Content

What is the Current Lubricants Market Size and Share?

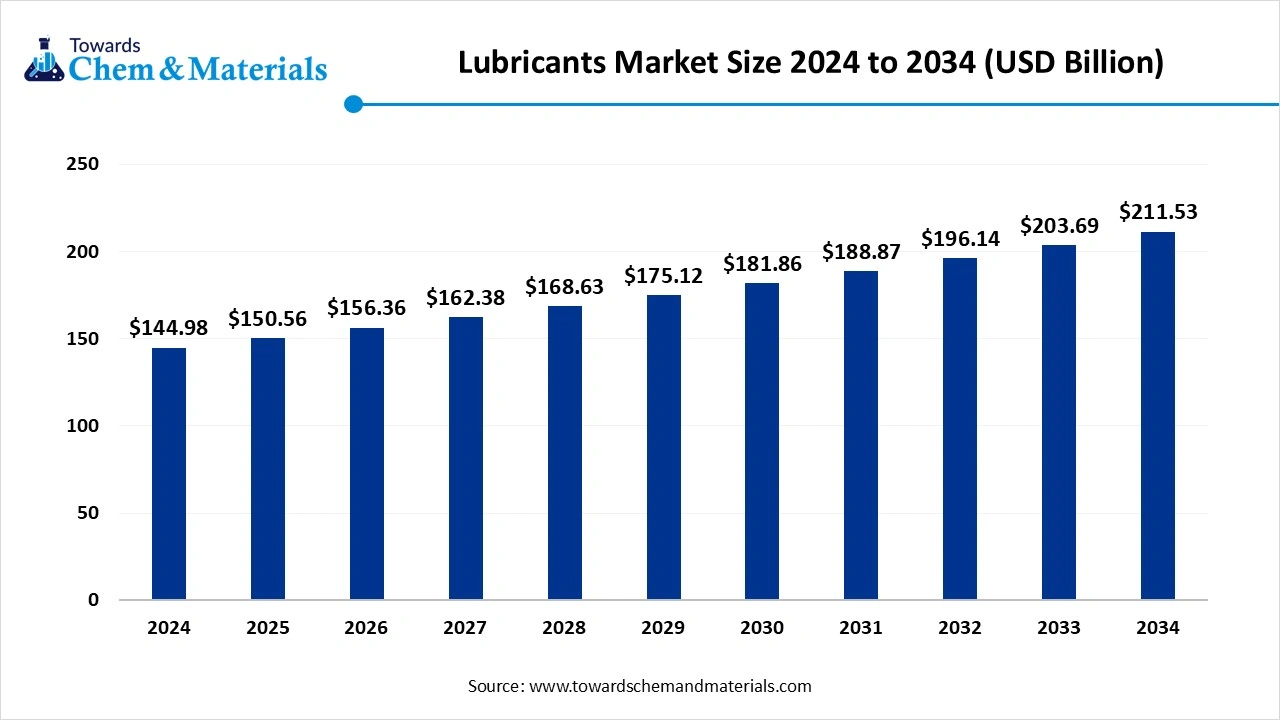

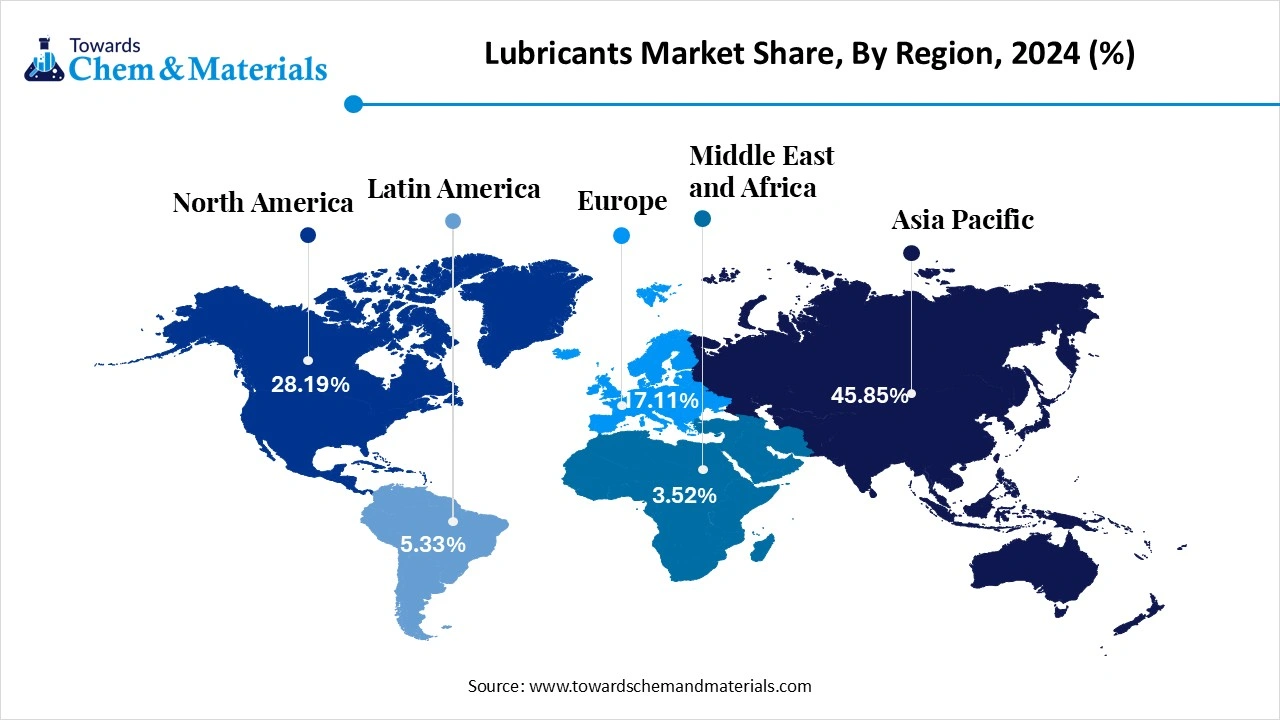

The global lubricants market size was USD 150.56 billion in 2025 and is predicted to increase from USD 156.36 billion in 2026 and is expected to be worth around USD 219.67 billion by 2035, growing at a CAGR of 3.85% from 2026 to 2035. Asia Pacific dominated the lubricants market with the largest revenue share of 46.05% in 2025.The rapid industrial growth, growing demand from the automotive sector, and advancements in lubricant technology drive the market growth.

Key Takeaways

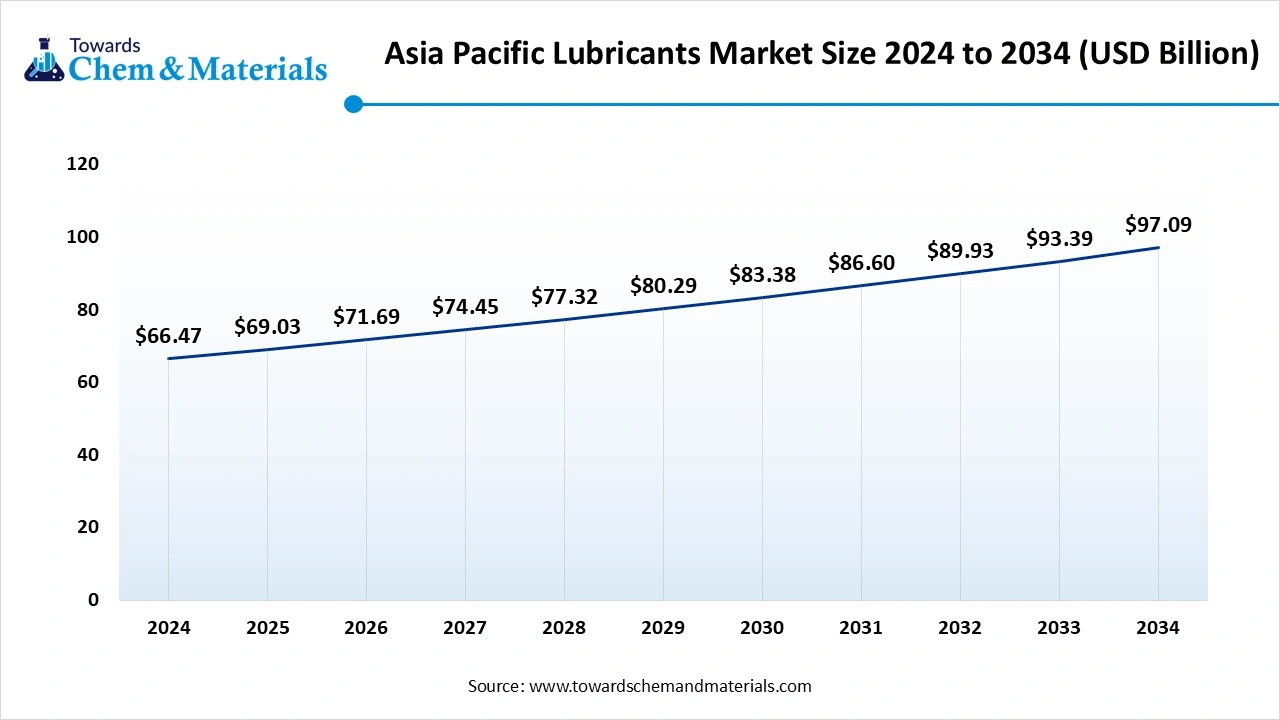

- The Asia Pacific dominated the global lubricants market with the largest volume share of 46.05% in 2025.

- By product, the mineral oil segment dominated the market and accounted for the largest volume share of 64.78% in 2025.

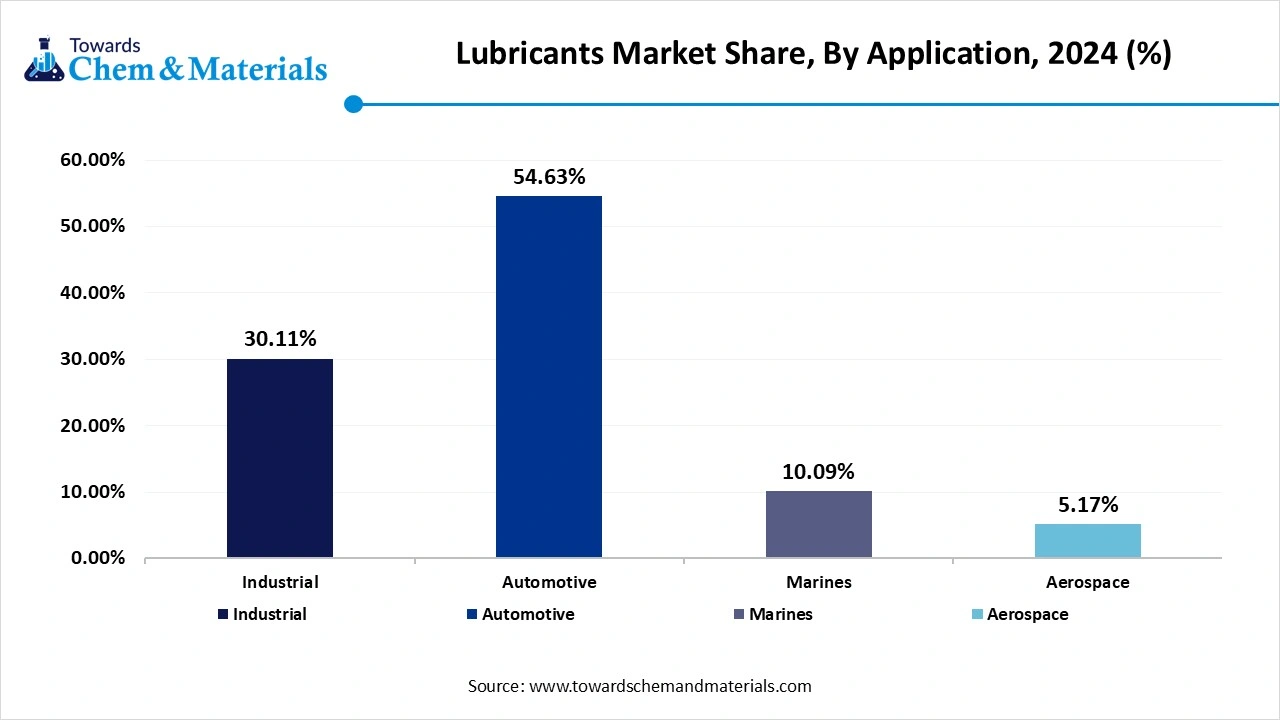

- By application, the automotive segment led the market with the largest revenue volume share of 55.61% in 2025.

Lubricants: Silent Hero Behind Industrial Smoothness and Machinery

Lubricants are substances which is used to minimize heat generation, friction between moving parts, and wear. They are available in diverse forms like solids, liquids, and even gases. They help in preventing corrosion, heat transfer, and sealing. Lubricants consist of high-boiling-point, high-viscosity-index, and low-freezing-point. It consists of thermal stability, hydraulic stability, and high oxidation resistance. Lubricants are made up of 10% additives and 90% base oils. Liquid lubricants include mineral oils, synthetic oils, and vegetable oils. Solid lubricants include molybdenum disulfide, polytetrafluoroethylene, graphite, and boron nitride.

The growing manufacturing facilities globally increase demand for industrial lubricants. The increasing adoption of automation in various sectors increases the consumption of various lubricants. The rising vehicle ownerships and growing vehicle sales increases demand for automotive lubricants to ensure smooth operation. The growing demand for commercial vehicles and passenger vehicles helps in the market growth. Factors like a rise in electric vehicles, growing demand for high-performance engines, advancements in lubricant formulations, and growing demand from the marine & aerospace industry drive the overall growth of the lubricants market.

- Germany exported 179,291 shipments of the lubricant.(Source: Volza.com)

- Germany exported 178,943 shipments of lubricating oil.(Source: volza.com)

- Vietnam exported 14,040 shipments of industrial lubricants.(Source: volza.com)

- Vietnam exported 20,913 shipments of industrial lubricant oil.(Source: volza.com)

- Japan exported 26,428 shipments of the lubricant grease.(Source: volza.com)

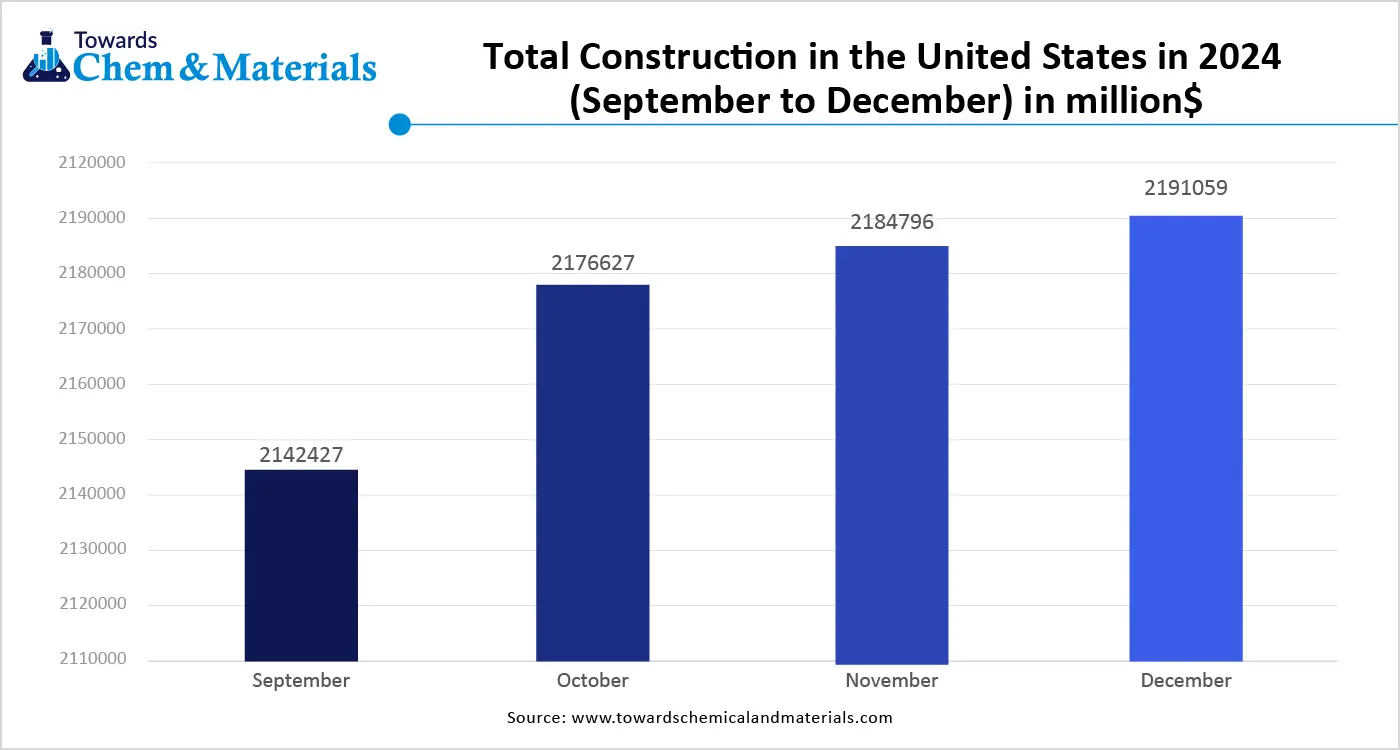

The Growing Construction Industry Propels Lubricants Market Growth

The rapid urbanization increases demand for various construction activities like residential, commercial, and infrastructural construction. The growing various construction activities is driving demand for a wide range of machinery. The growing demand for various equipment like bulldozers, haul trucks, drilling rigs, excavators, cranes, concrete mixers, and loaders increases the demand for lubricants for various applications like hydraulics, engines, and transmission. The growing demand for extending longevity and maintaining the performance of equipment increases demand for lubricants.

The growing investments in infrastructure development, like buildings, bridges, and roads, fuel demand for high-performance construction equipment that uses lubricants. The growing adoption of robotics & automation in construction projects is leading to demand for specialized lubricants. The strong focus of the construction industry on sustainability increases the adoption of eco-friendly lubricants. The growing construction industry is a key driver for the growth of the lubricants market.

- China exported 161,225 shipments of construction equipment.(Source: volza.com)

Market Recent Growth and Trends

- Shift Toward Low-Carbon and Bio-Based Lubricants: Demand for low-carbon and bio-based lubricants is increasing as OEMs, industrial operators, and regulatory bodies prioritize sustainability and lifecycle emissions reduction. Advanced base oils derived from renewable feedstocks (e.g., plant oils and ester blends) are being formulated to match or exceed the performance of conventional mineral oils, particularly in applications such as industrial gearboxes, marine engines, and wind turbine gear systems. This shift is also supported by corporate decarbonization targets and certification frameworks like ISO 14067 (carbon footprint).

- Integration of Advanced Additive Technologies: Lubricant formulations increasingly incorporate nanoparticle additives, friction modifiers, and anti-wear agents based on engineered chemistry to extend service life, reduce energy loss, and improve equipment reliability. Additives such as molybdenum disulfide (MoS₂) and boron-based compounds are being used to lower metal-to-metal contact, enhance oxidation stability, and support higher operating temperatures in EV drivetrains and heavy-duty industrial machinery.

- Rise of Electrification-Compatible Lubricants: The growth of electric vehicles (EVs) and hybrid powertrains is reshaping lubricant demand. EVs require specialized lubricants for thermal management of batteries, cooling of power electronics, and reduction of gear noise in e-axles, distinct from traditional engine oils. This is driving development of thermal interface fluids, dielectric cooling oils, and e-axle gear lubricants with low electrical conductivity and high heat transfer efficiency.

- Digitalization and Predictive Maintenance: Industrial and automotive end users are increasingly leveraging IoT sensors, cloud-based analytics, and machine learning to monitor lubricant condition in real time. Online oil condition monitoring enables early detection of contamination, viscosity breakdown, and additive depletion, helping to prevent unplanned downtime and extend drain intervals. Predictive maintenance platforms are also optimizing lubricant change schedules based on operating profiles rather than fixed intervals, improving equipment uptime and lowering total cost of ownership.

- Focus on Circular Economy and Used Oil Management: Recycling and reclamation of used lubricants are gaining traction, especially in regions with stringent waste-management regulations. Advanced reclaiming technologies are enabling removal of contaminants, oxidation by-products, and degraded additives, allowing base oils to be reused without compromising performance. Initiatives such as extended producer responsibility (EPR) and national used-oil collection programs are supporting growth of circular value chains in North America, Europe, and parts of Asia Pacific.

- Premiumization and Performance Differentiation: End users are increasingly willing to pay a premium for high-performance, long-life lubricants that improve fuel efficiency, reduce maintenance frequency, and support extended equipment warranties. High-viscosity index lubricants, synthetic formulations, and OEM-approved products are capturing share in industrial, commercial vehicle, and marine segments. This trend is particularly notable in markets with high fleet utilization or extreme operating environments.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 156.36 Billion |

| Expected Size by 2035 | USD 219.67 Billion |

| Growth Rate from 2026 to 2035 | CAGR 3.85% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | CASTROL LIMITED, FUCHS, ExxonMobil Corporation, TotalEnergies, AMSOIL INC., Chevron Overseas Limited, Eurol, Caltex Lubricants, Shell, ENGEN PETROLEUM LTD, Puma Energy, HP Lubricants, Petronas, Motul, Lukoil |

Market Dynamics

Driver: Electrification, Energy Efficiency, and Demand for High-Performance Lubricants

The global lubricants market is being driven by technology shifts in transportation and industrial systems that increase demand for high-performance fluids. Electrification in mobility is creating demand for new lubricant categories such as thermal management fluids, dielectric coolants, and e-axle gear oils. At the same time, internal combustion engine platforms are transitioning toward synthetic and semi-synthetic lubricants to meet fuel efficiency and emission standards.

In industrial applications, higher operating temperatures, increased equipment speeds, and energy efficiency requirements are driving demand for lubricants with improved oxidation resistance, thermal stability, and extended service life. Manufacturing hubs such as China, Germany, the United States, Japan, and South Korea are increasingly adopting advanced lubricant formulations to reduce downtime, improve asset reliability, and lower total operating costs.

Restraint: Base Oil Price Volatility and Structural Demand Shifts

Growth in the lubricants market is constrained by volatility in crude oil prices and base oil supply availability, which directly affects production costs and pricing stability. Fluctuations in Group II and Group III base oil supply increase formulation costs and compress margins for lubricant blenders, particularly smaller manufacturers.

In addition, the growing adoption of electric vehicles reduces demand for conventional passenger vehicle engine oils, creating structural pressure on high-volume lubricant segments. Compliance with environmental regulations related to waste oil disposal and emissions also increases operating costs and slows market expansion in price-sensitive regions.

Opportunity: Circular Lubrication Models and Digital Condition Monitoring

The lubricants market presents opportunities through circular economy practices and digital maintenance technologies. Re-refining and reuse of used lubricating oil allow recovery of high-quality base stocks with lower lifecycle emissions, supporting cost efficiency and regulatory compliance.

Digital oil condition monitoring enables predictive maintenance by tracking viscosity degradation, contamination, and additive depletion in real time. This supports longer drain intervals and increases adoption of premium synthetic lubricants in industrial, automotive, marine, and energy applications, positioning advanced formulations as enablers of operational efficiency and sustainability.

Value Chain Analysis

- Raw Material Acquisition and Refining: This involves the exploration and extraction of crude oil, followed by the complex refining process to produce base oils.

- Key Players: ExxonMobil, Shell, BP, Chevron, TotalEnergies, Sinopec, PetroChina, Indian Oil Corporation, and HPCL.

- Blending and Manufacturing: In this, base oils are blended with various additives to create finished lubricant products with specific performance characteristics for different applications.

- Key Players: Fuchs, Valvoline, Petronas Lubricants International, Carl Bechem, and ExxonMobil.

- Logistics and Distribution: In this finished lubricants are transported from manufacturing sites to regional distribution centers, wholesalers, and retail outlets.

- Key Players: DHL Group, FedEx Logistics, Shell, Indian Oil, and Castrol.

- End-User Consumption and Service:In this, customers purchase and use lubricants in machinery and vehicles for friction reduction, heat dissipation, and corrosion prevention.

- Key Players: Maruti Suzuki and Tata Motors.

- Waste Management and Circularity:After their service life, used lubricants are collected from workshops and industrial sites.

- Key Players: Min Oils Ltd., Lubreff Bangladesh Ltd., and TotalEnergies.

Segmental Insights

Product Insights

How Mineral Oil Segment Dominated the Lubricants Market?

The mineral oil segment led the market share 64.78% in 2025. The growing demand from various industrial processes like mining, metalworking, and power generation helps in the market growth. Mineral oils are inexpensive and easily available across various industries. The growing automotive industry increases demand for mineral oil to maintain vehicle components' lifespan, engine performance, and fuel efficiency. The growing expansion of the automotive sector and rapid industrialization fuel demand for mineral oil. The growing demand from various sectors like industrial machinery, the marine sector, automotive, and agriculture drives the overall growth of the market.

The synthetic oil segment is the fastest growing in the market during the forecast period. The growing production of high-performance vehicles increases demand for synthetic oil. The growing demand for various industrial machinery, like manufacturing, mining, and construction, helps in the market growth. Synthetic oils provide better thermal breakdown & oxidation resistance and consist uniform molecular structure. They offer stable viscosity and reduce friction between engine components. Synthetic oils minimize volatility and reduce environmental impact. The growing demand from the defense and aerospace sector supports the overall growth of the market.

Application Insights

Why did the Automotive Segment Dominate the Lubricants Market?

The automotive segment dominated the lubricants market share 55.61% in 2025. The growing number of vehicles, like commercial vehicles and passenger cars, increases demand for lubricants. The increasing demand for repairing and maintaining vehicles helps in the market growth. The growing adoption of fuel-efficient vehicles increases demand for lubricants. The growing advancements in engine technology in modern vehicles fuel demand for high-performance lubricants. The growing vehicle ownership helps in the market growth. The growing automotive industry in countries like Brazil, China, & India, and the growing production of a wide range of vehicles, drives the overall growth of the market.

The industrial segment experiences the fastest growth in the market during the forecast period. The growing industrialization in various sectors like mining, manufacturing processes, and construction increases demand for industrial lubricants. These lubricants prevent corrosion, friction, and wear in machinery. Industrial lubricants extend equipment lifespan and preferred choice for various applications. These lubricants minimize maintenance costs and ensure smooth operation. The growing agriculture, power generation, and construction sectors increase demand for industrial lubricants. The increasing demand across various applications like compressor lubrication, metalworking, gear lubrication, and hydraulic systems supports the overall growth of the market.

Regional Insights

The Asia Pacific hair lubricants market is expected to increase from USD 69.03 billion in 2025 to USD 100.81 billion by 2034, growing at a CAGR of 3.86% throughout the forecast period from 2025 to 2035.The rapid industrialization in the region, including mining, manufacturing, and construction, increases demand for lubricants. The growing production of vehicles and the rising expansion of the automotive industry help in the market growth. The growing investment in infrastructure development increases demand for lubricants. The growing consumer spending on goods & services like vehicles, fuel adoption of lubricants. The booming construction sector in the region increases demand for lubricants. Additionally, growing vehicle ownership and rapid industrial growth in countries like India & China drive the overall growth of the market.

China Lubricants Market Trends

China is a major contributor to the market. The growing sales and production of vehicles increase demand for various lubricants like transmission fluids, greases, engine oils, and many others. The growing expansion of a manufacturing base, like equipment manufacturing and machinery, helps in the market growth. The strong government support for the construction and automotive industry increases demand for lubricants. The growing production of electric vehicles is fueling demand for lubricants. The growing mining sector, especially for gold, coal, and iron ore, leads to a need for heavy machinery, driving overall growth of the market.

- China exported 189,229 shipments of the lubricant.(Source: volza.com)

- China exported 186,080 shipments of engine oil.(Source: volza.com)

Why Lubricants Market Growing in India?

India is significantly growing in the lubricants market. The growing sales of two-wheelers and passenger vehicles increase the demand for lubricants like engine oils. The rising disposable incomes and growing spending on personal vehicles help in the market growth. The growing expansion of various industries like construction, manufacturing, and mining leads to higher demand for lubricants. The growing development of infrastructure projects increases demand for heavy machinery is fueling demand for lubricants. The growing focus on maintaining vehicles and purchasing more vehicles increases the consumption of lubricants. The growing adoption of electric vehicles supports the overall growth of the market.

- From October 2023 to September 2024, India exported 7315 shipments of the oil lubricant. (Source: volza.com)

- From October 2023 to September 2024, India exported 4249 shipments of engine oil.(Source: volza.com)

- India exported 17,409 shipments of automotive lubricants.(Source: volza.com)

How is North America the Fastest Growing in the Lubricants Market?

North America experiences the fastest growth in the market during the forecast period. The growing expansion of various sectors like mining, manufacturing, and construction in the region increases demand for various lubricants like turbine oils, metalworking fluids, and hydraulic oils. The growing demand for commercial & passenger vehicles and the increasing production of vehicles help in the market growth.

The stringent environmental regulations fuel the adoption of synthetic & bio-based lubricants. The ongoing technological advancements in lubricant formulations help the market growth. The growing aerospace industry, like aircraft maintenance & manufacturing, increases demand for lubricants for various components like landing gear, engines, and hydraulics. The growing production in various sectors like energy, automotive, and manufacturing drives the overall growth of the market.

United States Lubricants Market Trends

The United States is a key contributor to the market. The presence of diverse industrial sectors like energy, manufacturing, and construction increases demand for lubricants. The aging vehicle fleet and the rise of electric vehicles help in the market growth. The growing innovations in the lubricants sector and stringent environmental regulations increase the production of bio-based & synthetic lubricants. The well-established logistics & transportation infrastructure fuels demand for lubricants. The well-developed marine and aerospace industries contribute to the overall growth of the market.

- The United States exported 381,986 shipments of the lubricant.(Source:volza.com)

- The United States exported 518,403 shipments of lubricating oil.(Source: volza.com)

- The United States exported 113,214 shipments of engine oil.(Source: volza.com)

How will Europe influence the Lubricants Market?

Europe is regarded as a notably growing region, primarily due to its strict environmental regulations, strong emphasis on technological innovation, and robust automotive and industrial base. Major global chemical and lubricant manufacturers, such as Shell, BP, TotalEnergies, and FUCHS, are based in Europe and invest heavily in research and development. These companies strive to meet the demanding requirements of modern machinery and vehicles for efficient and reliable operation.

In addition, tightening emissions standards and sustainability mandates are accelerating the development of low-viscosity and bio-based lubricant formulations. Strong demand from advanced manufacturing, renewable energy installations, and electric vehicle production is expanding application scope. Collaboration with automotive OEMs and industrial equipment manufacturers is supporting co-development of application-specific lubricants. Europe’s mature testing, certification, and regulatory frameworks also enable faster validation and market entry of next-generation lubricant products.

Germany Lubricants Market Trends

Germany stands out as a notable market within Europe, known for its strong manufacturing and automotive sectors. As a center for research and development, Germany is a significant producer of specialty lubricants, with local players like Fuchs Petrolub SE competing against global brands. The market is shifting towards synthetic and bio-based lubricants, driven by stringent environmental regulations, including the EU's emission standards, and an increasing focus on fuel efficiency and sustainability.

Emergence of Latin America in the Lubricants Market

Latin America is also a rapidly growing region in the global market, largely due to strong demand from its expansive automotive sector and robust activities in heavy industries such as construction, mining, and power generation. Countries like Chile, Peru, and Colombia have significant mining operations that require high-performance synthetic lubricants to ensure the longevity of heavy machinery operating in harsh conditions. However, compared to other regions, the adoption of EVs in Latin America has been slower, primarily due to limited charging infrastructure outside major urban centers.

In addition, sustained investment in infrastructure development is increasing demand for lubricants used in earthmoving equipment and power generation assets. High operating temperatures, dust exposure, and extended duty cycles are reinforcing the need for advanced formulations with strong thermal and oxidation stability. Regional manufacturers and distributors are expanding product availability to serve remote industrial sites. Gradual improvements in regulatory standards and equipment modernization are also supporting steady market expansion across industrial end-use segments.

Brazil Lubricants Market Trends

Brazil is a major consumer of finished lubricants in Latin America, driven by its substantial automotive fleet and expanding industrial and agricultural sectors. It serves as a major production hub for the region, featuring a competitive landscape with both international companies and strong local firms like Petrobras. While the market has been primarily supported by mineral oil-based lubricants, there is a growing demand for higher-performance synthetic and semi-synthetic products.

How will The Middle East and Africa contribute to the Lubricants Market?

The Middle East and Africa are key contributors to the global market. This growth is attributed to rapid industrialization, significant infrastructure development, and an expanding automotive sector. The rising middle class, increased consumer purchasing power, and growing vehicle ownership in countries such as South Africa, Nigeria, the United Arab Emirates, and Saudi Arabia also foster this demand. Consequently, the need for automotive lubricants has surged to support heavy-duty mining equipment operating under extreme conditions.

In addition, large-scale mining, oil and gas, and construction projects are increasing demand for high-performance lubricants with strong thermal and oxidation stability. Harsh operating environments, including high temperatures and dust exposure, are reinforcing the need for advanced formulations that extend equipment service intervals. Government-led infrastructure programs are further supporting sustained consumption across industrial and commercial vehicle fleets. Expansion of local blending and distribution networks is also improving product availability in remote and high-growth areas.

Saudi Arabia Lubricants Market Trends

Saudi Arabia plays a crucial role in this region. The market is experiencing a shift towards premium synthetic lubricants and the development of e-fluids for the future EV market, while conventional mineral oils still dominate. The Kingdom is strategically positioning itself as a major producer and potential exporter of lubricants and base oils, leveraging its abundant petrochemical resources.

Recent Developments

- In December 2025, two-wheeler aftermarket platform Partnr announced the nationwide launch of its branded spare parts and lubricants portfolio, signaling its entry into organized two-wheeler components for internal combustion engines and electric vehicles. The new range of Partnr Genuine Spares & Lubricants is set to address challenges in India’s two-wheeler aftermarket.(Source: auto.economictimes.indiatimes.com)

- In October 2025, Researchers have developed a new class of nontoxic, biodegradable solid lubricants that can be used to facilitate seed dispersal using modern farming equipment, with the goal of replacing existing lubricants that pose human and environmental toxicity concerns. The researchers have also developed an analytical model that can be used to evaluate candidate materials for future lubricant technologies.(Source: www.eurekalert.org)

Top Companies List

- CASTROL LIMITED

- FUCHS

- ExxonMobil Corporation

- TotalEnergies

- AMSOIL INC.

- Chevron Overseas Limited

- Eurol

- Caltex Lubricants

- Shell

- ENGEN PETROLEUM LTD

- Puma Energy

- HP Lubricants

- Petronas

- Motul

- Lukoil

Segments Covered

By Product

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Application

- Automotive

- Engine Oil

- Gear Oil

- Transmission Oil

- Brake Fluids

- Coolants

- Greases

- Industrial

- Process Oils

- General Industrial Oils

- Industrial Engine Oil

- Process Oil

- Metalworking Fluids

- Greases

- Others

- Marines

- Hydraulic Oil

- Turbine Oil

- Engine Oil

- Gear Oil

- Greases

- Others

- Aerospace

- Gas Turbine Oil

- Piston Engine Oil

- Hydraulic Fluids

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait