Content

Methanol Market Volume and Growth 2025 to 2034

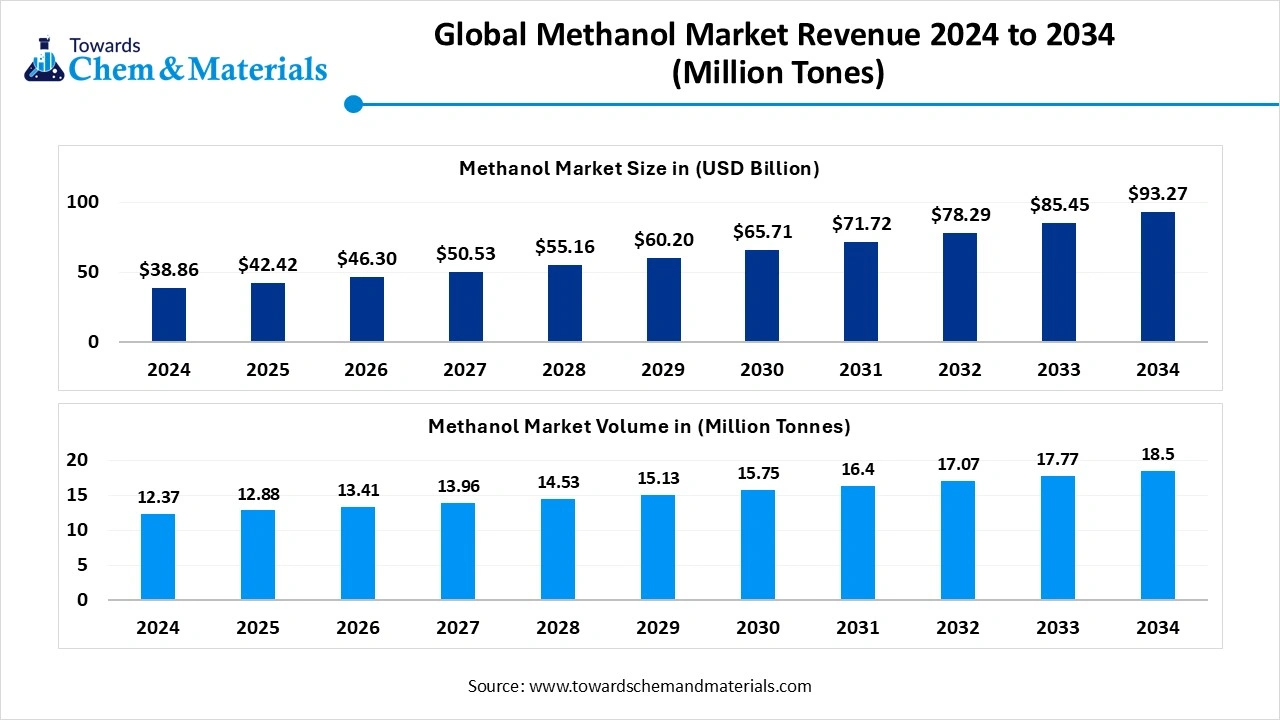

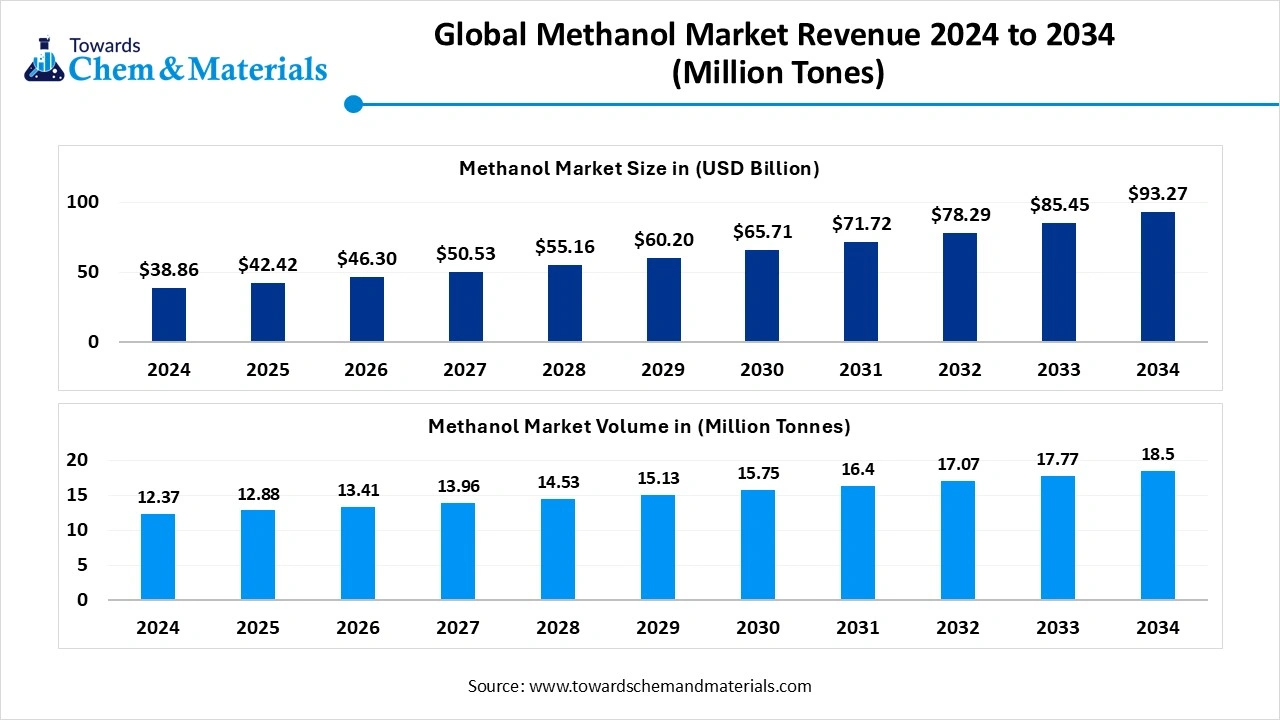

The global methanol market volume was reached at 12.37 million tons in 2024 and is expected to be worth around 18.50 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period 2025 to 2034. The growing production of various chemicals, increasing construction activities, and growth in marine applications drive the growth of the market.

Methanol Market Size & Forecast

- 2024 Market Size: USD 38.86 Billion

- 2034 Projected Market Size: USD 93.27 Billion

- CAGR (2025-2034): 9.15%

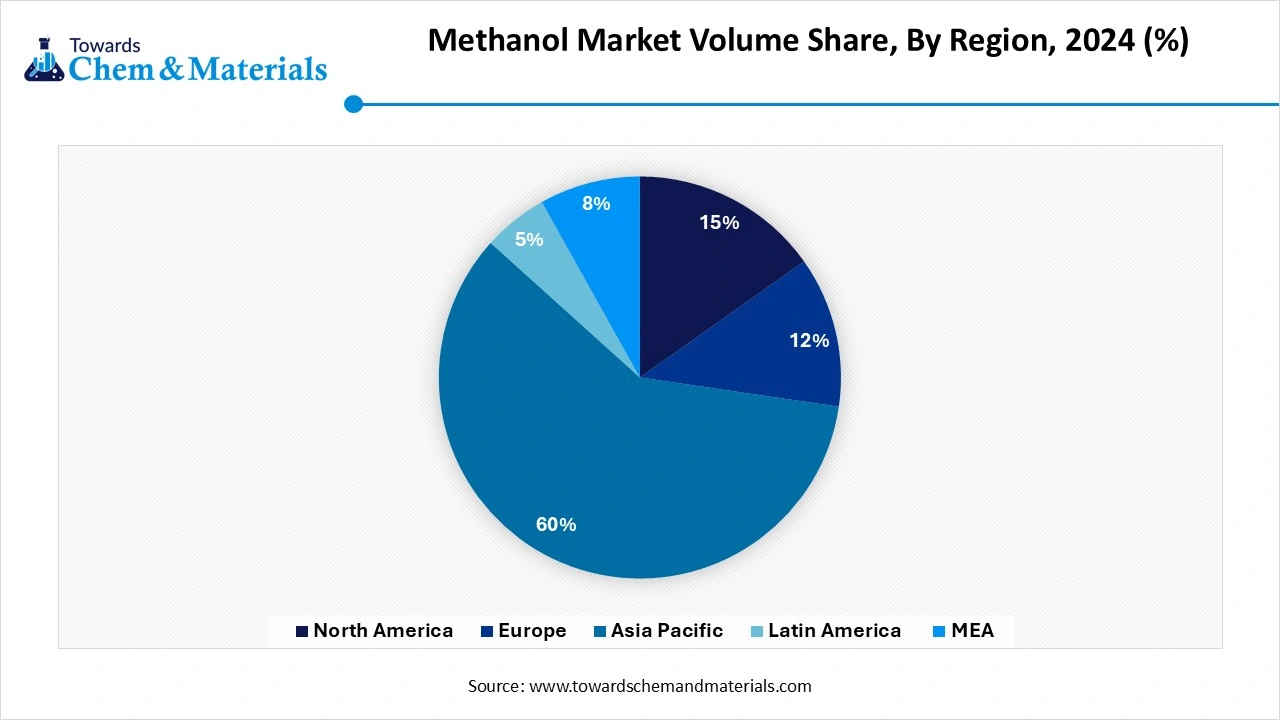

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Key Takeaways

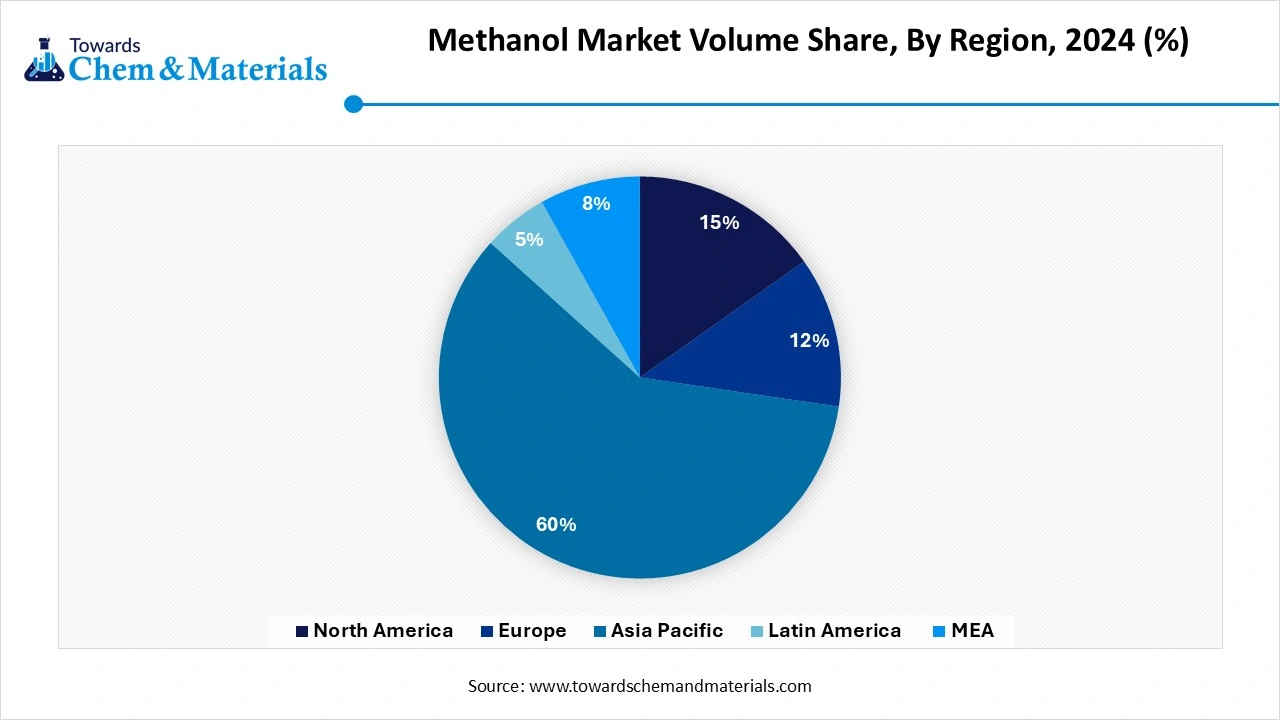

- By region, Asia Pacific held approximately a 63% share in the methanol market in 2024 due to the growing automotive manufacturing.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the presence of vast natural gas reserves.

- By feedstock, the natural gas segment held approximately a 60% share in the market in 2024 due to the cost-effectiveness and vast availability.

- By feedstock, the biomass segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on reducing carbon footprint.

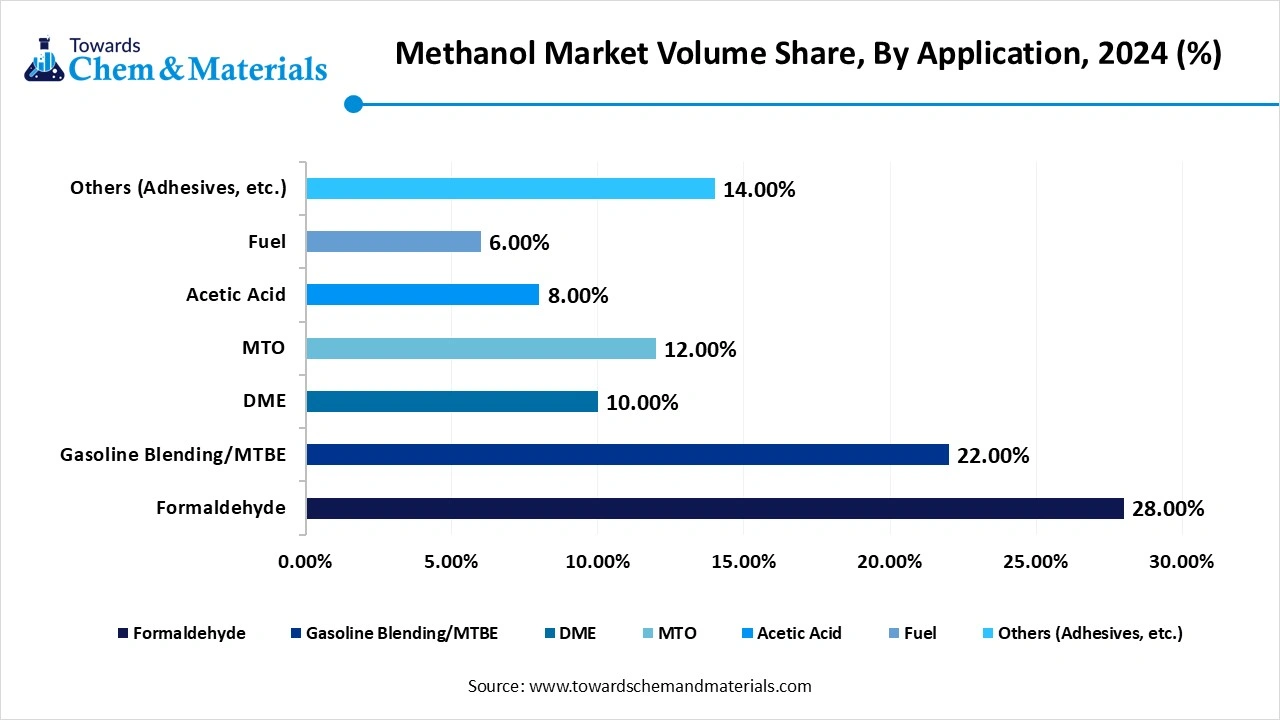

- By derivative type, the formaldehyde segment held approximately a 28% share in the market in 2024 due to the increasing production of construction materials.

- By derivative type, the methanol-to-olefins segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong presence of diverse feedstocks.

- By end-use industry, the chemicals & petrochemicals segment held approximately a 44% share in the market in 2024 due to the increasing production of chemicals.

- By end-use industry, the marine & shipping segment is expected to grow at the fastest CAGR in the market during the forecast period due to the stricter emission regulations.

- By distribution channel, the direct sales to end users segment held approximately a 65% share in the market in 2024 due to the need for building stronger relationships.

- By distribution channel, the online B2B platforms segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong demand for streamlining transactions.

Methanol: Backbone of the Chemical Industry and Sustainable Fuel

Methanol is an organic chemical compound and is a simple form of alcohol. The chemical formula of methanol is CH3OH and is also known as methyl alcohol or wood alcohol. It is widely used as fuel, a solvent, and an antifreeze. It is produced in the presence of catalysts through the reaction of hydrogen gas & carbon monoxide. It does not have color and consists of a distinctive odor. The molecular weight of methanol is 32.04g/mol, and it is flammable.

The growing production of various chemicals like formaldehyde, propylene, and other chemicals increases the demand for methanol. The increasing demand for clean-burning fuels and the growing need for alternatives to traditional fuels increase demand for methanol. The stricter regulations on carbon emissions and technological advancements in the production of methanol increase the production of methanol. The growing demand for methanol across various industries like electronics, construction, automotive, and chemical contributes to the overall growth of the methanol market.

- The United States exported $1.03B of methyl alcohol (methanol) in 2023.(Source: oec.world)

- The United Arab Emirates exported $634M of methyl alcohol (methanol) in 2023.(Source: oec.world)

- Oman exported $770M of methyl alcohol (methanol) in 2023.(Source: oec.world)

- Iran exported $554M of methyl alcohol (methanol) in 2023.(Source: oec.world)

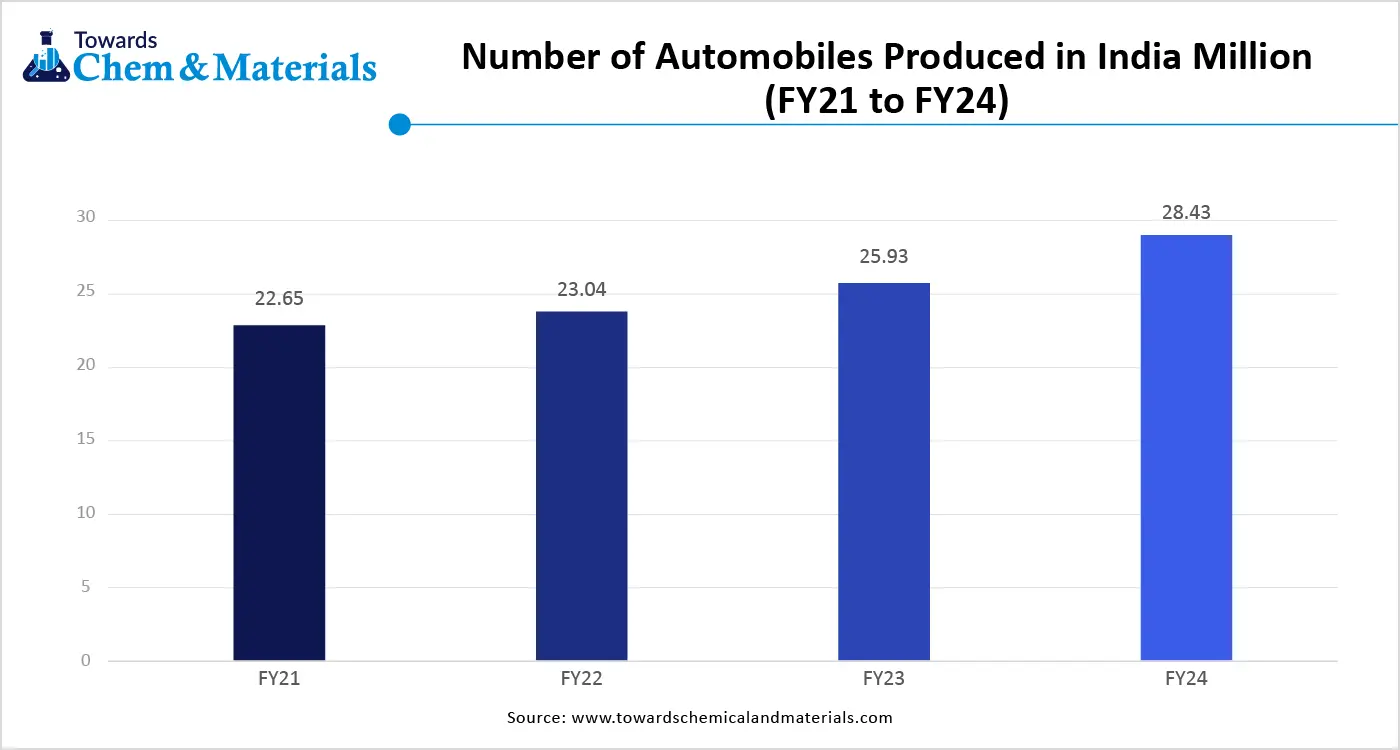

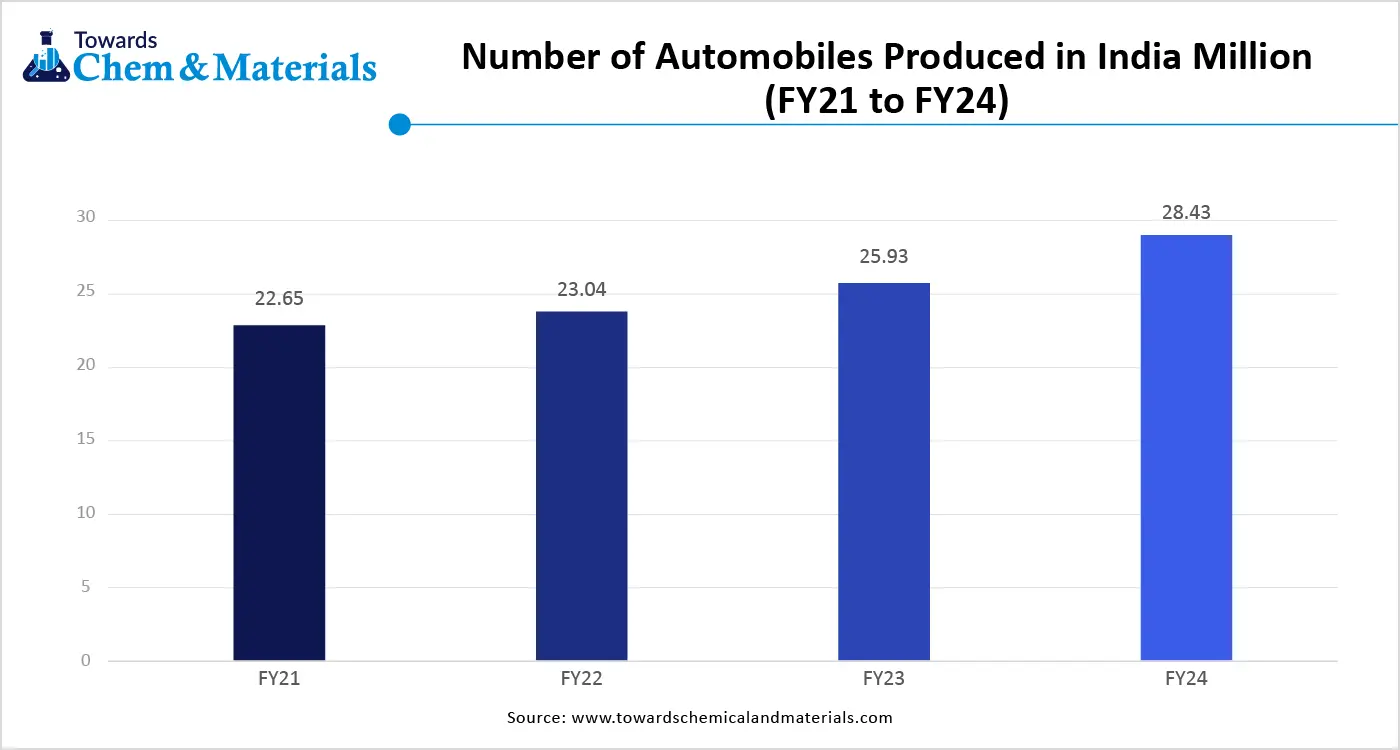

Growing Automotive Industry Surges Demand for Methanol

The growing automotive industry in various regions and the increasing production of vehicles increase demand for methanol. The strong focus of the automotive industry on renewable energy resources increases the adoption of green methanol. The increasing demand for fuel in diesel & gasoline engines increases demand for methanol. The growing manufacturing of various automotive parts like exterior & interior body parts, automotive electrical & electronics components, engine & exhaust system, and driving support & security system increases the adoption of methanol.

The focus on reducing emissions and stricter emission regulations increases the adoption of methanol as a fuel. The strong government support for renewable fuels and the increasing production of vehicles increase the demand for methanol. The growing automotive industry is a key driver for the growth of the methanol market.

Market Trends

- Growing Focus on Sustainable Fuels: The strong focus on decarbonization and increasing demand for traditional fuel alternatives in sectors like energy & transportation increases demand for methanol.

- Growing Electronic Industry: The growing expansion of the electronic industry and increasing manufacturing of display screens, printed circuit boards, advanced electronics, and semiconductors increases the adoption of methanol.

- Increasing Production of Green Methanol: The focus on lowering carbon footprint and reducing greenhouse gas emissions increases demand for green methanol in various industries like automotive, shipping, and chemicals.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 12.88 Million Tons |

| Expected Volume by 2034 | 18.50 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 4.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Feedstock, By Derivative / Product Type, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | BASF SE, Mitsui & Co. Ltd., Celanese Corporation, Petroliam Nasional Berhad (PETRONAS), SABIC, Methanex Corporation, Mitsubishi Gas Chemical Co., Inc., QAFAC (Qatar Fuel Additives Company Limited), Qualcomm Technologies, Inc., Zagros Petrochemical Company |

Market Opportunity

Growing Construction Activities Unlocks Methanol Market Opportunity

The rapid urbanization and growing construction activities in various regions increase demand for methanol for various construction applications. The growing commercial, residential, and infrastructural construction activities increase demand for methanol products like formaldehyde.

The increasing demand for various wood products like particleboard, fiberwood, plywood, and other materials in construction activities increases the demand for methanol.

The growing demand for paints and coatings in building & construction projects increases the adoption of methanol. The increasing need for sound and thermal insulation in construction is leading to a higher demand for methanol for the development of insulation materials & foams. The growth in applications like finishing, bonding, and sealing increases the demand for methanol. The growing construction activities create an opportunity for the growth of the methanol market.

Market Challenge

High Production Cost Restrains the Methanol Market Growth

Despite several benefits of methanol in various industries, the high production cost restricts the market growth. Factors like high consumption of energy, fluctuations in feedstock costs, and the development of plant infrastructure are responsible for high production costs. The fluctuations in prices of raw materials like coal and natural gas increase the costs.

The development and maintenance of plant infrastructure, like compressors, auxiliary systems, reactors, and pipelines, requires high costs. The energy-intensive processes, like compression and heating, increase the production cost. The need for renewable energy resources like wind & solar power for the production of green methanol increases the production cost. The high production cost hampers the growth of the methanol market.

Regional Insights

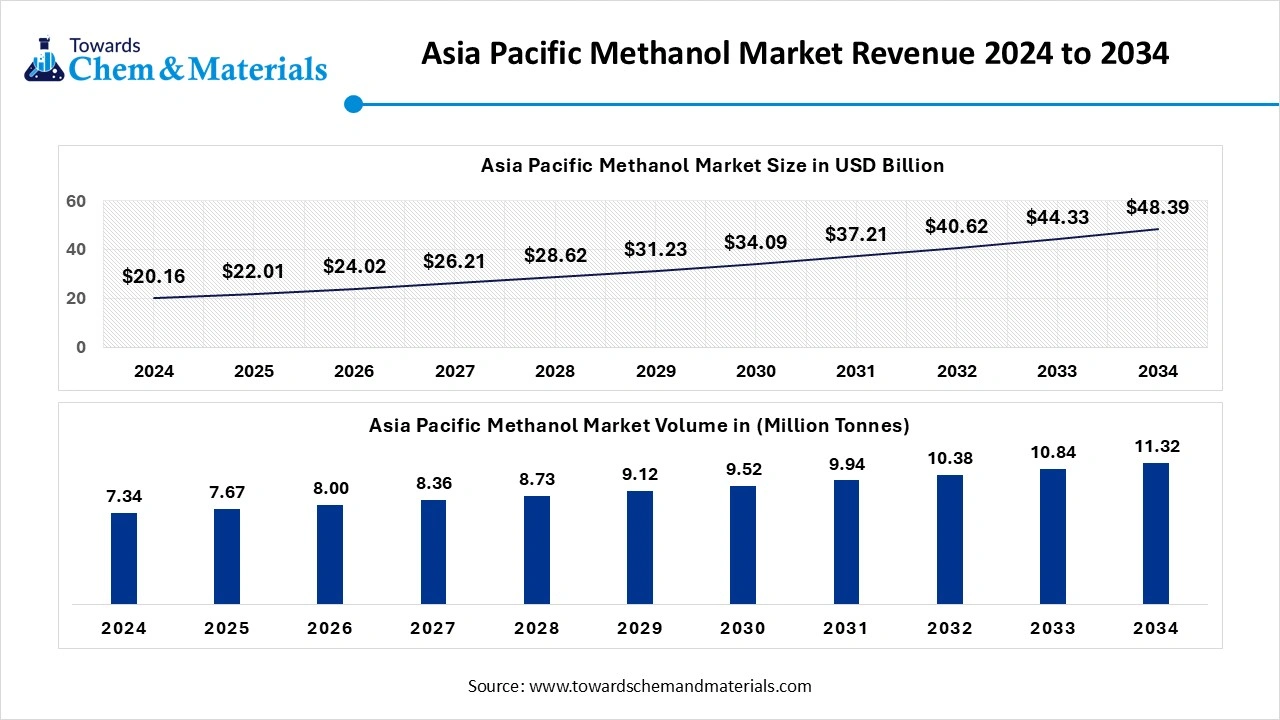

Asia Pacific Methanol Market Trends

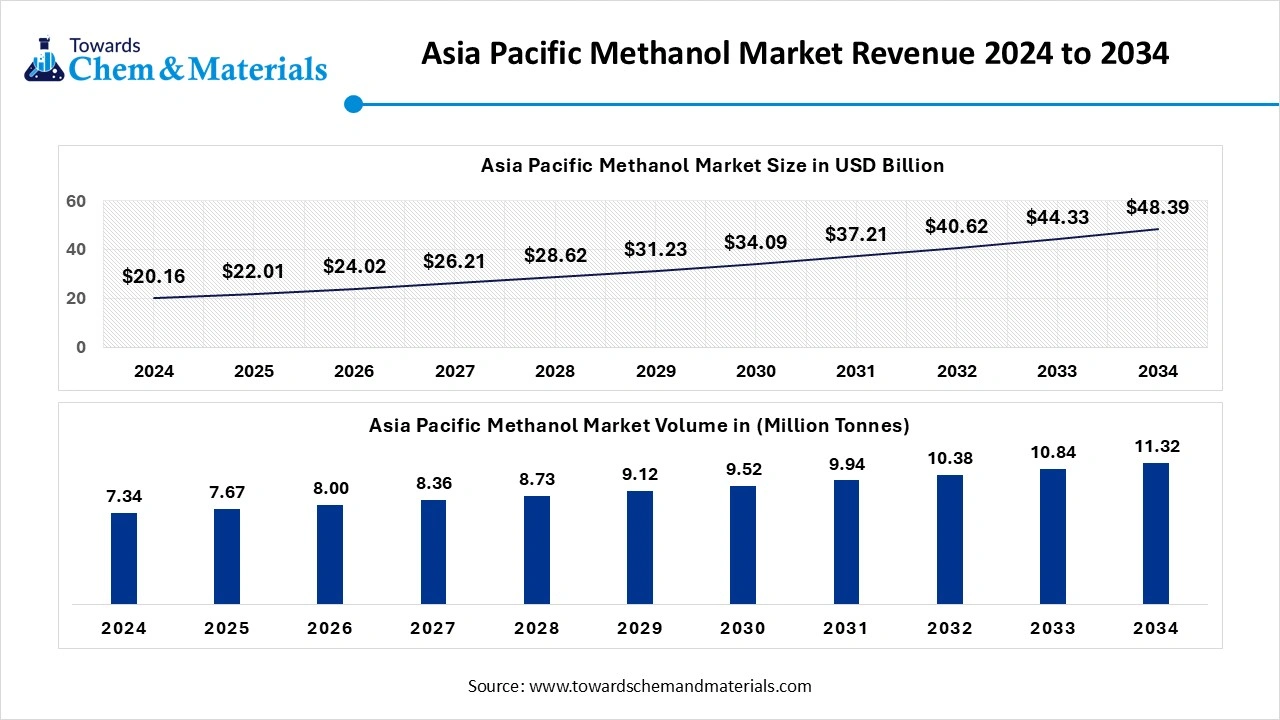

The Asia Pacific methanol market volume was estimated at 7.34 million tons in 2024 and is anticipated to reach 11.33 million tons by 2034, growing at a CAGR of 4.43% from 2025 to 2034.

Asia Pacific dominated the methanol market in 2024. The rapid urbanization and growing industrialization in the region increase demand for methanol for various industrial activities. The increasing production of formaldehyde and olefins increases the adoption of methanol. The growth in automotive manufacturing and the increasing production of construction materials increases demand for methanol. The increasing production of methanol and strong government support for renewable fuels help the market growth. The strong focus on cleaner transportation and growing demand across sectors like electronics, petrochemicals, and automotive drives the overall growth of the market.

China Methanol Market Trends

China is a key contributor to the methanol market. The presence of abundant coal reserves and increasing investment in the methanol-to-olefins technology increases the production of methanol. The growing construction activities and increasing demand for fuel additives in the automotive industry increase the demand for methanol. The strong government support for the adoption of methanol and the growing demand across industries like electronics, automotive, and chemical manufacturing drive the overall growth of the market.

- China exported $48,789.17K of methanol in 2023.(Source: wits.worldbank.org)

Middle East & Africa Methanol Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The abundant reserves of natural gas and increasing demand for chemicals like MTBE, formaldehyde, & acetic acid help the market growth. The strong government support for the production of methanol and increasing investment in the downstream processing increase the production of methanol. The focus on green methanol production and growing construction activities increases demand for methanol. The presence of key players like Qatar Fuel and SABIC in the region supports the overall growth of the market.

Saudi Arabia Methanol Market Trends

Saudi Arabia is growing in the methanol market. The strong presence of natural gas reserves and the low cost of feedstocks increase the production of methanol. The heavy investment in the methanol transportation networks and ports helps market growth. The increasing production of olefins, formaldehyde, and acetic acid increases demand for methanol. The growing investment in the production of green methanol and advancements in MTO technology support the overall growth of the market.

- Saudi Arabia exported $1.68B of methyl alcohol in 2023.(Source: oec.world)

Methanol Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) |

| North America | 15.21% | 1.88 | 14.11% | 2.61 | 3.33% |

| Europe | 12.11% | 1.50 | 11.23% | 2.08 | 3.32% |

| Asia Pacific | 59.36% | 7.34 | 61.22% | 11.33 | 4.43% |

| Latin America | 5.21% | 0.64 | 4.23% | 0.78 | 1.96% |

| Middle East & Africa | 8.11% | 1.00 | 9.21% | 1.70 | 5.44% |

| Total | 100% | 12.37 | 100% | 18.50 | 4.11% |

Segmental Insights

Feedstock Insights

Why did the Natural Gas Segment Dominate the Methanol Market?

The natural gas segment dominated the market in 2024. The inexpensiveness and the presence of abundant natural gas reserves help the market growth. The well-established infrastructure for the transportation, extraction, and processing of natural gas increases the production of methanol. The focus on reducing greenhouse gas and carbon emissions increases the adoption of natural gas. The growing demand for natural gas across various industries like electronics, automotive, pharmaceuticals, and construction drives the overall growth of the market.

The biomass segment is the fastest-growing in the market during the forecast period. The focus on meeting sustainability goals and reducing carbon footprints increases the adoption of biomass. The increasing preference for renewable resources and cost-effectiveness increases the demand for biomass. The increasing climate change concerns and stricter environmental regulations increase demand for biomass. The strong focus on waste management and government support for renewable resources increases the adoption of biomass. The ongoing technological advancements in biomass technologies like catalytic synthesis & gasification, and increasing demand across industries like chemical manufacturing, transportation, & power generation support the overall growth of the market.

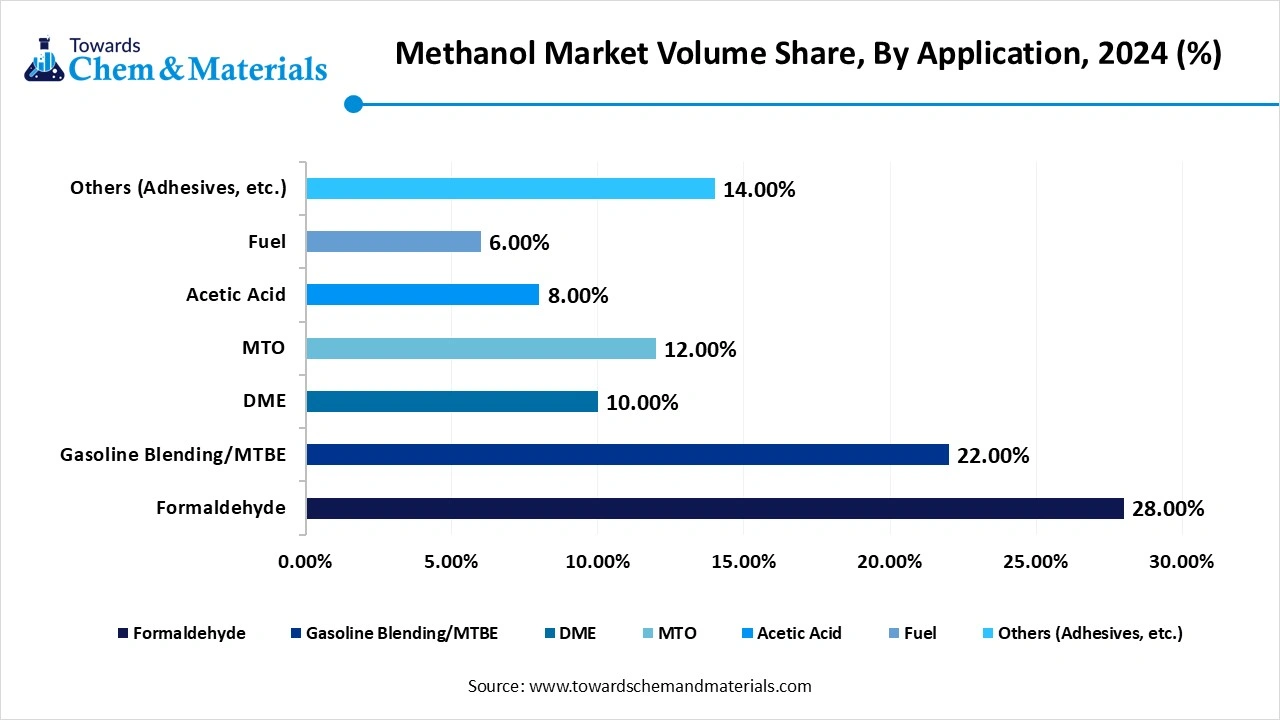

By Application

How Formaldehyde segment Held the Largest Share in the Methanol Market?

The formaldehyde segment held the largest share in the market in 2024. The growing utilization of phenol-formaldehyde and urea-formaldehyde resins in construction materials like insulation, plywood, and particleboard increases the production of formaldehyde. The growing manufacturing of furniture and construction materials increases demand for formaldehyde. The increasing production of components like interior panels and dashboards increases demand for formaldehyde. The growing demand for formaldehyde across industries like chemical intermediates, pharmaceuticals, and textiles drives the overall growth of the market.

The methanol-to-olefins (MTO) segment is experiencing the fastest growth in the market during the forecast period. The growing demand for packaging and the increasing utilization of plastics increases demand for MTO. The availability of diverse feedstocks like renewable biomass, natural gas, and coal increases the production of MTO. The growing advancements in MTO processes and increasing investment in MTO technology help the market growth. The growth in industries like construction and automotive increases the adoption of MTO, supporting the overall growth of the market.

Methanol Market Volume Share, By Application 2024-2034 (%)

| By Application | Volume Share, 2024 (%) | Market Volume Million Tons 2024 | Volume Share, 2034 (%) | Market Volume Million Tons 2034 | CAGR(2025 - 2034) |

| Formaldehyde | 28.00% | 3.46 | 26.00% | 4.81 | 3.34% |

| Gasoline Blending/MTBE | 22.00% | 2.72 | 21.00% | 3.89 | 3.62% |

| DME | 10.00% | 1.24 | 12.00% | 2.22 | 6.02% |

| MTO | 12.00% | 1.48 | 15.00% | 2.78 | 6.46% |

| Acetic Acid | 8.00% | 0.99 | 7.00% | 1.30 | 2.73% |

| Fuel | 6.00% | 0.74 | 8.00% | 1.48 | 7.15% |

| Others (Adhesives, etc.) | 14.00% | 1.73 | 11.00% | 2.04 | 1.63% |

| Total | 100% | 12.37 | 100% | 18.50 | 4.11% |

End-Use Industry Insights

Which End-Use Industry Dominated the Methanol Market?

The chemicals & petrochemicals segment dominated the market in 2024. The growing production of various chemicals like methyl methacrylate, formaldehyde, and acetic acid helps the market growth. The rising expansion of the petrochemical industry increases demand for methanol. The increasing synthesis of methylamine, MMA, and methyl chloride increases the adoption of methanol. The growing demand for chemicals & petrochemicals in industries like automotive, textiles, construction, and packaging drives the overall growth of the market.

The marine & shipping segment is the fastest-growing in the market during the forecast period. The stricter emission regulations in ships and the focus on lowering greenhouse gas emissions increase demand for methanol. The growing awareness about climate change and the increasing demand for sustainable fuels in shipping are increasing the adoption of methanol. The growing cost of traditional marine fuels and increasing investment in methanol-powered vessels increase demand for methanol. The presence of major shipping players like Proman Stena Bulk, Maersk, and Stena Line supports the overall growth of the market.

Distribution Channel

How Direct Sales to End Users Segment Held the Largest Share in the Methanol Market?

The direct sales to end users segment held the largest share in the market in 2024. The availability of customized pricing structures and tailored agreements increases the adoption of direct sales. The focus on reducing disruptions and a consistent supply of methanol to end users increases demand for direct sales. The focus on building stronger relationships between buyers and suppliers increases the demand for direct sales, driving the overall growth of the market.

The online B2B platforms segment is experiencing the fastest growth in the market during the forecast period. The focus on connecting sellers and buyers directly increases the adoption of online B2B platforms. The need for improving operational efficiency and lowering transaction costs increases the adoption of online B2B platforms. The strong focus on streamlining transactions like contract management, secure payment gateways, and logistics support increases the adoption of online B2B platforms, supporting the overall growth of the market.

Methanol Market Value Chain Analysis

Feedstock Procurement

The feedstock procurement for methanol is coal, natural gas, biomass, and carbon dioxide. The feedstock is converted into syngas to produce methanol.

- Key Players :- SABIC, Proman, Methanex Corporation, Mitsubishi Gas Chemical Company

Compound Formulation and Blending

The compound formulation of methanol includes a methyl group linked to a hydroxyl group. Methanol readily blends with fuel cells, vehicle fuels, and biodiesel to reduce emissions and enhance combustion.

Regulatory Compliance and Safety Monitoring

The Ministry of Chemicals and Fertilizers, PESO Guidelines, REACH, ACGIH, and OSHA provide regulations for the production and use of methanol in various industries.

Recent Developments

- In April 2025, ICODOS launched a climate-neutral methanol plant in Mannheim, Germany. The facility is using wastewater for the production of climate-neutral methanol, and 80000 wastewater treatment plants are present in Europe.(Source: worldbiomarketinsights.com)

- In July 2025, Tsuneishi launched a methanol dual-fuel Kamsarmax Bulker in the Philippines. The new bulker reduces sulfur oxide emissions by 99% and carbon dioxide emissions by 10%. The bulker is a sustainable vessel option and supports a green future.(Source: breakbulk.news )

- In February 2025, Maire, Eni, and Iren launched a circular methanol plant in Italy. The plant converts non-recyclable waste into syngas and then into circular methanol. The project reduces landfill waste and meets the EU Renewable Energy Directive Standards.(Source: www.chemanalyst.com)

Methanol Market Top Companies

- BASF SE

- Mitsui & Co. Ltd.

- Celanese Corporation

- Petroliam Nasional Berhad (PETRONAS)

- SABIC

- Methanex Corporation

- Mitsubishi Gas Chemical Co., Inc.

- QAFAC (Qatar Fuel Additives Company Limited)

- Qualcomm Technologies, Inc.

- Zagros Petrochemical Company

Segments Covered

By Feedstock

- Natural Gas

- Coal

- Biomass

- Municipal Solid Waste (MSW)

- CO₂ + Hydrogen (Green Methanol)

By Application

- Formaldehyde

- Acetic Acid

- Methyl Tertiary Butyl Ether (MTBE) & Fuel Additives

- Methanol-to-Olefins (MTO)

- Methyl Methacrylate (MMA)

- Solvents

- Dimethyl Ether (DME)

- Others (biodiesel, chloromethanes, etc.)

By End-Use Industry

- Chemicals & Petrochemicals

- Automotive & Transportation

- Construction & Infrastructure

- Energy & Utilities

- Marine & Shipping

- Pharmaceuticals

- Consumer Goods

By Distribution Channel

- Direct Sales to End-Users

- Chemical Distributors

- Online B2B Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait