Content

Green Ammonia Market Size | Top Companies Analysis

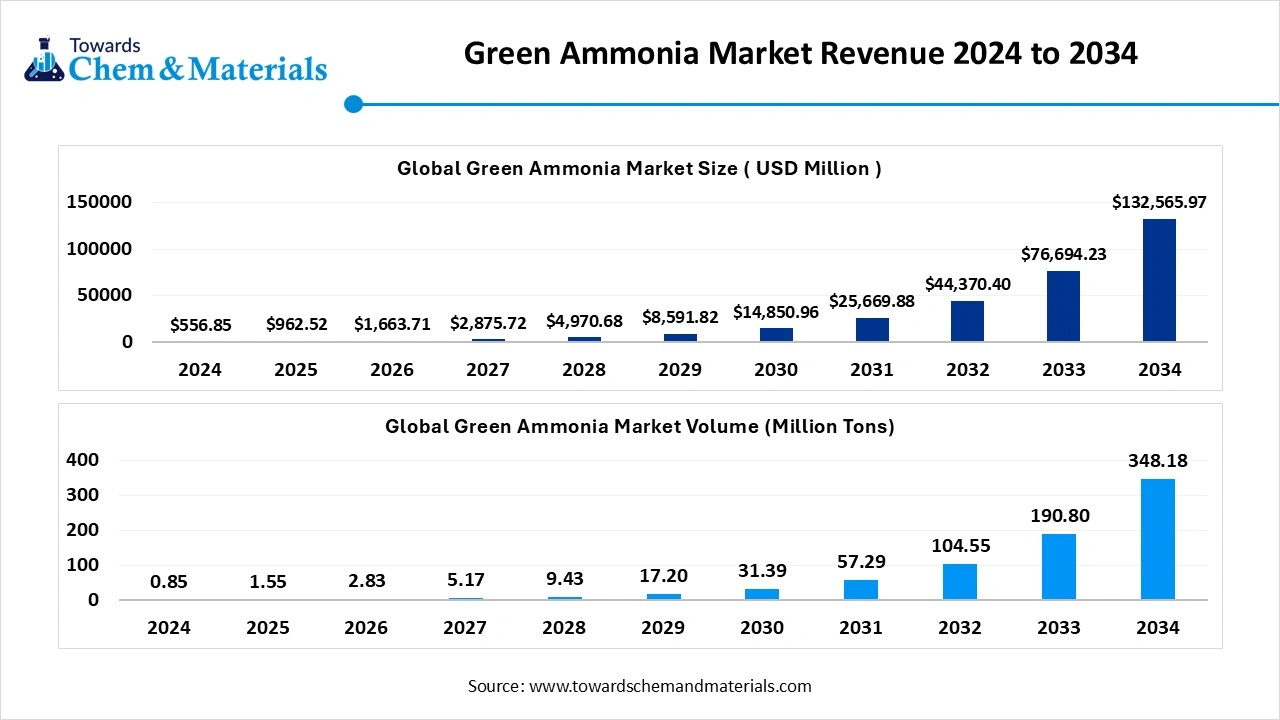

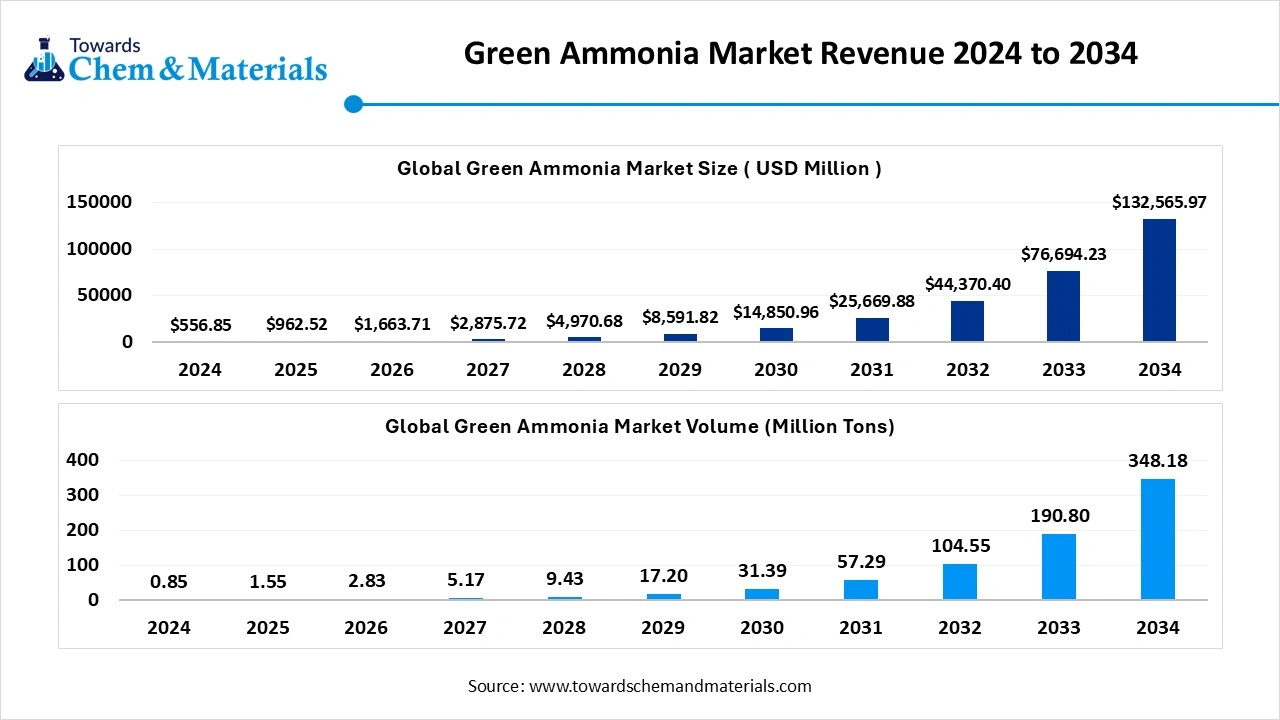

The global green ammonia market is experiencing rapid growth, with volumes expected to increase from 1.55 million tons in 2025 to 348.18 million tons by 2034, representing a robust CAGR of 82.49% over the forecast period.

The green ammonia market size is calculated at USD 556.85 million in 2024, grew to USD 962.52 million in 2025, and is projected to reach around USD 132,565.97 million by 2034. The market is expanding at a CAGR of 72.85% between 2025 and 2034. Seeing trends like increased adoption of renewable energy sources, technological advancements, the need for green fertilizers, and expansion of the shipping industry is driving the growth of the market.

Market Overview

The green ammonia market has seen stable growth in recent years as green ammonia has become a key solution for the promotion of renewable energy and reduce carbon emissions. In the production of green ammonia, wind, solar, and hydropower are essential ingredients that create hydrogen through electrolysis and then combine with nitrogen to produce ammonia. Increased need for green energy and several government initiatives towards green energy are leading the market expansion these days.

Technological advances are anticipated to increase ammonia sales during the forecast period. The producers and consumers are facing high-cost factors of green ammonia which is caused by the electrolysis process in the production of ammonia. Thus, recent technological developments can reduce the high cost of the electrolysis process by innovating advanced electrolyzer in the projection period. Manufacturers are heavily investing in research and development in the current period.

For instance, Topsoe has announced its dynamic ammonia technology. This technology can enable efficient conversion of green hydrogen to green ammonia by synthesis. They will launch the first phase by 2027.

Market Trends:

- The rapid growth of the shipping industry is fuelling market expansion in the current phase due to the increasing demand for the effective and eco-friendly alternatives to traditional fuel. Moreover, stricter government regulations can marine industry to turn toward green energy resources such as green ammonia and others.

- The increased need for green fertilizers is accelerating the demand for the advancements in the market. The agriculture sector is transforming in this modern period, farmers are actively looking for environment-friendly alternatives which leads cost efficient and greater crop production. Thus, the individuals are actively implementing ammonia-based fertiliser in the current period.

- Growing adoption of electric vehicles is stimulating market expansion of green ammonia. Ammonia is used as a key ingredient source of hydrogen for fuel cells which produce power

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 962.52 Million |

| Expected Size by 2034 | USD 132,565.97 Million |

| Growth Rate from 2025 to 2034 | CAGR 72.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | Technology Outlook, End-use Outlook, Regional Outlook |

| Key Companies Profiled | Siemens Energy, MAN Energy Solutions, Nel Hydrogen, Hydrogenics, ITM Power PLC, ThyssenKrupp AG, Electrochaea, Enapter, Green Hydrogen Systems, McPhy Energy, EXYTRON, ENGIE, AquaHydrex, BASF SE, Yara International, Uniper, Haldor Topsoe, Queensland Nitrates Pty Ltd |

Market Opportunity

Next-Gen Energy: Green Ammonia’s Potential

The rising need for clean fuel for electricity generation and energy storage is anticipated to create lucrative opportunities during the forecast period. The increasing preference towards the green ammonia over the traditional natural power resources like natural gas and coal and with the rising installing ammonia-powered turbines and converting it into hydrogen for fuel cells contributing to the further driving demand for the green ammonia market.

Market Challenge

Biofuels & Renewable Gases: A Roadblock to Green Ammonia Expansion

The competition from alternative renewable resources is projected to hamper market growth during the forecast period. With the requirement of fewer technological changes and lower infrastructure upgradation, biofuels, and renewable gases expected greater adoption than green ammonia in the future. Moreover, factors such as affordability and greater energy capacity can hinder market growth in the coming years.

Regional Insights

North America

North America dominated the green ammonia market in 2024. The growth of the market is attributed to the rising awareness regarding the environmental pollution and rising carbon footprint due to the excessive use of conventional power sources which accelerate the demand for the greener alternative to the fuels that contributed to the further growth for the market.

Latest technological advancements and increased R&D for hydrogen production have led the market growth in the region recently. Furthermore, the expansion of the automobile industry and the adoption of renewable sources further contributed to the green ammonia sales in the countries.

The United States has a large consumer base of green ammonia. Greater adoption of renewable sources in several sectors is leading market share of ammonia in the country. The rising availability of the well-developed energy sector and leading automobile players that are constantly investing on the green fuel alternatives that boots the expansion of the market in the country. Moreover, strong government policies and investment in hydrogen energy are making a huge impact on green ammonia production in the country.

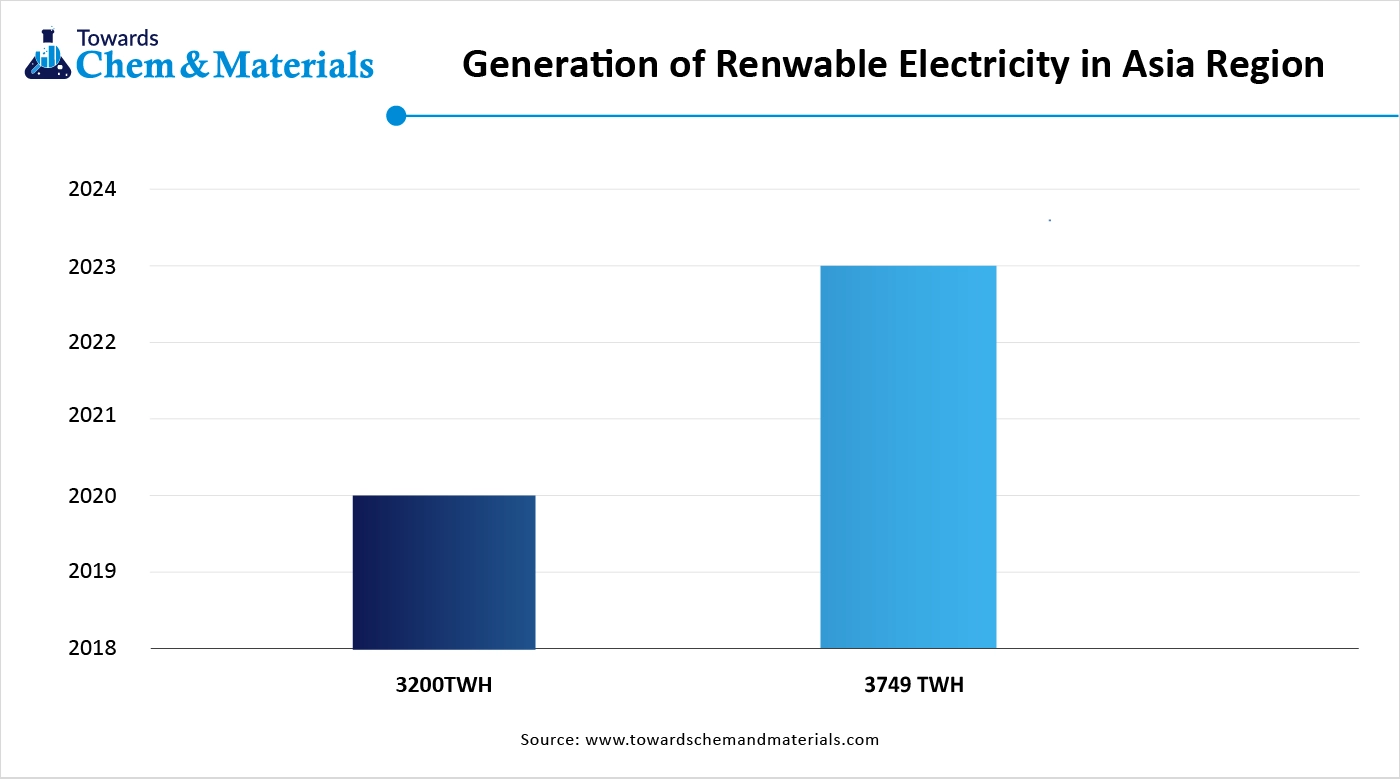

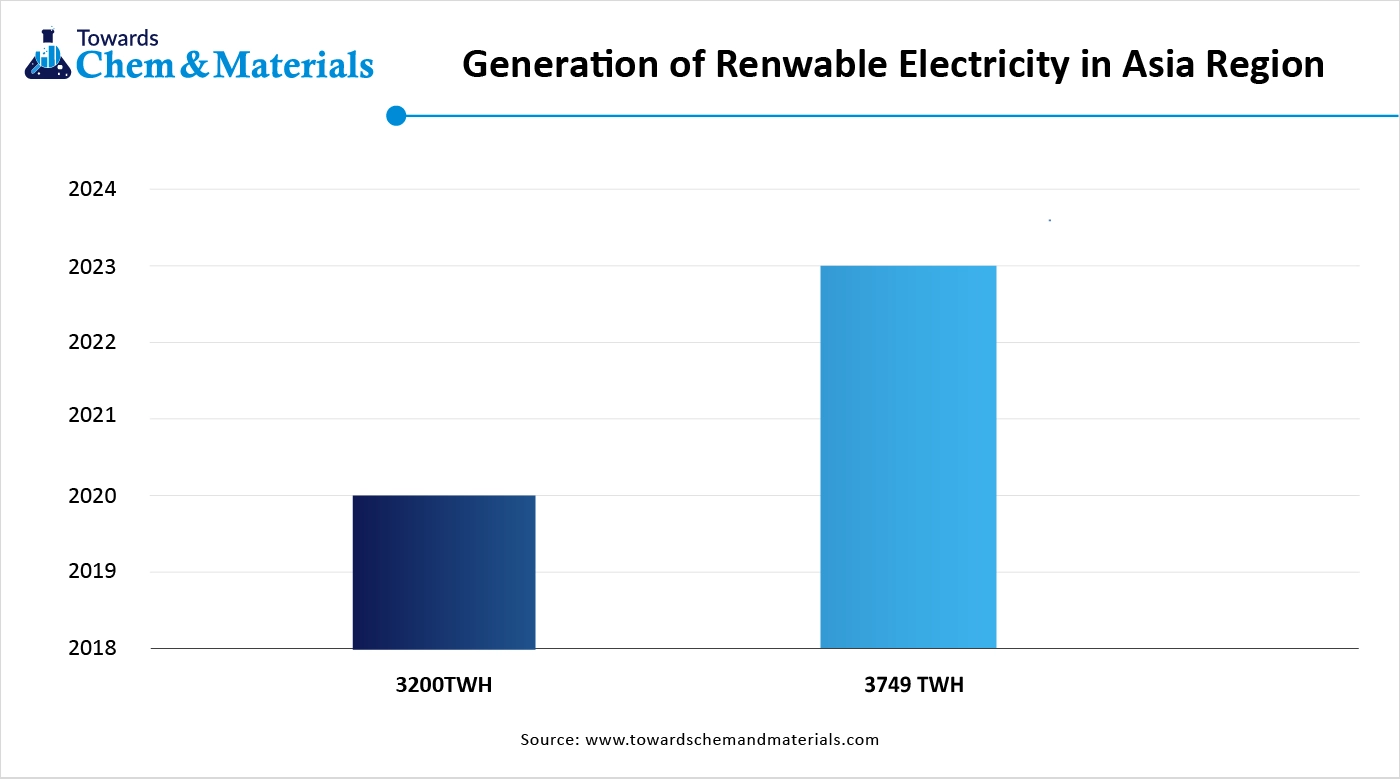

Asia Pacific expecting a significant growth in the market during the predicted period.The growth of the market is owing to the continuously growing population and the rise in the industrialization which accelerate the demand for the green or eco-friendly fuel alternative and the constant growth in the automotive sector in the regional countries like China, India, and Japan which drives the adoption of the green fuel for reducing carbon emission boosts the growth of the market. The government is increasing subsidies to consumers that increase the sales of green energy and eco-friendly energy cultures contributes in the growth of the green ammonia market in the region.

According to the International Renewable Energy Agency (IRENA), Asia generated 3749 TWH of renewable energy including solar, hydropower, wind, and bioenergy in the year 2023.

The strong commitment towards renewable energy and large industrial capacity can increase China’s market share in the Asia Pacific region. The massive application of green gases in the industrial sector in China can create significant market opportunities for green ammonia producers in the future. The shipping industry, chemical manufacturing industry,

Segmental Insights

By technology

The proton exchange membrane technology segment held the dominant position in the market in 2024. The growing awareness about technological advances boosted the segment growth in the current period. However, solid oxide electrolysis technology segment is expected to gain substantial market share during the forecast period. By offering higher efficacy than other electrolysis, the solid oxide electrolysis segment is anticipated to gain popularity in the coming years.

By End-Use

The transportation segment led the green ammonia market in 2023. Factors such as the production of zero carbon emissions and limited availability of traditional fuels have contributed significantly to segment growth in recent years. Moreover, the power generation segment is expected to gain market attraction in the coming years. The need for green energy and power independence can create significant opportunities for the power generation in the future.

Recent Developments

- In 2025, Kyuden and Uniper SE collaborated and signed an MOU for the exploration of hydrogen, ammonia trading, CCUS, and renewable energy.

- In 2024, Saipem made a partnership with Nel ASA, and launched IVHYTM 100. this is modular and scalable 100 MV green hydrogen solution to decarbonisation.

Top Companies List

- Siemens Energy

- MAN Energy Solutions

- Nel Hydrogen

- Hydrogenics

- ITM Power PLC

- ThyssenKrupp AG

- Electrochaea

- Enapter

- Green Hydrogen Systems

- McPhy Energy

- EXYTRON

- ENGIE

- AquaHydrex

- BASF SE

- Yara International

- Uniper

- Haldor Topsoe

- Queensland Nitrates Pty Ltd

Segments Covered:

Technology Outlook

- Solid Oxide Electrolysis

- Proton Exchange Membrane

- Alkaline Water Electrolysis

End-use Outlook

- Power Generation

- Transportation

- Fertilizer

- Refrigeration

- Others

Regional Outlook

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait