Content

Green Building Materials Market Volume to Exceed 1,271.6 Million Tons by 2034

The global green building materials market volume was reached at 600 million tons in 2024 and is expected to be worth around 1,271.6 million tons by 2034, growing at a compound annual growth rate (CAGR) of 7.80% over the forecast period 2025 to 2034. The increasing focus on improving indoor air quality, stringent environmental regulations, and growing environmental awareness drives the market growth.

Key Takeaways

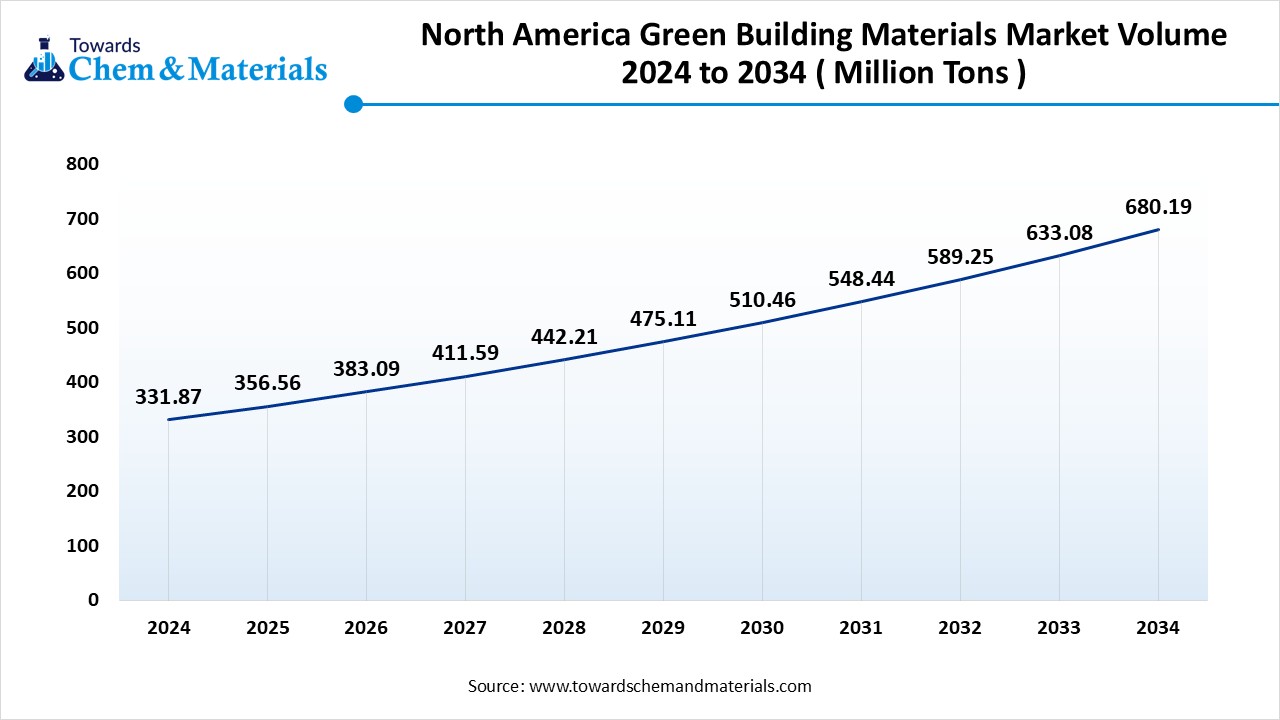

- The North America green building materials market Volume is estimated at 202.30 million tons in 2025 and is expected to reach 414.63 million tons by 2034, growing at a CAGR of 8.30% from 2025 to 2034.

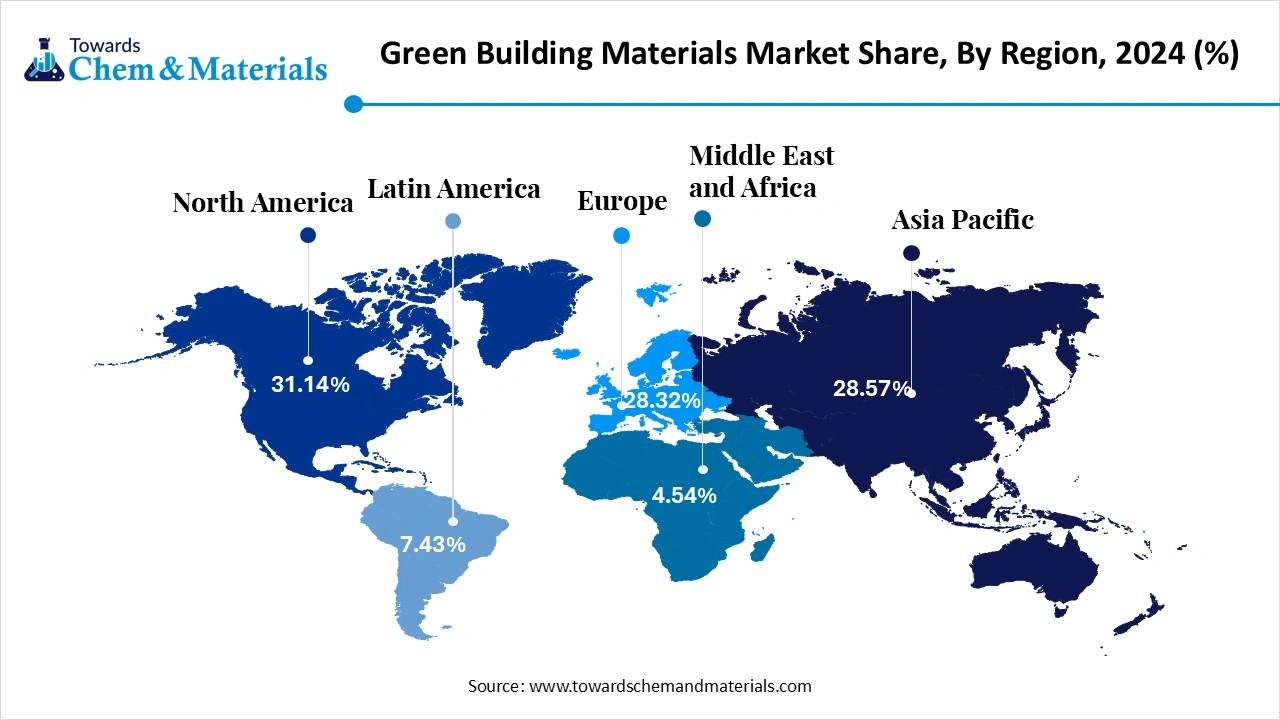

- The North America green building materials market held the largest volume share of 31.14% of the global market in 2024.

- The Asia Pacific green building materials market is expected to register the fastest CAGR of 8.34% over the forecast period by 2025-2034.

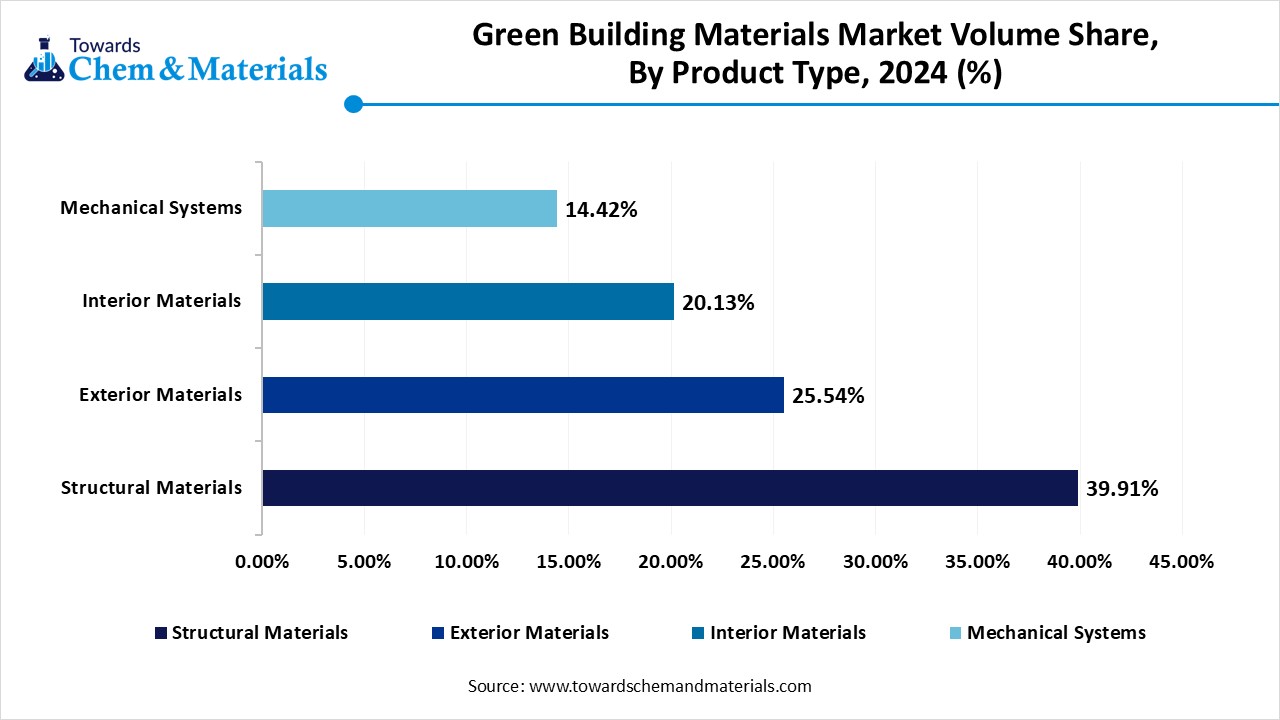

- By Product Type, the structural materials segment dominated the market with the largest volume share of 39.91% in 2024.

- By Product Type, the exterior materials segment is projected to grow at the fastest CAGR of 9.52% over the forecast period by 2025-2034.

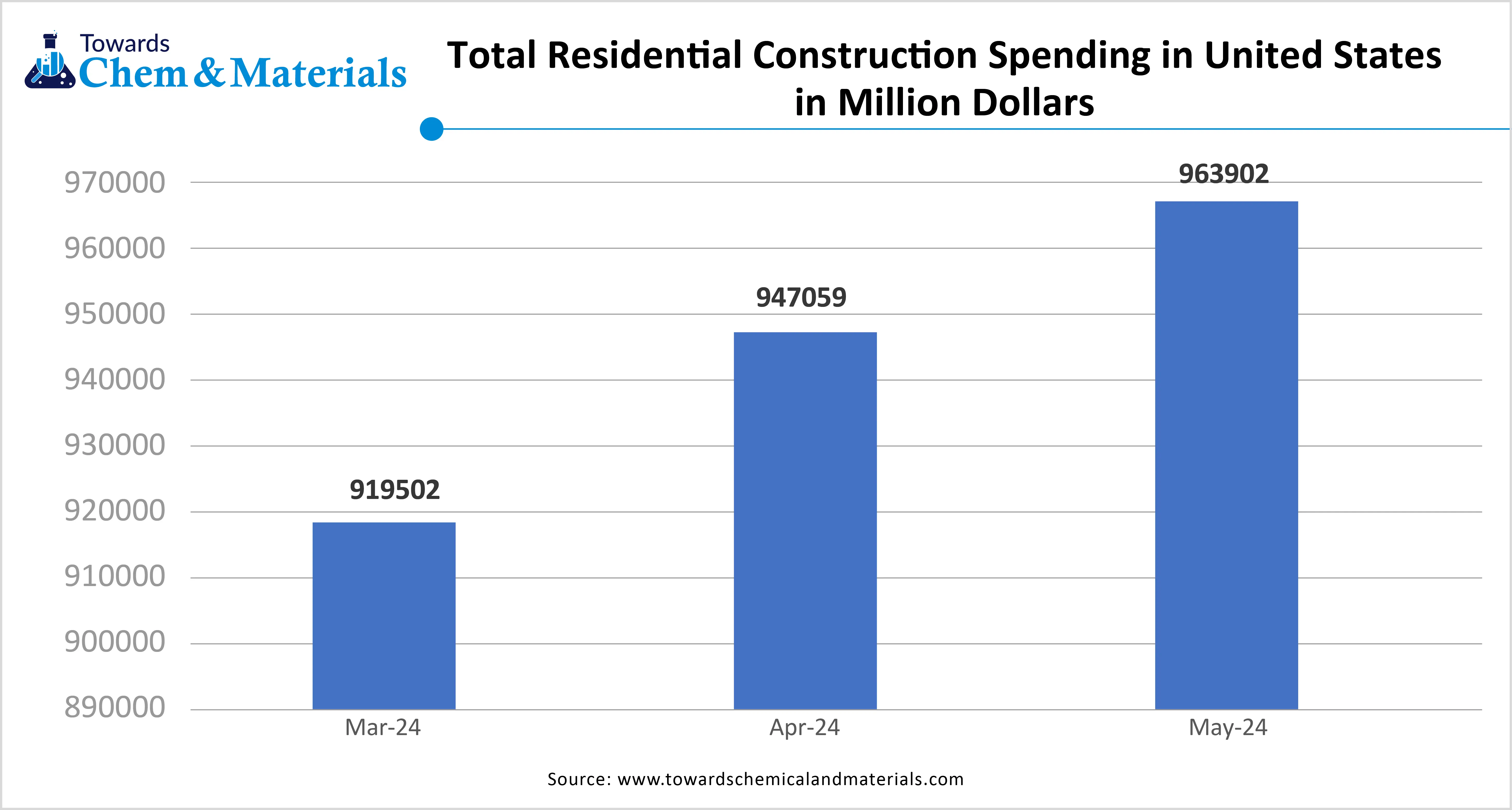

- By application, the residential segment held approximately a 60% share in the market in 2024 due to the increasing spending on residential construction.

- By application, the public infrastructure segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing development of government buildings.

- By end-use objective, the energy efficiency segment held approximately 38% share in the market in 2024 due to the stricter building codes.

- By end-use objective, the indoor air quality segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing focus on improving ventilation.

- By construction type, the new construction segment held a 70% share in the green building materials market in 2024 due to the growing development of commercial spaces.

- By construction type, the retrofit segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on resource conservation.

Green Building Materials: Power Behind Sustainable Future & Construction

Green building materials are materials that improve sustainability by lowering environmental impact. These materials are sustainably produced and sourced for use in construction. These materials require minimal resources and energy for production. Green building materials are highly durable and minimize the need for frequent replacements. They can be reused or recycled and do not release any harmful pollutants. Green Building materials include reclaimed wood, hempcrete, bamboo, recycled materials, straw bales, sheep’s wool, cork, and many more. Green building materials enhance indoor air quality, improve energy efficiency, and lower waste. The growing focus on reducing carbon footprint increases demand for green building materials. The stringent government regulations increase the adoption of green building materials. Factors like focus on improving indoor air quality, growing construction activities, technological advancements, smart building integration, and growing focus on sustainable construction contribute to the green building materials market growth.

- Vietnam exported 192,472 shipments of bamboo.(Source: www.volza.com)

- Malaysia exported 47,578 shipments of precast concrete.(Source: www.volza.com )

- Brazil exported 156,960 shipments of fiber cement.(Source: www.volza.com )

- India exported 51 shipments of reclaimed wood floor.(Source: www.volza.com )

Who are the Leading Exporters of Cross-Laminated Timber?

| Country | Export |

| Austria | $252M |

| Germany | $53.6M |

| Canada | $17.4M |

Growing Construction Activities Surge Demand for Green Building Materials

The rapid urbanization increases demand for various construction activities. The growing construction activities in various regions increase demand for green building materials. The increasing environmental concerns focus on the development of environmentally friendly construction. The growing commercial, industrial, and residential construction increases the adoption of green building materials. The increasing construction industry shift towards sustainable construction practices fuels demand for green building materials.

The focus on the development of smart city solutions increases demand for green building materials. The growing government investment in infrastructure development, like government buildings, offices, and airports, fuels demand for green building materials. The increasing development of green office spaces and the focus on indoor air quality require green building materials. The growing construction activities are a key driver for the green building materials market.

Market Trends

- Growing Environmental Concerns: The growing environmental concerns, like climate change, pollution, and many more, increase the adoption of green building materials. These materials help in boosting energy efficiency, lowering carbon footprints, and conserving resources.

- Increasing Focus on the Development of Sustainable Construction: The growing development of sustainable construction increases demand for green building materials to lower environmental impact and carbon emissions.

- Growing Expansion of Non-Residential Construction: The growing expansion of non-residential construction, like industrial facilities, malls, commercial offices, and others, increases demand for green building materials to meet sustainability demands.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 646.8 Million Tons |

| Expected Volume by 2034 | 1,271.6 Million Tons |

| Growth Rate from 2025 to 2034 | 7.80% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By Application, By End-Use Objective, By Construction Type, By Region |

| Key Companies Profiled | BASF SE, Saint-Gobain S.A., Kingspan Group, Interface, Inc., Holcim Ltd (LafargeHolcim), CertainTeed Corporation, Owens Corning, The Dow Chemical Company, Knauf Insulation, Rockwool International A/S, PPG Industries, Inc., Sherwin-Williams Company, Sika AG, DuPont de Nemours, Inc., Forbo Holding AG, Armstrong World Industries, Toray Industries, Inc., Tarkett S.A., Homasote Company, National Fiber |

Market Opportunity

Growing Demand for Energy-Efficient Buildings Drives Market Growth

The increasing awareness about climate change and the growing energy cost increases demand for energy-efficient buildings. The government focuses on higher energy efficiency standards, fueling demand for green building materials. The focus on reducing the cost of energy increases demand for materials in green buildings, like reflective roofing, high-performance insulation, and low-e windows. Energy-efficient buildings improve indoor air quality by offering better insulation and ventilation. The integration of green buildings with solar panels and various renewable energy sources supports energy-efficient buildings.

The increasing demand for reducing the consumption of energy fuels the adoption of green building materials. The stricter energy-efficient codes help in the development of energy-efficient buildings. The increasing consumer awareness about climate change is fueling the adoption of energy-efficient buildings, which increases demand for green building materials. The growing demand for energy-efficient buildings creates an opportunity for the growth of the green building materials market.

Market Challenge

High Initial Cost Limits Expansion of Green Building Materials Market

Despite several benefits of green building materials, the high initial cost restricts the market growth. Factors like specialized labor, increased production expenses, need for specialized technologies, and premium eco-friendly materials are responsible for the high initial cost. The cost of materials like bamboo, energy-efficient insulation, recycled steel, and reclaimed wood is high. The development of green building materials requires specialized technologies and skills that increase the cost.

The need for specialized materials like specialized insulation, solar panels, and energy-efficient windows increases the initial investment. The green materials, like recycled content material and timber, increase the initial cost. The need for specialized knowledge for the installation of green materials increases the cost. The high initial cost hampers the growth of the market.

Regional Insights

Why North America Dominated the Green Building Materials Market?

The North America green building materials market volume was estimated at 186.80 million tons in 2024 and is anticipated to reach 414.63 million tons by 2034, growing at a CAGR of 8.30% from 2025 to 2034.

North America dominated the green building materials market in 2024. The strong presence of the LEED rating system increases the adoption of green building materials. The stricter environmental regulations and strong government support for green buildings help the market growth. The increasing consumer awareness about the advantages of green building increases demand for green building materials. The increasing focus on a healthier indoor environment increases demand for green building materials. The growing industrial, residential, and commercial green building construction drives the market growth.

United States Green Building Materials Market Trends

The United States is a major contributor to the market. The growing construction activities in the commercial and residential sectors increase demand for green building materials. The increasing awareness of green building benefits among policymakers, consumers, and businesses helps the market growth. The ongoing technological advancements in the development of sustainable building materials and presence of the LEED certification program support the market growth.

- In April 2025, the U.S. Green Building Council launched a new rating system, LEED v5, to accelerate decarbonization in buildings. The aim is to reduce carbon emissions and offer higher performance. The rating system focuses on resilience, decarbonization, and human & ecological health.(Source: esgnews.com )

Which Region is the Fastest-Growing in the Green Building Materials Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing construction activities increase demand for green building materials. The increasing government investment in smart cities and infrastructure development fuels demand for green building materials. The strong government support for green building practices helps market growth. The increasing consumer awareness regarding resource depletion, climate change, and pollution is fueling demand for green building materials. The extensive government investment in infrastructure development and growth in industrial, residential, and commercial construction drives the overall growth of the market.

China Green Building Materials Market Trends

China dominates the green building materials market in the Asia Pacific. The focus on sustainable development increases demand for green building materials. The specific targets for green building renovation and construction help market growth. The rapid urbanization and growing development of new buildings increase demand for green building materials. The policies, like the Green Building Action Plan, and increasing construction activities, support the market growth.

- China exported 289,618 shipments of bamboo.(Source: www.volza.com )

Green Building Materials Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| North America | 31.14% | 186.8 | 30.11% | 414.63 | 8.30% |

| Europe | 28.32% | 169.9 | 29.31% | 372.7 | 9.12% |

| Asia Pacific | 28.57% | 171.4 | 27.72% | 352.5 | 8.34% |

| Latin America | 7.43% | 44.6 | 7.83% | 99.6 | 9.34% |

| Middle East & Africa | 4.54% | 27.2 | 5.03% | 64.0 | 9.95% |

| Total | 100% | 600.0 | 100% | 1,271.6 | 7.80% |

Segmental Insights

Product Type Insights

How Structured Materials Segment Held the Largest Share in the Green Building Materials Market?

The structured materials segment held the largest revenue share in the green building materials market in 2024. The increasing need for foundational elements like load-bearing components, foundation, and framework increases demand for structured green building materials. The increasing focus on promoting healthier living, improving indoor air quality, and lowering toxin exposure increases demand for structural materials. The focus on minimizing energy consumption and the need for better insulation increases demand for structured materials. The growing demand for structured materials like recycled steel and engineered wood drives the overall growth of the market.

The exterior materials segment is the fastest growing in the market during the forecast period. The growing focus on minimizing waste and the carbon footprint of construction projects increases demand for exterior materials. The stricter government regulations and certifications, like LEED, increase demand for exterior materials. The growing environmental concerns like pollution, climate change, and resource depletion increase demand for exterior green building materials. The growing demand for exterior materials like recycled metal, energy-efficient doors & windows, fiber cement siding, sustainable wood, and cool roofing materials supports the overall growth of the market.

Green Building Materials Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Structural Materials | 39.91% | 239.5 | 37.26% | 473.8 | 7.88% |

| Exterior Materials | 25.54% | 153.2 | 27.31% | 347.3 | 9.52% |

| Interior Materials | 20.13% | 120.8 | 22.31% | 283.7 | 9.95% |

| Mechanical Systems | 14.42% | 86.5 | 13.12% | 166.8 | 7.57% |

| Total | 100% | 600.0 | 100% | 1,271.6 | 7.80% |

Application Insights

Which Application Segment Dominated the Green Building Materials Market?

The residential segment dominated the green building materials market in 2024. The increasing disposable incomes and growing spending on residential construction increase demand for green building materials. The rapid urbanization increases demand for residential construction. The increasing consumer demand for energy-efficient homes fuels demand for green building materials. The consumer focuses on improving indoor air quality, minimizing energy consumption, and reducing utility bills of residential increases in demand for green building materials. The strong government support for residential construction and preference for multi-generational living homes drive the market growth.

The public infrastructure segment is experiencing the fastest growth in the market during the forecast period. The strong government support for the development of public infrastructure through various investments and policies increases demand for green building materials to improve indoor environments and enhance energy efficiency. The increasing development of public utilities and government buildings helps the market growth. The focus on long-term benefits like maintenance, energy consumption, and water usage increases demand for green building materials. The increasing demand for lowering greenhouse gas emissions and reducing waste in public infrastructure fuels demand for green building materials, supporting the overall growth of the market.

End-Use Objective Insights

How Energy Efficiency Segment Held the Largest Share in the Green Building Materials Market?

The energy efficiency segment held the largest revenue share in the green building materials market in 2024. The growing demand for energy-efficient building materials like efficient HVAC systems, high-performance insulation, and energy-efficient windows increases demand for green building materials. The increasing demand for energy-efficient buildings and homes helps market growth. The government support for energy-efficient buildings through subsidies, tax credits, and rebates increases demand for green building materials. The stringent building codes and innovations in energy-efficient materials drive the market growth.

The indoor air quality segment is the fastest growing in the market during the forecast period. The focus on improving air circulation and ventilation in residential and commercial spaces increases demand for green building materials for better indoor air quality. The increasing health concerns like allergies, respiratory issues, and many more increase the demand for better indoor air quality. The focus on reducing VOC emissions and the integration of green building materials like bamboo, wool, clay, and cork help to improve indoor air quality. The certifications, like LEED, and the growing health benefits of green building materials support the market growth.

Construction Type Insights

Why did New Construction Segment Dominate the Green Building Materials Market?

The new construction segment dominated the green building materials market in 2024. The strong government support for new construction through rebates, tax breaks, and grants increases demand for green building materials. The focus on the development of net-zero emission construction helps market growth. The growing advancements in construction techniques, like modular construction, increase demand for green building materials. The increasing integration of energy management systems and smart building solutions increases demand for green building materials. The rapid urbanization and growing demand for non-residential & residential construction drive the market growth.

The retrofit segment is experiencing the fastest growth in the market during the forecast period. The growing demand for retrofitting older buildings with advanced HAVC systems, high-performance insulation, and energy-efficient windows helps market growth. The government support for retrofitting commercial & residential spaces increases demand for green building materials. The focus on resource conservation and extending the lifespan of buildings increases the adoption of retrofit. The increasing demand of renters and buyers for retrofitted buildings helps the market growth. The preference for preserving cultural significance & historical value and improving indoor air quality increases demand for retrofitting, supporting the overall market growth.

Recent Developments

- In April 2025, T2Earth launched fire-retardant OnWood Plywood. The plywood gets certification from the International Code Council and is safe, sustainable, strong, and affordable. It is a sustainable option for developers & builders and is made up without any toxic chemicals.(Source: www.woodworkingnetwork.com )

- In March 2025, Cadivi launched an eco-friendly cable line for sustainable construction. The product is made up of LSHF materials and LF insulation. The material enhances fire safety and lowers environmental impact. The cables are suitable for prioritizing durability, energy efficiency, green building projects, resource conservation, and safety.(Source: e.vnexpress.net)

- In October 2024, CRH Ventures launched a sustainable building materials accelerator program. The program supports Series B, Seed, & Series A startups in the climate tech & construction sector. The program aims to enhance energy efficiency, lower emissions, and decrease waste in construction activities. The program focuses on the development of CO2 mineralized materials, sustainable binder solutions, and the development of new materials & applications. (Source: worldbiomarketinsights.com)

Top Companies List

- BASF SE

- Saint-Gobain S.A.

- Kingspan Group

- Interface, Inc.

- Holcim Ltd (LafargeHolcim)

- CertainTeed Corporation

- Owens Corning

- The Dow Chemical Company

- Knauf Insulation

- Rockwool International A/S

- PPG Industries, Inc.

- Sherwin-Williams Company

- Sika AG

- DuPont de Nemours, Inc.

- Forbo Holding AG

- Armstrong World Industries

- Toray Industries, Inc.

- Tarkett S.A.

- Homasote Company

- National Fiber

Segments Covered

By Product Type

- Structural Materials

- Cross-Laminated Timber (CLT)

- Recycled Steel

- Rammed Earth

- Bamboo

- Precast Concrete (Green)

- Exterior Materials

- Roofing (Cool Roofs, Green Roofs, Recycled Shingles)

- Facades/Cladding (Fiber Cement, Recycled Metal Panels, Wood Composite)

- Windows (Low-E Glass, Double/Triple Glazed)

- Doors (FSC Certified Wood, Recycled Metal)

- Interior Materials

- Flooring (Reclaimed Wood, Cork, Bamboo, Linoleum, Recycled Tiles)

- Insulation (Cellulose, Sheep Wool, Cotton/Denim, Aerogel, Hempcrete)

- Drywall & Interior Panels (Recycled Gypsum, Magnesium Oxide Boards)

- Paints & Coatings (Low/Zero-VOC Paints, Natural Paints, Reflective Coatings)

- Adhesives & Sealants (Low-VOC, Water-Based Adhesives)

- Mechanical Systems

- HVAC Systems (Energy-Efficient, Geothermal)

- Lighting (LEDs, Daylighting Systems)

- Plumbing (Low-Flow Fixtures, Recycled Water Systems)

By Application

- Residential

- New Constructions

- Renovations & Retrofits

- Commercial

- Offices

- Hospitality

- Retail

- Healthcare

- Educational Institutions

- Industrial

- Warehousing

- Manufacturing Units

- Public Infrastructure

- Airports

- Stadiums

- Government Buildings

By End-Use Objective

- Energy Efficiency

- Water Efficiency

- Indoor Air Quality

- Sustainable Sourcing

- Thermal Performance

By Construction Type

- New Construction

- Renovation / Retrofit

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait