Content

Asia Pacific Battery Raw Materials Market Size | Top Companies Analysis

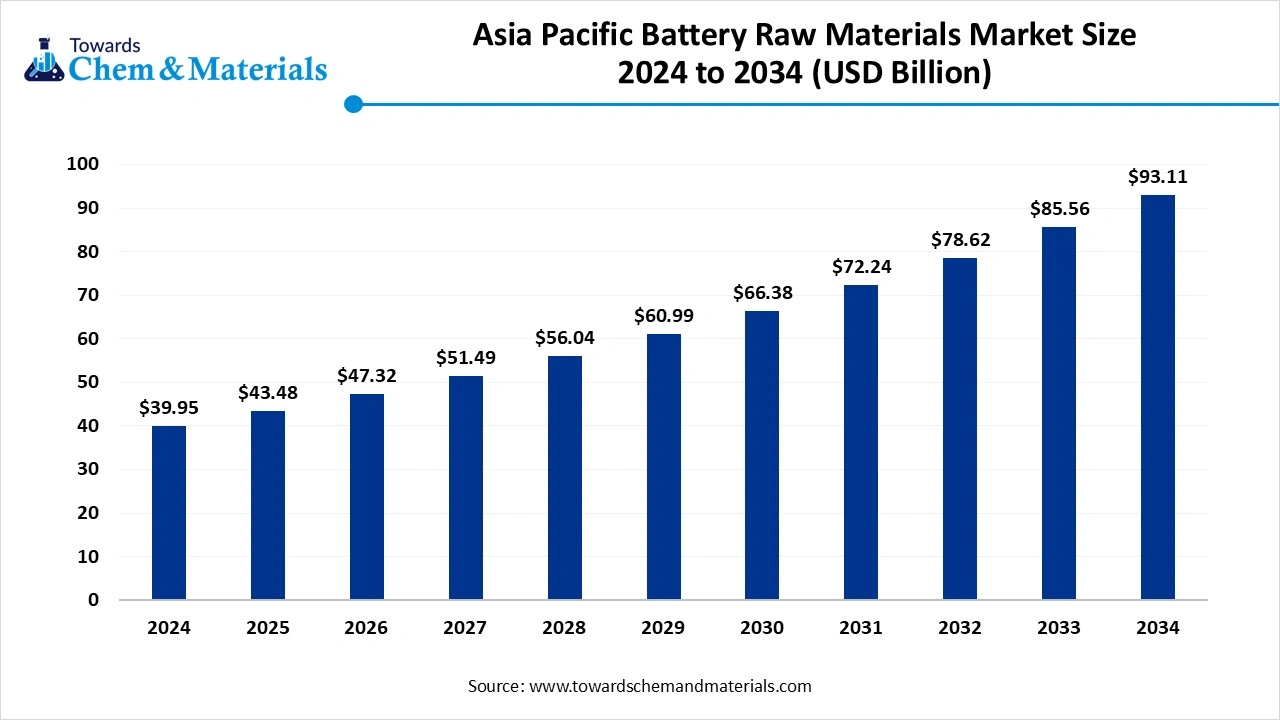

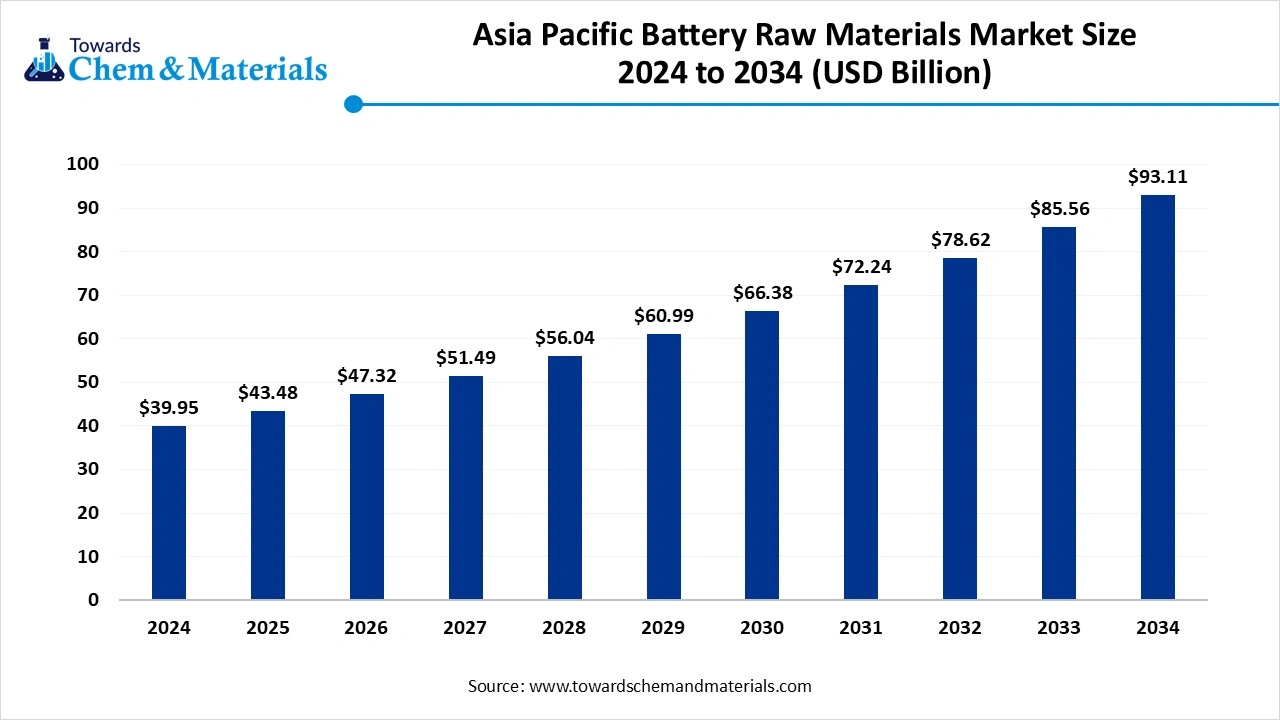

The Asia Pacific battery raw materials market size was valued at USD 39.95 billion in 2024 and is expected to hit around USD 93.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.83% over the forecast period from 2025 to 2034. The growing demand for electric vehicles (EVs) across the globe is the major factor driving market growth. Also, innovations in battery technology, coupled with the increasing demand for renewable energy storage systems, can fuel market growth further.

Key Takeaways

- By material type, the lithium compounds segment dominated the market with approximately 30% share in 2024.

- By material type, the cathode active materials (CAM) segment is expected to grow at the fastest CAGR of approximately 10% over the forecast period.

- By source, the primary mined + chemical refinement segment held approximately 78% market share in 2024.

- By source, the recycled/recovered battery material segment is expected to grow at the fastest CAGR of approximately 7% over the forecast period.

- By end use, the electric vehicles (EVs) segment dominated the market with approximately 65% share in 2024.

- By end use, the energy storage systems segment is expected to grow at the fastest CAGR of approximately 15% during the forecast period.

- By value chain, the raw mining segment held an approximately 50% market share in 2024.

- By value chain, the recovered materials segment is expected to grow at the fastest CAGR of approximately 7% over the study period.

What is Battery Raw Materials?

Asia Pacific is the world's largest regional market by demand and a dominant node in refining and materials manufacturing. This market covers mined, refined and manufactured raw inputs that go into rechargeable batteries (primarily Li-ion chemistries): lithium compounds (carbonate, hydroxide), nickel, cobalt, manganese, natural & synthetic graphite (anode material), cathode active materials (CAM), electrolytes (salts & solvents), separators, copper/aluminium foils and other binders/additives plus battery-grade recycling feedstock and precursor intermediates.

Asia Pacific Battery Raw Materials Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is expected to witness substantial growth due to robust government support through various policies and incentives for green technologies, along with the investment in Electric Vehicles infrastructure. An expanding consumer electronics sector, fuelled by demand for laptops, smartphones, and other portable devices, creates substantial demand for high-performance batteries.

- Sustainability Trends: This trend includes innovations in recycling technology and an ongoing emphasis on sustainable and ethical sourcing to address environmental and social impacts. The emergence of safer and more sustainable battery options, such as lithium iron phosphate (LFP), is rapidly gaining traction as they offer enhanced thermal stability.

- Global Expansion: Major companies such as CATL are building joint venture factories in Europe by collaborating with automakers such as FAW and Geely to establish a global presence. Also, many Indian companies are partnering with foreign businesses to build EV battery factories that use locally sourced battery materials.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 43.48 Billion |

| Expected Size by 2034 | USD 93.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.83% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material Type, By Source / Supply Route, By End-Use / Application of the Materials, By Value Chain / Product Stage |

| Key Companies Profiled | Albemarle , SQM , Livent , Jinchuan Group / China Nonferrous , Tsingshan Group (China / Indonesia) , PT Vale Indonesia / Vale ,, Syrah Resources Pulead Technology / BTR New Energy Materials, Ningbo Shanshan / Shanshan , Sumitomo Metal Mining (Japan), POSCO / POSCO Chemical (Korea), Asahi Kasei (Japan) , Toray Industries (Japan) , Capchem / Hunan Zhongke (China) , Umicore / Johnson Matthey, Huayou Cobalt (China) , Redwood / Regional recyclers / emerging recyclers, CATL / Contemporary Amperex Technology Co. Ltd. (China) |

Key Technological Shifts in the Asia Pacific Battery Raw Materials Market:

The key technological shifts in the market are focusing on growing energy density, securing supply chains, and enhancing overall sustainability. These shifts are further driven by increasing demand for grid-scale energy storage systems and electric vehicles (EVs). AI-powered analytics helps to predict demand and manage inventories, helping to tackle the challenges of fluctuating material prices.

Companies such as GEM and Brunp use hydrometallurgical processes to recover key materials such as cobalt, lithium, and nickel from spent lithium-ion batteries. This minimizes China's dependence on imported raw materials and enhances supply chain security in the country.

Trade Analysis of the Asia Pacific Battery Raw Materials Market: Import & Export Statistics

- China: China imported 12 million short tons of raw and processed battery minerals and exported 11 million short tons of battery materials, packs, and components in 2023.(Source: www.eia.gov)

- South Korea: South Korea was the primary export destination for China's ternary cathode precursors in May 2025, receiving 92% of NC exports and 83% of NCM exports.(Source: www.metal.com)

- India: A fast-growing consumer and one of the largest global importers of processed lithium and lithium-ion batteries.(Source: www.icwa.in)

Value Chain Analysis of the Asia Pacific Battery Raw Materials Market

- Feedstock Procurement : It is the process of sourcing and securing the required raw materials, both recycled and virgin, for manufacturing batteries.

- Chemical Synthesis and Processing : It refers to the whole series of chemical and industrial steps that convert raw, mined materials into battery-grade chemical compounds.

- Packaging and Labelling : It is the crucial processes that ensure secure, safe, and regulated storage and logistics of materials such as lithium and cobalt.

- Regulatory Compliance and Safety Monitoring : It is a complex framework of standards, rules, and oversight that controls the overall battery manufacturing process.

Asia Pacific Battery Raw Materials Market’s Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/Launches |

| China | In 2025, China introduced new restrictions on exporting technologies related to the production of electric vehicle (EV) batteries, including key lithium iron phosphate (LFP) technologies. |

| South Korea | In 2024, a legislative bill was introduced that would require EV batteries to contain a certain percentage of recycled raw materials |

| India | The scheme, with an outlay of over Rs. 18,100 Crore aims to establish 50 GWh of competitive Advanced Chemistry Cell (ACC) battery manufacturing within the country. |

Market Opportunity

Launch of Grid-Scale Energy Storage Projects

The growing imperative to combine large-scale renewable energy sources to improve grid stability creates lucrative opportunities in the market. Developing countries in the region are increasingly investing in projects to store energy generated from wind and solar farms. Furthermore, the push towards the development of smart grids across the region, with policies focused on innovating power infrastructure, further drives market expansion.

Market Challenge

Insufficient Recycling Infrastructure

Despite being an emerging market, many parts of the region have limited recycling infrastructure to handle the surging volume of end-of-life batteries, which is a major factor hindering market growth. Moreover, the high cost related to recycling, such as specialized equipment and expensive technologies, can pose a challenge to market growth further.

Segmental Insights

Material Type Insight

How Much Share Did the Lithium Compound Segment Held in 2024?

The lithium compounds segment dominated the market with approximately 30% share in 2024. The dominance of the segment can be attributed to the growing demand for consumer electronics, electric vehicles (EVs), and renewable energy storage. The extensive use of portable electronics such as laptops, smartphones, and digital cameras, all powered by lithium-ion batteries, contributes to segment expansion further.

The cathode active materials (CAM) segment is expected to grow at the fastest CAGR of approximately 10% over the forecast period. The growth of the segment can be credited to the ongoing government initiatives supporting battery technology adoption, along with the increasing demand for consumer electronics. Additionally, the region also has a strong infrastructure supporting battery cell manufacturing and R&D.

Source Insight

Which Source Type Segment Dominated the Asia Pacific Battery Raw Materials Market in 2024?

The primary mined + chemical refinement segment held approximately 78% market share in 2024. The dominance of the segment can be linked to the growing need for lithium-ion batteries across several major sectors and the expansion of renewable energy sources such as solar and wind. Furthermore, urban mining helps supplement primary mined resources.

The recycled/recovered battery material segment is expected to grow at the fastest CAGR of approximately 7% over the forecast period. The growth of the segment can be driven by technological innovations in recycling processes like hydrometallurgy, coupled with the stringent government incentives. Also, the extensive use of portable electronics contributed to the segment expansion.

End-Use Insight

Which End Use Segment Dominated the Asia Pacific Battery Raw Materials Market in 2024?

The electric vehicles (EVs) segment dominated the market with approximately 65% share in 2024. The dominance of the segment is owed to the rapid investments in battery production and R&D, along with the innovations in advanced battery technologies. The increasing deployment of BaaS models presents new avenues for EV battery providers in the region.

The energy storage systems segment is expected to grow at the fastest CAGR of approximately 15% during the forecast period. The growth of the segment is due to increasing renewable energy adoption and rapid urbanization and industrialization in the region. Decreasing lithium-ion battery costs make them a more attractive and affordable option for energy storage applications.

Value Chain Insight

How Much Share Did the Raw Mining Segment Held in 2024?

The raw mining segment held an approximately 50% market share in 2024. The dominance of the segment can be attributed to the ongoing government initiatives supporting local and clean energy manufacturing. The growing adoption of batteries in ESS for renewable energy projects also boosts the demand for major raw materials.

The recovered materials segment is expected to grow at the fastest CAGR of approximately 7% over the study period. The growth of the segment can be credited to the growing demand for electric vehicles (EVs) coupled with the need to secure crucial raw materials such as lithium, cobalt, and nickel. Furthermore, an ongoing push for a circular economy in the region optimizes the reuse of materials and products.

Country Insights

China Asia Pacific Battery Raw Materials Market Trends

China dominated the market with approximately 55% share in 2024. The dominance of the country can be attributed to the growing adoption of renewable energy systems, along with the rapid advancements and innovations in battery technology. In addition, China is a leading manufacturer of battery materials and has a robust integrated supply chain, which supports the country's growth further.

Southeast Asia & India Asia Pacific Battery Raw Materials Market Trends

Southeast Asia & India are expected to grow at the fastest CAGR of approximately 7% over the forecast period. The growth of the region can be credited to the rapid surge in the middle-class population and growing disposable incomes among this population. Moreover, demand for EVs in India is growing due to an increase in pollution concerns and fuel costs, fuelling the demand for domestic battery production.

Country-level Investments & Funding Trends for the Asia Pacific Battery Raw Materials Market:

- India: In 2023–2024, Indian firm ACME and Japan's IHI signed a $5 billion deal to supply green ammonia from a plant in Odisha to Japan.(Source: www.pib.gov.in)

- Japan: The Japan Bank for International Cooperation (JBIC) co-launched a $600 million fund with India's NIIF in 2023 to invest in environmental sustainability.(Source: www.pib.gov.in)

Recent Development

- In March 2024, Jitendra EV announced the launch of sodium-ion battery-powered vehicles. Sodium-ion batteries give an option to lithium-ion batteries, as they can be obtained and accessed more easily within the country.(Source: www.energetica-india.net)

Top Vendors in the Asia Pacific Battery Raw Materials Market & Their Offerings:

- Ganfeng Lithium: Ganfeng Lithium is a major global supplier in the Asia-Pacific battery raw materials market, with a vertically integrated business model covering upstream resource development, midstream processing, and downstream battery manufacturing and recycling.

- Tianqi Lithium: Tianqi Lithium holds a strategic and dominant position in the Asia Pacific battery raw materials market, driven by its integrated global supply chain and extensive lithium resource portfolio.

Other Players

- Albemarle

- SQM

- Livent

- Jinchuan Group / China Nonferrous

- Tsingshan Group (China / Indonesia)

- PT Vale Indonesia / Vale

- Syrah Resources

- Pulead Technology / BTR New Energy Materials

- Ningbo Shanshan / Shanshan

- Sumitomo Metal Mining (Japan)

- POSCO / POSCO Chemical (Korea)

- Asahi Kasei (Japan)

- Toray Industries (Japan)

- Capchem / Hunan Zhongke (China)

- Umicore / Johnson Matthey

- Huayou Cobalt (China)

- Redwood / Regional recyclers / emerging recyclers

- CATL / Contemporary Amperex Technology Co. Ltd. (China)

Segment Covered

By Material Type

- Lithium compounds (carbonate & hydroxide)

- Natural & Synthetic Graphite (Anode)

- Nickel & Nickel Sulfate

- Cathode Active Materials (CAM - precursors & active powders such as NCM / NCA)

- Electrolyte salts & solvents (e.g., LiPF₆, solvents)

- Separators, binders & coating additives

- Cobalt & Cobalt Sulfate

- Manganese & Manganese Oxides

- Copper / Aluminium foils & other conductors

By Source / Supply Route

- Primary mined + chemical refinement

- Refined imported intermediates (conversion / precursor imports)

- Recycled / recovered battery materials

By End-Use / Application of the Materials

- Electric Vehicles (EVs) — traction batteries

- Consumer Electronics (phones, laptops)

- Energy Storage Systems (ESS: grid & commercial storage)

- E-mobility (e-bikes, scooters) & light vehicles

- Other (medical, aerospace prototypes)

By Value Chain / Product Stage

- Raw mining (ores, brines) & primary concentrates

- Chemical refining & precursor production (Li compounds, NiSO₄, CoSO₄)

- Active material manufacture (CAM, anode materials) & processing

- Recovered materials / recycled intermediates