Content

What is the Current Sustainable Aviation Fuel (SAF) Market Size and Share?

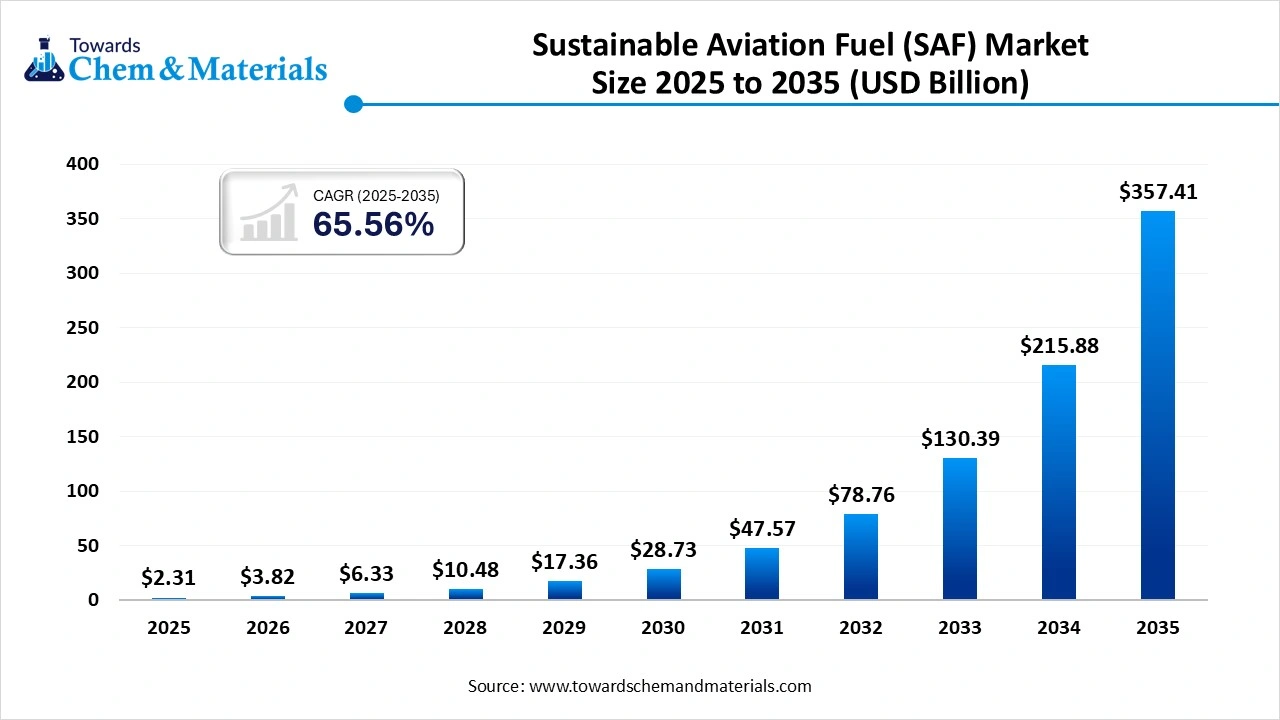

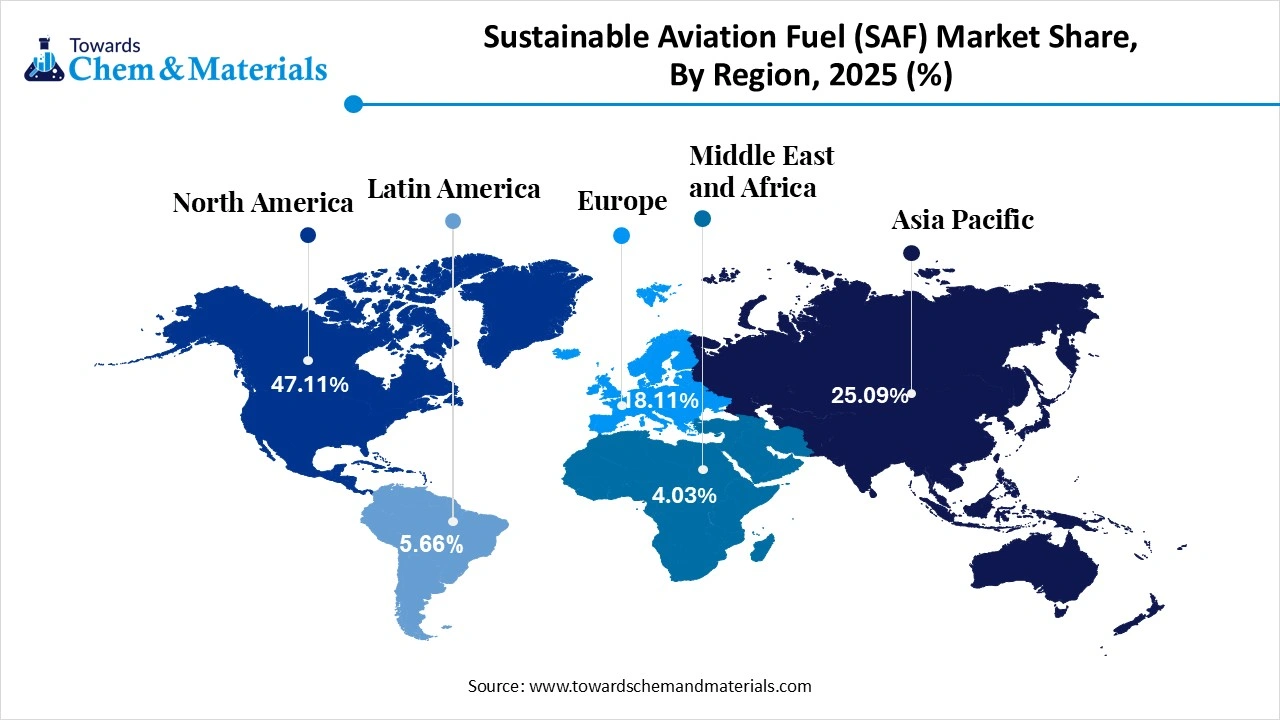

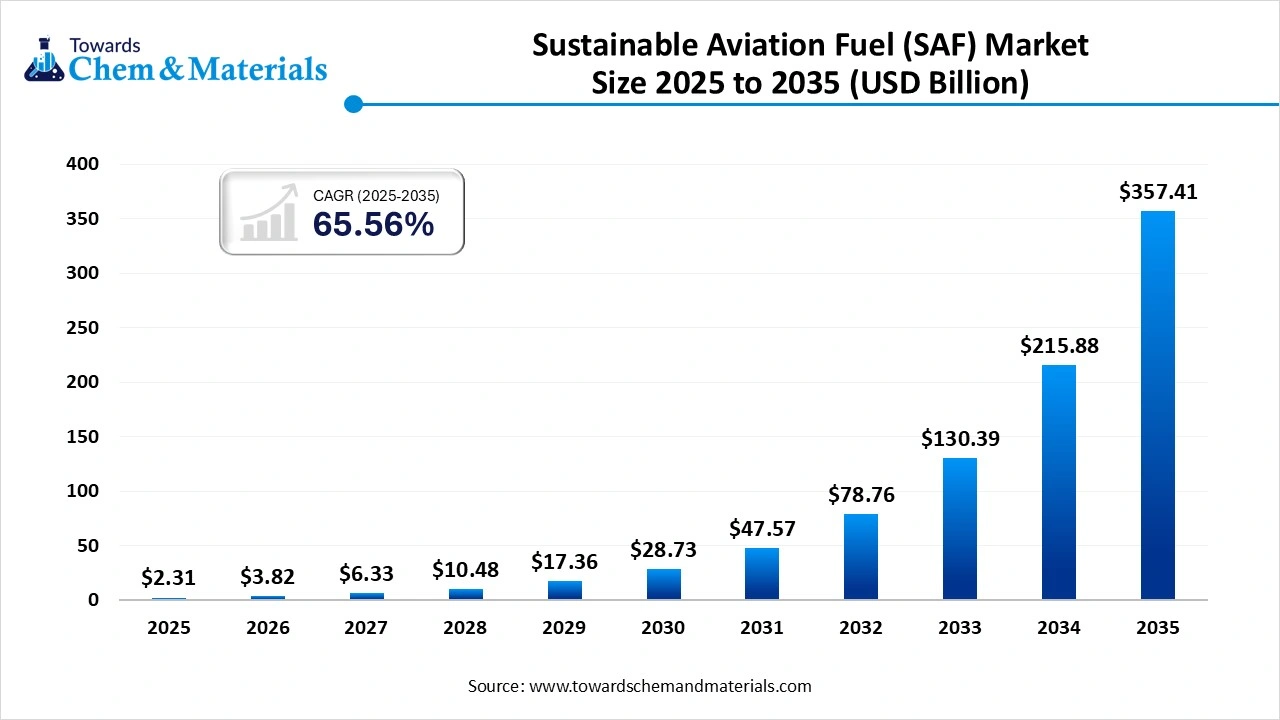

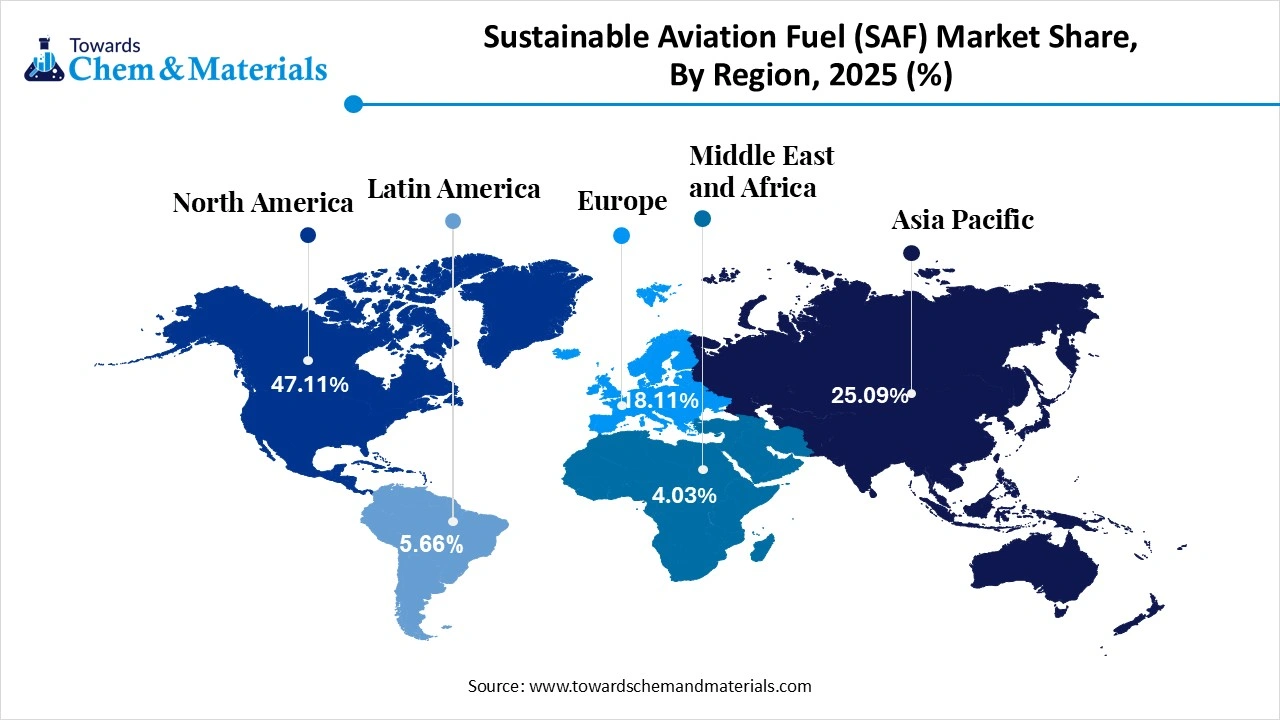

The global sustainable aviation fuel (SAF) market size is calculated at USD 2.31 billion in 2025 and is predicted to increase from USD 3.82 billion in 2026 and is projected to reach around USD 357.41 billion by 2035, The market is expanding at a CAGR of 65.56% between 2026 and 2035. North America dominated the sustainable aviation fuel (SAF) market with a market share of 47.11% the global market in 2025. The global shift towards the reduction of aviation emissions and sustainability has fueled the industry's potential in recent years.

Key Takeaways

- By region, North America led the sustainable aviation fuel (SAF) market with the largest revenue share of over 47.11% in 2025.

- By feedstock type, the vegetable oils segment led the market with the largest revenue share of 36.11% in 2025.

- By feedstock type, the waste oils and fats segment is expected to grow with a 25% industry share during the forecast period.

- By processing technology, the hydroprocessed esters and fatty acids (HEFA) led the market with the largest revenue share of 41.23% in 2025.

- By processing technology, the Fischer-Tropsch (FT) synthesis segment is expected to grow with a 25% industry share during the forecast period.

- By application, the commercial aviation segment accounted for the largest revenue share of 71.09% in 2025.

- By application, the private and business aviation segment is expected to have with 10% industry share during the forecast period.

- By distribution channel, the direct sales to airlines segment dominated with the largest revenue share of 60.56% in 2025.

- By distribution channel, the fuels blending/ suppliers segment is expected to grow with a 25% industry share during the forecast period.

Cleaner Skies Ahead: Sustainable Aviation Fuel Takes Flight

The sustainable aviation fuel refers to a cleaner alternative fuel to the traditional jet fuel, which is primarily made from low-carbon sources such as waste oils, vegetable oil, sugar, fats, and biomass. Furthermore, the manufacturers are focused on the sustainability of the fuel, which can work safely in existing aircraft without changing engines or airport infrastructure and systems.

Sustainable Aviation Fuel (SAF) Market Trends:

The development of the carbon smart airports is positively impacting revenue potential and industry scalability in the current period. Moreover, several aircraft are seen in the development of shared systems for airlines, which allows multiple carriers to access blended jet fuel rapidly.

The increasing usage of artificial intelligence to predict feedstock availability has driven investor confidence in the industry’s future. Moreover, several manufacturers have observed in the heavy installation and replacement of traditional mechanisms with robotic procedures for better accuracy and precision.

The emergence of the SAF credits for corporate flyers is likely to contribute to favourable market economies for the industry during the forecast period. Moreover, the SAF credits, where airlines can sell certificates that display how much SAF was used on behalf of corporate customers.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 3.82 Billion |

| Revenue Forecast in 2035 | USD 357.41 Billion |

| Growth Rate | CAGR 65.56% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Feedstock Type, By Process Technology, By Application / End-Use, By Distribution Channel, By Region |

| Key companies profiled | TotalEnergies, LanzaJet, World Energy, Neste, Shell Aviation , BP (British Petroleum) , ExxonMobil , Velocys , Gevo, Inc. , Red Rock Biofuels , Repsol , SkyNRG , Fuji Oil , Phillips 66 , Honeywell UOP , EnBW Energie Baden Württemberg , Chevron , Amyris, Inc. , Fulcrum BioEnergy , Air BP |

One Refinery, Many Pathways: The New Face of SAF Innovation

The sustainable aviation fuel (SAF) market is experiencing a major technological shift towards multi-feedstock, multi-pathway biorefineries that can switch between vegetable oils, waste oils, algae, sugars, and biomass based on cost and availability. New refineries are designed to run several processing technologies in one facility, such as HEFA, Fischer-Tropsch, and Alcohol-to-Jet pathways.

Value Chain Analysis of the Sustainable Aviation Fuel (SAF) Market:

- Distribution to Industrial Users: The primary users of Sustainable Aviation Fuel (SAF) are airlines and business aviation operators, with distribution channels largely integrated into existing jet fuel supply chains at airports. The key players in the production and distribution of SAF include major energy companies and specialized biofuel producers.

- Key Players: Neste and World Energy.

- Chemical Synthesis and Processing: Sustainable Aviation Fuel (SAF) is produced via several complex chemical synthesis and processing pathways that convert renewable or waste feedstocks into jet-fuel-range hydrocarbons. These fuels are designed to be "drop-in" replacements for conventional jet fuel, compatible with existing infrastructure, and must meet stringent quality standards set by organizations like ASTM International

- Key Players: Honeywell UOP and Topsoe

- Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring for Sustainable Aviation Fuel (SAF) involve a multi-layered framework established by international and national authorities, standard bodies, and third-party certification schemes to ensure that the fuel is both safe for flight and genuinely sustainable.

- Key Agencies: Fuel Producers and Suppliers, and Airlines (Economic Operators)

Sustainable Aviation Fuel (SAF) Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Promoting "green chemistry" to eliminate hazards at the design stage |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | incentivizing the design of inherently safe chemicals and processes ("Safe and Sustainable by Design" framework) |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law | Driving demand for advanced catalytic processes to meet stringent environmental regulations |

Segmental Insights

Feedstock Type Insights

How did the Vegetable Oils Segment Dominate the Sustainable Aviation Fuel (SAF) Market in 2025?

By feedstock type, the vegetable oils segment led the market with the largest revenue share of 36.11% in 2025, due to factors like easy sourcing, greater availability, and its already use by many biodiesel plants earlier. Moreover, having clean and consistent feedstock such as soybean, canola, palm, and camelina, the vegetable oil segment has gained major industry share in recent years.

The waste oils & fats segment is expected to grow with a 25% industry share owing to its affordability and greater sustainability. The waste oil and fats have seen offering much lower carbon emissions as compared to the vegetable oils, which is likely to create lucrative opportunities in the industry in the coming years.

The sugar & starch-based segment is also notably growing, owing to their flexibility and renewable option to produce alcohol intermediates like isobutanol and ethanol. Moreover, by supporting the new pathways like synthetic biofuels and Alcohol to Jet, the sugar and starch-based segment has gained significant industry attention in recent years.

Processing Type Insights

Why does the Hydroprocessed Esters and Fatty Acids (HEFA) Segment Dominate the Sustainable Aviation Fuel (SAF) Market?

The hydroprocessed esters and fatty acids (HEFA) segment dominated the market with 41.23% market share in 2025 because it is the most mature, proven, and reliable technology for producing sustainable jet fuel. It can easily process vegetable oils, waste cooking oils, and animal fats using similar equipment used in renewable diesel plants. HEFA has lower production costs, high efficiency, and strong certification support from aviation regulators.

The Fischer-Tropsch (FT) synthesis segment is expected to grow with a 25% market share because it can convert a wide range of feedstocks such as agricultural residues, forestry waste, municipal solid waste, and even captured CO2 into high-quality jet fuel. FT technology supports large industrial plants and produces very clean fuel with ultra-low emissions.

The alcohol to jet segment is also notably growing because many countries already have large ethanol and alcohol production industries, allowing rapid conversion into aviation fuel. Also, ATJ can use sugarcane ethanol, corn ethanol, and cellulosic alcohol made from agricultural waste, giving it flexibility in feedstocks.

Application Insights

How did the Commercial Aviation Segment Dominate the Sustainable Aviation Fuel (SAF) Market in 2025?

The commercial aviation segment dominated the market with 71.09% industry market in 2025 because airlines operate thousands of flights daily and consume the largest amount of jet fuel. Big carriers like American Airlines, Lufthansa, Air China, and Emirates are under strong pressure to cut emissions, making SAF a top priority.

The private and business aviation segment is expected to grow at a 10% market share because these customers can pay higher prices and adopt new fuel technologies faster than commercial airlines. Corporate jets, VIP operators, and luxury travel companies want to show environmental responsibility, and using SAF improves their sustainability image.

The military/defense aviation segment is also notably growing, because governments want to reduce fuel risks, improve energy security, and cut carbon emissions from their large aircraft fleets. SAF helps militaries reduce dependence on imported oil and meet national climate goals.

Distribution Channel Insights,

Why does the Direct Sale to Airlines Segment Dominate the Sustainable Aviation Fuel (SAF) Market?

The direct sale to airlines segment dominated the market with 60.56% industry share in 2025 because airlines prefer buying SAF straight from producers to ensure consistent quality, secure supply contracts, and negotiate better pricing. Large carriers sign multi-year agreements with SAF manufacturers to guarantee fuel availability.

The fuel blending/suppliers segment is expected to grow with a 25% market share because they can mix SAF with conventional jet fuel and distribute it through existing airport fuel systems. This makes scaling SAF much easier and cheaper. Blending suppliers work with refiners, pipelines, and airports, allowing large-volume distribution that individual SAF producers cannot manage alone.

The government programs and mandates segment is also notably growing because countries want to reduce aviation emissions and push airlines to adopt SAF. Many governments are introducing SAF blending requirements, tax incentives, carbon credits, subsidies, and funding to support new SAF plants.

Regional Insights

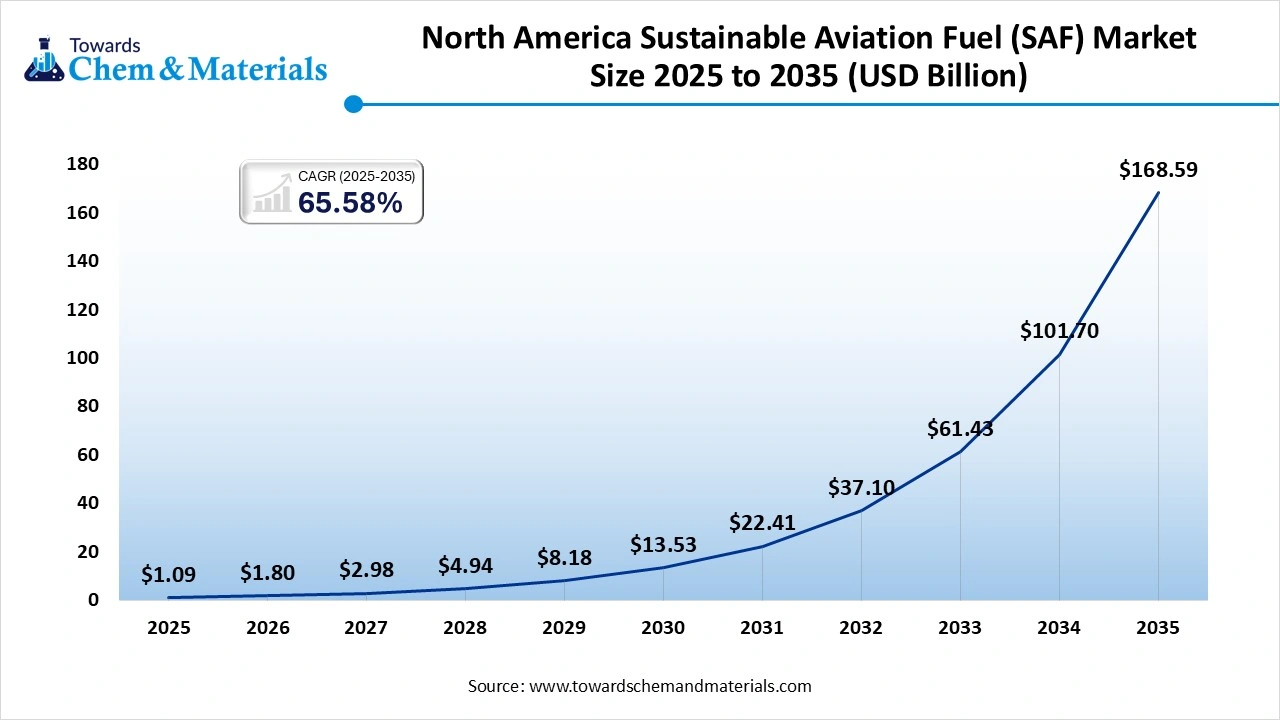

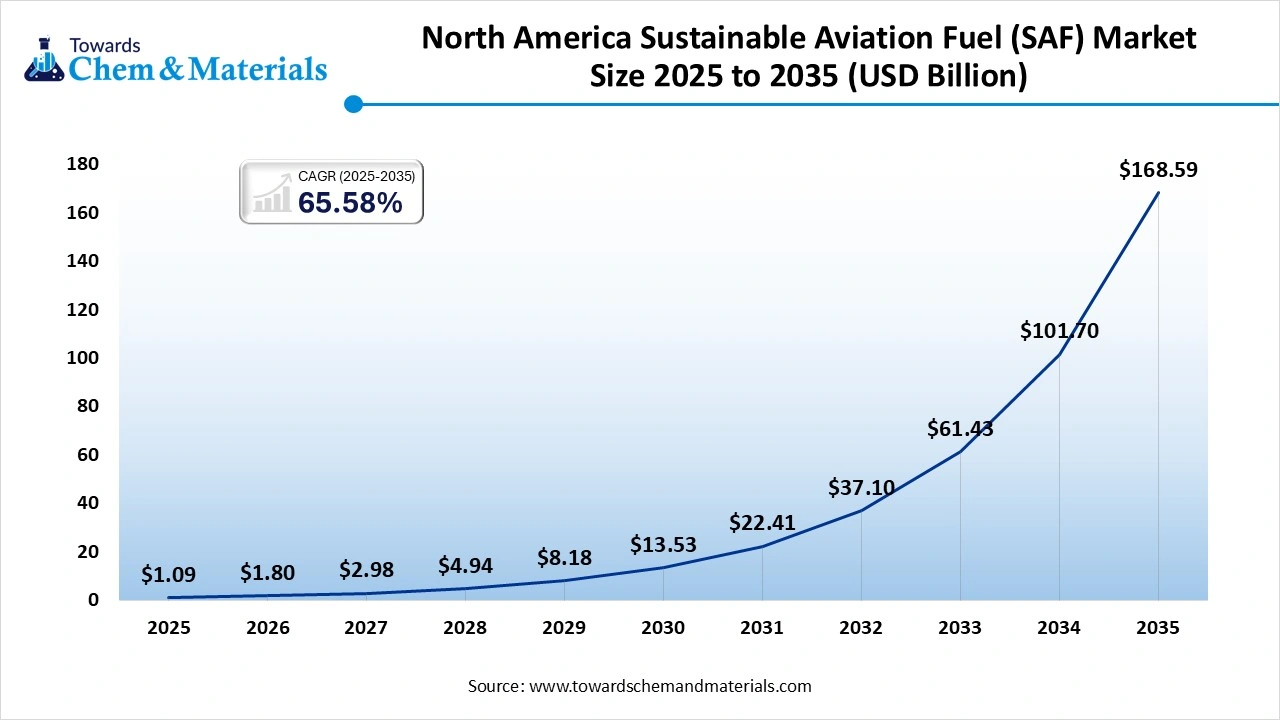

The North America sustainable aviation fuel (SAF) market size was valued at USD 1.09 billion in 2025 and is expected to reach USD 168.59 billion by 2035, growing at a CAGR of 65.58% from 2026 to 2035. In 2025, North America dominated the sustainable aviation fuel (SAF) market with a 47.11% industry share, owing to the presence of one of the world's largest and advanced aviation production units in the current period.

Moreover, factors like stronger climate policies and the presence of the major SAF production plants are driving industry growth in the region nowadays. Also, the early access to advanced technology and stronger investment have increasingly supported the market growth in recent years.

Massive SAF Blending Facilities Strengthen America’s Clean Aviation

The United States maintained its dominance in the market due to factors like enlarged availability of the feedstock and advanced refineries. Moreover, the major fuel suppliers and American airports are seen in building heavy SAF blending and storage facilities in the current period, as per the recent observation.

Europe Sustainable Aviation Fuel (SAF) Market Examination

Europe is expected to capture a major share of the market with a 30% share, owing to stronger regional laws for aviation fuel in the current period. Moreover, the region has implemented mandatory blend requirements under the specific aviation initiative, such as ReFuelEU and others. Also, the region has invested heavily in renewable fuels earlier.

Germany Accelerates Toward Leadership in Next-Generation SAF

Germany is expected to emerge as a prominent country for the sustainable aviation fuel (SAF) market in the coming years, owing to the country's advanced technology innovation. Moreover, Germany has seen under a heavy investment in hydrogen, which ultimately supports future SAF pathways such as power to liquid fuels and Fischer-Tropsch.

Asia Pacific Sustainable Aviation Fuel (SAF) Market Evaluation

Asia Pacific is a notably growing region due to the rising air travel demand in the region's countries in the current period. Moreover, the regional countries like China, India, and Japan have seen in heavy implementation of policies for the reduction of aviation emissions while supporting SAF production in the current period.

China’s Aviation Boom Fuels Massive SAF Expansion

China is expected to gain a major industry due to its largest aviation growth, large feedstock supply, and strong government commitment to carbon neutrality. The country is developing multiple SAF pathways, including waste cooking oil-based HEFA, agricultural-residue-based FT, and CO2-to-fuel technologies.

Sustainable Aviation Fuel (SAF) Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the market because major aviation hubs like the UAE, Saudi Arabia, and Qatar are investing heavily in sustainable fuels to support global airline operations. These regions want to reduce their dependence on crude oil and move toward cleaner aviation.

Saudi Arabia Leads the Next Era of Clean Aviation Fuel

Saudi Arabia is expected to emerge as a prominent country for the sustainable aviation fuel (SAF) market in the coming years, as the country is investing heavily in SAF as part of its initiative, like the Vision 2030 strategy, to diversify the economy and become a global clean energy leader. The country is developing advanced fuels using green hydrogen and Fischer-Tropsch technology.

Sustainable Aviation Fuel (SAF) Market Trends in South America

The Sustainable Aviation Fuel (SAF) market in South America is expanding due to abundant feedstocks, established biofuel industries, and rising interest in aviation decarbonization. Brazil and Argentina lead development, supported by new SAF plants, technological partnerships, and growing institutional backing. More than 15 projects are in planning or early stages, and regional cooperation is increasing.

Brazil Sustainable Aviation Fuel (SAF) Market Trends

In Brazil, the Sustainable Aviation Fuel (SAF) market is gaining momentum due to the country’s strong biofuel foundation, especially its well-developed sugarcane ethanol industry. Brazil is emerging as a regional leader, with multiple pilot and early-stage SAF projects exploring pathways such as alcohol-to-jet and synthetic fuels using biomass, glycerin, and captured CO₂.

Recent Development

- In October 2025, Motana Renewables introduced its sustainable aviation fuel blend. Moreover, the newly launched fuel called MaxSAF™, and the company has entered into a collaboration with Calmet Montana Refining (CMR).(Source: www.prnewswire.com)

Top Vendors in the Sustainable Aviation Fuel (SAF) Market & Their Offerings:

- Neste: A global leader in renewable fuels, specializing in producing sustainable aviation fuel (SAF), renewable diesel, and other renewable products from waste and residue raw materials.

- World Energy: A leading low-carbon solutions company that is a major producer of SAF in North America, with a focus on delivering net-zero fuels to drive the decarbonization of the aviation industry.

- LanzaJet: A sustainable aviation fuel technology company that uses alcohol-to-jet technology to produce drop-in SAF and renewable diesel, aiming to accelerate the industry's transition to clean energy.

- TotalEnergies: A broad energy company that produces and supplies SAF as part of its goal to become a major player in the energy transition, using a variety of feedstocks in its European refineries.

Top Companies in the Sustainable Aviation Fuel (SAF) Market

- TotalEnergies

- LanzaJet

- World Energy

- Neste

- Shell Aviation

- BP (British Petroleum)

- ExxonMobil

- Velocys

- Gevo, Inc.

- Red Rock Biofuels

- Repsol

- SkyNRG

- Fuji Oil

- Phillips 66

- Honeywell UOP

- EnBW Energie Baden-Württemberg

- Chevron

- Amyris, Inc.

- Fulcrum BioEnergy

- Air BP

Segments Covered in the Report

By Feedstock Type

- Vegetable Oils

- Soybean Oil

- Rapeseed Oil

- Palm Oil

- Waste Oils & Fats

- Used Cooking Oil

- Animal Fats

- Sugar & Starch-Based

- Sugarcane

- Corn

- Algae-Based

- Microalgae

- Lignocellulosic Biomass

- Wood Residues

- Agricultural Residues

- Other Feedstocks

- Municipal Solid Waste

By Process Technology

- Hydroprocessed Esters and Fatty Acids (HEFA)

- Fischer-Tropsch (FT) Synthesis

- Alcohol-to-Jet (ATJ)

- Direct Sugars-to-Hydrocarbons (DSHC)

- Other Technologies

By Application / End-Use

- Commercial Aviation

- Military / Defense Aviation

- Private & Business Aviation

- Other Applications

By Distribution Channel

- Direct Sale to Airlines

- Fuel Blending / Suppliers

- Government Programs & Mandates

- Other Channels

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa