Content

What is the Current Automotive Stainless Steel Market Size and Volume?

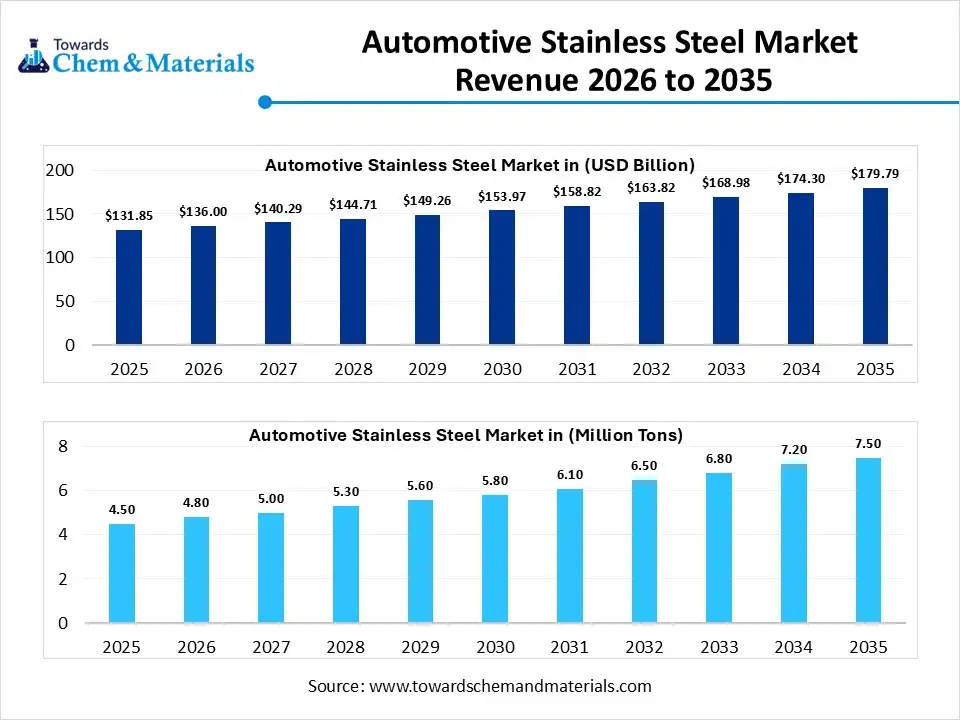

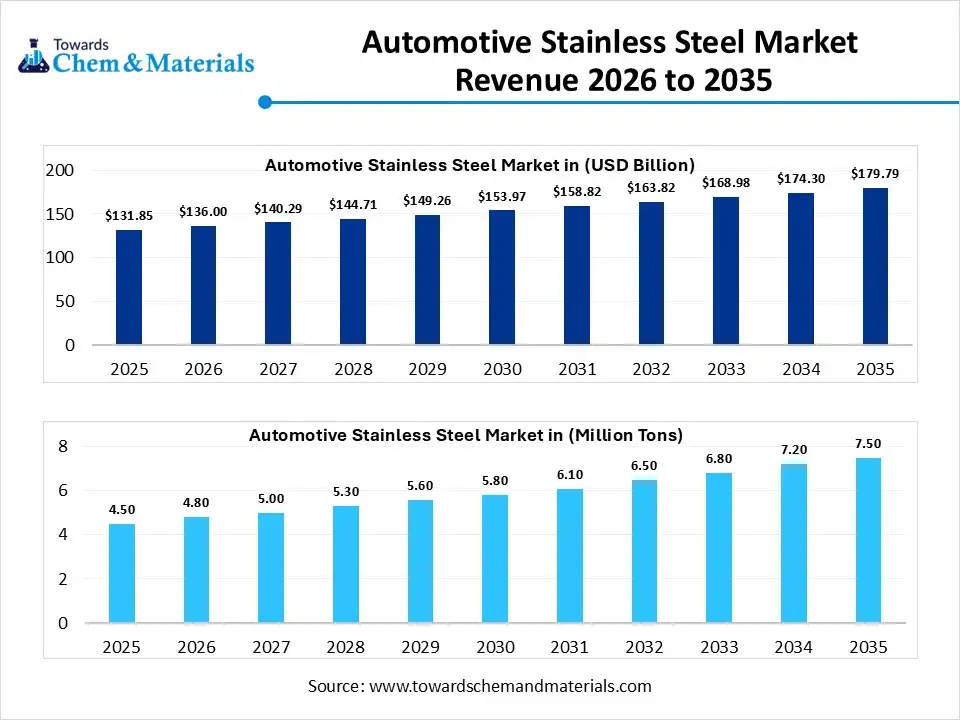

The global automotive stainless steel market size was estimated at USD 131.85 billion in 2025 and is expected to increase from USD 136.00 billion in 2026 to USD 179.79 billion by 2035, growing at a CAGR of 3.15% from 2026 to 2035. In terms of volume, the market is projected to grow from 4.50 million tons in 2025 to 7.50 million tons by 2035. growing at a CAGR of 5.18% from 2026 to 2035. Asia Pacific dominated the automotive stainless-steel market with the largest volume share of 52.59% in 2025. The turn towards lightweight vehicles and fuel efficiency has accelerated the industry’s growth in recent years.

Market Highlights

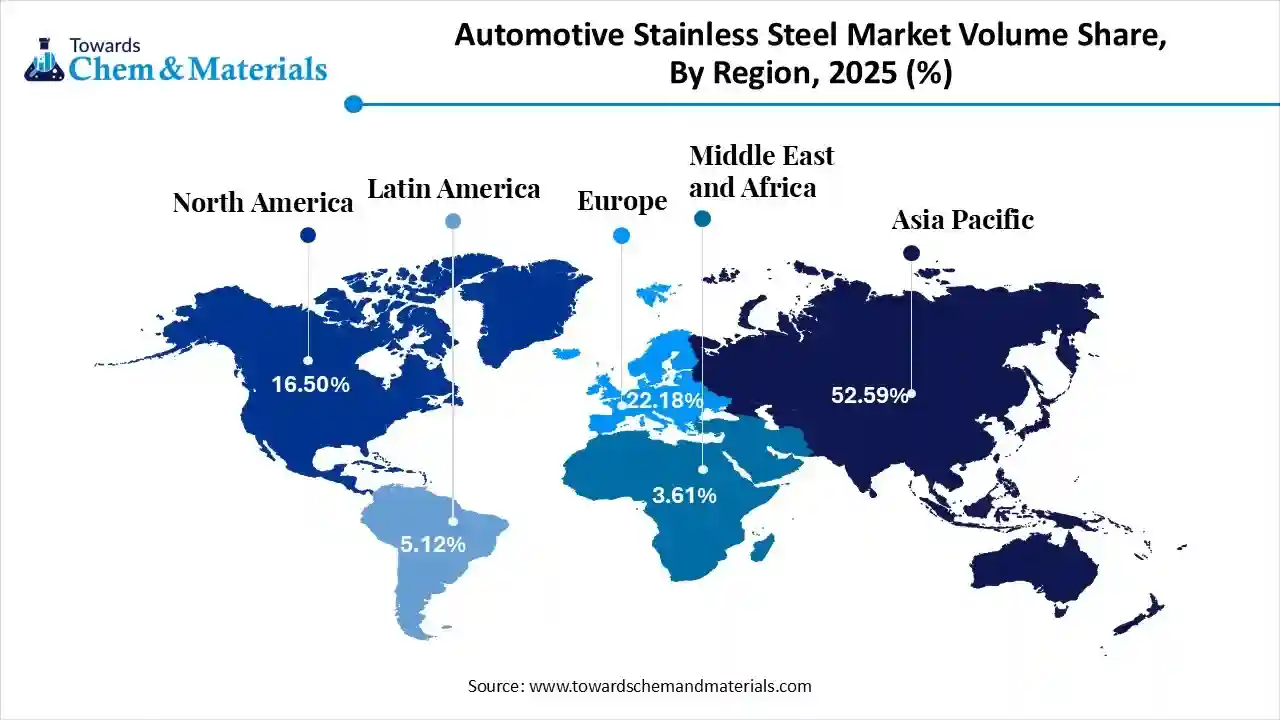

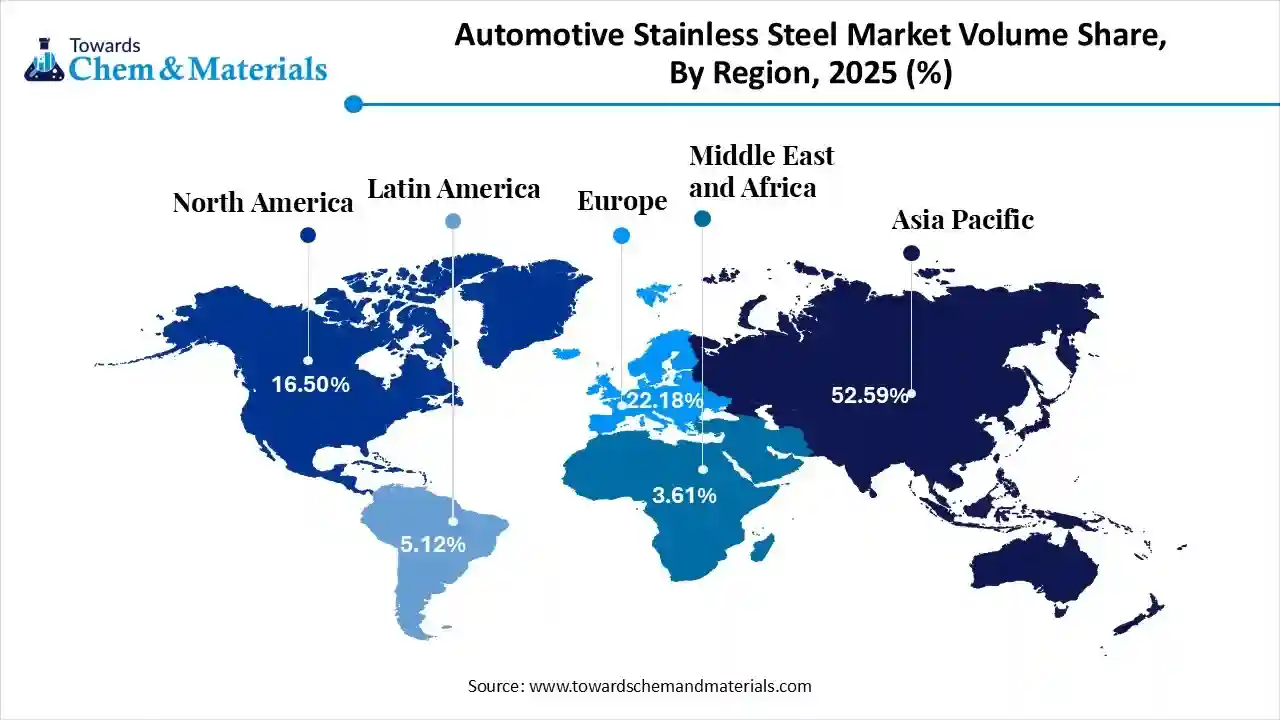

- The Asia Pacific dominated the global automotive stainless-steel market with the largest volume share of 52.59% in 2025.

- The automotive stainless-steel market in Europe is expected to grow at a substantial CAGR of 6.42% from 2026 to 2035.

- The North America automotive stainless-steel market segment accounted for the major volume share of 16.50% in 2025.

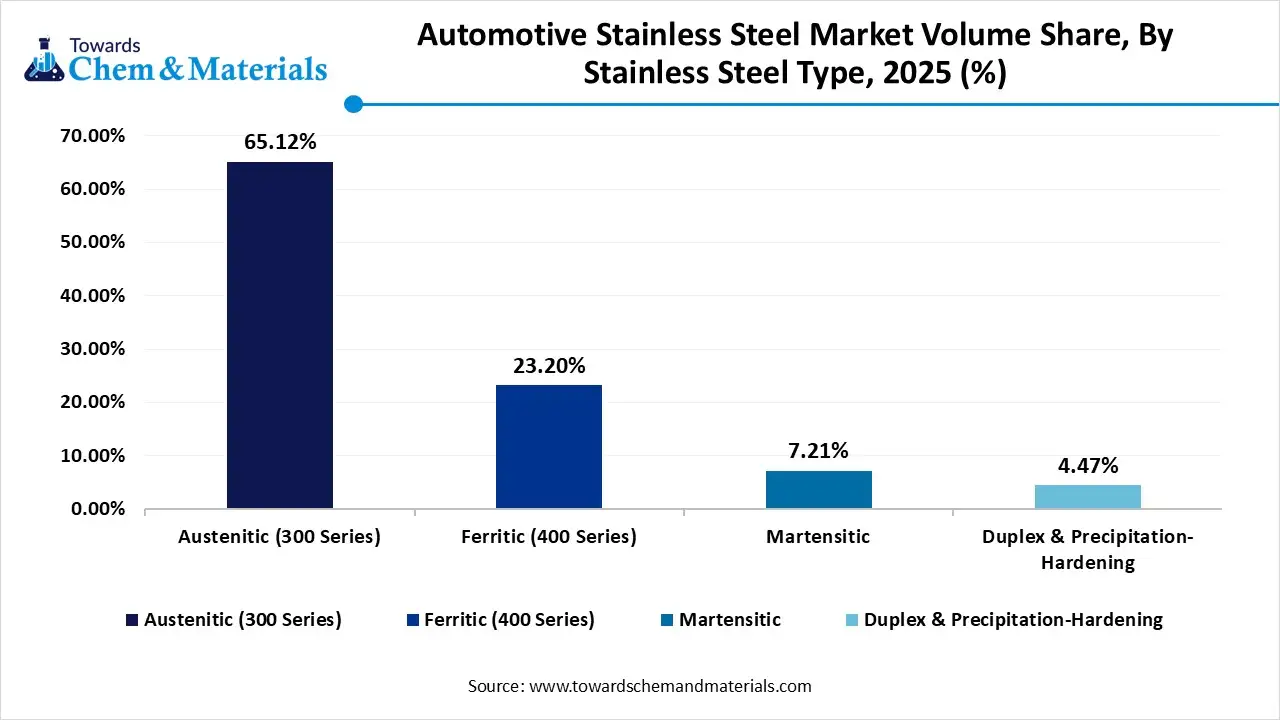

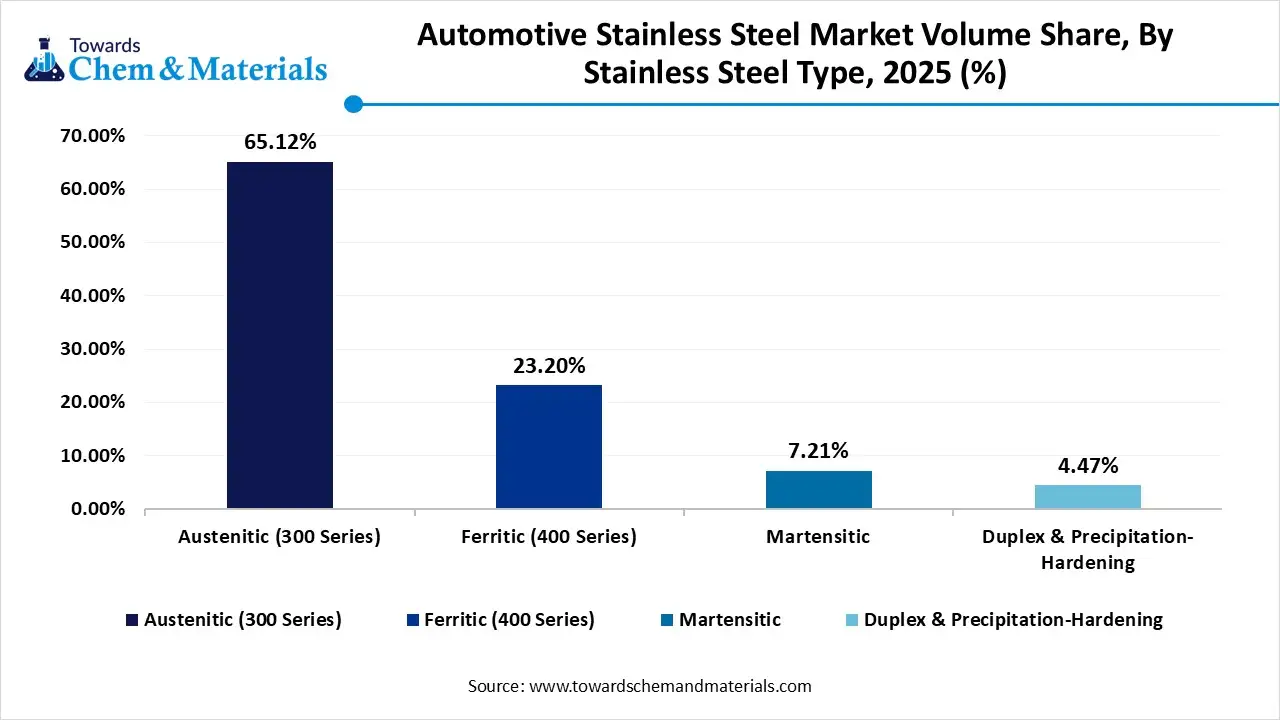

- By type, the austenitic (300 Series) segment dominated the market and accounted for the largest volume share of 65.12% in 2025.

- By type, the duplex & precipitation-hardening segment is expected to grow at the fastest CAGR of 7.14% from 2026 to 2035 in terms of volume.

- By application, the exhaust systems segment led the market with the largest revenue volume share of 43.1% in 2025.

- By product form, the flat products segment dominated the market and accounted for the largest volume share of 73.0% in 2025.

Automotive Stainless Steel: Powering Strength, Durability, and Profitable Innovation

The specific type of steel which is primarily designed and used for vehicles owing to its strength, rust resistance, and long life, is known as the automotive stainless steel. Moreover, by including the iron mix with chromium, which offers better corrosion protection against heat, road chemicals, and water, the automotive stainless steel has opened profitable avenues for manufacturers in recent years.

Automotive Stainless Steel Market Trends:

- The emergence of lightweight designs, where high-strength steel has enhanced the market participation for producers in the current period. also, by allowing the vehicle manufacturers to use thinner material without minimizing safety or strength, the high-strength steel has gained industry attention in recent years.

- The heavy expansion of electric vehicles has boosted the revenue potential in the current period, as the vehicle manufacturers have been seen using stainless steel to reduce vibration and handle heat. Also, with the trend towards the eco-friendly and minimisation of carbon emissions, stainless steel is likely to receive grater consumer base in the upcoming years.

- The heavy investment towards enhancing sustainability, durability, and recycling of the stainless steel is likely become the major driver of future opportunities for manufacturers in the upcoming years. Also, several global governments are seen n under the releasing heavy benefits for the sustainable manufacturing and recycling initiatives in recent years.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 136.00 Billion / 4.80 Million Tons |

| Revenue Forecast in 2035 | USD 179.79 Billion / 7.50 Million Tons |

| Growth Rate | CAGR 3.15% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Stainless Steel Type (Grade), By Product Form, By Application Area, By Region |

| Key companies profiled | ArcelorMittal S.A., POSCO, Nippon Steel Corporation, Thyssenkrupp AG, Interphasic Corporation, Tianhe Resin Co., Ltd., Swancor Holding Co., Ltd., Eternal Materials Co., Ltd., Upica Company Ltd., Allnex GMBH , MMP Industries Ltd. |

From Trial-and-Error to Data-Led Material Mastery

Redefining material performance standards across the industry is likely to enable high-return ventures for manufacturers. The transition from conventional grades to advanced high-strength stainless steels has enabled superior corrosion resistance, enhanced crash performance, and optimized design flexibility. Modern forming techniques and data-driven material modeling have replaced traditional trial-and-error approaches.

Trade Analysis of the Automotive Stainless Steel Market:

Import, Export, Consumption, and Production Statistics

- China holds the major stainless-steel export in 2024, and the exported volume of the year is around 39.44 million tons, as per the published report.

- The United States has exported a huge amount of stainless steel wire in 2024, and the estimated value of these trades is approximately $203 million, as per the published report.

Value Chain Analysis of the Automotive Stainless Steel Market:

- Distribution to Industrial Users: Industrial users in the automotive sector acquire stainless steel through direct supply agreements with steel mills or via specialized metal service centers.

- Key Players: ArcelorMittal SA and POSCO (Pohang Iron and Steel Co.)

- Chemical Synthesis and Processing: Industry is defined by advanced chemical refining techniques and high-precision processing aimed at producing lightweight, high-strength components for both traditional and electric vehicles (EVs).

- Key Players: Nippon Steel Corporation and Jindal Stainless Limited

- Regulatory Compliance and Safety Monitoring: The automotive stainless steel market is governed by rigorous global safety standards and environmental mandates aimed at decarbonization and material circularity.

Safety Standards- REACH & RoHS and ISO 26262

Automotive Stainless Steel Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory | Key Regulations | Focus |

| United States | Environmental Protection Agency (EPA) | Emissions Regulations (Clean Air Act) | Reducing vehicle emissions and improving fuel efficiency through lightweight |

| European Union | European Chemicals Agency (ECHA) | End-of-Life Vehicles (ELV) Directive (2000/53/EC) | Promoting a circular economy through high recyclability targetsand microplastic restrictions |

| China | Ministry of Ecology and Environment (MEE) | Steel Action Plan (2025-2026) | Combating overcapacity in the steel industry |

Segmental Insights

Stainless Steel Type Insights

How did the Austenitic (300 Series) Segment Dominate the Automotive Stainless Steel Market in 2025?

The austenitic (300 Series) segment dominated the market with 65.12% industry share in 2025, due to its offerings such as better corrosion resistance, a balance of strength, and affordability. Moreover, by performing well under the higher vibration and heat, the austenitic has gained major industry attention in the past few years, as per the latest survey. Also, the austenitic has the greater design flexibility, which is driving the segment growth in the current period.

The duplex & precipitation-hardening segment is expected to grow with a rapid CAGR 7.14%, owing to its unique characteristics like higher strength with less material thickness in recent years. Moreover, the turn towards vehicle weight reduction is likely to create lucrative opportunities for the segment in the coming years, as per the future industry expectations. Also, the emergence of the next-generation EV platforms is expected to provide a sophisticated consumer base to the segment during the forecast period.

Automotive Stainless-Steel Market Volume and Share, By Stainless Steel Type, 2025-2035

| By Stainless Steel Type (Grade) | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Austenitic (300 Series) | 65.12% | 3.0 | 4.7 | 5.24% | 62.23% |

| Ferritic (400 Series) | 23.20% | 1.1 | 1.9 | 6.87% | 25.45% |

| Martensitic | 7.21% | 0.3 | 0.5 | 5.92% | 7.30% |

| Duplex & Precipitation-Hardening | 4.47% | 0.2 | 0.4 | 7.14% | 5.02% |

Application Insights

Why does the Exhaust Systems Segment Dominate the Automotive Stainless Steel Market?

The exhaust systems segment dominated the market with 43.1% share in 2025, owing to longer vehicle warranties, which require parts that do not fail early. Moreover, stainless steel helps manufacturers avoid costly replacements. As emission standards become stricter, exhaust systems become more complex and demanding. This keeps stainless steel essential for exhaust components, maintaining its strong position in the market.

The EV battery enclosures segment is expected to grow at a rapid CAGR, akin to it is known as a critical part of electric vehicles, and stainless steel is increasingly used for this purpose. It protects batteries during crashes and prevents damage from external conditions. Another advantage is its ability to handle thermal expansion during charging and discharging.

Product Form Insights

How did the Flat Products Segment Dominate the Automotive Stainless Steel Market in 2025?

The flat products segment dominated the market with 73.0% share in 2025, akin to their processing convenience. Also, they can be stamped into complex shapes with high accuracy. Automakers rely on flat products to maintain production efficiency and consistency. Another benefit is better surface quality, which is important for visible automotive parts.

The tubular products segment is expected to grow with a rapid CAGR, by allowing manufacturers to reduce weight while maintaining strength. These products are increasingly used in EV platforms, especially for battery cooling and structural support. Another advantage is improved durability under vibration and stress.

Regional Insights

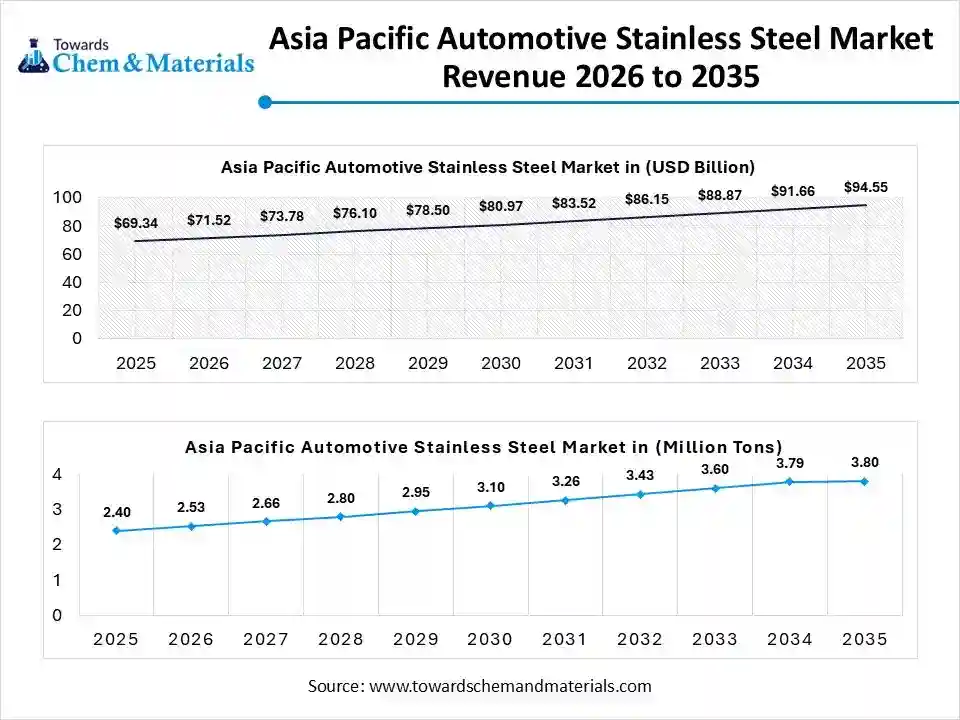

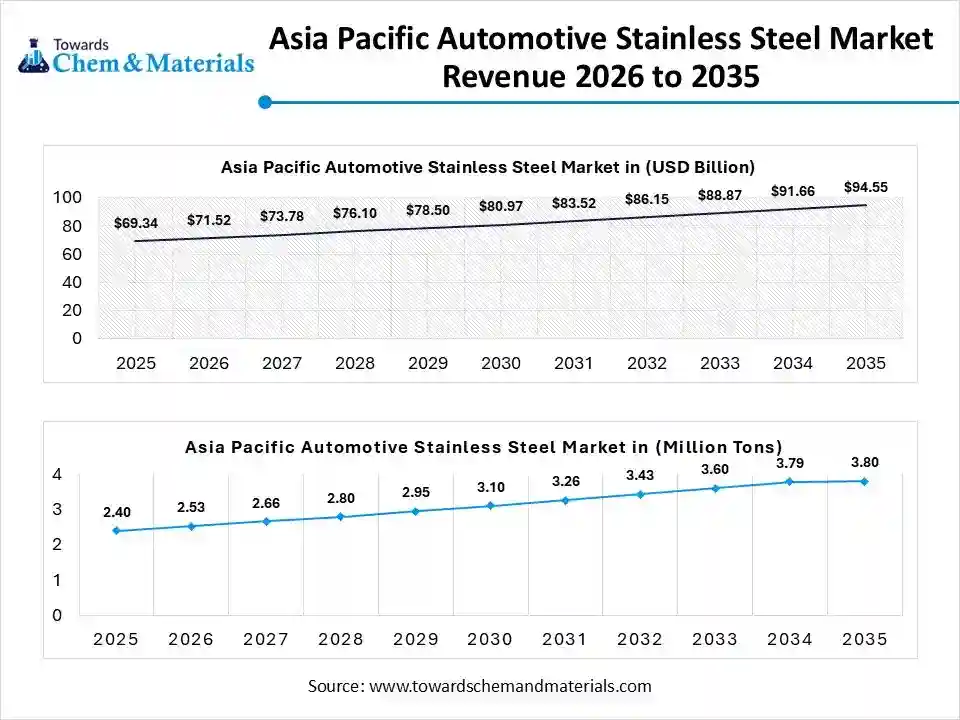

The Asia Pacific automotive stainless steel market size was valued at USD 69.34 billion in 2025 and is expected to be worth around USD 94.55 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 3.17% over the forecast period from 2026 to 2035.

The Asia Pacific automotive stainless steel market volume was estimated at 2.4 million tons in 2025 and is projected to reach 3.8 million tons by 2035, growing at a CAGR of 5.25% from 2026 to 2035. Asia Pacific dominated the automotive stainless-steel market with a 52.59% share in 2025, due to the increased production of advanced and safety vehicles. Moreover, with stronger manufacturing ecosystems and lower production and labor costs, the region has gained major attention from all over the globe in the past few years. Also, the domestic supply demand has contributed to the industry growth in the region.

Battery Enclosures Boost Stainless Steel Usage

China maintained its dominance in the market, owing to the country being known for its heavy vehicle production and automotive parts exports. Also, the manufacturers in China have been seen using automotive stainless steel in electric vehicle specifically in exhaust systems, battery enclosures, and chassis parts in recent years, as per the latest survey.

Automotive Stainless-Steel Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 16.50% | 0.7 | 1.4 | 6.81% | 18.01% |

| Europe | 22.18% | 1.0 | 1.8 | 6.42% | 23.44% |

| Asia Pacific | 52.59% | 2.4 | 3.8 | 5.25% | 50.32% |

| Latin America | 5.12% | 0.2 | 0.4 | 6.00% | 5.22% |

| Middle East & Africa | 3.61% | 0.1 | 0.2 | 3.66% | 3.01% |

North America Automotive Stainless Steel Market Examination

The North America automotive stainless steel market volume was estimated at 0.7 million tons in 2025 and is anticipated to reach 1.4 million tons by 2035, growing at a CAGR of 6.81% from 2026 to 2035, owing to having the advanced automotive technology and heavy manufacturing infrastructure. Also, the regional countries, such as the United States and Canada, are heavily investing in durable, heat-resistant, and safer materials akin to the country’s future export goals as per the latest report.

Digital ESG Goals Drive Material Adoption

The United States is expected to emerge as a prominent country for the market in the coming years, akin to the ongoing Ev production strategy and technology advancement. Moreover, the manufacturers in the United States have been implementing digital tracking initiatives to track ESG goals in recent years, where heavy investment is possible in the upcoming years, as per the future industry expectations.

Europe Automotive Stainless Steel Market Evaluation

The Europe automotive stainless steel market volume was estimated at 1.0 million tons in 2025 and is anticipated to reach 1.8 million tons by 2035, growing at a CAGR of 6.42% from 2026 to 2035. Europe is a notably growing region, owing to manufacturers designing vehicles around full life-cycle responsibility, not just performance, in recent years. Moreover, stainless steel supports this since it lasts longer and is easier to recycle without quality loss. Moreover, Europe's push for material transparency, where automakers disclose material composition publicly.

Germany Elevates EV Safety Standards

Germany is expected to gain a major industry share, akin to Germany's shift toward over-engineered safety margins for EVs, increasing the use of stainless steel and structural and thermal protection parts. German automakers are also testing vehicles for extended warranties beyond 15 years, which favors corrosion-resistant materials in recent years.

South America Automotive Stainless Steel Market Evaluation

The South America automotive stainless steel market volume was estimated at 0.2 million tons in 2025 and is anticipated to reach 0.4 million tons by 2035, growing at a CAGR of 6.00% from 2026 to 2035. South America is a notably growing region due to changing vehicle usage patterns. The demand for multi-purpose vehicles that operate in both urban and rural conditions is driving the regional growth. Also, Stainless steel helps handie corrosion, vibration, and fuel variation. Automakers in the region are also extending vehicle model lifespans instead of launching new ones frequently in the current period.

Ethanol Fuel Boosts Stainless Steel Demand

Brazil is expected to gain a major industry share, akin to its diverse fuel ecosystem. Also, the stainless steel performs better in vehicles using ethanol and mixed fuels, increasing its usage in exhaust and fuel-related components in the country. Also, automakers in Brazil are also focusing on export-ready vehicles, requiring corrosion resistance for shipping and a varied climate.

Automotive Stainless Steel Market Study in the Middle East and Africa

The Middle East and Africa automotive stainless steel market volume was estimated at 0.1 million tons in 2025 and is anticipated to reach 0.2 million tons by 2035, growing at a CAGR of 3.66% from 2026 to 2035. The Middle East and Africa are expected to capture a notable volume share 3.61% of the industry, due to environmental and usage conditions. Moreover, the vehicles in this region are designed for continuous exposure to heat, dust, and long idle times, where stainless steel performs better than coated steel. Furthermore, fleet-based vehicle usage for logistics and ride services is increasing demand for durable materials in the region.

Stainless Steel Supports Saudi Smart Mobility

Saudi Arabia is expected to emerge as a prominent country, akin to future-focused vehicle planning. Also, the vehicles are being designed for smart-city environments, where long service life is required in the country. Moreover, stainless steel supports this by reducing part replacement.

Recent Developments

- In May 2025, Tata Steel Netherlands unveiled the latest hot-rolled steel product line for automotive parts. Moreover, the newly launched steel product is known as the CP800 hyperflange. Also, the company has been trying to deliver more optimized stainless steel under this HyperFlange® branding, as per the published report. furthermore, the company has motive to provide automotive parts with the suitability of lightweight vehicles. (Source: products.tatasteelnederland.com)

Top Vendors in the Automotive Stainless Steel Market & Their Offerings:

- ArcelorMittal S.A.: Headquartered in Luxembourg, it is the world's second-largest steelmaker and a global leader in automotive-grade and low-carbon "XCarb" steel solutions.

- POSCO: Based in South Korea, this global steel giant is currently expanding into "Energy Materials" like lithium and cathode components for the electric vehicle battery market.

- Nippon Steel Corporation: Japan's largest steel producer, the company is aggressively expanding its international footprint in 2026, including a multi-billion-dollar strategic plan for U.S. Steel.

- Thyssenkrupp AG: This German industrial conglomerate is undergoing a major 2026 restructuring, including the spin-off of its marine division and a transition toward hydrogen-based green steel production.

- Interplastic Corporation

- Tianhe Resin Co., Ltd.

- Swancor Holding Co., Ltd.

- Eternal Materials Co., Ltd.

- Upica Company Ltd.

- Allnex GMBH

- MMP Industries Ltd.

Segments Covered in the Report

By Stainless Steel Type (Grade)

- Austenitic (300 Series)

- Ferritic (400 Series)

- Martensitic

- Duplex & Precipitation-Hardening

By Product Form

- Flat Products

- Long Products

- Tubular Products

By Application Area

- Exhaust Systems

- Structural Components

- Powertrain & Fuel Systems

- Trim & Aesthetics

- EV Specific

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa