Content

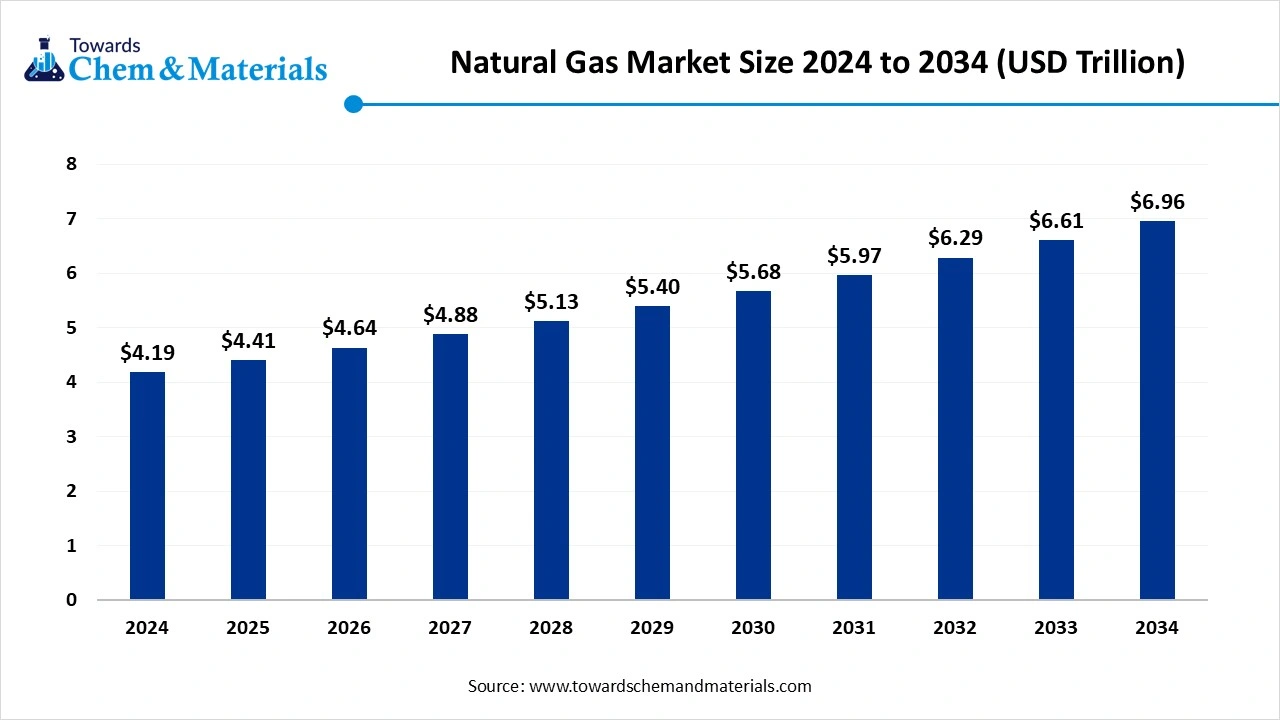

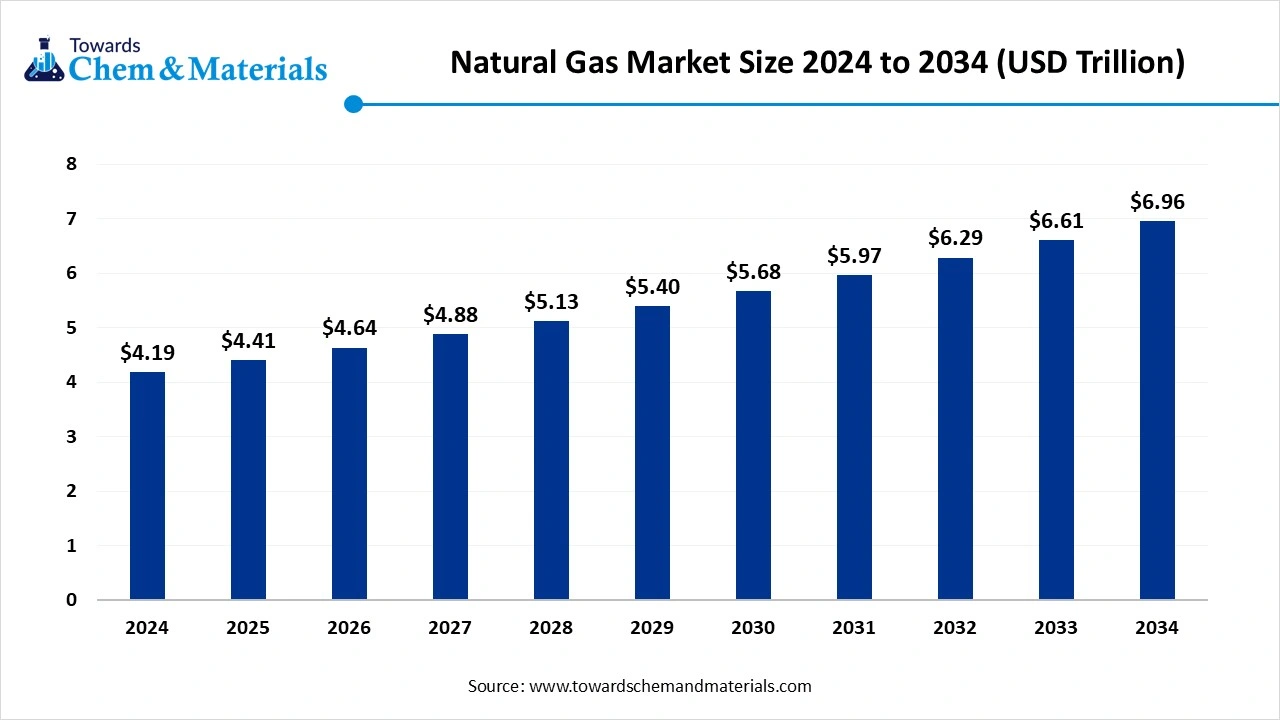

Natural Gas Market Size and Growth 2025 to 2034

The global natural gas market size accounted for USD 4.19 trillion in 2024 and is predicted to increase from USD 4.41 trillion in 2025 to approximately USD 6.96 trillion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034. Growing demand for cleaner energy sources is the key factor driving market growth. Also, the major transition towards sustainable energy solutions coupled with technological innovations in the extraction process can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the global natural gas market with the largest share in 2024. The dominance of the region can be credited to the rapid economic growth, industrialization and surge in population in nations.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be attributed to the raised emphasis on minimizing carbon emissions and supporting renewable energy integration.

- By resource type, the unconventional segment dominated the market in 2024. The dominance of the segment can be attributed to the growing energy need and demand for cleaner energy sources.

- By resource type, the liquified natural gas segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in investment and global demand for LNG export facilities.

- By end-use application, the power generation segment held the largest natural gas market share in 2024. The dominance of the segment can be linked to an increasing focus on cleaner energy sources and their low carbon emission property.

- By end-use application, the residential segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by ongoing government initiatives, rising energy demand, and expansion of infrastructure.

- By distribution method, the pipeline segment held the largest market share in 2024. The dominance of the segment is owning to the expansion of global and regional energy connectivity coupled with the rising demand for natural gas.

- By distribution method, LNG carrier segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the increasing need for liquefied natural gas (LNG) globally.

Growing Demand in Industrial Applications is Expanding Market Growth

The market includes the manufacturing, transportation, processing, distribution, and sale of natural gas a fuel composed of methane. It also involves different activities that are required for the extraction of gas. The market is distinguished by regional differences; some areas are highly developed and other depends on long-term contracts with totally different pricing mechanisms. The four major gas markets are European, North American, Asian, and Central and South (Latin) American. Natural gas is traded on both financial and physical markets. Physical markets include the actual delivery of gas and financial markets enable speculation and price hedging.

What Are the Key Trends Influencing the Natural Gas Market?

- The growth in the market is due to a surge in global economic activity along with the rise in the utilization of electricity especially in developing nations. Natural gas is mainly used in gas turbines and steam turbines to generate electricity. This can be further used to generate electricity at lower costs.

- Natural gas and crude oil extraction companies are making substantial renewable energy sources for the eco-friendly extraction of natural gas and crude oil from oil fields. Natural gas and crude oil production are energy intensive and technologies such as wind, solar, biomass and geothermal are increasingly being used in producing natural gas and crude oil.

- Government initiatives that aim at expanding natural gas pipeline infrastructure and consumption of natural gas are another trend propelling market growth. The growth of LNG infrastructure optimizes the distribution and import of natural gas, promoting a stable supply to fulfil the extensive demand for natural gas.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.41 Trillion |

| Expected Size by 2034 | USD 6.96 Trillion |

| Growth Rate from 2025 to 2034 | CAGR 5.20% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Resource Type, By End-Use Application, By Distribution Method, By Region |

| Key Companies Profiled | ExxonMobil, Chevron, Royal Dutch Shell, TotalEnergies, BP, Gazprom, Qatar Petroleum, ONGC (Oil and Natural Gas Corporation), Reliance Industries Limited, Eni S.p.A., ConocoPhillips, Equinor, Petronas, Sempra Energy |

How is the Government Supporting the Natural Gas Market?

The Indian government is supporting the market through different initiatives meant to raise its share in expanding infrastructure, and energy mix, and optimizing domestic production. These efforts like supporting city gas distribution networks, growth in the natural gas grid, and providing incentives for natural gas exploration and production. The government has implemented a major initiative HELP to promote exploration and production via revenue-sharing contracts and open acreage licensing.

The U.S. government supports the market through different initiatives and policies aimed at improving infrastructure, fuelling production, and vacillating exports. These also include infrastructure development, deregulation, and diplomatic efforts to promote American LNG exports. The Federal Energy Regulatory Commission (FERC) is working on changing the approval process for Liquefied Natural Gas (LNG) export projects.

Market Opportunity

Surge in Role of Natural Gas as a Transition Fuel

The rising role of natural gas as a transition fuel across the globe is the major factor creating lucrative opportunities in the market. Various industries and governments are adopting natural gas as a sustainable and cleaner alternative to conventional fossil fuels, contributing to lower emissions of carbon. Furthermore, the growth of the liquefied natural gas (LNG) infrastructure is a substantial trend, improving the flexibility of global natural gas trade.

- In January 2025, The Indian Gas Exchange (IGX) announced the expansion of long-duration contracts for 3-6 months. The launch further follows approval from the Petroleum and Natural Gas Regulatory Board (PNGRB). The LDCs are created to provide market participants with greater flexibility.(Source: energy.economictimes)

Market Challenge

Regulatory and Environmental Pressures

The market is facing regulatory hurdles, especially around operational permits and methane emissions. The Environmental Protection Agency (EPA) has implemented stringent methane standards, impacting operators by needing updates to infrastructure for compliance. Moreover, these changing policies can challenge production and exploration efficiency, particularly if further regulations are introduced without stable and clear guidelines for compliance.

Regional Insight

Asia Pacific dominated the natural gas market in 2024. The dominance of the region can be credited to the rapid economic growth, industrialization, and surge in population in nations such as China and India. Moreover, initiatives supporting cleaner energy sources and efforts to minimize air pollution contribute to the increasing use of natural gas. Improved infrastructure projects to expand LNG import terminals and pipeline networks play a crucial role in optimizing access to natural gas.

Natural Gas Market in China

In Asia Pacific, China dominated the market by holding a large market share due to the ongoing strategic goals for energy security and growing demand for low-carbon transition. The country is actively strengthening domestic production, especially of traditional sources such as shale gas, while also heavily depending on imports through LNG and pipelines. The Chinese government is working towards market-oriented solutions to transform the natural gas industry.

- In March 2025, woodside signed a purchase agreement with China Resources Gas International Limited. The deal underscores the depth and length of demand for LNG in developing countries as this nation seeks to give sustainable energy supplies.(Source: lngindustry.com)

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be attributed to the raised emphasis on minimizing carbon emissions and supporting renewable energy integration. Demographic advantages like high population density and a strong industrial base in urban areas support this increased demand. In addition, countries such as the U.S. and Canada have well-established infrastructure and substantial natural gas resources for production and export.

Natural Gas Market in the U.S.

In North America, the U.S. led the market owing to the strong presence of major market players in the country like Chevron Corporation, Exxon Mobil, and Conoco Phillips. These players keep a competitive edge through substantial investments in LNG infrastructure along with strategic partnerships. Also, their emphasis on sustainable energy alternatives and carbon management initiatives helps to expand their market reach in the country.

Which are the Top Countries in Natural Gas Production in 2023?

| Country | Natural gas production (bcm) |

| United States | 1,084 |

| Russia | 669 |

| Iran | 292 |

| China | 272 |

| Canada | 216 |

(Source:yearbook.enerdata.net)

Segmental Insight

Resource Type Insight

Which Resource Type Segment Held The Largest Natural Gas Natural Gas Market Share In 2024?

The unconventional segment dominated the natural gas market in 2024. The dominance of the segment can be attributed to the growing energy need and demand for cleaner energy sources. These unconventional sources need innovative extraction technologies such as horizontal drilling and hydraulic fracturing to be accessed. Also, unconventional gas encompasses many types such as tight gas, shale gas, and coalbed methane each having unique extraction methods and characteristics.

Liquefied natural gas is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in investment and global demand in LNG export facilities along with its extensive adoption in both power generation and industrial applications. Additionally, LNG enables the smooth transportation of natural gas across large distances, joining supply sources with demand centres across the globe.

- In May 2025, POSCO group unveiled its latest liquified natural gas carrier, stepping a major step towards its push to grow into the global market. The move is aimed at maintaining a stable energy transport network to improve the company's capability to navigate supply chain disruptions.(Source: chemanalyst)

End-Use Application Insight

Why did power generation segment dominate the natural gas market in 2024?

The power generation segment led the market in 2024. The dominance of the segment can be linked to an increasing focus on cleaner energy sources and their low carbon emissions property. The extensive conversion of coal-fired plants to natural gas and ongoing government incentives have boosted the demand for natural gas in the market. Economic development and population growth have fuelled the demand for electricity.

The residential segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by ongoing government initiatives, rising energy demand, and expansion of infrastructure. Enhancements in gas infrastructure and appliances are making natural gas more appealing and efficient for residential use. Natural gas is increasingly utilized for heating homes, especially during colder months.

Distribution Method Insight

How Did Pipeline Segment Dominate The Natural Gas Market In 2024?

The pipeline segment held the largest natural gas market share in 2024. The dominance of the segment is owning to the expansion of global and regional energy connectivity coupled with the rising demand for natural gas. Moreover, the ongoing shift towards natural gas as a sustainable energy source as compared to other fuels is also propelling the expansion of pipeline infrastructure. Governments across the globe are investing heavily in energy infrastructure such as natural gas pipelines.

LNG carriers are expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the increasing need for liquefied natural gas (LNG), growth in LNG trade routes, and an upsurge in investments in LNG infrastructure. Furthermore, the development of export facilities and new liquefaction in Qatar, Mozambique, the US, and Australia is expanding LNG across the world.

Recent Developments

- In May 2025, Amplify ETFs in partnership with Samsung Asset Management announced the launch of Amplify Samsung U.S. Natural Gas Infrastructure ETF, providing exposure to companies empowering the U.S. natural gas market.(Source: globenewswire)

- In December 2024, BP and XRG finalized the deal to launch a new natural gas platform called Arcius Energy. The new venture integrates technical expertise and has good track records for both companies, aiming to create a highly competitive natural gas portfolio.(Source: chemanalyst)

Top Companies List

- ExxonMobil

- Chevron

- Royal Dutch Shell

- TotalEnergies

- BP

- Gazprom

- Qatar Petroleum

- ONGC (Oil and Natural Gas Corporation)

- Reliance Industries Limited

- Eni S.p.A.

- ConocoPhillips

- Equinor

- Petronas

- Sempra Energy

Segments Covered

By Resource Type

- Conventional Natural Gas

- Unconventional Natural Gas (Shale Gas, Tight Gas, Coalbed Methane)

- Liquefied Natural Gas (LNG)

By End-Use Application

- Power Generation

- Industrial Use

- Residential

- Commercial

- Transportation

By Distribution Method

- Pipelines

- LNG Carriers

- Compressed Natural Gas (CNG)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait