Content

What is the Current Water Treatment Membrane Market Size and Share?

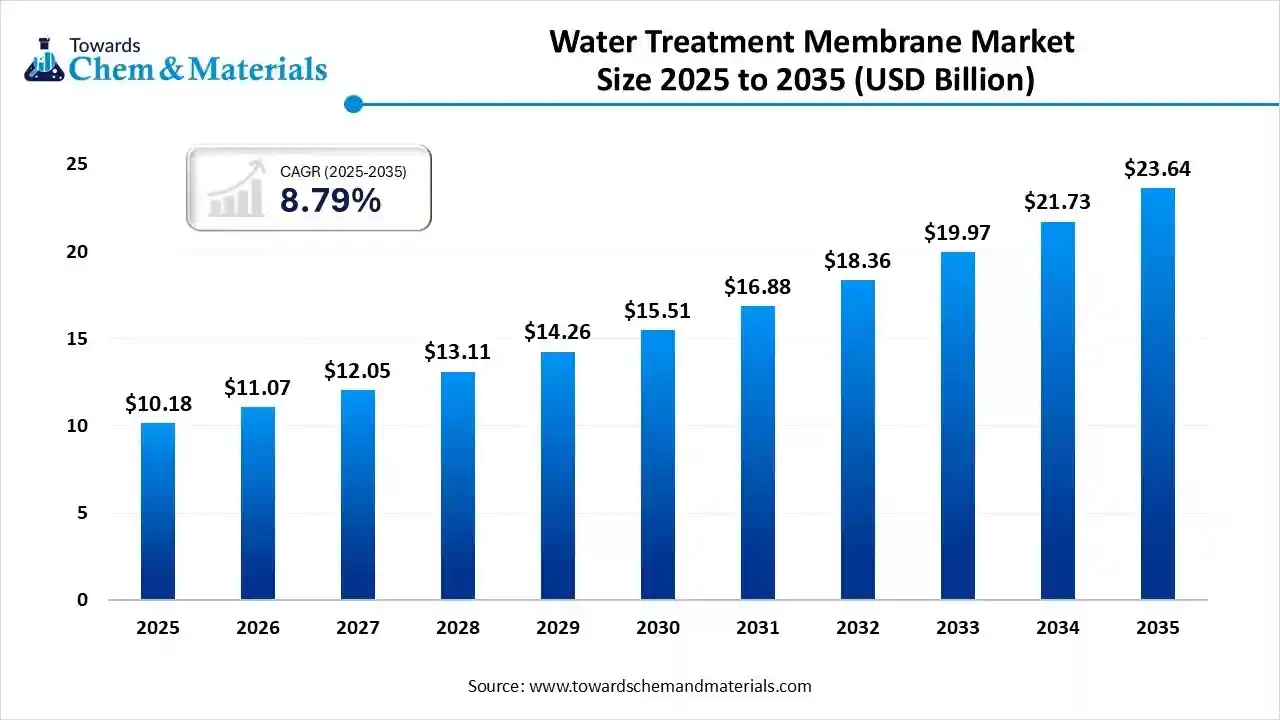

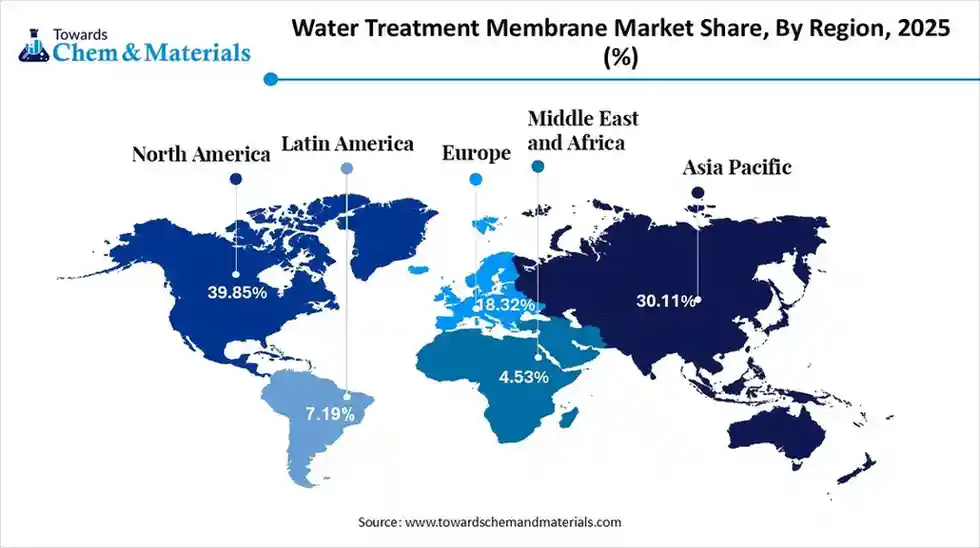

The global water treatment membrane market size was estimated at USD 10.18 billion in 2025 and is predicted to increase from USD 11.07 billion in 2026 and is projected to reach around USD 23.64 billion by 2035, The market is expanding at a CAGR of 8.79% between 2026 and 2035. North America dominated the water treatment membrane market with a market share of 39.85% the global market in 2025.The increasing strain on freshwater resources and growing industrial expansion drive the market growth.

Key Takeaways

- By region, North America led the water treatment membrane market with the largest revenue share of over 39.85% in 2025.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period.

- By technology, the reverse osmosis (RO) membrane segment led the market in 2025.

- By technology, the nanofiltration membrane segment is growing at the fastest CAGR in the market during the forecast period.

- By sales channel, the aftersales segment led the market in 2025.

- By sales channel, the original equipment manufacturers segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use, the industrial water treatment segment led the market in 2025.

- By end-use, the municipal water treatment segment is expected to grow at the fastest CAGR in the market during the forecast period.

What’s Driving Water Treatment Membrane Growth?

The water treatment membrane market growth is driven by increasing need for clean drinking water, high strain on freshwater resources, stringent regulations on wastewater discharge, expansion of the pharmaceutical sector, increasing reuse of water, and growing water contamination.

The growing use of technologies like ultrafiltration, microfiltration, reverse osmosis, and nanofiltration removes contaminants like dissolved solids, pathogens, & solid particles and offers high-purity water. The growing water reuse across applications like potable supply, agriculture, and industrial processes increases demand for water treatment membrane.

What is a Water Treatment Membrane?

A water treatment membrane is a type of semi-permeable barrier that separates clean water from concentrated waste. The membrane allows the flow of only water molecules for diverse applications like wastewater reuse, drinking, and industrial purposes. The membrane is available in diverse pore sizes and is made up of materials like ceramics, metals, polymers, and others.

A water treatment membrane is available in diverse shapes, like tubular, spiral wound, hollow fiber, and flat sheet. The membrane purifies seawater, surface water, and groundwater. These membrane is widely used in applications like wastewater treatment, desalination, drinking water, and industrial processes.

Water Treatment Membrane Market Trends:

- Growing Water Scarcity Issues: The growing population and increasing water contamination increase water scarcity, which requires a water treatment membrane. The high strain on freshwater resources and the increasing need for clean water require a water treatment membrane.

- Increasing Public Health Concerns: The growing risk of waterborne diseases increases demand for high-purity water in diverse sectors healthcare, residential, agricultural, and municipal.

- Stringent Regulations: The government's stricter regulations on wastewater purification and industrial wastewater discharge increase demand for better water membrane technologies.

- Industrial Expansion: The continuous expansion of industrial sectors and a strong industrial focus on wastewater management increases demand for water treatment membranes. The rapid expansion in industrial sectors like chemicals, pharmaceuticals, power, and food & beverages increases demand for water treatment membranes.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 11.07 Billion |

| Revenue Forecast in 2035 | USD 23.64 Billion |

| Growth Rate | CAGR 8.79% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments covered | By Technology, By Sales Channel, By End Use, By Region |

| Key companies profiled | Asahi Kasei Corporation , DuPont , Hydranautics , Koch Separation and Solutions, Pall Corporation , Pentair, Suez Water Technologies and Solutions, Toray Industries Inc, LG Chem Ltd, Veolia, Alfa Laval, Evoqua Water Technologies, Xylem |

Key Technological Shifts in the Water Treatment Membrane Market:

The water treatment membrane market is undergoing key technological shifts driven by the demand for sustainability, lower fouling, and higher efficiency. The technological innovations like smart membranes, integrated systems, novel materials, digitalization, energy-efficient designs, IoT integration, and bio-integrated systems treat tough contaminants and minimize energy. The major shift is the integration of artificial intelligence (AI) enables operational efficiency and optimizes performance.

AI adjusts parameters like flow rate, aeration intensity, pH, & chemical dosing and increases the efficiency of the process. AI detects equipment failures and minimizes membrane fouling. AI lowers operational expenditure and effectively removes contaminants from water. AI accelerates the discovery process of new materials and easily predicts new membrane performance. AI optimizes water cleaning cycles and reduces the use of unnecessary processes. Overall, integration of AI ensures high performance and supports intelligent operations.

Trade Analysis of Water Treatment Membrane Market: Import & Export Statistics

- India exported 2,984 shipments of RO membrane.

- The 1,263 shipments of Industrial RO membrane exported by China.

- China exported 1,584 shipments of water filtration membrane.

- Turkey imported 122 shipments of micro filtration membrane.

- The United States exported 44 shipments of nanofiltration membranes.

Water Treatment Membrane Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement is sourcing of raw materials like polyethersulfone, polyamide, cellulose acetate, ceramics, silica, polysulfonate, metals, polyvinylidene fluoride, metals, carbon nanotubes, biochar, cellulose, polypropylene, graphene, and cellulose acetate.

- Key Players:- Toray Industries, Inc., Veolia, Kovalus Sepration, Solutions, DuPont, LG Chem, Hydranautics

- Chemical Synthesis and Processing: The chemical synthesis involves processes like polymerization, nanomaterial synthesis, & inorganic synthesis to manufacture advanced additives & base materials. The chemical processing involves techniques like phase inversion and surface modification using coating & chemical grafting.

- Key Players:- Hydranautics, Kovalus Separation Solutions, Pentair, DuPont, LG Chem, SUEZ, Toray Industries, Inc.

- Quality Testing and Certifications: The quality testing involves testing of diverse properties like nanoparticle, bubble point, safety, organic contaminants, structural integrity, conductivity, flow monitoring, membrane integrity, & performance, and certifications like WQA Gold Seal, Kiwa Watermark, NSF International, & BIS.

- Key Players:- UL Solutions, Kiwa, Qualitek Labs, SFTS Lab, UL Solutions, NSF International, BIS

Membrane Matrix: Unlocking Types, Pore Size, and Applications

| Type | Pore Size | Uses | Majorly Installed Industries |

| Reverse Osmosis | 0.0001 µm |

|

|

| Nanofiltration | 0.1 to 10 nm |

|

|

| Microfiltration | 0.1 to 10 µm |

|

|

| Ultrafiltration | 0.01 to 0.1 µm |

|

|

Segmental Insights

Technology Insights

Why Reverse Osmosis (RO) Membrane Segment Dominates the Water Treatment Membrane Market?

The reverse osmosis (RO) membrane segment dominated the water treatment membrane market in 2025. The strong focus on removing superior contaminants and the increasing need for high-quality water require an RO membrane. The increased conversion of brackish water & seawater into potable water and the rise in utilization of residential purifiers increase demand for RO membranes. The adaptability of the RO membrane in massive plants & residential units and the energy-efficient process help market expansion. The growing use of RO in applications like process water, drinking water, and wastewater treatment drives the overall market growth.

The nanofiltration (NF) membrane segment is the fastest-growing in the market during the forecast period. The growing water scarcity issues and focus on removing contaminants from water increase the use of nanofiltration. The cost-effectiveness and selective contaminant removal property of nanofiltration help market growth. The growing need for water softening and wastewater treatment uses NF. The increasing use of NF across sectors like pharma, municipal drinking water, F&B, and chemical processing supports the market growth.

The ultrafiltration (UF) membrane segment is growing at a significant rate in the market. The strong focus on removing contaminants like bacteria, macromolecules, and suspended solids from water requires UF. The energy efficiency minimized chemical dependency, and compact footprint of ultrafiltration help market expansion. The increasing need for treated wastewater recycling and clean water regulations requires UF, supporting the overall market growth.

Sales Channel Insights

How did the Aftersales Segment hold the Largest Share in the Water Treatment Membrane Market?

The aftersales segment held the largest revenue share in the water treatment membrane market in 2025. The growing need for the replacement of membranes and increased degradation of membrane performance increases demand for aftersales. The strong focus on cleaning chemicals & maintenance, and the increasing need for operational adjustments, increases the use of aftersales. The strong focus on ensuring operational efficiency and the growing installation of water treatment membrane drive the market growth.

The original equipment manufacturers (OEM) segment is experiencing the fastest growth in the market during the forecast period. The increasing need for customized membrane solutions across various industries and a strong focus on water scarcity issues increase demand for OEMs. The strong focus on lowering operational expenses and integration with value-added services requires OEMs. The growing demand for scalable & compact systems and the need for diverse components increase the use of OEM, supporting the overall market growth.

End Use Insights

Which End Use Segment Dominated the Water Treatment Membrane Market?

The industrial water treatment segment dominated the water treatment membrane industry in 2025. The continuous growth in the pharmaceutical sector and stringent industrial wastewater discharge rules increase demand for water treatment membrane. The increasing need for highly pure water across industries like chemicals, manufacturing, and power generation helps market expansion. The increasing investment of industries in water treatment membrane and high wastewater generation drive the overall market growth.

The municipal water treatment segment is the fastest-growing in the market during the forecast period. The high strain on freshwater resources and stringent regulations on water quality increase demand for water treatment membrane. The strong municipal focus on water reuse and depletion of freshwater resources requires a water treatment membrane. The municipality's strong focus on providing high-quality drinking water supports the overall market growth.

The residential water treatment segment is significantly growing in the market. The growing prevalence of health concerns and increased water shortage issues requires a water treatment membrane. The high strain on water supplies and stricter regulations on drinking water quality standards increase the use of water treatment membrane. The growing use of ultrafiltration, reverse osmosis, microfiltration, and nanofiltration membrane in residential water treatment drives the overall market growth.

Regional Insights

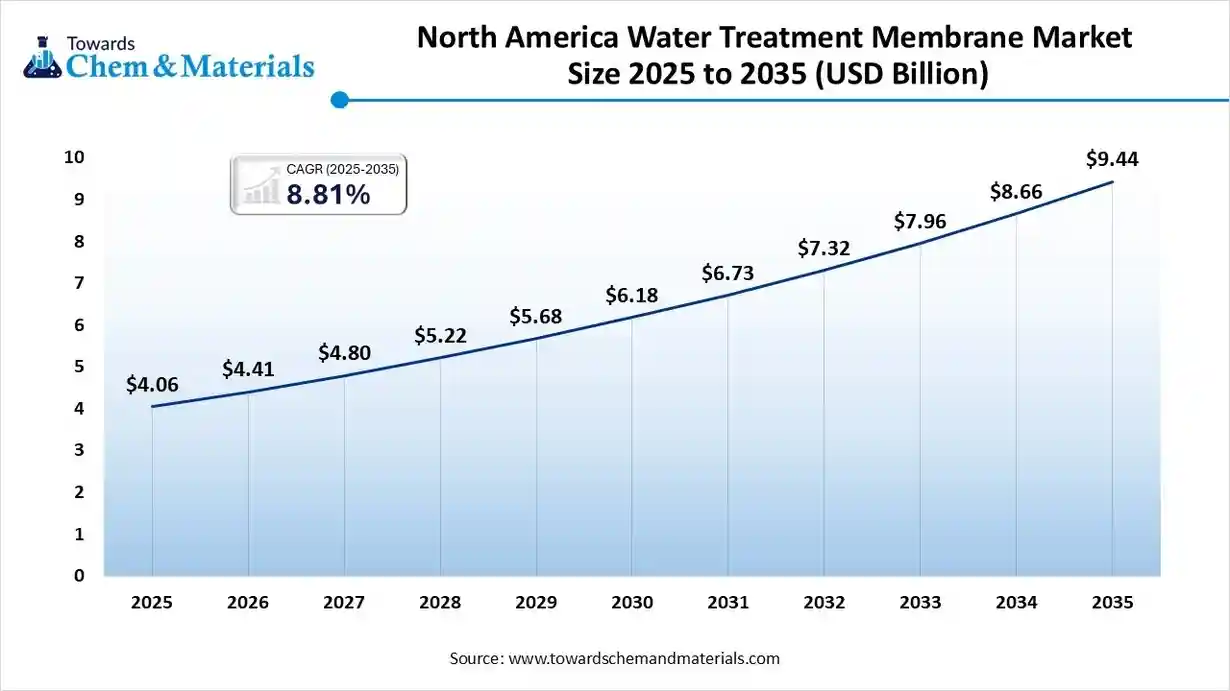

The North America water treatment membrane market size was valued at USD 4.06 billion in 2025 and is expected to reach USD 9.44 billion by 2035, growing at a CAGR of 8.81% from 2026 to 2035. North America dominated the market in 2025. The growing water scarcity issues and focus on modernizing aging water infrastructure increase the adoption of water treatment membrane. The strong focus on water reuse and the need for smart water management require a water treatment membrane. The growing demand for wastewater treatment across industries like power, pharmaceutical, and food & beverage increases demand for water treatment membrane, driving the overall market growth.

Filtering Water: The United States' Role in Water Treatment Membrane

The United States is a major contributor to the market. The stricter environmental mandates for high water quality and increasing water stress in areas like the Southwest increase demand for water treatment membrane. The increasing investment in water infrastructure and growing demand for safe drinking water require water treatment membrane. The growing industries like chemical manufacturing, pharmaceuticals, and food & beverage increase demand for water treatment membrane, supporting the overall market growth.

- The United States exported 462 shipments of Industrial RO membrane.(Source: www.volza.com)

Asia Pacific Water Treatment Membrane Market Trends

Asia Pacific expects the fastest growth in the market during the predicted period. The growing water pollution and focus on sustainable water management require a water treatment membrane. The growing expansion of industries like oil & gas, food & beverage, manufacturing, and pharmaceuticals increases demand for water treatment membrane. The stringent water treatment policies in countries like India and China, and strong government support for water infrastructure development, require water treatment membrane, driving the overall market growth.

Clean Water: China’s Rise in Water Treatment Membrane Technology

China is a key contributor to the market. The growing water pollution in the Northern area and a strong focus on reusing water increase demand for water treatment membrane. The increasing strain on water resources and increased consumption of processed food require a water treatment membrane. The increasing demand for high-quality water in diverse sectors like clean energy, food & beverage, pharmaceuticals, and chemicals requires water treatment membrane, supporting the overall market growth.

- China exported 6,820 shipments of RO membrane.(Source: www.volza.com)

Europe Water Treatment Membrane Market Trends

Europe expects to grow at a significant rate in the market. The stringent regulations on wastewater treatment and growing waterborne diseases increase demand for water treatment membrane. The diminishing freshwater resources and strong focus on water conservation require a water treatment membrane. The aging water infrastructure and focus on lowering environmental footprints require water treatment membrane, driving the overall market growth.

Smart Filtration: How Germany is Shaping Water Treatment Membrane

Germany is growing substantially in the market. The increasing need for high-purity water in industries like electronics, pharma, and biotech increases demand for water treatment membrane. The strong focus on wastewater recycling and growing water scarcity issues requires a water treatment membrane. The strong government support for environment-friendly water treatment membrane supports the overall market growth.

Middle East & Africa Water Treatment Membrane Market Trends

The Middle East & Africa are growing in the market. The presence of limited freshwater resources and a strong focus on water desalination requires a water treatment membrane. The increasing prevalence of waterborne diseases and increasing investment in water infrastructure require water treatment membrane. The increased generation of wastewater in industries like power, food, and chemicals requires water treatment membrane, driving the overall market growth.

Saudi Arabia’s Water Treatment Membrane Revolution

Saudi Arabia is growing significantly in the market. The strong focus on converting seawater into freshwater and the presence of large-scale desalination plants require a water treatment membrane. The increasing need for safe drinking water and growing industrial activities require water treatment membrane. The increasing use of membranes like MF, RO, and UF drives the overall market growth.

- Saudi Arabia exported 136 shipments of Industrial RO membrane.(Source: www.volza.com)

South America Water Treatment Membrane Market Trends

South America is growing at a significant rate in the market. The increasing strain on water resources and stricter regulations on water discharge require a water treatment membrane. The growing health concerns and increasing water recycling for purposes like drinking water & irrigation require a water treatment membrane. The broadening sectors like mining, F&B, and pharma require high-purity water, which increases demand for water treatment membrane, supporting overall growth of the market.

Tropical Tech: Brazil’s Impact on Water Treatment Membrane Innovations

Brazil is growing substantially in the market. The pipe water deficiencies and the presence of old municipal water systems require a water treatment membrane. The increasing awareness about water pollution and a strong focus on water reuse require a water treatment membrane. The changing rainfall patterns and increasing use of reverse osmosis drive the overall market growth.

Recent Developments

- In October 2025, Toray launched a reverse osmosis membrane, TLF-400ULD, for sewage treatment and industrial wastewater reuse. The membrane consists of a flow-channel design and offers double chemical resistance. The membrane simplifies operational management and minimizes environmental impact.(Source: www.toray.com )

- In November 2025, PPG launched an ultrafiltration antifouling membrane for water treatment. The membrane consists of a super-hydrophobic surface and purifies industrial water. The membrane focuses on separating emulsified contaminants, oil, & grease.(Source: news.ppg.com)

- In August 2025, Transfilm Technology launched a new membrane company, IonClear, to serve North America. The company offers high-performance water treatment solutions and accelerates innovation. The company focuses on providing localized service and strengthening membrane technology.(Source: www.filtsep.com )

Companies List

Asahi Kasei Corporation:- The Japanese chemical company developed water treatment membranes like Microza Hollow Fiber to serve diverse industries like pharmaceutical, chemical, power, and food.

DuPont:- The American-based company manufactures high-performance membranes like nanofiltration, reverse osmosis, ultrafiltration, and integrated solutions for commercial, municipal, & industrial water treatment.

Hydranautics:- The advanced membrane technology company develops NF, MF, RO, and UF products to support applications like industrial process water, wastewater recycling, seawater desalination, and residential drinking water.

Koch Separation and Solutions:- The company provides ultrafiltration, reverse osmosis, microfiltration, and nanofiltration membrane technology for wastewater & water treatment.

Pall Corporation:- The company is the leading provider of MF, RO, UF, and IMS for municipal water treatment and the production of ultrapure water.

Water Treatment Membrane Market Top Companies

- Asahi Kasei Corporation

- DuPont

- Hydranautics

- Koch Separation and Solutions

- Pall Corporation

- Pentair

- Suez Water Technologies and Solutions

- Toray Industries Inc

- LG Chem Ltd

- Veolia

- Alfa Laval

- Evoqua Water Technologies

- Xylem

Segments Covered

By Technology

- Ultrafiltration Membrane

- Microfiltration Membrane

- Reverse Osmosis (RO) Membrane

- Nanofiltration Membrane

By Sales Channel

- Aftersales

- Original Equipment Manufacturers (OEM)

By End Use

- Residential Water Treatment

- Municipal Water Treatment

- Industrial Water Treatment

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa