Content

What is the Current Conductive Polymers Market Size and Volume?

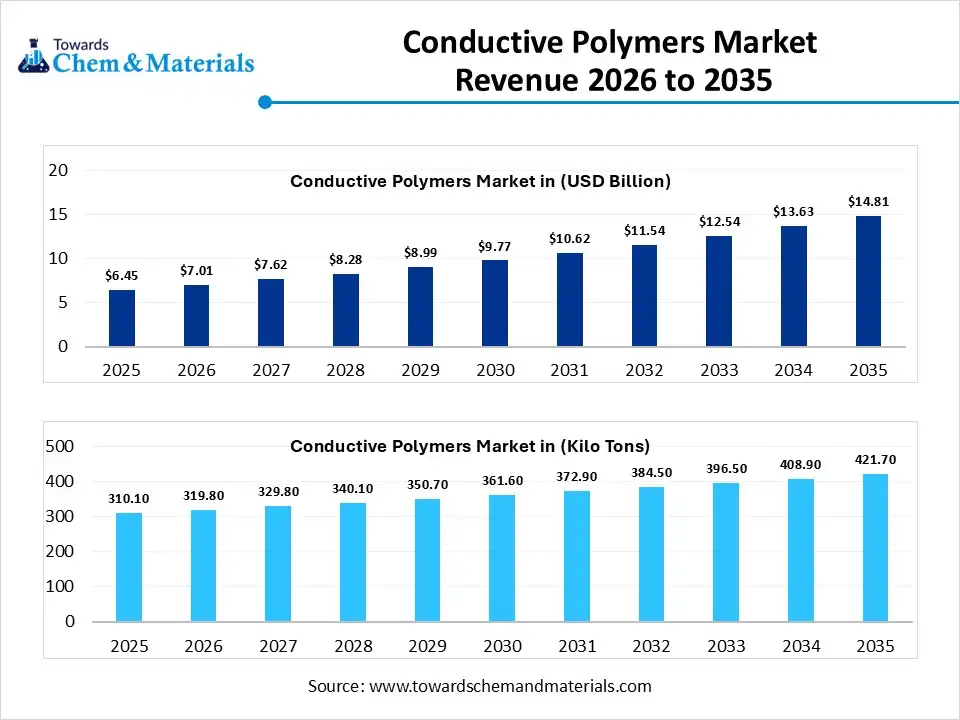

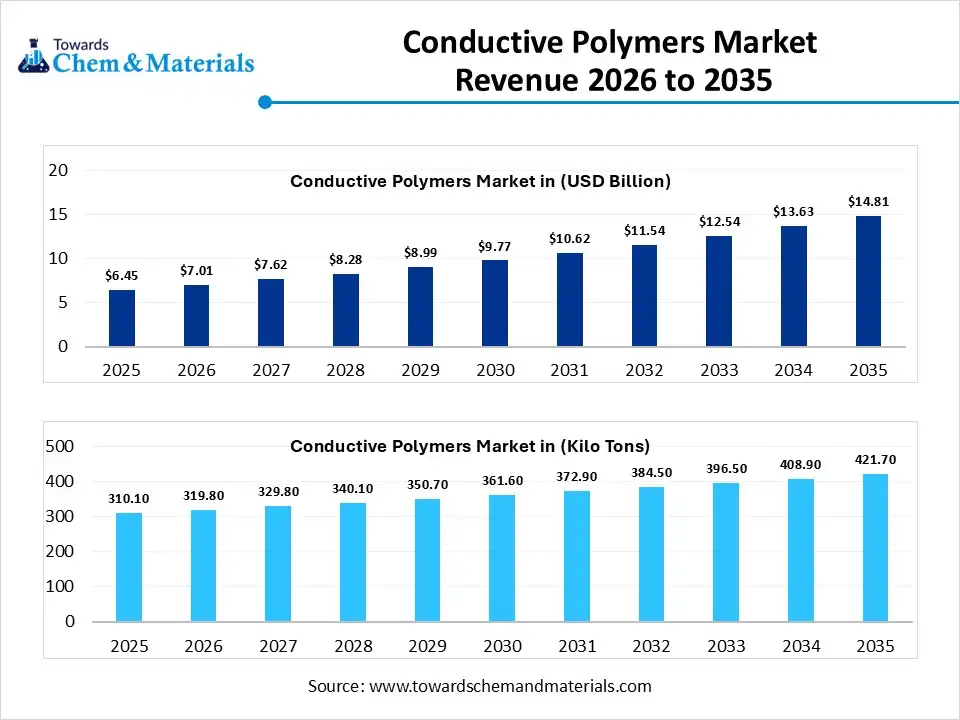

The global conductive polymers market size was estimated at USD 6.45 billion in 2025 and is expected to increase from USD 7.01 billion in 2026 to USD 14.81 billion by 2035, growing at a CAGR of 8.67% from 2026 to 2035. In terms of volume, the market is projected to grow from 214.5 kilo tons in 2025 to 481.0 kilo tons by 2035 growing at a CAGR of 8.41% from 2026 to 2035. Asia Pacific dominated the conductive polymers market with the largest volume share of 46.12% in 2025. The growing polymer demand in the automotive and electronics sectors is the key factor driving market growth. Also, ongoing innovations in manufacturing technology, coupled with the global push towards sustainable solutions, can fuel market growth further.

Market Highlights

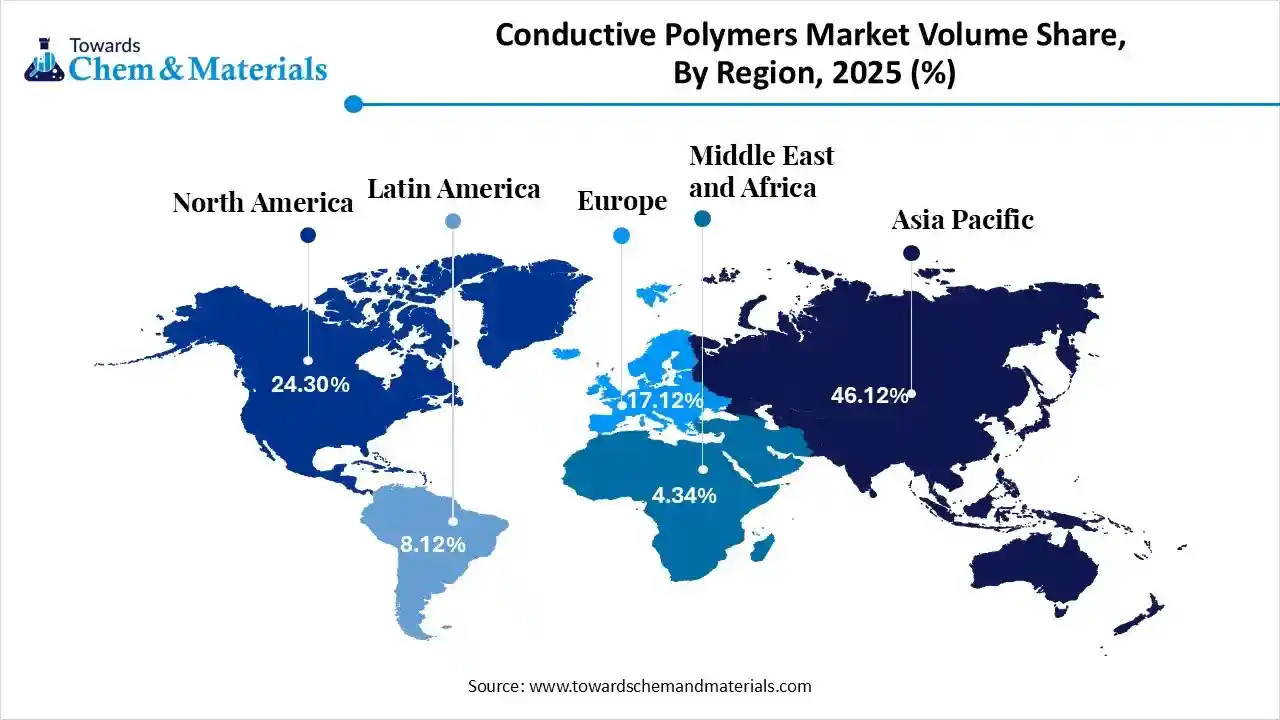

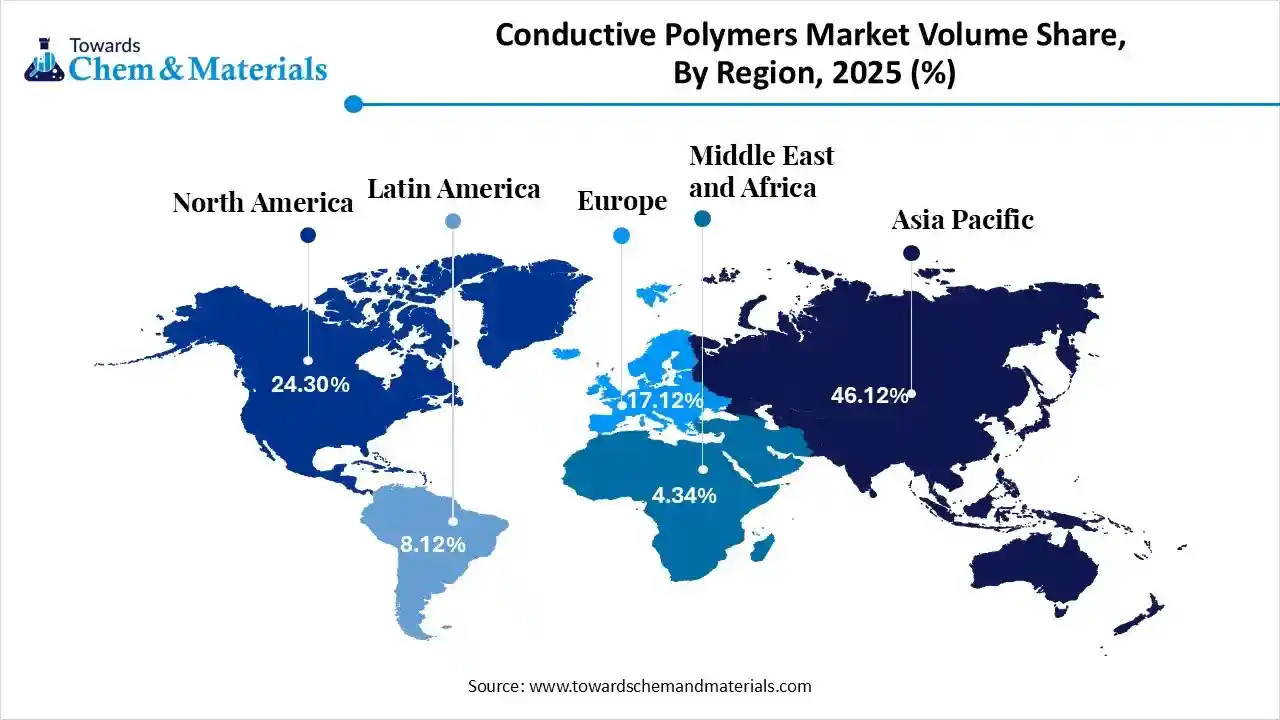

- The Asia Pacific dominated the global conductive polymers market with the largest volume share of 46.12% in 2025.

- The conductive polymers market in North America is expected to grow at a substantial CAGR of 10.27% from 2026 to 2035.

- The Europe conductive polymers market segment accounted for the major volume share of 17.12% in 2025.

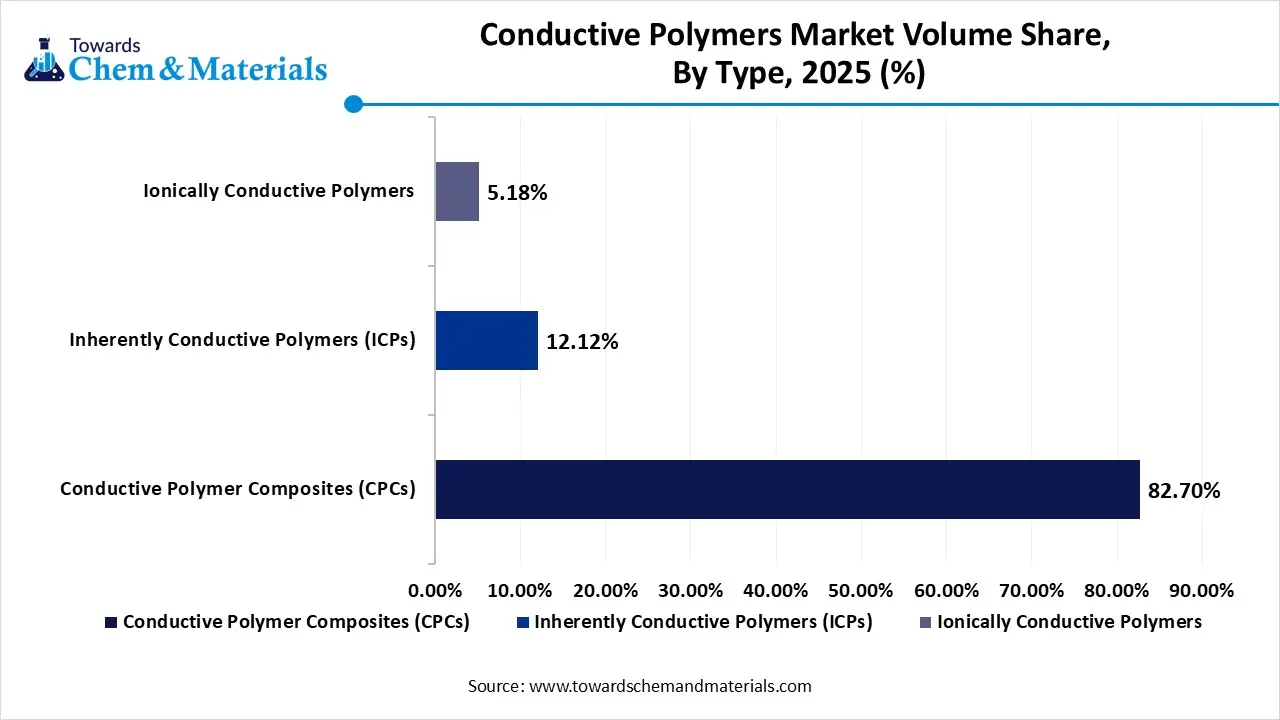

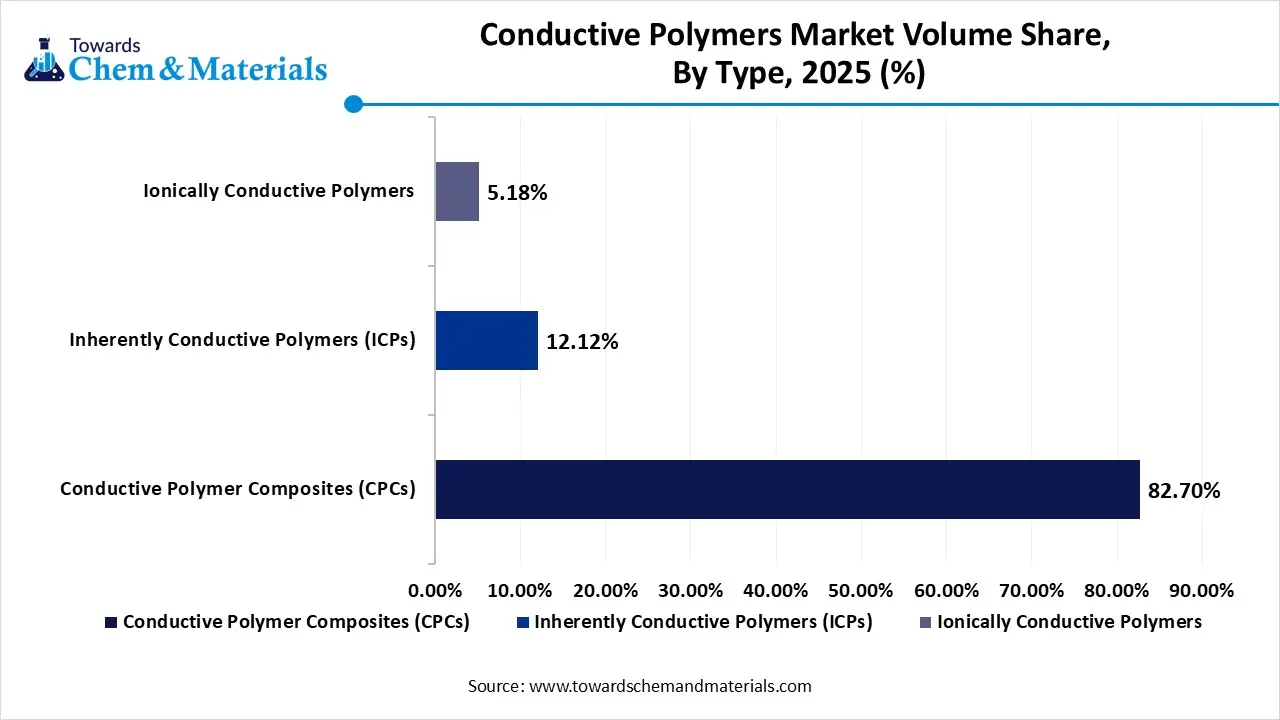

- By type, the conductive polymer composites segment dominated the market and accounted for the largest volume share of 82.70% in 2025.

- By type, the inherently conductive (ICPs) segment is expected to grow at the fastest CAGR of 11.26% from 2026 to 2035 in terms of volume.

- By material, the polyaniline (PANI) segment led the market with the largest revenue volume share of 36.0% in 2025.

- By application, the ESD/EMI shielding segment dominated the market and accounted for the largest volume share of 42.8% in 2025.

- By end use, the electrical & electronics segment led the market with the largest revenue volume share of 41.5% in 2025.

What are Conductive Polymers?

Conductive polymers are organic polymers that conduct electricity. They combine the mechanical properties (flexibility, lightweight, and ease of processing) of plastics with the electrical properties of metals. This market focuses on materials like Polyaniline (PANI) and PEDOT, which are replacing traditional inorganic conductors in applications requiring flexibility, such as wearable electronics, bio-implants, and advanced energy storage systems.

Conductive Polymers Market Trends

- The growing demand for advanced electronic devices is the latest trend in the market. This factor boosts the adoption of conductive polymers in different applications such as sensors, printed circuit boards, and other electronic components.

- The surge in the use of lightweight materials is shaping positive market growth in the near future. These materials can be utilized in the form of conducting materials. Also, increasing defence spending by major economies in North America and the Asia Pacific region can contribute to market expansion further.

- The growing demand for flexible electronics is another major trend in the market. These polymers are known for their exceptional mechanical flexibility and electrical conductivity, which are being combined into different applications like wearable devices.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 7.01 Billion / 319.8 Kilo Tons |

| Revenue Forecast in 2035 | USD 14.81 Billion / 421.7 Kilo Tons |

| Growth Rate | CAGR 8.67% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type (Conduction Mechanism), By Material, By Application Area, By End-Use Sector, By Region |

| Key companies profiled | 3M Company, Heraeus Group, SABIC, Solvay S.A., The Lubrizol Corporation, Covestro AG, Celanese Corporation, Arkema S.A., Agfa-Gevaert Group, Avient Corporation (formerly PolyOne), RTP Company, Premix Group |

How Cutting-Edge Technologies Are Revolutionizing the Conductive Polymers Market?

The market is experiencing a major revolution, driven by advanced technologies like nanotechnology, artificial intelligence (AI), and innovative additive manufacturing in material design. Furthermore, this advanced technology optimises the fabrication of convenient designs, necessary for various applications like biomedical implants and soft robotics.

Trade Analysis of Conductive Polymers Market: Import & Export Statistics

Exports

- In 2024, the United States exported $369M of Natural Polymers, being the 461st most exported product in the United States.

- In 2024, the main destinations of the United States' Natural Polymers exports were: Japan ($64.3M), the Netherlands ($45.9M), Canada ($43.8M), Belgium ($43.3M), and China ($31M).

Imports

- In 2024, the United States imported $475M of Natural Polymers, being the 534th most imported product in the United States.

- In 2024, the main origins of the United States' Natural Polymers imports were: China ($112M), Sweden ($87.6M), Austria ($77M), Norway ($42.8M), and France ($25.9M).

Conductive Polymers Market Value Chain Analysis

- Feedstock Procurement: It is the process of acquiring necessary raw materials, such as monomers and conductive fillers, for further manufacturing of conductive polymers.

- Major Players:3M Company, Agfa-Gevaert Group

- Chemical Synthesis and Processing: It refers to the industrial methods used to produce inherently conductive polymers such as polypyrrole (PPy) and polyaniline (PANI) from their base monomers.

- Major Players: SABIC, Solvay SA

- Packaging and Labelling: This stage emphasizes using these materials to manufacture anti-static packaging for delicate electronic components.

- Major Players: Avient Corporation, Premix Group

- Regulatory Compliance and Safety Monitoring: This stage involves adhering to a complex network of national and international standards that emphasize ensuring product quality and workplace safety.

- Major Players: Arkema S.A, SABIC

Conductive Polymers Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (US) | The use and disposal of chemicals are primarily regulated under the Toxic Substances Control Act (TSCA), administered by the Environmental Protection Agency (EPA). |

| India | The Central Pollution Control Board (CPCB) has issued guidelines for the co-processing of specific polymer wastes, like fiber-reinforced plastic (FRP) waste, in cement kilns. There is also a strong push for sustainable solutions and adherence to global standards. |

| China | It has a "2% polymer rule" similar to other regions, where polymers containing existing reactants that constitute less than 2% w/w of the final product may not be considered new substances. |

Segmental Insights

Type Insights

How Much Share Did the Conductive Polymer Composites Segment Held in 2025?

The conductive polymer composites segment dominated the market with 82.70% share in 2025. The dominance of the segment can be attributed to the growing need for flexible, lightweight, and efficient materials in the automotive and electronics sectors. In addition, these polymers are crucial in energy storage and solar cells for improved efficiency and quality.

The inherently conductive (ICPs) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing adoption of smart devices and ongoing technological innovations in the manufacturing process. ICPs provide a substantial mechanical flexibility and weight reduction necessary for portable devices and sensors.

Conductive Polymers Market Volume and Share, By Type, 2025- 2035

| By Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Conductive Polymer Composites (CPCs) | 82.70% | 177.4 | 385.4 | 9.00% | 80.12% |

| Inherently Conductive Polymers (ICPs) | 12.12% | 26.0 | 67.9 | 11.26% | 14.12% |

| Ionically Conductive Polymers | 5.18% | 11.1 | 27.7 | 10.68% | 5.76% |

Material Insights

Which Material Type Segment Dominated Conductive Polymers Market in 2025?

The polyaniline (PANI) segment held a 36.0% market share in 2025. The dominance of the segment can be linked to the rising demand for AI electronics, flexible displays, and portable devices. Furthermore, PANI provides a more metal-free and sustainable alternative to conventional conductive materials, aligning with green policies.

The PEDOT segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its capability to replace brittle metal-based conductors with more durable devices. The ongoing innovations of artificial intelligence (AI) and electronics tools have created lucrative opportunities in the market soon.

Application Insights

How Much Share Did the ESD/EMI Shielding Segment Held in 2025?

The ESD/EMI shielding segment dominated the market with 42.8% share in 2025. The dominance of the segment is owing to the rapid proliferation of cutting-edge electronics devices and the push towards flexible and lightweight materials to replace conventional metals. Also, the enforcement of strict regulations on electronic devices impels market players to use effective shielding materials.

The capacitors & energy storage segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing adoption of electric vehicles and solar panels, which boosts demand for lightweight and high-performance capacitors to store energy effectively. In addition, particularly in nanocomposites, rapid R&D, increased the overall stability and conductivity of capacitors.

End-Use Insights

How Much Share Did the Electrical & Electronics Segment Held in 2025?

The electrical & electronics segment held a 41.5% market share in 2025. The dominance of the segment can be attributed to the rising demand for lighter, smaller, and energy-efficient materials for improved flexibility and conductivity. Furthermore, the surge in e-commerce has raised the demand for anti-static bags, trays, and wraps manufactured from conductive polymers.

The automotive segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for safer, lighter, and more effective vehicles, boosted by cutting-edge electronics. These polymers offer efficient EMI and shielding against electrostatic discharge, vital for safeguarding delicate electronic components.

Regional Insights

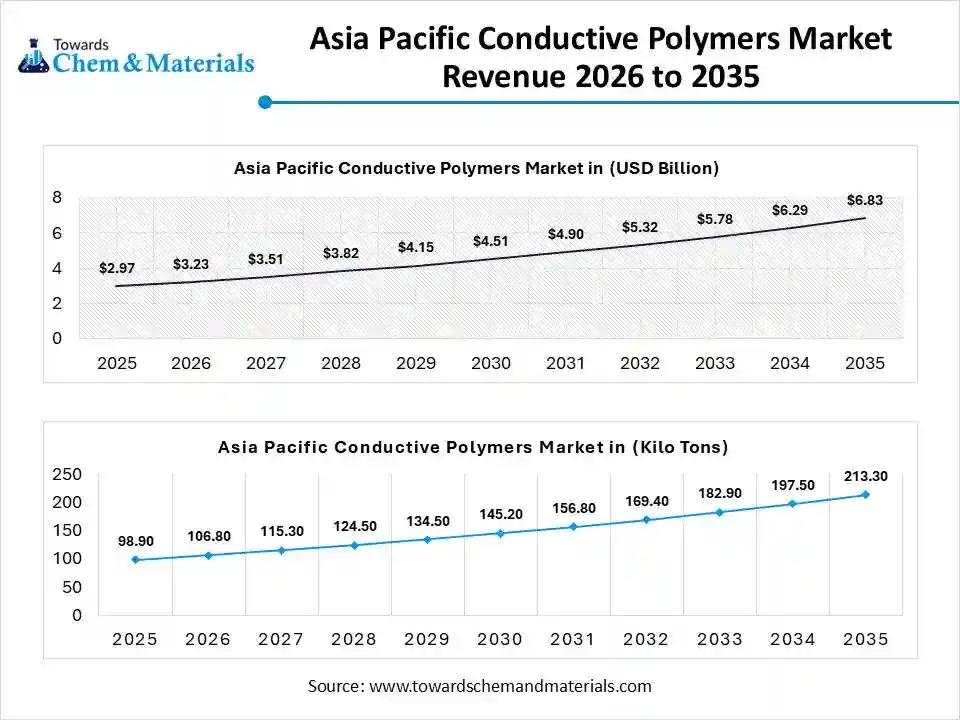

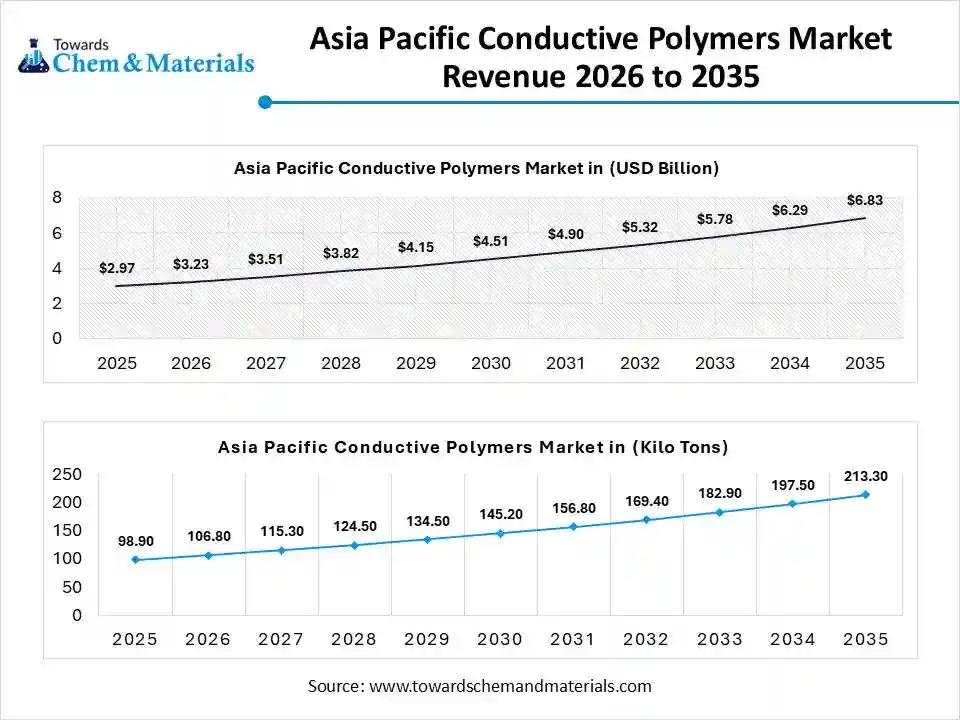

The Asia Pacific conductive polymers market size was valued at USD 2.97 billion in 2025 and is expected to be worth around USD 6.83 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.68% over the forecast period from 2026 to 2035. The Asia Pacific conductive polymers market volume was estimated at 98.9 kilo tons in 2025 and is projected to reach 213.3 kilo tons by 2035, growing at a CAGR of 8.91% from 2026 to 2035. Asia Pacific dominated the market with 46.12% share in 2025.

The dominance of the region can be attributed to the increasing need for flexible and lightweight materials in sensors, smart devices, and renewable energy sources. In addition, supportive policies for advanced electronic and renewable energy infrastructure contribute to regional expansion soon.

China Conductive Polymers Market Trends

In the Asia Pacific, China dominated the market owing to robust government support for smart production along with the extensive demand for laptops, smartphones, and tablets. Also, a surge in investments in solar panels and other projects fuels demand for conductive polymers in various applications.

North America Conductive Polymers Market Trends

The North America conductive polymers market volume was estimated at 52.1 kilo tons in 2025 and is anticipated to reach 125.7 kilo tons by 2035, growing at a CAGR of 10.27% from 2026 to 2035. North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing product demand in expanding sectors such as electronics and electric vehicles (EVs). The region benefits from a robust network of research flexibility and conductivity, impacting positive market growth. Additionally, the robust investment in R&D by companies and universities is propelling new performance improvements in the region.

U.S. Conductive Polymers Market Trends

In North America, the U.S. led the market due to growing polymer use in energy-efficient systems and other battery components. The country is a major hub for research, with rapid investment in new applications and properties such as 3D-printable and bio-based polymers.

Europe Conductive Polymers Market Trends

The Europe market volume was estimated at 36.7 kilo tons in 2025 and is anticipated to reach 86.3 kilo tons by 2035, growing at a CAGR of 9.96% from 2026 to 2035. Europe is expected to grow at a notable CAGR 9.96% over the forecast period. The Europe conductive polymers market segment accounted for the major volume share of 17.12% in 2025. The growth of the region can be driven by rapid advancements in material science and the growing demand for remote monitoring systems. Additionally, the healthcare sector in the region is a major hub for research into innovative medical devices like implantable devices and neural interfaces.

Conductive Polymers Market Volume and Share, By Region, 2025- 2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 24.30% | 52.1 | 125.7 | 10.27% | 26.13% |

| Europe | 17.12% | 36.7 | 86.3 | 9.96% | 17.95% |

| Asia Pacific | 46.12% | 98.9 | 213.3 | 8.91% | 44.34% |

| Latin America | 8.12% | 17.4 | 40.5 | 9.84% | 8.43% |

| Middle East & Africa | 4.34% | 9.3 | 15.2 | 5.57% | 3.15% |

Germany Conductive Polymers Market Trends

The growth of the market in the country can be fuelled by the strong presence of major innovators, including Covestro and Henkel. Increasing demand for flexible displays, anti-static packaging, and miniaturized components propels the adoption of ESD/RFI shielding and performance.

South America Conductive Polymers Market Trends

Latin America conductive polymers market volume was estimated at 17.4 kilo tons in 2025 and is anticipated to reach 40.5 kilo tons by 2035, growing at a CAGR of 9.84% from 2026 to 2035. South America held a major market share in 2025. The growth of the region can be propelled by growing product demand in wearables, flexible electronics, and consumer devices, boosted by a surge in disposable income and rapid urbanisation. Moreover, the growth of the Internet of Things (IoT) and telecommunications generated demand for innovative materials in connectivity components.

Brazil Conductive Polymers Market Trends

The growth of the market in the country can be boosted by its push for wind and solar energy, along with sophisticated energy storage solutions. Also, the country's robust renewable energy targets and industrial modernisation efforts create a strong base for conductive polymers.

Middle East & Africa Conductive Polymers Market Trends

The Middle East & Africa conductive polymers market volume was estimated at 9.3 million tons in 2025 and is anticipated to reach 15.2 million tons by 2035, growing at a CAGR of 5.57% from 2026 to 2035. The Middle East & Africa conductive polymers market segment accounted for the major volume share of 4.34% in 2025. The growth of the market in the Middle East & Africa can be boosted by the growing demand for lightweight, smart, and cost-effective solutions, along with a rapid shift towards EVs. Furthermore, major companies in the region, such as Covestro and Saudi Basic Industries Corporation (SABIC), have a robust regional footprint, contributing to market growth. In addition, construction projects in the region use conductive polymers for cutting-edge applications.

Saudi Arabia Conductive Polymers Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be linked to the government's support for innovative production techniques and sustainable development. The country's push for technological developments and industrial diversification positions its market for sustainable growth.

Recent Developments

- In September 2025, CSIR and Filament Factory announced the launch of nano-reinforced material. This advanced material gives improved radio frequency (RF) absorption, better electromagnetic interference (EMI) shielding, and excellent electrical conductivity.(Source: www.voxelmatters.com)

- In February 2025, Swedish startup N-ink introduced the n-type conductive inks that can be used in transport layers of perovskite solar cells. N-ink has several other advantages besides handling and performance benefits, as it allows for a fully printed PV process.(Source: www.pv-magazine.com)

Conductive Polymers Market Companies

- 3M Company: 3M Company is a leading global player in the conductive polymers market, specifically dominating the electrically conductive polymer composites segment for applications such as ESD/EMI shielding and anti-static solutions.

- Heraeus Group: Heraeus Group is a key player and pioneer in the conductive polymers market, primarily through its subsidiary Heraeus Epurio and its flagship product line Clevios™, based on PEDOT: PSS chemistry.

- SABIC

- Solvay S.A.

- The Lubrizol Corporation

- Covestro AG

- Celanese Corporation

- Arkema S.A.

- Agfa-Gevaert Group

- Avient Corporation (formerly PolyOne)

- RTP Company

- Premix Group

- Other Key Players

Segments Covered in the Report

By Type (Conduction Mechanism)

- Conductive Polymer Composites (CPCs)

- Inherently Conductive Polymers (ICPs)

- Ionically Conductive Polymers

By Material

- Polyaniline (PANI)

- Polypyrrole (PPy)

- Poly(3,4-ethylenedioxythiophene) (PEDOT)

- Polythiophene (PT)

By Application Area

- ESD & EMI Shielding

- Anti-static Packaging

- Capacitors

- Sensors & Actuators

- Batteries & Energy Storage

By End-Use Sector

- Electrical & Electronics

- Automotive

- Healthcare

- Aerospace & Defense

Other End-Use Sectors

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa