Content

What is the Current U.S. Chemical Distribution Market Size and Share?

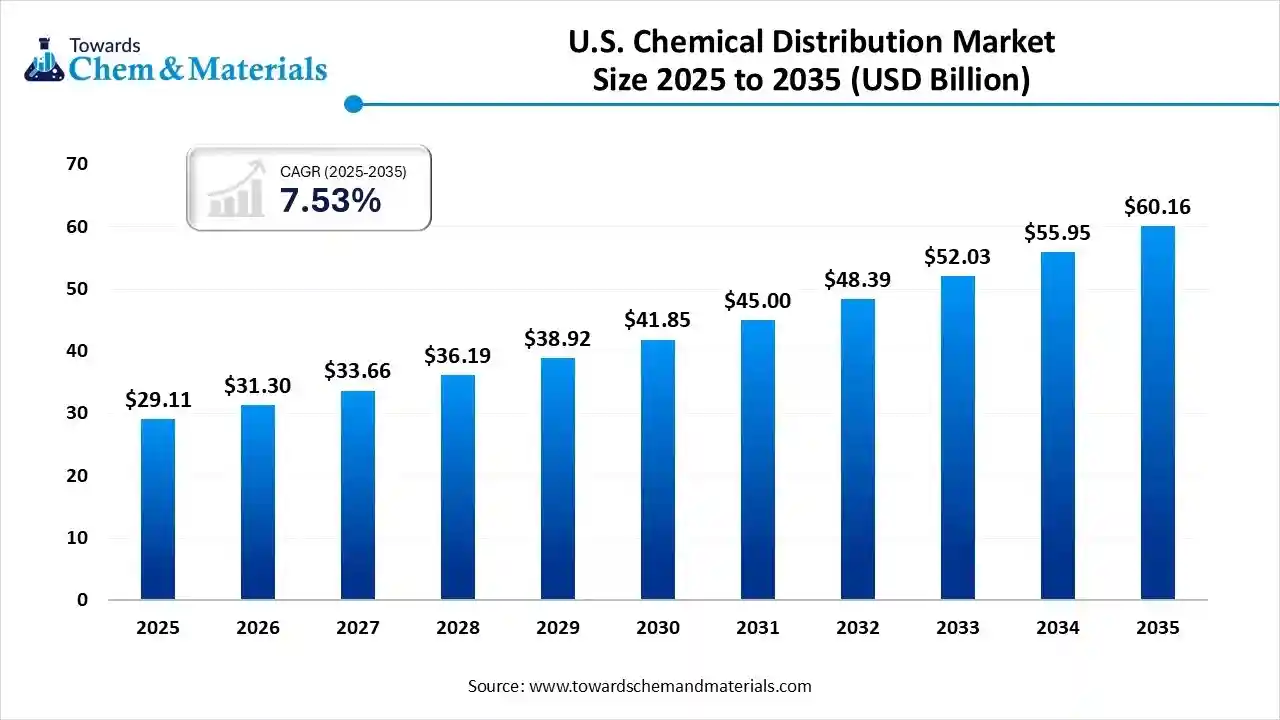

The U.S. chemical distribution market size is calculated at USD 29.11 billion in 2025 and is predicted to increase from USD 31.30 billion in 2026 and is projected to reach around USD 60.16 billion by 2035, The market is expanding at a CAGR of 7.53% between 2026 and 2035.The growth of the market is driven by the growing demand from various sectors, technological advancements and the growing shift towards sustainability, which fuels the growth of the market.

Key Takeaways

- By product, the commodity chemicals segment led the market with the largest revenue share of 71% in 2025.

- By product, the speciality chemicals segment is expected to grow fastest in the market during the forecast period between 2026 and 2035.

Market Overview

What Is The Significance Of The U.S. Chemical Distribution Market?

The significance of the U.S. chemical distribution market is its critical role as a supply chain intermediary, ensuring a reliable and efficient flow of essential chemicals to a vast array of industries like agriculture, pharmaceuticals, and manufacturing. It is vital for the U.S. economy, which is a global leader in chemical production and consumption, supporting everything from basic industrial processes to high-tech advancements. The market's importance is further underscored by its adaptability, innovation, and ability to provide value-added services that are crucial for industrial growth and the economy.

U.S. Chemical Distribution Market Growth Trends:

- Shift to Speciality Chemicals: There is a growing demand for high-value, application-specific speciality chemicals. Distributors are offering value-added services like blending, custom formulation, and technical support for these products.

- Digital Transformation & Automation: The industry is adopting digital technologies like e-commerce, AI-driven inventory management, automated warehousing, and real-time tracking to improve efficiency.

- Sustainability and Green Chemistry: Environmental awareness and regulations are increasing the demand for eco-friendly and bio-based chemicals. Distributors are expanding their product offerings and adopting greener practices.

- Supply Chain Resilience: Disruptions have led companies to diversify suppliers, invest in local infrastructure, and develop contingency plans to strengthen supply chains.

- Consolidation and M&A Activity: The market sees ongoing mergers and acquisitions by major players to expand reach, diversify portfolios, and gain economies of scale.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 31.30 Billion |

| Revenue Forecast in 2035 | USD 60.16 Billion |

| Growth Rate | CAGR 7.53% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Segments covered | By Product |

| Key companies profiled | Univar Solutions Inc.,Brenntag North America, IMCD US, Helm US Corporation, Ashland, CONNELL BROTHERS, ICC Industries, Inc., NEXEO Solutions, Safic Alan, Barentz, Biesterfeld AG |

Key Technological Shifts In The U.S. Chemical Distribution Market:

The U.S. chemical distribution market is experiencing significant technological shifts driven by digital transformation, the adoption of artificial intelligence (AI) and automation, and a strong focus on sustainability and regulatory compliance. These changes are designed to improve efficiency, transparency, safety, and customer experience across the entire supply chain.

Trade Analysis Of U.S. Chemical Distribution Market: Import & Export Statistics

- According to global export data, the world shipped 82 shipments of speciality chemicals to the United States from June 2024 to May 2025 (TTM). These shipments were sent by 22 exporters to 34 U.S. buyers, representing an -8% decline compared to the previous twelve months.

- Most of the world's speciality chemical exports go to Russia, the United States, and Turkey. The top three global exporters of speciality chemicals are Bangladesh, Germany, and China. Bangladesh leads with 3,489 shipments, followed by Germany with 2,970, and China with 2,734.

- Meanwhile, according to U.S. export data, the United States exported 4,357 shipments of organic chemicals from June 2024 to May 2025 (TTM). These were supplied by 254 U.S. exporters to 44 buyers, with a significant 217% growth rate compared to the previous year.

- Most U.S. organic chemical exports go to India, Brazil, and Belgium. Globally, the top three exporters are the U.S., India, and China. The U.S. leads with 9,110 shipments, followed by India with 3,750, and China with 2,588.

U.S. Chemical Distribution Market Value Chain Analysis

- Chemical Synthesis and Processing: Chemical distributors in the US supply a wide range of chemicals, including commodities, specialities, solvents, polymers, and performance chemicals sourced from domestic manufacturers and international producers. These materials undergo repackaging, blending, formulation, dilution, and quality-controlled handling to meet industry-specific requirements.

- Key players: Univar Solutions, Brenntag North America, IMCD US, Nexeo Plastics, Azelis Americas.

- Quality Testing and Certification: Distributed chemicals are tested for purity, composition, safety compliance, and regulatory adherence under standards such as ISO 9001, Responsible Care®, and OSHA Hazard Communication requirements (HAZCOM).

- Key players: SGS, Intertek, UL Solutions, NSF International.

- Distribution to Industrial Users: Chemicals are supplied to pharmaceuticals, electronics industries, agriculture, automotive, food & beverage, and construction, through nationwide distribution networks, logistics services, and warehousing centers.

- Key players: Univar Solutions, Brenntag North AmericaIMCD US, Azelis Americas.

Chemical Distribution Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency) | TSCA (Toxic Substances Control Act), FIFRA (for pesticides), EPCRA, Clean Air Act, Clean Water Act | Chemical safety, reporting, emissions control, handling/storage compliance | TSCA reform under the Lautenberg Act increased review of both new and existing chemicals in distribution. |

| United States | OSHA (Occupational Safety & Health Administration) | HazCom Standard, Process Safety Management (PSM) | Worker safety, hazard communication, labelling, and chemical handling practices | Requires SDS, GHS-aligned labelling, and strict protocols for hazardous chemicals in warehouses. |

| United States | DOT (Department of Transportation) | Hazardous Materials Regulations (HMR) | Transport safety, packaging, classification, documentation | Crucial for chemical distributors transporting hazardous materials domestically. |

| United States | DHS (Department of Homeland Security) | CFATS (Chemical Facility Anti-Terrorism Standards) | Security, inventory tracking, risk-based facility assessment | Chemical distributors storing high-risk chemicals must meet security and reporting requirements. |

Segmental Insights

Product insight

How Did the Commodity Chemicals Segment Dominate The U.S. Chemical Distribution Market In 2025?

The commodity chemicals segment dominated the U.S. chemical distribution market with a share of 71% in 2025. Commodity chemicals form a major part of the market as they include high-volume, standardised materials such as acids, solvents, polymers, and basic industrial chemicals used across manufacturing, agriculture, construction, and automotive sectors. Their distribution relies heavily on extensive logistics networks, bulk handling systems, and long-term supply contracts. Growth in US industrial production, petrochemical expansion, and infrastructure spending continues to boost demand for efficient and cost-optimised commodity chemical distribution services, particularly in bulk transport, storage, and value-added repackaging.

The speciality chemicals segment expects fastest growth in the market during the forecast period between 2026 and 2035. Speciality chemicals represent a high-value segment within the US chemical distribution landscape and include formulations such as additives, coatings, adhesives, performance materials, personal care ingredients, and speciality polymers.

Distribution focuses on technical selling, application support, regulatory compliance, and customised formulations rather than bulk volumes. As US industries prioritise innovation, sustainability, and advanced material performance, distributors of speciality chemicals increasingly offer lab services, formulation development, and regulatory assistance. This segment grows faster than commodity chemicals due to rising demand in sectors such as electronics, pharmaceuticals, advanced materials, cosmetics, and automotive lightweighting.

Recent Developments

- In November 2025, Lindsay Goldberg agreed to acquire EMCO Chemical Distributors, one of North America's largest independent chemical distributors. The private equity firm aims to leverage EMCO's established infrastructure and market position in the Midwest to drive future growth.(Source: www.indianchemicalnews.com)

- In March 2025, Centrium Energy Solutions launched to bridge service gaps and reduce costs in oilfield chemical distribution by focusing on domestic sourcing and technical expertise. The new oil and gas chemical supplier, a subsidiary of Cathedral Holdings, aims to address challenges like inconsistent supply and reliance on overseas suppliers.(Source: www.oilfieldtechnology.com)

- In June 2025, Nouryon launched an Innovation Centre for oilfield solutions in Houston, Texas, its first such centre in the US. The centre will concentrate on research and development for sustainable solutions in drilling, production, and stimulation processes.(Source: www.indianchemicalnews.com)

Top Players in the U.S. Chemical Distribution Market & Their Offerings:

- Univar Solutions Inc.: Univar Solutions is one of the largest chemical distributors in North America, offering a broad portfolio of commodity and speciality chemicals. The company serves industries such as pharmaceuticals, food ingredients, personal care, industrial manufacturing, and coatings, supported by strong logistics, technical expertise, and value-added formulation services.

- Brenntag North America: Brenntag is a global leader with a strong US footprint, distributing a wide range of speciality and industrial chemicals. The company provides supply-chain support, custom blending, packaging, and regulatory compliance services to sectors like agriculture, water treatment, adhesives, and personal care.

- IMCD US: IMCD specialises in distributing high-value speciality chemicals and ingredients across pharmaceuticals, coatings, plastics, food, and personal care markets. The company is known for its technical sales force, formulation support laboratories, and strong partnerships with global chemical manufacturers.

- Helm US Corporation: Helm US supplies chemicals and ingredients for agriculture, industrial processing, pharmaceuticals, and nutrition markets. With strong import/export capabilities and long-standing supplier partnerships, the company supports the distribution of high-quality chemicals with reliable logistics and technical support.

Top Companies in the U.S. Chemical Distribution Market

- Univar Solutions Inc.

- IMCD US

- Helm US Corporation

- Brenntag North America

- Ashland

- CONNELL BROTHERS

- ICC Industries, Inc.

- NEXEO Solutions

- Safic Alan

- Barentz

- Biesterfeld AG

Segments Covered:

By Product

- Speciality Chemicals

- CASE

- Agrochemicals

- Electronic

- Construction

- Specialty Polymers & Resins

- Flavor & Fragrances

- Others

Commodity Chemicals

- Plastic & Polymers

- Synthetic Rubber

- Explosives

- Petrochemicals

- Others