sustainability also encourage widespread adoption of high-performance chemical formulations.

North America Specialty Oilfield Chemicals Market Trends

North America is growing rapidly in the specialty oilfield chemicals market due to its strong shale oil and gas production base. According to the United States Energy Information Administration, the United States remains the world’s largest producer of oil and natural gas, largely due to extensive shale development. The widespread use of technologies such as hydraulic fracturing and horizontal drilling increases the need for chemicals that improve well stimulation, manage flowback, and maintain production performance in complex reservoirs.

Government support for domestic energy production and continued focus on improving operational efficiency also drive demand. Federal and state programs that encourage upstream investment, infrastructure upgrades, and enhanced recovery projects contribute to the growing use of advanced chemical formulations. These chemicals are essential for controlling scale, preventing corrosion, stabilising emulsions, and improving recovery rates across both conventional and unconventional fields.

Chemical Ingenuity: How the U.S. is Shaping the Future of Oilfield Operations

The United States is experiencing notable growth in the specialty oilfield chemicals industry because of rising energy demand and the continued expansion of shale oil and gas development. Data from the United States Energy Information Administration show that shale formations account for a significant share of national crude oil and natural gas output, underscoring the need for chemicals used in drilling, well stimulation, and production enhancement. These chemicals help maintain well integrity, improve flow efficiency, and address common operational challenges in unconventional reservoirs.

Stricter regulatory compliance also drives the market. Standards from agencies such as the American Petroleum Institute and the Environmental Protection Agency require companies to follow specific guidelines for corrosion control, water treatment, and chemical handling. These regulations encourage the adoption of high-quality chemical formulations that can meet performance and environmental requirements across diverse operating conditions.

Europe Specialty Oilfield Chemicals Market Trends

Europe is significantly growing in the market. The growing demand for oil and gas, along with increasing exploration activities for unconventional and offshore resources, is driving demand for specialty oilfield chemicals. These chemicals support drilling stability, flow assurance, and equipment protection, which makes them essential for both mature and newly explored fields.

Stringent environmental regulations, such as REACH and regional ESG goals, drive the production of sustainable oilfield chemicals. Companies are developing cleaner formulations that meet European compliance standards while still performing in harsh field conditions. The growing regional oil and gas activities across major basins continue to drive the overall market growth, supported by investment in new wells, enhanced recovery projects, and routine field maintenance.

Specialty Oilfield Chemicals Market Share, By Region, 2025 (%)

| Regional | Revenue Share |

| North America | 25.11% |

| Europe | 19.44% |

| Asia Pacific | 45.50% |

| Latin America | 6.11% |

| Middle East and Africa | 3.84% |

Germany’s Role in Specialty Oilfield Chemicals Production

Germany is growing rapidly in the specialty oilfield chemicals sector. The increasing investment in research and development and in new technologies supports market growth. Public reports from Germany’s Federal Ministry for Economic Affairs show continued funding for chemical innovation and advanced manufacturing, which strengthens the country’s ability to supply high-performance formulations for drilling, recovery, and production operations.

The strong focus on exporting oilfield chemicals, along with the presence of key players such as Lanxess AG, BASF SE, and Evonik Industries AG, supports overall market growth. Germany’s well-established chemical infrastructure and global trade connections allow manufacturers to supply specialty chemicals to major oil-producing regions. This combination of innovation capacity and export strength continues to position Germany as an important contributor to the specialty oilfield chemicals industry.

South America Specialty Oilfield Chemicals Market Trends

South America contributes to the growth of the specialty oilfield chemicals industry. The growing development of unconventional resources and rising offshore exploration in countries like Guyana and Brazil are increasing demand for specialty oilfield services. Recent updates from regional energy ministries show that new offshore discoveries in Guyana and expanding deepwater projects in Brazil require advanced chemical formulations to support drilling stability, flow assurance, and well integrity.

Increasing energy demand and investment in enhanced oil recovery drive market growth. National programs across South America continue to support field expansion, and operators are increasingly using surfactants, polymers, and corrosion-control chemicals to improve recovery rates in mature fields. These trends highlight the region’s growing reliance on specialty oilfield chemicals as production activity expands both onshore and offshore.

Brazil Specialty Oilfield Chemicals Market Trends

Brazil is growing in the specialty oilfield chemicals sector. The growing exploration of pre-salt reserves and offshore activities increases demand for specialty oilfield chemicals. Reports from Brazil’s National Agency of Petroleum show that pre-salt fields continue to contribute a rising share of national output, and these deepwater reservoirs require advanced chemical solutions for drilling, production stability, and equipment protection in high-pressure environments.

The increasing investment in the oil and gas landscape and the growing domestic energy demand are driving market growth. Government-supported exploration programs and long-term investment plans continue to expand drilling activity, which raises the need for performance-driven chemicals across production stages. The strong focus on enhanced oil recovery and the complexity of extraction resources support overall market growth, as operators rely on surfactants, polymers, and flow assurance chemicals to maintain efficiency in challenging offshore and pre-salt conditions.

Recent Developments

- In June 2023, Clariant Oil Services launched a sustainable solution, PHASETREAT WET, for oil and gas industry demulsification. The new solution simplifies logistics processes and lowers operational costs. The solution supports safe operations and lowers carbon emissions. (Source: www.clariant.com )

- In November 2025, Rodanco launched a combined demulsifier & naphthalene inhibitor DM

2456 for crude oil treatment. The dual-action approach lowers the consumption of chemicals and enhances the efficiency of the separation of oil & water.(Source: rodanco.nl) - In June 2025, Nouryon launched an innovation center for oilfield solutions in the United States. The centre offers a platform for training sessions, workshops, and focuses on R&D for sustainable production & drilling operations. (Source: www.indianchemicalnews.com)

- In May 2024, BASF expands paraffin inhibitors production capacity of the Basoflux range in Tarragona, Spain, for the oil & gas industry.(Source: www.basf.com)

Top Companies List

- Baker Hughes Company: The company provides equipment and services like evaluation, pipelines, drilling, LNG, & completion for the oil & gas industry.

- Halliburton Company: The leading energy service company operates in over 70 countries and offers oilfield services, including stimulation, intervention, cementing, & artificial lift.

- Schlumberger Limited: The Texas-based company offers products & core services like drilling, processing, reservoir characterization, production, & others, and operates in more than 120 countries.

- BASF SE: The Germany-based company offers a product portfolio for cementing, production, drilling, and stimulation operations.

- Clariant AG: The Swiss-based company produces various chemicals like scale & wax control agents, corrosion inhibitors, and demulsifiers to overcome challenges during the production of oil & gas.

- Dow Inc.:Dow supplies a broad portfolio of surfactants and specialty chemical additives used across home care, industrial cleaning, agrochemicals, and personal care. The company focuses on high-performance, sustainable, and biodegradable surfactant technologies.

- Nouryon :Nouryon produces surfactants, polymers, and specialty additives used in cleaning, personal care, oilfield, and agrochemical applications. Its offerings emphasize performance efficiency, surface modification, and environmentally friendly solutions.

- Solvay SA :Solvay develops specialty surfactants and functional additives for industries such as home & personal care, mining, agriculture, and coatings. The company focuses on bio-based chemistries and high-efficiency formulations.

- Croda International Plc :Croda manufactures bio-based and specialty surfactants used in cosmetics, healthcare, crop care, and industrial markets. Its portfolio emphasizes sustainability, mildness, and high-performance emulsification.

- Innospec Inc. :Innospec produces specialty surfactants for fuel additives, personal care, oilfield chemicals, and industrial applications. The company is known for its innovative formulations and advanced performance chemistries.

- Kemira Oyj:Kemira supplies surfactants and process chemicals primarily for water treatment, pulp & paper, and industrial applications. Its formulations enhance wet strength, dispersing ability, and process stability.

- Lubrizol Corporation :Lubrizol offers surfactants and polymer solutions used in personal care, home care, coatings, and industrial fluids. The company emphasizes rheology modification, mild cleansing, and multifunctional surfactant technologies.

- Huntsman Corporation – Huntsman manufactures a wide range of amine-based and ethoxylated surfactants used in detergents, agriculture, oilfield, and industrial processing. Its products focus on performance, stability, and efficiency.

- Stepan Company :Stepan is a major global producer of surfactants for cleaning, personal care, food & beverage processing, and industrial applications. Its portfolio includes anionic, nonionic, cationic, and amphoteric surfactants.

- Arkema S.A.: Arkema produces specialty surfactants and performance additives for coatings, adhesives, personal care, and industrial markets. The company focuses on advanced chemistry, sustainability, and high-efficiency surface solutions.

Segments Covered

By Type

- Demulsifiers

- Corrosion & Scale Inhibitors

- Surfactants

- Polymers

- Biocides

- Pour Point Depressants

- Others (Oxygen Scavengers, pH Adjusters)

By Application

- Drilling Fluids

- Cementing

- Enhanced Oil Recovery (EOR)

- Production Chemicals

- Workover & Completion

By End-Use

- Onshore

- Offshore

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa