Content

What is the Current Plastic Resin Market Size and Share?

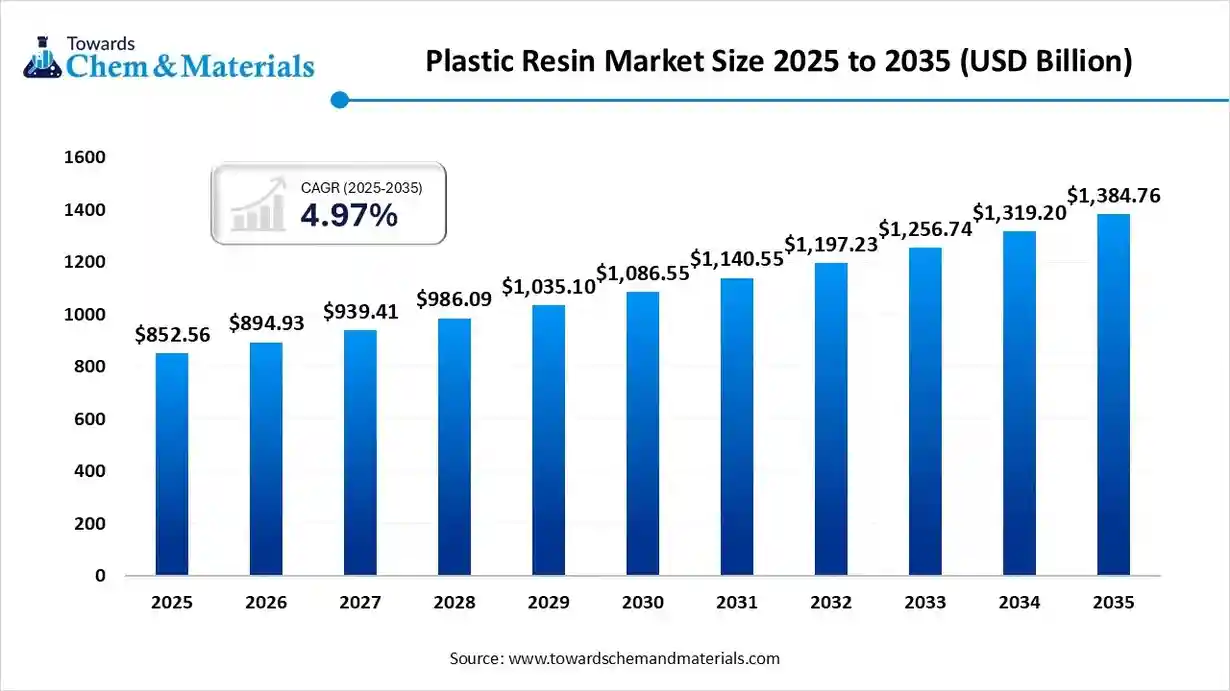

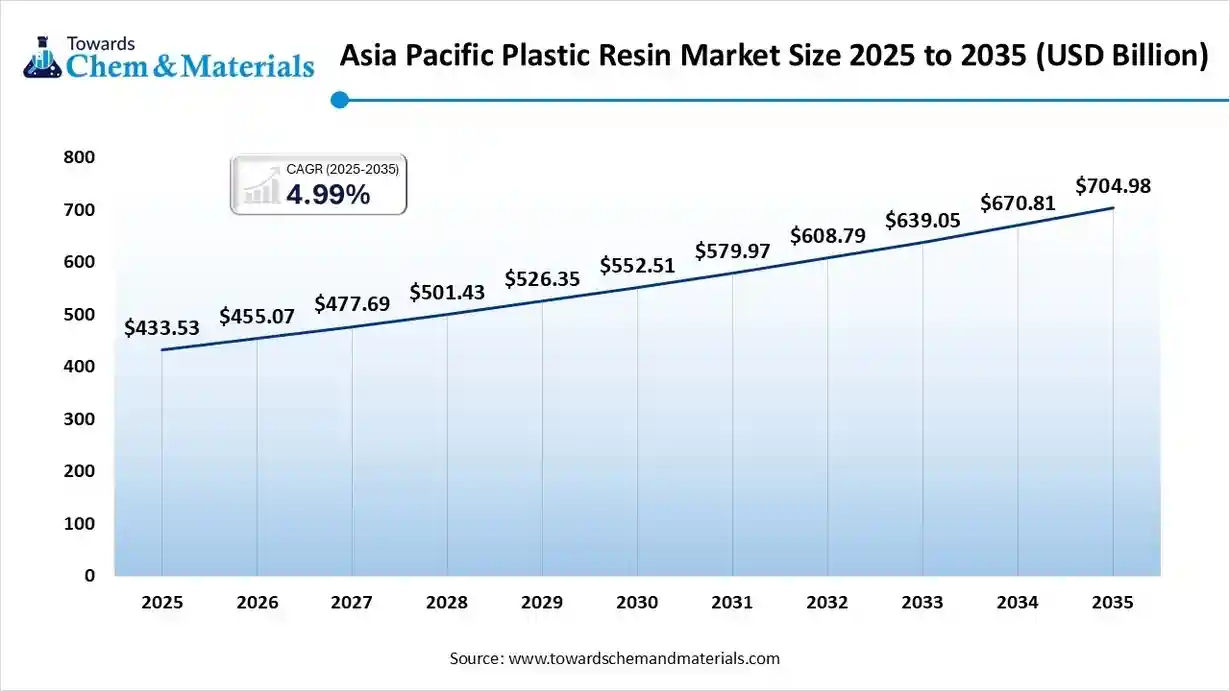

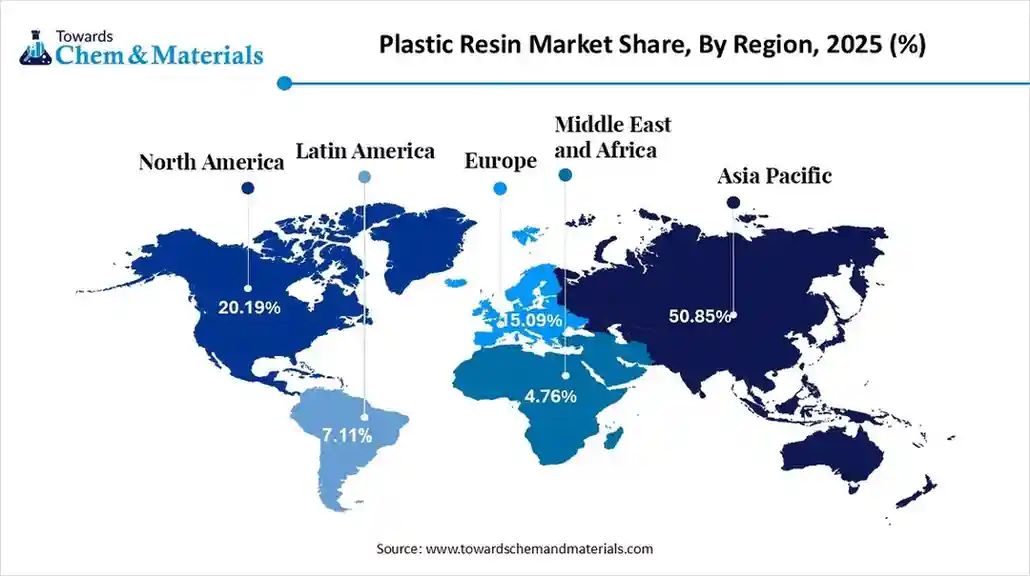

The global plastic resin market size was estimated at USD 852.56 billion in 2025 and is predicted to increase from USD 894.93 billion in 2026 and is projected to reach around USD 1,384.76 billion by 2035, The market is expanding at a CAGR of 4.97% between 2026 and 2035. Asia Pacific dominated the plastic resin market with a market share of 4.99% the global market in 2025. The growth is fueled by economic growth, urbanisation, and e-commerce expansion.

Key Takeaways

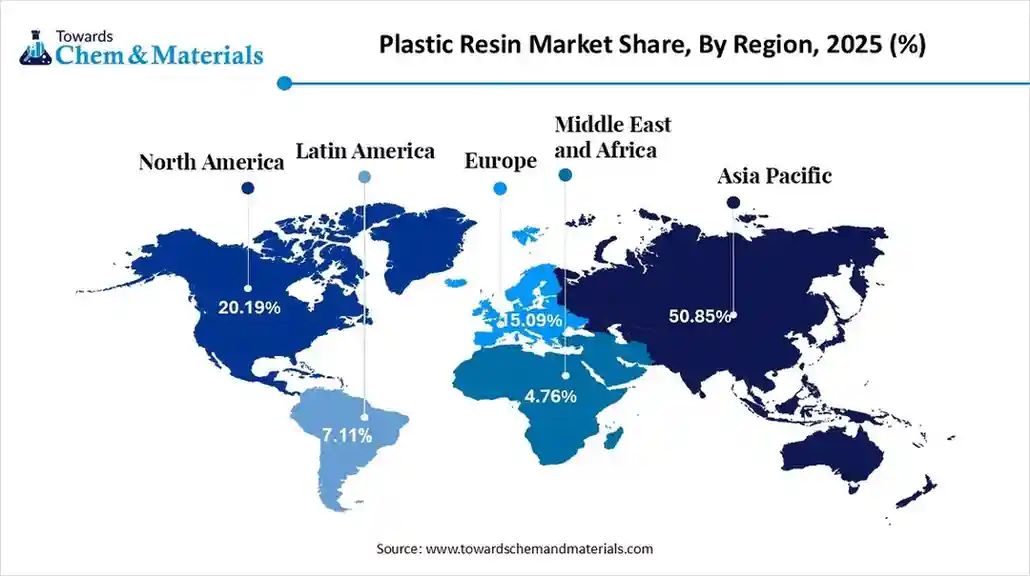

- By region, Asia Pacific led the plastic resin market with the largest revenue share of over 50.85% in 2025.

- By resin type/polymer type, the commodity plastics segment led the market with the largest revenue share of 31.19% in 2025.

- By application, the packaging segment led the market with the largest revenue share of 38.14% in 2025.

- By source/feedstock, the fossil fuel-based (conventional) resins segment accounted for the largest revenue share of 91.12% in 2025.

- By process type/structure, the thermoplastics segment dominated with the largest revenue share of 85.78% in 2025.

- By manufacturing process, the injection molding segment dominated the market and accounted for the largest revenue share of 41.10% in 2025.

Market Overview

Plastic resins are the base material, typically in granular, pellet, or powder form, composed of synthetic or semi-synthetic polymers. They are the primary raw material derived primarily from petrochemical feedstocks (like naphtha, ethylene, and propylene) or renewable biomass (for bioplastics).

What Is The Significance Of The Plastic Resin Market?

The significance of the plastic resin market lies in its foundational role in modern manufacturing, providing versatile and cost-effective materials for industries like packaging, automotive, construction, and electronics. Its importance is driven by factors such as lightweighting for fuel efficiency in vehicles, durability for construction, and a wide range of applications for consumer goods. The market's significance is also growing due to innovation in high-performance and sustainable resins to meet new demands.

Plastic Resin Market Growth Trends:

- Sustainability: There is a growing focus on producing and using recycled and bio-based resins to meet environmental goals and consumer demand for eco-friendly products.

- Market consolidation: Companies are acquiring others to strengthen their market position and expand their operational capabilities.

- Resin variety: The market includes a wide range of resins, such as polyethene (PE), polypropylene (PP), and polyethene terephthalate (PET), each with different properties and applications.

- Technological advancements: Innovation in materials and processing technology continues to drive the market.

- Government investment: Increased infrastructure spending in emerging economies like China and India is boosting demand in the construction sector.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 894.93 Billion |

| Revenue Forecast in 2035 | USD 1,384.76 Billion |

| Growth Rate | CAGR 4.97% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Resin Type/Polymer Type, By Source/Feedstock, By Process Type/Structure, By Application/End-Use Industry, By Manufacturing Process, By Region |

| Key companies profiled | ExxonMobil Chemical, Dow Inc., LyondellBasell Industries, SABIC, BASF SE, INEOS Group, Sinopec (China Petroleum & Chemical Corporation) , Formosa Plastics Corporation , Mitsubishi Chemical Corporation (Mitsubishi Chemical Group) , Lotte Chemical Corporation , Chevron Phillips Chemical Company LLC , Sumitomo Chemical Co., Ltd. , DuPont de Nemours, Inc. , TotalEnergies SE , Braskem S.A. , Celanese Corporation , Covestro AG , LG Chem Ltd. , Toray Industries, Inc. , Evonik Industries AG |

Key Technological Shifts In The Plastic Resin Market:

The significance of the plastic resin market lies in its foundational role as the raw material for countless products across major industries like packaging, automotive, construction, and electronics. Its importance is driven by the demand for lightweight, durable, and cost-effective materials that enable advancements such as fuel efficiency in vehicles and long-lasting building materials. The market is also central to sustainability efforts through the development of bio-based and recyclable resins, and is a barometer for both economic growth and technological innovation in material science.

Trade Analysis Of Plastic Resin Market: Import & Export Statistics

- According to Global Export data, the world shipped a total of 232,335 shipments of Plastic Resin. These were exported by 2,573 exporters to 5,499 buyers.

- Most of these exports go to Peru, the United States, and India. The leading global exporters are China, Italy, and the United States.

- China tops the list with 109,278 shipments, followed by Italy with 68,908 shipments, and the US with 29,798 shipments.

- India exported 285 shipments of Plastic Resin. The exports done by 37 Indian exporters to 53 buyers. The main destinations are the United States and Spain.

- Globally, China remains the top exporter with 104,460 shipments, followed by Italy with 66,195 shipments, and the United States with 24,823 shipments.

Plastic Resin Market Value Chain Analysis

- Chemical Synthesis and Processing: Plastic resins are produced from petrochemical and bio-based feedstocks through polymerisation processes such as addition polymerisation and condensation polymerisation. These are processed using extrusion, injection molding, blow molding, and thermoforming to manufacture finished plastic components.

- Key players: ExxonMobil Chemical, Dow Inc., LyondellBasell Industries, SABIC, BASF SE.

- Quality Testing and Certification:Plastic resins undergo testing for melt flow index (MFI), thermal performance, mechanical strength, and chemical resistance under standards such as ISO 9001, ASTM D1238 (MFI), ASTM D638 (tensile properties), and REACH compliance (EU).

- Key players: SGS, Intertek, TÜV SÜD, UL Solutions, Bureau Veritas.

- Distribution to Industrial Users: Plastic resins are distributed to packaging, automotive, construction, electronics, textiles, and consumer goods industries through global resin suppliers, polymer distributors, and direct OEM partnerships.

- Key players: LyondellBasell Industries, Dow Inc., ExxonMobil Chemical, SABIC.

Plastic Resin Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | - TSCA (Toxic Substances Control Act) - Clean Air Act (CAA) for emissions - FDA CFR Title 21 (resins for food contact) |

- Polymer safety - VOC emissions - Food-grade resin compliance |

TSCA requires polymer exemption review; stricter VOC caps in several states (CA, NY). Food-contact resins must meet FDA migration limits. |

| European Union | European Chemicals Agency (ECHA) | - REACH - CLP Regulation - EU Plastics Regulation (EU 10/2011 for food-contact resins) |

- Chemical registration - Additive restrictions - Food-contact certification |

REACH is the strictest framework; restrictions on BPA, phthalates, and microplastics directly impact resin formulations. |

| China | Ministry of Ecology and Environment (MEE) | - MEE Order No. 12 - GB Standards for plastics - Food-contact material standard GB 4806 |

- Polymer registration - Environmental safety - Food-grade resin limits |

Foreign manufacturers must appoint a Local Agent; China is tightening regulations on plastics additives, especially non-compliant colourants. |

| India | CPCB + BIS (Bureau of Indian Standards) | - Plastic Waste Management Rules - BIS Resin Standards - Hazardous Chemicals Rules |

- Resin production compliance - Recycling obligations (EPR) - Additive approvals |

EPR mandates significantly impact resin producers; new BIS standards for packaging resins are being updated to align with global norms. |

| Japan | METI + MHLW | - CSCL (Chemical Substances Control Law) - Food Sanitation Act for resin additives |

- Pre-market approval - Additive safety - Environmental impact |

Japan requires detailed polymer notification if outside polymer exemption limits; strict review for additives in food packaging resins. |

| Southeast Asia | Various national agencies (e.g., DOE Malaysia, Pollution Control Dept Thailand) | - Local chemical control acts - Packaging and food-contact material rules |

- Resin manufacturing permits - Import controls - Packaging safety |

ASEAN is harmonising plastics standards; several countries are implementing bans on hazardous resin additives (lead stabilisers, certain phthalates). |

Segmental Insights

Resin Type/Polymer Type Insights

Which Resin Type/Polymer Type Segment Dominated The Plastic Resin Market In 2025?

By resin type/polymer type, the commodity plastics segment led the market with the largest revenue share of 31.19% in 2025. Commodity plastics (PE, PP, PVC, PS) constitute the largest volume segment due to low cost, versatile processing, and broad end-use compatibility. Ongoing innovations focus on recyclability and PCR integration to meet sustainability targets, while capacity expansions in emerging markets continue to support global supply and demand.

The engineering plastics segment expects significant growth in the plastic resin market during the forecast period. Engineering plastics provide enhanced mechanical, thermal, and chemical properties for demanding applications in automotive, electrical, and industrial equipment. Growth is driven by electrification, electronics miniaturisation, and higher service-temperature requirements, with suppliers developing modified grades and blended solutions to replace metals in many components, driving the growth.

The super engineering plastics segment has seen notable growth in the market. Super engineering plastics serve high-end applications requiring extreme thermal stability, chemical resistance, and mechanical integrity. Demand is niche but fast-growing as industries pursue weight reduction, higher operating temperatures, and extended service life for premium components and critical subsystems.

Application/End Use Industry Insights

How Did the Packaging Segment Dominated The Plastic Resin Market In 2025?

By application, the packaging segment led the market with the largest revenue share of 38.14% in 2025. Packaging is the largest end-use for plastic resins, favouring PE, PP, PET, and emerging bio-resins for flexible films, rigid containers, and labels. Sustainability is reshaping choices, brands increasingly pushing resin makers to offer PCR-compatible grades and bio-based alternatives while maintaining cost-effectiveness and regulatory compliance.

The medical & healthcare segment expects the fastest growth in the market during the forecast period. The medical and healthcare segment demands high-purity, sterilizable resins for devices, disposables, and diagnostic components. Growth is supported by expanding healthcare infrastructure, single-use device adoption, and advanced polymer formulations for minimally invasive tools and drug-delivery systems, where traceability and regulatory support are essential.

The automotive and transportation segment seen a significant growth in the market. Automotive and transportation use engineering and super-engineering plastics for lightweight body panels, under-the-hood components, interiors, and electrical housings. The integrated push for emission reduction, fuel efficiency, and cost-effective materials substitution drives R&D into recycled, reinforced, and bio-based resins tailored for mass production and regulatory safety standards.

Source/Feedstock Insights

Which Source/Feedstock Segment Dominated The Plastic Resin Market In 2025?

By source/feedstock, the fossil fuel-based (conventional) resins segment accounted for the largest revenue share of 91.12% in 2025. Conventional resins derived from petrochemical feedstocks remain the backbone of resin supply due to well-established production economics and broad performance profiles. While demand is still robust, OEMs and regulators are steadily pressuring producers to reduce lifecycle emissions, adopt lower-carbon processes, and provide compatibility with circular systems to meet sustainability commitments and future-proof supply chains.

The recycled resins segment expects significant growth in the plastic resin market during the forecast period. Recycled resins, mechanically recycled PCR and chemically recycled feedstocks are increasingly integrated into mainstream formulations to meet corporate ESG targets and regulatory recycled-content mandates. Adoption is strongest in packaging, consumer goods, and non-critical auto parts.

The sustainable and bio-based resins segment has seen notable growth in the market. Sustainable and bio-based resins offer lower cradle-to-gate carbon footprints and alternative value chains using renewable feedstocks. They are adopted where lifecycle emissions and end-of-life options matter. Major brand commitments and policy incentives continue to accelerate commercialisation across packaging, textiles, and select durable goods.

Process Type/Structure Insights

How Did the Process Type/ Structure Segment Dominated The Plastic Resin Market In 2025?

The thermoplastics segment dominated the market with a share of 85.78% in 2025. Thermoplastics constitute the dominant structural class, prized for remeltability, recyclability, and processing flexibility across extrusion, injection moulding, and film casting. Continuous material innovation focuses on high-performance, recycled-content, and bio-based thermoplastics to balance functionality with environmental targets.

The thermosets segment expects significant growth in the plastic resin market during the forecast period. Thermosets are key where permanent crosslinked networks deliver superior heat resistance, dimensional stability, and load-bearing performance, notably in composites and structural adhesives. Development efforts concentrate on recyclable thermoset chemistries, dynamic covalent networks, and hybrid systems that permit repairability and circularity improvements.

Manufacturing Process Insights

Which Manufacturing Process Segment Dominated The Plastic Resin Market In 2025?

The injection molding segment dominated the market with a share of 41.10% in 2025. Injection molding is the principal manufacturing method for complex, high-volume plastic parts, enabling tight tolerances and fast cycle times for automotive components, medical devices, and consumer products. Ongoing process enhancements microinjection, multi-material molding, and in-line quality control, improve part performance and reduce scrap, making it central to modern mass-production workflows.

The rotational molding segment expects significant growth in the plastic resin market during the forecast period. Rotational molding produces large, hollow plastic parts with uniform wall thickness, commonly used for tanks, containers, and playground equipment, favouring polyethene and speciality grades. Innovations target material blends and demonstrable durability under UV and chemical exposure to broaden application in industrial and infrastructure segments.

The extrusion segment has seen notable growth in the market. Extrusion converts resins into films, sheets, pipes, and profiles with continuous high-throughput capability, underpinning packaging films, piping systems, and building materials. Advances include high-speed lines, sustainable resin compatibility, and integration with downstream converting to improve material efficiency and product functionality.

Regional Insights

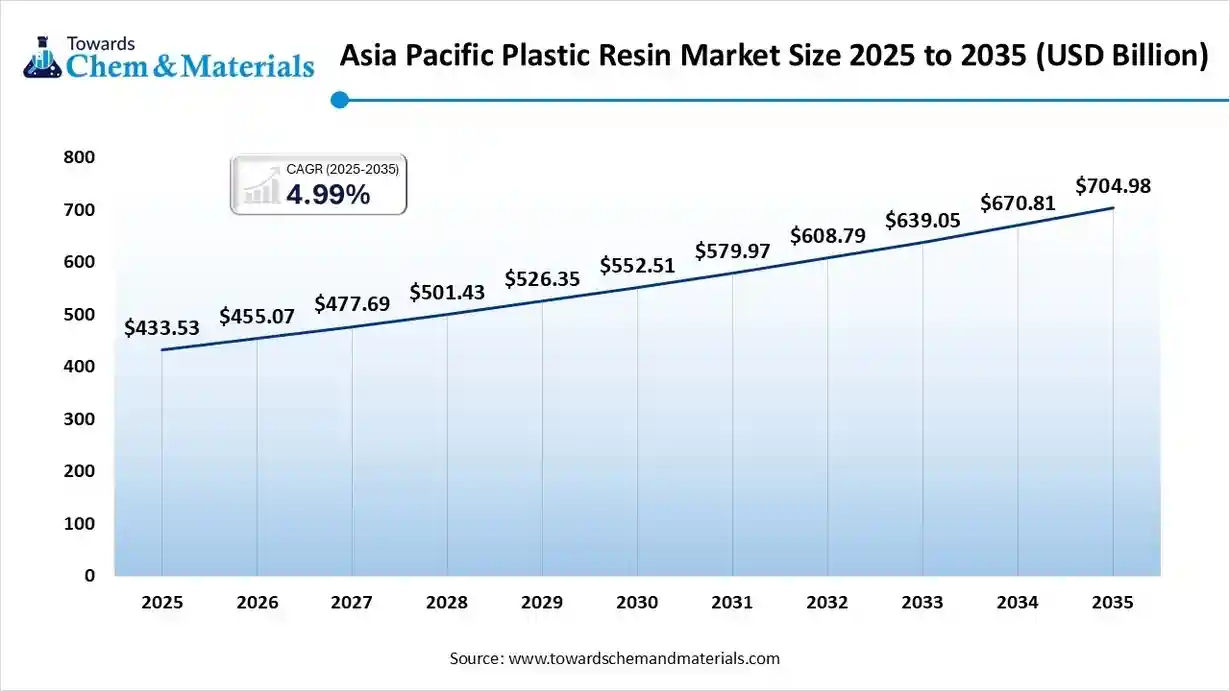

The Asia Pacific plastic resin market size was valued at USD 433.53 billion in 2025 and is expected to reach USD 704.98 billion by 2035, growing at a CAGR of 4.99% from 2026 to 2035. Asia Pacific dominates the market with share of 50.85% in 2025. Asia Pacific is the world’s largest plastic resin market, driven by rapid industrialisation, expanding manufacturing capabilities, and large consumer markets. The region is a major global production hub for polyethylene, polypropylene, PVC, and engineering plastics, with massive capacity expansions underway. Despite rising environmental concerns, APAC continues to dominate resin production and downstream plastic processing due to cost advantages and scale.

China: Plastic Resin Market Growth Trends

China is the largest plastic resin producer and consumer in the Asia Pacific, supported by extensive petrochemical facilities, massive packaging demand, and a strong electronics and automotive industry. Rapid urbanisation, industrial growth, and export-oriented manufacturing continue to fuel resin consumption. China is also investing in circular plastics initiatives, enhanced recycling infrastructure, and bio-based resin technologies as part of its long-term sustainability goals.

North America: Plastic Resin Market Growing Investments

North America is expected to experience significant growth in the market in the forecast period. The North American plastic resin market is driven by strong demand across packaging, automotive, construction, medical devices, and consumer goods. The region is also witnessing increased investments in chemical recycling, sustainability-driven R&D, and high-performance polymer development, making North America a key contributor to global resin innovation.

United States: Plastic Resin Market Growth Trends

The United States leads the regional plastic resin landscape due to its extensive petrochemical infrastructure, high production capacity for polyethene and polypropylene, and strong downstream industries. Strong R&D spending, robust manufacturing, and cost-efficient feedstocks make the U.S. a global powerhouse in resin production and consumption.

Europe: High Investments By The Governing Bodies Drives The Growth

Europe’s plastic resin market is shaped heavily by sustainability regulations, including carbon neutrality targets and strict mandates on recyclable materials. Growth is driven by high demand in sectors, with a shift toward advanced engineering resins and greener polymer solutions. Europe remains a leading hub for speciality resins and high-performance plastics, supported by strong industrial capabilities and innovation ecosystems.

Germany: Plastic Resin Market Growth Trends

Germany dominates the European market due to its strong automotive, industrial engineering, and packaging sectors. The country has a high consumption of engineering resins, including polyamide, polycarbonate, and speciality polymers used in precision manufacturing. Investment in industrial automation and material innovation further strengthens Germany’s position as a leader in resin demand, processing technology, and sustainable polymer development within Europe.

South America's Growth Is Driven By Growing Support Fueling Growth

South America’s plastic resin market is expanding steadily due to growth in consumer goods, packaging, construction, and automotive sectors. Countries like Brazil, Mexico, and Argentina drive regional demand, supported by rising industrial output and increasing use of polyethylene and polypropylene. Local manufacturing improvements and trade integration are further strengthening South America’s role in the global resin supply chain.

Brazil: Plastic Resin Market Growth Trends

Brazil represents the largest market in South America, driven by strong packaging, construction materials, and agricultural film demand. The country benefits from established polymer producers and increasing investments in polypropylene and polyethylene capacity. Brazil’s large industrial base and domestic consumption make it a central player in South America’s resin market growth.

The Middle East & Africa region is emerging as a key supplier of plastic resins, especially polyethylene and polypropylene, supported by abundant petrochemical feedstocks and large-scale manufacturing capacity in GCC countries. African markets are witnessing increasing adoption of plastic resins due to urbanisation and industrial growth. MEA continues to attract global investments due to its cost-efficient production and export potential.

Saudi Arabia: Plastic Resin Market Growth Trends

Saudi Arabia plays a major role in the regional and global resin market due to its massive petrochemical capabilities, led by companies such as SABIC. The country is one of the world’s largest producers of polyethylene and polypropylene, supported by low-cost feedstocks and strong export infrastructure. Saudi Arabia’s strategic focus on petrochemical value-chain diversification continues to strengthen its global market presence.

Recent Developments

- In June 2025, Pact Group launched rFresh 100, a new food-grade natural High-Density Polyethylene (HDPE) resin made from recycled milk and juice bottles. This recycled plastic is produced at the Circular Plastics Australia (CPA) facility in Laverton, Melbourne, a joint venture between Pact and Cleanaway Waste Management.(Source: wastemanagementreview.com.au)

- In February 2025, Toray Industries developed a new damping nylon resin that offers significantly enhanced high-temperature rigidity and moldability compared to standard options like butyl rubber. This material, developed using proprietary NANOALLOY™ technology, is currently in the sample stage, with commercialisation targeted for the fiscal year ending March 31, 2027. (Source: interplasinsights.com)

- In May 2025, SABIC launched a new extrusion grade of Ultem resin designed for high-voltage electric vehicle (EV) applications, specifically magnet wire insulation. This material offers productivity and performance advantages over incumbent materials like polyether ether ketone (PEEK) and thermoset polyimide (PI) enamel coatings.(Source: www.designworldonline.com)

Top players in the Plastic Resin Market & Their Offerings:

- ExxonMobil Chemical: ExxonMobil is one of the largest global producers of plastic resins, offering a wide portfolio including polyethylene (PE), polypropylene (PP), and speciality performance polymers. The company serves packaging, automotive, consumer goods, and industrial applications, supported by strong R&D and large-scale petrochemical infrastructure.

- Dow Inc.: Dow is a major leader in polyethylene, speciality elastomers, and engineered plastic resins used across packaging, construction, healthcare, and mobility sectors. Its focus on circularity, advanced recycling, and high-performance resin formulations strengthens its global positioning.

- LyondellBasell Industries: LyondellBasell is a dominant supplier of polyolefins, including PP and PE resins under its renowned Catalloy and Hostalen brands. With world-scale manufacturing assets and proprietary catalyst technologies, the company supplies key markets such as packaging, automotive components, and consumer products.

- SABIC: SABIC offers a broad range of plastic resins, including PP, PE, PET, and engineered thermoplastics tailored for high-performance applications. Its materials are widely used in electronics, healthcare, automotive, and industrial sectors, driven by strong innovation and sustainability initiatives.

- BASF SE: BASF produces a wide range of resin systems, including engineering plastics like polyamides, PBT, and high-performance thermoplastics. The company emphasises material solutions for automotive lightweighting, electrical components, packaging, and consumer appliances through continuous product innovation.

- INEOS Group: INEOS is a prominent global supplier of polyolefin resins with significant production capabilities in PP, PE, and styrenics. Its offerings support packaging, construction, pipes, films, and industrial applications, leveraging large-scale petrochemical operations in Europe and North America.

Top Companies in the Plastic Resin Market

- Sinopec (China Petroleum & Chemical Corporation)

- Formosa Plastics Corporation

- Mitsubishi Chemical Corporation (Mitsubishi Chemical Group)

- Lotte Chemical Corporation

- Chevron Phillips Chemical Company LLC

- Sumitomo Chemical Co., Ltd.

- DuPont de Nemours, Inc.

- TotalEnergies SE

- Braskem S.A.

- Celanese Corporation

- Covestro AG

- LG Chem Ltd.

- Toray Industries, Inc.

- Evonik Industries AG

Segments Covered

By Resin Type/Polymer Type

- Commodity Plastics (Bulk Resins)

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Engineering Plastics (E-Plastics)

- Polycarbonate (PC)

- Polyamide (PA) / Nylon

- Acrylonitrile Butadiene Styrene (ABS)

- Polyoxymethylene (POM) / Acetal

- Polybutylene Terephthalate (PBT)

- Polymethyl Methacrylate (PMMA)

- Modified Polyphenylene Ether (PPE)

- Super Engineering Plastics (High-Performance)

- Polyether Ether Ketone (PEEK)

- Polysulfone (PSU) / Polyethersulfone (PES)

- Polyphenylene Sulfide (PPS)

- Liquid Crystal Polymer (LCP)

- Polyimide (PI)

By Source/Feedstock

- Fossil Fuel-Based (Conventional) Resins

- Petroleum-Based

- Natural Gas-Based

- Sustainable/Bio-Based Resins

- Bio-degradable Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Polybutylene Adipate Terephthalate (PBAT)

- Non-biodegradable Bioplastics (Bio-PE, Bio-PET)

- Bio-degradable Bioplastics

- Recycled Resins

- Post-Consumer Recycled (PCR)

- Post-Industrial Recycled (PIR)

By Process Type/Structure

- Thermoplastics

- Crystalline Thermoplastics (e.g., HDPE, PP, PET)

- Amorphous (Non-Crystalline) Thermoplastics (e.g., PS, PC, PVC)

- Thermosets

- Epoxy Resins

- Phenolic Resins

- Unsaturated Polyester Resins (UPR)

- Polyurethane (PU)

By Application/End-Use Industry

- Packaging

- Rigid Packaging (Bottles, Containers, Trays)

- Flexible Packaging (Films, Bags, Pouches, Wraps)

- Industrial & Transit Packaging (Pallets, Crates)

- Construction

- Pipes, Fittings, & Conduits

- Insulation & Glazing

- Profiles & Decking

- Automotive & Transportation

- Interior Components (Dashboards, Trims)

- Exterior Components (Bumpers, Lighting)

- Under-the-Hood Components

- Electrical & Electronics (E&E)

- Wire & Cable Insulation

- Housings & Casings

- Connectors & Components

- Consumer Goods

- Appliances

- Toys & Sporting Goods

- Furniture & Housewares

- Medical & Healthcare

- Disposables (Syringes, Bags)

- Devices & Equipment Casings

- Pharmaceutical Packaging

- Textile & Clothing (Synthetic Fibres)

- Agriculture (Films, Irrigation, Containers)

By Manufacturing Process

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Rotational Molding

- Compression Molding

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa