Content

U.S. Recycled Plastics in Green Building Materials Market Size and Share 2034

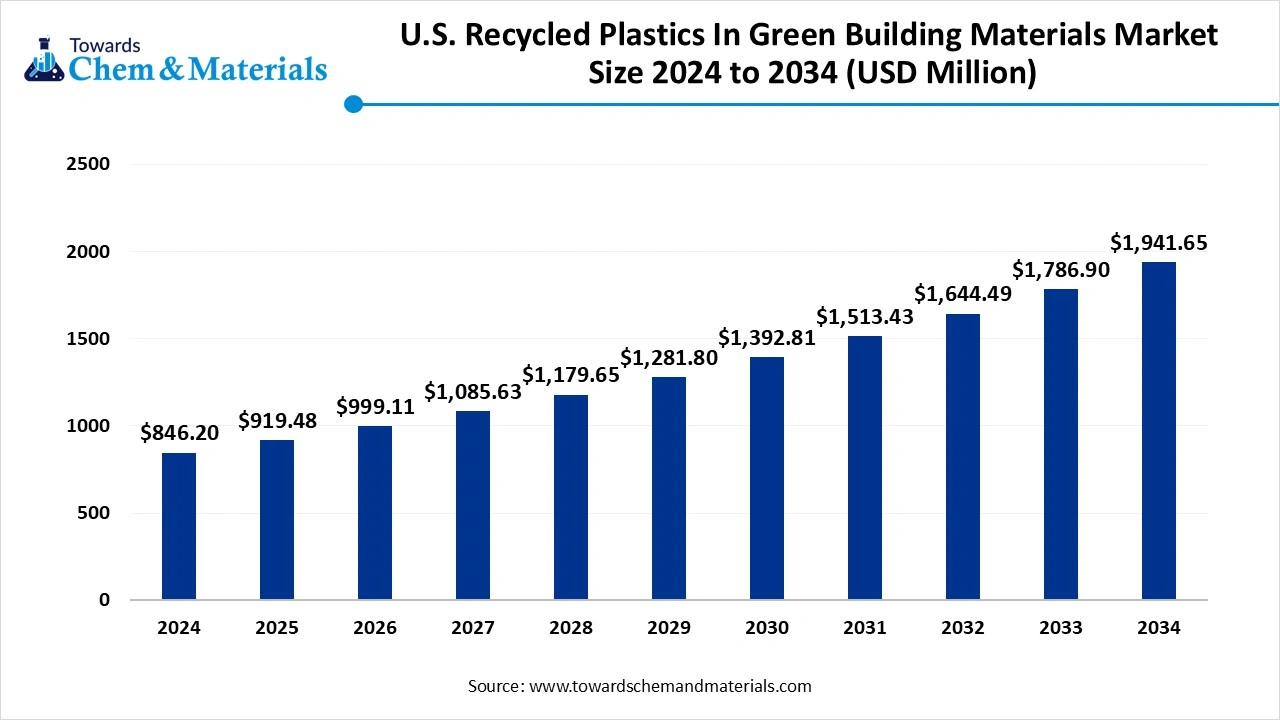

The U.S. recycled plastics in green building materials market size was reached at USD 846.20 million in 2024 and is expected to be worth around USD 1,941.65 million by 2034, growing at a compound annual growth rate (CAGR) of 8.66% over the forecast period 2025 to 2034. The global shift towards an eco-friendly environment has accelerated industry potential in recent years.

Key Takeaways

- By product type, the plastic lumber & decking segment led the U.S. recycled plastics in green building materials market in 2024 with 30% market share, due to factors such as the low maintenance and durability in the current period.

- By product type, the composite building component segment is expected to grow at the fastest rate in the market during the forecast period, akin to the increasing need for recycled plastic, which has the versatility, insulation, while having superior strength in recent years in the country.

- By polymer feedstock, the recycled HDPE segment emerged as the top-performing segment in the market in 2024 with 30% industry share, due to having the unique characteristic such as easy recycling, abundance, making the ideal for applications like pipes, decking, and panels in the current period.

- By polymer feedstock, the recycled PET and PET-based fibres are expected to lead the market in the coming years, due to booming construction, infrastructure, and automotive sectors worldwide.

- By product form, the extruded profiles segment led the market in 2024 with 40% market share because they are cost-effective, customizable, and widely used in products like window frames, trims, and siding.

- By product form, the composite/molded panels segment is expected to capture the biggest portion of the market in the coming years because they combine recycled plastics with other materials to create strong, moisture-resistant, and insulating products.

- By certification type, the certified recycled content segment led the market in 2024 with 45% market share, because it's a straightforward and widely recognized proof of sustainability for green building projects in the United States.

- By certification type, the LCA verified/cradle to cradle certified segment is expected to grow at the fastest rate in the market during the forecast period, because it assesses the full environmental impact of a product, from sourcing to disposal.

- By end user type, the homeowners & residential contractors segment emerged as the top-performing segment in the market in 2024 with 40% industry share, because they are the largest buyers of recycled plastic materials for renovations, landscaping, and new home construction.

- By end user type, the architects and specifiers are expected to lead the market in the coming years, because they decide on materials for large-scale projects, including commercial, institutional, and high-end residential buildings.

- By distribution type, the building materials & retailers segment led the market in 2024 with 50% market share, because they make recycled plastic building products widely accessible to both professionals and DIY customers.

- By distribution type, the B2B direct contracts segment is expected to grow at a notable rate during the predicted timeframe,, because it allows manufacturers to work directly with developers, contractors, and architects on customized solutions for specific projects.

Market Overview

Plastic with Purpose: Redefining Green Construction in the United States

The U.S. recycled plastics in green building materials market covers production, processing, and use of recycled polymer feedstocks (post-consumer and post-industrial plastics) converted into sustainable building products.

These materials, including recycled HDPE, PET, PVC, PP, and mixed plastic resins, are manufactured into items such as plastic lumber, decking, cladding, roofing components, insulation facings, geosynthetics, pavers, acoustic panels, and interior finishes. The market emphasizes circular-economy benefits (diverting plastic from landfill/incineration), embodied carbon reductions, lifecycle performance, and compliance with green building standards (LEED, Living Building Challenge, etc.). Recycled-plastic building products are chosen for durability, low maintenance, moisture resistance, and growing acceptance in both residential and commercial construction.

What Factor is Driving the U.S. Recycled Plastics in Green Building Materials Market?

The sudden increased demand for sustainable construction materials is spearheading industry growth in the current period. The country’s population has become increasingly aware of environmentally friendly products and their advantages in recent years. Also, having specific organizations like LEED and others actively contributing to the growth of the market in the United States nowadays. Furthermore, the local governments are alternatively pushing these sustainability trends, which are likely to create immense industry opportunities in the upcoming years in the United States, as per the future industry predictions.

Market Trends

- The sudden shift towards composite products is driving industry growth in the current period. As the products that are made from wood fibers, glass, and other reinforcements with plastic blends are gaining popularity nowadays

- The increased usage of certified sustainable materials has contributed to the growth of the industry in the past few years, as several builders are promoting their construction activities and materials as more sustainable on various platforms, according to the latest industry survey.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 919.48 Million |

| Expected Size by 2034 | USD 1,941.65 Million |

| Growth Rate from 2025 to 2034 | CAGR 8.66% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Polymer Feedstock, By Product Form / Processing Route, By Certification / Sustainability Grade, By End-User / Buyer Type, By Distribution Channel |

| Key Companies Profiled | Waste Management, Republic Services, Veolia North America, KW Plastics, Plastipak, CarbonLITE Industries, B. Schoenberg & Co., Envision Plastics , TerraCycle, Avangard Innovative, Advanced Environmental Recycling Technologies (AERT), Custom Polymers, Circular Polymers, Clean Tech Incorporated , Cycletex LLC, WM Recycle America |

Market Opportunity

Expanding Sustainable Portfolios Unlocks Market Advantages

The expanding portfolio into high-performance and certified recycled products is expected to create lucrative opportunities for the manufacturers during the projected period. Moreover, the United States government is trying to apply more sustainable initiatives, while the durability and strength of products, where the manufacturers have the chance to get major industry attention in the coming years, as per the recent industry survey.

Market Challenge

Manufacturers Can Face Headwinds Amid Material Gaps

The inconsistent supply of recycled plastic is anticipated to hamper the industry's growth in the upcoming years. Moreover, factors such as the availability of the proper recycled plastic feedstock and others can create growth barriers for industry manufacturers during the forecast period. These factors can affect the growth of the new market entrants and mid-sized businesses for the future period, as per future industry expectations and predictions nowadays.

Segmental Insights

Product Type Insights

How did the Plastic Lumber & Decking Segment Dominate the U.S. recycled plastics in green building materials market in 2024?

The plastic lumber & decking segment held the largest share of the market in 2024, due to factors such as the low maintenance and durability in the current period. As plastic lumber is highly preferred by individuals for outdoor use, for likely to gain immense industry fences and landscaping, as per the recent industry observation. Furthermore, the United States homeowners and the contractors are actively seen in seeking long-term solutions where the segment is likely to gain immense industry attention in the upcoming years.

The composite building components segment is expected to grow at a notable rate during the predicted timeframe, akin to the increasing need for recycled plastic, which has versatility, insulation, while having superior strength in recent years in the country. Moreover, the builders and constructors are actively seen in the replacement of traditional materials in applications such as roofing, structural panels, and siding, where the composite building material is expected to gain major industry share during the forecast period.

Polymer Feedstock Insights

Why does the Recycled HDPE Segment Dominate the U.S. Recycled Plastics in Green Building Materials Market by Polymer Feedstock?

The recycled HDPE segment held the largest share of the U.S. recycled plastics in green building materials market in 2024, due to having the unique characteristic such as easy recycling, abundance, making the ideal for applications like pipes, decking, and panels in the current period. Furthermore, having resistance to moisture, the country's green building manufacturers consider it a crucial item in their work, owing to the country’s climate.

The recycled PET & PET-based fibers segment is expected to grow at a notable rate due to the sudden increased need for strong thermal and sound isolation in the United States recently. Moreover, the PET-based fibers have been actively used in applications such as wall panels, carpet backing, and decorative finishes in the past few years. As the PET bolts are lightweight with durable can create significant opportunities for building and construction manufacturers in the coming years, as per future industry expectations.

Product Form Insights

Why does the Extruded Profiles Segment Dominate the U.S. Recycled Plastics in Green Building Materials Market in 2024?

The extruded profiles segment dominated the market with the largest share in 2024 because they are cost-effective, customizable, and widely used in products like window frames, trims, and siding. The extrusion process produces consistent shapes from recycled plastic with minimal waste. In the United States, demand for standardized, easy-to-install building products is high, especially for residential projects. Extruded profiles are durable, weather-resistant, and low-maintenance, making them appealing for long-term building solutions.

The composite/molded panels segment is expected to grow at a significant rate because they combine recycled plastics with other materials to create strong, moisture-resistant, and insulating products. These panels are ideal for modular construction, prefabricated buildings, and high-performance interiors. The United States' demand for multi-functional and sustainable products is increasing, especially in commercial and green-certified projects.

Certification Insights

Why does the Certified Recycled Content Segment Dominate the U.S. Recycled Plastics in Green Building Materials Market by Certification?

The certified recycled content segment held the largest share of the U.S. recycled plastics in green building materials market in 2024, because it's a straightforward and widely recognized proof of sustainability for green building projects in the country. This certification is accepted by programs like LEED and helps products qualify for government incentives or meet project requirements. Builders and contractors prefer it because it's easy to verify and cost-effective to achieve.

The LCA verified/cradle to cradle certified segment is expected to grow at a notable rate because it assesses the full environmental impact of a product, from sourcing to disposal. This aligns with the United States' push for deeper sustainability and ESG commitments. Architects, developers, and green building programs are increasingly requiring comprehensive environmental performance metrics. These certifications offer a competitive edge by demonstrating superior sustainability credentials.

End User Type Insights

How did the Homeowners & Residential Contractors Segment Dominate the U.S. Recycled Plastics in Green Building Materials Market in 2024?

The homeowners & residential contractors segment held the largest share of the market in 2024, because they are the largest buyers of recycled plastic materials for renovations, landscaping, and new home construction. United States homeowners value the durability, low maintenance, and eco-friendly aspects of these products, especially for outdoor applications like decks and fences. Residential contractors also benefit from the cost savings and quick installation of recycled plastic building products.

The architects and specifiers segment is expected to grow at a notable rate during the predicted timeframe, because they decide on materials for large-scale projects, including commercial, institutional, and high-end residential buildings. Their growing emphasis on sustainability and green certifications will lead them to specify recycled plastic products more often. Manufacturers targeting this group with technical data, certification support, and design flexibility will gain long-term business.

Distribution Type Insights

How did the Building Materials Distributors & Retailers Segment Dominate the U.S. Recycled Plastics in Green Building Materials Market in 2024?

The building materials distributors & retailers segment held the largest share of the market in 2024, because they make recycled plastic building products widely accessible to both professionals and DIY customers. Big-box stores, regional suppliers, and specialty outlets offer nationwide reach, marketing support, and customer education. Their established networks ensure fast product availability and visibility in the market.

The B2B direct contracts segment is expected to grow at a notable rate during the predicted timeframe, because it allows manufacturers to work directly with developers, contractors, and architects on customized solutions for specific projects. This approach ensures products meet precise performance, design, and certification needs. Large-scale green building projects, which are growing in the U.S., prefer such direct partnerships to ensure efficiency and compliance.

Recent Developments

- In February 2024, BASF introduced its latest recycled plastic building blocks in its latest projects called Chem recycling. Also, the building blocks offered have the ISCC+ certificate as per the report published by the company.(Source: www.basf.com)

- In November 2024, ExxonMobil plans to invest in plastic recycling and establish its units in North America and other regions. Also, the company’s budget has 200 million for plants in Baytown and Beaumont, Texas, as per the report published by the company recently.(Source: corporate.exxonmobil.com)

U.S. Recycled Plastics in Green Building Materials Market Top Companies

- Waste Management

- Republic Services

- Veolia North America

- KW Plastics

- Plastipak

- CarbonLITE Industries

- B. Schoenberg & Co.

- Envision Plastics

- TerraCycle

- Avangard Innovative

- Advanced Environmental Recycling Technologies (AERT)

- Custom Polymers

- Circular Polymers

- Clean Tech Incorporated

- Cycletex LLC

- WM Recycle America

Segment Covered

By Product Type

- Plastic Lumber & Decking

- Exterior Cladding & Siding Panels

- Roofing Components (underlayments, tiles with recycled content)

- Insulation Facings & Vapor Barriers

- Pavers, Tiles & Hardscape Elements

- Interior Panels, Acoustic & Ceiling Tiles

- Window & Door Profiles (recycled PVC/UPVC blends)

- Geosynthetics & Landscape Products (weed barriers, drainage mats)

- Composite Building Components (structural insulated panels, façade modules)

By Polymer Feedstock

- Recycled HDPE (High-Density Polyethylene)

- Recycled PET (Polyethylene Terephthalate)

- Recycled PVC (Polyvinyl Chloride)

- Recycled PP (Polypropylene)

- Mixed/Reprocessed Plastics (regrind, PCR blends)

- Bio-plastic blends / recycled content blends

By Product Form / Processing Route

- Extruded Profiles (lumber, siding profiles)

- Molded Components (pavers, tiles, panels)

- Sheet & Film (facings, membranes)

- Composite/Hybrid (wood-plastic composites, fiber-reinforced)

- Pellet/Granule (feedstock sales to manufacturers)

By Certification / Sustainability Grade

- Certified Recycled Content (e.g., PCR percentage certified)

- Low-VOC / Indoor Air Quality Rated

- Cradle-to-Cradle / LCA-verified Products

- Non-certified / Standard recycled content

By End-User / Buyer Type

- Residential Homeowners & Contractors

- Commercial Developers & General Contractors

- Architects, Specifiers & AEC Firms

- Public Sector / Municipal Procurement

- Landscape Architects & Municipal Agencies

- Building Product Distributors & Retailers

By Distribution Channel

- B2B Direct Contracts (spec & bulk orders)

- Building Materials Distributors & Wholesalers

- Home Improvement Retailers (big-box & specialty)

- Online Marketplaces & OEM partnerships

- Recycling-to-manufacturing vertical supply agreements